Introduction

Making a sound investment decision is one of the biggest challenges that investors encounter, especially when they want to explore the stock market. As Doepke and Schneider (2017) note, before investing money in the stock market, numerous factors have to be taken into consideration. The driving factor that makes one invest in a given company is the hope that the company will make profits and the value invested will increase after a given desired period. However, the truth is that market forces and the strategies used by the company can have a varying impact on its financial performance.

In some cases, the investor’s value is increased as was desired because of the impressive performance of the company within a specific period. In other cases, a firm may face challenging economic forces that may lead to a financial loss and a drop in the value of the investment made. Graham (2017) notes that many investors are always keen on ensuring that the value of their investment is not significantly lost in such situations. It means that selecting the most appropriate company in which to invest is critical. Making the right decision on whether to invest in shares or debentures is the next important step that one has to make. In this paper, the researcher seeks to determine whether it is prudent to invest in Qatar National Bank’s shares and debentures.

Critical Appraisal of the Financial Objectives of Qatar National Bank

Background of the Company

Qatar National Bank, also known as QNB Group, is a commercial bank that has its headquarters in Doha, Qatar. The company was founded on June 6, 1964, as the first commercial bank owned by the locals. The company experienced massive success in its early years, and it started spreading its operations to different parts of the country as Qatar’s population continued to increase. The rapid expansion of the company began to spread beyond the national borders in 1980. Acquisition has been the bank’s main expansion strategy in the regional and global market. In Egypt, it acquired ALAHLI Bank, and in Togo, it acquired over 20% stakes in Ecobank Transnational Inc.

It has used the same strategy in Jordan, the United Arab Emirates, the Kingdom of Saudi Arabia, Sudan, South Sudan, and Tunisia. The company has a strong presence in Libya, Syria, Turkey, Yemen, Kuwait, Oman, Jordan, Lebanon, and Iraq. In Asia, it has branches in India, China, Myanmar, Indonesia, Vietnam, and Singapore. In Europe, it has made an entry into the United Kingdom, France, and Switzerland. Bruner (2016) observes that Qatar National Bank currently has 4,300 branches spread across 31 countries.

From a small number of 35 employees that the company had in its first year of operation, the bank currently employs over 28,000 in different parts of the world. Its revenue has increased to over USD 6.4 billion for the financial year that ended on December 31, 2016. Ulrichsen (2014) says that 50% of the company’s stakes are owned by the Qatar Investment Authority while the other 50% are owned by the public.

Company’s Financial Objectives

As an investor, it is important to evaluate the financial objectives of the targeted company after analyzing its background. Azevedo and Gottlieb (2017) explain that a prudent investor should ensure that the financial objectives of the desired company are in line with the personal objectives to avoid the need to sell one’s shares only after a short period. Qatar National Bank’s primary financial objective is to expand its profits in the global market. After years of massive expansion in the Middle East, North America, Asia, and Europe, the company is now focused on making profits and improving the value of investment for its shareholders.

According to a report by Ghantous and Zhdannikov (2018), the company seeks to increase its profits by about 8% for the financial year ending on December 31, 2018. The company’s chief executive officer, Ahmed al-Kuwari explained, “Our strategy and vision is to become among the leading banks in the Middle East, Africa, and Southeast Asia,” (Ghantous & Zhdannikov 2018, para. 2). The statement from the chief executive officer of the company demonstrates that the focus of Qatar National Bank is to not only make impressive profits but also to promote its growth. The current market size of the company may increase, especially as the company focuses its attention on the South West.

As the company is setting ambitious financial goals of increasing its profits both in the local and global market, it is prudent for an investor to analyse the historical financial records to determine the possibility. As Kübler and Polemarchakis (2017) explain, a firm that has been making impressive profits and showing growth in the market over the past few financial years may have a solid ground of proposing higher rates of profitability. This bank is the largest in the Middle East and African market, and for it to set a goal of making a profit increase by 8%, it must have a clear approach to achieving that. A critical review of the financial records of the company over the past few years shows that the set financial objective is realistically possible. In the financial year that ended on December 31, 2017, the company’s profit increased by 6% to USD 3.59 billion. The company’s profits have been consistently growing in the past ten years, as evident in its financial documents, which is a sign that the management understands the changing trends in the market and the needs of its customers. It is aligning its products and strategies with these needs, and it explains why it has registered such impressive levels of success.

