Supply, Demand and Elasticity

Main Products &general characteristics of Abu Dhabi Islamic Bank

Abu Dhabi Islamic Bank (ADIB) carries out its operations in the National commercial banks’ sector. The bank is headquartered in the United Arab Emirates. The bank is a public listed company majoring in the provision of Sharia-compliant Islamic financial products, investment and banking products and services. Throughout the country (United Arab Emirates), Abu Dhabi Islamic Bank has a total of 69 branch networks. For this study, we will evaluate the Al Bateen main branch. The branch operates under five main business segments that are: the wholesale banking segment, which offers credit facilities and financial services current accounts and deposit accounts both for institutional and corporate customers, the retail segment offers commercial and consumer Ijara, Murabaha, funds transfer facilities and Islamic covered card.

In addition, trade facilities are provided under this segment. The third segment is the private banking segment, this segment provides credit and financing facilities, similarly, the segment offers current accounts and deposit-taking for individual affluent customers. The fourth segment is the real estate category, which majors in acquisition, development, selling and leasing. The final category is the capital markets segment that undertakes treasury and trading services, a brokerage in the money market. The total revenues for the company registered in the 2010 fiscal year stood at AED 3074 million, representing an increase of 22 percent from the 2009 figure. Net profit registered was AED 1024 million over the same period (ADIB Annual Report 8).

Islamic covered cards and car finance product

The Islamic covered cards and the car finance product are two important products, respectively, that Abu Dhabi Islamic Bank offers.

Islamiccover cards

The cover cards are products offered by the bank to individuals seeking to be protected against financial emergencies. This product gives the customer unmatched convenience in accessing quick liquidity during abrupt and emergency situations. The bank was the pioneer in the issuance of Islamic cover cards. The cards are of two categories; Gold card which combines both high coverage and competitive profit margins and a Platinum card with high limits of spending, lifestyle benefits and high-profit rates (AIDB 1). The sales from Islamic cover cards increased from AED 98686, in 2009 to AED 158448 in 2010, representing an increase of 61 percent (AIDB Annual Report 61).

Car finance (Vehicle murabaha)

Over the last two years, the product has experienced a decline in its sales revenues. In 2009, sales from vehicle murabaha generated a total of AED 8,022,334,000 while in 2010, the product registered total sales of AED 7,904,499,000, representing a decline of 1.5 percent (AIDB Annual Report 61).

Analysis of the firm’s supply and demand

Product: Car Finance (Vehicle murabaha)

Consumers’ income

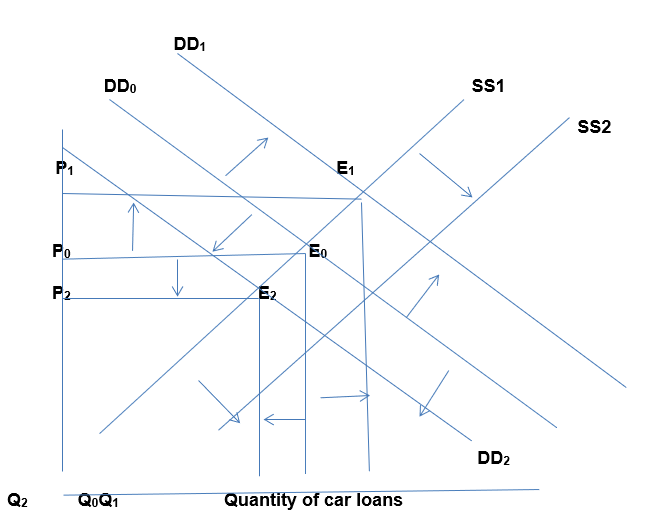

When consumers income increases, the total disposable income increases. The consumers can afford to pay their interests on loans. For this reason, they demand more loan products from the bank. This leads to an outward shift in the demand curve for loans from DD0 to DD1 a new equilibrium is achieved at point E1 with price P1 and a higher quantity Q1.

Conversely, when income reduces, individuals’ disposable incomes reduce, given that cars are luxury goods, the demand for car finance declines, the quantity of car finance demanded from the bank drops from the initial Q0 to Q2, and the corresponding price falls from the initial P0 to P2. A new equilibrium is achieved at point E2.

Prices of competing products/services

The car loan market in the UAE is significantly developed with many competitors and products to choose from. Given the stiff competition, ADIB faces a situation where consumers have more power in that they tend to select the best deals in the market. According to Money Camel (1), currently, the bank offers car loans up to a maximum of AED 350,000 for new cars representing approximately 80 percent of the new car value. The loan amount is to be repaid within a period of 4 years (48 months). One percent of the loan amount is charged as a processing fee. The bank faces substitutes such as Auto finance offered by the Noor Islamic Bank, which also increases competition for the products offered y the bank (Noor Islamic Bank 1). If the interest rates charged on Auto finance in Noor bank is reduced, then the demand for car loans offered by ADIB will decline represented by an inward shift in the demand for car loan products. On the other hand, if the price (interest) on the substitute product (Auto finance) is increased. Customers will show more preference for Car loans offered by Abu Dhabi Islamic Bank. This will lead to an outward shift in the demand for car loan products offered by ADIB quantity demanded increases from Q0 to Q1, and a new equilibrium is attained at the point E1.

