Abstract

This research project was conceived to identify whether the price is a primary factor in the purchase of vacation accommodations. In the current economic climate, both the literature review and the primary research survey confirmed that price has become more important. The literature showed that about 80% of the target audience still made their choices by perceived value for the money rather than raw price. However, it is still a little murky, because the literature did not clearly separate price and perceived value for the money. This research confirmed that price was becoming more important, but also that perceived value for the money was primary for most of the target audience.

Introduction: Background

Maslow (1970) proposed a hierarchy of needs for humans that ranked what people expend time and energy to gain in the order of importance. Jordan (1999) has taken the idea of a hierarchy of needs from Maslow (1970) and applied it to human factors proposing a hierarchy of user needs as follows: Level 1-functionality, Level 2-usability, Level 3-pleasure. (Maslow 2007) A similar hierarchy was proposed by the members of the Ergonomics and Design workgroup of the S.I.E. Italian Ergonomics Society (see Bandini Buti 1998) regarding product requirements for user needs Level 1-respect of the environment, Level 2-health.

The aim of this dissertation is to discover the importance of price in marketing. It is understood that the provisions of the hospitality industry are not sought by the poorest people and further that the very rich have no real need to concern themselves with anything but purpose in utilizing hospitality facilities, so the target audience here is the middle and upper-middle class. In order to create the best marketing mix, it is necessary to know where the price fits when creating a marketing plan. In the current economic climate, this is certain to have changed, but it is expected that price will still not be the defining aspect of purchasing choice, though it will have risen in importance. It is expected that “value for money” will actually be how price is defined, and that has become more important.

Objectives

- To examine the scope of literature on pricing in the hospitality industry and customer behavior

- to explore its role within a marketing mix for the hospitality industry

- to examine the literature on hospitality industry marketing strategies

- to define and illustrate the relationship of perceived value with buying behavior

- to study how this relationship influences purchasing decisions

The research question involves identifying the target audience and investigating their buying behavior as mentioned in the Objectives. It is important for marketers, especially in this very volatile industry, to understand how customers make their buying decisions, since marketing and planning, both by the customer and the organizations which make up the industry, must be done quite far ahead, and forecasting is of primary importance. This dissertation can help to identify the effectiveness of certain marketing strategies and how they can communicate the perceived value sought by customers. It can help to set the marketing mix among all the variables which make it up. IN order to win new customers and successfully retain loyal ones, the marketing departments of hospitality services must know where price and perceived value fit into the customer’s decision-making process. Even branding is critical. It is necessary to see how the various brands are perceived in light of the customers’ decision-making process.

The introduction provides a background of the problem and the proposed solution. A literature review will provide the formal secondary research background against which the primary research will be conducted. We will examine what has already been written about this subject and identify the holes and niches in current research.

Literature Review

Business in the hospitality industry in the UK was holding steady during the summer, but there is an expected fall-off coming and it will include a devaluing of the hotel and resort properties by up to 20%. (Sharkey, Gemma 2008) The industry stake action. Boella and Goss-Turner say “business was the purpose in 2003 for 22.3 million trips in the UK by UK residents and 7 million trips by overseas visitors. These trips equate to a spend of about £6 billion by UK residents and £3.4 billion by overseas visitors.” (Boella, Michael J., Goss-Turner, Steven 2005) However, over time, the demographics have changed. Pleasure is often combined with business in order to take advantage of discount pricing and maximize time. (BERTAGNOLI, L., 2007) The aim of this literature review is to discover what has been studied concerning price and perceived value in conjunction with customer buying behavior in the hospitality industry.

The hospitality industry is made up of four major sectors:

- Travel and Transportation: both local and long-distance carriers figure in here:

- Airlines

- Trains

- Buses

- Taxis

- Rental Vehicles

- Travel agencies

- Tour Operators

- Accommodations

- Hotels

- B&Bs

- Self Catering

- Apartments: long term corporate rentals

- Food and Drink

- Restaurants

- Pubs

- Entertainment

- Sports Events

- Sporting Facilities

- Recreational Attractions

- Natural Environments

- Historical Sites

- Theatre, Dance, Music and Drama

- Cultural Events

- Other

- Theme Parks

- Spas

- Special Facilities

- Children’s Attractions

Of these sectors, we will concentrate upon the Accommodations sector. The other sectors will be included as they relate to the marketing of accommodations.

Major and Minor Organizations Providing Accommodations

While these are normally not included in a literature review, they are too numerous and too influential to be ignored. All organizations providing accommodations would be well advised to be certain that they have an Internet presence. While a separate site that includes complete descriptions is extremely useful, a presence on travel and accommodations sites is just as important. One article “discusses the findings of Global Reviews’ survey of online users in Great Britain. The survey discovered that hotels are one sector that has yet to pursue best practices when it comes to website design and functionality. A gap was found between best practices and what hotels are offering. The results indicate that consumers with Internet access have a strong preference for searching for a hotel online. Even among business travelers, the Internet is popular. The most important category to consumers is hotel selection, led by Holiday Inn.” (Goodvach, Adam 2008) In July, the Hand Picked group will launch a Web site called www.handpickedmeetings.co.uk for event planners. In relevance, the company has developed the Hand Picked Service Promise designed to offer high standards of service and attention to clients.

Websites have become important enough that the hospitality industry has its own “webby awards”. In Categories (2008), “The article lists the categories of the Caterersearch.com Web awards including the hotel website independent, digital marketing campaign, and foodservice website.” Hudson and Gilbert (2008) cover internet marketing for small businesses on The Internet and Small Hospitality Businesses: B&B Marketing in Canada. While this is not the UK specifically, it shows a trend and a strategy. The revamped site for the Budget Hotel group, developed by Glasgow agency the Equator, includes a simplified, three-stage booking process and an improved navigation system, and it gives detailed hotel information and a large selection of images. (Brownsell, Alex 2008)

Images seem to increase interest across the board with all test groups. Bourne Leisure Ltd. is seeking an agency to handle the digital account for its Leisure Hotels brand in Great Britain. (Kimberly, Sara 2008) Many independent companies, such as Rocket and Kitcatt Nohr Alexander Shaw, have developed to market online for the hospitality industry. It is a lucrative business and works well for the industry, since the hotels, already stretched thin for staff, do not have to worry about hiring programmers and webmasters. (Marketing Week 2008) Search Engine Optimization is another consideration that specialty companies can provide. (Sander, Tim 2008)