It is necessary to evaluate the strategies that the company seeks to use to achieve the set financial objectives. According to Ghantous and Zhdannikov (2018), Qatar National Bank’s operations have been affected by the strained relationship between Qatar and other regional economies such as Saudi Arabia, the United Arab Emirates, and Egypt. The economic sanction that was placed by these countries against Qatar has affected its growth. In Egypt, the company was forced to sell about 3% of its market share in response to new policies put in place by the Egyptian stock exchange market (Arnold & Awadalla 2018). In response to these market challenges, the company has taken various initiatives to ensure that its expansion and profitability is not affected. The company is currently using diversification as a means through which it seeks to achieve its financial objectives. It is currently holding the United States public bond to a tune of $ 17.5 billion (Ghantous & Zhdannikov 2018).

The company’s chief executive officer stated that the firm is not planning to cash in on the bond in the current financial year because it is not experiencing any liquidity challenges. It means that it will continue earning interest on such bonds. The company has also introduced new debt instruments into its products portfolio. Ghantous and Zhdannikov (2018) observe that the company introduced Formosa and Kangaroo bonds as a way of responding to the embargo placed on Qatar by the regional countries. Qatar has initiated an ambitious project of increasing its liquefied gas production from 77 million to 100 million tonnes, a project that is estimated to cost USD 40 billion (Ghantous & Zhdannikov 2018). The bank has put in place systems that will ensure that it becomes the main financier of the project. It is also keen on making aggressive growth in South East Asia. The company also has a raft of other initiatives meant to ensure that it increases its market share and profitability in the global market despite the challenges that it is currently facing. As an investor, these are some of the basic factors that must be considered when planning to buy shares of the company.

How the Objectives Satisfies My Personal Objectives

A critical analysis of the financial objectives of this financial institution demonstrates that it is keen on increasing the value of investment for its shareholders. The company’s financial statements and reports from media outlets show that it is willing to go an extra mile to ensure that it meets the goals and objectives of its customers. I am satisfied with the set financial objectives and the strategies that have been put in place to ensure that they are achieved. I believe that Qatar National Bank is one of the best financial institutions that an investor can bet on when planning to buy shares in the market. Its highly diversified product portfolio and operations in various countries around the world enable it to overcome shocks in some of its market both regionally and at the global level. Investment in Qatar National Bank would most likely guarantee impressive performance for the company.

The Role of an Accountant in Ensuring the Achievement of Financial Objectives

According to Kyle and Obizhaeva (2016), accountants play a critical role in ensuring that a company realizes its set objectives. Tian (2018) argues that different types of accountants perform varying duties in an organizational setting. One of the most important roles of an accountant is to prepare financial statements (income statements, cash flow statements, balance sheet, and profit and loss statements) used in determining the progress that a company is making towards its set financial objectives (Jiekun 2018).

Accountants are also expected to perform financial calculations, especially the relevant ratios that help in determining whether the company is moving towards the path of profitability or not. Once the documents have been compiled, it is the responsibility of accountants to make an ethical report to the management and other relevant external stakeholders about the firm’s financial position. Investors are able to determine the attractiveness of a company in the market by conducting a careful analysis of the documents prepared by accountants. Accountants play a critical role in the preparation of a budget. They have to balance expenses with available resources to ensure that the company achieves its goals. They are also expected to offer sound financial advice to the top management when planning to make major decisions that may affect the financial position of the firm both in the short and long term. As Tian (2018) puts it, accountants must ensure that their companies do not make serious financial blunders. These officers play a critical role in ensuring that Qatar National Bank remains on course towards achieving its set objectives.

