Abstract

Through the production of harmful gases like methane and Carbon IV Oxide, the oil and gas sector has been listed as the major cause of global pollution and how corporate governance and leadership of organizations affect their sustainability practices and plans. For these reasons, it is essential for business and economics scholars and professionals to examine oil and gas companies’ sustainable leadership and corporate governance. The research will be essential in establishing how these organizations’ current corporate governance strategies affect their commitment to zero-emission, pollution, and climate change goals. It is also necessary to assess the benefits and weaknesses of the current corporate governance approaches used by oil and gas companies to achieve sustainability goals and be responsible corporate citizens. Moreover, scholars and business managers, as the audience of the report, will understand the recommended and proposed changes that oil and gas firms can implement to reduce their carbon footprints.

The primary aim of the research is to examine gaps or weaknesses in the current corporate governance strategies of the top 5 oil and gas companies. The research assesses how corporate governance approaches of ConocoPhillips, Exxon Mobil, TotalEnergies, Corporation Chevron Corporation, and Shell plc impact their abilities to meet emission goals. In this case, through a systemic review of the literature published between 2017 and 2022, the study developed advantages of current corporate governance approaches of these companies, including ways of improving them to meet their long- and short-term commitments to climate change goals. The systemic review method also presented challenges that might hinder these companies from effectively implementing the proposed changes on their corporate leadership to reduce their organizational and sectoral carbon footprints. Finally, the systemic review of the proposal recommended solutions to enhance the viability of the proposed changes in the corporate governance practices of the major oil-and-gas-producing companies to reduce their carbon emission and better environmental health and safety.

Introduction

Alnuaim, S. (2019) believed the world could not handle the climate crisis without the oil and gas industry’s involvement and engagement. Exxon Mobil Corporation (XOM), Chevron Corporation (CVX), Shell plc. (SHEL), Total Energies (TTE), and ConocoPhillips (COP) are among the world’s top 5 oil and gas-producing companies based on their market values. The Yahoo Finance (2022) report indicates that market caps for XOM, CVX, SHEL, TTE, and COP are $ 431.66B, $ 336.84B, $ 202.04B, $ 153.71B, and $ 145.37B (Omri & Hadj, 2020). Therefore, the research will assess how corporate values, regulations, policies, leadership, practices, alignments, and systems impact their sustainability practices to reduce carbon emissions (Safdar et al., 2022). The strategic value of sustainable corporate governance among leading oil and gas producers includes reducing negative environmental impacts such as pollution and climate change. Another prerequisite for long-term Sustainability for oil and gas firms is a tighter relationship with local population development (Ben-Naecur, 2019).

Background

Macro-industry factors and external business circumstances promote poor corporate governance and sustainable practices in the oil and gas industry. According to Ahmad et al. (2018), external forces such as economic stability, stakeholder demands, and market competition affect carbon-reducing strategies in the industry. In addition, political stability, energy transition, and industry regulations also impact corporate governance strategies for the oil and gas industry, aiming to reduce carbon emissions (Ahmad et al., 2018). For instance, stakeholder pressure to maximize returns, sales, and revenues make oil and gas companies engage in unsustainable business practices with high carbon emission (Udemba, 2020; Li et al., 2020; Hanein et al., 2018; Rafiee and Khalilpour, 2019; Kätelhön et al., 2019; Raut et al., 2018; Sadik-Zada and Gatto, 2021; Basile et al., 2021; Mishra et al., 2017; Daneeva et al., 2020). In addition, extreme competition, increasing oil and gas demand, and poor corporate socially responsible (CSR) policies make companies have improper corporate governance strategies to reduce their carbon emissions.

The poor corporate governance and carbon-reducing practices of oil and gas firms globally have negative health, economic, financial, and environmental impacts. For instance, Farooq et al. (2019) demonstrate that improper carbon emission control measures increase health risks for living components of the environment. Secinaro et al. (2020) also indicate that globally, the lack of practical control measures for carbon emission in the oil and gas industry exposes the world to detrimental economic effects.

Objectives

- To establish the weaknesses in current corporate governance strategies of reducing carbon emissions for XOM, CVX, SHEL, TTE, and COP.

- To assess the advantages of current corporate governance practices to reduce carbon footprints for SHEL, TTE, COP, XOM, and CVX.

- To propose the viability/practicability and ways of improving the current corporate governance practices to reduce carbon footprints for CVX, SHEL, XOM, TTE, and COP.

- To examine and demonstrate the challenges that may prevent the effective implementation of new corporate governance strategies for reducing carbon emissions for COP, CVX, SHEL, TTE, and XOM.

Influential Theories

Figure 1 shows that the carbon footprint theory is among the influential theoretical frameworks guiding the research proposal of controlling emissions for CVX, SHEL, XOM, TTE, and COP. The model entails assessing the greenhouse gases contribution or the amount that the identified companies produce in the oil and gas market (e Cunha et al., 2021; Sama et al., 2022). The data will be key in identifying the companies that significantly contribute to carbon emissions in the oil and gas sector (Griffin and Heede, 2017; O’Reilly Media, Inc., n.d.). The collected data will also contribute to research about increasing pollution and climate change resulting from the oil and gas industry.

Method of Analysis

The research scope includes deciphering strengths and weaknesses in the current corporate governance strategies that support XOM, CVX, SHEL, TTE, and COP in reducing carbon emissions. This will also include proposing reforms and improvements in current corporate governance policies of the top 5 oil and gas companies to enhance their ability to meet industry carbon emission, pollution, and climate change goals. Finally, conducting viability tests to establish the strengths and hindrances of proposed corporate governance reforms of COP, CVX, SHEL, TTE, and XOM to reduce their emission will be part of the proposal scope. The search process involved establishing the search terms used in searching literature sources to answer the research questions. Currency, relevance, authority, accuracy, and purpose (CRAAP) analysis or model will guide the research sources’ evaluation.

The search and systemic review will define corporate governance and related oil and gas sector theories. The section will also analyze the importance of sustainable corporate governance and commitment towards policy changes to enhance sustainability practices in the business world. Through the doughnut economic model (DEM), the systemic review will graphically show how sustainable corporate governance impacts companies’ leadership, social activities, and the environment. The thematic analysis will be used in the systemic review to examine the information in the studied literature.

Evidence and Data

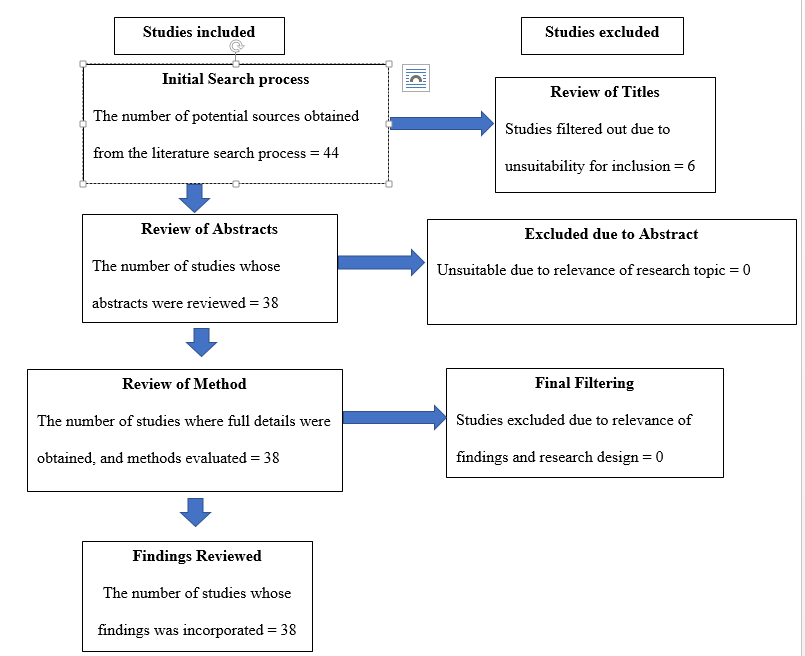

The current corporate governance strategies for top oil and gas companies have challenges, gaps, and drawbacks that the research will explore. The exploration will pave the way to identifying the strength and opportunities of improving the corporate governance approaches used by these companies to reduce carbon emissions. In addition, the data will demonstrate the recommendations for improving the leadership of major oil and gas companies for the best interest of stakeholders, improving profitability, and reducing their contribution to global warming. Using over 44 sources, databases, and search terms, the study or report will incorporate and analyze qualitative data to answer the research questions. Through thematic analysis of the 38 credible and reliable sources, the report will establish the strengths and weaknesses in the current corporate governance strategies of 5 oil and gas companies. The articles will also provide reliable qualitative data about the best changes these firms can incorporate in their leadership and corporate governance to control their emission and pollution contributions.

