Introduction

Living in the era of globalisation implies that the firms have to prioritise their expansion strategies and view it as the core of their businesses. In this case, River Island, the company with its headquarters in the UK, considers Asian markets as potential targets for increasing the firm’s profits and international presence. Malaysia and Indonesia could be viewed as the beneficial sources for expansion, as they tend to have favourable economic conditions while experiencing continuous growth (Jones, 2015). Consequently, the primary goal of this paper is to determine the best option for the expansion while assessing the flow of FDIs, corruption rates, transaction exposure, trade barriers, tariffs, regulations, and corporate governance while conducting SWOT and OLI assessments. In the end, the conclusions are drawn to underline the rationale for the outcomes and highlight a strategy suitable for expansion in the clothing segment.

Overview of the Company

General Information

River Island is one of the well-known brands with a high recognition in the fast-fashion industry with its headquarters in London (River Island: About us, 2016). It currently offers an extended variety of clothing items while covering the target markets such as kids, youngsters, women, and men (River Island: About us, 2016). Despite its initial focus on the UK market, the firm tends to have offices in different regions such as Europe, the Middle East, and Asia (River Island: About us, 2016). The company focuses on the maximisation of its profits while highlighting the financial stability as its priority. Nonetheless, it tends to reduce its impact on the environment while using the sources of renewable energy (River Island: Corporate social responsibility, 2016). In this instance, prioritising global expansion strategy will help the firm increase its profits and enlarge its geographical coverage while complying with its mission statement and underlying the gravity of social responsibility.

The Need for Expansion

Currently, the firm has the revenues of $1,382.969 (Hoovers: River Island, 2016). Nevertheless, it is not a complete maximum that the company is able to reach by operating in the selected markets (Hoovers: River Island, 2016). The desire to optimise its profits could be regarded as one of the main drivers to underline the significance of expansion while regarding it as one of the principle revenue-generation tools.

As it was mentioned earlier, Asian markets have a tendency to be highly attractive due to their large market size and favourable economic conditions for the development of the foreign businesses (Jones, 2015). In this case, they tend to experience a high degree of FDIs inflows due to their gradual growth rates in terms of technological development, infrastructure, and well-established macroeconomic features of the countries (Jones, 2015). Taking advantage of these matters will assist River Island in reaching its organisational goals and objectives while increasing their shares in the Asian markets and maintaining their competitive edge in the intensified global rivalry. Overall, expanding to Malaysia and Indonesia could be regarded as the beneficial options in this context.

The Corporate Governance and Corruption Rates

Nowadays, it remains apparent that the governance and the political stability are essential aspects, which determine the country’s global competitiveness index and emphasise whether the region is attractive to the FDIs (World Economic Forum: Methodology, 2016). Simultaneously, the level of political risks and corruption rates also have a critical impact on the desire of the companies to enlarge to the countries while expanding the theory of Adam Smith (World Economic Forum: Methodology, 2016). Consequently, assessing the political environment in Malaysia and Indonesia will have a positive influence on understanding their appropriateness as the regions for expansion.

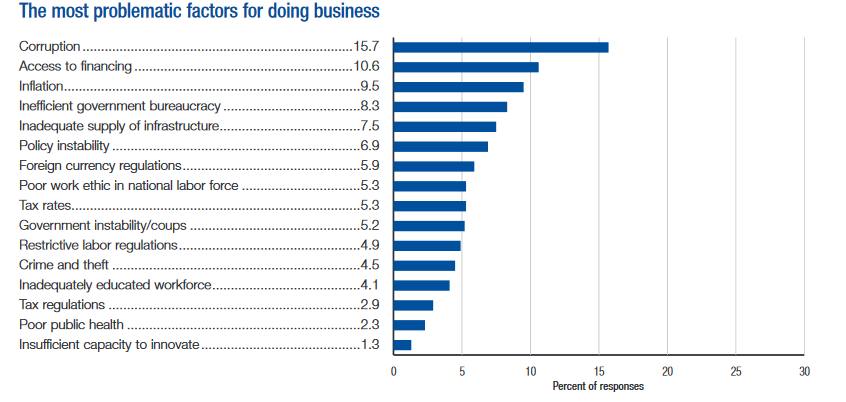

Indonesia

Global competitiveness report indicates that Indonesia is the efficiency-driven economy with only 4.1/7 score in the section of political institutions (Schwab, 2015). Meanwhile, the primary risks linked to the operations in this country include significant corruption rates (15.7), inefficient government bureaucracy (8.3), and high level of the governmental instability (5.2) (Schwab, 2015). Figure 1 provides detailed information about the risks that the company might face while operating in Indonesia The presence of these aspect underline that River Island may face these difficulties when starting its operations in the Indonesian market. As for the corruption rate, Indonesia has the 103rd position in the global ranking with the score of 34 (Transparency International: Corruptions perceptions index, 2014). These aspects could be regarded as high and are not the most appropriate for conducting business.

