Introduction

The concept of an optimal capital structure for business firms remains a cornerstone of financial economics theory since the seminal works of Modigliani and Miller (1958; 1963) that focused on tax benefits and other costs of debt. According to Vasiliou and Daskalakis (2006), the capital structure of the firm can be a combination of the long-term sources of funds employed by the firm.

A firm is said to be less leveraged when it has not included any debts in its capital structure. On the other hand, with a high level of debts the firm is highly leveraged. In a leveraged firm, the value of the firm is equivalent to the value of the firm reduced by the value of the debt (Brealey et al, 2003; Song 2005).

Large corporations arrive at a combination of owned and borrowed funds to ensure maximum benefits from the capital structure. This paper analyzes the financing of the capital structure of TUI AG, a German based company operating in the tourism industry.

Overview of TUI AG

Established in 1997, TUI is the industry leader in the tourism industry of Europe. The Group operates in holiday destinations in more than 180 countries worldwide. The company serves nearly 30 million customers spread in 27 source markets globally. TUI Group is in the business of operating around 240 hotels in different destinations, and most of them are four or five-starred hotels.

TUI travel, hotels and resorts, and cruise lines are the three business segments, which the company is operating. TUI travel division undertakes the businesses of tour operating, online sales, high street outlets and air travels.

The company owned Hapag Lloyd AG, container shipping division and TUI sold this division in March 2009. After the sale of container shipping division, the business of the company has become completely tourism-oriented. The following sections outline the capital structure and debt financing of TUI AG.

Capital Structure of TUI AG

TUI is a highly leveraged company with more debt financing. The capital stock of the company as at September 30, 2010 consisted of 251,548,525 ordinary shares having a value of EUR 643,073,592.

The company’s external debt consists mainly of convertible bonds. During the financial year 2009-2010, the total financial liabilities of the company increased by EUR 797 million and as at the end of September 30, 2010 the total liabilities stood at EUR 4,512 million. Table 1 in Appendix shows the breakup of the non-current liabilities of TUI AG.

The total financial liabilities for 2008-09 was EUR 3,275 million and the increase in the liabilities for the year 2009-10 amounted to 37.8% over the previous year’s liabilities.

The total equity of the company as at the end of the financial year 2009-10 was EUR 2,434.20 (for 2008-09 = EUR 2,240.8). Table 2 in the Appendix shows the different components of equity of TUI AG.

The total equity for 2009-10 has increased by 8.6% over the previous year. While the subscribed capital has not changed significantly, the reserves have increased by 14.3% over the previous year. The equity as a percentage of total assets stood at 17% for both the years. Non-current capital of the Group decreased by 4% as compared to the previous year and stood at EUR 6,989 million.

Table 3 in Appendix shows the equity, non-current liabilities and total assets of TUI AG. Equity and non-current liabilities (debt financing) amounted to 36% of the total assets of the Group (for the previous year it was 40% of the total assets). The increase in non-current liabilities signifies that the company has resorted to additional external funds to support its operations.

With increased external debts, the interest burden on the company is increasing, which in turn affects the current ratio of the company, because of the increase in the current liabilities. With this policy of increasing the external funds, TUI AG is increasing its current financial obligations in the form of interest payments. With a strain on the liquidity of the company, TUI may find it difficult to meet the interest payments in time.

Hybrid Capital

In December 2005, TUI issued Hybrid Capital to the extent of EUR 300 million, the first of its kind from a non-investment grade organization. The Hybrid Capital represented a debt, which is deeply subordinated and unsecured. “The two main traits of a hybrid bond are a long maturity (hybrids are often perpetual) along with the possibility to defer interest payments under certain conditions” (Carlsson et al., 2006).

TUI AG introduced the features of “deep subordination, perpetual tenor, cumulative optional interest deferral and replacement language” (Corporate & Markets, 2006), in the structure of the Hybrid Capital to achieve equity credit from the rating agencies.