Number of consumers

The specific consumers that the ADIB targets with the Car Finance product are employees of Multinational Companies, Employees From Reputable Local Organizations, Private Universities, Airlines, Colleges, Schools, UN Bodies, International Aid Agencies, Government employees and Business Persons, Self-employed Professionals for instance Engineers, Doctors, Certified Accountants, Consultants and Architects. The loans are specifically meant for the purchase of new vehicles and reconditioned non registered cars. The loan amount is approximately 80 percent of the cars total value. The target populations are people between the ages of 30-55. Demographic changes that result in more people joining this age bracket will result in increased demand for car finance. The increased demand will push the demand curve outwards to the right from D0 to D1, the bank will be compelled to increase the quantity of car finance supplied to Q1 at an increased price P1. A new equilibrium is attained at the point E1 with a higher price and a higher quantity supplied of the car loans. Conversely, if the demographic changes result in fewer people falling within these age bracket, we expect the demand for ADIB car finance to decline. This is reflected by a leftward shift of the demand curve from D0 to D2. The bank is forced to reduce the quantity supplied of the car loans from Q0 to Q2 and a lower price P2. A new equilibrium is attained at the point E2.

Technology

Technology is increasingly becoming an integral part of banking service delivery. An improvement in technology that results in increased deposit creation by the bank will make loanable funds more available. As a result/, there will be more money available to lend under the car finance. The supply of car finance loans will shift outwards to the right from SS1 to SS2.

Number of competitors

Many competitors in the UAE banking industry compete for the same customers with ADIB. In addition, the banks offer almost similar products with the only difference being the brand names. These banks include: First Gulf Bank, Emirates Islamic Bank, National Bank Of Dubai, Commercial Bank International, Citibank, Emirates Bank International, Lloyds TSB bank, among others. Given the fact that the industry already has a large number of players, the industry can be said to be operating under perfect competition. For this reason, the entry or exit of a single firm will not affect the ADIBs supply of car finance. However, if many firms join the industry, they are likely to take away ADIBs customers by offering low prices and interest rates on their products. This will lead to a decline in the demand for ADIB loans because the demand shifts inwards to the left. Similarly, the exit of a single firm will leave ADIB bank lending unaffected. However, many firms exit from the industry; ADIB will acquire a substantial market share because of reduced competition. This will be reflected in the form of increased lending with the supply curve shifting outwards to the right.

Costs of production

The major costs incurred in processing car finance loans are employee salaries, processing fees and the costs incurred in situations of bad debts and debt collection. The costs are critical in determining the profitability of an organization.

Other non-price determinants (if applicable)

Other non-price determinants equally affect the demand for car finance. These include religion. Islam as a religion prohibits the setting of fixed interest rates on loans (riba) neither are the banks allowed to levy interest on their loans (Dar and Presley 3). For this reason, charging interest on loan products like car finance in a Muslim country affects the demand for the product. Other non-price determinants include variations in consumer preferences and tastes, demographic changes and changes in the prices of substitutes and compliments.

Analysis of the Price Elasticity of Demand for one of the products

The price elasticity of demand (PED) for (product/service)

Price elasticity refers to the degree of responsiveness of the quantity demanded of a product to changes in price. The price elasticity of demand for loan products has significant implication to the overall performance of the bank. Consumer price elasticity determines the firms pricing policy more specifically if it commands some market power. Borrowers often face a number of incentives that compel them to repay their loans. These include; the possibility of increased future loans if they exhibit a good credit history. This affects the price elasticity of demand for the bank’s loan products since more incentives motivate clients to repay their loans and vice versa.

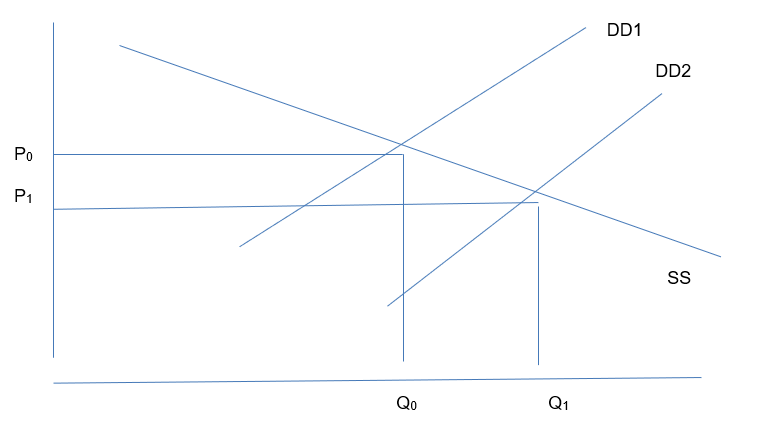

Price elasticity of demand diagram

Loan products are very responsive to price changes, for this reason, they are said to be price elastic. A small change in price (P0-P1) leads to a greater change in quantity demanded (Q0-Q1)

