Company’s Generic Strategy

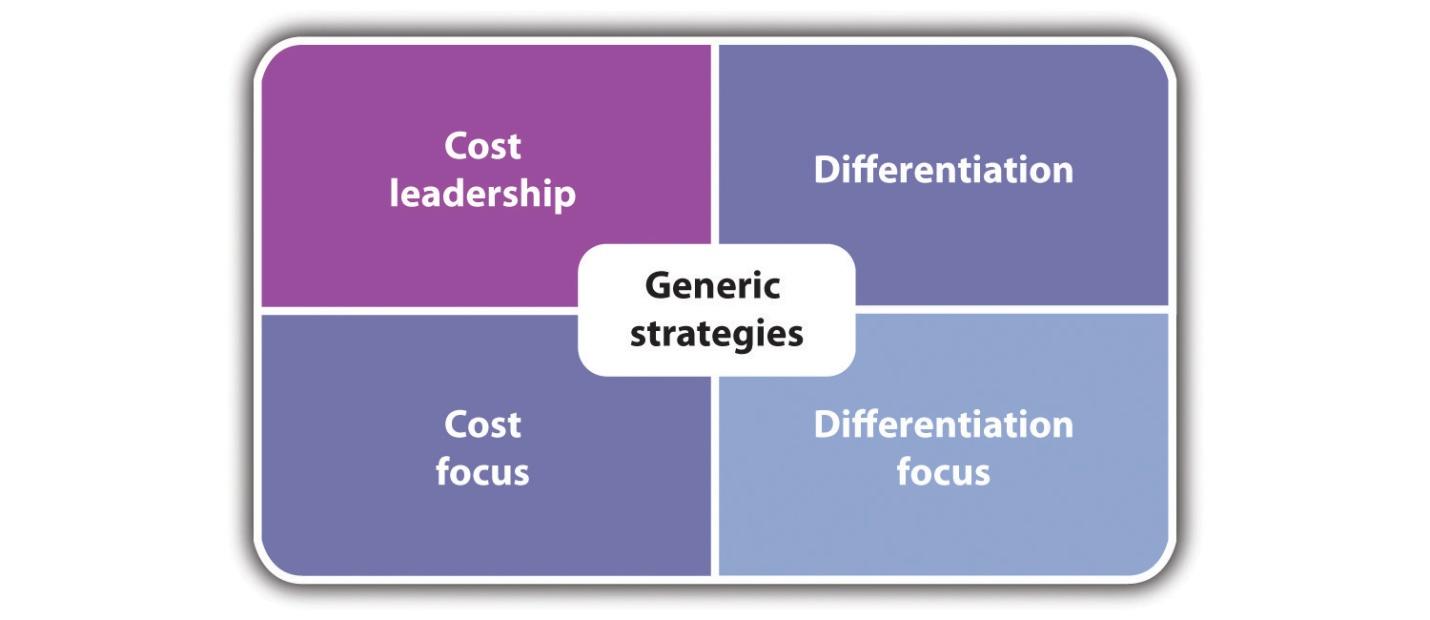

Goldman Sachs is aware of the competitive market forces and it knows that it must come up with an appropriate marketing strategy that can enable it to overcome challenges in the external environment. Sinn (2014) says that it is particularly important for a firm to come up with an appropriate generic strategy based on its strength and vision. The figure below shows four different approaches that a firm can take when choosing an appropriate generic strategy.

When choosing the appropriate strategy, Scherf (2014) advises that a firm must take into consideration its internal capabilities and external weaknesses. Goldman Sachs uses cost leadership as a way of gaining a competitive edge over its market rivals. Rumelt (2011) says that cost leadership can be achieved by “increasing market share through charging lower prices, while still making a reasonable profit on each sale because you’ve reduced costs” (p. 78). Goldman Sachs has been using this strategy as a way of attracting more clients to use its services.

When describing how Goldman Sachs was able to overcome the 2008 global economic recession, Hall and Yip (2016) say that “its involvement in subprime mortgages, Goldman Sachs was hit hard by the 2008 economic crisis” and the government had to come to its rescue (p. 54). This is a clear confirmation that the firm has been targeting clients with low purchasing power as a way of increasing its market share. The only way of attracting this market segment is to offer them products at relatively low prices. When the price is lowered, more clients are able to afford the products hence sales improve. This strategy is very dangerous, especially in cases of economic downturn because it is the middle class and the poor who are often worst affected. Their inability to pay back the loans may force the firm to write off their loans as bad debts. Such eventualities may lower the profitability of a company. Currently, the firm is still using the strategy, but in a cautious manner.

Diversification at the Company

Goldman Sachs believes in diversification as a way of earning more profits and increasing its market share. According to Mandis (2013), Goldman Sachs offers a wide range of financial products in the market. Initially, this firm primarily focused on commercial banking as the main product for its customers. This product is still available and is earning the firm’s attractive income. However, it has continued to diversify its products in its quest to meet the new needs of clients in the financial market. Asset management is one of the products currently available for the clients of this company.

Although it was affected by the recent economic recession, this product is currently earning this firm’s attractive income. Investment banking is another product that is becoming popular in the financial sector. It is available at this firm. Other products available at Goldman Sachs include commodities, investment management, prime brokerage, and mutual funds. The need to diversify product offerings in the market is very important because of the volatility of the market. With a large pool of products in different categories, a firm gets to benefit in case there are problems with one sector of the market. It is also one of the best ways of expanding market share in a market that has become very competitive due to the emergence of new firms.

References

Hall, D., & Yip, J. (2016). Discerning career cultures at work. Organizational Dynamics, 45(3), 174–184. Web.

Mandis, S. G. (2013). What happened to Goldman Sachs? An insider’s story of organizational drift and its unintended consequences. New York: Cengage.

Rumelt, R. (2011). Good strategy, bad strategy: The difference and why it matters. London: Profile.

Scherf, G. (2014). Financial stability policy in the Euro zone: The political economy of national banking regulation in an integrating monetary union. Wiesbaden: Springer Gabler.

Sinn, H. (2014). Austerity, Growth and Inflation: Remarks on the Eurozone’s Unresolved Competitiveness Problem. The World Economy, 37(1), 1–13.

Williams, E. F. (2016). Green giants: How smart companies turn sustainability into billion-dollar businesses. New York: Cengage.