TUI AG has used the important benefit of Hybrid Capital, in that, even though hybrid capital is perpetual debt of the company, it looks like equity on the balance sheet of the company. Hybrid Capital has a benign effect on the rating of the company.

The other advantage of Hybrid capital is that there would be no dilution and coupon payments are eligible for tax deduction. Because TUI AG structured hybrid in an ideal manner, it achieved appropriate equity credit from agencies and it was received well by investors.

Bonds

“In the case of funding via the corporate bond market, the monitoring of borrowers by many creditors, as is the case in the corporate bond market, could lead to unnecessary costs and free-riding problems” (Altunbas et al. 2009).

Volume of prior studies supports an extensive theoretical literature (Besanko and Kanatas 1993; Hoshi et al. 1993; Chemmanur and Fulghieri 1994; Boot and Thakor 2000; Holmstrom and Tirole 1997 and Bolton and Freixas 2000). TUI issued 3,868,373 units of convertible bond with subscription rights carrying a coupon rate of 5.5% payable semiannually.

These bonds are maturing in 2014. The nominal value of the bonds is EUR 218 million. To augment the debt financing, “TUI AG also issued notes worth EUR 100 million, maturing in August 2014.” The Group’s debt financing includes two convertible bonds of £ 350 million and £ 400 million issued by TUI Travel PLC. Large corporations such as TUI AG have used external loan funds as the important contributor of business funding.

Analysis of Debt Financing and Capital Structure of TUI AG

Management of firms can calculate the optimal capital structure, using theoretical models. However, many researchers have found most of the firms do not have optimal capital structure (Simerly and Li, 2000; Myers, 1997; Song and Thakor, 2008). This is true in the case of TUI AG. The capital structure of the Group was affected by the financing measures taken by TUI AG and TUI Travel PLC, in the form of bonds issued by both entities.

The capital structure of a company indicates the relative combination of long-term debt and equity in its capital. Majority of financial theories seeking to analyze corporate capital structures focuses on debt financing as a tax shield for firms. The capital structure of TUI AG shows an excessive reliance on debt financing, which is comparable with the norms of “Hotels, Restaurants and Leisure Industry” at 64.0% as of March 2011.

However, the operating profits and the liquid assets of the company are not strong enough to meet the financial obligations because of interest payable by the company on its external debts. TUI AG appears to be more effective in its cash collections as compared to other companies operating in the industry.

With the latest financial information available about the company, the uncollected receivables amounted to Euro 2.4 billions, which amount represented a Days Receivable Outstanding of 62.48 at the current sales figures of the company.

Despite the efficiency in the collection of book debts, the company is facing liquidity crunch because of its debt financing. One of the reasons for the liquidity crunch of TUI AG is the inefficiency in managing its inventories.

TUI AG has followed “Pecking Order Theory” in raising additional funds through issue of bonds. The company has preferred to use fixed interest bearing debts in the form of bonds, which underlines the operation of pecking order theory. In addition, use of Hybrid instruments indicates the application of pecking order theory.

The company cannot be said to have applied signaling to its shareholders, because the company has a precarious debt to equity position.

The company’s debt to equity position as shown by the following table indicates that the company has borrowed excessively by issue of long-term bonds. The interest payments on the long-term bonds would place significant strain on the cash flow of the company affecting the liquidity of the company.

When the company faces short-term liquidity crunch, the company might resort to securing additional long-term funds to meet the short-term obligations.

Table: Debt to Equity Ratio of TUI AG.

A look at the current ratios for the company for the current and previous years shows that the current ratio is less than one, which implies that the company has shortage of liquid funds to meet its short-term obligations. The company might have used its long-term funds raised by issue of bonds to meet their short-term financial obligations, which is not a desirable practice as such practice may lead the company to bankruptcy.

The next section of the paper focuses on the Shareholder Value Analysis model to value TUI AG as developed by Rappaport (1986).