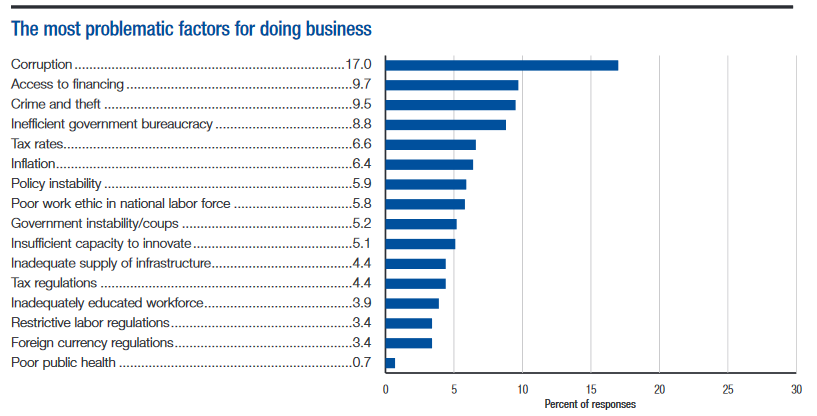

Malaysia

As for Malaysia, the country tends to be located in the transition stage between the efficiency to innovation-driven economy while having a higher score (5.7/7) than Indonesia concerning the infrastructure of political institutions (Schwab, 2015). In this instance, the major threats are associated with the same aspects as in Indonesia and include high corruption rate (17.0), ineffective government bureaucracy (8.8), and the great level of political instability (5.2) (Schwab, 2015) (see Figure 2). Speaking of corruption, Malaysia tends to support corruption-free culture with the 50th ranking of the least corrupted areas in the world and has the score of 52 (Transparency International: Corruptions perceptions index, 2014). When considering these matters, Malaysia’s economic environment can be regarded as a better country for growth in terms of political stability than Indonesia.

Regulations (Tariffs) and FDI

Another aspect that has to be measured is Foreign Direct Investment (FDI). In this instance, it is believed that a region or country with a higher degree of inflows is more favourable for the expansion, as this positive cash flow guarantees political and economic prosperity and well-developed policies (Wren & Jones, 2012).

Indonesia

In the country, the inflows of FDIs are determined by licensing procedures and monitored by BKPM (KPMG: Investing in Indonesia, 2013). The international investors can contribute to the national economy by establishing partnerships with the local companies with 45 % to 90 % ownership (KPMG: Investing in Indonesia, 2013). As for the inflows, the number of FDIs has experienced growth while having $4,878 million in 2009 and $18,444 million in 2013 (OECD: Foreign direct investment, 2014). This positive change pertains to the fact that Indonesian government establishes suitable policies to attack additional financial funds to cultivate the growth of the economy.

Alternatively, Indonesia is a part of the ASEAN free trade area while having non-trade barriers between the participants of the agreement (KPMG: Investing in Indonesia, 2013). Nonetheless, the ASEAN countries may introduce additional tariffs for the countries from outside of this trade zone (KPMG: Investing in Indonesia, 2013). In this case, having an import license is compulsory for conducting the importing activities on the territory of Indonesia. This matter could be viewed as a potential difficulty when exporting the operations to this country while having an additional state of expenditure for licensing.

Malaysia

Nowadays, Malaysia experience is a positive trend in attracting FDIs to its economy, but it has a tendency to face intensified rivalry from other participants of ASEAN agreement (OECD investment policy reviews, 2013). Malaysian FDI index accounts to be one of the highest among ASEAN countries and signifies that the country is the most open for imports and other forms of the financial interventions (OECD investment policy reviews, 2013).

Nonetheless, despite the desire of the government to optimise its economic stability by 2020, there is an extended variety of barriers and drawbacks in policies that the country has to enhance to increase a percentage of FDIs. One of the adverse aspects is the existence of restrictions, which are greater than in China and other OECD countries (OECD investment policy reviews, 2013). It is present in the form that some of the products and features are prohibited from importing. Nonetheless, the government of the country understands the significance of these matters and underlines the need to continue the liberalisation process. As for operations of River Island, these policies are not applicable in this context, as these goods are not mentioned in the list of restricted products.

