Introduction to forecasting

Forecasting could be defined as the method of formulating estimations of future events by managers (Armstrong, 2001). Forecasting helps managers determine future outcomes of events, and assist in the decision-making process. The data used in making forecasts immensely assists managers in accurately predicting outcomes of future events. In business, risk and uncertainty form the basis for applying forecasting in decision-making. Manufacturing companies apply the forecasting methods in planning for customer demand. Decisions made following forecasts immensely rely on available data from company databases. While forecasting continues to be significantly utilized in decision-making, modern times have seen the utilization of forecasting in predicting conflict development.

Critics of forecasting methods, discourage the application of forecasting methods in trying to determine future outcomes. Majority of the methods continue to be faulted as lacking accuracy. Inaccurate forecasts could immensely affect the performance of companies. Decisions made on wrong forecasts could bring catastrophic results to the performance of a company (Taylor, 2010). Confusion occurs occasionally relating forecasting to planning. Planning seeks to establish desired future status of a company. Forecasting, however, focuses on determining how things might be in the future. Managers, however, utilize forecasting when making future plans. Forecasting assists in formulating effective future plans in companies.

Numerous forecasting methods assist decision makers in preparing forecasts. Operations within companies need accurate forecasting to determine outcomes. The various methods commonly utilized fall in different categories. The categories of forecasting methods could be enumerated as indicated below.

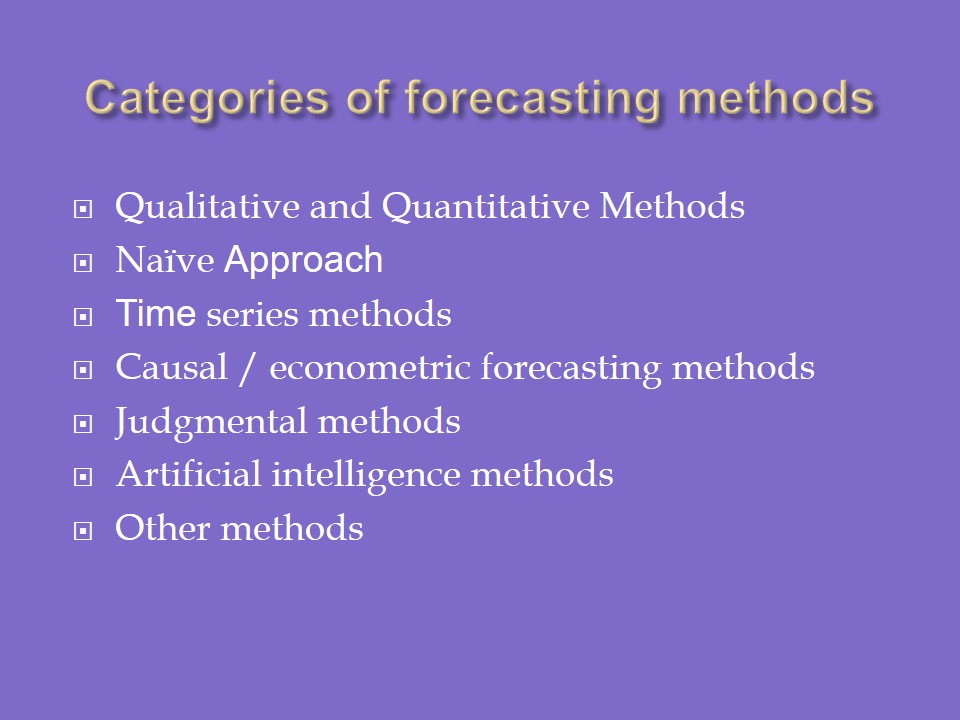

Categories of forecasting methods

- Qualitative and Quantitative Methods;

- Naïve Approach;

- Time series methods;

- Causal / econometric forecasting methods;

- Judgmental methods;

- Artificial intelligence methods;

- Other methods.

Qualitative and quantitative methods

Qualitative methods

Qualitative methods provide information regarding forecasts based on observatory measures. The forecasts continue to be excessively utilized in situations lacking previous data regarding the forecasts. This method could be termed as subjective in terms of forecasting. Lacking basic information, the forecasts provided by the method offer a subjective view of the forecasted element. The method presents a realistic informatory channels resulting from subjectivity. Opinions presented by the data result from informed analysis of situations affecting the forecasted element. The forecasts provided do not relate to any previous data. The method could, therefore, be said to be independent of external influence. Long term decisions can be made relying on the forecasting provided by qualitative methods. The methods follow data collected relating to factors that may influence the element under forecast. Examples of some qualitative methods include;

- market research;

- historical life-cycle analogy;

- Informed opinion and judgment.

Quantitative methods

As opposed to qualitative methods, quantitative methods provide predictions based of available data. The forecasts in this method become functions of the previous data. This method can only be used where past data can be availed. Basing predictions on past data, the methods make the major assumption that all factors affecting the outcomes remain constant. Under such circumstances, the accuracy of the methods cannot be questioned. In practice, however, factors keep on changing. Quantitative methods, therefore, might present significantly erroneous predictions (Hoshmand, 2010). The methods become utilized only in making short term decision because of the high probability of other factors changing in long-term situations. Application of these methods in long term decisions could be affected by changes assumed to remain constant. Examples of some commonly used quantitative methods include;

- Last period demand;

- Simple Moving Average (N-Period);

- Simple Exponential Smoothing.