Literature Review

Sustainability needs economic, social, and environmental foundations (Naciti, 2019). Sustainable corporate governance in the oil and gas business involves values-based leadership and policies to accomplish long-term and short-term economic objectives. Oil and gas firms know that business models, lines, products, and services affect stakeholders’ social and economic well-being. These firms conduct responsible, sustainable social-economic operations to reduce environmental consequences. Corporate governance policies preserve the environment, society, and economy for stakeholders (Naciti, 2019). Events must balance commercial, social, and environmental concerns for the present and future generations.

Identification and Definition of the Corporate Governance Theories

Corporate governance monitors corporate and government operations, culture, traditions, strategies, policies, and practices and balances stakeholders’ social, economic, and financial incentives (Liu et al., 2018). In addition, corporate governance establishes policies and objectives to increase Sustainability (Solomon, 2020). Furthermore, finally, corporate governance monitors company and government operations, culture, customs, strategies, policies, and business practices. Laws and regulations, including modifications, are also included (Du Plessis, Hargovan, and Harris, 2018).

The Need for Sustainable Corporate Governance and Practices in the Oil and Gas Sector

Sustainable corporate governance reduces the morality of breaching environmental regulations. These rules limit oil and gas industries’ emissions and pollution (Jagoda and Wojcik, 2019). Jacobson et al. (2019) found that oil industry stakeholders face health hazards from carbon emissions (Zhu et al., 2018; Springmann et al., 2017). The emissions also contribute to environmental pollution, climate change, and ecosystem degradation that may lead to skin and respiratory issues and water and food instabilities.

Sustainable corporate governance and business strategies decrease greenwashing within and outside markets. According to Yu, Van Luu, and Chen (2020), firms help sustainable development by limiting greenwashing. Leaders promote honest, accurate, and trustworthy environmental, social, and governance (ESG) reporting via effective and sustainable corporate governance (Yu et al., 2020). Khatun et al. (2017) show that sustainable leadership and practices provide green, clean palm oil fuels. The idea reduces emissions, pollution, and climate change in the oil and gas industry, boosting global Sustainability.

Conceptual and Theoretical Frameworks

Triple Bottom Line Theory

The triple bottom line (TBL) theoretical framework examines the value of a company from economic, social, and environmental perspectives. TBL reporting differs from traditional SEG reporting, which assigns values to financial and economic factors that define business operations’ success.

Implementation

The triple-bottom-line theoretical framework requires oil and gas companies to use the “three Ps or profit, people, and planet” principle to guide their emission-controlling practices, leadership, and corporate restructuring to meet stockholder needs (Miller, 2020). The model helps firms implement emission control policies without compromising their profits or financial success and supports organizations in managing their carbon footprint by considering the interests of stakeholders and stockholders.

Diagram 1 depicts that macro-industry factors are the primary implementation challenges for the triple bottom line theory in the oil and gas sector. Industry competition and profit-oriented business strategies prevent oil and gas companies from having excellent solutions for carbon emissions (Gao et al., 2021). Therefore, to overcome the outlined implementation obstacles, one will need to change the corporate value system, code of ethics, and company philosophies, in general.

Finally, one must acknowledge the fact that a large number of developing countries are involved in the oil and gas industry. In the specified countries, alignment with environmental policies and concerns for the ecosystem is not the top priority to pursue; instead, in the specified setting, financial gains and economic success are prioritized (Zhu and Li, 2017). The described situation stems not from the lack of moral fabric among the target populations but from the absence of vital resources.

Frameworks for Corporate Governance and Sustainability

Carbon Footprint Theory

The carbon footprint hypothesis values a corporation by its environmental impact. Greenhouse gases like carbon IV Oxide and carbon II Oxide harm the environment and cause climate change. The idea helps corporations understand their main pollution sources. Production, consumption, and transportation may release greenhouse gases (Cheng and Liang, 2021).

Implementation Process

The carbon footprint theory requires oil and gas companies to monitor and control the emissions they produce to the environment. The theory’s implementation for oil and gas firms entails tracking and publishing emission data for stockholders and stakeholders. The carbon emission data from SEC (nd) implies that XOM and competing companies in the industry, such as Total Energies, are accountable for their emissions (Becker et al., 2020). The companies’ accountability is key in enhancing their commitment to reducing carbon emissions in future decades and introducing a carbon intensity assessment approach. According to Masnadi et al. (2018), the carbon intensity model will allow oil and gas companies to measure the amount of emission they produce when generating different units of electricity for business operations.

Obstacles

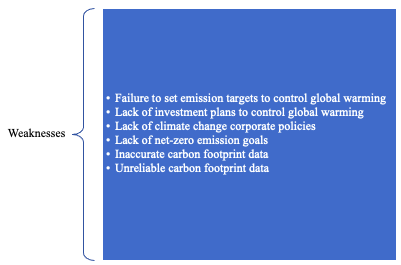

Diagram 2 demonstrates that the primary weakness of implementing the carbon footprint theory is the failure of firms to set emission targets and investment plans to control global warming (U.S. Securities and Exchange Commission (SEC), n.d.). The SEC (n.d.) reports that firms such as Exxon Mobil Corporation have failed to align corporate policies to reduce climate change. Therefore, these companies may publish underestimated or overstated data on the carbon gases they produce for the environment (Cooper et al., 2022). The inaccurate carbon footprint data will hinder effective resource planning and strategy implementation to reduce future emissions for these firms.

Sociological Theory

The sociological theoretical framework values a corporation based on its influence on a community’s social processes. The notion suggests that business governance and operations affect a community’s social welfare and activity. Thus, corporate executives must balance power, policy, and societal requirements to flourish and survive. Sustainable business practices win community acceptability and legitimacy, according to the premise.

Implementation

Implementing the sociological theory requires managers in the oil and gas sector to switch to clean energy production and use policies to enhance their Sustainability and corporate citizenship. According to Dincer and Acar (2018), oil and gas companies can implement smart energy solutions to reduce their carbon footprints. These organizations will fulfil emission objectives and improve profitability and brand image via behavioural adjustments.

Obstacles

Diagram 3 illustrates that the challenge that prevents the implementation of sociological corporate governance theory in the oil and gas sector is the centralized and top-down leadership structure and model. For instance, Ramon (2022) indicates that Chevron Corporation has a centralized leadership structure mainly controlled by executive managers. These top-level managers lead branches and create and implement sustainability policies. The structure hinders faster, inclusive, shared, collaborative, and consensus-based decision-making regarding carbon emissions in the oil and gas sector.

Stewardship Theory

The stewardship theoretical framework assesses the value of corporate firms based on how managers and leaders dedicate themselves to effectively serving the stakeholders and community. The theory requires corporate leaders to implement policies with selfless goals to meet the current needs of society. Thus, corporate leaders should involve community representatives who advocate for the needs of external stakeholders when implementing policies to promote environmental Sustainability.

Implementation

Diagram 4 shows that oil and gas business managers must behave responsibly while formulating and executing policies. The stewardship idea mandates supply chain changes and optimization to reduce carbon emissions for top oil and gas businesses. Kolaczkowski et al. (2021) advise oil and gas corporations to work with supply chain stakeholders to decrease emissions. The actions will strengthen the company’s commitment to zero-carbon supply chains and manufacturing (Singh, 2022). The approach follows stewardship and stakeholder frameworks by requiring oil and gas company management to include shareholders and stakeholders in corporate changes.

Obstacles

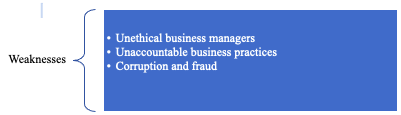

The corporate governance challenge of oil and gas firms relating to this theory includes irresponsible, unaccountable, dishonest, and unethical managers and leadership practices. For instance, Singh’s (2022) Yahoo Finance report indicates that XOM, CVX, and COP managers frequently practice taxation and accounting frauds, misleading investors and external stakeholders. Therefore, the unaccountable and irresponsible behaviours of managers in oil and gas firms prevent these organizations from controlling their carbon footprints.

