Abstract

Today, the banking industry is gaining its popularity among researchers, and the number of articles covering this topic continues to increase. Thus, to ensure that these articles are relevant and easy to read, the framework of ethical codes was developed. Consequently, the objective of this research was to analyse four issues that were present in 20 articles from New Zealand and other countries. The selected aspects were sampling frame, response rate, time of data collection, and related instruments. As for methodology, ten articles from each group (New Zealand and worldwide) were collected from Google Scholar and analysed with the help of content analysis. The research results were presented with the assistance of visuals such as diagrams and tables. It could be said that the publications from New Zealand seemed to have fewer issues than international ones. Thus, the most common ones were the time of data collection and response rate. Based on these findings, the conclusions were drawn. Consequently, it could be said that this analysis not only provided the sufficient background for the future research and expanded the understanding of the topic but also had a beneficial impact on development and revision of ethical codes in the context of customer satisfaction in the banking industry.

Introduction

Today, it could be said that banking activities play a pivotal role in everyday activities, as without them it will be impossible to make transactions and purchase different products. Nonetheless, due to the continuously intensifying rivalry, banks are concerned with maintaining their recognition and positive image in the market (Sahu, Dash, & Kumar, 2017). This matter can be discovered as a primary driver for the rising importance of customer satisfaction tools and instruments. To understand the working mechanism of this phenomenon, many studies were conducted, and some of them revealed a strong relationship between customer satisfaction and the quality of the provided services (Ahsan, & Azam, 2014; Sahu et al., 2017).

Apart from the need to find a correlation between different variables with the help of various research methodologies, it is essential for these publications to comply with ethics, as they will help deliver valuable information to readers. Consequently, using ethics is highly important since they can contribute to the research in the recent future. In this case, Frechtling and Boo (2012) proposed the guidelines to ensure that the research is ethical. For example, they stated that assuring the accuracy of the information and sufficient writing structure was important (Frechtling & Boo, 2012).

Based on the brief analysis of the topic mentioned above, a critical objective of the paper is to discover four key ethical issues that tend to be present in 20 scholarly articles covering consumer satisfaction in the banking segment in New Zealand and other countries. In the first place, the research methodology will be described since the concepts of content analysis will be utilised and define a flow of the search. The subsequent section presents the results by comparing the outcomes, describing ethical issues, and analysing each of them. To gain a better understanding of this process, a general analysis of ethical problems is conducted. In the end, the conclusions are drawn to summarise the main findings of the paper regarding ethical issues in New Zealand and other countries.

Methodology

In the first place, the preliminary research revealed that there were not many recent articles that covered this topic. The research started on March 29, 2017, and it was entirely completed on April 1, 2017, and represented by collecting 20 articles. Each publication was analysed by applying the principles of content analysis and retrieved from Google Scholar database.

Google Scholar was selected as a primary source of information since it offered links to other sources and databases and eased the process. The articles were searched with the help of keywords such as “banking” and “customer satisfaction”, and 57,000 results were discovered. Thus, to find publications covering New Zealand, the country’s name was added as a keyword (16,800 articles). In the first place, the articles from “2013” were selected by applying the principles of filtering. Nonetheless, due to the lack of recent research, older articles were also chosen. As for the finalisation of the selection process, the publications were selected based on their compliance with the topic while at least 10 of them had to cover New Zealand. Overall, 10 publications about New Zealand and 10 articles regarding other countries were chosen. It was important to note that due to the lack of articles in New Zealand, the publications that somehow covered the topic of customer satisfaction in this region were also selected.

Content analysis

Frechtling and Boo (2012) stated that one of the most relevant methods to analyse the compliance of the article with ethical codes was content analysis. In this case, the primary goal of this approach was to determine whether the publication covered the determined criteria (Fletching & Boo, 2012). Consequently, the following questions are used to assess the articles:

- Is the sampling frame specified?