Part II Valuation of TUI AG – Shareholder Value Analysis (SVA) Model

The intrinsic value of a stock can be determined using Gordon Growth Model. This model assumes a series of dividends payable growing at a constant rate over the future period. The model further assumes that dividend grows at a constant rate over the future years and the growth is in perpetuity. The present value of future dividends is considered to arrive at the intrinsic value of the shares.

However, in the case of TUI AG, considering the present financial status of the company, a constant dividend growth cannot be assumed and hence the Shareholder Value Analysis model is used to find the value of the shares.

To meet the shortcomings found in the traditional accounting measures, consultants like Rappaport (1986) and Stewart (1991) developed the concept of shareholder value and the ways in which shareholder value can be improved. This in turn has led to the development of metrics like Shareholder Value Analysis (SVA).

The SVA approach developed by Rappaport (1986) can be used for estimating the value of shareholders’ stakes. The value of operations of a business can be determined by discounting the future operating “free cash flows” at a cost of capital that is appropriate considering the capital structure of the company.

Principal Value Drivers for TUI AG

SVA value driver approach provides a simplified method. This method provides sufficiently reliable approximation in many of the situations. Seven value drivers need to be developed for estimating the value of operations during the planning horizon. The value drivers for TUI AG can be arrived as below.

Percentage of Annual Sales Growth

It is assumed that sales growth will remain -15% in 2011 and during the planning horizon of 5

years the rate of growth is assumed as below. An incremental sales growth of 5% is assumed during the future years, and the percentage change during the planning horizon period.

Operating Profit Margin

The operating profit margin is calculated based on the operating expenses during the past 5 years.

It is assumed that the business of TUI AG will earn an operating margin of 10% as was possible in the year 2010. The assumed percentage of operating margin for the planning horizon is shown below.

Cash Income Tax Rate

Cash income tax rate is assumed at 15% as the Group income is subjected to German corporation tax. As mentioned in the annual report, the cash income tax rate is assumed at 15% for all the years in the planning horizon, and no change is anticipated in the government policies, which will have an effect on the effective income tax rate.

Incremental fixed capital rate

The incremental fixed capital rate is calculated taking into account the historical cash outflow on

capital investment activities.

Assumed incremental capital investment rates are:

Investment in Working Capital Rate

Since there is no regular pattern is seen in the changes in the net working capital an incremental rate of increase in working capital investment of 5% is assumed.

Planning Horizon

Planning horizon is taken as the five-year period starting from 2011 until 2015 at the end of which it is assumed that the growth will be zero irrespective of any new investment in fixed capital or in working capital

Cost of Capital

Generally, Weighted Average Cost of Capital (WACC) is adopted as the measure for discounting the future cash flows. Weighted Average Cost of Capital (WACC) is an important constituent in the calculation of the valuation of a firm using SVA model. WACC is the weighted average of the cost at which equity capital is serviced and the cost of debt financing.

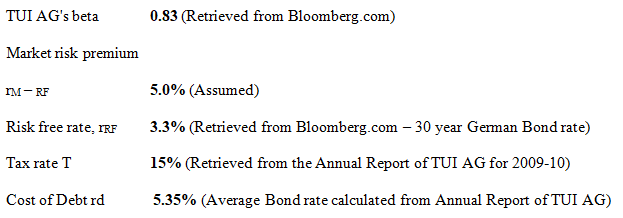

The ratio of external financing and own share capital in the company’s capital structure determines the relative cost of equity and debt of the firm. The cost of capital is calculated using Capital Asset Pricing Model (CAPM) method.

WACC of TUI AG based on the figures for the year 2009-10 is calculated as below.