Stakeholder Theory

The stakeholder theory examines the value of a company based on how it benefits the internal and external stakeholders. In this case, the theory insists on corporate leaders implementing policies that benefit the stakeholder equally. Therefore, the primary principle of the stakeholder theory requires corporate managers to treat stakeholders equally when considering their long and short-term needs during policy implementation. In this sense, corporate leaders should strive to develop positive relationships between stakeholders by engaging in sustainable leadership practices and business operations.

Implementation

Diagram 5 shows the importance of valuing stakeholders and stockholders, and implementing stakeholder theory may include introducing technological solutions to reduce carbon emissions. Corporate leaders of these oil and gas companies should increase funding or budget provision for technological reforms that support carbon footprint tracking, reconciliation, and reporting to stakeholders (Cooper et al., 2022). The solution will also make the companies accountable for violating emission regulations like those implemented in the global Paris Agreement.

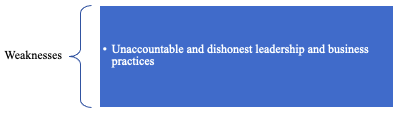

Obstacles

The corporate governance challenge related to this theory in the oil and gas industry also includes dishonesty and unaccountable managerial and leadership practices. For instance, Wamsley (2019) reports that managers in oil and gas firms such as XOM mislead stockholders and stakeholders about the company’s and competitors’ emission goals, data, and climate change effects.

Overall Obstacles for Implementing Carbon Footprint, Sociological, Stakeholder, Stewardship, and Triple Bottom Line Theories to Reduce Emissions

Ethics impede oil and gas companies from embracing stewardship, carbon footprint, sociological, triple bottom line, and stakeholder theories. Singh (2022) illustrates that oil and gas companies breach carbon emission tariffs. Budgetary, financial, and economic restrictions prohibit oil and gas companies from applying TBL, stewardship, sociological, stakeholder, and carbon footprint theories. Non-conventional fuel and energy are costly for these enterprises (Yu et al., 2021; Caineng et al., 2021). These restrictions prevent corporations from lowering emissions via legislation, conduct, and technology.

Finally, macro-business factors hamper sociological, stakeholder, TBL, carbon footprint, and stewardship theories in corporate leadership and governance. Ahmad et al. (2018) imply that intense oil and gas market competition leads company executives to unsustainable and unaccountable activities. Thus, oil and gas micro-business factors push management to prioritize cash earnings, brand equity, and other observable business values above social, economic, and environmental considerations.

Impacts of Sustainability and Corporate Governance on the Environment, Social, and Governance Framework (Doughnut Economy Model)

Sustainability and corporate governance impact the environment under the doughnut economic model. Ravindra, Singh, and Mor (2019) state that eco-friendly corporate strategies minimize emissions and pollutants. The technique reduces climate change and pollution to improve air, water, soil, and other natural resources. Diagram 10, from Doughnut Economics Action Lab (2022), shows that Sustainability protects biodiversity in the natural ecosystem. Sustainability techniques help protect natural resources from unfavourable human, industrial, and economic activity.

Doughnut model sustainability and corporate governance impact society. Doughnut Economics Action Lab (2022) Diagram 10 illustrates that sustainable business techniques increase social justice and productivity. In addition, sustainable business practices enhance access to housing, food, water, electricity, and other social well-being resources. Thus, sustainability rules for oil and gas businesses will boost stakeholder access to environmental and social benefits regardless of demographics and backgrounds.

According to the literature study, the carbon footprint, the triple bottom line, stakeholder, and stewardship theories contribute to sustainable corporate governance. The theories also relate to suggested corporate governance reforms to reduce carbon emissions (Ramon, 2022; Ahmad et al., 2018; SEC, n.d; Singh, 2022). The literature assessment lists net zero commitments, inaccurate carbon footprint reporting, external and macro-industry influences, centralized leadership, and unaccountable leadership as obstacles to using corporate governance theories to reduce emissions (Total Energies, n.d; Ramon, 2022; Exxon Mobil Corporation, 2022).

Method of Data Collection, Data Analysis, and Findings

Scholarly data on the top 5 oil and gas corporations’ corporate governance practices that cut carbon emissions will be examined. Chapter 3 will analyze various companies’ sustainability practices. The data and sources will also show why these corporations require new or improved corporate governance structures to accomplish their climate change and emission goals.

The methodology section will explain why the research employed a systemic review design. It will list the number of searches, outcomes, and inclusion and exclusion criteria for systemic review resources (Dekkers et al., 2021).

Table 1: Systematic Literature Review

This study will incorporate a systemic review to summarize data from primary sources regarding corporate governance approaches to reducing carbon emissions in the oil and gas sector.

The 7 Stages of the Systemic Literature Review

The scope of the research is to meet the 4 established objectives in Chapter 1 or the introductory section of the report. Therefore, the research scope will include assessing and demonstrating the disadvantages or impracticability of the current corporate governance models used by Exxon Mobil, Corporation Chevron Corporation, and Shell plc., among other firms, to reduce their carbon footprint. The study’s scope will also include deciphering the strengths of the corporate governance strategies that SHEL, TTE, COP, XOM, and CVX currently implement to meet their emission, climate change, and pollution goals. Moreover, the scope of the research will include recommending appropriate corporate governance reforms for the identified top 5 oil and gas producers and sellers globally. Finally, the focus of the research will be assessing the challenges COP, CVX, SHEL, TTE, and XOM would face when implementing the proposed reforms on their corporate governance to reduce their greenhouse emissions. The data will be primarily qualitative due to the focus of the study.

Search Process

Table 1: The search terms, period of gathered evidence, period of the conducted research, search engines, and databases accessed

Table 1 shows that the available databases have been studied and examined profusely. Specifically, these databases were utilized to locate the necessary resources to provide the needed information. The broad extent of search databases and the large number of search terms utilized in the process have helped locate the essential information. Furthermore, restricting the publication date to the range of 2017-2022 has helped obtain the latest research on the issue at hand.

Table 2: The search terms, search period, databases, and number of sources retrieved

As Table 2 above indicates, the search was overall successful. Specifically, several major sources were identified in the process as the main repository for obtaining core information regarding managing the carbon footprint in the oil and gas industry. Admittedly, the range of sources that each database has provided is quite scarce, with one source per database being the maximum number. However, the specified outcome indicates that only the most suitable and relevant studies have been selected, further increasing research accuracy and efficacy.

Evaluation of Quality

The CRAAP model guided the evaluation of the quality of sources included in the systemic literature review. The model helped assess the quality of the reviewed sources based on currency, relevance, authority, accuracy, and purpose criteria (Elhegazy, 2022). Concerning the currency of the sources, the review only included research articles published between 2017 and 2022. Therefore, the systemic literature review excluded any resource with information gathered earlier than 2017. The review included sources published after 2017 since they have updated information about corporate governance and carbon emission control in the oil and gas sector.

The review also included sources with information that is relevant to the research topic. For instance, the review included 38 sources with data that directly examine the advantages and disadvantages of current corporate governance approaches of Total Energies, ConocoPhillips, Exxon Mobil, Corporation Chevron Corporation, and Shell plc. Because the information in the 38 sources targeted post-graduate and graduate-level audiences or scholars, the references were relevant in addressing the research topic.

The CRAAP model also helped evaluate the authority of the sources gathered for the systemic literature review. In this criterion, the review only included sources published by well-recognized learning, research, corporate, and government institutions (Rybnicek & Königsgruber,2019). The study included sources published, owned, and affiliated with institutions such as Yahoo Finance, SEC, and World Economic Forum (Jianu et al. 2020). The systemic review of the literature also included sources with the authors’ education, work experiences, and institutional are accessible.

The reliability and accuracy of the information in the sources also helped in evaluating their quality before inclusion in the systemic review. In this case, the research included sources whose information can be verified from other substantial numbers of credible references. The criteria included comparing the information in the source with the data in references used as citations for the documents. In this criterion, the research included sources with no spelling mistakes and appropriate language that suits corporate, graduate, and post-graduate audiences. Finally, the researchers gathered data from sources with unbiased language, tone, or information while addressing the research question.

The final measure of the quality of the literature reviewed included the examination of their purpose in addressing the research topic. In this case, the research involved sources with more information that address the research topic without biases. The research included sources with no propaganda, disinformation, or religious-political-institutional-gender-or-cultural biases. Finally, the review included sources whose authors intended to educate and empower but not to persuade the audience to believe in the published data.