- Is the final response rate stated? Or does the article provide both effective and initial sampling sizes?

- Did the article show when the information was collected?

- Are data collection tools specified and described in details?

The answers can be Yes/No/Not Applicable, where “Yes” implies that the article complies with the standards indicated by Fletching and Boo (2012). “No” stands for the absence of a particular element in the publication, and “N/A” states that this criterion is not applicable to the article. The analysis of 20 publications was conducted based on the opinions of researchers from March 31 to April 1, 2017, and, they were presented with the help of tables and diagrams.

Results

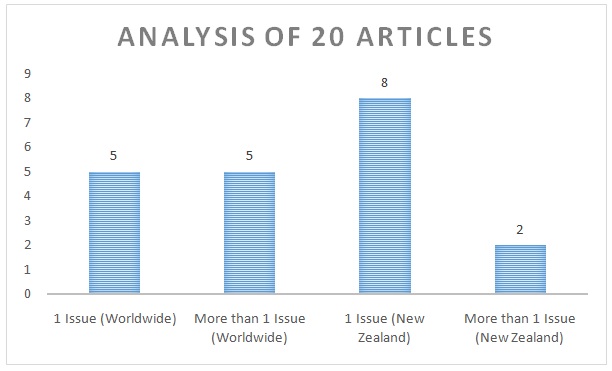

In the context of this paper, 20 articles were analysed, and it was determined whether the ethical issues with a sampling frame, response rate, time of data collection, and data collection instruments existed in these publications. Unfortunately, apart from the significance of these matters, every article had at least one ethical problem. For example, one issue was found in 50% of the articles from different countries, where other publications from this group accounted for two issues (50%). Regarding New Zealand, the situation was better, 80% and 20% out of 10 articles were with one matter or more respectively (see Bar Chart 1). In this case, 100% was viewed as the total number of articles in a group (10).

Thus, to understand the ethical problems reflected in the articles in details, Table 1 was designed. In this case, it was apparent that the majority of the publications from New Zealand (80%) had only one ethical issue. Meanwhile, the international articles with one and two issues were represented by 50% and 50%. It was important to admit that publications with three ethical issue were not found.

Table 1: Analysis of the articles with a focus on New Zealand or Worldwide regarding customer satisfaction with banking services.

At the same time, it was essential to understand the presence of a particular issue in the selected articles (see Table 2). For example, it was apparent that all publications had well-developed and described a sampling frame and data collection instruments. Nonetheless, sometimes, it was difficult to evaluate the articles, and the assessment was completed based on the understanding and opinion of the researchers.

Table 2: Ethical issue discovered in the articles: Summary.

