Introduction

As a result of various economic pressures it is a known fact that currency exchange rates vary over time. For example, in 1970 one US Dollar could be used to buy 627 Italian Lira or 3.65 German Marks. In 1998 both Italy and Germany were making preparations to make the Euro their common currency.

In this period one US Dollar could purchase 1,737 Italian Lira or 1.76 German Marks (Mankiw 2008, p. 707). From this data alone it is possible to grasp that the Dollar value dropped by over half when compared to the Mark while it increased almost twice when compared to the Lira.

Economists often make models that attempt to explain these large and opposite changes. To understand these changes it is crucial to provide in depth information that indicates how the various economic forces work to cause the fluctuations. The Purchasing Power Parity (PPP) theory is one of the simplest theories used in explaining this behavior in exchange rates.

This theory states that one unit of a given currency should be able to purchase the same quantity of goods in any part of the world. It has been suggested by several economists that the theory provides a description of the forces that affect exchange rates over a long duration (Mankiw 2008, p. 707).

The PPP theory is founded on a principle known as the law of one price. This law states a good must sell at a single price in all locations. If this is not the case then the market leaves opportunities for profit unexploited (Mankiw 2008, p. 707). For example if coffee costs $4 in one location and $5 in another location people will begin to do business between the locations making $1 profit from each sale.

This process of taking advantage of price difference of a product in different market is known as arbitrage (Mankiw 2008, p. 707). Based on this example the trade would increase demand in the source location and increase supply in the destination location. The forces of supply and demand would then act upon the price at the source and destination causing the price to be equal.

There are two popular applications of the PPP theory each with its implications. The first application is the Absolute form of PPP based on the notion that in the absence of international barriers the consumers are expected to shift their demand to where the lowest prices are offered.

This suggests the rice of a particular category of gods should be the same in different countries when compared using a common currency unit (Madura 2008, p. 214). Any shift in prices will cause a shift in demand based on the law of one price thus causing convergence of prices. However, the effect of tariffs, transport costs and such associated costs do not allow absolute PPP theory to be applicable.

The second application is the relative form of the PPP theory which considers the role of market imperfections such as tariffs, transport, etc. This suggests that prices for the same category of products may not necessarily be the same in different regions.

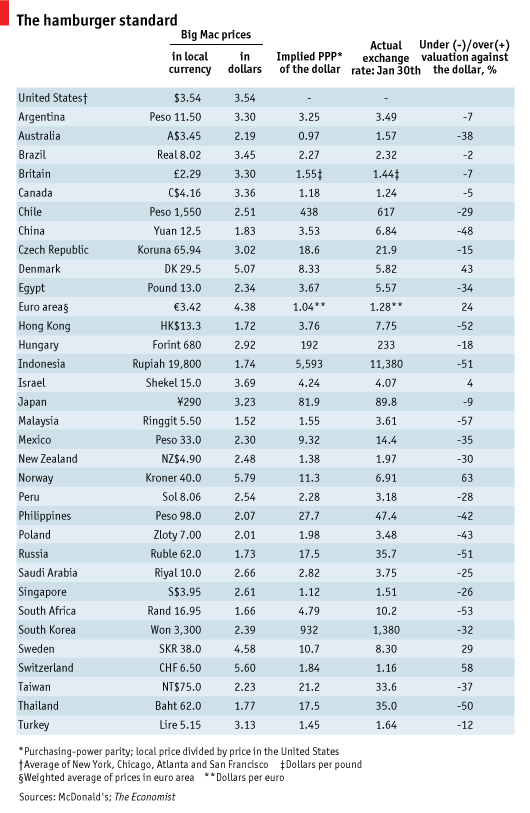

However, the theory suggests that the rate of change in price should exhibit similarity when market imperfections are considered and a common currency is used for measurement (Madura 2008, p. 215). Based on this estimation a specific product category price can be used to estimate exchange rates. Taking the example of the Big Mac Index, in 2009 a Big Mac cost $3.54 in the US and 290 Yen in Japan.

Based on this the expected exchange rate is 82 Yen to the Dollar whereas the actual rate was 122 Yen/Dollar (Mankiw 2008, p. 711). This example illustrates that the PPP theory is not always accurate for measuring the exchange rate though it can be used for estimation.

Empirical Literature on PPP

In a period of over twenty years after the Bretton Woods system of exchange there are still debates over whether real rates of exchange are mean reverting (Caner and Kilian 2000, p. 12). It is also reported that most economists agree on some form of PPP and recognize its essence in construction various macro economic models.