List of Sources

Summary

In summary, the systemic literature review involved more than 3 search engines and 5 databases. The search engines for finding research literature include Yahoo Finance, Google, and Google Scholar. On the other hand, the databases that provided credible research sources include the Exxon Mobil Corporation, World Economic Forum, Reuters, Google Scholar, and Yahoo Finance (Breitmayer et al., 2019). Other databases used in finding scholarly and credible literature for review include those hosted and owned by Chevron.com, Harvard Business School, Shell Global, Total Energies, SEC, and NPR News. Therefore, using these search engines and databases allowed the researchers to review diverse sources with different perspectives about the research topic and questions.

The systemic literature review incorporated 38 credible sources. These include articles, reports, journals, and other scholarly information developed by the government, educational, and research institutions. Initially, the review gathered nearly 44 resources for data collection and analysis. Later, the research excluded 6 of these resources because of failing to answer the research questions relevantly. In order to identify the resources that were relevant in addressing the research topic and questions, search terms including carbon footprint, corporate governance, and triple bottom line theory, among others, were used. In this case, resources, search engines, and databases that failed to provide relevant information based on the search terms were excluded from the research. As a result, scholarly sources such as Jagoda and Wojcik, 2019, Jacobson et al. (2019), Zhu et al. (2018), Springmann et al. (2017), and Chuah et al. (2020), among others, merited to be used in the literature review.

Current Corporate Governance Strategies Used in Top 5 Oil and Gas Firms

The existing policies related to the issue of upholding environmentally rational principles in the context of the oil and gas industry are quite numerous, yet ensuring that organizations align with the policies in question and controlling the implementation thereof represented a significant challenge. Specifically, in the U.S. context, three core regulations define the choice of frameworks for oil and gas mining (United States Environmental Protection Agency, n.d.). These are the Clean Air Act of 1963, with the following amendments added in 1990. The Clean Water Act of 1973 sets the principles for preventing water pollution, particularly the contamination of groundwater, and the Safe Drinking Water Act of 1974, serves as the extension of the teh1973 regulation (United States Environmental Protection Agency, n.d.). The specified standards allow for containing the extent of harm that fracking and the related activities required for oil drilling produce on the environment. The specified policies define the need for top leadership at XOM, CVX, SHEL, TTE, and COP to maintain environmentally safe standards and prevent harm associated with oil drilling from occurring. Currently, the XOM, CVX, SHEL, TTE, and COP track and publish emission data for stockholders and stakeholders. Moreover, these firms publish net zero goals, dedication, and commitment to net-zero goals and structure their leadership to sustain accountable and sustainable corporate governance. According to SEC (n.d), firms such as XOM projects their emissions as 11,801 million metric tons between 2021 and 2050.

In turn, the sustainability performance rates within the specified organizations indicate that while being admittedly efficient, the policies described above could use some improvements. Specifically, the issue of control over the choice of oil drilling approaches should be addressed first (SEC, n.d.). Indeed, the current situation represents an obvious failure to ensure that environmentally safe standards are applied homogenously across all oil drilling sites (SEC, n.d.). Specifically, control tools for ensuring that efforts to minimize harm to the ecosystem are applied thoroughly must be introduced into the present oil and gas context (Wanasinghe et al., 2020). Digital twin for the oil and gas industry: Overview, research trends, opportunities, and challenges. IEEE Access, 8, 104175-104197. Specifically, the sustainability targets associated with introducing cost-efficient methods of minimizing the carbon footprint have not been met, as recent reports indicate (SEC, n.d.). Therefore, appropriate leadership and governance strategies must be incorporated into the target environment to ensure that the core standards are met. Specifically, the Servant Leadership Model will have to be deployed since the specified framework allows for prioritizing the needs of key stakeholders while upholding core ethical standards (SEC, n.d.). Additionally, introducing the Transformational Leadership approach will be required to promote active change (SEC, n.d.). Finally, elements of the more rigid leadership frameworks will have to be incorporated to ensure tighter control over implementing the proposed change.

Gaps and Weaknesses in Current Sustainable Corporate Governance Approaches for Top 5 Oil and Gas Companies

The weaknesses and gaps in the current sustainable corporate governance models of XOM, CVX, SHEL, TTE, and COP include failure to set emission targets to control global warming and lack of investment plans to control global warming. Concerning the carbon footprint theory, these companies, including Exxon Mobil Corporation, lack climate change corporate policies and net-zero emission goals (SEC, n.d.). Other weaknesses in current corporate governance for these firms include unreliable and inaccurate carbon footprint data (Cooper et al., 2022; Ahmad et al., 2018). Concerning the triple bottom line theory, XOM, CVX, SHEL, TTE, and COP sustainability practices are inefficient because macro-industry factors such as competition hinder these companies from effectively implementing policies to reduce carbon emissions.

Based on the sociological theory, XOM, CVX, SHEL, TTE, and COP’s centralized and top-down leadership structure and model affect their sustainable corporate governance. Ramon (2022) indicates that Chevron’s top leadership creates and implements sustainability policies without including other stakeholders. Based on stewardship theory, unethical business managers, unaccountable business policies, and corruption affect these firms’ sustainable leadership styles. According to Singh (2022), XOM, CVX, and COP managers frequently practice taxation and accounting fraud, misleading investors and external stakeholders about sustainability reports. Concerning the stakeholder theory, the irresponsible, ethical, and unaccountable leadership in these firms hinder them from prioritizing environmental safety and the needs of external stakeholders.

Based on the triple bottom line, stewardship, and stakeholder theories, the top 5 oil and gas companies face ethical issues, budgetary and financial constraints, and profit-oriented business plans, goals, and practices as hindrances to sustainable corporate governance. For instance, these companies face financial issues when introducing green solutions, fuel, and technologies in their operations (Yu et al., 2021; Caineng et al., 2021; Wilberforce et al., 2019). These oil and gas producers also intensify industry competition with sellers regarding sales, revenues, and profitability (Ahmad et al., 2017). Thus, the top 5 oil and gas companies face economic, ethical, legal, and behavioral issues that make them compromise their sustainability practices and environmental safety.

Impact of the Present Sustainable Situation compared to a Greener Future

The current sustainable corporate governance approaches for XOM, CVX, SHEL, TTE, and COP help them meet their profitability and sustainability needs. Ramon (2022) and Exxon Mobil Corporation (2022) demonstrate that Chevron and Exxon Mobil Corporation changed their leadership structures to enhance profitability and reduce emissions (Boon 2019). For instance, Ramon (2022) shows that as of October 2022, the company has introduced a new executive committee to head the business development and sustainability plans. These changes help oil and gas companies, such as in value chain optimization, to enhance stakeholders’ and stockholders’ satisfaction, revenues, and sales, as well as reduce the impacts of their businesses on the environment.

How Oil and Gas Sustainable Corporate Governance Affects the Environment

The traditional, unaccountable, and unethical corporate governance strategies prevent top-5 oil and gas companies from meeting their emission, pollution, and sustainability goals. For instance, failure to track emission data compromises environmental health and safety (Crook et al.,2020). Similarly, lying to stakeholders about emission goals, impacts, and plans detrimentally affects the environment (Ahmad et al., 2018). These companies focus on enhancing profitability, shareholder value, and business image at the expense of environmental Sustainability, safety, and protection.

The Slow Improvement of Oil and Gas Sustainable Corporate Governance

The top oil and gas companies sustainability practices and corporate governance approaches are improving. The companies prioritize future generations’ environmental health, safety, and needs by implementing sustainable business practices and corporate governance strategies (Jan et al.,2019). The top 5 oil and gas companies are reforming their sustainability practices through behavioral changes (Tiron-Tudoret et al., 2019). For instance, Esan et al. (2022) note that companies such as Shell, Chevron, and Total encourage emission and environmental laws compliance through multidimensional policies and approaches. The managers of these firms also introduce weight management to control emissions from operations (Esan et al., 2022). Stakeholder training and education are also part of the new behavioral changes of corporate leaders in top oil and gas companies. XOM, CVX, SHEL, TTE, and COP leaders are empowering stakeholders about the risks of poor and unsustainable business practices. The leaders also educate stakeholders about the benefits of protecting environmental health and safety for future generations.