Critical Evaluation of Financial Statements

According to Donaldson and Micheler (2018), making an investment decision may not be very easy. It is not as simple as placing the money on a fixed deposit account for a given period to earn a specific profit. One has to be keen on ensuring that the selected company will offer the desired returns. Jiekun (2018) warns that sometimes the financial objectives set by a company may not be enough to determine whether it is appropriate to invest in it. Other than the set financial objectives, an investor will be required to investigate the financial performance of the company within a specific period to determine if the set objectives can be realized. Tian (2018) advises that a critical analysis of the financial statement may offer an insight into the company’s actual performance. It will indicate what an investor should expect from the company. In this section, the researcher is interested in evaluating the income statement, the balance sheet, and cash flow statement of Qatar Investment Bank.

Income Statement

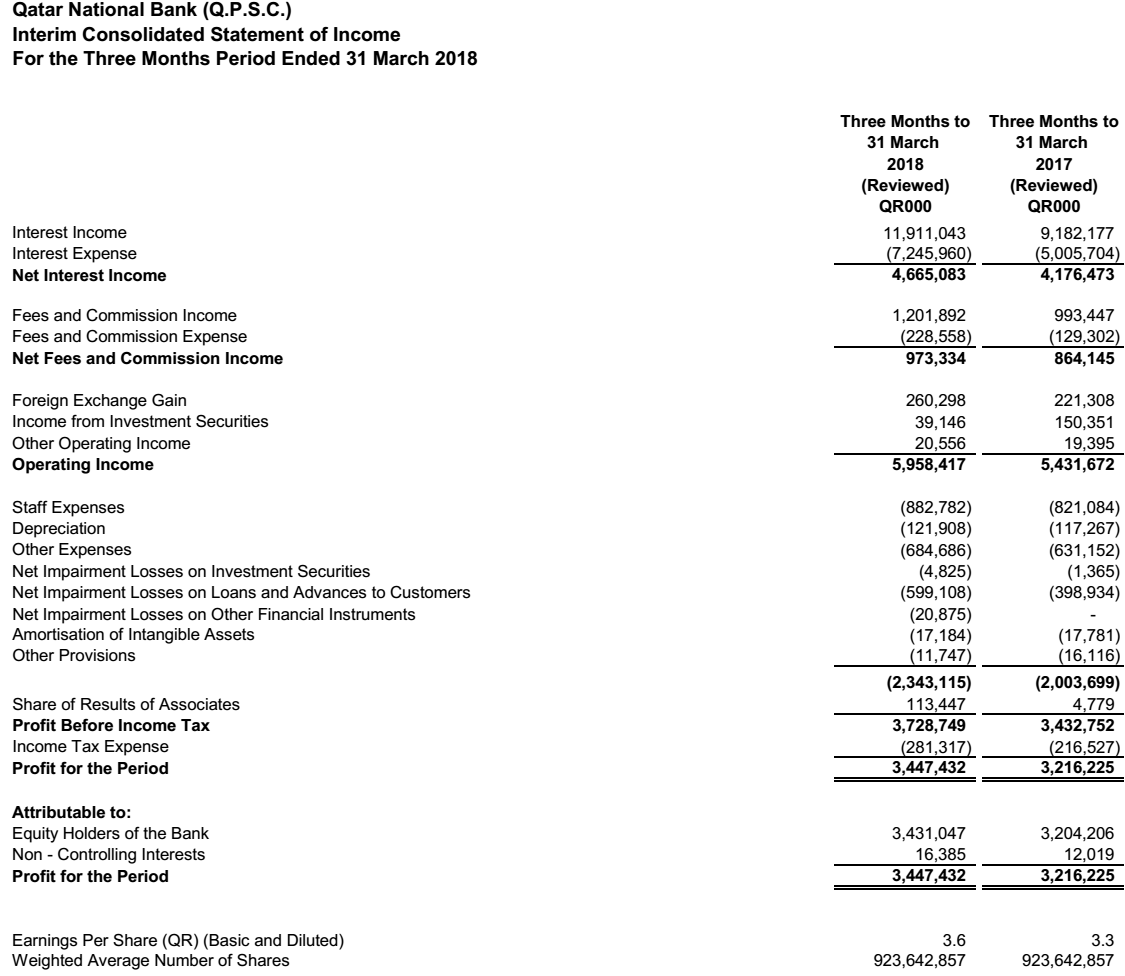

According to Broer (2018), some investors are always keen on determining the sources of income of a company before making investments. It is a necessary concern because some companies may have deceptive financial records because of involvement in shady businesses or highly volatile products whose future success cannot be guaranteed. The income statement shows that the main source of revenue for the company is net interest income. The interest earned from loans and investment into government bonds increased from QR 4,176,473,000 in the first quarter of the 2017 financial year to QR 4,665,083,000 in the first quarter of the 2018 financial year. Fees from commission also increased within that period of one year. Other important sources of income for the company within the period that was analysed include foreign exchange gains, income from investment securities, and other operating income. Tian (2018) observes that an investor will be interested in determining how well the company is diversifying on its products and the stability of each product in the market. It is important to note that this bank avoids the volatile mortgage market, which makes it even more attractive to an investor.

It is always in the interest of shareholders to have the expenses drop consistently over the years to increase a company’s profitability. Improving efficiency through the use of emerging technologies has helped financial institutions to cut their expenses on labour (Moreno, Rodríguez & Zambrana 2018). However, it is necessary to note that the consistent reduction of expenses may be possible to a given level. The income statement shows that the net expense of the company increased in the first quarter of 2018 when compared with that of 2017 (Figure 1).

The increased expenses are attributed to the expansion strategies of the company and increased impairment losses on loans and advances to customers (Bruner 2016). It is satisfying to note that the company’s net profit rose from QR 3,216,225,000 in the first quarter of 2017 to QR 3,447,432,000 in the first quarter of 2018. It is also of interest to note that the company’s earnings per share increased from QR 3.3 to 3.6 within the same period. The information further supports the financial relevance of investing in this company.

