Executive Summary

Qiddiya Investment Company has been assigned a critical role in implementing an ambitious project meant to transform the Kingdom of Saudi Arabia as it seeks to diversify its economy. However, analysis of the firm has revealed that it has fundamental weaknesses that may limit the ability to complete the Qiddiya project as was initially scheduled. In this research, the aim was to investigate how contracts department of the firm can implement category management to overcome weaknesses identified. The researcher relied on both primary and secondary data to inform the study. The analysis revealed that the company assigned the primary responsibility of implementing the project has major weaknesses that compromise the success of the initiative. Using category management, the contracts department needs to develop management units responsible for specific activities in the project. The strategy is meant to help segment and then consolidate purchases to improve procurement at the firm. It will also eliminate conflicts of interests and misuse or misappropriation of resources.

Introduction

Qiddiya is an ambitious project that seeks to create a hub for entertainment, sports, arts, and residential, just a few kilometers from Saudi Arabia’s capital, Riyadh. The project is in line with the country’s Vision 2030 and seeks to transform the country into a tourists’ destination, besides attracting other economic activities (Thompson, 2019). It is part of the initiative to help diversify the economy of the country. This Giga project is going to cost the government billions of riyals, and its success is critical for the overall growth of the country’s economy. Its strategic location was chosen to deliberately help decongest the country’s capital. The government handed over the management and implementation to Qiddiya Investment Company. The success of the project depends on the effectiveness of the contracts department in undertaking specific activities.

Weaknesses of this department can effectively be addressed by introducing category management and developing the resources in the contracts department. Conflict of interest and poor supply chain management are some of the challenges that this department faces, which Lynch (202) warns can have devastating consequences on the project. It is necessary to conduct an assessment of the current development contracts department approach against the proposed category management strategy to help develop a road map to achieve the desired goals. This paper focuses on how the contracts department can introduce category management and develop the resources to ensure that Qiddiya project is a success.

Background

The government of Saudi Arabia initiated an ambitious project in 2019 named Qiddiya, which was based on five cornerstones. They included parks and attractions, arts and culture, motion and mobility, sports and wellness, and nature and environment (Al-Qiddiya, 2018). The goal was to develop a city where people could relax, get entertained, engage in sports, and understand the country’s history and cultural practices. The city is also expected to host a thriving community, and as such, the project includes 5000 residential homes. The initial plan focused on ensuring that all the activities were to be completed and the project handed over in late 2023. As mentioned above, Qiddiya Investment Company was the overall entity responsible for managing various activities in the project.

Various issues have emerged in the implementation of this project, especially in the areas of strategy, infrastructure, resources, policies, and procedures followed by contractors. More specifically, some individuals in the contracts department of the company feel that their talents are misplaced because of the inappropriate distribution of tasks. While others are underwhelmed by tasks below their purview, others are overwhelmed by responsibilities beyond their comprehension. Mistrusts within the department has affected effective communication, leading to delays and unnecessary bottlenecks. Unambiguity when assigning responsibilities and inconsistencies in the procurement has also affected the delivery of these projects.

Introducing category management and developing the resources in the contracts department can help address the challenges identified. According to Ellsworth (2020), category management is “a strategic process of bundling like products into a singular category, or business unit, and then addressing procurement, merchandising, sales, and other retail efforts on the category as a whole.” The process can help improve procurement and general management of various activities in this project. The category department of this firm should find a way of using this strategy to lower the cost of procurement, allocate resources, including time, to specific activities that are critical to the overall success of the project.

External Environmental Factors and How They Affect the Contract Department

The contracts department of Qiddiya Investment Company has a major role to ensure that the project is a success. However, external forces, which affect this firm, directly affects various operational activities of the department. As such, the management has to get detailed information about the internal and external environments (Bogers et al., 2019). The analysis will help the management to develop an effective plan for the project.

External Analysis

Understanding the external environment is essential for this company as it seeks to improve its operations in the planned major projects. According to Hitt et al. (2020), analyzing the external environment enables the management to understand the nature of forces which are beyond the control of the firm. It means that the department will have to find ways of aligning its operations with these forces to achieve the desired level of success. Although some large corporations can influence some of the external environmental factors, it is not always guaranteed that they will succeed in such efforts. As such, the management should find ways of conforming to such forces, however undesirable they may be. In this part of the report, the focus is to use various analytical tools to assess the external environmental forces in Saudi Arabia that may affect the success of the contracts department of the firm in implementing the Qiddiya project.

STEEPLE analysis. This model has been used widely to assess the macro-environment in which a firm operates. The first external factor that it assesses is the social environment. Thompson (2019) explains that a firm’s ability to achieve success in the market depends on social, environmental factors such as cultural practices and beliefs and the way people interact. Qiddiya Investment Company’s operations are domiciled in the Kingdom of Saudi Arabia. The socio-cultural environment in the country is greatly influenced by Islamic principles and beliefs. According to International Monetary Fund (2018), Saudi Arabia is home to the two holy cities of Mecca and Medina, the cradle of the Islamic faith.

The overwhelming majority of the population are practicing Muslims who uphold strict teachings of the Quran. As such, a project manager of this company must understand these principles and ensure that the decisions the company makes reflect them. For instance, when borrowing to undertake the projects mentioned above, the company must avoid banks that charge interests because that is considered haram. Instead, it should find Islamic financial institutions, such as Samba Financial Group, which can offer products in line with Islamic principles (International Monetary Fund, 2018). The projects and all the supply chain activities should be conducted in the avoidance of speculations or any other financial strategy that is not acceptable under the Islamic faith. Observing these regulations will ensure that these projects get the support of the government and the public. They will be considered socio-culturally acceptable and worth giving financial support or any relevant assistance.

Technology has become another major factor that a firm cannot ignore when planning to undertake a major project. In supply chain management, technology has revolutionized how various activities are done. Bogers et al. (2018) explain that modern technologies have made it possible for firms to integrate a communication system. It means that the contracts department of this company can create a centralized data system that enables all the departments to share critical information. Whenever there is a need to purchase consumables or any other resource that is needed by any of the departments involved in the project implementation, the information will be made available to all the relevant departments simultaneously. The procurement department will receive the information and get a quotation for all the needed materials. The information will be instantly made available to the finance department to ensure that the needed resources are made available (Ketchen & Craighead, 2020). The logistics unit will have the information so that they can plan for the movement of the materials from the suppliers to the premises of the firm where it is needed.

The warehousing unit will be informed about what to expect so that necessary storage preparations can be made. Technology has also enhanced interaction between a firm and suppliers in the market. Close communication with suppliers helps in enhancing the reliability in the delivery of products. The department will also need to embrace emerging technologies in the implementation of various projects. It will help in cutting down the overall cost of operation and improve efficiency in each of the projects undertaken. Security concerns cannot be ignored when implementing projects in this firm’s portfolio. Using emerging security-related technologies, the firm can monitor and effectively neutralize these threats. Khurana et al. (2022) warn that when a firm is using digital data to facilitate its operations, it should be careful enough to manage cyber security concerns. This firm will need to ensure that its databases and communication channels are safe from potential cyber-attack.