Based on the carbon footprint, stewardship, stakeholder, and triple-bottom-line theories of corporate governance, the top 5 oil and gas companies help stakeholders meet current and future needs and environmental expectations. For instance, Masnadi et al. (2018) show that XOM, CVX, SHEL, TTE, and COP are introducing carbon intensity assessment approaches in their business models. Shell Global (n.d.) indicates that Shell monitors the number of greenhouse gases it produces for every volume of gas and oil it sells. SEC (n.d.) illustrates that Shell and Chevron have zero-emission goals to reduce carbon emissions. These firms are also innovating technological solutions to enhance their sustainability practices. Cooper et al. (2022) indicate that methane detection and quantification technologies are evolving in the oil and gas industry. Kolaczkowski et al. (2021) indicate that firms in the oil and gas sector are introducing supply chain reforms that support environmental health and safety. Dinner and Acar (2018) demonstrate that XOM, CVX, SHEL, TTE, and COP are also implementing smart energy innovations to reduce emissions. These companies are also partnering with sustainable fuel sellers and producers Alt Air Fuels and SkyNRG to improve their commitment to emission goals (Gutiérrez-Antonio et al., 2017).

Conclusively, the systemic review involved articles published by well-recognized institutions and authors. These organizations include the U.S. Securities and Exchange Commission (SEC), world economic forum, yahoo finance, and google. In addition, the systemic review involved articles published between 2017 and 2022. The criteria helped the research only to use current information to answer the research questions and understand the topic of study (Almaiah et al., 2020). Therefore, all the articles published earlier than 2017 were excluded from the research review. In addition, the review involved nearly 38 articles in diversifying the type of information used to answer the research questions (Lüthge 2020). The 38 resources used contributed different and unique information necessary in addressing corporate governance issues and solutions to these problems for top oil and gas sellers worldwide.

Additionally, the methodology section illustrates the advantages and disadvantages of the current corporate governance practices to reduce carbon footprints for XOM, CVX, SHEL, TTE, and COP. The analysis section of chapter 3 also assessed the opportunities for reforming the current corporate governance strategies for top-performing sellers of oil and gas companies to enhance their suitability practices and meet emission and climate change goals. The analysis section of chapter 3 projects the success rate or viability of reformed and improved corporate governance solutions for reducing carbon emissions in the oil and gas sector. Finally, chapter 3’s analysis section establishes the hindrances to the proposed corporate governance reforms aimed at reducing carbon emissions for COP, CVX, SHEL, TTE, and XOM.

Discussion of the weaknesses in current corporate governance strategies for reducing carbon emissions for XOM, CVX, SHEL, TTE, and COP

The primary weakness of the current corporate governance strategies of top-5 oil and gas companies is improper and compromised emission targets and commitments. These companies, including Exxon Mobil Corporation, have limited investments and plans to support long-term and short-term emission, pollution, and climate change goals (SEC, n.d.). The managers of these firms have low commitments to the ambitions of reducing emissions in the industry in the next decades.

The top 5 oil and gas producers use inaccurate data to track and monitor carbon emissions in their operations. According to Cooper et al. (2022), these organizations the estimates used by these firms about their emissions are understated or overstated. These challenges the companies from planning resources and objectives to reduce emissions in the future because of underestimation and overestimation of carbon footprints (Leal Filho et al., 2021). In this case, the companies and competitors will face challenges in developing future goals and allocating resources to control emissions because of inaccurate data.

Macro-industry or external business environment factors influence effective corporate governance to control emissions among XOM, CVX, SHEL, TTE, and COP. Ahmad et al. (2018) state that these factors include extreme market competition that makes competitors engage in unsustainable business practices to enhance sales, revenues, and profits. Ahmad et al. (2018) also show that stakeholder pressure makes the leadership of these companies have profit-oriented policies and corporate governance models that fail to support their climate change goals and objectives.

In order to guide further change, an appropriate change management framework will have to be introduced. Specifically, a focus on sustainable supply change management in the oil and gas industry context will be required (Sánchez-Flores et al., 2020). Additionally, alterations in the management and leadership frameworks, in general, will be required. Specifically, Kotter’s 8-step model will have to be implemented on the global level within the organizational context to encourage a positive shift toward a more sustainable management of the available resources and promote an environmentalism-based perspective.

Specifically, the integration of Kotter’s 8-step approach will require creating a sense of urgency, which can be implemented by introducing projections regarding the future performance of organizations in the oil and gas sector, pointing to the threat of a rapid drop in revenues. Afterwards, a team of committed participants will have to be formed to advance change within the target setting, namely, by enforcing the principles of environmentalism and compliance with the set standards during decision-making (Senn & Giordano-Spring, (2020). Next, the vision involving a sustainable and environmentally friendly framework for strategic decision-making and management of the core process will have to be introduced. The specified change will encompass issues ranging from the choice of technology and devices to be purchased to perform core operations to the selection of approaches that will minimize harm to ecosystems and prevent issues such as groundwater pollution and species endangerment from taking place.

The fourth step of communicating the vision will include setting the premise for a change in the ethics of decision-making and introducing innovative approaches to minimize the harm done to the environment. Specifically, alongside frameworks involving a shift toward the use of the lifecycle approach to minimize CO2 emissions, a more humanism-oriented framework for the code of ethics within oil and gas organizations will have to be introduced (SEC, n.d.). The proposed strategies are expected to produce an undeniably positive shit in the target context.

The next stage of the proposed model will involve empowering action, which can be facilitated by introducing a combination of financial and non-financial incentives. Afterwards, leaders should create small wins, which may involve celebrating the minimization of environmental risks by deploying appropriate tools and techniques (Winters et al., 2020). In turn, building on the implemented change will require further adjustments of the corporate decision-making framework to meet the new standards for environmentally safe solutions within the company (Górecki et al., 2019). Finally, to make the change stick following the eighth step of Kotter’s paradigm, one should introduce a reporting framework that will increase transparency within the oil and gas industry and promote alignment with the improved and safer standards for environmental protection. The proposed solution aligns with the integration of the Triple Bottom Line Theory, which emphasizes the importance of aligning the concepts of economic prosperity with environmental well-being and the concept of social equity since it introduces an opportunity for organizations and each of its stakeholders to benefit while remaining environmentally sustainable.

In the oil and gas sector, the top 5 producers depend on centralized and top-down management systems that impact their sustainability goals. For instance, in the Chevron Corporation report, Ramon (2022) indicates that the company has a centralized organizational structure. Most decisions and corporate changes to reduce emissions in these firms are centralized by regional and top-level managers (Wang et al., 2021). The model hinders inclusive and faster decision-making to implement laws that govern the emission of oil and gas firms.

Unethical leadership is also a corporate governance issue that affects current oil and gas companies’ goals to reduce emissions. Singh (2022) highlights that managers in these companies finance and accounting departments are unaccountable for the firms’ emission contribution. The managers lie about carbon footprint data, emission goals, impacts, and strategies implemented to meet these firms’ climate change and pollution commitments (Walenta 2020). For example, Wamsley (2019) indicates that XOM, through its leadership, lies to stakeholders about the company’s emission effects and strategic plans. In this case, managers engage in unethical leadership and policy-making because of being more concerned about public image, profits, and industry competition.

Discuss the advantages of current corporate governance practices to reduce carbon footprints for SHEL, TTE, COP, XOM, and CVX

The primary advantage of the current corporate governance strategies of the top 5 oil producing companies includes tracking of carbon footprint data. SEC (n.d) reports that companies such as XOM file, project, and estimate their emission data for 2021 – 2050. These estimations show that XOM, among other firms, is accountable for its emissions (Pedersen et al., 2021). The tracking of carbon footprint helps these companies implement strategies to control their global contribution to the greenhouse effect.

Currently, oil and gas firms also have emission goals and commitments. For instance, Total Energies’ emission goal is to reduce its carbon footprint by 40% before 2030 (Total Energies, n.d.). In the same way, Chevron aims to reduce its emission from all business operations by 2050 (Maniatis et al., 2021). The company’s objective is to reduce its carbon footprint by 100% before 2050 (Reuters, 2021). Thus, leaders of major oil and gas companies are committed to transforming business operations to reduce pollution and climate change.

Oil and gas companies implement leadership restructuring as a corporate governance strategy to reduce emissions. For instance, Ramon (2022) notes that in October 2022, Chevron changed its leadership structure to meet emission and strategic commitments. Exxon Mobil Corporation (2022) also shows that XOM transformed its corporate leadership system to enhance the value chain and promote its commitment to controlling global warming. Thus, these companies frequently change their outlook and organizational structure to meet profitability, Sustainability, and business continuity goals (Olujobi, (2021). The firms also evolve their organizational and leadership structure to meet stakeholders’ interests.

