Abstract

Islamic banks have developed alternatives to the derivatives that they use in their operations as per the sharia laws. This paper looks at these alternatives to the derivatives and how capable they are in sustaining the operations of these banks. The study shows that Murabaha, wa’ad, and musawama are some of the alternatives to the conventional derivatives that Islamic financial institutions use. They are capable of sustaining operations of these institution and they offer opportunities for Islamic banking to grow.

Introduction

Conventional banks use conventional derivatives in their operations. Customers deposit their money in the banks and the banks use the same to lend to other customers. The clients who deposit their money get interested in the banks and the customers who borrow money pay interest to the banks. According to Lewis, Mohamed, and Shamsher (2014), conventional banks rely on interest and sometimes speculations in the market to make profits. However, Islamic banks operate on a completely different platform. Islamic banks are sharia-compliant, which means that they do not permit the use of interests (usury/riba) as a way of earning income by financial institutions.

The Islamic financial institutions also prohibit high degrees of uncertainty where banks subject their clients to investments that may leave them dangerously exposed to external forces. However, these institutions still have a responsibility to their clients and the shareholders. Those who deposit their money in the bank would prefer having some form of return for having allowed the bank to stay with their money. However, the benefit cannot be given in the form of interests. On the other hand, shareholders would want to get returns from their investments. Islamic banks are forced to use substitutes for derivatives in their operations to ensure that they meet the needs of both their clients and their shareholders. This paper focuses on the investigation of the practice of Islamic finance by Islamic financial institutions as well as investors and policymakers.

Literature Review

Islamic banking is becoming increasingly relevant in many parts of the world, and it has attracted the attention of many scholars. It has been of interest among scholars to find ways in which banking can be practiced among Muslims without going against the teachings of Islam. Traditionally, banks were structured to earn money by charging interests on those who borrow money. To ensure that they have enough money at their disposal to lend to more borrowers, conventional banks came up with mechanisms to attract individuals and entities to deposit the money they do not use with them by giving interests (Brunn & Gilbreath, 2015). These practices are not permitted under Islamic law. For a long time, many banks in Islamic countries had no option but to offer conventional banking services to their predominantly Islamic customers and some Muslims who are strict in following their faith started questioning these conventional derivatives. The report shows that some of these faithful even opted to avoid banking services as a way of abiding by sharia. These institutions had to find a way out.

Growth of Islamic Banking and How It Was Affected by 2008 Economic Recession

In the mid-twentieth century, there was a growing concern among the Islamic scholars and economists about the financial services offered by conventional banks and their lack of compliance with sharia laws. In the late 1950s, an experimental local Islamic bank was established in the rural areas of Pakistan. In 1963, an Egyptian economist, Ahmad Elnaggar, came up with a concept that he believed could be used by Islamic financial institutions to operate in line with the teachings of sharia (Ahmed, Asutay, & Wilson, 2013). At first, many were skeptical about the ability of this technique to work both in the interest of the shareholders and those who deposit their money in the bank. It was largely seen as a concept that would benefit borrowers at the expense of other stakeholders. However, the commitment of the investors who strongly believed in the Islamic faith and their determination to have banks, which are sharia-compliant, has seen Islamic finance grow at unprecedented rates. Islamic finance grew in popularity very rapidly in the Middle East and North Africa (MENA) regions. At the onset of the 21st, Islamic finance started finding its way into parts of Asia, Europe, and the Americas. According to a report by Irfan (2015), it was estimated in 2014 that about $ 2 trillion of the world’s total assets are sharia-compliant. Sharia-compliant banks make about 1% of the world’s financial institutions in terms of the assets held.