In looking at the various documents found by searching the keywords: accommodation, UK, website, the body of literature found indicated that this was actually a topic of interest. The use of Internet sites ranged from listings with blurbs on travel and accommodations sites to blogs and full sites. However, it was found that a web presence is seen by marketers as desirable. Even academic papers have followed this trend. One peer-reviewed article was almost an advertisement: The author reflects on his stay with his family in Rignall Farm Barns and the Hankins’ Pear Tree Farm in Northamptonshire, England. (Ginger, Richard. 2008)

Ross Bentley (2008) covers other technology issues and how they may impact the service level, efficiency and the bottom line in hotels and restaurants. Ian Boughton (2008) tells us about making coffee more British, that is, more to the British customer’s taste. It is interesting to note that with the expectation of more people staying nearer to home this year, this could have a strong impact on marketing.

An expected finding in this literature review is that perceived value is more important than price alone. However, median hotels and budget level chains are advertising by price. (Charles, Gemma 2008) However, add-ons and extras, whether bonuses or simply offers seem to get more attention. “Debbie Goffin, head of sales and marketing, that providing extra services such as spa and restaurant bookings will effect in more customers returning to book their next holiday with the agent.” (Treavel Weekly UK 2008)

Emma Allen (2008) “takes a look on how hotels are coping with the credit crunch in Great Britain. With the impact of the credit crunch, operators will be forced to target alternative markets, typically at lower rates. The hotels will also cut their sales and marketing spending. Moreover, it suggests that hotels will need to bring strategic thinking on how to spend money wisely.”

Michael Shepherd, (Allen, Emma 2008) “general manager at the five-star London Hilton on Park Lane hotel, believes that, so far, the capital has managed to ride the storm, partly due to the positive effects of traditional events such as the Chelsea Flower Show, Farnborough Air Show and Wimbledon, which have all helped to draw high-spending visitors to the country this summer.” His hotel is holding at a 7% increase and 80% occupancy. It is clear that events help. “Jonathan Slater, managing director of the five-star Chester Grosvenor and Spa, says that passing trade is slower now than it was a year ago, simply because the city center is so much quieter….. The answer, Slater believes, is an “aggressive” sales and marketing policy that covers every angle of the business. “We’re leveraging every opportunity at the moment,” he says, “from looking hard at third-party providers to see where we can increase sales to creating out-of-the-box packages. (Allen, Emma 2008)

“Thistle Hotels’, chief operating officer Chris Gillett says that clients are looking for good deals at the moment and feels that the MICE (meetings, incentives, conventions, exhibitions) sector, in particular, has taken a hit in recent months. The group has seen a 10% reduction in MICE spending since March this year as more companies cut back on areas such as training staff and entertaining. For Gillett, savvy pricing and promotions are more effective than bringing down rates, which can have long-term effects. ‘It’s not about discounting, or a slash-and-burn policy,’ he explains. ‘It can take a very long time to build prices back up again, and we don’t want to corrupt the brand.’” (Allen, Emma 2008)

Paul Harvey at Travelodge says that price is key in the budget sector. “The brand is offering more than 2,500 roomnights at £29 or less this summer.” (Allen, Emma 2008) Grant Hearn (2008) tells us that the domestic travel and hospitatlity industry is estimated annually at 11.4 billion pounds. “This summer, Travelodge is to launch a campaign to attract British holiday-makers to seasonal destinations with a £19 room sale and many more linked offers. Because of our “no frills” offer and lack of fancy restaurants, these new customers will spend an average of £30 per day in the communities they visit. This means that fish and chip restaurants, rock shops, piers, parks and pubs have the opportunity to capture some of this additional revenue.” Package presentation formats were offered to students in a survey and the only discernable difference was that the sample showed a higher intention to visit when the price was used as the package heading. (Rewtrakunphaiboon W, Oppewal H. 2008) However, even though the price is important, the TMCs (Travel Management Companies), which have been pushing corporate rates down are found to be less valuable than internal marketing departments which can respond to the market with dynamic pricing, and not offer low corporate prices all the time, but base them on the market. (Taylor, Ian 2008)

Roy Tillard (2008) “ reports on the opening of Callow’s yard in Castletown in Ireland. It is a venture of Roy Tillard worth £16 million that is scheduled to open in March 2009. The facility took four years in the making and it includes 28 swanky high-specification serviced apartments, retail spaces, restaurants and bars. It was also supported by Tony Brown, chief minister of the island and the Isle of Man Department of Tourism and Leisure. “(Tillard, Roy 2008) The article lists a number of hotels and restaurants and their pricing structure. Tillard says that including some meals at modest prices and a superior wine list with only a 50% markup on the higher quality wines encourages diners to “trade up”, since they perceive good value for the money.

An article in the August issue of Caterer and Hotelkeeper reports that “Jumeirah International opines that he remember that past master of recession marketing Ramon Pajares stuck to his selling price, regardless of demand. Alastair Storey, chief executive of Baxter Storey says that their competitors are high-street food retailers and from them, they have learned to continually innovate.” (Have you Learnt from Your Competitors? 2008) Mike Murray, the managing director of Cranley, asserts that lack of expertise has stopped hoteliers from selling direct to consumers in Great Britain. (Travel Trade Gazette UK and Ireland 2008)

Promoting British heritage is seen as a key strategy for keeping British visitors interested in home vacations, and also for attracting foreigners, especially for the 2012 Olympics. That initiative needs to begin now. (Bokale, Jemima 2008) Development for the 2012 games is expected to develop the entire tourist industry. (Harwood, Jonathan 2008)

This article presents “A calendar of events related to the hospitality industry in London, England for September to November 2008 is presented which includes the London Restaurant Awards, the Hospitality Action Ball, and the Hotel Cateys.” (Events 2008) Some of these events even have appealed to the public. “An increase of 14% in attendance has been observed during the 2008 Summer Eventia.” (Industry Bodies 2008) Events in Manchester are credited with the higher occupancy there. (WHY MANCHESTER? 2008).

