Company Description

Salaam Ethical Investing R&D is a company that provides enterprise analysis, evaluation, and employee education services for customers found in conventional banking and Islamic banking sectors. Modern banks are massive enterprises that are comprised out of hundreds and thousands of employees located in numerous offices and branch facilities under the patronage of a single banking entity.

Our company is comprised of professionals with experience and skills in conventional and Islamic banking practices and possesses the means of conducting large-scale evaluations as well as employee training and education efforts in order to help our customer organizations improve and adapt quickly and efficiently. With over 15 years of experience in the R&D market, Salaam Ethical Investing R&D has a good reputation in the field with a notoriety for bringing results.

Vision and Mission Statements

Vision Statement

To bring stability to the world’s financial and banking systems by becoming the primary promoter of Sharia-based banking practices. To free the world from mounting debt by opposing compounded interest practice and providing alternative solutions to the banking sector. To stop the environmental decline and social stagnation that results from fractional reserve banking.

Mission Statement

Salaam Ethical Investing R&D provides R&D services for banks and similar financial organizations and offers the means of quality employee training and skill improvement. The mission of the organization is to promote the transition to the Islamic banking model and enhance banking services according to the tenets of the Sharia financial system.

Products and Services

- Solid specialized training for employees and managers employed in the banking sphere. The training system is tailored to particular customers and particular banks in order to ensure maximum operational success.

- Training videos, employee recruitment support, job search support, live webinars, professional certification tools.

- Custom learning tool development in order to address specific training and recruitment needs that cannot be fulfilled via standardized training tools and sequences.

- Organizational evaluation and analysis of the current systems, problems, and needs.

- Employee and customer surveying.

- Sharia financial law services and counseling.

Staff Qualifications and Education Requirements

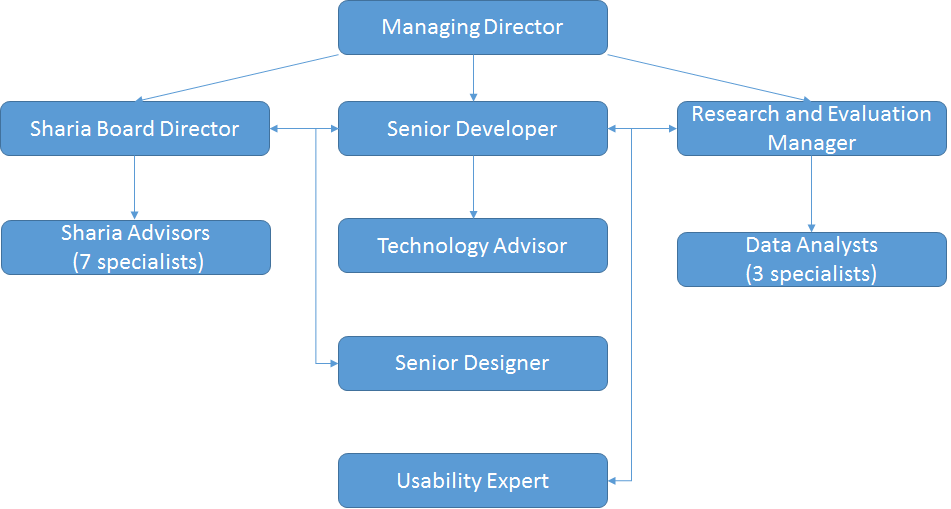

Staff qualification and education requirements for Salaam Ethical Investing R&D vary from one position to another, depending on its importance and duties that a particular employee is expected to fulfill. The managing director of the company is expected to be well versed in conventional and Islamic banking and have an appropriate level of formal education pertaining to the subject. The senior developer is in charge of coordinating different teams and branches of the organization during the project phase.

He or she is expected to have experience in R&D project management, familiarity with the education system, technical and support system, as well as legal and financial procedures required for the completion of the project. The evaluation and analysis manager will be in charge of the data collection and analysis team, and thus must have education in conventional and Islamic banking as well as fluency in the use of different research methodologies as well as data collection and analysis systems. Members of the Sharia Board must have at least ten years of direct experience teaching Islamic Finance or managing funds with Sharia principles as the portfolio’s defining objective.

