Executive Summary

This is a risk management plan for the expansion of a company known as Performance Plastics Inc., and the acquisition of its parent company known as Shimtech Industries. Performance Plastics Inc., is a company, which specialises in the production of high precision aerospace components.

The expansion plan exposed the company to several risks, which include financial, technological, environmental, acquisition, business environments, industry, and retention and employee layoffs.

Other issues include legal, intellectual property rights, leadership, human resource, and corporate strategy risks. The risks are entered into a risk register and a risk response plan of risk avoidance; acceptance, mitigation and transfer are considered.

Project Summary

The project scope includes a risk management plan for the expansion and acquisition of the Shimtech Industries by the Plastics Inc, company, which will be achieved by merging the departments of the companies and the ability to manage the risks associated with the human resource, finance, market/industry, and management issues (Carter & Rogers, 2008).

Requirements

The proposed risk management plan consists of risk project manager, stakeholders, and employees (Mikes, 2009).

Schedule

The project schedule will cover the entire acquisition and expansion period, which was estimated to take one month (Mikes, 2009).

Constraints

The constraints include problems with previous risk management framework, organisational resistance to change, and the difficult of merging the organisational cultures of the two companies into a single organisational culture (Mikes, 2009).

Risk Management Framework

The risk management strategy provides the strategic direction for the successful implementation of the risk management plan by complying with regulatory bodies and standards, increasing resiliency, and by creating an effective risk management strategy portfolio, which provides the direction to achieve short term and long term survival goals of the company (Mikes, 2009).

Strategy

Application of resources

The resources to be committed to achieve the strategic process include financial and human resources to address the risk management plan. Financial statements, profit and loss accounts, costs cutting measures, research and development, reduction of manufacturing costs are some of the measures to ensure successful implementation of the acquisition and expansion strategies (Mikes, 2009).

Areas in which risk is accepted

The areas include finance, human resource, production and engineering, and supply chain management systems of the two companies.

Process

Risk identification

The risk identification process includes continuous assessment of the sales volumes, market share, employee turnover, profits and loss, and variations in the budgeted project financial figures. Here, internal and external risks exist. External risks include competition, loss of market share, and the quality of the products and internal risks are from within the company (Loch, DeMeyer & Pich, 2006).

Assessment

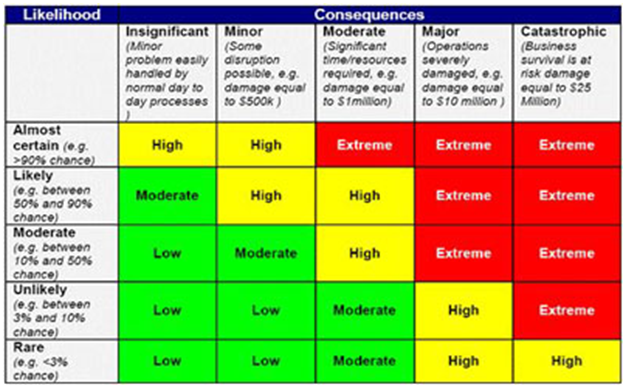

The potential impact of management, financial, market, product, and employees risk among others will be recorded in a risk matrix.

Prioritization

In the risk management plan, the risks will be prioritised into catastrophic, critical, moderate, minor, and negligible as tabulated below.

The risks are prioritised as shown below

Management

The management will be responsible for defining and formulating strategies to mitigate the risks using the risk control, implementation, and monitoring techniques.

Reporting and communicating

The risk reporting and communication plan includes the vertical and horizontal communication paradigms, which are enabled by the use of an information system for information sharing across all departments. The communication plan covers the strategic, tactical, and operational management levels.

Executing Organization

The organisation responsible for risk management includes the newly formed company, which is known as the Performance Plastics Inc., company.

Risk Identification

Risks identification shows that the sources of risks include external and internal sources, which occur during the project lifecycle, which are recorded in a risk matrix document.

Risk Analysis

Explanation of risk analysis

Risk analysis is the strategic techniques of identifying the factors, which may prevent the implementation of the processes based on the background of the companies, which sepcialise in manufacturing aerospace equipment (Tang, 2006).

Qualitative risks

The qualitative risks include credit rating of the companies, financial commitment to the requested investment to purchase the company assets. Those risk issues include approvals by the management of both companies, the past and present financial performance of the companies. The data from bank will be important for the purchase of new equipment and to address the cost of equipment and relocation, and ISO 1900 compliance.

Quantitative

Quantitative risks include work order volumes, the capacity of employees, impact of existing projects, equipment failure, project deadline extension, timing and placement of orders, and the timing of placement of equipment orders (Tang, 2006).

Semi-quantitative

Such risks lie between quantitative and qualitative risks and will be identified by the project manager and stakeholders and include the employee uneasiness failing to meet deadlines and equipment shutdown for longer than estimated (Tang, 2006).

Assessment of risks

Risks will be assessed by the project stakeholders to determine the cause and effect of each risk, and the information will be will be entered into the risk register. The assessment will include the likely impact on project progress (Cooper, Grey, Raymond & Walker, 2005).

Risk Response Planning

The strategic approach includes avoidance, acceptance, transfer, and mitigation.

Risk Tracking

The risk register will be used to track risks from the beginning to the end of the project.

Explanation of risk register

A risk register is a document which consists of the risks, which are defined throughout the project implementation lifecycle as described below.

Presentation of risk register

Conclusion

For the acquisition of the project to be completed according to the project scope, a preliminary estimate shows that the company will incur $1m capital expenditure after the acquisition, which will be followed by an annual expenditure in phases of c. $0.5m for over years.

The acquisition case is consistent with the strategic importance of securing the approval of Boeing process, which it is important to achieve the operational efficiency of the new business.

References

Carter, C. R., & Rogers, D. S. (2008). A framework of sustainable supply chain management: moving toward new theory. International journal of physical distribution & logistics management, 38(5), 360-387.

Cooper, D. F., Grey, S., Raymond, G., & Walker, P. (2005). Project risk management guidelines: Managing risk in large projects and complex procurements. West Sussex, England; John Wiley & Sons

Loch, C. H., DeMeyer, A., & Pich, M. T. (2006). Managing the unknown: A new approach to managing high uncertainty and risk in projects. Hoboken, NJ: John Wiley & Sons.

Mikes, A. (2009). Risk management and calculative cultures. Management Accounting Research, 20(1), 18-40.

Tang, C. S. (2006). Perspectives in supply chain risk management. International Journal of Production Economics, 103(2), 451-488.