Introduction: Resource-Based Strategy

Creating a sustainable strategy depends on identifying those strengths and resources of the firm that can be leveraged for real, economic value. Identifying strengths and rendering weaknesses irrelevant is the basis of competitive advantage.

David Ricardo is credited with an early 19th-century discourse on the differential advantage of economic resources based on the fact they are fixed and limited. This construct obviously applies to crude oil reserves, a production line, a wide inventory of goods in a superstore, and financial assets. There are exceptions, such as hydrogen as infinitely-renewable car fuel, but these are rare.

Unlike the more complete framework posed by Porter, the resource-based theory is almost exclusively inward-looking. Finding the distinctive resource traits of the firm makes for a better understanding of strategic options and performance than analysis of environmental factors (Peteraf, 1993; Pralahad & Hamel, 1990; Wernerfelt, 1984). Since it is inward-looking, resource-based strategic management looks to above-average returns (rather than, say, market share or national dominance) for non-replicable assets and capabilities (Grant, 2008).

In contemporary times, the theory holds that the inventory and deployment of a firm’s tangible and intangible assets ensure whether that organization has a sustainable competitive advantage (SCA) or not (Barney and Arikan, 2001). Resource-based strategic management involves a) Identifying the resources the firm has in its possession; b) Determining whether these are valuable, rare, inimitable, and non-substitutable; and, c) Defending strong resources and strengthening those that are comparatively weak.

Every organization owns assets and deploys multiple resources – talent, proprietary processes, R&D, knowledge bases, structure, raw materials, brands, financial and other assets, information, value and supply chains and the very attributes of the firm itself – that to some extent or other are drivers for efficiency and effectiveness (Barney, 1991). Deciding which of these ought to be used for creating competitive advantage is crucial. There are four broad decision criteria. First, it must be an inherent strength that can be used to create value, for which customers are willing to pay a price that returns an economic profit to the firm. Secondly, it should be exclusive: impossible to duplicate, protected by patent or intellectual property law at least for a time, not preemptible by others without great expenditure of time and investments. It is so exclusive as to be rare in economic terms. Under ideal “perfect competition”, the current price of that resource would be tied to the present discounted value of above-average returns in the future (Dierickx and Cool, 1989, p1504; Barney, 1991, p100). This is consistent with the rationale that organizations with superior resources are hard to obtain from other sources and that the market values will have superior results.

Third, comparative advantage should be sustainable. This means that the bundle of valuable resources, preferably heterogeneous and not easily lost, can neither be completely duplicated nor substituted without great effort (Hoopes et al., 2003). Alternatively, sustainability might be a question of ex post facto accomplishment: the competition has essentially ceased attempting to neutralize or disrupt it. This can mean competition moves to different markets or take a different promotional tack because the pioneer has positioned itself so strongly on that value proposition that all rivals come off as me-too, second-class options.

The fourth element of the resource-based theory is whether the firm is able to exploit its valuable, rare, and pretty much inimitable resource (Barney and Hesterly, 2005). IBM today remains a giant in the global IT scene, despite diminished demand for mainframes and having lost the PC business it pioneered, because the firm retained its core strengths in technical service and customer-oriented consulting.

Carried to its logical conclusion, the lens of human resources as a basis for sustainable advantage has implications for leadership and effective individual coaching (Sherman, 2007). The author proposes constructive coaching based on four questions about the resources of the individual worker: a) What are his valuable resources? b) How rare is the resource for his reference peer group? c) Do these reference groups suffer constraints about acquiring this important resource? D) And does the employee use his resource to the utmost and earn full economic value from it? Employed continuously, resource-based analysis and discussion benefit both the individual and the organization as a whole.

Contemporary Examples

Managing a Plentiful Natural Gas Resource: Trinidad and Tobago

Trinidad and Tobago is a small archipelago in the southern Caribbean with a population of 1,305,000 as of 2005. And yet, the nation is more industrialized than any of the Caribbean island nations owing to an abundance of hydrocarbon resources and strategic governance decisions are taken since independence. In 1971, natural gas was found off the North Coast. This development, along with subsequent finds, catapulted the country to global pre-eminence as the fifth-largest source of natural gas globally (Ministry of Energy and Energy Industries, 2007).

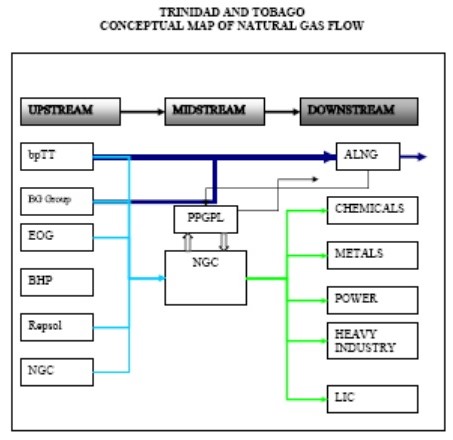

Since independence, this parliamentary democracy embraced a free-market philosophy and opened up segments of the energy sector to foreign investors, particularly in power generation and transportation fuels.

