Corporate Valuation

It is possible to apply several methods that can help to evaluate Robertson Tool Company. One of them is the discounted cash flow valuation. The major advantage of this method is that it takes into account the time value of money. To calculate the value of a company based on discounted cash flow, one has to take into account the following variables:

- income generated during a year ($ 55, 5 mils.).;

- capital expenses ($ 2.9 mil);

- weighted average cost of capital;

- the growth rate of an enterprise (6 percent per year).

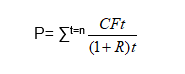

Based on these estimations, Monmouth can determine the maximum price that they can afford to pay for Robertson Tool. To do it, one has to use this formula:

In this case, CF is cash flow, and t is the period during which the investment will bring revenues, and R is the discount rate. If one evaluates Robertson Tool in this way, the price of this company will equal 37 dollars. This form of assessment shows the future value of this enterprise.

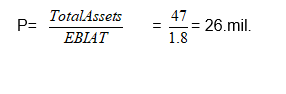

A company can also be evaluated with the help of the EBIAT model. A person, who uses this approach, to take into account the company’s earnings after taxes but prior interest rate; EBIAT of Robertson Tools equals 1.8 mils. Furthermore, one should take into consideration the total assets of an enterprise ($47 mil). EBIAT market multiple evaluations should be done according to this formula.

This is the price that Monmouth can afford to pay for the company. However, one should take into consideration that EBIAT multiple factors model does not take into account the future growth of a company. Unlike, the discounted cash flow model, this approach overlooks the time value of money. This is why the discounted cash flow model remains the most used method for company valuation. Certainly, the management of Monmouth may insist on using EBIAT multiple model evaluation, but it is quite probable that in this case Roberson will their offer.

Stockholders’ Concerns

Robertson Tool Company’s shareholders may express different concerns about the possible acquisition of their enterprise. One of them is the possible devaluation of their stock, especially if this company can merge with NDP corporation, the stocks of this company do not perform very well on the market. This argument is particularly relevant for those people who will refuse to sell their shares. There are several alternatives, available to them. First, they can trade some of their stocks for the shares of similar companies such as Idea Corp. or Stanley Works. They can also decide to organize a tender for their shares.

The second group of stakeholders includes those people who decide to sell their stock to other companies. Their major concern is that they will not receive the proper price for their stocks. These people should carefully assess the value of their shares. Based on this assessment, they will be able to determine which offer is the most profitable one. On the whole, we can say that the stockholders of Robertson Tools should make everything to diversify their investment portfolio. At the present moment, the future value of their stocks is very difficult to determine, and they need to avoid potential risks.