Nick Huber (2008) explains the new hospitality worker diploma initiative and states that hotels have been asked to track the impact of better-trained workers on the industry. The better service which is presumed to be an outcome of offering trained workers could also be seen as a “value-added” by customers.

An example of the costs to offset carbon emissions for one flight from Toronto to London

Table 1. Price Differences for offsetting a return flight from Toronto, Canada to London, Source: (www.zerofootprint.net, www.carbonzero.ca, www.offsetters.ca).

- England (Heathrow)

- Name of offsetter Measure of C02 Price (Cdn$)

- Zerofootprint 1.20 tonnes 19.30

- Carbon Zero 1.25 tonnes 28.88

- Offsetters 2.30 tonnes 45.20

Since the article indicates that many tourists are actually concerned, but do not know how to help, this could become a differentiating factor for perceived value. The majority of those asked thought that these concerns should be the responsibility of the government, but the article indicates that this will not be effective.

Going green can be an excellent marketing tool. That is a win-win.

Considerate Hoteliers Association

Short-term aims:

- If you have achieved great things on the environmental front, then shout about it. Turn your hard work into a marketing tool and unique selling point for your business.

- Reduce your waste. It’s not just about recycling the waste you have already accumulated. Much of it is created by excessive packaging, so make more considered purchases.

- Lobby the Government and your local MP about supporting domestic tourism. There is much work to be done in this area — especially in the lead-up to the 2012 Olympics.

- Work with other local hoteliers to improve your corporate social responsibility (CSR) and make your destination more attractive.

- Enter for the Considerate Hotel of the Year award (entry closing date, 31 January 2009).” (Birkett, Rosie 2008)

“But as Rebecca Hawkins, a senior research fellow at the International Centre for Responsible Tourism at Leeds Metropolitan University, says, “Any business that is not looking at resource costs is not only environmentally irresponsible but, more importantly, not very good at business.” If £1b a year is being wasted by hospitality through its current energy planning, as the Carbon Trust estimates, then there’s a good case for going green.” (How Green is Your Industry? 2008)

Conclusions from the Literature Review

It is plain from the literature that price has become more important as an attraction to ads and website content. It is also true that certain target sectors in the lower income levels are much more price-conscious than previously. However, the literature shows that approach, as in having a presence on the web and a brand, plus value-added by perception is more important. A web presence is very important since most people in the target group have access to computers and prefer to search online, where they can compare and see pictures of the accommodations and the area to be visited. Events marketing has become an important value-added, and other offerings being made available, such as tours, entertainment and rental cars, are also primary drawing cards for business, even if there are extra charges for these add-ons. Even well-trained staff can raise the occupancy rate over time. So, for the most part, price is a secondary consideration, all else being equal.

Methodology

Because the literature review shows a definite tendency for the main portion of the target population to look at perceived value before actual price, we believe that a survey of that target sector would yield important information about purchasing attitudes on a survey. To that end, an arrangement was made to exchange participants with a student in the UK who needed a survey done in the USA. The survey created for this site was posted online and emails were sent to UK students asking them to ask their parents, teachers and another family to participate. In exchange for the UK student sending an email to student children of prospective participants, I emailed his questionnaire to students in USA college and university students through my friends and acquaintances. In all, 78 participants responded and took the survey. On this side of the pond, 112 students agreed to participate in the other student’s survey. Since he was a student and mine were the parents of students, we found this quite satisfactory.

The questionnaire is designed to elicit responses that show the attitude of the middle to upper-middle-class British parents or teachers toward vacation and travel, especially concerning accommodations. It is expected that many participants will be vacationing closer to home this year, and that price will be a factor.

Results

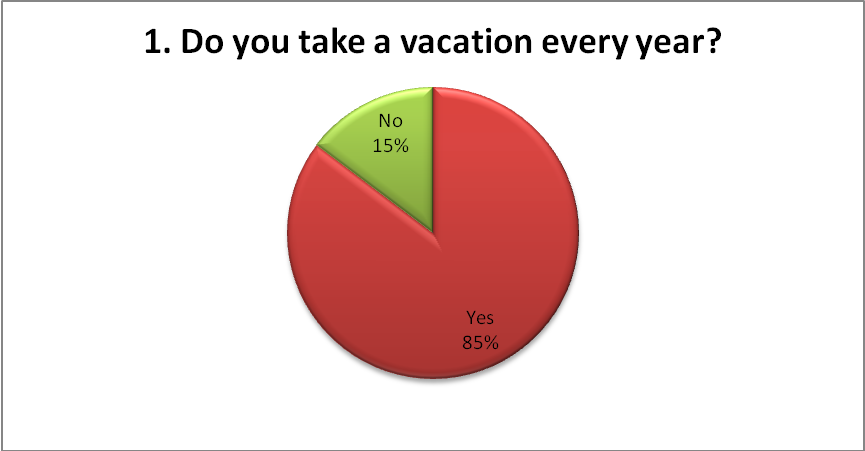

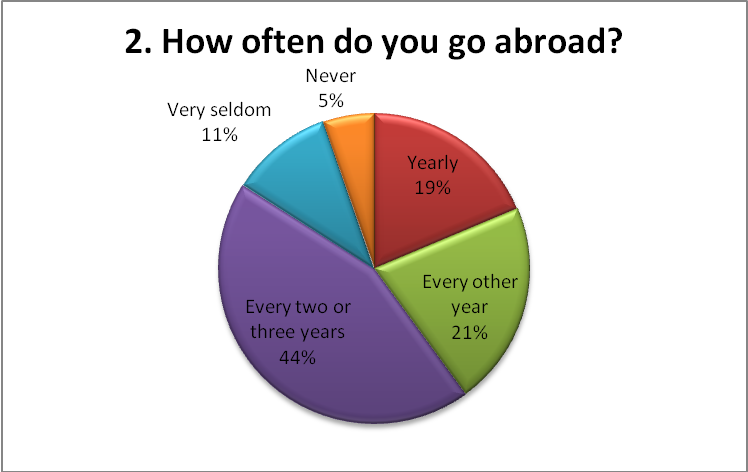

According to the survey, most of the respondents (85%) take a vacation every year, and the same percentage go abroad at least every third year. However, only 20% go abroad annually and 5% never go abroad.

