The Finance and Banking industry

Goldman Sachs is one of the dominant players in the banking industry in the United States and Europe. The banking industry has experienced significant changes over the past decades due to a number of external factors in the market.

According to Williams (2016), the banking industry is one of the most important industries in any economy because of the level of dependency that other industries have on it. The industry has very tight regulations in the United States compared to others because it is entrusted with the country’s wealth. It is an attractive industry in terms of profitability and that is why it has attracted numerous firms keen on tapping into the profits that it offers. In the United States, there are numerous financial institutions offering varying products to their clients. Goldman Sachs is one of the leading local players in this industry.

Foreign financial institutions have also emerged to compete with local firms in this industry. Scherf (2014) says that over the past five decades, competition in the banking industry has intensified as new firms are created to compete with the existing firms over the same market share. The United States banking industry is one of the most attractive in the world because of a number of factors. The country is home to some of the world’s largest companies such as Apple Inc, Coca Cola Company, Microsoft Corporation, Wal-Mart, Exxon Mobil, and many others.

It also has a huge population of relatively rich people compared to other parts of the world. People and companies all depend on banks for their financial transactions. It makes the country’s banking industry one of the most competitive in the world. That is why it has been attracting both local and international firms. This industry is prone to external environmental forces that individual firms must understand in order to survive.

Analysis of the Finance and Banking Industry

The management of Goldman Sachs has been keen on ensuring that operations of this firm are in line with its strategic goals. Williams (2016) says that in the current competitive business environment, the success of a firm largely depends on its ability to understand the external environment and to align internal environmental factors to these external environmental forces.

It is, therefore, very necessary to conduct a comprehensive analysis of the external environment of the banking industry where this firm operates. The analysis will focus on the market environment in the United States and Europe where this firm majorly operates. PESTEL analysis can be very useful in this analysis.

The United States has enjoyed a long period of political stability since the end of the Civil War in the 1860s. The country went through the civil rights era where a section of the society championed their rights, but that did not destabilize the country. During the First and Second World War era, Goldman Sachs was already in operations, but its main market was in the United States. Given that the war was not fought on the United States soil, this firm and the local finance and banking industry at large was not affected.

According to Williams (2016), political stability is very critical for a given industry because it defines how secure firms are in a given region. When there is no political stability within a country, then there will be no law and order, which means that companies cannot operate normally. Europe has also experienced a long period of political stability, especially the specific countries where this firm operates. The stability in these countries is one of the major reasons why it has remained successful for the past 147 years.

The economic environment is also an important factor that affects firms operating in the finance and banking industry. According to Rumelt (2011), when the economy is booming, citizens have enough cash to spend and to save. Individual companies in other industries will benefit from the boom and will also need the banking industry to handle their increased finances. The overall impact will be the improved profitability of the firms in the banking industry. The United States and Europe were hit hard by the 2008 economic recession.

One of the industries that were worst hit was the banking industry. The rate of incidences of bad debts increased and the number of private individuals using banking services dropped. Companies that were previously having high financial transactions toned down their banking operations because of the slowing economy. However, Scherf (2014) notes that since the end of the recession, the industry has continued to register impressive growth both in Europe and the United States.

The social environment also plays a significant role in the growth of the industry. According to Sinn (2014), there is a culture in Europe and the United States that favors banking. People trust banks with their wealth. As such, cases where people keep large sums of money in their houses are rare.

People also rely on banks to get loans for developmental purposes. The social environment in these countries makes financial institutions very important hence highly profitable. Their services are popular among people of Europe and the United States, unlike in other developing parts of the world where many people are yet to understand the relevance of banks in their socio-economic lives.

Technology is one of the factors that have had a major impact on the finance and banking industry, especially over the past two decades. According to Rumelt (2011), financial institutions, just like other industries around the world, find themselves in a very tight position technology-wise where they have to embrace new approaches of conducting business in order to survive.

Emerging technologies have introduced a number of new products in this market that never existed before. Internet banking and mobile banking are products that have become very popular over the past decade because they simplify the process of banking and enables clients to access their money without visiting banking halls. Technology has also transformed the approach that firms take when transacting businesses.

The issue of ecology is a concern to many firms all over the world. Companies are now trying to find ways of operating without posing significant threat to the environment. Firms in this industry have followed suit in trying to make their operations environmentally friendly. Most of these companies are now moving towards paperless transactions to ease pressure on our trees. Some of these companies, such as Goldman Sachs, have also been supporting environmental initiatives in their corporate social responsibilities. The legal environment is another external environmental factor that affects all firms operating in this industry.

As Scherf (2014) notes, a firm cannot survive in a market that has not clear legal structures. Laws protect firms, clients, government itself, and third parties from unfair practices. Williams (2016) says that in both the United States and Europe, the legal environment has been very supportive of both local and foreign firms, creating a platform where firms can fairly compete.