The ability of this investment company to achieve success in the ten project portfolios is significantly influenced by the economic environment in the country. Saudi Arabia is the largest economy in the Arab world and the world’s largest exporter of oil (International Monetary Fund, 2018). KSA, just like many other countries around the world, has had economic disruptions because of the outbreak of the COVID-19 pandemic. However, the country has already made an impressive recovery. The increased exportation of oil to the international market means that the government, and the country’s economy in general, are making an economic recovery. The department will be assured of getting the resources it needs to undertake specific activities.

The current invasion of Ukraine by Russia means that oil from Eastern Europe, especially from Russia, may not be accessible to the global market because of several sanctions and other challenges. It has created a unique opportunity for the country to increase its sales of oil at higher prices. The government has been directly investing in the local economy as a way of diversifying its income. The improving prospects in the country’s economy mean that this firm will receive the financial support that it needs to undertake the projects. The improved relations between Saudi Arabia and European nations, the United States, China, Japan, and African countries mean that this Saudi company will not struggle to source materials that are not available locally to complete the Qiddiya project.

Ecology can no longer be ignored when defining a firm’s strategies and in decision-making processes in the market. According to Fuertes et al. (2020), global warming and climate change have become legitimate concerns that business entities can no longer ignore. At the same time, environmental pollution from industrial effluent and irresponsible disposal of wastes are causing serious health and social concerns in various countries around the world. The contracts department of the company has a responsibility to ensure that its activities do not have a negative influence on the environment. As a desert country, water is a precious commodity that has to be utilized prudently. Some of the mega projects of this company involve the use of this commodity. The management has the responsibility to ensure that there is the responsible use of water at each of the stages of project implementation.

The firm also has a responsibility to effectively manage all its wastes when undertaking the project. The government of Saudi Arabia has launched an ambitious project to promote the production and consumption of renewable energy (Thompson, 2019). As a government entity, this firm is expected to take the initiative of producing renewable energy, especially solar power, to meet part of its energy needs. The strategy will not only lower its reliance on energy from the national grid and petroleum products but also cut the overall cost of operations, besides protecting the environment. It will also be essential for this firm to regulate its emissions of greenhouse gases when implementing the projects. It can achieve the goal by embracing modern methods of operations.

The political environment has powerful implications for a firm’s operations. Yuksel and Dincer (2021) explain that political stability is one of the crucial elements that a company needs to achieve success in the market. Peace and security in a given country are defined by its political stability. Saudi Arabia remains one of the most politically stable countries in the Middle East and North Africa (MENA) region (International Monetary Fund, 2018). The political class has managed to create an environment where the majority feels contented with the country’s leadership.

Saudi Arabia is one of the few countries in the MENA region that was not significantly affected by the Arab spring (Thompson, 2019). The ability to overcome this challenge was an indication that the government has been able to understand the concerns of the masses. Qiddiya Investment Company has and is likely to continue enjoying political stability in the country. Operations of the company will proceed uninterrupted if the current political climate is maintained. Given that currently, the firm’s biggest client is the government, protecting it becomes crucial for this firm. It creates the guarantee that the company will be paid upon the completion of the project.

The management of this company must ensure that it observes legal requirements, as explained in this analysis tool. Barczak et al. (2021) reiterate that a firm cannot successfully operate in a lawless environment. The law is meant to regulate and protect the relationship between a firm and its customers, suppliers, regulators, and the public. Saudi Arabia’s government has enacted laws and regulations that have to be observed by both public and private companies. It is the responsibility of the management of Qiddiya Investment Company to understand these laws and to ensure that its operations do not breach any of them. It also has to train its employees to understand the relevant regulations that define their activities and responsibilities to different stakeholders. Breaching these laws may have undesirable financial and operational consequences for the firm. For instance, it is a legal requirement for this firm to meet its clients. The law requires the company to complete every single project that it undertakes in line with agreements made with clients. It also has the responsibility to pay the government tax and other dues, as explained in the registration documents.

This external environmental analysis tool identifies ethics as a factor that a firm has to consider in its operations. The image that a firm creates for itself in the market defines the popularity and success of its brand. Ethics goes beyond the legal requirements to ensure that a firm does what is right and remains of benefit to society (Lynch, 2021). One of the ways through which this company can remain ethical is to serve the local community, which can be done in various ways. It can start by ensuring that when recruiting employees for specific projects, priority is given to the locals.

The firm should also consider engaging in regular corporate social responsibilities (CSR), especially helping the needy and facilitating planting of trees. It should ensure that its activities do not pose environmental threats in the local community. Serving the community will help strengthen the brand and enhance chances that the community will support the firm whenever it is necessary. It should also remain ethical to its clients by ensuring that it promises only what it can deliver, and once the promise is made, it should not disappoint the customer.

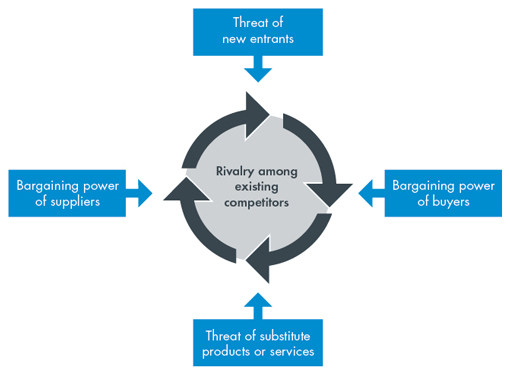

Porter’s five forces. After a detailed analysis of the external environment, it is important to analyze industry-specific factors that may have a direct impact on the performance of the company, especially its contract’s department. Porter’s five forces model identifies some of the fundamental forces in the industry that the management of a firm should be ready to manage. As shown in figure 1 below, the first factor is the level of rivalry among existing players. Kafel and Ziebicki (2021) observe that the rivalry among competitors is often determined by factors such as the size of the competitors, the number of firms in the industry, and the aggressiveness of individual firms as they fight to protect and expand their market share. The level of rivalry defines factors such as the pricing of products, the time within which a firm will be under pressure to complete a project, and additional benefits that clients will demand. It means that in a highly competitive market, a company is likely to have significantly lower profit unless they can significantly lower their costs of operations.

Qiddiya Investment Company faces stiff completion in the market. The engineering and construction industry is highly competitive as there numerous local and international engineering and construction companies keen on working on such projects. Some of these international companies have worked on similar projects within the region and in other parts of the world. In such a competitive market, it is critical for a firm to ensure that its operations meets the needs of the client in the best way possible (Henry, 2021). The contracts department should find effective ways of utilizing the assigned resources to ensure that the project is a success. It should ensure that it embraces unique procurement strategies to maintain its costs as low as possible. This department should find ways of being highly creative to manage the high level of market rivalry.

The threat of a new entrant is another concern that a firm may have in the market. When new firms can easily get into the market, it means that the level of rivalry can increase at any time. Government policies, the amount of capital needed for a firm to start operations, and market attractiveness are some of the factors that define the ease with which new firms can enter a new market (Emeagwali, 2019). Qiddiya Investment Company has been given a unique responsibility by the government, and it is less likely that another company can be assigned similar responsibilities. However, it must understand the fact that barriers to market entry is significantly low. Other companies can easily be assigned the project if this firm fails to meet the set goals.

