Our project will focus on scheduling and forecasting. Consequently, the Dubai Islamic Bank will be used as the basis for this study. The operations management exercise will focus on one aspect of scheduling and forecasting namely teller scheduling. On the other hand, forecasting for Dubai Islamic Bank will take into account long, short, and medium term factors.

Teller Scheduling

Sequencing Jobs

In the course of their operations, Dubai Islamic Bank tellers utilize the ‘first come, first served’ approach of customer service. In addition, the bank tellers carry out six distinct jobs that include:

- Providing high levels of customer service through the bank teller functions and making sure that all bank functions are efficient through the handling process.

- Counting the money that is given to and received from customers and ensuring that all notes and denominations are accurately represented.

- Tellers are also expected to conduct an accurate reconciliation of cash balances in the course of banking activities. At the end of every banking session, it is the responsibility of bank tellers to ensure that all cash balances are reconciled.

- Being responsible for guiding customers when they are seeking safekeeping of both assets and highly valuable items. For instance, the customers should be able to access their safe deposit boxes at all times.

- Acting as custodians in the approval of banking transactions that are beyond the normal limits.

- Ensuring that other bank departments are able to maintain a viable cash balance at all times. For instance, bank tellers should alert the management when demand for cash money appears to be outstripping the bank’s supply.

Table 1: Below is a table that indicates how processing time and due dates for all the above jobs as per the data from Dubai Islamic Bank

Table 2: A representation of an operation management chart that indicates how job sequencing leads to lateness

From the figures in the table above, the task completion time will be counted as the total flow time divided by the number of tasks: 60/6=10 days

The percentage of utilization will be derived by taking the total processing time and correlating it to the total flow time of all the six tasks: 18/60*100=30%

From the data above, the average number of jobs in the teller-functions will be equal to the total flow time divided by the calculated flow time: 60/18= 3.33 jobs

It is also possible to determine the average job lateness whereby it will be equal to total amount of job-lateness in relation to the number of tasks: 9/6= 1.5 days

Cyclical Scheduling

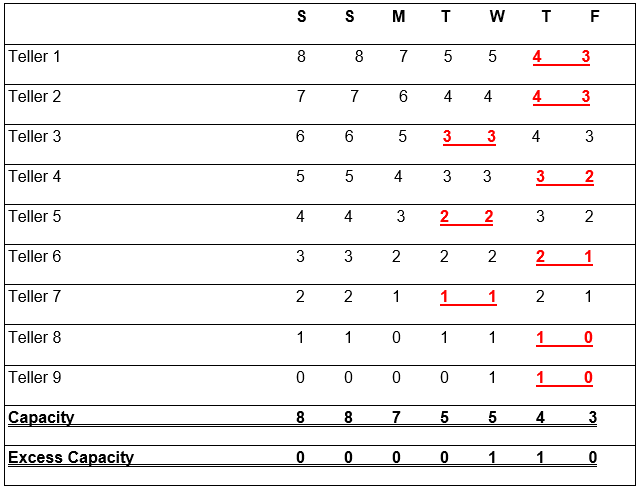

When setting schedules for its tellers, the Dubai Islamic Bank utilizes a cyclical scheduling system whereby the methodology comes in handy when setting the days off for its tellers. This cyclical scheduling is particularly useful to the employees who work in the bank’s call centre. Operations in the Customer Service Department happen from Saturday to Thursday but the call centre remains operational throughout the week. In the course of Dubai Islamic Bank’s scheduling, the bank first predicts the overall number of tellers that are required in all of its branches. Consequently, the bank determines the two consecutive days when the number of operations will be low. Using these projected figures, the bank sets one of the less-busy days as a day-off for one employee. The Dubai Islamic Bank’s cyclic scheduling is represented in the table below.

Forecasting

The financial assets of the Dubai Islamic Bank are projected to increase in value thereby reaching US$3.24 trillion in the year 2020. These forecasts are courtesy of the Dubai Islamic Economy Development Centre (DIEDC) and Thomson Reuters State of Global Islamic Economy (SGIE) (Abduh & Othman, 2014). The rosy financial projections are attributed to various financial deals that the Dubai Emirate has conducted in the last few years (Abdel-Magid, 2012).

According to observers, these critical financial deals are quickly solidifying the position of Dubai as the financial services industry leader as far as the Islamic Economy is concerned. The management of Dubai Islamic Bank has outlined various forecasts including short-term and long-term ones with the view off stabilizing its operations in the coming years. During the course of the bank’s forecasts, both internal and external factors are put into consideration.

Some of the long-term factors that influence the bank’s forecasts include market dynamics, competition within the industry, internal and external banking policies, and other industry factors. On the other hand, short-range forecasts for Dubai Islamic Bank depend on cost of operations, teller’s job scheduling, employee accommodation, advertising and promotion, and the number of employees who are needed to maintain a free-flow of service.

During the course of its forecasts, the Dubai Islamic Bank also has to factor-in the costs of developmental-technology as well as the need for research and technology. Other medium-range factors that influence the bank’s forecasting include revenue dynamics, profitability, turnovers, costs of materials, and provisional budgets. Any business also requires to take into account the long-range factors that apply to its operations and subsequent forecasts. In the case of Dubai Islamic Bank, the long-range factors that influence its forecasting include the costs of expansion and long-term investments (Pure Decisions Limited, 2016).

References

Abdel-Magid, M. F. (2012). The theory of Islamic banking: accounting implications. International Journal of Accounting, 17(1), 79-102.

Abduh, M., & Othman, A. A. (2014). Service quality evaluation of Islamic banks in UAE: An importance-performance analysis approach. Journal of Islamic Economics, Banking and Finance, 10(2), 103-113.

Pure Decisions Limited. (2016). The Tactical & Strategic Report on Dubai Islamic Bank. Web.