Recent Inflation and Changes in Exchange Rates

Inflation (Indonesia & Malaysia)

Another vital component to consider in both countries is historic inflation rate, as it tends to portray the financial stability of the country while indicating the changes in consumer price index (CPI) and purchasing power. In this instance, Figures 3 and 4 depict the historic flow of inflation. Figure 3 displays that inflation rate in Indonesia experience negative dynamics and creates the advantageous environment for the businesses and foreign entrepreneurs including River Island, which attempts to expand their activities to this country. In 2015, inflation accounted only for 3.35 % annually and reached one of its lowest points since 2000 (Inflation.eu, 2016).

As for historic inflation rates in Malaysia, the country has been relatively economically stable, and its inflation values were 3.14 % at its highest in 2014 (Statista: Malaysia, 2016). Despite its stability, discovering the historic flow of inflation helps see that its overall value continues to grow and will reach the rate of 3% in the subsequent years (Statista: Malaysia, 2016). In this instance, both of the countries have relatively low inflation rates, but Figure 3 depicts that the economy of Indonesia is more unstable. Consequently, selecting Malaysia will assist River Island in reaching its financial targets by minimising the impact of costs of inflation.

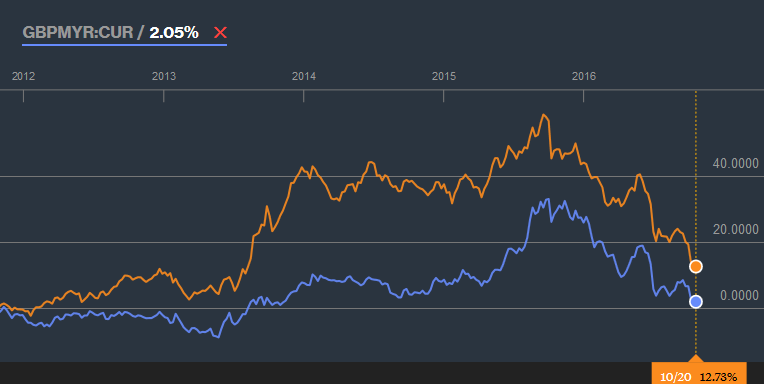

Exchange Rates (Indonesia & Malaysia)

Alternatively, conducting a sufficient analysis of exchange rates will help understand whether the selected countries are appropriate for exporting River Island outlets and clothing items to them. Figure 5 displays two currency exchange tendencies with orange (GBPIDR) and blue graphs (GBPMYR). It remains apparent that both of the tendencies experience that both currencies are decreasing in value in comparison to GBP, and this downward trend signifies that Malaysian and Indonesian markets have favourable conditions to prioritise export activities as their major revenue-generating instrument. Nonetheless, River Island may experience a substantial loss when exporting to these markets due to the critical drop of this currency pair at the capital market.

Based on the analysis, the effects of translation and economic exposure also have to be depicted to understand the potential of the selected markets. The transaction and translation exposures can be viewed as high since the analysis of the currency pairs indicates that both currencies may continue downward shift and cause a critical loss of the revenue of River Island. To support this hypothesis, Figure 5 portrays that both GBPIDR and GBPMYR a significant drop in their value from the end of 2015, and this trend may continue to evolve due to the general principles of the rules of demand and supply of the capital markets (Bloomberg markets: Spot exchange rate, 2016). As for the economic exposure, River Island may face crucial challenges due to the gravity of globalisation, high price volatility, the lack of the economic and political stabilities, and their dependence on the stronger currencies such USD, EUR, and GBP.

Cost of Debt and Share Price Index

Furthermore, it is vital to access the actual cost of debt and share price indices in Malaysia and Indonesia, as they determine the countries’ values regarding their operations in capital markets. It indicates the present share of the region in the stock market and determines the financial amount required to return in debt.

Indonesia and Malaysia

As it was mentioned earlier, the economic conditions and financial stability of the countries are dependent on the actions of the major trade players and capital influencers on the value of currency exchange rates. Alternatively, both of the countries are dependent on the interest rates imposed by the American government due to the country’s significant contribution to the economic development of Indonesia and Malaysia by issuing debt. In this case, the situation in both of these countries will continue to worsen due to the need to increase the interest rates to stabilise the economy of the United States (Aristide, 2015).This matter will assist in the development of stagnating trends in Indonesian and Malaysian economies, as in the recent past, the external debt in Malaysia has emerged from 48.1 % to 68.7 % (Aristide, 2015). Nonetheless, both of these countries could be viewed as the most effective ASEAN economies, which were able to minimise the consequences and outcomes of the financial crisis (Aristide, 2015). Speaking of share price indexes, the regions aim at increasing governmental securities up to 30% (Aristide, 2015). Simultaneously, the overall operating value in FX has elevated from 0.1 to 0.37 in Malaysia and 0.3 to 0.67 in Indonesia over the past six years (Aristide, 2015). This information signifies that both of the countries are similar in the structure and values of the capital markets.