According to Ayoub (2014), in 2008 the world was hit by the worst economic recession since the end of the Great Depression from 1929 to 1939. One of the sectors that were worst affected in many parts of the world were financial institutions. The report shows that a number of financial institutions in parts of MENA regions were also affected. However, Islamic financial institutions were not affected in a significant manner. This is mainly attributed to the practices they have embraced where banks are not permitted to speculate transactions and high risks businesses. Conventional banks, which often engage in high-risk businesses and speculative activities, were hit hard by the recession. For the first time in the history of Islamic banking, stakeholders saw the benefits of these institutions in terms of their stability. Investors never lost their money despite the harsh environment that was caused by the global recession. According to Ayoub (2014), Islamic financial institutions are growing faster than conventional banks at over 17% per annum. The future of Islamic banking is bright as economists and financial experts continue to find more Islamic derivative products that these institutions can offer in line with the Islamic laws.

Usury and Gharar

According to Mobin and Ahmad (2014), conventional financial institutions thrive in environments where they can make profits through the interests they earn from the money they lend to customers. However, under strict sharia law, interest earned by financial institutions is equated to usury, a practice that is prohibited. Sharia laws permit borrowing money from individuals and institutions, but it prohibits the borrowers from charging interests on that money. The borrower may request for a share of the profits earned in case the borrowed money was invested in the business, but that share should not be considered interest. Charging interest, as Khan (2013) explains, is seen as being exploitative under sharia law. This is so because sometimes one may borrow the money to help a sick relative or to address a personal problem. The law considers it immoral for one to charge interest on money borrowed to help address a social or medical problems. As such, interest is one of the products that financial institutions do not charge on their businesses. It is one of the most distinctive features of Islamic finance that makes it unique compared with other conventional banking systems.

Islamic financial institutions also prohibit high degrees of uncertainty, also known as gharar (Brunn & Gilbreath, 2015). Financial institutions are allowed to invest the money that their clients deposit with them. However, the investment decisions must be fully disclosed to the clients before it is made. Depositors must be fully aware of the way their investment is used by these financial institutions. High-risk projects must be avoided by these institutions because they may subject the depositors to unforeseeable risks. According to Samers (2016), Islamic finance also demands that a bank can only invest in ethical projects or causes. Whether the bank is planning to make a direct investment or if intends to give money to other institutions for purposes of investments, it must be confirmed that the intended project is of just cause and that it is in line with Islamic teachings. As such, it is not easy for one to borrow money from sharia-compliant financial institutions for the purposes of investing in pork business or any other business that is viewed as unjust under Islamic laws.

Substitute for Derivatives

The above strict conditions force Islamic banks to come up with substitutes for derivatives which can be used in place of the conventional derivatives in the field of banking and finance. According to Mobin and Ahmad (2014), one of the Islamic derivative products that financial institutions currently use to meet the interest of the shareholders, depositors, and the lenders is the profit-sharing agreement. Once a client comes to deposit his or her money in the bank, the institution will explain the nature of business the savings made will finance. The depositor is, therefore, aware that the money deposited will not sit idle in the bank but will be used in other investment activities. After the agreed period, the clients can go back to the bank, pick their money back, and take the profits as per the agreement. In some cases, a loss made from such an investment is shared by the bank and the depositors while in other cases banks are forced to suffer a loss on their own instead of sharing it with the depositors. Most of the financial institutions have different accounts that offer varying options for the depositors in terms of how their money will be used to finance other projects when they can access their savings and the amount of interest they earn. This strategy is used to attract as many depositors as possible so that these financial institutions can have enough cash for their operations.

Those who are borrowing from the ban are not charged any interest on the money given to them by the bank. Instead, a new product that is in line with Islamic teachings has been introduced (Samers, 2016). These borrowers are expected to share their profits with the bank. After assessing the risks of the business of the borrower and the ethical issues associated with it in line with sharia law, the bank will enter into a business contract with the borrower. The two parties will rich an agreement on how the profits, earned directly from the money borrowed, shall be shared. A time-frame is also provided within which the share of profit should be given to the bank. Although it is a more risky strategy compared with other conventional derivatives given that profitability is not guaranteed, profit sharing is one of the few options that these Islamic banks have to use to make profits. Another sharia-compliant derivative that is available for Islamic banks is direct investments. These institutions can make direct investments into various projects that are legal and acceptable to the shareholders in order to earn profits. Khan (2013) notes that these banks are also not barred by sharia law from earning income by offering financial advisory services to their customers.