Discussion for the Recommendations to Improve Corporate Governance Strategies for the Top 5 Oil and Gas Companies

The recommendations to improve corporate governance and emission goals of the top 5 oil and gas companies include using a carbon intensity measuring model. Masnadi et al. (2018) indicate that the solution will be key for these firms to track and monitor the amount of greenhouse they produce in business operations. In these cases, companies such as TTE and COP should monitor the amount of carbon they produce for every volume and weight of gas and oil they produce or sell.

XOM, CVX, SHEL, TTE, and COP also require reforms that make them committed to the net or carbon-zero goals. These companies should draft short-and-long term goals that guide their operations to zero-emission futures (Falduto & Rocha, 2020). In this case, the SEC (n.d.) report suggests that investors should assess companies’ commitment to carbon emission reduction before investing (Rokhmawati, (2021). Therefore, the top 5 oil and gas companies will attract more investors if they improve their commitment to reducing emissions.

The major oil and gas companies require technological reforms to enhance their carbon emission strategies. In this case, Cooper et al. (2022) recommend satellite innovations that these firms can integrate to improve their commitment to zero-carbon goals. These satellites help that monitor greenhouse gases or emissions produced by oil and gas firms during business operations. Based on this, managers and other stakeholders of oil and gas companies should implement policy reforms to support technological innovations that monitor and reduce their emissions.

Corporate leaders of top oil-producing companies need to implement supply chain changes to promote carbon emission goals. These leaders may initiate corporate partnerships with suppliers sensitive to environmental health and safety (Kolaczkowski et al., 2021). Based on Kang et al. (2019) and Sun et al. (2020), companies should also monitor fuel consumption and emission in their supply chain activities. The solution will be essential for oil and gas companies to reduce fossil fuel consumption and emissions for their logistics, transport, and warehousing operations.

Corporate oil and gas sector leaders should also encourage changes or policies introducing green energy. Dincer and Acar’s (2018) findings indicate that companies can change from conventional fuel to non-conventional energy sources with lower emission values. In this case, even though non-conventional fuels are costly, the long-term environmental benefits are incredible (Al-Amin & Doberstein, 2019). Thus, leaders in companies such as Shell should develop strategies for increasing their production and use of clean energy for internal and external operations. Moreover, these organizations can collaborate with sustainable fuel producers such as SkyNRG to reduce their dependency on fossil or conventional fuels that compromise environmental Sustainability (Gutiérrez-Antonio et al., 2017). The companies can also start producing and selling sustainable fuel to support environmental health.

Corporate leaders in the oil and gas sector should encourage behavioral changes among stakeholders to control their emissions. Esan et al. (2022) note that behavioral changes may include managing the weight of goods during business operations to control fuel consumption and emission. Esan et al. (2022) also recommend using clean, sustainable, and non-conventional fuels for oil and gas firms to control their emissions. Moreover, corporate leaders in these organizations should change their strategies from business strategies concerned with profits and adopt those that prioritize environmental health and stakeholder well-being (ElAlfy et al., 202). Finally, through stakeholder training, the leadership of oil and gas firms will support behaviors that align with the emission and net-zero goals of the industry.

The proposed solutions also meet the principles that the carbon footprint theory promotes. Specifically, implying that the consistent increase in the core processes within the oil and gas industry inevitably entails a rise in the carbon footprint rates (Nguyen et al., 2020). The theory in question leads to the assumption that a change in leadership practices and the promotion of a more ethical decision-making framework will allow the companies in question to recognize their effects on the environment (Ferrell & Fraedrich, 2021). Thus, making the necessary adjustments to the core policies and introducing appropriate tools for controlling change.

Obstacles and Challenges of Implementing the Sustainable Corporate Governance Strategies for the Top 5 Oil and Gas Companies

Ethical and budget issues and profit-oriented business strategies may hinder oil and gas firms from effectively changing their corporate governance to meet their emission and climate change goals. Singh’s (2022) Yahoo Finance report confirms that companies such as Chevron Corporation, Exxon Mobil Corp, and ConocoPhillips have managers that frequently engage in fraudulent, unethical, and unaccountable managerial practices. These leaders undermine the interest and needs of key stakeholders, such as investors, by lying to them amount emission goals and impacts (Seddon et al., 2021). The companies may also experience high costs of introducing new technologies to enhance carbon monitoring and capturing (Yu et al., 2021; Caineng et al., 2021; Wilberforce et al., 2019). These costly technologies make profit-oriented oil and gas leaders rethink their decisions to introduce them into their business operations. The profit-oriented managers, culture, and business strategies of companies such as Shell, Chevron, and Total focus on minimizing the cost of production and maximizing sales while ignoring the impacts of these decisions on the environment.

By enhancing the extent of commitment and the overall understanding of the value of Sustainability in the oil and gas sector, one will be able to implement appropriate changes and improve the current approach toward promoting environmentally safe principles in the target setting (Singh, 2022; Wamsley, 2019). On the other hand, the advantages of these companies’ current corporate governance approaches include tracking carbon footprint data, emission goals, and leadership restructuring (SEC, n.d.; Total Energies, n.d.). Thus, the weaknesses in current leadership practices in these firms are the primary reasons why companies such as Exxon Mobil, TotalEnergies, and ConocoPhillips need corporate governance reforms to boost their ability to meet emission goals.

Specifically, it is strongly recommended to reframe the current approach toward leadership and ethical decision-making in the oil and gas sector by introducing practices and standards geared toward acknowledging the needs and rights of all stakeholders involved. The specified change will allow the organizations in question to restructure their current frameworks and introduce changes to their decision-making, as well as the core production processes, supply chain management, and the associated tasks (Cohen & Lee, 2020). Additionally, the proposed change is expected to involve increased transparency in communication between the organizations in question and their stakeholders (Cornelissen, 2020). Specifically, the core processes within the companies under analysis and the associated decisions are expected to become completely transparent and available to the public; thus, the focus can be set on Sustainability and pursued adequately.

The proposed recommendations to improve these firms’ current corporate governance strategies include a carbon intensity measuring model, commitment to net or carbon zero goals, and technological reforms. Other proposed improvements of the corporate governance policies of these companies include supply chain reforms, the introduction of clean and sustainable energy sources, behavioral changes, and stakeholder education (Masnadi et al., 2018; SEC, n.d.; Cooper et al., 2022; Kolaczkowski et al., 2021; Dincer and Acar, 2018). Even though the recommended corporate governance changes are practical, they are susceptible to ethical and cost constraints and challenges (Bhaumik et al., 2019). In addition, the unethical and unaccountable leadership may also compromise the viability of the proposed corporate governance changes to improve the sustainability practices of Shell plc., TotalEnergies, ConocoPhillips, Exxon Mobil, and Corporation Chevron Corporation.

Recommendations

The recommendations to enhance corporate governance for the top 5 oil and gas producers will be based on reducing hindrances to the identified and proposed reforms. In this case, the first recommendation will be to encourage leaders and managers of these organizations to have environmentally-sensitive corporate behaviors, strategies, and investments (Dincer & Acar, 2018). In this case, the managers should be more concerned about meeting emission goals, reducing global warming, and changing the behaviors of stakeholders to support their carbon-zero commitments (Dincer & Acar, 2018). The recommendation would reduce the overdependency of these companies on profit-oriented businesses that produce significant amounts of emissions to the environment (Olujobi, 2020). Based on the triple bottom line theory, the recommendation will be essential in improving the profitability of these firms without compromising environmental health and their emission goals.

Promoting Compliance

Encouraging compliance with business ethics and principles among the managers of the top 5 oil and gas companies will be essential in aligning their leadership approaches with emission and climate change goals. These companies must punish managers who violate emission laws and regulations for personal interests (Ciepley, 2019). Managers who engage in fraudulent and deceptive reporting of emission goals, plans, and impacts to stakeholders should be held accountable for their behaviors (Cooper et al., 2018). In addition, training managers about current business ethics and the importance of upholding them will improve corporate governance and the ability of these companies to reduce their carbon footprints.

Stakeholder Cooperation

Finally, stakeholder collaboration will improve major oil and gas sellers’ corporate governance and emission control strategies. The strategy emphasizes the importance of inter-extra-and-intra-sectoral partnerships with stakeholders with sustainable business practices, products, and services (Inigo & Albareda, 2019). The intervention will allow the firms to learn the new and innovative sustainable business and corporate governance strategies to meet their emission commitments (Ramon, 2022). The solution will also increase access to necessary technological, knowledge, and human resources essential for oil and gas companies to reduce emissions, capture greenhouse gases, and control their sectoral contribution to climate change and pollution.