The statistical tests on the PP theory f mean reversion have to date produced conflicting results. As earlier stated the theory operates based on the law of one price. This law suggests that in time forces of supply and demand will always work to make a product price stabilize (Mankiw 2008, p. 707).

This position has made this a case of interest that may be worth testing using the null hypothesis that real exchange rates are mean reverting. Though a failure to reject this null hypothesis is inadequate to convince skeptics of the existence of long run PPP such attest would provide compelling evidence against long run PPP (Caner and Kilian 2000, p. 12).

Tests to determine the stationarity of the PPP theory have failed to be proven and as such suggest that PPP theory can not accurately determine the exchange rate. This is because results mainly show many contradictions and spurious acceptance.

The intuitive appeal of PPP notwithstanding it has been found that there is inconclusive evidence in support of the theory. This has been based on an analysis in countries with relatively low inflation rates in the post Bretton Woods era (Ender and Dibooglu 2004, p. 1).

This has been observed in numerous co integration tests known as stage three tests that indicate exchange rates exhibit major fluctuations with a very slow rate of decay towards a long run average. This point is especially unfortunate since stage three tests appear very suitable for the task.

The stage three tests typically require no assumptions with regard to exogeneity. In addition to that these tests are based on a sensible implication and dynamic between price levels and exchange rates (Ender and Dibooglu 2004, p. 1).

After conclusive testing using fur pairs of countries, it is reported that this theory is inadequate for calculation of exchange rates in industrialized countries. It has been suggested that the move by central banks to influence exchange rate movements may be the cause of the poor results (Ender and Dibooglu 2004, p. 16).

In addition to this it has been observed that national prices levels are prone to increase more readily than to decrease. As a result prices and exchange rates show different adjustment patterns for positive deviations from PPP as opposed to the adjustment patterns for negative deviations (Ender and Dibooglu 2004, p. 16). The source of such behavior as stated before may be due to the role of central banks.

Following the collapse of the Bretton Woods institutions the exchange rates are calculated using data from a relatively short span of time. The result has seen the use of the floating exchange rate and has caused much controversy on the use of the PPP theory (Pedroni 2001, p. 727). This is especially true since PPP theory is accurate over longer periods of time using much more data.

The use of co integrated tests is based on the realization that PPP is affected by several factors such as transportation, production costs, etc. which vary from one region to another. It is assumed that since there is a variation in these factors there is varying significance to these in different regions.

This is what gives rise to the null hypothesis test to confirm relevance of the co integrated relationships (Pedroni 2001, p. 727). Despite the fact that these tests prove a relationship between these factors it is not adequate to give strength to the PPP theory.

It is reported that in the period of two decades that has seen the use of the random walk in predicting foreign exchange rates, research has failed to produce models that can provide accurate predictions. The conclusion of many economists is that the standard models for estimation are inadequate. Others go further to say that the system is sound despite its poor implementation as a liner statistical model (Kilian and Taylor 2001, p. 1).

However some researchers argue that PPP test when carried out with respect to national prices and allowance for exchange rate shocks remains valid (Coakley, Flood, Fuertes and Taylor 2005, p. 273). This is because the exchange rate is influenced by the movement relative prices between two countries. Thus the changes in currency exchange are offset by price changes in the currencies of the countries.

For this evaluation to be successful the data set should include heterogeneous countries. The relationship between the countries is crucial especially with regard to stock and growth rates (Head and Shi 2003, p. 1556). Any change in money stocks or growth rates is likely to lead to error in the results generated.

There have been many tests that have applied co integration to PPP but the results provided are still inadequate to provide the theory required plausibility (Froot and Rogoff 1994, p. 23). Some researchers argue that the data produced is misleading due to sample bias in the studies.

There has been resurgence in studies on PPP and it is promising to note that on the long term there appears to be a convergence to PPP values (Froot and Rogoff 1994, p. 39). However, it is crucial to note that in most studies where such convergence is evident rely on some fixed data. This has been accompanied by several studies on government expenditure and real exchange rate shocks.

It is hoped that in time this data when applied with econometric techniques will allow researchers to determine how long it takes for convergence with PPP values to be realized (Froot and Rogoff 1994, p. 40).

This is crucial given that PPP appears to play a central role in the calculation of exchange rates. With this in mind a clear understanding of the role of various shocks may prove fruitful in providing a solid method of estimating exchange rates.