According to Irfan (2015), murabaha, known in financial terms as cost-plus-based financing or simply as mark-up, is currently one of the most popular Islamic derivatives used by Islamic banks around the world. This new derivative allows banks to help their clients to purchase an item even if they cannot make the whole payment instantly. For instance, when a client wants to purchase a car and he or she lacks all the money needed for the car, the client will approach the bank and explain the case. The bank will look for the product in the market and explain to the customer the nature of the product and the cost. The bank will also explain the mark-up price (the original price the bank will purchase the car at plus a fee for the bank) to the customer and terms of payment. If the customer is pleased by the terms, the bank will purchase the car and hand it over to the client, but retain the title. When the customer makes complete payment of the mark-up price, the bank will hand over full ownership of the car to the customer. The concept used in Murabaha is the same as that or mortgage, only that the concept of interest is replaced by fee for the help that the bank will be extending to the client. According to Irfan (2015), new Islamic derivates such as wa’ad (unilateral pledge) and musawama (cost, plus financing where the cost of the underlying asset is unknown at the time of signing the agreement) are also emerging.

Hypothesis Development

It is important to come up with a hypothesis when conducting research. The hypothesis states what the researcher believes will be the findings of the study after collecting and analyzing both primary and secondary data. It is often based on the researcher’s initial knowledge about the research topic. In this research project, the following research questions will be used to develop hypothesis.

What do Islamic banks use as substitute for derivatives in their operation?

Based on the above question, the research hypothesis will focus on determining whether the alternatives to derivatives used by the Islamic banks are profitable enough to sustain their operations in the current competitive financial market. Below is the hypothesis that the researcher seeks to determine after analysis of the primary data.

H1: Alternatives to derivatives used by Islamic financial institutions are capable of sustaining their operations in the financial markets.

The review of the literatures above and analysis of primary data will help confirm or reject the above hypothesis.

Data and Methodology

In this section of the research project, the focus will be to describe the process that was used in collecting, analyzing, and presenting data. It will look at the approach that was used in identifying the sample, how data was collected from the sample, and the method used in the analysis. It helps in explaining the validity of the study. Data was collected from both primary and secondary sources. Secondary data was collected from books, articles, and reliable online sources. Primary data was collected from a sample of respondents.

Sampling

The nature of information required can be collected from experts in Islamic finance within the United Arab Emirates. Currently, a number of Islamic banks are in operation in major cities across the country. It means that numerous people qualify to be part of our study. However, given that this academic research was limited in terms of time, a small sample was used to identify participants for the study. Simple random sampling was considered appropriate. The sample was collected from three major Islamic financial institutions in Dubai. 20 participants were selected to take part in the study.

Data Collection

The researcher used a face-to-face interview to collected data from the respondents in their respective banks. The researcher was interested in talking directly to the participants when collecting data so that when necessary they would be requested to clarify their answers. Data was collected from the sampled participants using questionnaire that had been prepared. Mix of open and closed-ended questions was used to collect the needed information. Closed-ended questions made it possible to code the responses and analyze them by using mathematical methods. On the other hand, open-ended questions made it possible for the respondents to explain their answers in an elaborate way and using their own words.

Data Analysis

The collected data was analyzed in order to answer the research question and to confirm the set research objectives. Analysis of primary data was done using mixed methods. Quantitative data analysis was important because it enabled the researcher to use mathematical methods to determine the magnitude of the alternative to derivatives in terms of their ability to sustain the operations of Islamic financial institutions. Results obtained from the quantitative analysis were presented in the form of graphs and charts for the purposes of clarity. Qualitative analysis was necessary in explaining phenomena where these alternatives to derivatives proved useful and sustainable to the operations of the Islamic financial institution. Allowing the respondents to explain the phenomena in their own words made it possible to have a clear understanding of the issues being investigated.

