Ratio analysis is a method used to determine the current financial state of a business entity in relation the previous years, other business entities or the economy at large. Ration analysis is usually based on a company’s financial statements and it helps in determining the company’s performers, activity and liquidity.

There are various ratios that can be calculated so as to express these parameters. Some of the ratios include the liquidity measurement, probability indicator, debt, operating performance, cash flow indicator and investment valuation rations.

This report focuses on the Compnet International Company. So as to ensure a long-term growth of the company, a number of strategies have to be put in place; this includes incurring dept. This is aimed at increasing the company’s stock.

While focusing on the liquidity ratio for instance, the company has to incur some short term debt against its liquid assets so as to increase its stock. Through ratio analysis it is also possible to determine the current performance of the company in relation to the previous years, its competitors and the economy at large.

The most significant ratios in this case would be the liquidity measurement ratios, the investment valuation ratios, profitability indicator and cash flow indicator rations.

This is because they indicate the current performance of the company and its ability to grow and certain itself in the event that debts are incurred in the name of the company. The return on operating performance ratios might be of less significance in this case given that it puts into consideration the daily operations of the companies yet the given data is not on a daily basis but quarterly.

The comparison between the current year and prior year’s ratio is important as it enables one to determine whether the company is progressing in terms of performance and profit making or whether it is deteriorating. The ratio between the company and its competitors is significant in determining whether the company is performing well in the industry or whether it is underperforming.

Current Ratio Analysis

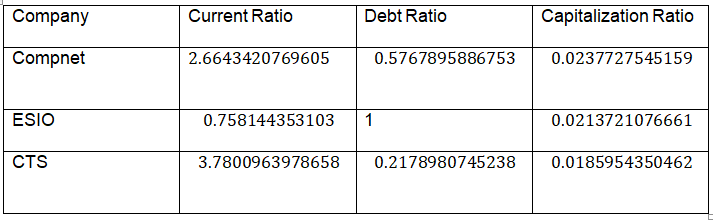

Current Ration Analysis for Compnet for 2010 =$235,344/$$88,331 = 2.6643420769605

Current Ratio for ESIO by 2011 =$330068/$435363 = 0.758144353103

Current Ratio for CTS by 2010 =$3518234/$930726 = 3.7800963978658

According to the current ratio analysis, the business entity with a higher current ratio is deemed as being well off. This is because the company or business entity has more short-term assets that are able to cater for its short term liabilities.

In the above case, CTS is deemed as more viable to invest in when compared to Compnet and ESIO. Its current ratio is at 3.7800963978658 which is an indication that it has a greater short-term asset base when compared to compnet which is at; 2,6643420769605.

Compnet on the other hand is well placed to handle short-term liabilities when compared to ESIO which is at 0.758144353103. ESIO therefore has a smaller short-term asset base hence its inability to cater for the short-term liabilities.

Debt Ratio

The Formula for Debt Ratio is as follows;

Debt Ratio for Compnet in 2010 =$304,125/$527,272 = 0.5767895886753

Debt Ratio of ESIO for 2011 = $435,363/$435,363 = 1

Debt Ratio of CTS by 2010

= 0.2178980745238

According to the calculations, Compnet has a debt ratio of 0.5767895886753 which is smaller than that of ESIO but larger than that of CTS.

The company therefore has a lager debt when compared to CTS but less debt when compared to ESIO. It is therefore more viable to invest in CTS than in Compnet if the issue of debt is considered. This ratio does not just consider the debts alone but the operational liabilities as well.

Capitalization Ratio

Capitalization Ratio for Compnet by 2010 = $5,434/ ($5,434+ $223,147) = 0.0237727545159

Capital Ratio for CTS for 2010 = 67,917/ (67,917+3,584,431) = 0.0185954350462

Capital Ratio for ESIO =

= 0.0213721076661

Capitalization Ratio usually indicates the company’s capital structure in relation to its growth prospects as well as its operations. The smaller the ratio the better as it is an indication that the company or business entity has the capability to sustain itself and experience growth as well.

In the above case, CTS has the smallest ratio which is an indication that it is able to sustain its operations and growth as well. Compnet which has the highest ratio is less viable as its development and operation cost is likely to be overwhelmed by its liabilities. ESIO on the other hand has a capitalization ratio of 0.0213721076661 which is slightly less than that of Componet.

ReferencesAccording to the analysis it is quite obvious that CTS is the best company to invest in while ESIO is the least viable company for any investment. The Company has the highest current ratio which is an indication that is has a greater short-term asset base and is therefore able to cater for the short-term liabilities.

On the other hand it has a smaller debt ratio which is an indication that it is less indebted. The smaller capitalization ratio is an indication that it can sustain its operation cost and at the same time experience significant growth.

References

Allison, G. (2009). Ratios For Financial Analysis Statement analysis. Oxford: Oxford University Press.

Eugene Brigham. (2010). Financial Management Theory and Practice. Cambridge: Knopf Doubleday Publishing Group.

Johnson, M. (2006). Managerial Economics and Financial Analysis. Macmillan: New York.

Martin, S. (2011). Financial Ratio analysis. London: Macmillan Publishers.

Moley, M. (2010). Ratio Analysis. Michigan: University of Michigan.

Robinson, M. (2009). Financial Ratios Explanation. Harvard : Harvard University.

Vandyck, C. (2006). Finantial Accounting, Rations and Analysis. Harvard: Harvard University.

Zearley, T. (Finantial Ratio Index). Oxford: Oxford University Press.