Overall, the core recommendations to be implemented in the case under analysis involve the focus on the active promotion of the relevant ethical standards utilizing revisiting the existing leadership farmworker. On a broader scale, the perceptions of core business goals and the appropriate methods needed to be reconsidered in the oil and gas industry (Hawash et al., 2020). Specifically, companies will need to accept the idea of accountability as the main principle based on which decisions should be made (Carroll & Brown, 2022). Specifically, environmentalism and sustainable solutions will have to be reinforced for the companies in question (García-Sánchez et al., 2019). The outlined change can be made by pointing out the connection between unsustainable performance in the oil and gas sector and the associated costs and losses that organizations will eventually suffer (Liczmańska-Kopcewicz et al., 2020). Additionally, the target organizations should outline the long-term benefits of sustainable approaches, including a positive public image and the opportunity to improve their reputations in the global market environment (Sadiq et al., 2021). With the focus on combining the transformational, situational, and servant leadership models and integrating an appropriate model of change, the companies in question will successfully transition to the required mode of operations.

References

Ahmad, W. N. K. W., Rezaei, J., Sadaghiani, S., & Tavasszy, L. A. (2017). Evaluation of the external forces affecting the Sustainability of oil and gas supply chain using Best Worst Method. Journal of cleaner production, 153, 242-252. Web.

Al-Amin, A. Q., & Doberstein, B. (2019). Introduction of hydrogen fuel cell vehicles: prospects and challenges for Malaysia’s transition to a low-carbon economy. Environmental Science and Pollution Research, 26(30), 31062-31076. Web.

Almaiah, M. A., Al-Khasawneh, A., & Althunibat, A. (2020). Exploring the critical challenges and factors influencing the E-learning system usage during COVID-19 pandemic. Education and information technologies, 25(6), 5261-5280. Web.

Alnuaim, S. (2019): “Oil and Gas Sustainability,” presentation at the University of Houston, 2019. Web.

Basile, V., Capobianco, N., & Vona, R. (2021). The usefulness of sustainable business models: Analysis from oil and gas industry. Corporate Social Responsibility and Environmental Management, 28(6), 1801-1821. Web.

Becker, S., Bouzdine-Chameeva, T., & Jaegler, A. (2020). The carbon neutrality principle: A case study in the French spirits sector. Journal of cleaner production, 274, 122739. Web.

Bhaumik, S., Driffield, N., Gaur, A., Mickiewicz, T., & Vaaler, P. (2019). Corporate governance and MNE strategies in emerging economies. Journal of World Business, 54(4), 234-243.

Boon, M. (2019). A climate of change? The oil industry and decarbonization in historical perspective. Business History Review, 93(1), 101-125. Web.

Breitmayer, B., Massari, F., & Pelster, M. (2019). Swarm intelligence? Stock opinions of the crowd and stock returns. International Review of Economics & Finance, 64, 443-464. Web.

Caineng, Z. O. U., Xiong, B., Huaqing, X. U. E., ZHENG, D., Zhixin, G. E., Ying, W. A. N. G.,… & Songtao, W. U. (2021). The role of new energy in carbon neutral. Petroleum exploration and development, 48(2), 480-491. Web.

Carroll, A. B., & Brown, J. (2022). Business & society: Ethics, Sustainability & stakeholder management. Cengage Learning. Web.

Central Michigan University. (n.d.). Website research: CRAAP test. Web.

Chuah, S. H. W., El-Manstrly, D., Tseng, M. L., & Ramayah, T. (2020). Sustaining customer engagement behavior through corporate social responsibility: The roles of environmental concern and green trust. Journal of Cleaner Production, 262, 121348. Web.

Ciepley, D. (2019). Can corporations be held to the public interest, or even to the law?. Journal of business ethics, 154(4), 1003-1018. Web.

Cohen, M. A., & Lee, H. L. (2020). Designing the right global supply chain network. Manufacturing & Service Operations Management, 22(1), 15-24. Web.

Cooper, J., Dubey, L., & Hawkes, A. (2022). Methane detection and quantification in the upstream oil and gas sector: the role of satellites in emissions detection, reconciling and reporting. Environmental Science: Atmospheres, 2(1), 9-23. Web.

Cornelissen, J. P. (2020). Corporate communication: A guide to theory and practice. Corporate Communication, 1-336.

Crook, B., Willerton, L., Smith, D., Wilson, L., Poran, V., Helps, J., & McDermott, P. (2020). Legionella risk in evaporative cooling systems and underlying causes of associated breaches in health and safety compliance. International Journal of Hygiene and Environmental Health, 224, 113425. Web.

Daneeva, Y., Glebova, A., Daneev, O., & Zvonova, E. (2020). Digital transformation of oil and gas companies: Energy transition. In Russian Conference on Digital Economy and Knowledge Management (RuDEcK 2020) (pp. 199-205). Atlantis Press. Web.

Dekkers, R., Carey, L., and Langhorne, P. (2021). Making Literature Reviews Work: A Multidisciplinary Guide to Systematic Approaches. Springer.

Dincer, I., & Acar, C. (2018). Smart energy solutions with hydrogen options. International Journal of Hydrogen Energy, 43(18), 8579-8599. Web.

Doughnut Economics Action Lab. (2022). About doughnut economics. meet the doughnut and the concepts at the heart of doughnut economics. Web.

Du Plessis, J. J., Hargovan, A., & Harris, J. (2018). Principles of contemporary corporate governance 4e. Cambridge University Press.

e Cunha, M. P., Rego, A., Clegg, S., & Jarvis, W. P. (2021). Stewardship as process: A paradox perspective. European Management Journal, 39(2), 247-259. Web.

ElAlfy, A., Palaschuk, N., El-Bassiouny, D., Wilson, J., & Weber, O. (2020). Scoping the evolution of corporate social responsibility (CSR) research in the sustainable development goals (SDGs) era. Sustainability, 12(14), 5544. Web.

Elhegazy, H. (2022). State-of-the-art review on benefits of applying value engineering for multi-story buildings. Intelligent Buildings International, 14(5), 544-563. Web.

Esan, A. O., Smith, S. M., & Ganesan, S. (2022). A non-conventional sustainable process route via methyl acetate esterification for glycerol-free biodiesel production from palm oil industry wastes. Process Safety and Environmental Protection, 166, 402-413. Web.

Exxon Mobil Corporation. (2022). ExxonMobil streamlines structure to enhance effectiveness, grow value, reduce costs. Web.

K. Ben-Naecur. (2019). How the oil and gas companies contributing to sustainability journal of petroleum technology.

Falduto, C., & Rocha, M. (2020). Aligning short-term climate action with long-term climate goals: Opportunities and options for enhancing alignment between NDCs and long-term strategies. Web.

Farooq, M. U., Shahzad, U., Sarwar, S., & ZaiJun, L. (2019). The impact of carbon emission and forest activities on health outcomes: Empirical evidence from China. Environmental Science and Pollution Research, 26(13), 12894-12906. Web.

Ferrell, O. C., & Fraedrich, J. (2021). Business ethics: Ethical decision making and cases. Cengage learning. Web.

Gao, P., Yue, S., & Chen, H. (2021). ‘Carbon emission efficiency of China’s industry sectors: From the perspective of embodied carbon emissions.’ Journal of cleaner production, 283, 124655.

García-Sánchez, I. M., Gomez-Miranda, M. E., David, F., & Rodríguez-Ariza, L. (2019). The explanatory effect of CSR committee and assurance services on the adoption of the IFC performance standards, as a means of enhancing corporate transparency. Sustainability Accounting, Management and Policy Journal. Web.

Griffin, P., and Heede, C. R. (2017). The carbon major’s database. CDP carbon majors report 2017, 14. Web.

Górecki, J., Núñez-Cacho, P., Corpas-Iglesias, F. A., & Molina, V. (2019). How to convince players in construction market? Strategies for effective implementation of circular economy in construction sector. Cogent engineering, 6(1), 1690760. Web.

Gutiérrez-Antonio, C., Gómez-Castro, F. I., de Lira-Flores, J. A., & Hernández, S. (2017). A review on the production processes of renewable jet fuel. Renewable and Sustainable Energy Reviews, 79, 709-729. Web.

Haines, A., Amann, M., Borgford-Parnell, N., Leonard, S., Kuylenstierna, J., & Shindell, D. (2017). Short-lived climate pollutant mitigation and the Sustainable Development Goals. Nature Climate Change, 7(12), 863-869. Web.

