Introduction

Goldman Sachs has operated for the last 147 years and has become one of the leading financial institutions in the United States and global market. This firm’s success is partly attributed to a number of external environmental factors, such as the growing economy in the United States, increasing globalization, and the rising number of the middle class globally.

However, its internal environment is largely responsible for the years of success that this firm had experienced, even at a time when its major market rivals, such as Lehman Brothers, were forced out of the market. According to Williams (2016), the internal environmental factors make a firm unique compared to its competitors in the market. It gives a company unique capabilities in terms of meeting market challenges. Goldman Sachs has proven that it has a detailed understanding of the market forces not only in the home country in the United States but also in other global markets where it operates. In this report, the focus is to conduct a comprehensive analysis of the internal environment of this firm.

Key Internal Factors

According to Williams (2016), the competitiveness of a firm in the market is often determined by its key internal factors. In most of the cases, firms within a given industry often face similar environmental forces as long as they are operating in the same market. The success of a firm largely depends on the nature of its internal environment. For Goldman Sachs, the finance market where it operates is highly competitive. It has one of the top companies all competing for the same market. To achieve a greater market share, a firm needs to develop an internal structure that makes its operations more efficient and less straining to its employees. The management of this company has been keen on developing an enabling internal environment to help it achieve success in the market.

Core competencies

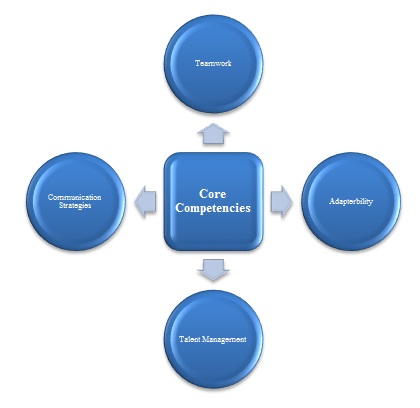

Looking at Goldman Sachs core competencies is one of the ways of analyzing its internal environment with a view of determining its uniqueness in the market. Mandis (2013) defines core competencies as “defining capability or advantage that distinguishes an enterprise from its competitors.” They may a company stand out among the rest as a firm that has unique capabilities uncommon in other rival companies. The figure below shows some of the key competencies of this company.

As shown in the above figure, one of the greatest core competencies of Goldman Sachs is the value it places on teamwork. According to Williams (2016), a firm that embraces teamwork is capable of achieving success because employees will cherish working as a unit instead of just completing the assignments given to them. Employees will be willing to help their colleagues to address tasks which are complex. It is also in such environments where employees will embrace positive competition among the departments. At Goldman Sachs, each department often treats its employees as part of a larger team. Members of every team are responsible for everything that happens within their department. For instance, all employees in the marketing department are responsible for the outcome of the activities of this department.

A mistake of an individual employee within the department is regarded as a mistake of all the members. As such, all the employees within the marketing department will do everything within their powers to eliminate such mistakes as much as possible. This approach in its operations has enabled this company to achieve success even after losing some of its talented employees. The employees are often willing to train newly recruited staff so that they can understand the concepts and culture of this company. Through teamwork, they are always able to come up with creative ways of solving problems in very unique ways. Although other firms in the industry also practice teamwork, Goldman Sachs has taken this strategy to the next level where it is the responsibility of everyone to ensure that success is achieved.

Communication is one of the most important factors that define the ability of a firm to achieve success in a highly competitive market. According to Williams (2016), different firms employ different communication strategies based on the organizational culture that it has embraced. At Goldman Sachs, maintains an open-door policy where employees are allowed to interact with the top managers without any restrictions. According to a study by Rumelt (2011), open-door policy is one of the most effective communication strategies that a firm needs to embrace to promote interaction between top managers and junior employees. The main problem that many firms often face is how to effectively employ this strategy.