As long as this firm accomplishes responsibilities as per the expectation of the relevant stakeholders, the threat of it being replaced is significantly low. It must therefore find effective ways of undertaking this project as per its specification. Rao (2021) notes that when a firm operates in a highly competitive market, it should focus more on research and constant improvement of its products in the market instead of investing in promotional programs. For this company, the management should find ways of ensuring that it introduces category management and develop the resources in the contracts department.

The threat of substitutes is identified in this model as another factor that has to be considered. The problem with substitutes is that sometimes a client may opt to use them if they can offer equal or superior satisfaction to products that a firm offers (Dyer, 2019). In such a case, they can be considered direct competitors of a firm. Qiddiya Investment Company must understand the fact that the government has introduced various similar initiatives. Neom, Amaala, Red Sea, Qiddiya, and Deriya are some of the similar initiatives that the government is funding. It is a major concern that makes it necessary for the company to improve the quality of products. The government of Saudi Arabian has an important role in meeting the needs of its citizens. It means that it will focus on supporting projects that are more promising within the portfolio. As such, even if it would be interested in supporting a local company, it would be forced to find alternatives if the local entity fails to meet the set objectives.

The bargaining power of buyers is another industry-specific factor that needs the attention of the management of a firm. According to Kafel and Ziebicki (2021), when customers have high bargaining power, they can dictate terms that are favorable to them at the expense of the company. Factors such as competition in the industry, the purchasing power of the buyer, and the power it enjoys in the market are some of the factors that define the bargaining power of buyers. For Qiddiya Investment Company, there is a balance of this power. On the one hand, the company enjoys a monopoly in the market, which means that it does not need to worry about the price that a rival firm may offer.

The client has to rely on this firm to accomplish specific projects. On the other hand, most of the projects that this company focuses on are for the government department. Organizational buyers with high purchasing power tend to have strong bargaining power. The fact that they are government entities further lowers the possibility that they can be exploited. This firm relies on the government as a client and protects it from competitors. As such, it is less likely that it may use the bargaining power to exploit this client.

The bargaining power of suppliers is the other element in this model that should be considered when assessing the level of attractiveness of a market. Suppliers will have a strong bargaining power when they are selling to numerous small companies in the market. The more the customers, the higher the demand, which means that they have the power to dictate terms (Yuksel & Dincer, 2021). The number and size of suppliers also define their bargaining power. When they are few in the market, the demand is likely to exceed supply, which gives them power. Similarly, when the supplier is a large company, they can find customers in other makes, which makes them more demanding.

Qiddiya Investment Company does not have to worry about the power of the suppliers. Although other companies use the same resources to facilitate their operations, it is one of the largest clients for these customers. The company has also created strategic partnerships with some of the large local suppliers and international companies to make available products it needs to facilitate its operations. Although it may not dictate terms of trade at the expense of the suppliers, it is powerful enough to ensure that it is not exploited either.

The analysis of the market in which Qiddiya Investment Company shows that the company enjoys favorable forces in the market. The company operates in a near-monopoly market. It does not have to worry about powerful competitors or suppliers. The possibility that the level of rivalry may be high is also low. In such a market, the company can easily achieve rapid growth. However, the firm must ensure that it remains innovative in the market. Benchmarking can be the best way of identifying and embracing best practices in the industry.

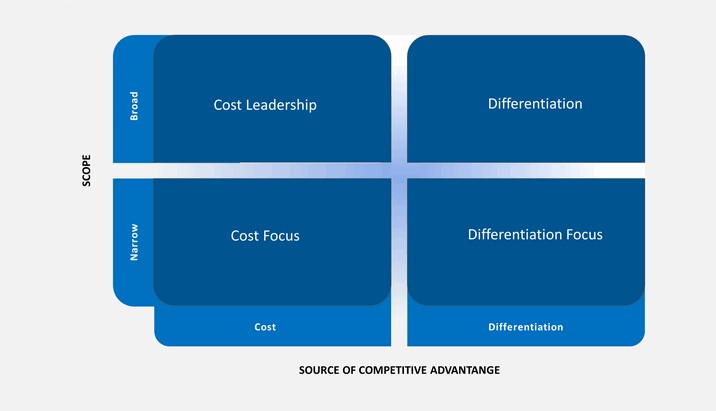

Porter’s generic strategies. This model, shown in figure 2 below, identifies four different strategies that a company can use to achieve a completive advantage over its rivals in the market. The first strategy is defined as cost leadership. It involves achieving competitive edge in the market by maintaining low cost of operation as a way of protecting profits of a firm. (Ketchen & Craighead, 2020). At Qiddiya Investment Company, cost leadership can be achieved when category management is introduced at the contracts department. By segmenting the purchases, the department will have a better capacity of planning the procurement process. In each category, the procurement department can identify the best suppliers that can deliver quality products at the lowest cost possible. Purchasing items in bulk will also enhance its bargaining power.

Differentiation is another common strategy that firms use when they are operating in highly competitive markets. In this case, a firm focuses on introducing new and unique features to its products as a way of making them different from that of rival companies. The unique features should add unique value to customers (Kafel & Ziebicki, 2021). The contracts department of this firm is under pressure to ensure that specific activities are completed in time using the availed resources. There are similar projects that the government is sponsoring across the country. The contracts department should use differentiation by using the limited resources available to deliver a unique product that exceeds the expectation of the client. This goal can only be achieved if this department employs category management as a way of enhancing its procurement.

Cost focus is another source of competitive advantage that a firm can consider when operating in a highly competitive market. In this strategy, a firm focuses on maintaining low costs while serving a niche of the market (Bogers et al., 2019). This strategy may work for this investment company. The firm has been assigned specific project that it has to complete within a given period. the contracts department will need to embrace global best practices to understand how it can serve this niche at the lowest cost possible. Instead of focusing on the wider market, it will master the unique requirements and challenges of serving this niche (Henry, 2021). It will then develop unique strategies that will enable it to lower the cost of serving these customers as effectively as possible. Cost focus is an effective strategy when targeting organizational clients or customers with similar traits (Kafel & Ziebicki, 2021). It enables a company to offer high-quality products to its clients at a relatively low cost.

Differentiation focus is the last strategy in this model that a firm may consider. It involves developing unique products for a small niche in the market. Rao (2021) explains that the strategy is effective when operating in a highly competitive business environment. It combines both niching and differentiation to ensure that a firm gains a unique position in the market. Although it is an effective strategy, Qiddiya Investment Company may not need to use it. The level of competition is significantly low, which means that the firm does not need to uniquely differentiate its products. However, it can still use its principles to enhance the quality of products that it currently offers in the market.