Balance Sheet

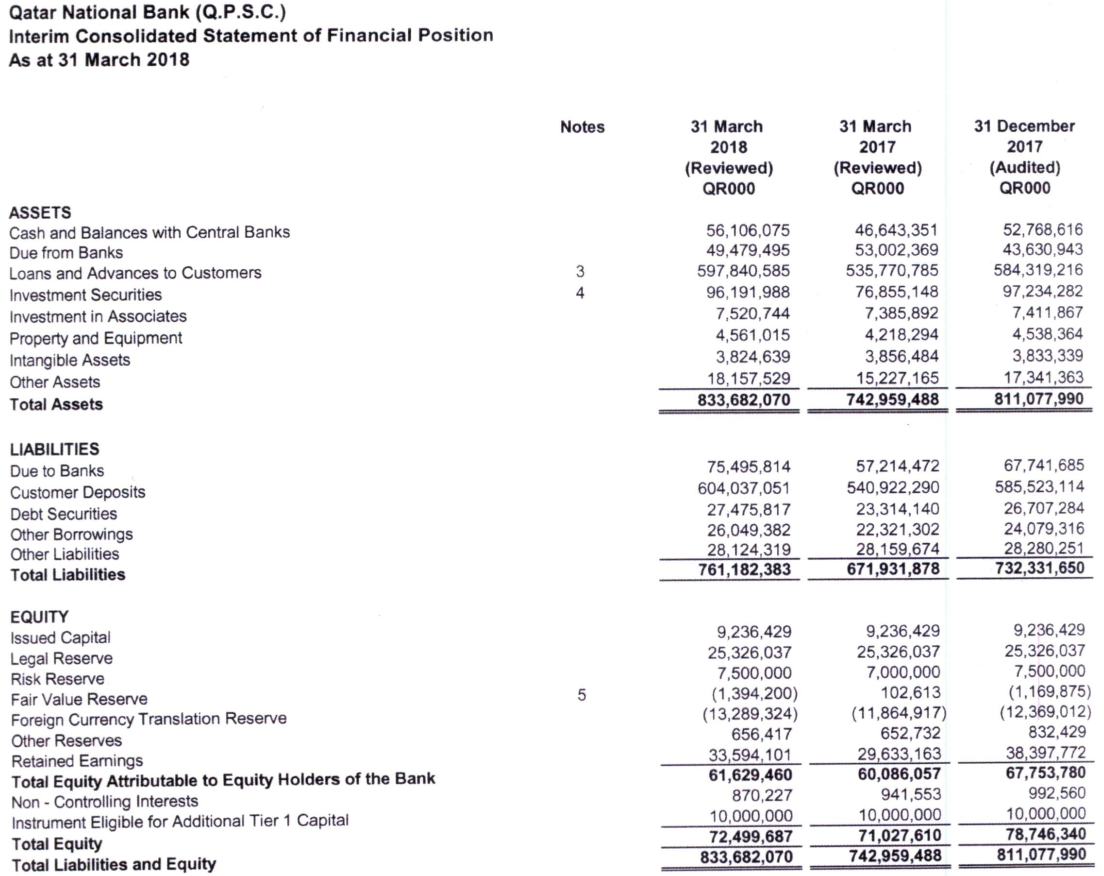

An investor will need to review the balance sheet of a company of interest to evaluate its financial position as at a given period. Bernile, Bhagwat, and Yonker (2018) explain that the size and growth of the asset, the company’s liabilities, and the equity are always of interest to the investor. The assets of the company as of December 31, 2017, were valued at QR 811,077,990,000. The asset value increased in the first quarter of 2018 to QR 833,682,070,000 as at March 31, 2018.

Within a span of one year, the company had made an attractive increase in the value of its assets because their value as of March 31, 2017, was 742,959,488,000. It means that the accounts of the company show that it has registered a consistent increase in the value of its assets within that trading period. Tian (2018) argues that the consistency is essential to an investor. It enables an individual to predict the possible trend that is likely to be witnessed in the future.

Liabilities, as Broer (2018) explains, are not undesirable elements in a company’s balance sheet as long as they can be paid in full within the desired period. A company that is expanding rapidly such as Qatar National Bank may not avoid taking loans. Given that the bank’s liabilities also include deposits from its customers, its growth is an indication that the company is attracting more clients interested in making their savings with the company.

On March 31, 2017, the company’s total liabilities stood at QR 671,931,878,000. It increased to QR 732,331,650,000 as of December 31, 2017. The amount raised to QR 761,182,383,000 in the first quarter of 2018. It is worth noting that there was a consistent increase in cash deposits received from customers within the same period, a sign that the bank is attracting more customers and winning their trust in the market. Total equity at the company has registered mixed performance. It increased in the last quarter of 2017 but dropped in the first quarter of 2018.