Part 2 – Costs and Market Structure

All businesses incur costs, and in order to generate profit, enterprises have to spend. For this reason, a business a firm should ascertain its business costs with as much accuracy as possible.

Analysis of the firm’s costs

Abu Dhabi Islamic BANK incurs three types of costs in its operations. The first categories are the sunk expenses which the business spent initially when starting the business or when expanding its branch networks within the UAE. These costs were in the form of expenditures on registration, expenses incurred to acquire ATM machines, money counting machines, furniture and fittings, among others. The second categories of costs that the bank continues to incur on a regular basis are the fixed costs. These costs are not related in any way to the services and products that the company offers to its clients. These costs include rent payments and employee salaries and wages. The final category of costs that AIDB incurs is the variable costs. These costs are unique in that they depend on the level of sales that the bank makes on its various products and services. They include; advertising expenditures, electricity payments, overtime allowances given to the employees and expenses incurred on stationary and materials.

Implicit costs and the economic profit for the firm

Implicit costs simply refer to the opportunity cost of the resources which ADIB bank has tied in its current operation and production. These costs lack capital outlay. An example of the implicit costs incurred by the bank is the value of the managers labour that he foregoes by dedicating his effort to the bank. Similarly, the banks assets which are tied up in the current operations could generate good returns if they were invested in the stocks of other companies and not tied up in the current business. Because of this they represent an implicit cost. In undertaking a business, entrepreneurs face the risk of losing some benefits if they fail on their current endeavors. The choice taken may not end up successful in all instances and it is this probability of failing that is referred to as an implicit cost.

In practice, firms face both implicit and explicit costs and it is important that both are taken into consideration when computing economic profits. The accounting discipline requires that data is evaluated to facilitate decision-making, however, some standard bookkeeping practices ignore this purpose because they fail to consider the implicit costs. In spite of this, managerial accounting provides a good alternative as it closely matches the economic definition of costs.When implicit costs are not accounted for, in the economics field, when thinking of the total opportunity cost, both explicit and implicit costs are included. On the other hand, bookkeepers often fail to take into account the input costs which the owners of the firm incur when defining the implicit costs. Economic profits by definition refer to what remains after both implicit and explicit costs have been accounted for. This underscores the need for inclusion of both implicit and explicit costs before the economic profits are ascertained.

Production Costs and classification

Direct resident care labor costs include salaries, wages, and benefits related to routine banking services offered by the banks personnel. Direct labor costs include labor expenditures associated permanent front office employees, as well as expenditures associated with temporary agency staffing.

Indirect care labor cost category incurred by the bank include all labor costs related to staff support in the delivery banking services including but not limited to medical allowance , in service education, and machine operations and maintenance.

Administrative costs include allowable administrative and general expenses of the banking facility including allocated expenditures related to allowances. The administrative cost incurred by the bank include allowable property insurance costs, and exclude expenditures associated delivery of bank services, liability insurance, facility license fees, and employees medical records

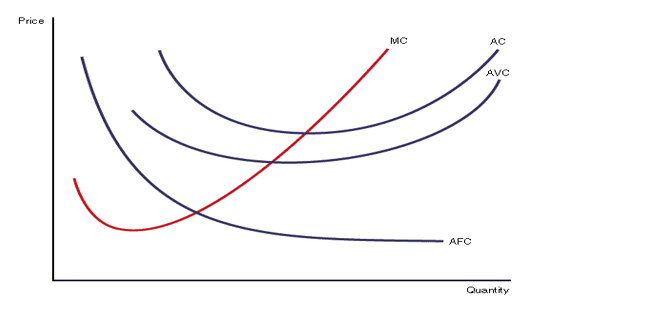

Average cost curves shapes

The banks average costs refers to the total costs incurred by the bank in its operations divided by the total output level. From the figures obtained from the bank, the average fixed costs fall as the level of the firms output increases. This is explained by the fact that the total volume of output is spread over a large output level. The banking industry exhibits a high fixed to variable cost ratio. For this reason, the bank has the potential to enjoy reduced fixed costs per unit if it can produce output level large enough (ADIB 3).