Testing PPP Theory (IMF, 2010).

In this example the null hypothesis being tested was whether the PPP theory can be used to accurately estimate the customer price index for two given countries. In such a test either the (PPI) Producer Price Index or (CPI) Consumer Price Index may be used.

In this case, the statistics offered data for the CPI and hence the CPI was used for the countries USA and UK. The CPI is an established average price for a given set/basket of goods within a give country (Ignatiuk 2007, p. 8). To calculate the inflation rate of the country the test required the selection of a base year and a target year. For this case the base selected was 2000 and the target was 2009. Using the average CPI for the base year and target year inflation is calculated.

The result is multiplied by a hundred to get a percentage. The difference between this sum and 100 is the inflation that has been experienced during the range of years selected (Ignatiuk 2007, p. 8).

Possible Reasons for the Results

As stated above the rejection of the PPP null hypothesis is inadequate to reject the theory entirely. The problem is that PPP requires a very long term for mean convergence to be achieved and deviations in results and the PPP estimates is too persistent (Parsley and Wei 2004, p. 1). For the reason that exchange rates are prone to several short term factors it would appear that PPP is better suited for making long term foreign exchange predictions.

There are several factors that are likely to influence the exchange rate and thus the PPP. Among these factors is the growth or the slump in the Gross Domestic Product (GDP). In addition to this are any potential interventions by the central bank in the economy (Dun and Bradstreet 2007, p. 21).

In summary the behavior of a currency is similar to commodity behavior in a market and is influenced by forces of supply and demand. An increase in demand for a specific currency due to trade increases leads to increases in the exchange price for that particular currency. Any increase in supply of the same currency also leads to decline in the exchange price for that currency (Dun and Bradstreet 2007, p. 21).

Justification for the Estimation Method

The theory of PPP is known to be based on the rule of one price (Mankiw 2008, p. 707). For this reason an accurate estimation of prices in various countries would require a product with a price that can be used as a standard price. In this case the study selected the USD Big Mac Index. The selection of the Big Mac Index was considered favorable because for an accurate estimation of the PPP a basket of goods is necessary. In our case the Big Mac is a widely accepted product and is well suited as a basket of goods. The Big Mac produced by the McDonald’s franchise is made from known ingredients that can also help in assessment of a specific basket of goods (Parsley and Wei 2004, p. 3).

Another crucial factor to consider in the application of PPP theory is the inflation rate of the countries being compared. Thus to perform an accurate PPP analysis countries that bear similar economic traits should be considered Head and Shi 2003, p. 1556. Inflation which is mainly the increase in cost of goods is influenced by many external and internal factors (Brigham and Houston 2009, p. 609).

The rate of inflation will therefore affect the Consumer price index which is used in calculation of the PPP. With such changes accounted the PPP may be less inaccurate (Adams 2003, p. 98). According to the theory of PPP the increases in prices of goods is reflects the inflation rates in a country.

The last point that justifies the use of the CPI to study PPP and exchange rates is due to the fact that baskets across different countries are not identical. This is because new products are added over time and quality of the ingredients varies from one region to the next (Parsley and Wei 2004, p. 2). The CPI is calculated based on a given set of goods that are available in all countries.

Results

In this test the CPI has been used to test the validity of the PPP theory with regards to accurate estimation of CPI data. The results of this test indicate that the CPI calculated using the PPP theory indicate some similarities but are significantly inaccurate based on the data in the CPI index (Parsley and Wei 2004, p. 23). This indicates that the PPP theory is inappropriate to estimate the CPI probably due to exclusion of variables in the calculation. In the course of the study some interesting facts are established. In similar studies that used the Big Mac Index it is established that a significant percentage of Big Mac Prices are attributable to non tradable components.

In addition to that there is a more significant dispersion with regard to the price of the non traded component as opposed to the traded components (Parsley and Wei 2004, p. 23). This suggests that for greater accuracy of the PPP theory in calculation of CPI such factors must be considered. In addition to this it was also revealed that there was greater convergence for non traded inputs across the country as opposed to traded inputs (Parsley and Wei 2004, p. 23).

It is hoped that through the study of PPP using non standard indexes such as the Big Mac Index, the evasive answers concerning the slow convergence rate may be unveiled. This is because the theory (PPP) has long been in use though its accuracy in short term situations has been found wanting.