Cash Flow Statement

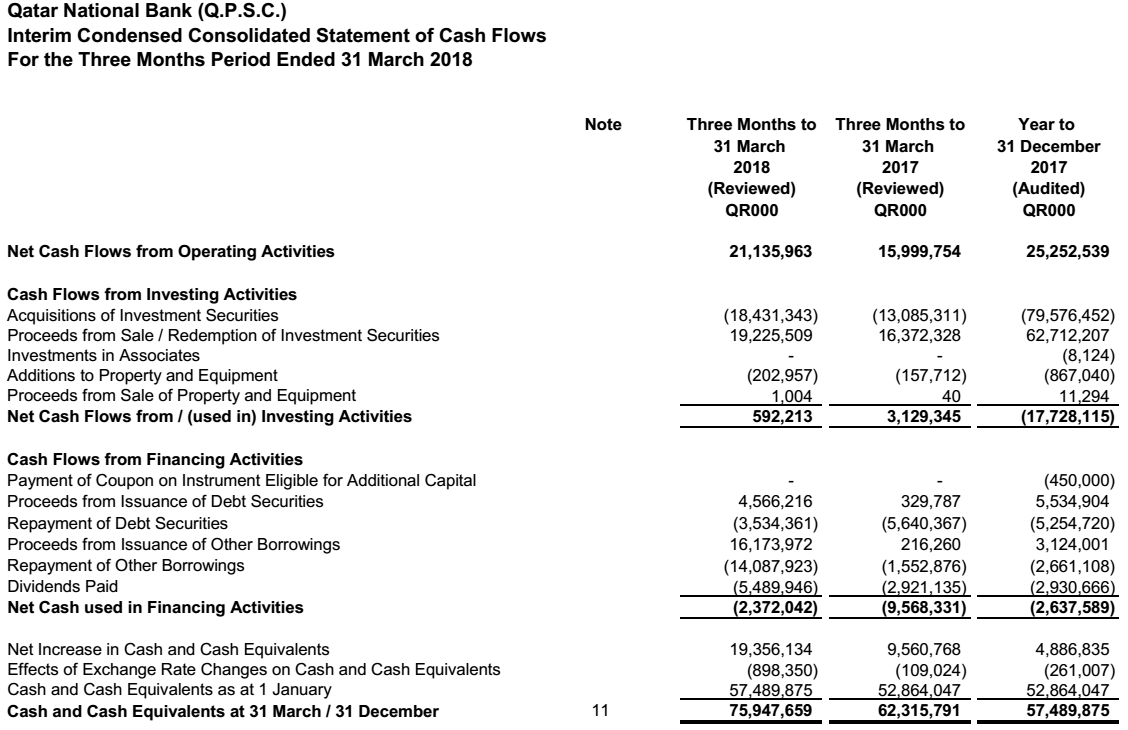

An investor may also be interested in the analysis of cash flow statement (Figure 3). It may be a further demonstration of the sources of cash for the company and areas where it is spent in normal operational activities. The statement shows that the company’s cash inflow from operating activities increased from QR 15,999,754,000 in the first quarter to QR 25,252,539 in the last quarter of 2017.

However, it experienced a slight drop in the first quarter of 2018. The drop is attributed to larger amount of investment activities that increased cash outflows. The document shows that financing activities is the main area of expense for this company. Although there has been a consistent drop in this area, it still makes a significant percentage of the amount of money that the bank spends in each accounting period.

On March 31, 2017, it was QR 9,568,331,000. It dropped to QR 2,637,589,000 in the last quarter of that financial year. It registered a further drop to QR 2,372,042,000 in the first quarter of the 2018 financial year. The document shows that the management of the company has been keen on reducing the expenses to help increase profits and the value of investment for shareholders. The company’s cash and cash equivalents vary based on a number of factors, but that is not a major concern to an investor.

Information Gathered by Other Stakeholders from the Statements

According to Broer (2018), it is always prudent for an investor to evaluate what other experts say about financial statements of a given company. The experts may provide an important warning about the documents. For that reason, the researcher embraced due diligence by reviewing responses made by others about the financial health and position of this financial institution. A report by Bruner (2016) indicates that Qatar National Bank is the largest financial institution by asset base. The document shows how the bank has experienced consistent growth over the years and the impressive records that have been witnessed in its balance sheet. Ulrichsen (2014) looked at the company’s profit and loss statements and income statement over the past ten years. In the report, it is clear that the company has registered a consistent increase in its profitability.

