Revlon Inc.’s Strategic Analysis

Revlon, Inc. is an American multinational company that deals with cosmetics, personal care, fragrance, and skincare. The company filed for bankruptcy in the second quarter of 2021. Caldwel (2022) explained that Revlon, Inc. is speculated to have sent an invitation to interested organizations and individuals to make offers for the company’s assets. Lawyers from the company claimed that the American cosmetics behemoth is in the process of assessing possible bidders.

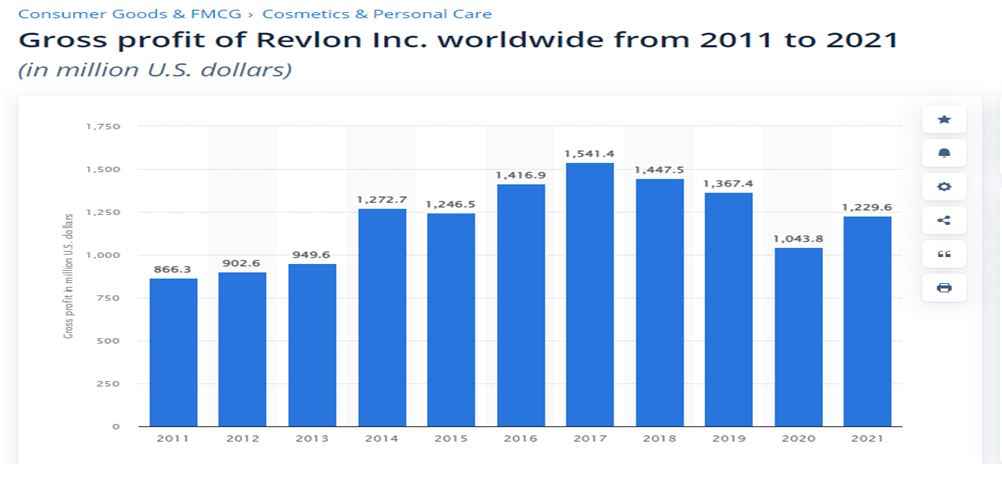

The global cosmetics giant Revlon announced a ten percent decline in sales for the third quarter of 2021. Due to ongoing financial difficulties, since it filed for Chapter 11 fiscal reorganization in June 2021, Revlon announced that it would not have an earnings conference call due to the bankruptcy hearings (Revlon, 2021). Revlon’s bankruptcy loan conditions stipulated that the firm had to meet stringent timelines to provide value to its creditors (Prance-Miles, 2022). Caldwel (2022) wrote that United States Bankruptcy Judge David Jones maintained that deadlines fostered ingenuity and solutions and aimed at seeing how creative the people would be in finding answers.

Analysis: Company Evaluation

During the third quarter of 2022, the company’s net sales totaled $468.3 million, a decrease from the $521.2 million recorded during the same period in the previous year.

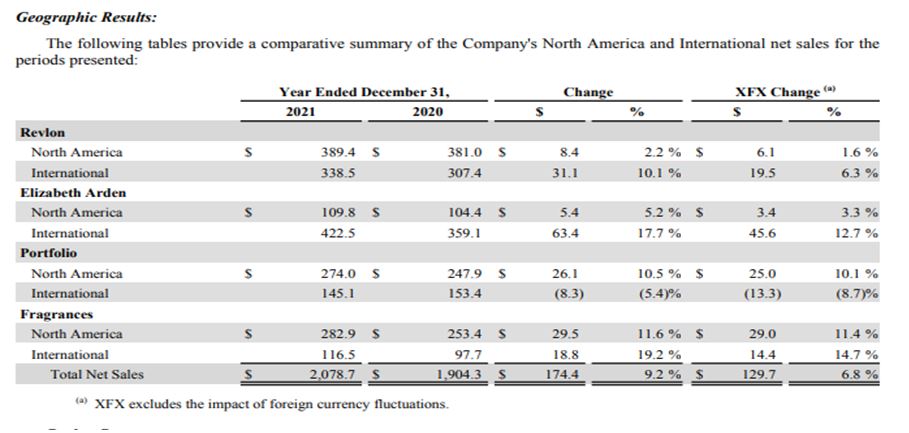

According to Prance-Miles (2022), the financial reports of similar players in the market, like Elizabeth Arden, indicate that their revenues decreased to $120.6 million, down from $122.9 million.