The Government embarked on resource-based industrialization to exploit natural gas resources. After establishing the Point Lisas Industrial Estate as a hub, the government accorded the National Gas Company (NGC) a monopoly on the purchase, sale, and transportation of natural gas while the state-owned National Energy Corporation funded and ran several energy-based projects. From 1979 to 1984, foreign investors put up iron and steel, ammonia, urea, methanol, and additional power generation enterprises.

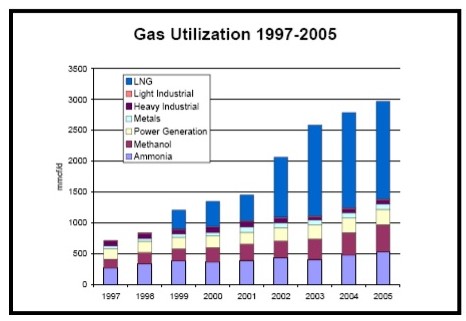

Resource-based industrialization accelerated in the 1990s. Consequently, there was a rapid expansion of natural gas utilization. This climbed rapidly from a little over 500 mmscfd in 1993 and crossed the 1 bcfd mark by 2000.

In 1999, ALNG train 1 began operations and launched the country into the Liquefied Natural Gas (LNG) business. Since then, production capacity reached four trains and brought natural gas utilization to 3.1 billion cubic feet per day by the end of 2005.

Openness to foreign investment meant that major transnational corporations account for the lion’s share of both upstream and downstream segments of the natural gas sub-sector, comprising 4 LNG Trains (absorbing 54% of gas produced for export), 7 methanol plants (15% share), 10 ammonia plants (18% share), 1 urea plant, and an iron and steel complex (3%), cement plants 2%) and two independent power producers. As well, there are 110 light industrial and commercial enterprises that absorb 1 % of gas volume (McGuire, Poveda, and Raphals, 2007).

Today, natural gas accounts for 80% of total primary energy consumption. Under the people-oriented and planful resource-based industrialization strategy of the government, gas utilization grew at a compounded 18% per annum. In total, the energy sector that natural gas dominates accounts for 34.1% of GDP, 85.5% of merchandise exports, and contributes 37.1% to Government revenues.

The Taiwan Semiconductor Industry

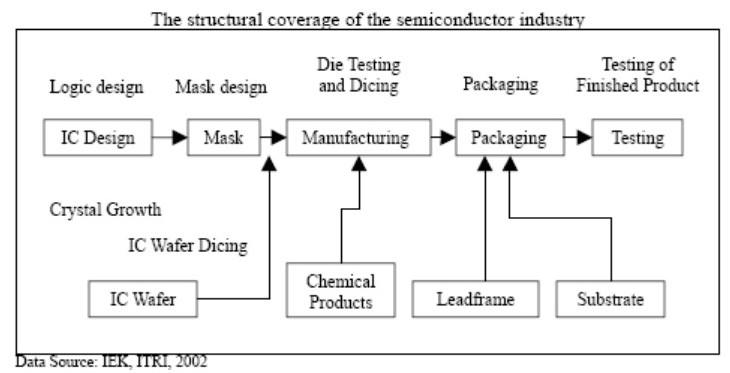

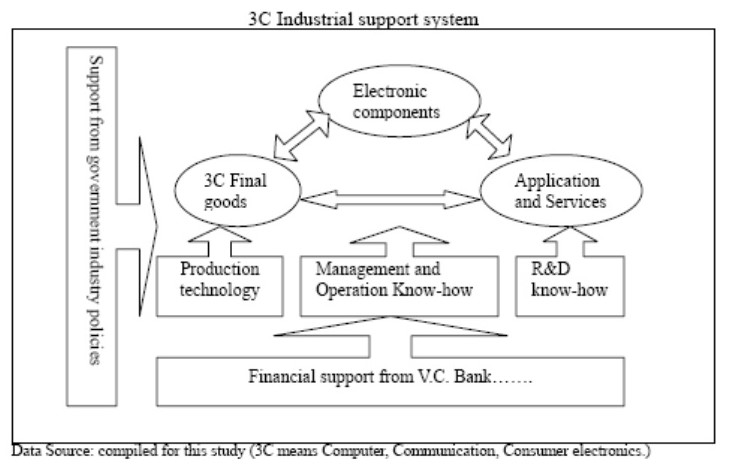

The Taiwan semiconductor industry is the fourth largest in the world. Backed by Taiwanese governmental science and technology budgets, ERSO of ITRI, Taiwan, pioneered the business by importing wholesale from RCA of the U.S. the entire spectrum of product planning, design, photo-masking, manufacturing, packaging, and testing. ITRI trained the technical staff and, as each project matured, spun it off as a separate company. As a result, the country built a comprehensive base of up-, mid-and down-stream industries emphasizing IC design, photo-masking, specialized manufacturing, packaging, and testing (Liu and Shieh, 2004).

The benchmarks of industry success comprise:

- an extensive wafer foundry industry that produced fully 73 percent of worldwide value as of 2003;

- an IC design center that does one-fourth of world requirements and ranks second internationally;

- No less than 40 wafer factories;

- Foresight and consistency in government R & D support and tax incentives;

- A complete industrial testbed in domestic 3C (computer, communication, and consumer electronics) manufacturing; and,

- the consequent development of managerial know-how.