The company’s approach to diversifying its product portfolio has registered it to earn significant earnings from various sources. According to Bruner (2016), Qatar National Bank is one of the most financially sound banks in the Middle East and African markets. When a section of the GCC countries placed an embargo on Qatar, many expected that this giant financial institution might experience serious challenges, especially in countries such as the United Arab Emirates, the Kingdom of Saudi Arabia, and Egypt. However, that was not the case, as Ulrichsen (2014) observes. The company has remained resilient in the face of these challenges and even registered an impressive increase in profits. It is a further confirmation that the company is capable of dealing with challenges that emerge in the local and global market as it strives to offer the best value to its shareholders. This information is crucial for an investor who is cautious enough to avoid making mistakes but is interested in the company.

Critical Assessment of the Performance of the Company

After a critical assessment of the company’s financial objectives and evaluation of the financial statements, the next important step is to assess its performance. According to Tian (2018), before investing in a given company, a firm must evaluate its financial health. One must determine whether it is capable of meeting its financial obligations within the expected period. A firm that is incapable of meeting its financial obligations within the required period may not be an attractive company to invest money into even if it is making impressive progress in the market growth. Jiekun (2018) gives an example of Lehman Brothers that collapsed during the 2008 global financial crisis.

At that time, Lehman Brothers was one of the leading global financial companies. It was in active operation in North America and Europe, and it was almost impossible to imagine that such a large company would fall. However, some of its unattractive products, especially in the increasing rates of bad debts in the mortgage segment of the market, had a serious impact on the company. Investors lost their money to the company that they had so much faith in for decades. If a large and successful company such as Lehman Brothers could fall, then anything is possible even for a company such as Qatar National Bank. As an investor, it will be necessary to avoid a similar fate by evaluating the performance of the company using accounting ratios and appraisal ratios.

