Introduction

The purpose of this report is to recommend a selected company “Saudi Dairy & Foodstuff Company (SADAFCO)” to develop supply chain considering collaborative planning forecasting and replenishment (CPFR), green supply chain, vendor managed inventory (VMI), free zones in the UAE, disaster management using supply chain, cold chain logistics, third party logistics, cloud computing applications in supply chain and so on.

However, this paper will concentrate on halal food supply chain, key strategic tools, main elements of supply chain and the role of overall supply chain, industry scan of the practice, internal strengths and weaknesses, external threats and opportunities, PEST factors, benchmarking and spider analysis for SADAFCO.

Supply Chain Practice of the Company Including Key Elements and Role

Collaborative Planning Forecasting and Replenishment (CPFR)

CPFR is one of the most useful business practices in which trading partners apply information technology to upgrade supply chain management system and to facilitate inter company coordination along with to gain competitive advantages (Kim & Mahoney, 2006, p.4).

According to the report of Hoppe (1999, p.38), this business model was first implemented by the Benchmarking Partners of Wal-Mart in 1995, which enables trading partners to advance visibility into one another’s critical actions and broaden cooperative arrangements to combine their intelligence in the planning and fulfillment of consumer demand and to standardize joint processes across companies.

However, Hoppe (1999, p.38) further added that CPFR model plays vital role in industries where inventory comprises a major portion of total logistics costs; therefore, manufacturers and retailers in the consumer packaged products industry have excitedly responded to CPFR though it is difficult to implement this model practically because of it exists cultural challenges within organization and among trading partners.

This model includes nine steps to collaborate three phases such as planning, forecasting and executing; however, figure number one shows CPFR model more elaborately –

Phase I – Planning

Edwards (2003, p.6) reported that first phase relates to people, procedures, and developing of trust to remove cultural gap between manufactures and partners by sharing vision and identifying appropriate procedure to work together with the suppliers. However, this phase includes two steps, such as –

Step 1– Development of the Front-end Agreement: This is one of the most critical and time-consuming stages though it establishes cooperative relationship between customers and suppliers; nevertheless, content writer will play vital rule in order to develop this model in the company.

However, if companies integrate CPFR, all the partners will be able to access data and other information using portal and they will be able to provide feedback, share views and sent documents to signing and publishing agreement within short time and agreement will be binding on both parties;

Step 2- Creating Joint Business Plan: Both parties of the contract may share lots of information each other and many of such information are too important to review present strategies and set up new business plan. Therefore, the companies need to include some advanced planning software, which gives the opportunity to share information easily regarding quantities, lead times and capacity limitations and so on;

Phase II – Forecasting

Edwards (2003, p.7) stated that CPFR model starts function with the joint forecast of end-user demand and continues through all issues of supply chain arrangement, ensuring support for both long-term and day-to-day decisions; thus, the parties will be able to take prompt decision regarding financial and operational issue and they further able to know about sales forecast and order volume.

However, this process help the companies identify complexities in the operational system and business environment;

Step 3- Create Sales Forecast: Manufactures and other retailers in the consumer packaged products need to incorporate demand forecasting, demand consensus, production and distribution planning software because it is important step to set up promotional plan considering historical data and sales forecast;

Steps 4 and 5 – Collaborating to Develop a Shared Forecast: In this stage, the companies need to find out some special items that differ more than a certain percentage and then system software and communication tools give the chance to the all users to up-to-date information at their ends;

Step 6- Forecasting Orders: Based on the output of previous step, causal information, inventory strategies and the customers’ inventory data, the manufacturers would develop a time-phased, item and actual volume numbers, and allocate production capacity against demand. However, this step is important for the following reasons –

- The order forecast integrates the sales estimate with order necessities to expand exact demand (Williams, 2010);

- Software is breaking down production requirements on a daily or even hourly basis to fill the essential order;

- Immediate collaboration decreases the insecurity between trading partners

Steps 7 and 8- Identifying and Resolving Exceptions: In first stage, companies need to identify exceptions that fall outside the front-end agreement. At the same time, all exceptions are resolved by immediate communication between the partners, for instance, query shared data and submit results to support the process;

Phase III – Executing

Execution of the CPFR model in the company is one of the major difficult tasks; however, this process includes two steps, such as –

Step 9- Generating Orders: The last stage in the CPFR procedure is generating the order, promising the delivery and maintaining positive relationship with partners and customers by ensuring that the product is ready when needed;

Step 10- Executing to the CPFR Plan: Though order generation is last stage of the formal CPFR model, but it needs to concentrate on the execution of the order.