The analysis Liu and Shieh compiled from questionnaire-based interviews with government and private-sector opinion leaders showed a set of policies and actions that encouraged the growth of the semiconductor industry (see table overleaf). Industry success was based on such resources as affordable financing and a broad-based local market, both of which guaranteed market share and profits that could be plowed back. As well, the semiconductor firms leveraged close contact with customers that quickened the pace of product modifications and also evoked buyer satisfaction, a ready pool of trained talent, and a friendly government.

Table 2:

AC Ltd

Finally, we take into account the fact that SCA is not necessarily the sole preserve of resource-based strategy-setting. Employing the framework of business process analysis, one may integrate market- and resource-based strategic management (Acur and Bititci, 2004). This is a case where the authors implemented the Process-oriented Performance-headed Strategy (PROPHESY), using both financial and operational performance measures, to make strategic decisions that integrated both resource- and market-based frameworks.

AC Ltd. was in the business of designing, constructing, and selling luxury residences in Scotland. The company had attained a strong reputation for building very attractive homes. Order winners, therefore, consisted of style, high standards, and individualized design that both suited and upgraded the neighborhood. Competitive qualifiers were timeliness of delivery, flexibility, and customer support.

Prior to the intervention, AC seemed content to lead the market for designing, building, and selling luxury residences. However, the company had capital constraints which translated to a lack of flexibility in coping with fluctuating labor and material costs and being unable to consistently purchase desired properties.

After analyzing growth profitability objectives, financial profile, strategy, processes, trade-offs, and consolidation options, as well as desirable targets such as P & L performance, value proposition, strategic options (sell-off, buy, milk, etc.), and conceiving measurable objectives, AC management realized:

- That marketing opportunity could be maximized by understanding customer requirements, location preferences, lifestyles, and other socio-demographic details better.

- That more capital was needed to make strategic land acquisitions.

- That already-superlative service could be enhanced to accommodate potential buyer requirements for energy efficiency, for ready-to-use Internet connections, and for better acoustics.

Ultimately, AC strengthened its emphasis on market-based strategy with a parallel strategy to develop the resources needed to cater to its market niche better.

Executive Summary

A resource-based view is a valuable tool for the internal assessment stage of strategy formulation. After all, the most comprehensive environmental scanning program needs to be matched with the strengths of the firm that can be turned to sustainable comparative advantage. Still, the cases and literature reviewed leave the nagging thought that there is no hard-and-fast taxonomy to definitively guide real-world planners in choosing all possible resources that could be used. As well, the success attained in the Taiwan and Trinidad & Tobago cases simply brings to the fore the often-overlooked advantages of government ownership and incentives.

Thirdly, resources are not only providers of economic value and ROCE, they cost money to acquire, develop and implement. All too often, strategic planners do not think through the analysis by Dierickx and Cool (1989) that resources are characterized by uncertainty, path-dependent processes, specificity, and long-run terms of maturation. But these traits impose unavoidable and hidden costs and other constraints.

References

Acur, N. & Bititci, U. (2004). A balanced approach to strategy process. International Journal of Operations & Production Management, 24(3/4), 388-408.

Barney, J.B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, (1), 99-120.

Barney, J.B. & Arikan, A. M. (2001). The resource-based view: Origins and implications. Eds. Hitt, M. A. & Harrison, J.H. The Blackwell Handbook of Strategic Management. Malden, MA: Blackwell Publishers Ltd., 124-88.

Barney, J. B. and Hesterly, W. S. (2005). Strategic management and competitive advantage: Concepts and cases. Upper Saddle River, N.J.: Pearson Education Inc.

Dierickx, I. & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 35, (12), 1504-11.

Grant, R.M. (2008). Contemporary strategy analysis (6th ed.) Okford: Blackwell.

Hoopes, D.G.; Madsen, T.L., Walker, G. (2003). Guest Editors’ Introduction to the Special Issue: Why is there a resource-based view? Toward a theory of competitive heterogeneity. Strategic Management Journal, 24, 889-902.

Liu, D. & Shieh, L. (2004). Measuring government’s industry development strategy using balanced scorecards and resource-based theory – a case study of Taiwanese semiconductor industry. International Journal of Business, 9, (4).

McGuire, G., Poveda, M., & Raphals, P., (2007). Competition in energy markets: Trinidad and Tobago case study. Calgary, Canada: OLADE/CIDA.

Ministry of Energy and Energy Industries (2008). Overview. Trinidad and Tobago. Web.

Peteraf, M. (1993). The cornerstones of competitive advantage: a resource-based view. Strategic Management Journal. 14 (3): 179-91.

Pralahad, C. K. & Hamel, G. (1990) The core competence of the corporation. Harvard Business Review, 68 (3) 79-91.

Sherman, W. S. (2007). Improving organizations by coaching individual development using the resource-based business strategy. S.A.M. Advanced Management Journal, 72(4), 40-46.

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal. 5 (2) 171-80.