Naïve Approach

This approach might relate to the quantitative methods because of the utilization of past data. The naïve approach, however, only focuses on data immediately before the forecasting period. Stability of external factors favors application of this method in making forecasts. The approach assumes no significant change could be realized within two adjacent periods. While the method also makes critical assumptions, the relationship of two adjacent periods could not include significant differences. The approach factually identifies the predicted value for any period as equaling the actual value for the previous period (Rescher, 1998). While adjacent period might not contain significant differences, organizational changes might affect the predicted results negatively. Changes in operations could render forecasts made using this method utterly erroneous. Practically, forecasts made using this method always seek to be improved by other methods for accuracy. The method, therefore, forms the base for making forecasts using other, available methods.

Time series methods

Time series methods immensely utilize historical data in providing estimations. The future outcomes predicted in these methods rely on calculations obtained from available data. These methods mostly utilize averages for historical data (Armstrong, 2001). While other methods seem easy to establish values, the time series methods include several calculations before arriving at any figures. Historical data for basing the calculations also needs to be availed in time series methods. Scientists and economists favor these methods due to the inclusion of calculations at arriving to figures. Some examples of time series method used include the following.

- Autoregressive integrated moving average (ARIMA);

- Weighted moving average;

- Growth curve.

Causal / econometric forecasting methods

Causal/econometric forecasting methods try to integrate the various elements affecting the variable under prediction. These methods incorporate other factors thought to significantly affect the outcomes of the variable under prediction. Consideration of such factors makes these methods seem appropriate, and more accurate than the rest. While other methods assume the impact of external factors, econometric forecasts provide an assessment of the possible impact of external factors. The methods consider relationships between variables affecting each other (Ellis, 2008). Consideration of external factors immensely improves the credibility of forecasts made using this method. When using these methods of forecasting, emphasis ought to be made on the credibility of the initial information used in making the calculations. Relying on data from another forecast could provide inconclusive results. Examples of methods used in this category include;

- Regression analysis;

- Autoregressive moving average with exogenous inputs (ARMAX).

Judgmental methods

These forecasting methods present subjective predictions based on personal judgments of situations. Managers assess situations, and consider opinions in coming up with figures using judgmental methods. The methods provide forecasts based on data collected from sources related to the variable under forecast (Hoshmand, 2010). The methods could be closely associated with qualitative methods owing to their subjectivity of variables. The forecasts presented are based on personal observations by the decision makers. The methods might focus on current affairs within an industry, and not a company (Taylor, 2010). The subjectivity of the forecasts helps in providing forecasts based on factors and trends within an industry. The methods present a widened decision-making scope for managers. Some examples of these methods include:

- Surveys;

- Technology forecasting.

Artificial intelligence methods

These methods heavily rely on the ability of individuals to analyze situations. These methods provide very personalized ways of forecasting. Each person makes forecasts based on personal beliefs and attributes. While these methods might utilize available data concerning a variable, interpretation of the data lies purely on the person making the decision (Rescher, 1998). The person producing the forecast remains at liberty to provide a forecast based on personal understanding. The independence of these forecasting methods means they produce totally different forecasts on similar variables. Stereotypes could immensely affect the accuracy of the results presented using these methods (Armstrong, 2001). The possibility of considering numerous factors affecting the variable, however, could enhance the accuracy of the results significantly. Examples of methods within this category include:

- Group method of data handling.

- Artificial neural networks.

Other methods

These could be identified as forecasting methods not clearly attached to any of the above categories. These methods include the use of random selection methods of forecasting. Several of these independent methods combine aspects several forecasting methods in determining their own forecasts (Rescher, 1998). A combination of several methods produces unique results. Some of these methods also rely on reference from forecasts presented by other data forecasting methods. Reference class forecasting, for example, looks at outcomes of previous similar situations (Menard, 2008). The problem with such method of forecasting comes in the limit to use the method. When difficult situations occur, it might be difficult to establish a situation when similar occurrence happened. These methods could provide highly accurate forecasts based on the similarity of the situations under comparison. Other methods classified under this category are;

- Simulation;

- Prediction market;

- Probabilistic forecasting and Ensemble forecasting.

References

Armstrong, J. (2001). Principles of forecasting: a handbook for researchers and practitioners. Norwell, Massachusetts: Kluwer Academic Publishers.

Ellis, K. (2008). Production Planning and Inventory Control Virginia Tech. New York: McGraw Hill.

Hoshmand, A. (2010). Business Forecasting: A Practical Approach (2nd Ed.). New York: Routledge.

Menard, S. (2008). Handbook of longitudinal research: design, measurement, and analysis. London: Elsevier Inc.

Rescher, N. (1998). Predicting the future: an introduction to the theory of forecasting. New York: State University of New York Press.

Taylor, B. (2010). Introduction to management science (10th ed.). Upper Saddle River, NJ: Pearson/Prentice Hall.