Ethical Considerations

When collecting data, the researcher was keen to put into consideration ethical concerns. Before approaching the respondents for the purposes of sampling, the researcher approached the management of the three financial institutions to seek for permission to conduct the study in their institutions. The respondents were approached only after getting the approval of the management unit. The researcher explained the nature of the study to the respondents and selected participants based on their willingness to be part of the study. The researcher also ensured that the identity of the respondents was protected. Instead of using their real names, the researcher used codes to identify the respondents.

Results

In this section the researcher will present the results of the analysis and discuss the findings in line with the research topic. The analysis started by looking at the research question. Below is the primary research question that was used in the study.

What do Islamic banks use as substitute for derivatives in their operation?

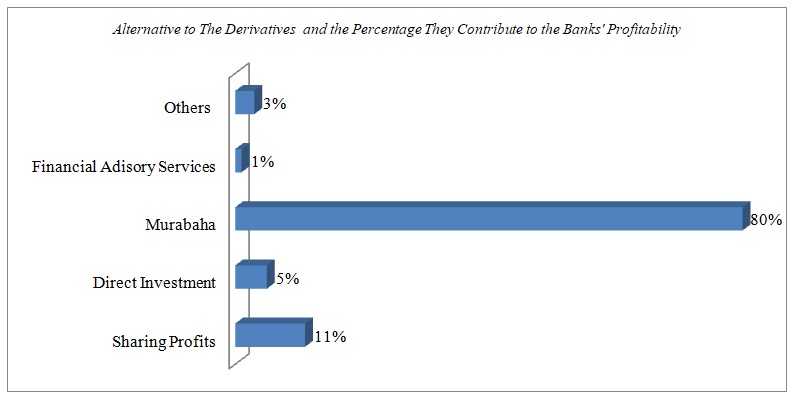

This question wanted to determine what Islamic banks use as a substitute for derivatives in their operations. The question was posed to the participants and their response was analyzed mathematically. The figure below shows the outcome of the analysis.

As shown in the figure above, murabaha is currently the best alternative to the derivatives used by financial institutions. The respondents noted that local Islamic banks heavily rely on murabaha as a way of generating their profits. The principle used is in line with sharia law and it allows the bank to earn attractive profits. The clients also benefit because they get the help of these financial institutions to purchase items they need even if they lack the full amount needed for the product at the time of the purchase. The respondents noted that wa’ad and musawama are also becoming conventional sharia-compliant derivatives that Islamic financial institutions can use in their operations. As shown in the graph above, profit sharing, direct investment, and financial advisory services are the other important sources of income for Islamic financial institutions.

H1: Alternatives to derivatives used by Islamic financial institutions are capable of sustaining their operations in the financial markets.

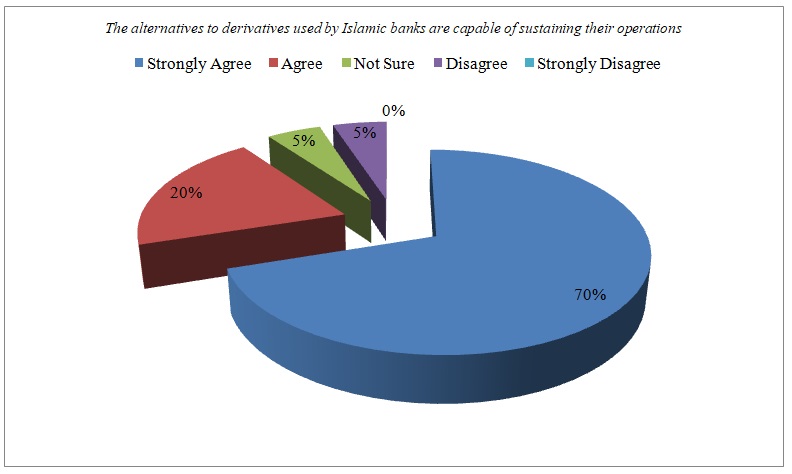

The primary data collected from the respondents was analyzed in order to confirm the hypothesis that was set in the paper. The participants respond to the issue based on their experience handling the alternative to the derivatives in the Islamic banks. The chart below shows the response obtained from the respondents.