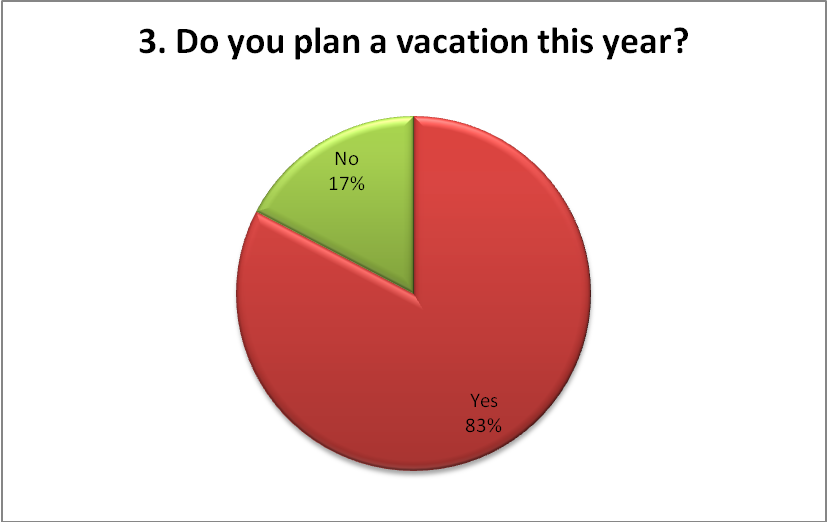

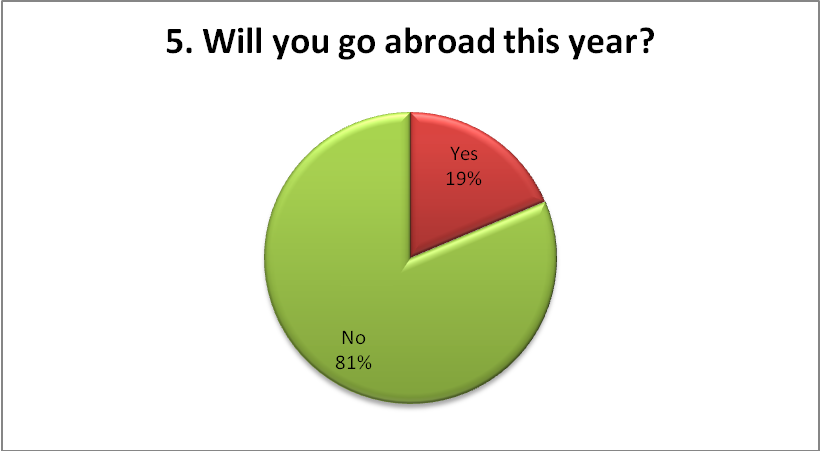

This leaves an annual target of 36% in any given year if the demographic give a true representation of the general target population. 83% plan to vacation this year, with 69% having two weeks, and 80% do not plan to go abroad this year. This is a sizable domestic target.

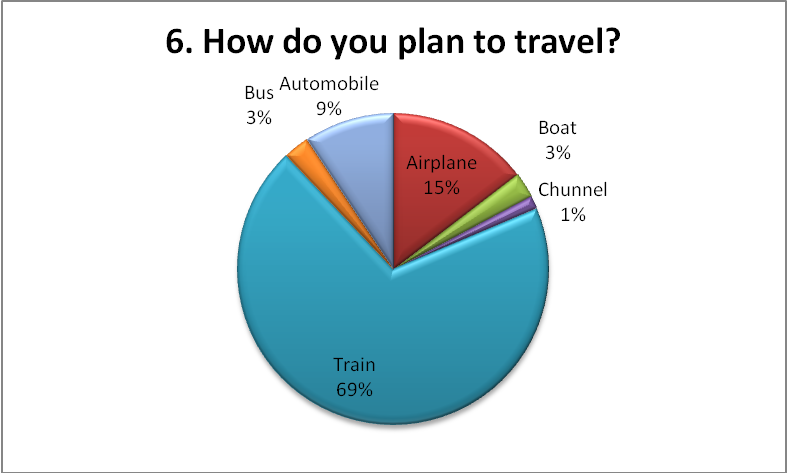

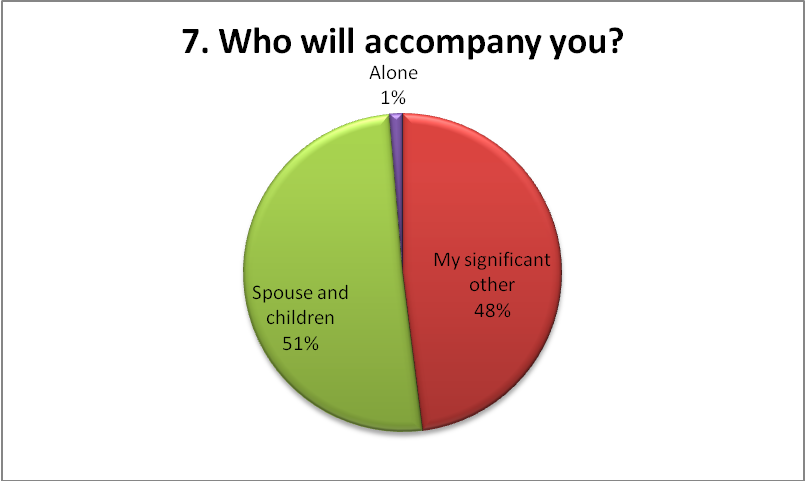

Only three percent will be driving, so transportation at the destination is possibly an added value hotel could offer to raise the perception of value-added. Only one respondent planned to travel alone. The rest of the respondents were split almost equally between traveling with a spouse or significant other and traveling with the whole family, including children.

With more than half the travelers vacationing with children, another possible value-added would include child care, lower meals for children and family-type activities. One interesting thing is that 75% of our respondents said they have already made their reservations. This would be for next year since this is the end of this year. So whatever the hotels have now is probably more than half of what they will get if they do not add something to draw more vacationers.