Analysis of the External Environment Using Five Forces Model

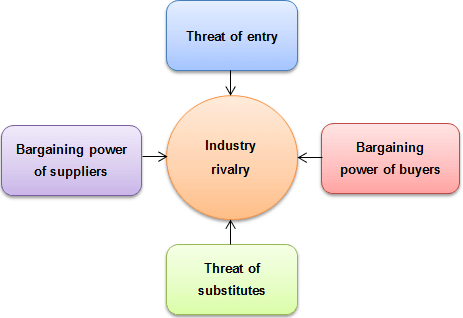

The management of Goldman Sachs needs to clearly understand industry-specific forces that may directly affect the firm’s operations in the market. Five-Forces Model may be very critical in understanding these forces and knowing how to effectively deal with them. The figure below shows the model.

The industry rivalry is very stiff both in Europe and United States as many firms continue to emerge and are keen on capitalizing on the opportunities available in the market. The stiff market competition in this industry has forced some firms out of operation. Others have been forced to come up with unique ways of acquiring new market share such as offering sub-prime mortgages. The industry rivalry has been intensified by the threat of entry into the market. Most of the European markets and that of the United States have laws that make it easy for new firms to enter the market. As such, the threat of having new firms entering this market is real.

The bargaining power of the suppliers in this industry is increasingly becoming high (Hall & Yip, 2016). Suppliers in this case are people who are depositing their cash in the bank are demanding high profits. The bargaining power of the buyers (those who are buying various products from the banks such as loans) are also becoming more demanding because they know they have a number of options to make. They demand for low interest rates. The threat of substitutes is also becoming real as non-banking institutions are coming up with banking services such as money transfer.

Goldman Sachs’ Strategic Group Map

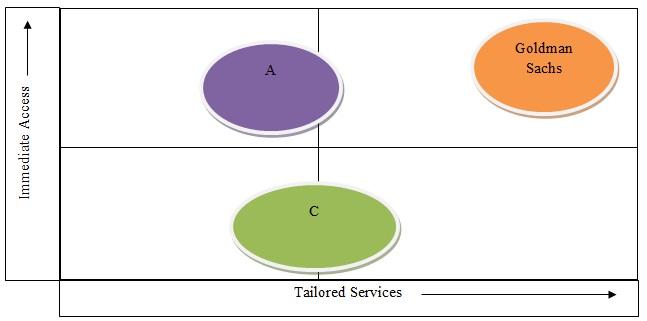

Strategic group map helps in determining the position of a firm in the market in terms of the ease with which its products are accessible and how specific the products are in meeting varying needs of the customers. Using this map, it is possible to explain why a given firm is making a better progress compared to others. The following map shows Goldman Sachs’ relative market position.

As shown in the figure above, Goldman Sachs’ products are easily accessible in the market. The accessibility of these services is high because the firm has come up with a wide range of products that target the rich, the middle class, and those with limited financial capabilities. The firm also offers highly tailored services for its customers. Unlike before when financial products were universal, currently clients can personally negotiate for better interest rates and other unique services at the bank.

Threats and Opportunities

The management of Goldman Sachs should be able to understand opportunities and threats in the market to ensure that it achieves the success desired. The external market forces can be analyzed using SWOT Analysis Model, primarily focusing on the threats and opportunities. The market has a number of opportunities that this firm can take advantage of if it is capable of identifying them and taking the right action at the right time. One of the biggest opportunities is the growing middle class in the market where this firm operates.

The growth means that the market is expanding, making it possible for the firm to expand its market shares. Technology is also offering financial institutions the opportunity to develop new products that can serve the needs of the clients in a better way. The management must also take note of the threats in the market that may threaten its operations. Stiff market competition and slowing economy are the major threats that the management should be keen on in the market. Issues such as terrorism and cybercrime are also becoming major concerns that this organization can no longer ignore.

Extent to Which Goldman Sachs Strategy Match Competitive Conditions

The management of Goldman Sachs is aware of the stiff competitive forces in the market and, therefore, it has been keen to ensure that it aligns its strategies with these conditions that it confronts. The ability of this company to survive the 2008 global economic recession is a clear indication that its current strategy appears a good match for the competitive conditions it confronts (Rumelt, 2011).

Although the firm was blamed by some of its clients because of the strategies it used to overcome this recession, it was clear that the firm was able to identify the threat early enough. It dealt with this threat effectively and the company emerged successful from the recession. Its success in the overseas markets, especially in the European markets, is another indication that the company’s strategies effectively match the competitive conditions that it has to deal with. That is why this company is one of the leading financial institutions in the country.

References

Hall, D., & Yip, J. (2016). Discerning career cultures at work. Organizational Dynamics, 45(3), 174–184. Web.

Mandis, S. G. (2013). What happened to Goldman Sachs? An insider’s story of organizational drift and its unintended consequences. New York: Cengage.

Rumelt, R. (2011). Good strategy, bad strategy: The difference and why it matters. London: Profile.

Scherf, G. (2014). Financial stability policy in the Euro zone: The political economy of national banking regulation in an integrating monetary union. Wiesbaden: Springer Gabler.

Sinn, H. (2014). Austerity, Growth and Inflation: Remarks on the Eurozone’s Unresolved Competitiveness Problem. The World Economy, 37(1), 1–13.

Williams, E. F. (2016). Green giants: How smart companies turn sustainability into billion-dollar businesses. New York: Cengage.