As shown in the figure above, majority of the respondents (70%) strongly feels that the alternatives to the derivatives can sustain operations of the Islamic banks. Another 20% supports this view. Only 5% of the participants had a different view.

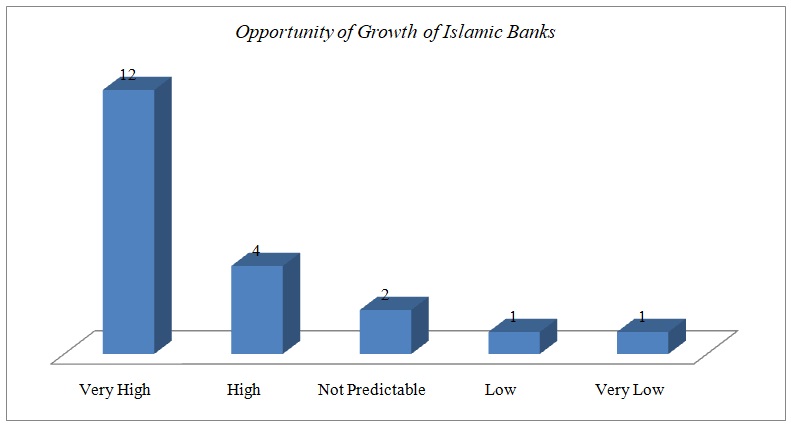

The researcher also wanted to determine the opportunity for growth of Islamic banks given that they avoid using derivatives popular among conventional banks. When asked how they feel about the opportunities for growth of Islamic banks, the figure below shows their response.

As shown in the figure above, majority of the respondents feel that Islamic banks have very high opportunities for growth. These respondents stated that Islamic banking is growing in popularity in various countries around the world. Only two of the twenty respondents had skeptical view of the growth opportunities for Islamic banks, claiming that avoiding the derivatives in the banking system is not easy for financial institutions.

Conclusion

Islamic financial institutions are keen on offering products which are in line with the sharia laws. As such, they avoid derivatives considered to be against Islamic teachings. As shown in the discussion above, these financial institutions are forced to come up with alternatives to the derivatives used in conventional banks. Murabaha, wa’ad, and musawama and some of the new alternative derivatives developed for Islamic banks in line with sharia law. The Islamic banks sometimes rely on direct investments and financial advisory services to earn income and sustain their operations. The study shows Islamic banks have huge opportunity of growth in the international markets as their products continue to gain popularity among the Muslims around the world.

References

Ahmed, H., Asutay, M., & Wilson, R. (2013). Islamic banking and financial crisis: Reputation, stability and risks. Edinburgh, UK: Edinburgh University Press.

Ayoub, S. (2014). Derivatives in Islamic finance: Examining the market risk management framework. Edinburgh, UK: Edinburgh University Press.

Brunn, S. D., & Gilbreath, D. A. (2015). The changing world religion map: Sacred places, identities, practices, and politics. Dordrecht, Netherlands: Springer

Irfan, H. (2015). Heaven’s bankers. New York, NY: The Overlook Press.

Khan, M. A. (2013). What is wrong with Islamic economics: Analyzing the present state and future agenda. Northampton, MA: Edward Elgar Publishing.

Lewis, M., Mohamed, A., & Shamsher, M. (2014). Risk and regulation of Islamic banking. Cheltenham, UK: Edward Elgar.

Mobin, A., & Ahmad, A. (2014). Liquidity management of Islamic banks: The evidence from Malaysian practice. The Global Journal of Finance and Economics, 11(2), 175-186.

Samers, M. (2016). Conceptualizing Islamic banking and finance in Malaysia and Singapore: Conventional rule regimes, national forms of governance, and Islamic financial architectures. Pulau Ujong, Singapore: National University of Singapore.