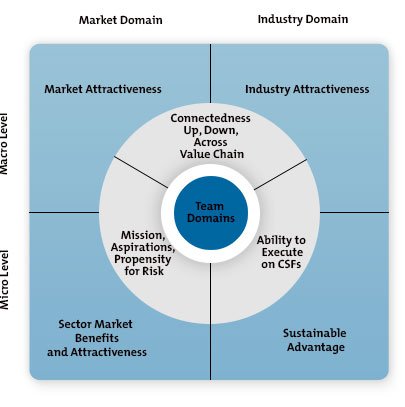

Mullins’ framework. The ability of a firm to succeed in a highly competitive market depends on how well the management plans for various activities. Mullins’ framework identifies seven factors that the management needs to consider during the planning stage to assess the attractiveness of the market. It classifies them as macro and micro environmental factors. As shown in figure 3 below, the first domain in the macro environment is market attractiveness. When using this planning model, the contracts department of this company will focus on the size of the project, the value of the project, and possible projects once the current one is completed (Thompson, 2019). The analysis will also focus on trends witnessed in the market and the possible challenges that the contracts department will need to understand.

Industry attractiveness is another macro-level domain that this tool emphasizes that should be utilized. When a firm is planning to expand its operations, it needs to consider the level of attractiveness of the market. The expansion may need a considerable investment made to enhance its market reach (Kafel & Ziebicki, 2021). When the level of attractiveness is relatively low, a firm should be slow in its expansion initiatives. The assessment of the attractiveness of the industry, done above using Porter’s five forces, demonstrates that Qiddiya Investment Company is operating in a highly attractive industry. As such, it can consider rapid expansion as there is a huge potential in the market.

The model identifies sector market attractiveness and benefits as another macro-market domain that should be assessed. Lynch (2021) explains that a firm may not effectively meet the needs of the entire market. Sometimes it is advisable to focus on a specific niche of the market that it can serve the best. A significant number of projects that Qiddiya Investment Company undertake are sponsored by the government. When using this model, this company can focus on how it can meet the needs of this market niche in the best way possible. It will need to assess the specific needs of this client and how best it can meet them. The niching also helps in lowering the cost of operation.

The fourth macro-environmental factor is the level of connectedness of a firm, up and down and across the value chain. The ability of a firm to achieve success depends on how well it has developed relationships with companies along the value chain (Barczak et al., 2021). This company will need to create a mutually beneficial relationship with suppliers to ensure that it always has access to products that it needs. It also needs to coordinate closely with logistics companies to facilitate the movement of materials and products when undertaking various projects.

The model also identifies micro-level factors, which directly influence a firm’s competitiveness in the market. One of them is the ability to execute on its critical success factors (Yuksel & Dincer, 2021). The management must know specific decisions that may have a significant impact on the performance of the company. Knowledge, skills, and commitment of employees directly influence a firm’s ability to execute the success factors. Mission, aspirations, propensity for risk are the other critical factors identified in this model. Defining a clear mission will help Qiddiya Investment Company to develop a sense of direction. Subsequently, self-motivated employees will have aspirations which are aligned with the mission of the firm. Assessing the propensity for risks helps in planning specific projects that should be undertaken by the company. Sector market benefit and attractiveness is the other domain that a firm should consider when using the model (Dyer, 2019). It focuses on a firm’s ability to identify special segments that it can serve effectively based on its capabilities.

Pedler’s challenges approach. Mike Pedler was concerned about the challenges that people in power face when making critical management decisions. Every leader would want to make a decision that everyone would find acceptable (Kafel & Ziebicki, 2021). However, sometimes one has to make unpopular decisions to foster growth and development. A leader is expected to embrace decisions that foster growth instead of those that promote their popularity in their organization. Using this model, they need to take into consideration the concerns of all stakeholders. When it is apparent that the right decision is unpopular, the leader should engage the stakeholders and explain to them why a given decision was made.

Research Methodology

When conducting research, it is critical to define the method used to collect and process data from various sources. According to Bell et al. (2018), a research document can be used by policy-makers, scholars, and other individuals who may find the document informative. Anyone using such a document may need reassurance that information provided is reliable and trustworthy. They always check the methodology that was used to collect and process data. In this section, the focus is to discuss the method that the researcher obtained and processed data.

Sources of Information

Data used in this study were collected from two different sources. The first source was secondary data obtained from published materials. They included scholarly sources such as books and journal articles. Using digital libraries and online search, the researcher was able to find the needed resources for this study. The research also used publications from reputable institutions. CIPS knowledge areas and resources proved useful when conducting the study. Course materials such as CIPS advanced practitioner modules also formed part of the sources used. Secondary data formed the basis of the review of the literature. It enabled the researcher to develop background knowledge of the study and to identify possible knowledge gaps in the existing literature.

The second source of data in the study was from primary sources. Development of contracts and supply chain in project management go through many changes over time. Information that is available in secondary sources may not accurately reflect the current realities. As such, it is advisable to gather current data through interviewing participants. As Ngulube (2020) observes, primary data collection makes it possible to address the possible knowledge gaps and to gather current data. It makes the conclusion and recommendations more authoritative because it relies on data collected by the author of the document.

Method Employed

The researcher used various methods to help achieve the aim and objectives of the study. Benchmarking with best practices and leading companies in the private sector was considered an effective way of improving the success of projects at the company. By comparing what other large and successful companies are doing, this firm would be able to identify its weaknesses and develop effective ways of overcoming them. It will also learn about new strategies for implementing projects and ensuring that its supply chain is as effective as possible.

Study and analyzing of the available company resources, structure, and documentation. Addressing challenges at the company will require a detailed analysis of operations within the firm. The internal analysis will make it possible to identify possible areas where the company is making mistakes and how they can be addressed. Company documents such as contracts it signed before and supply chain management information will explain how the company has been conducting activities. The review of the documents will help the researcher to propose ways of solving the identified challenges.

Interview with subject matter experts was another integral method used to collect data in the study. It was essential to interview the participants and understand their views on this topic. The researcher sampled employees in the contracts department of Qiddiya Investment Company to determine their views about contract development at the firm. The focus was to determine how the relevant department makes the contracts to facilitate an effective supply chain to ensure that specific activities are completed in time using the assigned resources.

Sampling

Qiddiya Investment Company is a relatively large company, and it was not possible to collect data from all employees within the time that was available for the study. As such, it was necessary to select just a few people with the right information to be part of the investigation. Allibang (2020) advises that it is necessary to choose a sampling strategy that helps address the specific issue in a study. In this case, it was not helpful to get the view of the entire population. The researcher needed to understand a specific issue at the firm, and as such, data had to be collected from specific individuals with the knowledge needed. As such, judgmental sampling was used to identify individuals with the right knowledge needed for the study. Employees working in the contracts department and those who have handled major projects were identified and requested to participate in the study. Those in the managerial positions, especially in the finance, logistics, and operations departments, were also selected. The researcher decided that a sample size of 20 individuals was adequate for the study.

Data Collection and Analysis

Primary data was collected from the participants through face-to-face interviews. The researcher developed a questionnaire to facilitate the data collection. After identifying the right sample, the researcher used the questionnaire to facilitate the interview process. Consent was obtained from the management of the targeted company before reaching out to their employees. Individuals who accepted taking part in the study were contacted by making direct phone calls. The researcher gave them an explanation about the relevance of the research and the responsibility that they were to play. The researcher scheduled interviews based on the timeframe that was suggested by the participants. Data collection took place within the premises of the firm soon after the participants had completed their shifts.