Goals of the Current Project

The purpose of this project is to assist a newly conducted merger between a conventional bank and an Islamic bank in order to help transition the employees of the conventional bank towards a new operational model. The transition will require the manager and employee re-education, reconfiguration of the bank’s systems and services in order to adhere to the principles of Sharia financial law, elimination and replacement of the hedge fund department and interest crediting department with services more appropriate to the tenets of Islamic banking, and replacement of any employees who refuse to conform to new changes.

Management Team

The management team is comprised out of 17 professionals with academic backgrounds in western and eastern banking. While the majority of western-based R&D companies have only theoretical and academic knowledge of Islamic banking, our professionals have hands-on financial experience in the fields of Islamic banking, investment banking, logistics, econometrics, charitable trust management, and risk management. Five of our experts have advanced degrees in Islamic Finance & Law. Finally, Dr. Mujahid Amir, who leads our Shariah Advisory Board, has a doctorate in Commercial Banking, Islamic Finance, and Management from MIT.

Skills Necessary for the Project Team

Since this is a large project that will involve the entirety of the organization in order to organize an adequate program, all three departments will be engaged in work. Each department will provide a unique set of skills and competencies required for the completion of the project.

The Research and Evaluation Team will conduct surveys and tests in order to evaluate the levels of acceptance among the employees and management teams as well as their current skill levels in order to estimate the amount of workload for the program development and education teams. The required skills for this department include surveying, data compilation and analysis, and data interpretation and evaluation skills.

The Development Team would be tasked to act upon the information provided by the R&E team in order to compile and proceed with the training process. Required skills include knowledge and capabilities to create custom learning and training programs, pedagogical skills, systems knowledge, and capabilities, as well as the ability to create digital software to assist with employee training.

The Sharia Board will work in close proximity with the Development Team and provide valuable information and insight on Sharia banking practices and their incorporation into the learning process. Required skills include pedagogical skills, knowledge of conventional and Islamic banking systems, and experience in similar projects.

Measurement and Evaluation Plan

The following measurement and evaluation plan will be implemented in order to evaluate the learning and education process before, during, and after the training course has been completed. In addition, the plan will evaluate the program’s long-term value and effectiveness.

Greater Learning Objectives

In order to facilitate the transition from the conventional banking model towards Islamic banking model and ensure the merger between two banks is successful, the following greater learning objectives must be achieved:

- Acceptance of the Islamic banking model by all employees and managers of the merger organization.

- Successful re-education of the employees from hedge fund and crediting departments, with subsequent formation of the Islamic investment department.

- General understanding and implementation of principles of Islamic banking on all levels of the merger organization.

- Trust and cooperation between members of different branches and parts of the merger.

Data Collection and Evaluation Methods

Data collection will be done utilizing surveys and interviews, as well as various tests in order to achieve the aforementioned objectives.

The initial data collection process will be conducted at the beginning of the project in order to estimate the employee levels of skill, knowledge, and acceptance towards the merger and principles of Islamic banking. This will allow offer valuable information upon which a comprehensive training program may be assembled. Various competence tests will be conducted during the implementation tests in order to assess the training progression. At the end of the project, a conclusive data collection process will be launched in order to compare the results of training with the initial data assembled at the beginning of the project.

Formative Evaluation

A formative evaluation process is typically conducted during program development phase, which means prior to actual implementation. In order to evaluate the proposed training program, members of the project team will review the designed system based on personal experience and various sources of professional literature that would be used to evaluate and support the ideas behind the project on every step of the way. It is possible that a standardized approach will be used. The initial program could be adapted from a similar project and customized to fit the customer’s situation.

Summative Evaluation

Summative evaluation refers to evaluations conducted at the beginning, during, and at the end of the project. The effectiveness of the program can be adequately assessed at any step of the project using data gathered from tests and surveys. Should the results be found inadequate or suboptimal, alterations in the initial project would be required. Unlike in the formative section of evaluation, the results will be assessed using both qualitative and quantitative measures of data evaluation.

Confirmative Evaluation

Confirmative evaluation involves assessing the long-term value of the training program, which includes the contemporary value of knowledge acquired by the employees as well as the necessity for training in the future. Confirmative evaluation is similar to a forecast, which means it will assess the transition of the provided knowledge into real-world practice as well as a comparison to present and future trends in any particular sphere. In order to conduct a confirmative evaluation, the company will require assembling data on the practices and processes of other Islamic banks and compare them to practices and knowledge provided to the customer.