75% of vacationers learned about their accommodation from brochures (19%), travel agents (28%) and the Internet (29%). Nearly half of the respondents learned about their destination from these sources. 32% chose the location because of either special attractions or seminars/trade shows. 18% were repeated travelers to the area. This leaves half of the target open to the influence of family or friends, and all of these can be influenced by excellent marketing.

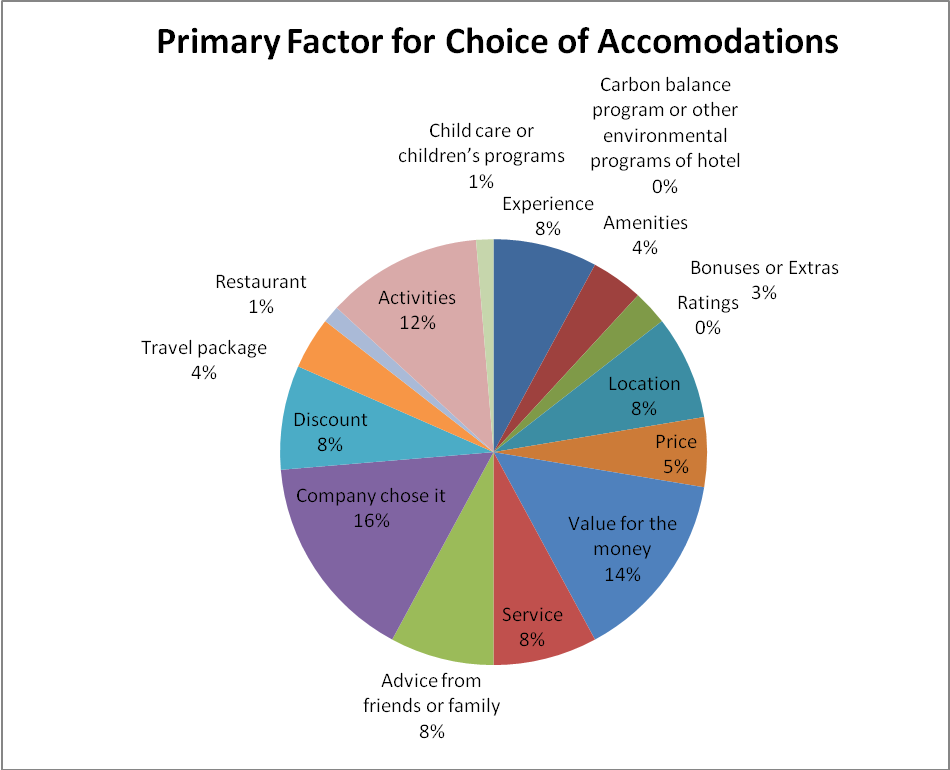

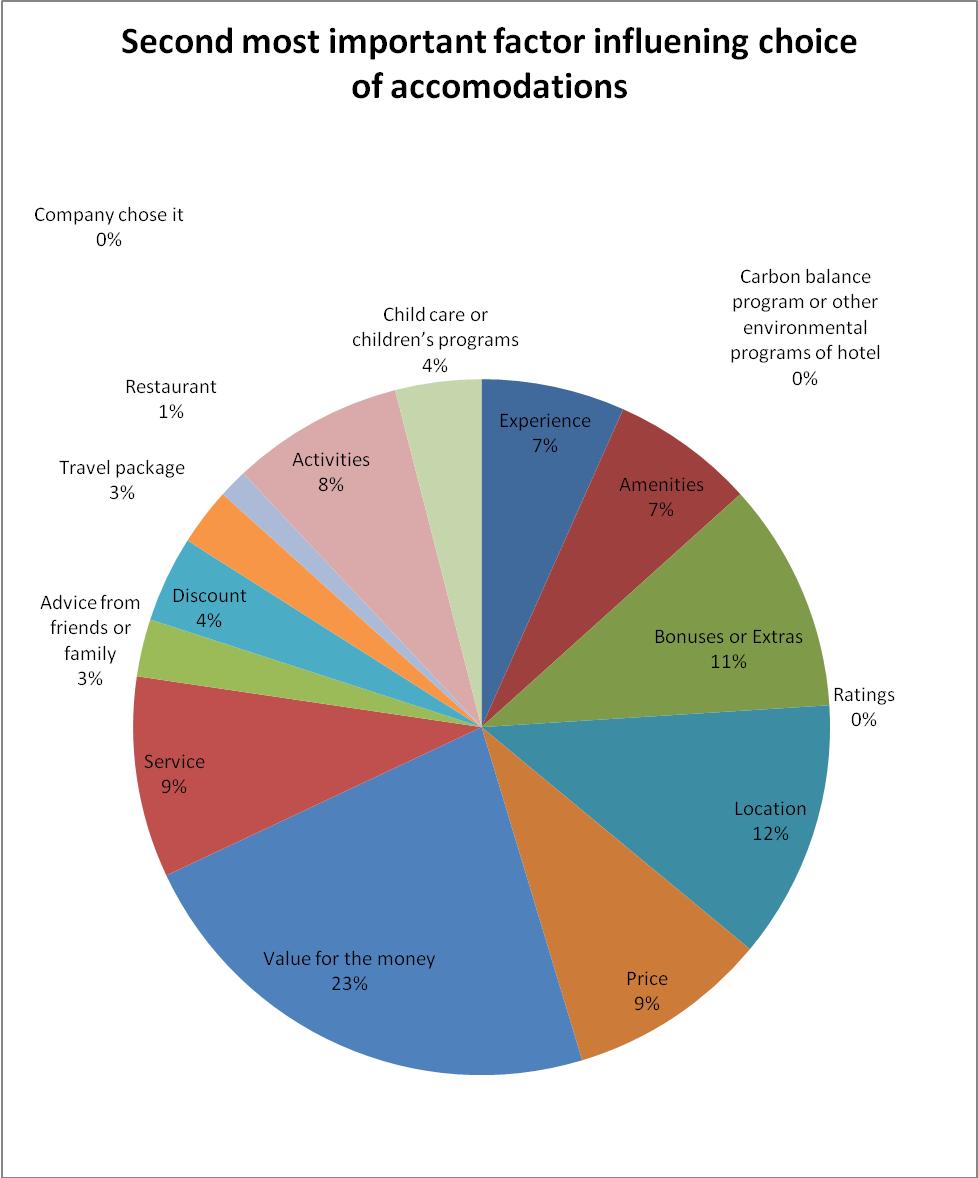

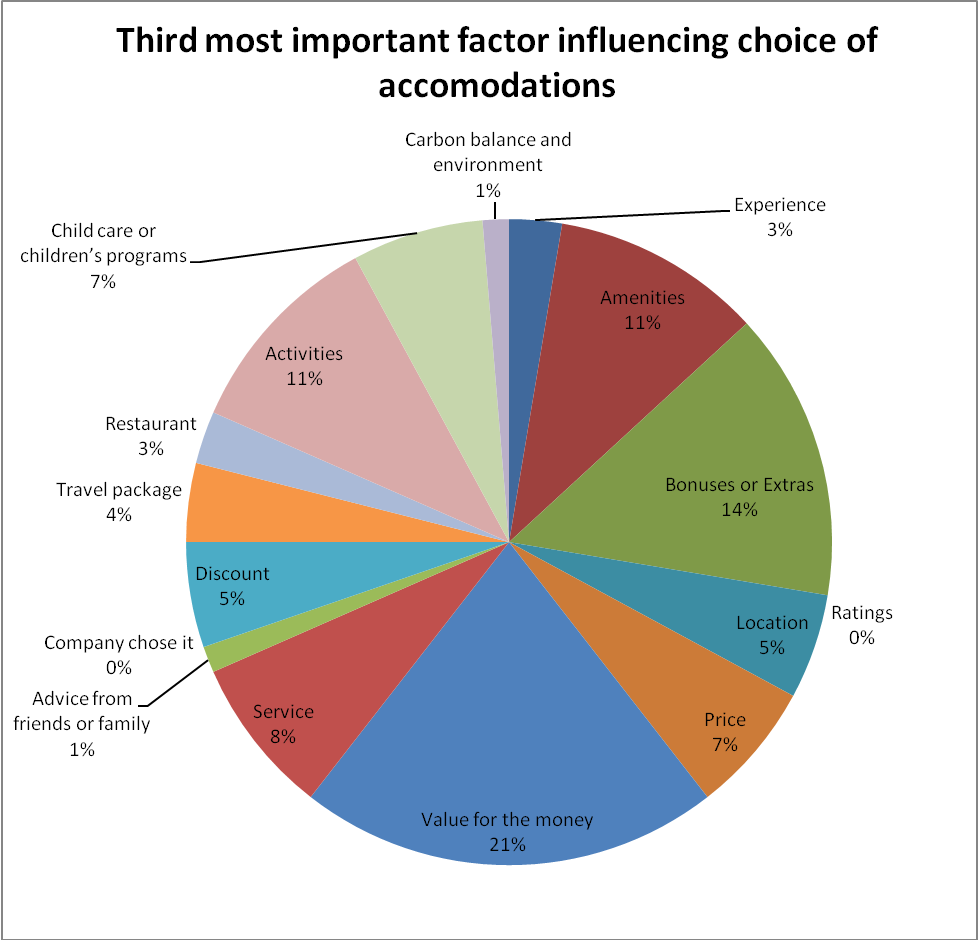

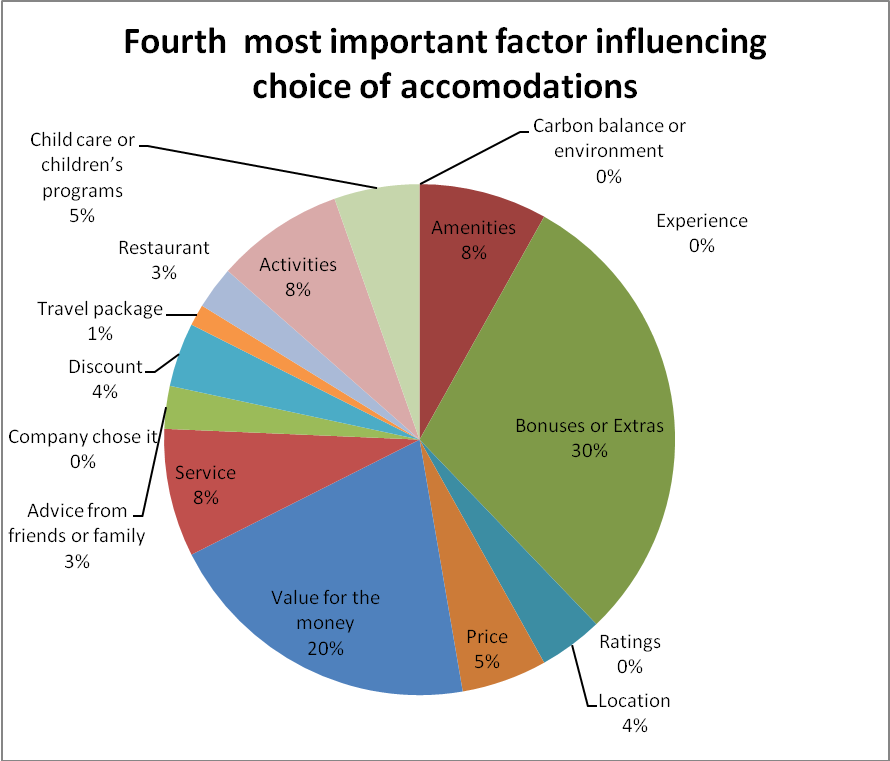

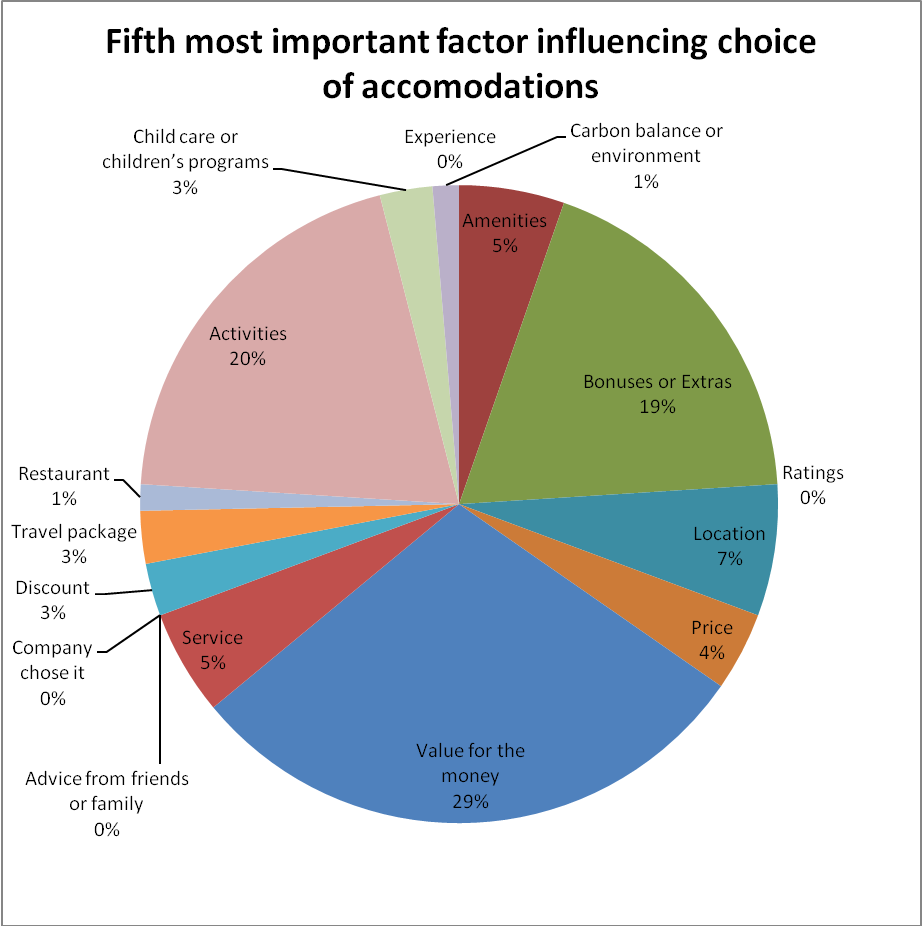

Question twelve was very important and the results are listed separately for the top five reasons for choosing their accommodations. Only 4 of 75 respondents chose price as a primary factor. Seven chose price as secondary, and only five chose it as tertiary, totaling only 17 picking price in the top three reasons for choosing accommodations, or about 22% of respondents. This is certainly significant, but it indicates that for most of the target population, price is not a prime factor in choosing accommodations. By contrast, more than half of the respondents put perceived value for the money in the top three. All respondents place value for the money in the top five. Therefore, the thesis being investigated in this research project is certainly proven for this target group.

In looking at what activities in which people plan to participate, a special attractions, tours and sports rank especially high, and most respondents said that these were offered by either their travel agent or the hotel. They also said that their hotel offered swimming, which was popular. In all, there is a wide array of attractions and activities in which the respondents are interested, offering hotels the opportunity to provide access, special discounts or other bonuses to their guests as a value-added. Local businesses, attractions and activities will likely be very responsive to offering some kind of special to visitors through the hotel and share the cost with the hotel.