Hanein, T., Galvez-Martos, J.-L., & Bannerman, M. N. (2018). Carbon footprint of calcium sulfoaluminate clinker production. Journal of Cleaner Production, 172, 2278–2287. Web.

Hawash, B., Asma’Mokhtar, U., Yusof, Z. M., & Mukred, M. (2020). The adoption of electronic records management system (ERMS) in the Yemeni oil and gas sector: Influencing factors. Records Management Journal, 30(1), 1-22. Web.

Inigo, E. A., & Albareda, L. (2019). Sustainability oriented innovation dynamics: Levels of dynamic capabilities and their path-dependent and self-reinforcing logics. Technological Forecasting and Social Change, 139, 334-351. Web.

Jacobson, T. A., Kler, J. S., Hernke, M. T., Braun, R. K., Meyer, K. C., & Funk, W. E. (2019). Direct human health risks of increased atmospheric carbon dioxide. Nature Sustainability, 2(8), 691–701. Web.

Jagoda, K., & Wojcik, P. (2019). Implementation of risk management and corporate Sustainability in the Canadian oil and gas industry: An evolutionary perspective. Accounting Research Journal. Web.

Jan, A., Marimuthu, M., & Hassan, R. (2019). Sustainable business practices and firm’s financial performance in islamic banking: Under the moderating role of islamic corporate governance. Sustainability, 11(23), 6606. Web.

Jianu, I., Dobre, I., Bodislav, D. A., Radulescu, C. V., & Burlacu, S. (2020). The implications of institutional specificities on the income inequalities drivers in European Union. arXiv preprint arXiv:2007.11436. Web.

Kang, M., Mauzerall, D. L., Ma, D. Z., & Celia, M. A. (2019). Reducing methane emissions from abandoned oil and Gas Wells: Strategies and costs. Energy Policy, 132, 594–601. Web.

Kätelhön, A., Meys, R., Deutz, S., Suh, S., & Bardow, A. (2019). Climate change mitigation potential of carbon capture and utilization in the chemical industry. Proceedings of the National Academy of Sciences, 116(23), 11187–11194. Web.

Khatun, R., Reza, M. I., Moniruzzaman, M., & Yaakob, Z. (2017). Sustainable Oil Palm Industry: The possibilities. Renewable and Sustainable Energy Reviews, 76, 608–619. Web.

Kolaczkowski, M., et al. (2021). How the oil and gas industry can take a lifecycle approach to reducing emissions. The World Economic Forum. Web.

Leal Filho, W., Abubakar, I. R., Kotter, R., Grindsted, T. S., Balogun, A. L., Salvia, A. L.,… & Wolf, F. (2021). Framing Electric Mobility for Urban Sustainability in a Circular Economy Context: An Overview of the Literature. Sustainability, 13(14), 7786. Web.

Liu, J. et al. (2018). Nexus approaches to global sustainable development. Nature Sustainability, 1(9), 466-476.

Li, Z. et al. (2020). Reducing carbon footprint of deep-sea oil and gas field exploitation by optimization for floating production storage and offloading. Applied Energy, 261, 114398. Web.

Liczmańska-Kopcewicz, K., Pypłacz, P., & Wiśniewska, A. (2020). Resonance of investments in renewable energy sources in industrial enterprises in the food industry. Energies, 13(17), 4285. Web.

Lüthge, A. (2020). The concept of relatedness in diversification research: review and synthesis. Review of Managerial Science, 14(1), 1-35. Web.

Maniatis, K., Chiaramonti, D., & van den Heuvel, E. (2021). Post COVID-19 recovery and 2050 climate change targets: Changing the emphasis from promotion of renewables to mandated curtailment of fossil fuels in the EU policies. Energies, 14(5), 1347. Web.

Masnadi, M. S. et al. (2018). Global carbon intensity of crude oil production. Science, 361(6405), 851-853. Web.

Miller, K. (2020). The triple bottom line: What it is and why it’s important. Harvard Business School. Web.

Mishra, R. K., Singh, P., & Sarkar, S. (2017). Rethinking CSR: The case of the oil and gas sector in India. Corporations and Sustainability (pp. 179-196). Routledge.

Nasih, M., et al. (2019). Carbon emissions, firm size, and corporate governance structure: Evidence from the mining and agricultural industries in Indonesia. Sustainability, 11(9), 2483. Web.

Nguyen, T. T., Pham, T. A. T., & Tram, H. T. X. (2020). Role of information and communication technologies and innovation in driving carbon emissions and economic growth in selected G-20 countries. Journal of environmental management, 261, 110162. Web.

Olujobi, O. J. (2020). The legal Sustainability of energy substitution in Nigeria’s electric power sector: renewable energy as alternative. Protection and Control of Modern Power Systems, 5(1), 1-12. Web.

Olujobi, O. J. (2021). Combating insolvency and business recovery problems in the oil industry: proposal for improvement in Nigeria’s insolvency and bankruptcy legal framework. Heliyon, 7(2), e06123. Web.

Omri, A., & Hadj, T. B. (2020). Foreign investment and air pollution: do good governance and technological innovation matter?. Environmental research, 185, 109469. Web.

O’Reilly Media, Inc. (n.d.). Theoretical basis of corporate governance. Business Ethics and Corporate Governance, Second Edition. Web.

Pedersen, L. H., Fitzgibbons, S., & Pomorski, L. (2021). Responsible investing: The ESG-efficient frontier. Journal of Financial Economics, 142(2), 572-597. Web.

Rafiee, A., & Khalilpour, K. R. (2019). Renewable hybridization of oil and gas supply chains. In Polygeneration with Polystorage for Chemical and Energy Hubs (pp. 331-372). Academic Press. Web.

Ramon, S. (2022). Chevron evolves leadership structure to further enhance execution. Chevron.com. Web.

Raut, R. et al. (2018). An ISM approach for the barrier analysis in implementing sustainable practices: The Indian oil and gas sector. Benchmarking: An International Journal. Web.

Ravindra, K., Singh, T., & Mor, S. (2019). Emissions of air pollutants from primary crop residue burning in India and their mitigation strategies for cleaner emissions. Journal of cleaner production, 208, 261-273. Web.

Raworth, K. (2017). Doughnut economics: Seven ways to think like a 21st-century economist. Chelsea Green Publishing.

Reuters. (2021). Chevron commits to net zero operational emissions by 2050. Web.

Rokhmawati, A. (2021). The nexus among green investment, foreign ownership, export, greenhouse gas emissions, and competitiveness. Energy Strategy Reviews, 37, 100679. Web.

Rybnicek, R., & Königsgruber, R. (2019). What makes industry–university collaboration succeed? A systematic review of the literature. Journal of business economics, 89(2), 221-250. Web.

Sadik-Zada, E. R., & Gatto, A. (2021). The puzzle of greenhouse gas footprints of oil abundance. Socio-Economic Planning Sciences, 75, 100936. Web.

Safdar, S., Khan, A., & Andlib, Z. (2022). Impact of good governance and natural resource rent on economic and environmental Sustainability: An empirical analysis for South Asian economies. Environmental Science and Pollution Research, 29(55), 82948-82965. Web.

Sadiq, M., Nonthapot, S., Mohamad, S., Keong, O. C., Ehsanullah, S., & Iqbal, N. (2021). Does green finance matter for sustainable entrepreneurship and environmental corporate social responsibility during COVID-19? China Finance Review International. Web.

Sama, L. M., Stefanidis, A., & Casselman, R. M. (2022). Rethinking corporate governance in the digital economy: The role of stewardship. Business Horizons, 65(5), 535-546. Web.

Sánchez-Flores, R. B., Cruz-Sotelo, S. E., Ojeda-Benitez, S., & Ramírez-Barreto, M. E. (2020). Sustainable supply chain management—a literature review on emerging economies. Sustainability, 12(17), 6972. Web.

Secinaro, S. et al. (2020). Impact of climate change mitigation policies on corporate financial performance: Evidence‐based on European publicly listed firms. Corporate Social Responsibility and Environmental Management, 27(6), 2491-2501. Web.

Seddon, N., Smith, A., Smith, P., Key, I., Chausson, A., Girardin, C.,… & Turner, B. (2021). Getting the message right on nature-based solutions to climate change. Global change biology, 27(8), 1518-1546. Web.

Senn, J., & Giordano-Spring, S. (2020). The limits of environmental accounting disclosure: enforcement of regulations, standards and interpretative strategies. Accounting, Auditing & Accountability Journal. Web.

Shell Global. (n.d.). Our climate target: Frequently asked questions. Web.