Calculation of WACC

Cost of Equity = Risk Free Return + Beta (Market Risk Premium)

= 3.3% + 0.83 (5%) = 7.45%

Cost of Debt = = Weighted Interest Rate x (1 – Effective Income Tax Rate)

= 5.35% x (1-15%) = 5.35% x 85% = 4.5%

Weighted Average Cost of Capital

Equity Weight (Cost of Equity) + Debt Weight (Cost of Debt)

= 44% (7.45%) + 56% (4.5%)

= 3.28% + 2.52% = 5.80% or 6.00%

Effect of Changes in Key Assumptions

This section discusses the changes in the key assumptions, by changing the relevant values in three different excel sheets based on the original SVA model. In view of different steps involved in the calculations, this simple working method is adopted instead of using “Whatif” function in Excel.

With the key assumptions of shareholder values the intrinsic value of common share of TUI AG is worked at Euro 0.45 per share. Relevant calculations are shown in the Excel sheet attached. Using the SVA model, the following changes are made in the key assumptions and the effect of the changes made significant changes in the shareholder value.

At the first instance, the sales growth is assumed at 10% from sales of the base year 2010. At the rate of 10% increase in sales the intrinsic value per share increased 0.61 Euro per share. In the second case, along with the increase in sales growth the operating margin is assumed to be 20% of sales, which resulted in a share value of Euro 1.05 per share.

The third working shows the share value at Euro 1.08 with changes in the sales growth rate, operating margin and increase in working capital at 15% during the planning horizon.

The calculations in SVA model thus enable mangers to understand the change in the value of the firm with changes in the key assumptions, which in turn help them in many decision-making situations. For instance, TUI AG can find out the required changes in the capital structure to bring about changes in the working capital and the resultant changes in the shareholder value of the operations of TUI AG.

Difficulties in Applying SVA in Practice

The most significant issue in using SVA model in practice is the prediction of the variables or key assumptions required to be used in the analysis. A variety of factors including changes in consumer behavior and economic changes will have an influence in affecting the shareholder value. In practice, it is difficult to assume these changes to arrive at the key assumptions.

It is difficult to make assumptions about discount rate planning period and projected cash flows in the varying business circumstances. Most of the criticisms reflect on the application of the SVA model. Generally, companies lack imagination and rigor in their strategic thinking, which disable them from linking the figures assumed for SVA with their actual strategic planning.

This is a serious problem, which affects the practicality of the application of SVA to real life situations. In addition, because different sets of organizational members are involved in the formulation of strategies and development of SVA model in the context of large companies human shortcomings like over-optimism and narrow thinking cannot be ruled out, which would vitiate the results of the SVA model adopted.

Although one can understand these shortcomings, they are not acceptable for an effective use of the SVA model in practice. This is the reason managers often find different ways of working with SVA models to avoid the usual pitfalls and to ensure successes to be achieved with SVA” (Day and Fahey, 1990).

One other criticism against the application of SVA model is that the managers often spend considerable time in developing SVA models and testing the sensitivity of the key inputs.

This extended executive time spent on sensitivity testing exercises reduces the time of the executives spent on strategic thinking. In addition, there is unlikely to be agreement among the executives on the values of key inputs like the discount rate, planning period and projected cash flows. This disagreement might affect the practical value of SVA models.

Market Valuation of TUI

The market valuation of TUI has been calculated based on the free cash flows and Shareholder Value Analysis (SVA) model, taking a planning horizon of five years from 2010-11 until 2014-2015 taking 2009-2010 financial year as the base year for calculation. Even though the current market value of the shares of TUI AG is Euro 7.56, the intrinsic value of the shares is arrived at Euro 0.45 only based on the SVA model of Rappaport (1986).

The excessive borrowing of the company through bonds and the financing from banks has reduced the value per share. This is because, the intrinsic value of the shares is calculated after deducting the market value of debt from the total corporate value as at the end of the planning horizon of 5 years.

With more debt financing the intrinsic value will go down to the extent of debt financing. Therefore, when the company has more external debts, the intrinsic value is likely to go down.

