A General Overview of Sage 50

There are several accounting applications available in the market. One of them is the Sage 50 software. It is mainly used in Canada and the US. It was originally referred to as ‘Peachtree Accounting’ in the US. The Canadian version was referred to as ‘Simply Accounting’ (Bride, 2010). Both versions were revised in 2013 to come up with a single edition. Today, the software is referred to as Sage 50. It is used in many countries across the globe to manage businesses.

The accounting system is one of the easiest technologies to use in managerial decision making processes. In addition, it is highly efficient. The efficiency saves time used in computation of accounts. The time saved can be used in other activities that promote the growth of the business. In addition, the users of the system do not have to worry about downloading the latest version of the software (Kelly, 2012). The reason is that it supports automatic updates when one is connected to the internet. New legislations and features incorporate themselves into the already existing software without any effort from the user. At the same time, it does not interfere with the reports that had already been generated using older versions.

There is a wide variety of Sage 50 products available in the market today. They are available to customers at different prices and contain varying features. Customers can also download free trial versions of these variants to assess whether or not they meet their business needs. Sage 50 Pro Accounting is the latest version of the software. It enables businesses to meet such needs as rapid growth and expansion. At the same time, it guarantees stability (Oganessian & Utyonkov, 2015).

It also makes the management of customer sales and contacts easier. Other capabilities of the software include vendor and inventory customization, track job, as well as purchasing and shipping operations (Bride, 2010). The price of the software is $299 annually. Sage 50 Premium Version 2016 has additional features. They include the ability to track employee compensation, process bills, and compute financial statements. It retails at $449, $849, and $1,249 for one, three, and five users respectively. Sage 50 Quantum Accounting is the most advanced software. It offers advanced security to the users. It also supports automated workflow. The software retails at $1,499, $1,999, and $3,249 for three, five, and ten users respectively.

For Sage 50 to be successfully installed, certain software and hardware specifications need to be met. To begin with, it can be supported by both 64 and 32-bit variants of Windows Vista, 7, 8, and 8.1. At the same time, it is supported by Windows Server 2008*, 2008 R2*, 2012*, and 2012 R2* (Kelly, 2012). The computer system to be installed with the software should have a processor of at least 2GHz. All 32-bit systems require a minimum of 2GB RAM. For 64-bit systems, a minimum of 4GB RAM is required (Oganessian & Utyonkov, 2015).

A minimum of 5GB free space is required in the installation disk. A network speed of 100mbps is also a prerequisite. A screen resolution requirement of 1024*768 should be met. An internet connection of 2mbps is also needed to update the software. Sage 50 is compatible with Microsoft Office 2003, 2007, 2010, and 2013. Excluding the software from routine antivirus checks also optimizes its performance.

Transactional Processing for Sage 50 Software

Numerous versions of the accounting software are available in the market today. They are used to deal with a wide range of customers’ needs. The Sage 50 system plays an important role in the management of expenditure and revenue cycles. It achieves this by handling expenses and incomes associated with a given business (Bride, 2010). In matters of revenue, the system is used to make invoices that are sent to customers.

Consequently, it plays a critical role in debt collection. Good record keeping shields businesses from the risk of losing money (Kelly, 2012). The system helps to achieve this objective. The management is able to keep the firm profitable in the long run when this goal is met (Kelly, 2012). At the same time, Sage systems help the business owners to keep accurate bank accounts. Payments made to a company are clearly recorded to ensure that cash flow is monitored effectively. The number of transactions that a company can enter into is not limited. What this means is that the system is flexible.

In this analysis, the author will provide a detailed analysis of how a company can use Sage 50 to manage its payroll. Payroll is one of the important elements of a firm’s accounting transaction. With the help of Sage 50, companies can effectively keep track of expenditure on their employees. For example, payroll data can be easily processed. The software enables businesses to keep the records of all their employees in a safe and orderly manner. Changes in the workforce are reflected immediately in the business’s payroll (Oganessian & Utyonkov, 2015). In effect, expenses on human resource and associated elements can be managed.

According to Bride (2010), Sage 50 can also help the owners of a company to automatically calculate tax alongside other statutory deductions within an organization. After the deductions are made, pay slips for the workforce are prepared. Affordable monthly salaries are then availed to the employees. With the help of Sage 50, account managers can channel funds from the company’s bank account to those of individual employees (Bride, 2010).

The records for such transactions are filed away by the system for future reference. The evidence of these transactions is used by both internal and external auditors to determine the financial transactions carried out by a given business. Any errors can be tracked and corrected on time (Oganessian & Utyonkov, 2015). Correcting such mistakes does not necessarily require the accounts manager to do away with all the information that had been previously fed into the system.

Final Thoughts on Sage 50 as a Modern Accounting System

Sage 50 was initially intended to help accountants operating from the US and Canada. However, its use in contemporary accounting has become widespread. Today, the system is used in many countries across the globe to inform managerial decision making processes. The software is also reasonably priced. The affordability makes it accessible to many firms and individuals in the business world. Payments for using the software are made annually (Bride, 2010).