After collecting data from the participants, the next step was to process it to help in answering specific questions in the study. The questionnaire used in the data collection process employed both structured (closed-ended) and unstructured (open-ended) questions. This was necessary to facilitate mixed-method analysis of data. Mixed method research makes it possible for a researcher to have a comprehensive analysis of an issue both statistically and with the use of qualitative methods (Bell et al., 2018). It helped in addressing the different research objectives as developed in the proposal.

Ethical Considerations

A researcher should observe ethical concerns when conducting a study. Tan (2018) explains that when research involves human participants, they have to be protected. They can be victimized if their views contradict that of the majority of those in powerful positions. As such, the researcher ensured that the identity of these participants was protected. Respondents were informed about the significance of the study and the role they were expected to play. Only those who agreed to participate voluntarily formed part of the participants. As an academic paper, the researcher made sure that all forms of plagiarism were avoided. Information obtained from secondary sources was appropriately referenced using the American Psychological Association (APA) method. The researcher also made an effort to ensure that the document was delivered on time.

Analysis of the Current Development Contracts Department Approach and Resources

The contracts department has a major role to play in ensuring that all projects in the portfolio are accomplished. It is necessary to assess the current approach and resources at the company. As Rao (2021) observes, assessing a firm’s internal capabilities helps in identifying the possible weaknesses and threats which should be overcome using its strengths while taking advantage of the opportunities in the market. A SWOT analysis can help in assessing the internal environment of the firm, and specifically the development contracts department.

This firm’s major strength is that it is handling prestigious projects, which are meant to redefine the face of the country. As such, many suppliers, engineers, architects, and contractors would want to be part of the project. It means that this department has the benefit of choosing from numerous experts to take part in the project. It was also revealed that the firm would benefit from full funding from the government, which means that it will not struggle to pay suppliers and other stakeholders. The government support also means that the firm will not face numerous bottlenecks from government agencies. The physical location of the project site is strategic as it is 40 kilometers from the city of Riyadh. It means that its operations are not going to be affected by traffic congestion in the city and other logistical challenges. It offers the contracts department a unique power to implement category management, especially when it comes to selecting the most desirable suppliers in the market.

The analysis revealed that this department, and the company in general, has weaknesses that will have to be addressed. One of the major weaknesses is the limited experience in undertaking similar projects. Qiddiya Investment Company has never undertaken such a Giga project before. As such, there are many things it is learning in the process of implementation. The analysis revealed that there is a problem in this department of matching tasks with the skills and abilities of employees. The overall performance in the implementation of these projects is compromised because the firm is not fully utilizing human resources. The firm has a poor data management system, which limits its ability to keep records accurately. This challenge may significantly reduce its ability to implement category management. The contracts department lacks the right information to segment expenses and plan its procurement.

The poor governance at the top management level of the company has created mistrust among a section of the stakeholders of the company. Some feel that they are denied the resources that they need to complete their tasks successfully. The mistrust has made it difficult for these stakeholders to share data freely, limiting the success of the projects. It has also led to a conflict of interest when implementing the project, further affecting the success of various activities. The department has also failed to create an effective supply chain system to ensure that materials needed for the project are made available at the right time. These further strains the ability to implement category management.

The market presents opportunities that the company can exploit to enhance its success in the market. One of the major opportunities is the availability of supplies. The COVID-19 pandemic slowed down the construction sector (Barczak et al., 2021). As such, suppliers are willing to dispose of their products at relatively low prices because of the low demand in the market. If the company improves its supply chain system, it can take advantage of the opportunity. The firm can easily get strategic partners, especially suppliers and contractors, to facilitate the successful completion of the project. Emerging technologies also promise improved communication and modern construction strategies if the company remains flexible. These present opportunities for this firm to develop effective planning for its procurement to help achieve project objectives.

The management of the company should understand that there are specific threats that may affect the effective implementation and completion of various activities in the project. One of the main threats is the existence of other projects that the government of Saudi Arabia is supporting, in line with its Vision 2030. As such, if this project is seen as being less attractive, it may be denied funds needed for its completion. COVID-19 containment measures may also deny the firm the opportunity to hire some of the best experts in the industry from other countries. The management should also realize that the same suppliers also serve other companies undertaking other projects across the country. If it fails to create a lasting and mutually beneficial relationship with these suppliers, then they may sometimes fail to get materials that they need at fair prices. These challenges may affect the implementation of category management by the firm’s contracts department. Table 1 below summarizes the strengths, weaknesses, opportunities, and threats that the company faces.

Table 1: SWOT Analysis

The current contracts department’s approach to procurement and resource management is poor, based on the analysis conducted. The contracts department has failed to carefully segment the expenses and develop an effective procurement strategy. The approach is poor and undefined, causing conflicts and cases where some tasks are unaccomplished. The resources are also not effectively made available where they are needed because of the ineffective procurement system. As Emeagwali (2019) warns, when a firm fails to have a proper approach to the implementation of a project and allocation of resources, it cannot achieve specific goals set by the relevant stakeholders. The development contracts department has to reevaluate its strategies and address the identified weaknesses to ensure that Qiddiya is a success. Implementation of category management and effective utilization of the resources will be one of the ways of addressing the problem.

Proposed Category Management Strategy and Resources Development

The analysis of the firm revealed that there is a need for transformational change to help address the identified weaknesses. It is essential to deliberately formulate strategies that will facilitate the implementation of the category management strategy for the project to ensure that the overall goals are met. The study strongly suggests that there is a need for the contracts department to establish independent divisions under a centralized management system. Implementing category management is one of the best ways of ensuring that procurement is enhanced and conflict of interest is eliminated. The new management structure will ensure that there is an effective matching of job requirements with the skills of the employees. It will also enhance the allocation of resources in a way that will enhance the success of the project within the planned duration. Figure 4 below identifies the divisions that should be created.

It is necessary to note that the new structure is meant to facilitate category management at the company. It will help in segmenting purchases as per the department, and then developing effective ways of procurement. It will also ensure that there are specific officers who will be held individually responsible for the management of the resources once they are made available to their respective departments. The strategy will enhance a sense of responsibility when utilizing resources.

At the top of this new management, the structure is the central command of the Development Contracts Department that is responsible for the overall implementation of the entire project. Under him are the four departments with specific responsibilities. There is a division overseeing the upper plateau portfolios. There are several projects in this division, headed by project managers. Then there is the lower division overseeing the lower plateau portfolios, which also has several projects under the head of this division. There will be a corporate procurement unit, which will be fully responsible for availing all the resources needed for undertaking various activities in the project. The vendor management and support unit will be responsible for ensuring that there is an effective collection, management, and sharing of data among all the relevant stakeholders. There will be a need for an independent auditor to help in the supervision of activities.