This study definitely showed that Internet presence is very important. Considering that much information was gathered about destinations and accommodations either on the Internet or through travel agents who likely have an Internet presence, Internet marketing is becoming almost mandatory for any hotel to succeed. It also showed that more than 80% were spending more this year than last and had made some changes to save money.

Finally, the last question asked respondents to rank price for its importance in choosing accommodations. We realize that this may be somewhat redundant since this was also part of question twelve. However, we believed that people might not rank it the same when they were not presented with the whole range of reasons for their choice. None of the respondents chose 1-3 of 10, with ten being the highest. This means that all respondents consider price as important. However, only 4 of 74 chose price as the most important factor. In fact, most responses fell between 5, 6 or 7, and when averagi8ng the responses, the average was 5.6 out of 10. This places the price rather further down than expected.

In looking at the demographics, this sample seems to fall largely within the target population of those between ages 20 and 60+, with family income between 15 and 60k. The average household was four, three adults, or two adults with children. As was expected, 65 of the 75 respondents had children in college or university. This fits the demographics of the target vacation hotels.

Considering that the literature review showed that price was becoming more important, the survey did prove this out. However, the literature seemed to see price as more important than this survey proved. Our respondents seemed to feel that perceived value for the money was the most important factor in purchasing vacation accommodations. This may show in the future that the budget hotels which have lowered their prices, expanded or even been created by corporations as secondary to their higher-priced hotels will have to add value to gain business.

The literature showed that cost was secondary. This research project puts costs even lower down. Perhaps somewhere there is confusion between price and perceived value for money. Our project showed that perceived value for the money was most important and had gained in importance since most respondents agreed that they were paying more, and had made changes because of increased cost.