Most firms often prefer using a structured communication system where employees communicate to their immediate supervisors as a way of creating a sense of order and ensuring that the top managers are allowed ample time to concentrate on strategic issues that affect the firm. However, Goldman Sachs has successfully created a communication system where junior employees can directly communicate with top managers without affecting their schedule on strategic matters of the firm. This communication strategy has enabled the top managers to understand forces that affect junior employees at their respective workplaces.

The relationship between those in top leadership and the junior employees has been good because of this effective environment for communication. Whenever there is an issue affecting an individual employee, he or she can visit the relevant manager and address the issue in an effective manner. The innovative nature of this firm is also partly attributed to the communication strategy that it has put in place. The employees have a rare opportunity of sharing their original ideas with the relevant managers without having to reach them through the middle managers.

Adaptability is another core competency that this firm has uniquely developed in a way that far exceed what other firms in the same industry are doing. Since its foundation about 147 years ago, this firm has been faced with numerous environmental challenges and changes that required it to adapt to new systems and structures. When the company was founded in 1869, computer technology that exists in the modern days had not been created. The firm relied on physical files and papers to tract the records of their clients. According to Scherf (2014), Goldman Sachs was one of the very first firms to adopt IBM computer systems as a way of keeping data. It realized that the new computer technology was critical for its success in the market. As time went by, internet emerged and technology kept on changing the operations in the banking sector.

When internet banking emerged, this company was one of the financial institutions that embraced this new product as a way of capturing more clients and making the banking process simpler. Internet banking was particularly critical for this firm because it allowed its clientele to operate their bank accounts irrespective of their location or time of the day. It named its online banking GS Bank and it mainly targeted clients in North America. It is important to note that other firms have similar products in the market, but not in the manner that Goldman Sachs did. What is unique about this firm is that it is quick in embracing emerging technologies and it understands how to overcome challenges that early adopters often face when using new technology. It has created a team of highly loyal and very effective workforce that is dynamic and embraces change. It explains why this firm often adapts to changes seamlessly and without any form of resistance from its employees.

Talent management is another critical tool that this firm is using to achieve a competitive edge over its market rivals. The top managers of this firm knows that the only way of managing stiff competition in this industry is to have a team of highly skilled, talented, and innovative employees. To achieve this, the firm has created an environment where its employees can come up with new ideas to address their current tasks or new challenges that they may encounter at work. Its highly competitive remuneration packages for its employees and other non-financial benefits have helped in retaining its highly qualified employees.

Strengths and competitive capabilities

It is clear from the above analysis of core competencies that this firm has a number of factors that give it competitive edge over its market rivals. One of the main strengths of this firm is its market experience of 147 years. It clearly understands the market forces, having encountered all the economic recessions in America’s modern history, and knows how to respond to these challenges. The strong financial base also gives it an edge over other emerging financial institutions. It is able to initiate major marketing or product development projects without straining. The team of highly skilled and dedicated employees also makes this firm to stand out among the rest as a dynamic company that is often ready to embrace change. The skilled and highly understanding top managers have also offered the vision needed to see this firm through some of the most significant challenges that it has often faced in the market. The loyalty it has gained among its clientele has also given it a competitive advantage against its top market rivals.

Weaknesses

According to Hall and Yip (2016), even some of the most successful firms have a number of weaknesses that needs to be addressed in order to make them function effectively. Goldman Sachs is no exception. One of the main weaknesses of this company that was once almost forcing it into bankruptcy during the 2008 economic recession is its overreliance on subprime mortgages. The firm offered this product because of the high number of customers who were willing to take such loans. However, when these debtors were unable to repay their loans, the firm faced serious challenges in its operations. Its inability to offer mobile banking to its non-American clients has also been considered a weakness.

Rationale

The core competencies of this, as discussed in this paper, were determined by the publications available in its websites, books, and other reliable sources. The focus was to identify core competencies that make it unique over its market rivals. The rationale of the analysis was to identify what makes Goldman Sachs more competitive compared to its market rivals.