Accounting Ratios

The accounting ratios are critical when an investor is making a decision on whether to buy shares of a given company. Broer (2018) explains that the financial capacity of a company is often determined by these ratios. In this section, the report will focus on the liquidity ratios, asset turnover ratios, financial leverage ratios, profitability ratios, and what they mean to say about Qatar National Bank.

Liquidity ratios

The liquidity ratios determine the capacity of a firm to meet its short-term financial obligations. For this bank, it should be able to pay its short-term debtors and money should always be available for the depositors who wish to make a withdrawal. A cash ratio analysis is necessary to determine the liquidity of this company.

- Current ratio = Current assets/Current liabilities

- Current assets = (cash and balances with the central banks+ due from banks+ loans and advances to customers+ investment in associated) = 807,138,887

- Current liabilities = (Due to banks+ customer deposits+ debt securities+ other borrowings) = 733,058,064

- Current ration = 807,138,887/733,058,064 = 1.101

With a cash ratio value that is greater than 1, it means that the bank has no liquidity challenges. It can address all short-term financial needs without having to borrow or liquidate some of its long-term assets.

Asset turnover ratios

It may be appropriate to determine asset turnover ratios, especially the inventory turnover. However, Broer (2018) observes that Cost of Goods Sold does not apply to banks and insurance companies. As such, it is not possible to calculate the inventory turnover and receivables turnover because of the unique nature of products offered in the banking sector. In its place, an investor may be interested in determining the number of new customers the firm has attracted and the number of deposits they have made. This is addressed in a different section of this document.

Financial leverage ratios

The financial leverage ratios help in measuring the overall debt picture of a company, as Zhaogang and Haoxiang (2018) note. In this analysis focused on determining the debt-to-equity ratio. The information from the financial documents enabled the analysis of this ratio.

Debt-to-Equity ratio = Total debt/total assets = 761,182,383/833,682,070 = 0.913

The outcome shows that the company’s debts are less than its assets. It is a further assurance that the company can meet its long-term financial obligations.

Profitability ratios

The return on investment is determined by the profitability ratio. The investor will be interested in knowing how much to expect from the company based on the investment that is to be made. In this analysis, return on assets was considered an appropriate analysis.

Return on assets = Net income/Total assets = 3,447,432/833,682,070 = 0.004

The positive value, although it may appear to be small, is what an investor needs to determine whether the investment will yield the desired results. The outcome of the analysis shows a positive value, which means that investors of this company should expect profits.

Dividend policy ratios

According to Broer (2018), one of the areas that is of great interest to an investor is the dividend policy. Even if a company is making impressive profits, its dividend policy determines how much of the earned profits will go to the shareholders. The analysis focused on the payout ratio analysis.

Payout ratio = Dividends per share/Earnings per share

- Dividends per share = (5,489,946/923,642,857) = 0.006

- Earnings per share = 3.6

- Payout ratio= 600

It is clear that the company’s payout ratio is impressive. Other than focusing on development and expansion, the company is keen on meeting the financial needs of its customers.

Appraisal Ratios

Appraisal ratios are critical when measuring the quality of a fund’s investment-picking capacity. The researcher used equity multiplier as the tool of analysis. The outcome of this analysis is shown below.

Equity Multiplier = Total Assets/ Total Equity = 833,682,070/ 72,499,687 = 11.499

The equity multiplier analysis shows that the company uses less debt to finance assets. It is an indication this firm is able to finance its activities without relying on external help. The fact that this company has been involved in ambitious expansion projects without relying on debts from other financial institution is a demonstration of its worthiness for a potential investor.

The Performance of the Company and its Current Share Price

The critical analysis of the financial documents of Qatar National Bank shows that it has registered impressive financial performance over the recent past. It is able to meet its financial obligations. Although it has been expanding rapidly, the management has succeeded in ensuring that the total debts do not exceed the company’s assets. An investor who buys the company’s shares is guaranteed of impressive returns if the current performance is maintained. The current share price of the bank is QR 152.99.