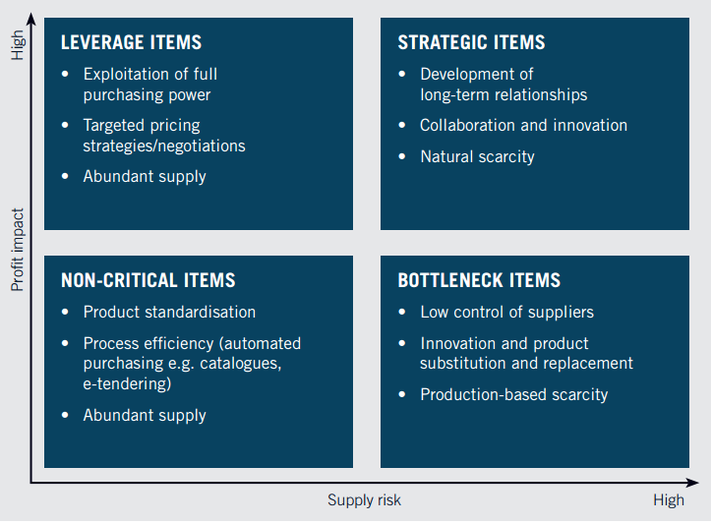

When redefining resource management, the company can consider using the Kraljic matrix, shown in figure 5 below, in its supply chain management. The model has four classes of items based on their supply risk and profit impact. The first class is those with high-profit impact and high supply risk, known as strategic items. They are naturally scarce but critical products, and as such, there is a need for the firm to develop long-term relationships and collaboration with these suppliers (Kafel & Ziebicki, 2021). Maintaining regular communication and a healthy, mutually beneficial relationship with these suppliers is critical for the overall success of the project.

The second class is the high-profit impact low supply risk items, known as the leverage items. Because of their abundance in supply, the firm should fully exploit its purchasing power through targeted pricing and negotiations. The firm should ensure that it gets the best out of these suppliers. The third category is the high-risk, low-profit impact materials, known as the bottleneck items (Rao, 2021). Because of their scarcity, the firm should be innovative enough to replace them with available substitute products. The last class is the low supply risk low-profit impact materials, referred to as non-critical items. Because of their abundance, the management should ensure that they are obtained at the lowest cost possible to help lower the overall cost of production.

Analyzing the Proposed Category Management Strategy and Resources Development

The proposed category management strategy above is meant to improve procurement at the firm, enhance a sense of responsibility among relevant stakeholders, eliminate conflict of interests, and minimize wistfulness in the use of resources. The categories or the departments are meant to ensure that skills are expertly matched with job requirements to enhance the overall output in each of the projects. It will also ensure that each stakeholder in the project understands their specific roles in the project. The resource allocation task, which falls under the corporate procurement unit, should be based on real data to help eliminate wastes in the project. The proposed category management strategy will also help the management of Qiddiya Investment Company to effectively assess its product portfolios and plan for them effectively. The BCG matrix, shown in figure 6 below, can be used to assess and classify products that this firm offers to help in effective planning.

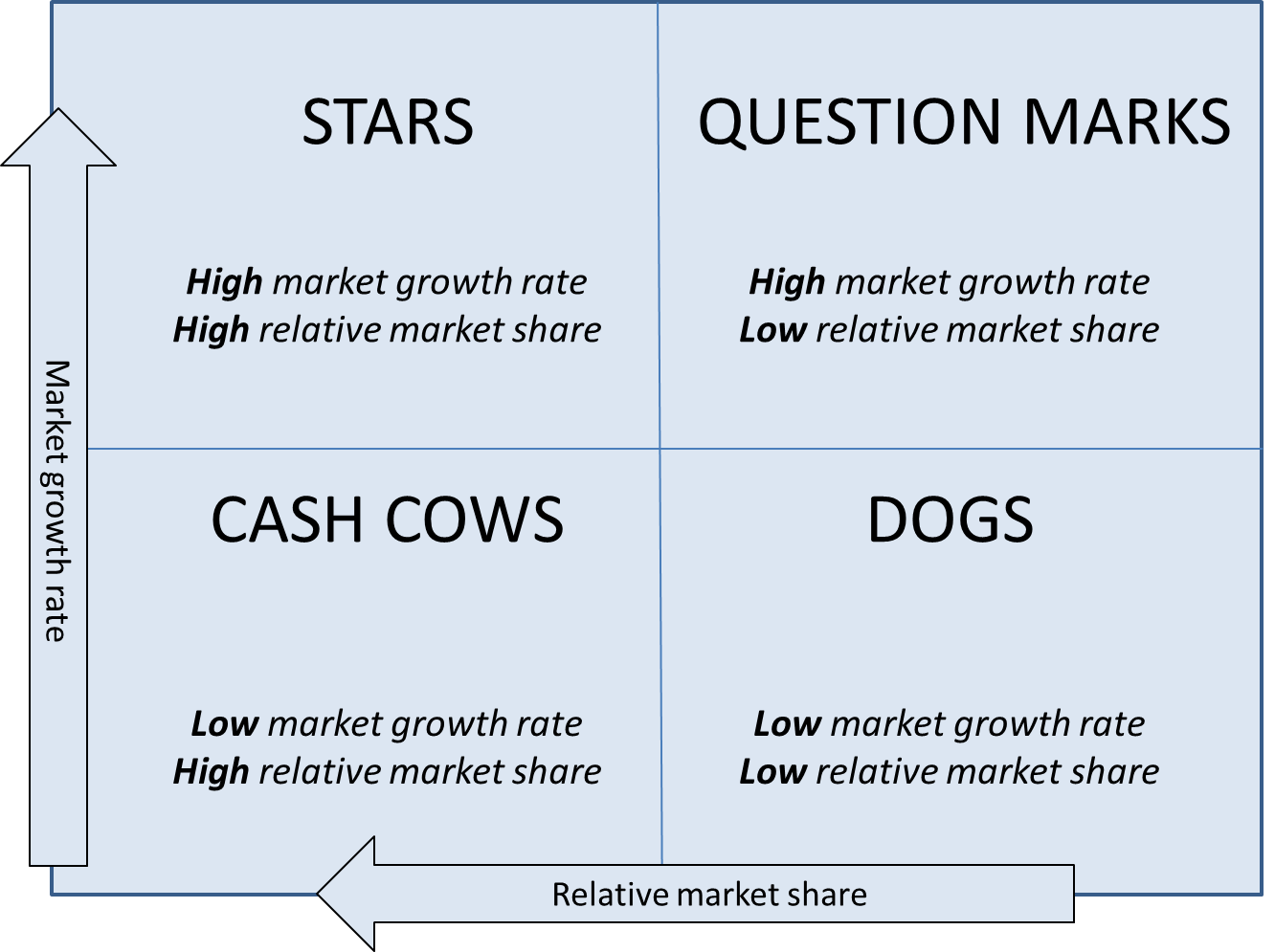

The BCG Matrix

When analyzing the proposed category management strategy and resource development, this firm can use the Boston Consulting Group matrix, shown in figure 4 below. The model helps in identifying areas of products with greater potential for growth that needs further investment and those that should be eliminated from the portfolio. According to Henry (2021), the first quadrant has products considered stars. They have a high market growth and a high relative market share (Yuksel & Dincer, 2021). Currently, most of the products in the portfolio of Qiddiya Investment Company fall into this category. They are fully sponsored by the government, and their success may enhance the company’s ability to grow in this industry.