Credit Ratings

Alternatively, credit rating also defines a condition of the economy and determine whether loans can be viewed as a possibility when expanding the activities to the selected countries.

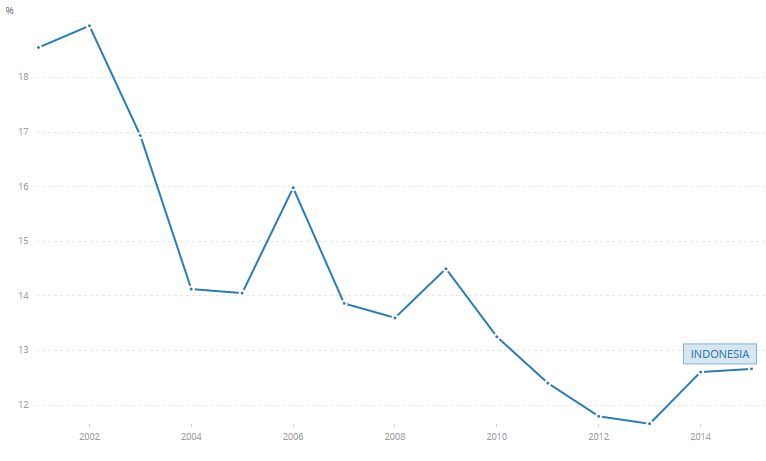

Indonesia

In the first place, Figure 6 represents the fluctuations of the credit rates since 2001 graphically. Initially, the rate was vehemently high with 18.5 % (The World Bank, 2015). Meanwhile, it experienced a significant downward shift and decreased to 12.6 % in 2015 (The World Bank, 2015). In this case, these aspects may have an adverse influence on the possibilities of River Island in the market, as high interest rates in Malaysia will increase the overall expenditure while decreasing the potential cash inflows.

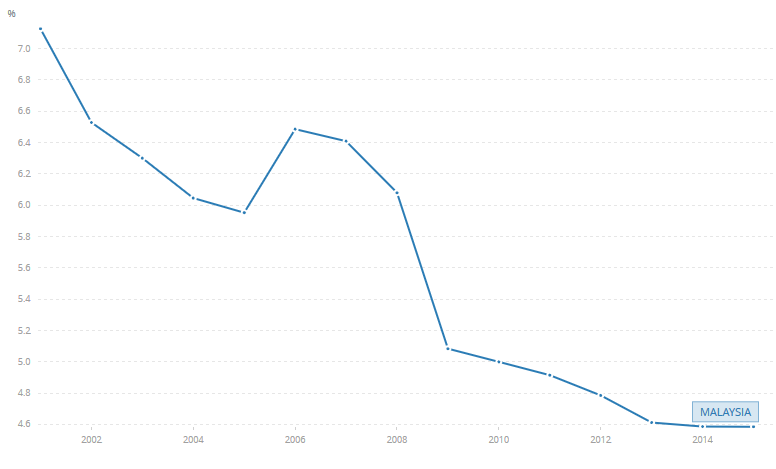

Malaysia

Figure 7 depicts that Malaysian economy also experienced a decrease in lending interest rates. Nonetheless, the initial rate was low with 7.1 % only (The World Bank, 2015). It continued its descending trend and dropped to 4.5 % in 2015 while expanding the loaning opportunities for the business owners and foreign investors (The World Bank, 2015). In comparison to Indonesia, these numbers are substantially lower and generate a gap of 8.1 % between the lending rates of these regions. In this case, prioritising Malaysia will be beneficial for River Island in terms of cost optimisation and financial efficiency.

SWOT and OLI Analyses

Based on the analysis of the financial factors such as inflation rate and lending interest rate and political matters, it is possible to conduct SWOT and OLI assessments to determine the countries appropriateness for expansion.

SWOT: Ownership (O)/ Location Advantage (L)

Table 1. SWOT analysis.