Finally, the literature showed that an Internet presence was becoming very important. This project shows that it is much more serious than that: it is becoming mandatory. Marketing departments will have to pay attention to how they market, how they make contact with their target audience and that they include both price and value-added features in their marketing. Hotels will need to partner with local agencies and other businesses in order to present value to the customer.

Problems, Lessons Learned and Suggestions for Future research

It became apparent while analyzing the surveys that some question should have been worded differently. Even though there was far more information here that the scope of this study could possibly analyze, more open questions using numerical scales might have yielded information more ealily understood and analyzed. The demographics should have been quantified much more carefully, since we only managed to get an average picture of our respondents from these results. We do believe that the demographics are far more important than we first believed. It will be of prime importance that the hospitality industry understand its target audience extremely well in the future. The information gathered here is useful, but it falls short of answering the needs of marketers. Fortunately, the intention was to investigate only the importance of price as a factor for purchasing accommodations.

We believe that the method we used to compensate for geographic displacement was useful. It there had been more time, we would investigate the possibility of using telephone interviews. These are less likely to yield overly considered results. In other words, a face ot face or a telephone interview is more likely to get results with a higher validity, since people do not have time to think carefully or weigh their responses rationally, so we would get a better idea of how people really feel. It is possible that results are slightly skewed by the ability for people to review their answers and change them.

A research project of this type suffers from shortage of time. If more time were allowed, and more careful planning were done, this project could have been more comprehensive and there surely would have been other methods possible. Among these would have been to contact hotels, travel agents and businesses directly.