The second category is products classified as being questionable. Although their market growth rate is high, their market share is low (Rao, 2021). They are promising to become stars, but their low market share means that they cannot support the company’s operation in the long term if their sales volume does not increase. In the Qiddiya Investment Company, these projects may include those that can only be implemented at this specific project because they are unique and cannot be applied somewhere else.

The third quadrant has products considered cash cows for the company. They have a high market share, although their market growth rate is low (Lynch, 2021). They are products that have reached the peak of their maturity and are the best earners for the firm. At this stage, most of the products in the portfolios discussed above are stars, but they will fall into this class of cash cows as they reach maturity. They are always the best earners for a firm and rarely need major investment because they are mature products.

The last quadrant has products classified as dogs, which are the least desirable in the group. These products are characterized by a low rate of market growth and low market share (Yuksel & Dincer, 2021). They bring the least income to the firm at the moment, and their growth rate shows that they may not be of benefit to the company in the future, at the moment. Qiddiya project does not have products that can be classified into this category. The best decision that the management of this company should make in case such products are identified is to eliminate them from the portfolio.

Implementation Strategy

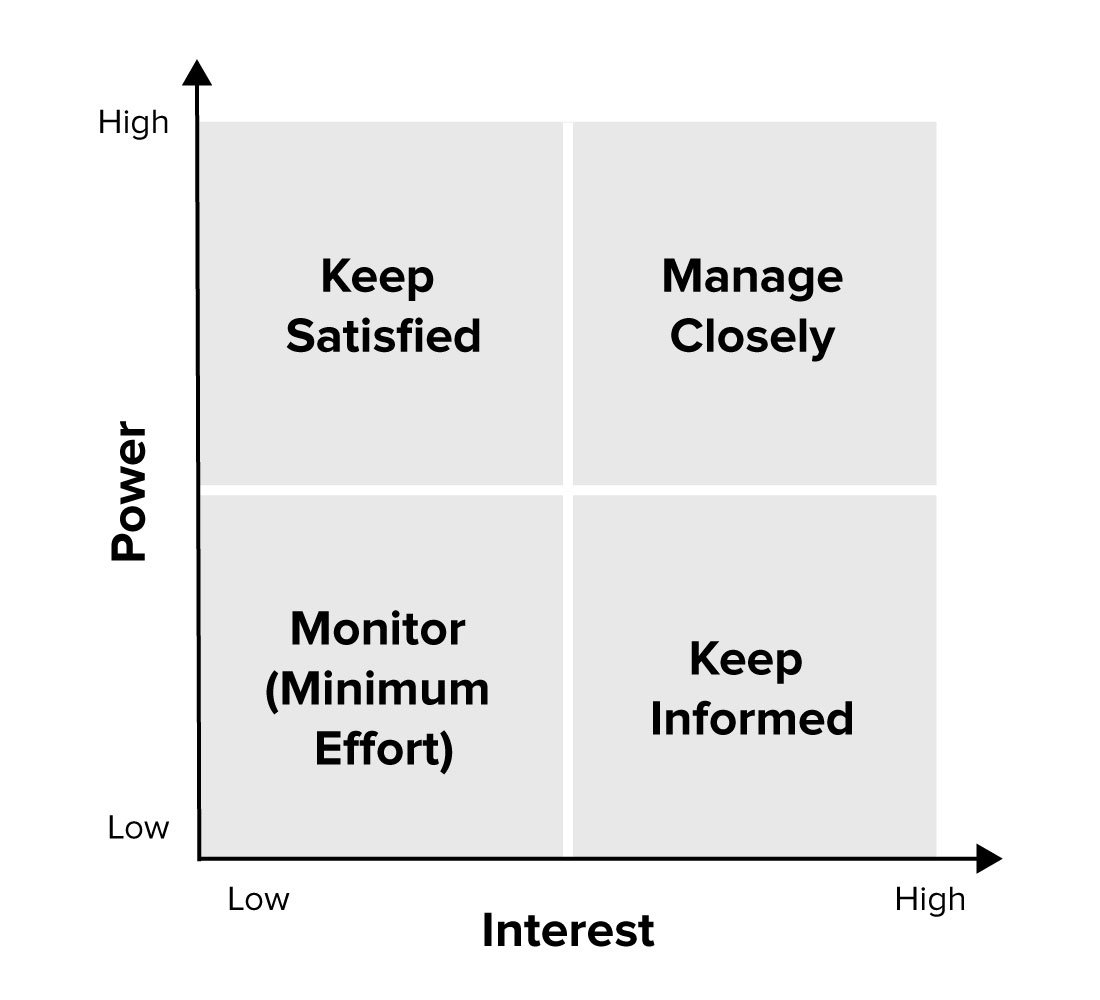

It is important for the contracts department to effectively implement category management to enable it improve its procurement and enhance resource management. It is the only way through which this firm will be able to ensure that the specific goals set out in 2019 when launching the Qiddiya project are realized. Primarily, the contracts department will need to introduce category management by creating the proposed units, shown in figure 4. The units will be responsible for segmenting purchases to identify similar products to enhance consolidation. The creation of these units will also enhance resource management once they are purchased. As the team focuses on the implementation of the new strategy, it will need to start by analyzing the stakeholders to determine the role that they need to play when change is introduced. The stakeholder’s analysis model, shown in figure 5 below, can help in classifying stakeholders and determining their role.

Stakeholders’ Analysis

When implementing the proposed changes above, the management of this firm will need to analyze stakeholders and find a way of involving them in the implementation process. The model classifies the stakeholders into four categories, as shown in figure 7 below. Stakeholders with high power and high interest in the project should be kept closely (Dyer, 2019). One such stakeholder in this project is the government of Saudi Arabia. It has the power to stop the funding, and it is highly interested in the success of the project. The management should ensure that it is regularly informed of the progress made and challenges that the implementing team is facing. Suppliers also fall in this class of high power and high interest (Henry, 2021). They are interested in the success of the project and are powerful because they make available the resources needed for the success of the same. The firm should develop a strategic partnership with these stakeholders.

The second category is stakeholders with high power but low interest in the project. Although they may not be keen on monitoring the progress of the project, they are powerful enough to determine the destiny. Members of the public fall into this category of high power-low interest category. Lynch (2021) advises that these stakeholders should be kept satisfied at all times. Issues like noise pollution and interruption with their daily activities should be avoided. The project should also meet the objectives that were set.

The third category is stakeholders with high interest but low power. They are interested in the successful completion of the project. However, they lack the power to directly influence the outcome of the project (Dyer, 2019). In the case of the Qiddiya project, these stakeholders include architects, engineers, designers, and other experts who are interested in the project but have not been hired to undertake any specific activity. The management should always keep them informed, in case it may be necessary to hire them at a later date in the course of the project.

The last category of stakeholders, as shown in the figure below, are those with low power and low interest in the project. They barely have an interest in the activities of the project and cannot influence activities (Henry, 2021). Tourists visiting the country may be considered to belong to this group in the case of the Qiddiya project. They may be aware of the project and its future benefits, but at the moment, they are less interested in the activities. The management of this firm should ensure that these stakeholders are adequately monitored but with a minimum effort.