The Company’s Capital Structure and Forward Strategy

The company’s capital structure demonstrates a commitment by the management to avoid debt funding and instead it is relying on its profits and earnings from its sale of shares. Its forward strategy is to expand its asset base and increase its market share in the global market, especially in South East Asia.

Conclusion

The critical analysis of accounts, strategies, and financial objectives of Qatar National Bank shows that this company is keen on offering the best value to its investors. The company has faced numerous challenges in the regional market, especially after governments of Saudi Arabia, Egypt, and the United Arab Emirates placed economic sanctions on Qatar because of socio-political alignments. These were crucial markets. The management of the company has maneuvered past these challenges and maintained its consistent increase in profitability.

The financial objectives and strategies put in place to achieve them are sound and realistic. The analysis of financial statements shows that the company’s asset value is increasing and its profits are attractive. The accounting ratios of the company show that it is capable of meeting both short-term and long-term financial obligations. The fear of a possible case of bankruptcy is not there based on these records.

As an expert in the field of investment, the researcher can make an informed advice to an investor that it is safe to invest in Qatar National Bank. Both short-term and long-term investors can consider this company as an appropriate avenue to increase the value of their money. Long-term investors are likely to benefit more because of the consistent increase in asset value, market share prices, and dividends paid to investors.

Reference List

Arnold, T & Awadalla, N 2018, ‘Update 1-Qatar National Bank to sell small stake in Egypt unit to comply with listing rules’, Routers. Web.

Azevedo, E & Gottlieb, D 2017, ‘Perfect competition in markets with adverse selection’, Econometrica Econometric Society, vol. 85, no. 1, pp. 67-105.

Bernile, G, Bhagwat, V & Yonker, S 2018, ‘Board diversity, firm risk, and corporate policies’, Journal of Financial Economics, vol. 127, no. 3, pp. 588-612.

Broer, T 2018, ‘Securitization bubbles: structured finance with disagreement about default risk’, Journal of Financial Economics, vol. 127, no. 3, pp. 505-518.

Bruner, C 2016, Re-imagining offshore finance: market-dominant small jurisdictions in a globalizing financial world, Oxford University Press, New York, NY.

Doepke, M & Schneider, M 2017, ‘Money as a unit of account’, Econometrica Econometric Society, vol. 85, no. 1, pp. 1537-1574.

Donaldson, R & Micheler, E 2018, ‘Resaleable debt and systemic risk’, Journal of Financial Economics, vol. 127, no. 3, pp. 485-504.

Ghantous, G & Zhdannikov, D 2018, ‘Qatar National Bank seeks growth in Southeast Asia’, Routers. Web.

Graham, B 2017, ‘An econometric model of network formation with degree heterogeneity’, Econometrica Econometric Society, vol. 85, no. 1, pp. 1033-1063.

Jiekun, H 2018, ‘The customer knows best: the investment value of consumer opinions’, Journal of Financial Economics, vol. 128, no. 1, pp. 164-182.

Kübler, F & Polemarchakis, H 2017, ‘The identification of beliefs from asset demand’, Econometrica Econometric Society, vol. 85, no. 2, pp. 1219-1238.

Kyle, A & Obizhaeva, A 2016, ‘Market microstructure invariance: empirical hypotheses’, Econometrica Econometric Society, vol. 84, no.1, pp. 1345-1404

Moreno, D, Rodríguez, R & Zambrana, R 2018, ‘Management sub-advising in the mutual fund industry’, Journal of Financial Economics, vol. 127, no. 3, pp. 567-587.

Qatar National Bank (QNB) 2018, Interim condensed consolidated financial statements 31 March 2018. Web.

Tian, M 2018, ‘Tradability of output, business cycles and asset prices’, Journal of Financial Economics, Elsevier, vol. 128, no. 1, pp. 86-102.

Ulrichsen, K 2014, Qatar and the Arab Spring, Oxford University Press, New York, NY.

Zhaogang S & Haoxiang, Z 2018, ‘Quantitative easing auctions of treasury bonds’, Journal of Financial Economics, vol. 128, no. 1, pp. 103-124.