The curves assume a U-shape because of diminishing returns to scale. When the output level exceeds a certain point, then the cost of producing an additional unit (marginal cost) begins to increase. When the average cost of production increases, both the marginal cost curve and the average total cost curve shift upward. For this reason, the bank can no longer supply more output while maintaining the same price. This results in an inward shift in the banks supply curve under competitive market conditions. From the explanations given, we can conclude that ADIB cost curves conform to theory.

Average cost curves chart

Current cost strategy

The bank has continued to focus on cost optimization strategies that has seen its expenses reduce by a margin of 0.7 percent. Nevertheless, due to the banks investment in the opening of six new banks over the last one year in the areas of human capital development and infrastructure, the total expenses related tom operations increased by a margin of 14.8 percent. The banks remains optimistic that it’s cost to income ratio will slowly improve in the near future owing to its massive investments in expansion programs coupled with higher increase in its revenue base.

The bank has undertaken significant cost reduction strategies. the cost reduction strategy focuses on the consolidation of the banks IT systems. The bank was able to achieve significant cost reduction in with more than 10 percent reduction in the IT consolidation efforts. Similarly, the bank employs both the bottom up strategy and the top down approaches given that it has already ascertained the direction of the UAE economy. The banks aims at reducing its operational costs while increasing the value of its stocks (AMEinfo 1)

Analysis of the firm’s market structure

The market structure can be categorized as perfect competition with many buyers and sellers trading in similar financial services and products. No individual buyer or seller commands the market power so that it can influence the price or quantity singlehandedly. The sellers cannot alter the market price because sellers have the freedom to enjoy the goods and services at the current price and they know where to get them.

Main competitors

The major competitors include striving to acquire the market in the UAE banking industry include; Real Estate Bank UAE, ABN-AMRO Bank NV, Al Ahli Bank of Kuwait, Arab African International Bank, Bank Muscat Al Ahli Al Oman, American Express Bank Ltd, ANZ Grindlays Bank PLC among many others. These firms compete with ADIB bank both directly and indirectly the industry.

The industry

Following the effects of the financial crisis, the banking industry as a whole is undergoing major transformation. Significant regulations have been put in place including the requirement that the banks should publish their annual accounts and reports.

Market Structure: number of sellers

The industry is characterized by a large under of retail banks who offer financial products that are almost similar with the only difference being the product names. Similarly, new entrants into the banking industry are continuously threatening the old players like ADIB. Through modern technology, the new players have made it possible for banking services and products to be delivered to the customers where they are and there is no need for physical movement to the bank premises. In total there are over 300 established retail banks in the UAE with many more expected to come.

Market Structure: type of products

The bank provides different categories of products that include: car finance, Twameel Finance, education finance, boat finance, Motor Takaful, cash cover Takaful, shares finance, Al Khair – Tadawul Takaful , Al Khair – Tadawul Takaful, home finance, electron accounts, savings account among others.

Market Structure: barriers to entry

Within the UAE banking industry, there is a strong ownership stake by the government. Similarly, foreign banks are can expand their branch networks beyond a certain limit. These factors have played in favor of local commercial banks like ADIB because they have kept barriers to entry within the sector at very high levels thereby enabling new industry entrants with any capital outlay to venture into the industry.

Market Structure: Price Setting

The company has been successful in finding new avenues for generating profits with a customer oriented pricing strategy. Given the extensive experience and knowledge in financial services, gives the bank an upper hand in understanding the challenges and opportunities related to pricing in the banking industry. Its modern pricing models have enabled the company to attract new clients, increase its bottom line while significantly reducing on the associated risks.

From the analysis of the AIDB, its external and internal environment, we can argue that the bank is in a sound position. Even though the firm is a price taker, it has significant operations in the UAE banking sector given that it is one of the main players in the industry. To remain competitive, the bank still needs aggressive promotional campaigns in order to further penetrate its target market. The bank has continued to focus on cost optimization strategies, which have seen its expenses, reduce by a margin of 0.7 percent. Nevertheless, due to the banks investment in the opening of six new banks over the last one year in the areas of human capital development and infrastructure, the total expenses related tom operations increased by a margin of 14.8 percent. The banks remains optimistic that it’s cost to income ratio will slowly improve in the near future owing to its massive investments in expansion programs coupled with higher increase in its revenue base.

Works Cited

ADIB. “Business covered cards.” ADIB. Web.

ADIB Annual Report. “Bank overview, mission, vision and values”. ADIB.Web. 2012, Web.

AMEinfo. “Abu Dhabi Islamic Bank posts record quarterly profit of Dhs319.1m.” AMEinf. 2012. Web.

Dar, Humayon and Presley, John. Lack of profit loss sharing in Islamic banking: Management and control imbalances. International Journal of Islamic Financial Services 2.2 (2000): 1-10.

Money Camel. “Abu Dhabi Islamic bank -new car loans-AIDB car finance.” Money Camel. 2012. Web.