Risk and Return

Stock prices have an intrinsic risk of varying significantly over time. The treasury bills, that are government bonds, are said to hold negligible or no risk at all. The return on the stocks is directly related to the risk involved. Higher the risk, greater will be the return offered to compensate for that risk. As in the exhibit, the return on treasury bills is very low and constant in any scenario since they hold no risk. Other stocks offer variance in returns in various scenarios. Also, they offer higher return for they bear higher risk.

Risk

The risk of the stocks is defined by number of factors. Variance (or standard deviation) and beta are most common measures to define risk of individual stocks. “Beta” is defined as the sensitivity of the stock’s return to market rate of return. A beta of 1 means stock moves with market, that of less than 1 means stock is less volatile than market. When Bill asks Mary to lower the beta of her portfolio, he means nothing but to lower the risk. Each individual stock in the portfolio contributes to form the beta of portfolio. Lowering beta of portfolio means lowering the risk attached with portfolio-return when market goes down.

Diversification

To lower the beta, Mary needs to diversify her portfolio. Diversification means making a combination of high and low risk stocks in the portfolio, such that the overall beta of portfolio is less 1. Diversification is a rational approach of investors all around the world to make a portfolio that offers decent return with minimum risk. This is important to note that not every person likes low risk. Some people are willing to bear greater risk and thus they make a portfolio that may give unusual high returns occasionally. In Mary’s case, since her high tech securities are losing value, she must diversify, so that when high tech securities go down, some other securities in her portfolio go up to nullify the effect. This is called diversification.

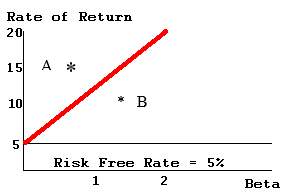

SML

Bill could use Security Market Line to demonstrate how sometimes investors undervalue and overvalue the stocks. Such line is the relation between market risk and returns in different scenarios. SML graphs of individual stocks are plotted. Those that lie above SML (A in diag.) are undervalued because the investor will expect a greater return for the same risk as market. A security plotted below the SML (B) is overvalued because the investor would be accepting less return t han market. Now there is no way to make unusually high returns on stocks. So a broker’s hot tip would be to be rational and diversify, since undervalued are soon priced to such that they lie on SML.

Interest Rates

If Mary makes a well diversified portfolio, changes in interest rates will not heavily affect the returns. When interest rates go too high, many investors take out money from stocks and invest in fixed income securities. Resultantly market goes down and returns are low. But in a diversified portfolio, that would be compensated by higher returns on treasury bills or other fixed income bonds. Now should one invest all money in fixed income bonds? Answer depends on required return by investor. Fixed income securities offer returns that are very low compared to stocks. If investor hates any risk, and can live with low return, he or she should go ahead. But a rational investor likes higher returns and is willing to bear a little risk for that; therefore he or she goes for a diversified portfolio that contains both stocks and interest bearing securities.

Situation 1: 50-50 investment in High tech and Countercyclical

If Mary invests all her money equally in high tech and counter cyclical, then after calculating expected return on high tech company considering probabilities, that is -2%, and on counter cyclical that is 9.9%, our expected return on such portfolio (50% of each company) comes out to be around 4%. And risk, or beta, that we can calculate using CAPM (capital asset pricing model), comes out to be 0.335.

In CAPM the stock return and beta are related as:

- Stock return = risk free ret. + (mkt ret. – risk free ret.) x beta of stock

The above situation seems realistic. Since one of the stocks is offering expected return of -2 and other almost 10, the expected return on portfolio is positive. Also, using above equation, beta of high tech is 2.25 and other is -1.58. So beta of portfolio is average of the two; 0.335.

70-30 High tech and Index fund

On other hand, if Mary were to put 70% in High tech and 30% in Index fund, that would give her portfolio return of almost -1%. That is certainly worse than first option.

Proposed Portfolio

Considering the expected returns on the stocks, High Tech Company is definitely a bad choice for investment. It is offering -2% return and a very high beta of 2.25. Countercyclical company is although offering a high return of 9.9%, but it also holds negative high beta of -1.58. Negative beta means that stock will react opposite to the market. Mary should make a combination of Index Fund, Usfity Company and treasury bills. A near rational portfolio can of 40% in Counter Cyclical, 30% in Usfity Company, 20% in index fund and 10% in Treasury Bills. Such a combination will offer a portfolio return of almost 7% and beta of -0.5.