As a result, a firm is able to utilize the system for an entire financial year without any disruptions. With the help of the software, business calculations and reports can be completed in a timely manner (Kelly, 2012). Less time is wasted on long calculations and other activities. The software also tends to update itself automatically. All that is required to achieve this is access to a stable internet connection (Kelly, 2012). Firms operating in today’s competitive business environment need to acquire the latest technology to support their operations. The systems help the companies to gain a competitive advantage over their rivals. Developers of Sage 50 are aware of this need. To this end, the automatic update feature in the accounting software ensures that firms can keep up with technological advances in their field of operation. It is important to note that the updates are provided to the users at no extra costs.

Sage 50 is beneficial to small and medium sized business enterprises. Experienced accountants can easily navigate through the software and its various modules (Oganessian & Utyonkov, 2015). Each of these modules performs a specific task that is required in the effective management of a modern business entity. Skilled professionals can easily manipulate the system with relative ease (Bride, 2010). What this means is that the business does not have to incur extra costs in training the accountants.

It is also noted that there are different versions of Sage 50 available in the market. Each of them satisfies specific needs of the customers (Bride, 2010). Cloud-based versions are also available, especially for medium-sized businesses. Consequently, the accounting needs of all contemporary firms are easily met by the developers of the software.

In spite of the various benefits associated with Sage 50, it has a number of limitations. For example, it is extremely challenging to install (Kelly, 2012). Given the complexity, many users, especially those who are not technologically savvy, opt not to use it. Installing the software is also a time consuming undertaking.

References

Bride, M. (2010). Get started in Sage 50. London: Hodder Education. Web.

Kelly, J. (2012). Sage 50 accounts for dummies (2nd ed.). Chichester, West Sussex: Wiley & Sons. Web.

Oganessian, Y., & Utyonkov, V. (2015). Super-heavy element research. Reports on Progress in Physics, 1(2), 36301-36302. Web.

Appendix

Appendix 1: Revenue

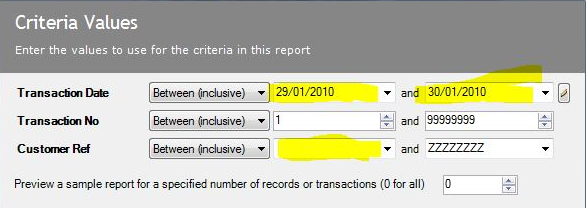

Appendix 1.1: A Sample Report for Customer Receipts

The issuance of receipts is evidence of payment. Sage 50 follows up sales made within an organization. It can record any number of transactions.

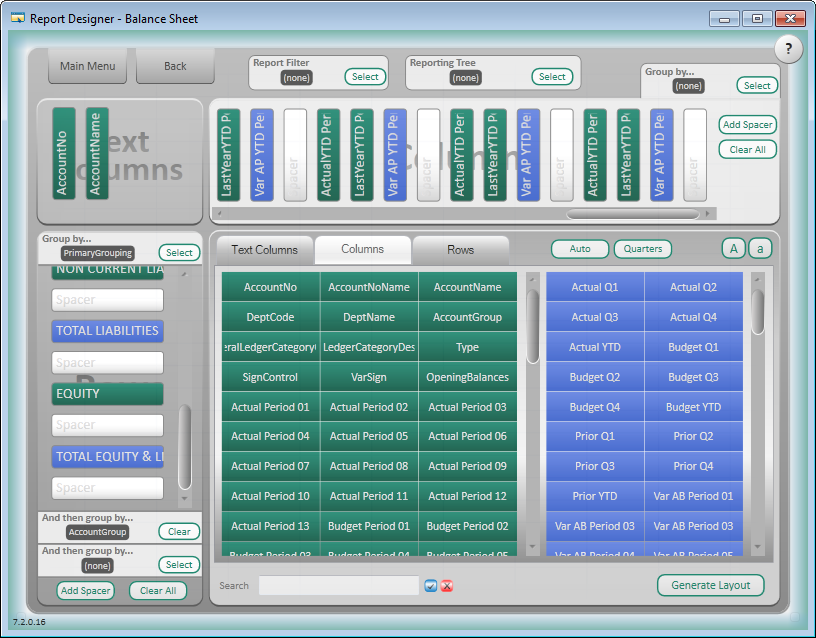

Appendix 1.2: A Screen Print of a Balance Sheet

Sage 50 allows the management to keep track of business assets and debts. The former are used to generate income.

Appendix 2: Expenditure

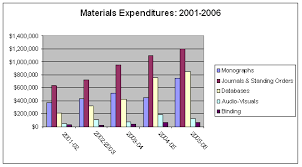

Appendix 2.1: Sample Report for Material Expenditure

As accounting software, Sage 50 can be used to record expenditure. The values can be presented in a graphical manner.

Appendix 2.2: A Screen Print for Inventory Items

By recording information about inventory, Sage 50 helps a business to keep track of its existing stock.