Resource-Based View

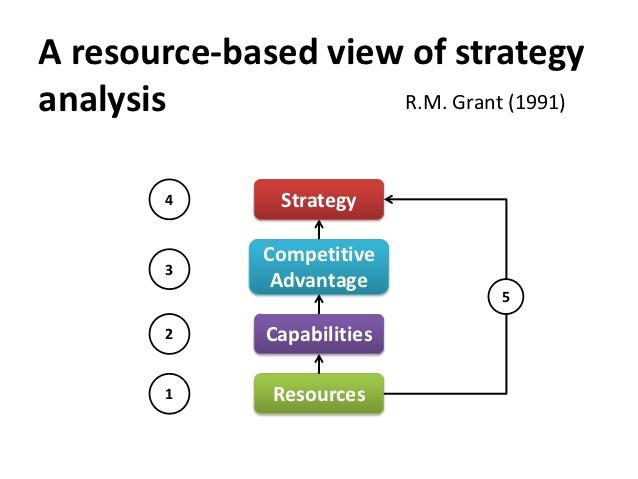

Successful firms have learnt how to use their resources to create competitive edge over their rivals and to develop market strategies that can help them overcome their market challenges. Using a resource-based view, it is possible to look at the path that firms take to turn their resources into competitive advantage and to develop market strategies. The figure below shows the RBV model.

As shown in the figure above, a firm uses its resources to create capabilities. Goldman Sachs has been using its financial resources to create new capabilities through various research projects that it often initiates, especially when faced with new challenges. These capabilities help in creating a competitive edge for the firm. It is able to overcome market challenges because of these unique capabilities. Most of the strategies that this firm develops are often based on competitive advantage it has over its market rivals.

Value Chain Analysis

Using value chain analysis may also help in understanding how this company generates value and effective strategies using its resources and capabilities. The figure below shows how primary and secondary activities work closely to generate margin for this firm.

As shown in the figure below, primary and supporting activities are used to generate the desired value. Inbound logistics, productions and operations, outbound logistics, sales and marketing, and services need human resources, technology, strategy, research, and development to enable a firm achieve the desired margin. As a financial institution, the supporting activities are very critical in enabling this firm achieve the desired success in the market. Human resources, technology, and strategy are of critical importance as discussed in the section above. Among the primary activities, marketing and quality services that this firm offers to its clients may help it make a difference in the market. Both the primary and supporting activities must be intertwined to achieve the level of success that is desired.

Conclusion

Goldman Sachs is one of the most successful financial companies not only in North America but also at global level. The firm has managed to overcome two main economic recessions that left many firms bankrupt. It has also weathered stiff competition in the global market. Its success is attributed to its internal environment. As discussed above, firms operating in the same industry within the same market largely rely on their internal environment to achieve competitive advantage over their market rivals. For Goldman Sachs, highly talented employees and a group of skilled and dedicated managers are some of the internal environmental factors that give it an edge over its market rivals. Its strong financial base and loyalty in the market has also enabled it to achieve success in the market.

Resources

Hall, D., & Yip, J. (2016). Discerning career cultures at work. Organizational Dynamics, 45(3), 174–184. Web.

Mandis, S. G. (2013). What happened to Goldman Sachs? An insider’s story of organizational drift and its unintended consequences. New York: Cengage.

Rumelt, R. (2011). Good strategy, bad strategy: The difference and why it matters. London: Profile.

Scherf, G. (2014). Financial stability policy in the Euro zone: The political economy of national banking regulation in an integrating monetary union. Wiesbaden: Springer Gabler.

Sinn, H. (2014). Austerity, Growth and Inflation: Remarks on the Eurozone’s Unresolved Competitiveness Problem. The World Economy, 37(1), 1–13.

Williams, E. F. (2016). Green giants: How smart companies turn sustainability into billion-dollar businesses. New York: Cengage.