Summary

Primitive Energy entered into a contract to sell gas at a constant price. The company is faced with the challenge of selecting the most appropriate drilling option. The two possible options are vertical and horizontal drilling. In the analysis, the NPV criterion is used to compare the two drilling options. Based on this criterion, horizontal drilling is selected because it has a higher NPV value than vertical drilling. Before, settling on horizontal drilling, other indicators should be used to analyze the two options. Also, other factors such as initial costs, number of years for the well, and NPV generated per year.

Methodology

The net present value (NPV) criterion is used to evaluate the viability of vertical and horizontal drilling. The calculation of NPV follows distinctive steps. The steps are summarized below.

- The first step is to estimate the earnings before interest, taxes, and amortization (EBITA). This is the difference between revenue and expenses.

- The second step is to calculate depreciation. The depreciation rate, in this case, will be the quotient of production per year and total production.

- This step entails calculating the royalties. The state royalties are 10% of the difference between revenue and allowed extraction costs.

- The fourth step entails calculating earnings before interest and tax (EBIT). It is the difference between EBITA and the sum of depreciation and royalties.

- This step entails calculating net operating profit after taxes (NOPAT). This is the difference between EBITA and taxes.

- The cash flow from operations is calculated at this point. This is the sum of NOPAT and depreciation.

- The net cash flow is calculated at this point. it is the difference between cash flow from operations and capital expenditure.

- This step entails calculating the NPV for each year. This is arrived at by multiplying the CFt and discount factor.

- The final step is calculating the total NPV. This is the sum of NPV for each year.

Recommendation

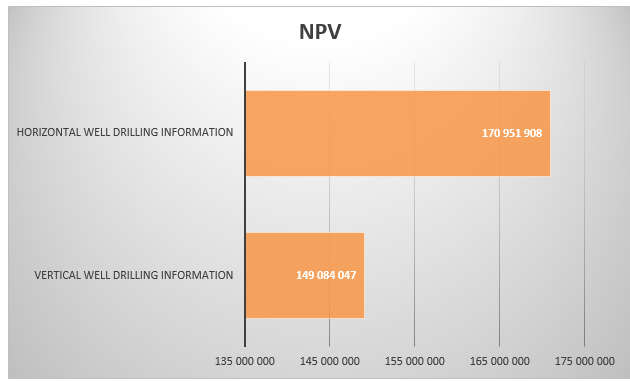

Based on this criterion, the decision is made by comparing the NPV value of each option. A positive and higher NPV value is preferred because it shows that the project will be profitable. Based on the calculations in the excel file, the NPV for vertical oil drilling is $149,084,047 while the NPV for horizontal good drilling amounts to $170,951,908. The results are displayed in the graph below.

The results and the graph above clearly show that horizontal well drilling generates a higher NPV value than vertical good drilling. Therefore, based on this criterion, Primitive Energy should select the horizontal well drilling.

Limitations

The recommendation made above is based on only one criterion. This criterion has several shortcomings. The first major drawback of NPV is that it is highly sensitive to changes in the discount rate. An increase or a decrease in the rate can significantly affect the NPV. The future cash flows are also difficult to estimate with accuracy. Thirdly, this criterion ignores the opportunity costs associated with a specific decision made.

Due to these limitations, the NPV criterion cannot be used alone. It is important to use a variety of capital investment criteria to evaluate the two options. Some of the other techniques that can be used are internal rate of return, accounting rate of return, the payback period, modified internal rate of return, discounted payback period, and other vital indicators that relate to the production and sale of oil. Also, other factors need to be taken into account when analyzing these two options.

For instance, it is important to compare the initial investment cost. The initial investment cost for vertical good drilling ($300,000,000) is higher than that of horizontal good drilling ($250,000,000). This higher cost, partly explains why vertical good drilling has a lower NPV value. The second factor is the difference in the number of years between the two wells. In the calculations, the vertical well is expected to last for 14 years while horizontal well will last for 21 years.

This also partly explains the difference in NPV. Another factor to consider is the NPV generated per year. Vertical drilling has a higher NPV per year than horizontal drilling. This can be an indication that is more profitable than horizontal drilling.