More research on marketing psychology might have been valuable in framing the questions for the survey. More data from primary government sources, especially on occupancy, would certainly be valuable, but this is very difficult to get at a distance. More time might have allowed this to be pursued to a better conclusion. However, secondary sources had to be used instead.

This field is actually well-populated with market research, all of which are costly to access. However, for academic research, the field is really not at all saturated. Buying patterns of target groups for the entire hospitality industry can provide for future research topics in a wide array of possible research topics. The current economic environment is fertile ground for learning new things about what motivates people to spend their money. When times are tough, people react more emotionally to shortages and are more likely to voice their concerns.

Research on marketing in the hospitality industry is a “win-win-win” for researchers, businesses and the target audience. Academia can become better able to conduct valid marketing research and that will be passed on to future students and made available to all. This research can help the industry to better market its products and services. They can learn more about their customers, how to reach them and how to serve them. That means that customers will be better served, and will be able to really choose what they want in hospitality. When I think about budget hotels, I realize that I really would rather be able to afford full-service accommodations. In fact, in my particular demographic group, the middle class, this is true of all purchases. I would rather have affordable quality in anything I purchase. So more research is needed to define affordable quality in the hospitality industry. That could open up a whole new range of research possibilities.

One more suggestion would be that research be done to identify exactly what perceived value for the money means, What exactly do the target audience members value? What is important in this kind of “unnecessary” spending” How necessary do people perceive vacations to be? When it comes to parting with discretionary income, what are people’s attitudes as compared with income spent for necessities? Is there a difference? How does that figure in the context of Maslow’s hierarchy of needs? Can we construct a hierarchy of needs for discretionary spending?

References

ALLEN, E., 2008. Get ready or go under. Caterer & Hotelkeeper, 198(4542), pp. 38-39.

Are hoteliers too lazy with marketing? 2008. Travel Trade Gazette UK & Ireland, (2816), pp. 31-31.

BENTLEY, R., 2008. Tech it to the limit. Caterer & Hotelkeeper, 198(4542), pp. 33-36.

BOKALE, J., 2008. Hilton to unite hotels under ‘family’ badge. Marketing (00253650), pp. 5-5.

BOKALE, J., 2008. VisitBritain extends UK welcome. Marketing (00253650), pp. 4-4.

BOUGHTON, I., 2008. The best possible taste. Caterer & Hotelkeeper, 198(4540), pp. 41-44.

BERTAGNOLI, L., 2007. The Ten-Minute Manager’s Guide To…targeting New Demographics. Restaurants & institutions, 117(3).

Boella, Michael J., Goss-Turner, Steven, 2005, Human Resource Management In The Hospitality Industry: An Introductory Guide / Amsterdam: Elsevier /Butterworth-Heinemann, 2005. Web.

BRADBURY, R., 2008. How to KEEP & FEED the Muse. Writer, 121(4), pp. 24-79.

BROWNSELL, A., 2008. Easy Hotel overhauls web booking service. Marketing (00253650), pp. 12-12.

CHARLES, G., 2008. Brands buy into credit crunch. Marketing (00253650), pp. 17-17.

Events. 2007. Caterer & Hotelkeeper, 197(4505), pp. 22-22.

Events. 2007. Caterer & Hotelkeeper, 197(4504), pp. 19-19.

Events. 2007. Caterer & Hotelkeeper, 197(4499), pp. 21-21.

Ginger, Richard. 2008. “A RURAL RETREAT.” In Britain, 54-58. Academic Search Complete, EBSCOhost.

GOODVACH, A., 2008. Hotels must up their game for online users. New Media Age, pp. 10-10.

HARWOOD, J., 2008. VisitBritain rejects claims of post-2012 tourist blight. Marketing Week (01419285), 31(28), pp. 3-30.

Hand Picked targets events. 2008. Conference & Incentive Travel, pp. 5-5.

Have you Learnt from Your Competitors? 2008, Caterer and Hotelkeeper, 2008.

HAYS, C., 2008. Summer Morning, Summer Night. Booklist, 105(1), pp. 60.

Hotel booking website turns to Rocket and Kitcatt Nohr. 2008. Marketing Week (01419285), 31(22), pp. 11-11.

How Green is Your Industry?, 2008, Publication: Caterer & Hotelkeeper, Publication Date: 2008.

HUBER, N., 2008. Success of new diploma will depend on employers. Caterer & Hotelkeeper, 198(4546), pp. 10-10.

HUDSON, S. and GILBERT, D., 2006. The Internet and Small Hospitality Businesses: B&B Marketing in Canada. Journal of Hospitality & Leisure Marketing, 14(1), pp. 99-116.

KIMBERLEY, S., 2008. Bourne Leisure starts digital agency search. Precision Marketing, 20(16), pp. 5-5.

Maslow, 2007, NetMBA.

MCCLARY, S., Most UK Hotel Guests are on Leisure Breaks Hotel.nAN: 14658465.

Sell add-ons or lose out to the web, says Premier. 2008. Travel Weekly (UK), pp. 14-14.

Summer Morning, Summer Night. 2008. Publishers Weekly, 255(37), pp. 49-49.

The Categories. 2008. Caterer & Hotelkeeper, 198(4538), pp. 17-17.

Travel Weekly (UK), Untitled. 2007., pp. 39-39.

Why Manchester? 2008. Conference & Incentive Travel, , pp. 11-11.

REWTRAKUNPHAIBOON, W. and OPPEWAL, H., 2008. Effects of Package Holiday Information Presentation on Destination Choice. Journal of Travel Research, 47(2), pp. 127-136.

SHARKEY, G., 2008. Campaign wants more UK tourists at seaside. Caterer & Hotelkeeper, 198(4537), pp. 8-8.

SHARKEY, G., 2008. Industry puts all its weight behind diplomas for 2009. Caterer & Hotelkeeper, 198(4521), pp. 7-7.

SHARKEY, G., 2008. Parker backs UK to deliver ‘fabulous’ Olympics in 2012. Caterer & Hotelkeeper, 198(4538), pp. 9-9.

SHARKEY, G., 2008. UK hotel property prices could fall by as much as 20%. Caterer & Hotelkeeper, 198(4543), pp. 7-7.