Sampling frame

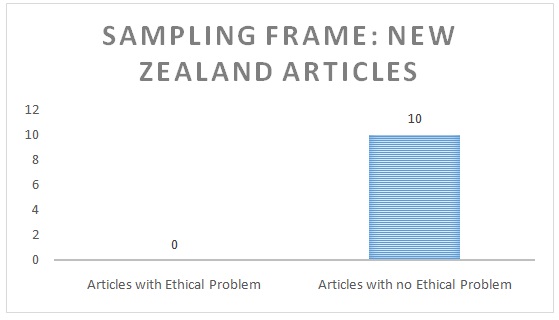

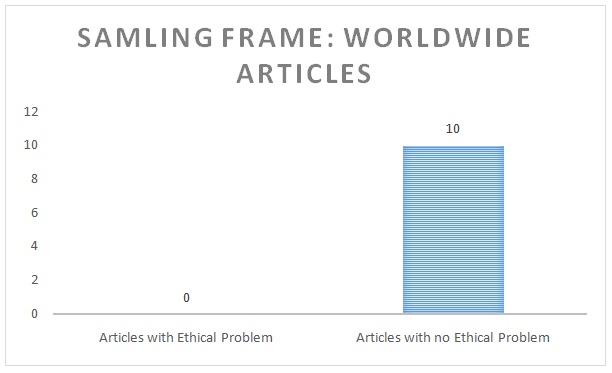

In the first place, the description of the sampling frame was evaluated, and it was revealed that all selected articles had this feature. For example, both publications of Abdullah et al. (2014) not only described the target audience but also provided interesting information about the selected location and specifics of New Zealand. Nonetheless, it could be said that researcher bias might be a primary cause of stating that all chosen articles covered this point. Simultaneously, it was difficult to determine the aspects that the sampling frame had to reveal. Thus, Bar Chart 2 and 3 are visual representations of results in New Zealand and worldwide.

Identification of Response Rate

In turn, one could not underestimate the significance of the response rate, as it identifies the number of responses that are valid and contribute to the research question (Fletching & Boo, 2012). Apart from being one of the critical components that ensured the publication’s compliance with the ethical framework, only a limited number of articles clearly indicated a precise number of initially selected responses and their quantity after evaluation. Nonetheless, the publication by Lee & Moghavvemi (2015) was one of the bright examples. In the first place, 900 questionnaire results were selected while after the assessment only 748 of them were used (Lee & Moghavvemi, 2015). It seemed that this parameter was clear, but for some articles, it was difficult to determine even the original sample size. For instance, Mandal & Bhattacharya (2013) utilised focus groups as a qualitative method, and it created difficulties for understanding the overall number of participants. Overall, apart from the difficulties Bar Charts 4 and 5 present the results for all articles. In New Zealand, this rate was rather low (20%) while in publications from other continents, it was 50%.

Determining Specific Timeframe of Data Collection

Another essential matter that was depicted in the standards was the need to identify the date when the information was collected (Fletching & Boo, 2012). It could be said that this information is usually present in the abstract of a publication or its methodology section. This matter is vital since it contributes to the validity of the provided information. Surprisingly, all articles did not reflect a precise time and date when the results were collected (see Bar Charts 6 and 7 for more information). It could be assumed that in the context of customer satisfaction in the banking sector, these details were not necessary. Alas, the absence of these aspects questioned the validity and relevance of the collected and interpreted findings. When conducting research in this industry, the researchers have to fill these gaps and include this important element in the abstract or methodology section.

Instrument Information

The last part of the evaluation process focused on the assessments of the instruments that were used to collect information and findings of the paper. Its substantial importance was underlined by actively and precisely describing it in all publications. Nonetheless, similar to the sampling frame, it was difficult to evaluate this matter, and the researchers had to rely on their opinions and interpretation of the ethical codes solely (see Bar Chart 8 and 9 for more information).

Conclusion

The primary goal of this report was to evaluate 20 articles regarding customer satisfaction of banking services in New Zealand and other countries, and all of them had at least one ethical issue with 100% issue rate. In this instance, the most common problems in New Zealand were a time of data collection (100%) while in the publications from different parts of the world, they were a time of data collection (100%) and a response rate (50%).

Nonetheless, the most common limitations were related to a particular interpretation of different standards by the researchers. For example, the required content of the sampling frame could be interpreted differently and reviewed from dissimilar angles. Another matter was the fact that only four issues were discovered, and conducting profound research in this sphere could be considered as an opportunity. Apart from this implication, the revealed findings can be used by scholars to assess the selected publications for literature review and revise the framework of the existent ethical code. At the same time, speaking of consumer satisfaction in the banking segment, scholars have to use the present ethical codes to conduct researches and write reports. Nonetheless, revising the existent framework can determine the criteria that are not necessary such as a time of data collection and ease the research process.

References

Abdullah, M., Manaf, N., Ahsan, K., & Azam, F. (2014). Service quality and consumer perception on retail banking facilities and employees’ courtesy in Malaysia and New Zealand. European Journal of Social Sciences Education and Research, 1(2), 70-80.

