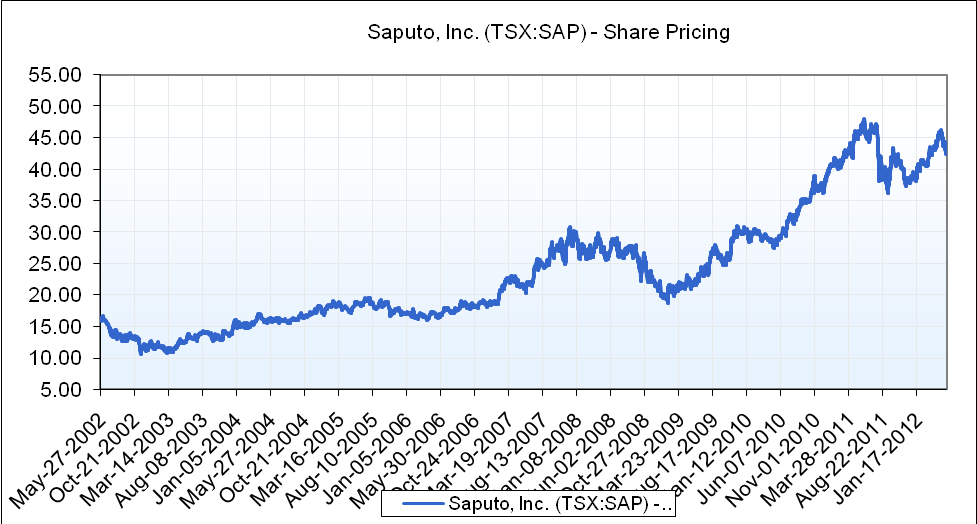

According to the stock market records, the company has witnessed an upward trend in its share prices. This clearly indicates that the firm is performing well and that its future is bright. As at May 2002, the share price ranged between 15 and16. However, its price appreciated up to 43 in the year 2012 despite fluctuations resulting from economic forces and the environment.

In addition, the company has experienced an increase in the amount earned per Share with the basic Earning per Share increasing from 0.78 in 2003, to 2.39 in 2012 (Business Hoovers Press, 2011). From the records, the share prices lack stability, which depicts a risk to shareholders. Instability in price shares would discourage potential shareholders, and this makes it hard to predict and project its future performance.

Improved performance of the share price of Saputo has also been influenced by acquisitions. Indeed, one of the key pillars of the company’s strengths lies in acquisitions. There is a positive correlation between acquisitions and corporate performance. Managers believe that a takeover increases corporate efficiency as well as increases shareholders’ wealth. For instance, the company reported high revenues early this year, a factor that can be attributed to its acquisition of Wisconsin’s DCI Cheese Co (Saputo.com, 2011).

These acquisitions especially the move to acquire international property has been a bold move, which has enabled the company to penetrate into the international market. Other acquisitions include the F&A Dairy of California, Biscuits Rondeau Incorporation and Boulangerie Inc. among others. Indeed, the net earnings from its operations in December 2011 went up to $ 129 million or 65 cents per share from $ 112.1 million or 54 cents per share. During the same period, the net earnings rose by 18% to $1.8 billion (Burns & Salamatian, 2004).

By looking at the EBITDA of Saputo, it can be deduced the profitability of the company over the years. For any investor keen on buying stocks from this company, the EBITDA could provide a rough estimate of how viable Saputo has been on its operations over the years (Plunkett, 2008).

Indeed, looking at the cash flows generated in the last 6 years before any capital expenditures provides an optimal value of Saputo since capital expenditures may not be useful or they might earn substandard returns, which might put off investors. According to the company reports, the company reported an EBITDA of $ 803 million, which is much higher than that of the EBITDA industry. Such performance can be a tremendous boost to investor confidence in the company, which might result in a higher interest in the stock of SAPUTO INC (Burns & Salamatian, 2004).

The environment will determine the number of people in a given locality, which in turn determines the number of the company’s products demanded which affects the interest earned. Some of the company’s competitors include Associated British Foods plc and Associated Milk Producers Inc (Davidson et al, 2001). For instance, if these competitors decide to lower the prices of their products or their share prices, this would also require Saputo to lower its price because the company is not operating in its own world. As a result, the interest in stock would decrease.

The internal environment, which comprises of employees and Equipment or available technology, affects the company’s performance in the Stock market. Qualified personnel and high-quality equipment or technology used in production ensure efficiency and high profitability. On the other hand, poor technology and an inefficient workforce are one of the biggest risks that a firm can have. Customer preference and choice can also affect the revenue and the expected returns. If customers prefer and buy the company’s products, revenue will increase.

References

Burns, N.B. & Salamatian, K. (2004). Saputo Inc. (SAP-TSX): Implications of the Paramalat SPA bankruptcy. New York: Harvard University Press.

Business Hoovers Press, (2011). Hoover’s Handbook of the World Business 2011. New York: Hoovers Inc,.

Davidson, E et al (2001). Who is Who in Canadian Business 2001. Toronto: University of Toronto Press.

Plunkett, W.J. (2008). Plunketts Food Industry Almanac 2008: The Only Comprehensive Guide to Food Companies and Trends. London: Plunkett Research, Ltd.

Saputo (2011). Strength through Unity. Unity 2011 Annual Report. Web.