OLI (Excluding I)

River Island can take advantage of the benefits of the location to reach its organisational goals and financial objectives. Overall, SWOT analysis reveals that both geographical have positive economic conditions for the expansion while underlying that River Island can receive an optimistic social response from its potential consumers in these countries. Alternatively, both of the countries aim at attracting FDIs by establishing policies to attract foreign investment and improve their presence in the capital markets.

Nonetheless, Indonesia tends to outweigh Indonesia in its lower corruption ranking and an insignificant impact of political risks on the financial development of the companies. On the contrary, Malaysia tends to be more economically stable while occupying a transitive economic stage and having lower inflation and interest rates than Indonesia. Emphasising these aspects assists the county in being prioritised for expansion activities by River Island due to an extended number of the positive features.

International Expansion Strategies

A combination of OLI and SWOT analyses reveals that the most appropriate methods for expansion are licensing, acquisitions, and Green Field Investment.

Acquisitions

It is one of the most relevant approaches in starting operations in Malaysia or Indonesia, as it allows creating strategic alliances to increase River Island’s recognition in a new country. In this instance, River Island can establish strategic partnerships with the local companies in Malaysia and Indonesia to reach its financial goals and objectives (Delios & Singh, 2012). Nevertheless, the primary challenge is selecting a partner, which will assure the alignment with River Island’s mission statement and vision and will help it face the challenges of the local markets and overcome the challenges of the financial instability and political risks.

Greenfield Investment

Using a Green Field investment can be regarded as another tactic that can be utilised by River Island to start its operation in the market. It implies starting activities in the selected countries without creating any partnerships or transferring any company’s facilities (Delios & Singh, 2012). It gives a firm an opportunity to be fully responsible for its actions and control the quality of the delivered goods. Nevertheless, the principle challenges are associated with the need for substantial financial investment, high costs, and the inability to control the possible responses of the target audience.

Licensing

One of the first methods is using licensing, and its working mechanism that River Island will offer a foreign company an opportunity to transfer some resources to operate in the clothing market in Indonesia or Malaysia. The critical benefit of this method is the fact that it ensures the company’s position by guaranteeing that the rights and obligations of the both parties are respected and reflected in the agreement (Delios & Singh, 2012). It is one of the most appropriate expansion strategies for the company, as it is associated with a high level of safety while this matter is vehemently important in the emerging markets. Simultaneously, it helps build a connection with the target audience while taking advantages of the competences of the local producers (Delios & Singh, 2012).

Nonetheless, River Island has to understand that granting a right to operate under the name of a brand might damage firm’s image in the case of not meeting the perceived expectations of the customers. Alternatively, applying the concepts of this approach will require finding a sufficient balance between the licensing party and River Island while underestimating this matter may be a potential cause for the conflict of interests.

Overall, it could be said that licensing have to be prioritised as the most effective strategies for River Island. In this case, it will require lower investment while applying other methods. The first step will be conducting a feasibility analysis of the company’s expansion tactic and set a list of firms, which will have all required features to correspond with River Island’s mission statement and goals. After that, selecting the most appropriate firm and negotiating the terms of this partnership will help establish an effective agreement and contract.

Conclusion

In the end, this report reveals that it is essential to evaluate economic and financial environment of the countries from dissimilar angles before continuing with a growth strategy. In River Island’s case, Malaysia has more benefits in terms of low inflation and interest rates and financial stability than Indonesia. Utilising licensing approach will help the clothing producer, River Island, discover the full potential of Malaysia and reach its financial goals and objectives.

References

Aristide, O. (2015). Foreign debt may stall growth in Malaysia, Indonesia. Bizmology. Web.

Bloomberg markets: Spot exchange rate. (2016). Web.

Delios, A., & Singh, K. (2012). Strategy for success in Asia: Mastering business in Asia. Hoboken, NJ: John Wiley & Sons.

Hoovers: River Island. (2016). Web.

Inflation.eu. (2016). Web.

Jones, M. (2015). Which ASEAN country is the most competitive? Web.

KPMG: Investing in Indonesia. (2013). Web.

OECD: Foreign direct investment. (2014). Web.

OECD investment policy reviews. (2013). Web.

River Island: About us. (2016). Web.

River Island: Corporate social responsibility. (2016). Web.

Schwab, K. (2015). The global competitiveness report. Web.

Statista: Malaysia. (2016). Web.

The World Bank: Lending interest rate. (2015). Web.

Transparency International: Corruptions perceptions index. (2014). Web.

World Economic Forum: Methodology. (2016). Web.

Wren, C., & Jones, J. (2012). Foreign direct investment and the regional economy. Hampshire, UK: Ashgate Publishing Ltd.