Abdullah, M., Manaf, N., Yusuf, M., Ahsan, K., & Azam, F. (2014). Determinants of customer satisfaction on retail banks in New Zealand: An empirical analysis using structural equation modelling. Global Economy & Finance Journal, 7(1), 63-82.

Alnsour, M. (2013). How to retain a bank customer: A qualitative study of Jordanian banks relational strategies. International Journal of Marketing Studies, 5(4), 123-131.

Baumann, C., Elliot, G., & Burton, C. (2012). Modelling customer satisfaction and loyalty: Survey data versus data mining. Journal of Services Marketing, 26(3), 148-157.

Chavan, J., & Ahmad, F. (2013). Factors affecting on customer satisfaction in retail banking: An empirical study. International Journal on Business & Management Intensions, 2(1), 55-62.

Clemes, M., Gan, C., & Du, J. (2012). The factors impacting on customers’ decisions to adopt Internet banking. Banks and Bank Systems, 7(3), 33-50.

Clemes, M., Gan, C., & Zheng, L. (2007). Customer switching behaviour in the New Zealand banking industry. Banks and Bank Systems, 2(4), 50-65.

Frechtling D. C. & Boo, S. (2012). On the ethics of management research: An exploratory investigation. Journal of Business Ethics,106(2), 149-160.

Gan, C., Clemes, M., Limsombunchai, V., & Weng, A. (2006). A logit analysis of electronic banking in New Zealand. International Journal of Bank Marketing, 24(6), 360-383.

Gan, C., Clemes, M., Wei, J., & Kao, B. (2011). An empirical analysis of New Zealand bank customers’ satisfaction. Banks and Bank Systems, 6(3), 63-77.

Gan, C., Cohen, D., Clemes, M., & Chong, E. (2006). A survey of customer retention in the New Zealand banking industry. Banks and Bank Systems, 1(4), 83-99.

Khan, M., & Fasih, M. (2014). Impact of service quality on customer satisfaction and customer loyalty: Evidence from banking sector. Pakistan Journal of Commerce and Social Sciences, 8(2), 331-354.

Lau, M., Cheung, R., Lam, A., & Chu, Y. (2013). Measuring service quality in the banking industry: A Hong Kong based study. Contemporary Management Research, 9(3), 263-282.

Lee, E., & Moghavvemi, C. (2015). The dimension of service quality and its impact on customer satisfaction, trust, and loyalty: A case of Malaysian banks. Asian Journal of Business & Accounting, 8(2), 91-122.

Lee, E., & Park, C. (2014). Does advertising exposure prior to customer satisfaction survey enhance customer satisfaction ratings? Marketing Letters, 26(4), 513-523.

Ling, G., Yeo, S., & Lim, K. (2016). Understanding customer satisfaction of internet banking: A case study in Malacca. Procedia Economics and Finance, 37(1), 81-86.

Mandal, P., & Bhattacharya, S. (2013). Customer satisfaction in Indian retail banking: A grounded theory approach. The Qualitative Report, 18(28), 1-21.

Rod, M., Ashill, N., & Carrunters, J. (2009). An examination of the relationship between service quality dimensions, overall internet banking service quality and customer satisfaction. Marketing Intelligence & Planning, 27(1), 103-126.

Sahu, R., Dash, M., & Kumar, A. (2017). Applying predictive analytics within the service sector. Hershey, PA: IGI Global.

Shah, F., Khan, K., Imam, A., & Sadiqa, M. (2015). Impact of service quality on customer satisfaction of banking sector employees: A study of Lahore, Punjab. Vidyabharati International Interdisciplinary Research Journal, 4(1), 54-60.

Yavas, U., Babakus, E., & Ashill. (2010). Testing a branch performance model in a New Zealand bank. Journal of Services Marketing, 24(5), 369-377.

Zeinalizadeh, N., Shoraje, A., & Shariatmadari, M. (2015). Modelling and analysis of customer satisfaction using neural network approach. International Journal of Bank Marketing, 33(6), 717-732.