Make or Buy Decisions

Decisions to make or buy has to be taken when the product being manufactured has a component part that can either be made within the factory or purchased from an outside firm. This decision can be arrived at only by comparing the supplier’s price with marginal cost. The choice between making or buying is one which is likely to face all businesses at sometime. It is usually one of the most important decisions by management for the critical effect on profits that may ensue. The choice is also critical for the management accountant who provides the cost data on which the decision is ultimately made.

A make or buy problem involves a decision by an organization about whether it should make a product or carry out an activity with its own internal resources or whether it should pay another organization to carry out the activity. The make option gives the management more direct control over the work, but the buy option may have benefits in that the external organization has expertise and special skills in the work making it cheaper.

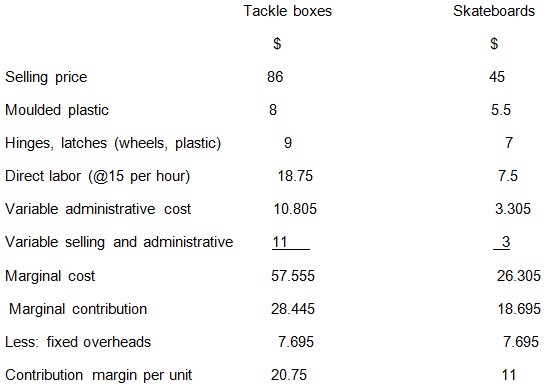

Total variable costs for tackle boxes – $

- Molded plastic – 8

- Hinges, latches, handle – 9

- Direct labor (@ $15 per hour) – 18.75

- Manufacturing overhead (12.5-1.695) – 10.805

- Selling and administrative costs (17-6) – 11

Total purchase cost of tackle boxes – 57.555

- 68+6(fixed overhead) =74

- Fixed overhead cost (6+1.695) =7.695

Fixed manufacturing overhead – $50,000

- 17,500+1,200 =$1.695

Marginal cost analysis

- Make or Buy Tackle Boxes – $

- Variable cost of buying per unit – (68+4) 72

- Variable cost of making – 57.56

- Extra variable cost of buying per unit – 14.44

- Number of units (40% of 12,000) – 4800

- Total extra cost VC of buying (4800×14.44) – 69,313

- Less: attributable fixed costs (7.695×4,800) – (36,936)

- Net extra costs of buying – 32,377

Decision: make the tackle boxes

Marginal Costing is the variable cost comprising prime cost and variable overheads. Analysing this definition we find that with the increase in one unit of output, the total cost is increased and this increase in total cost from the existing level to the new level is known as marginal cost. In marginal costing procedure, costs are regarded as the costs of the products being manufactured.

Marginal costing advantages include: it’s better suited to the needs of management in terms of need of knowledge of cost behavior under various operating conditions. Since fixed cost is more or less uncontrollable and variable cost is generally controllable, the management is more concerned with marginal costs than full cost. Marginal costing is simple to operate because it avoids the complexities of apportionment of fixed costs which is really arbitrary.

Marginal Cost Operating Statement

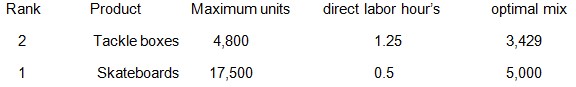

Product mix

When a company manufactures more than one product, a problem often occurs as to which product mix yield the highest profits.The cost-profit relation of different products will would vary depending upon the structure and composition of cost elements and sales price. The product that gives highest profits should be retained and its production increased. The production of products with low contribution margin should be reduced drastically. Marginal costing helps management in taking decisions to continue, increase, reduce or suspend production of a product or to change the product mix. The appropriate product mix is the one with the highest contribution margin.

Product mix decision

- Amount of skateboards manufactured=5,000.

- Amount of tackle boxes manufactured=3,429.

- Amount of tackle boxes purchased 60% of 12,000=7,200.

References

Jackson, S.R, Sawyers, B.R. (2008). Managerial Accounting: A focus on Ethical Decision Making.

Kimmel, D, P, Kieso, E.D. (2008). Accounting. New York: NY, John Wiley and Sons.

Kimmel, D.P, Weygandt, J, J. (2009). Managerial Accounting: Tools for Business Decision Making.