Table 1: Comparative sales from Revlon’s strongest markets between 2020 and 2021

Revlon’s revenue decreased from $173.04 million to $176.8 million in the same period as the previous year. Hence, this becomes a considerable weakness considering that the company has been a certified Amazon FBA partner since 2017 (Revlon, 2021). The reported operating income for the third quarter of 2022 was $12.8 million, a decline of $21.3 million compared to the operational revenue data for the same period in the preceding year, which was $34.2 million (Caldwell, 2022). The company’s weak online presence lowers its ability to reach out to Australian households shopping online.

Strategies

When looking at the financial operations of Revlon, there are a few primary techniques that may be implemented to assist the firm in achieving a lasting competitive advantage and improving financial performance.

- To begin, Revlon can concentrate on expanding both its physical presence and its online marketing initiatives. Nowadays, businesses must have a robust online presence to communicate effectively with the most significant number of people (Revlon, 2021). Revlon can consider developing a more sophisticated website and social media presence to broaden its customer base and form strategic partnerships with other digitally oriented businesses.

- Second, Revlon may create novel, forward-thinking items that appeal to customers. The company can acquire a broader consumer base and generate more sales by developing cutting-edge items that are unique compared to those provided by the company’s rivals (Revlon, 2021). For instance, the corporation can come out with new lipsticks that are not only colorful but also resistant to the formation of wrinkles. Women who are self-conscious about their looks and wish to maintain a youthful appearance would be particularly interested in this kind of goods.

- Lastly, Revlon was able to shift its attention to finding ways to minimize costs. The firm will be able to improve its profitability and keep up with the competition in the market if it seeks cost-cutting opportunities wherever they may be found (Caldwell, 2022). For instance, Revlon might reduce its manufacturing costs by adopting more sophisticated production methods or contracting parts of its activities out to a third party. In addition, the firm may investigate the possibility of cutting its administrative expenses in various ways, such as by developing a more effective marketing plan or cutting the number of employees they employ.

Implementation Plan

Revlon, Inc. should increase its digital presence and marketing efforts to increase its competitive advantage by developing new and innovative products and implementing cost-cutting measures. These strategies can be implemented in the following ways:

Increasing Digital Presence and Marketing Efforts

The organization’s main weakness is its digital presence in the industry. Historical sales recorded in 2019 suggested that roughly 6% of Revlon’s gross sales were derived from online channels (Revlon, 2021). Therefore, to increase its competitive advantage, Revlon should increase its digital presence and marketing efforts by creating a solid social media presence, developing targeted marketing campaigns, and creating informative and persuasive content.

Developing New and Innovative Products

Revlon, Inc. should develop new and innovative products that appeal to consumers to increase its competitive advantage. The company can do this by developing new formulations and ingredients, expanding into new markets, or entering into partnerships with other brands (Revlon, 2021). In addition, the company can provide customers with user manuals on how to use the products. In addition, the organization ought to create innovations for the convenience of the customers.

Implementing Cost-cutting Measures

Revlon, Inc. should implement cost-cutting measures to reduce its overall expenses, such as cutting back on marketing expenditures, reducing the number of employees, or increasing efficiency in the production process. The company can adopt in-house manufacturing techniques (Revlon, 2021). The idea would be beneficial to the company because it can reduce the unwanted costs of manufacturing and conduct saving initiatives.

Connection

Although the company is internationally recognized specializing in the field of cosmetics, it encounters a lot of competition in the market from other upcoming industries. The current financial state of the company is low and can be improved by following the outlined strategies as well as the implementation plan. Appropriate implementation of the above strategies will result in better performance and the generation of higher revenues from the company sales.

References

Caldwell, G. (2022). Revlon sale begins as bankruptcy deadline approaches. Global Cosmetics News. Web.

Prance-Miles, L. (2022). Revlon sales fall 10.1 years on year; net loss triples to US$152.8 million. Global Cosmetics News. Web.

Revlon, Inc. (2021). Revlon 2021 Annual Report. Revlon.com. Web.

Statista. (2022). Revlon Inc. gross profit 2021. Statista. Web.