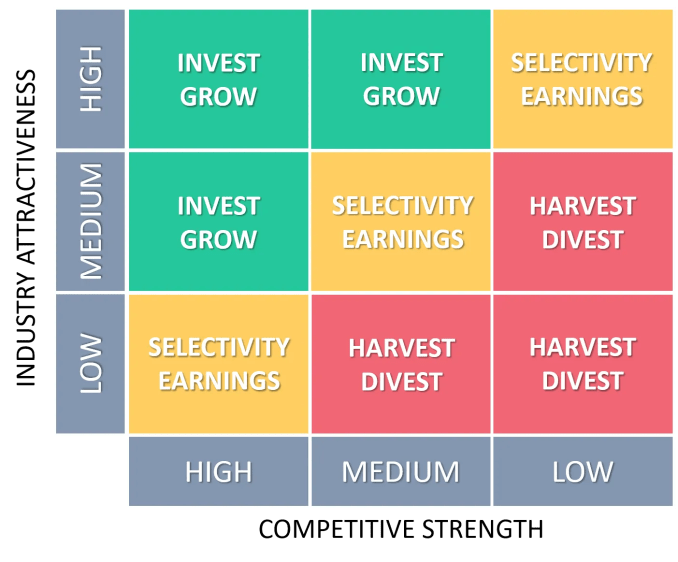

In the implementation process, the management of Qiddiya Investment Company will need to conduct further analysis of its product portfolio to determine the necessary decision that should be made. GE McKinsey’s nine-box matrix, shown in figure 8 below, helps in portfolio analysis and decision-making based on the industry attractiveness and competitive strength of a firm (Emeagwali, 2019). When the industry is attractive, and the firm’s competitive strength is high, the management should invest and grow its portfolio, as shown in the three quadrants. When the industry’s attractiveness is average, and the competitive strength is medium, the best action should be selectivity, ensuring that the firm continues to earn from these products while being ready to either invest or divest, depending on the changes in the industry and a firm’s competitiveness in the market.

The third class of product portfolio is those with low industry attractiveness and with low, competitive strength on the side of the firm. The best implementation strategy when handling these products is to divest because they are costly to hold on to them. When using the model to implement change at the Qiddiya project, the goal would be to have an effective allocation of resources. Activities that are classified as being critical to the overall success of the project should be given priority. On the other hand, activities that are identified to be redundant or less beneficial to the success of the firm should be eliminated to help improve efficiency in the utilization of scarce resources.

Conclusion

Qiddiya project seeks to create a hub for entertainment, sports, arts, and residential in the suburb of Riyadh city in Saudi Arabia. Initiated in 2019, the project was scheduled to be completed in 2023. However, an analysis of the project reveals that the development contracts department of Qiddiya Investment Company, the entity assigned the overall management of the entire project, has major flaws. One of the issues identified was the inability to match skills with job requirements. Cases where people are assigned tasks below or way above their skills and knowledge are common. This problem has led to inefficiency in the delivery of tasks in the project.

Introducing category management by the contracts department is seen as the solution to the challenges identified. Category management will help in segmenting purchases, classifying them into specific categories based on similarities, and then planning an effective procurement that will help lower the overall cost of the project. It will also ensure that resources are effectively utilized, by ensuring that specific employees are held individually responsible on how inventories are managed. This strategy will eliminate conflicts of interest, further improving the efficiency in operation and improving the attractiveness of Qiddiya project to various stakeholders.

Recommendations

The detailed assessment of the external and internal environment in which Qiddiya Investment Company is operating in its effort to complete the Qiddiya project shows that major transformational changes are necessary. The proposed changes in the category management within the development contracts department will help improve the overall performance. The following are the recommended roadmap that should be considered for change following steps provided:

- Step 1: Inform all the stakeholders in the project about the weaknesses of the current system and the need to introduce a new system that will enhance the success of the project

- Step 2: Create the four departments discussed in the paper to help align skills with job requirements;

- Step 3: Improve communication and data sharing among all stakeholders to eliminate mistrust and unnecessary conflicts;

- Step 4: Develop a strategic partnership with international firms that have implemented similar projects to address the problem of limited experience:

- Step 5: Review the new system and eliminate any weaknesses or conflicts of interest that may be identified in it.

References

Allibang, S. (2020). Research methods: Simple, short, and straightforward way of learning methods of research (2nd ed.). Wiley.

Al-Qiddiya. (2018). Al-Qiddiya factsheet [PDF document]. Web.

Barczak, B., Kafel, T., & Magliocca, P. (2021). A network approach in strategic management: Emerging trends and research concepts. Cognitione Foundation.

Bell, E., Bryman, A., & Harley, B. (2018). Business research methods (5th ed.). Oxford University Press.

Bogers, M., Chesbrough, H., & Moedas, C. (2018). Open innovation: Research, practices, and policies.California Management Review, 60(2), 5-16. Web.

Bogers, M., Chesbrough, H., Heaton, S., & Teece, D. J. (2019). Strategic management of open innovation: A dynamic capabilities perspective. California Management Review, 62(1), 77-94. Web.

Dyer, J. (2019). Strategic management: Concepts and cases. Wiley.

Ellsworth, M. (2020). What is category management? Definition and examples for retail professionals. Web.

Emeagwali, O. L. (Ed.). (2019). Strategic management: A dynamic view. IntechOpen.

Fuertes, G., Alfaro, M., Vargas, M., Gutierrez, S., Ternero, R., & Sabattin, J. (2020). Conceptual framework for the strategic management: A descriptive literature review. Journal of Engineering, 4(2), 1-7.

Henry, A. (2021). Understanding strategic management. Oxford University Press.

Hitt, M. A., Arregle, J. L., & Holmes, R. M. (2020). Strategic management theory in a post‐pandemic and non‐ergodic world. Journal of Management Studies, 3(1), 1-15.

International Monetary Fund. (2018). Saudi Arabia: Selected issues. International Monetary Fund.

Kafel, T., & Ziebicki, B. (2021). The evolution of strategic management: Challenges in theory and business practice. Cognitione Foundation.

Ketchen, D. J., & Craighead, C. W. (2020). Research at the intersection of entrepreneurship, supply chain management, and strategic management: Opportunities highlighted by COVID-19. Journal of Management, 46(8), 1330-1341. Web.

Khurana, I., Dutta, D. K., & Schenkel, M. T. (2022). Crisis and arbitrage opportunities: The role of causation, effectuation and entrepreneurial learning.International Small Business Journal, 40(2), 236–272. Web.

Lynch, R. (2021). Strategic management. Sage Publications Ltd.

Ngulube, P. (2020). Handbook of research on connecting research methods for information science research. IGI Global.

Rao, C. B. (2021). Strategic management: Practice and philosophy for India Inc. Notion Press.

Tan, W. (2018). Research methods: A practical guide for students and researchers. World Scientific.

Thompson, M. C. (2019). Being young, male and Saudi: Identity and politics in a globalized kingdom. Cambridge University Press.

Yuksel, S., & Dincer, H. (Eds.). (2021). Handbook of research on strategic management for current energy investments. Engineering Science Reference.