Conclusion

In this report the discussion presented has provided some information on the Purchasing Power Parity theory. The theory states that the change in price levels in two countries determines the change in exchange rates (Ignatiuk 2007, p. 4). This is based on the principle of one price and argues that exchange rates can adjust with ease when there is movement of goods from one country to another (Neave 2002, p. 247).

According to the theory when the prices of goods vary in regions there are opportunities created for arbitrage. This involves transfer of goods from the region with the lower price to the region with a higher price (Wu 2003, p. 252). It is assumed that through forces of demand and supply the prices should come to a mean value.

Based on its efficiency in providing accurate estimates of foreign exchange rates some practitioners have argued that the theory presents a good means of estimating exchange rates. It has been observed that despite the fact that the theory does over a long period of time result in convergence of prices.

It is unsuitable for estimation on a short term which would require more accurate analysis of econometric shocks that affect currencies. In addition to this the theory assumes similar goods packages which may not be readily available in all countries (Wessels 2006, p. 285)

In this report a test was carried out to confirm whether the theory is accurate for estimation of exchange rates. To simplify the process the CPI was selected due to ready availability of long term data and reliability. The results from calculations to estimate the CPI it was found that the PPP theory was inaccurate. However, it should be noted that the rejection of this null hypothesis is inadequate in disapproving the PPP theory.

The results merely indicate the inadequacy in exchange rate estimation. It is observed that the inaccuracy is as a result of the methods disregard to factors such as transportation, tariffs and the like (Burton, Nesiba and Brown 2009, p. 170). It is hoped that future work can provide a better integration of other factors to allow improved exchange rate estimation.

References

Adams, A 2003, Investment Mathematics, West Sussex, John Wiley & Sons Limited.

Brigham, EF & Houston, JF 2009, Fundamentals of Financial Management, Mason, OH, South Western Cengage Learning.

Burton, M, Nesiba, R & Brown, B 2009, An Introduction to Financial markets and Institutions, New York, M. E. Sharpe Inc.

Caner, M & Kilian, L 2000, ‘Size Distortions of Tests of the Null Hypothesis of Staionarity: Evidence and Implications for the PPP debate ’, Research Seminar on International Economics, Michigan, Discussion Paper No. 44, pp. 1-30.

Coakley, J, Flood, RP, Fuertes, AM & Taylor, MP 2005, ‘Purchasing Power Parity and the Theory of General Relativity: The first tests’, Journal of International Money and Finance, Vol. 24, pp. 293-316.

Dun & Bradstreet 2007, Foreign Exchange Market, New Delhi, Tata McGraw Hill Publishing Company Limited.

Ender, W & Dibooglu, S 2004, ‘Long run Purchasing Power parity with Asymmetric Adjustment’, Southern Economic Journal, pp. 1-23.

Froot, KA & Rogoff, K 1994, ‘Perspective on PPP and Long Run Exchange Rates’, NBER Working Paper, No. 4952, pp. 1-57.

Head, A & Shi, S 2003, ‘A Fundamental Theory of Exchange Rates and Direct Currency Trades’, Journal of Monetary Economics, Vol. 50, pp. 1555-1591.

Ignatiuk, A 2009, The Principle, practice and problems of Purchasing Power Parity Theory, Norderstedt, GRIN Verlag.

IMF 2010, ‘Consumer Price Index Manual: Theory and Practice’, International Monetary Fund. Web.

Kilian, L & Taylor, MP 2001,’Why is it so difficult to beat the Random Walk Forecast of Exchange Rates’, CEPR Discussion Paper, No. 3024, pp. 1-42.

Madura, J 2008, International Financial Management, Mason, OH, Thomson Higher Education.

Mankiw, N 2008, Principles of Economics, Mason, OH, South western Cengage Learning.

Neave, E 2002, Financial Systems: Principles and Organization, New York, Taylor & Francis E Library.

Parsley, DC & Wei, SJ 2004, ‘A Prism into the PPP Puzzles: The Micro Foundations of Big Mac Real Exchange Rates’, NBER Working Paper, No. 10074, pp. 1-27.

Pedroni, P 2001, ‘Purchasing Power Parity Tests in Co integrated Panels’, The Review of Economics and Statistics, Vol. 83, No. 4, pp. 727-731.

Peng, M 2008, Global Business, Mason, OH, South Western Cengage Learning.

The Economist 2009, ‘Big Mac Index’, The Economist, 2009. Web.

Wessels, W 2006, Economics, US, Baron’s Educational Series.

Wu, C 2003, Outline of International Price Theories, London Routledge.