When TUI AG is able to increase the sales and the percentage of operating margin, the company would be able to increase the free cash flows, which in turn would increase the present value of the cumulative cash flows during the planning horizon. With the result, the intrinsic value of the shares of TUI AG goes up.

This is reflected by the calculations using the basic SVA models. With a presumed increase in the percentage of sales growth, operating margin and operating capital the intrinsic value of the shares of TUI AG would go up Euro 1.08 per share.

It may be observed even with the presumed increase in the different variables, the intrinsic value is much less than the market value, implying that the shares of TUI AG are highly over-priced. With the imminent liquidity crunch, TUI AG might find it difficult to meet its current financial obligations with ease.

Conclusion

The exercise contained within this report was used to analyze the capital structure of TUI AG, a large multinational company operating in tourism industry. The company is found to be using excessive external borrowing in the form of bonds, which has increased the interest burden of the company and consequently has affected the liquidity of the company.

Although the debt to equity ratio is comparable with the other firms of the industry, the operating profits and the liquid assets of the company are not strong enough to meet the financial obligations because of interest payable by the company on its external debts.

Part II of the exercise was concerned with the determination of the market value of the firm using the Shareholder Value Analysis (SVA) model developed by Rappaport (1986). Because of the excessive external borrowing by the company, the intrinsic value of the company has been found to be very low as compared to the market price and hence the shares of the company can be considered over-priced.

References

Besanko, D. and G. Kanatas, 1993. Credit market equilibrium with bank monitoring and moral hazard, Review of Financial Studies, 6(1), pp. 213-32.

Bolton, P. and X. Freixas, 2000. Equity, bonds and bank debt: capital structure and financial market equilibrium under asymmetric information. Journal of Political Economy, 108, pp. 324-51.

Brealey, R. A., Myers, S., Partington, G., & Robinson, D. 2003. Principles of Corporate Finance. Sydney: Mcgraw-Hill Australia.

Carlsson Patric, Holm Oscar and Sello Martin, 2006, Corporate Hybrid Capital – Expensive Debt or Cheap Equity? Web.

Chemmanur, T., and P. Fulghieri, 1994. Reputation, renegotiation, and the choice between bank loans and publicly traded debt. Review of Financial Studies, 1, pp. 475-506.

Corporates & Markets, 2006, Corporate Hybrid Debt: Perspectives for a new asset class, Web.

Day George & Fahey Liam (1990), Putting Strategy into Shareholder Value Analysis, Web.

Holmstrom, B. and J. Tirole, 1997. Financial intermediation, loanable funds and the real sector. Quarterly Journal of Economics, 112, pp. 663-91.

Hoshi, T., A. Kashyap and D. Scharfstein, 1993. The choice between public and private debt: An analysis of post-deregulation corporate financing in Japan, NBER Working Papers 4421, National Bureau of Economic Research, Inc.

Modigliani, F.; Miller, M. 1958. The Cost of Capital, Corporation Finance and the Theory of Investment American Economic Review 48 (3): 261–297.

Modigliani, F. and Miller, M. 1963. “Corporate Income Taxes and the Cost of Capital: A Correction”, The American Economic Review, Vol. 53, pp. 433-443.

Myers, S., 1977. Determinants of corporate borrowing. Journal of Financial Economics, 25, pp. 99-122.

Simerly R. L, Li M. 2000. Environmental dynamism, capital structure and performance: a theoretical integration and an empirical test. Strategic Management Journal 21: 31-50.

Song Han-Suck 2005. Capital Structure Determinants. An empirical study of Swedish companies. CESIS Electronic Working Paper Series, Paper No. 25.

Song, F. and A. V. Thakor, 2008. Financial system architecture and the co-evolution of banks and capital markets. Working paper, Pennsylvania State University.

Vasiliou, D. and Daskalakis, N. 2006 “The Practice of Capital Structure in a Small Market and a Cross-National Comparison”, SSRN Working paper series.