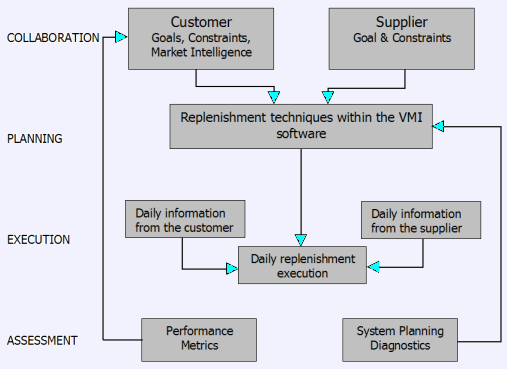

Vendor Managed Inventory (VMI)

Kumar & Kumar (2003) stated that VMI is the process, which allows the suppliers to create the purchase orders considering exact demand while third party logistics provider can also observe inventory level in order to mitigate the loophole of supply chain system; however, it has both positive and negative effects on the business.

Table 1: Benefits of Vendor Managed Inventory. Source: self generated from Kumar & Kumar (2003).

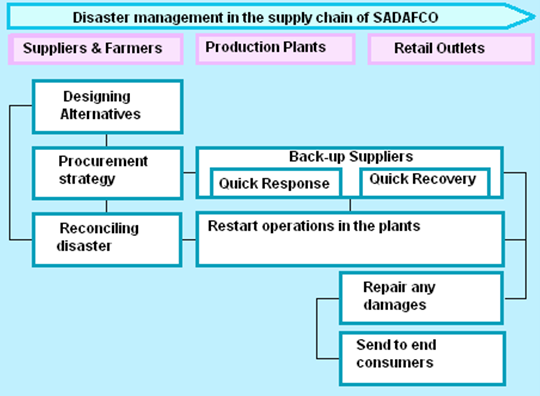

Disaster Management Using Supply Chain

The following flowchart shows the disaster management techniques in the supply chain of SADAFCO. It outlines the ways in which this company can quickly recover from any disasters at any levels of its supply chain by means of back up resources.

It is possible for the company to get rid of any kind of hindrances by means of strong back up facilities throughout the supply chain, starting from disaster of the farmers at the food cultivation level, to the failure of any equipment at the production plants.

Cold Chain Logistics

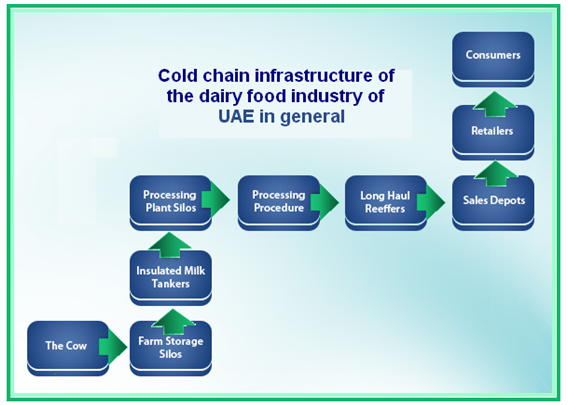

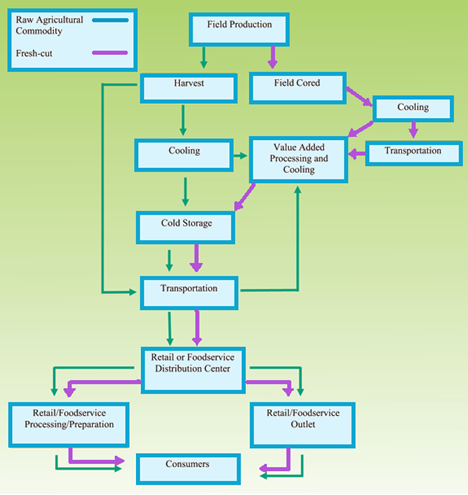

Global AgriSystem (2011) suggested that it is a logistic structure that imparts a sequence of amenities for upholding perfect storage-space environment for easily perishable goods from the starting-point to the end-consumption level in food SCM; it should begin at the farm level (harvest methods, pre-cooling, etc) and cover up to the consumer level or at least to the retail level.

A regimented cold-chain lessens food-spoilage, maintains quality of the products, and assures cost-efficient deliverance to the customer; the key characteristic of the chain is that if any of the links is absent or is fragile, the entire system stops working; in the dairy food industry of United Arab Emirates, cold-chain infrastructure generally consists pre-cooling-facilities, cold-storage, refrigerated-carriers, packaging, warehousing, and information-management-systems.

The following flowchart shows the dairy cold chain infrastructure adopted by most of the companies like SADAFCO in the dairy food industry of United Arab Emirates:

As SADAFCO also offers products like juices and tomato ketchup, it needs to focus on not just the dairy cold chain infrastructure, but also on the cold chain infrastructure of agricultural products like fruits and vegetables. The following flowchart shows the agricultural cold chain infrastructure adopted by the company –

Cloud Computing Applications in Supply Chain

SADAFCO has not yet initiated cloud computing for its data storage in supply chain; however, it is notable that cloud computing helps to backing-up and restoring an overgrowing-database whilst ascertaining high-level accessibility to global users, enhancing receptiveness through trouble-free access towards cost-effectiveness, offering technology stand for running resourcefully, and getting programmed disaster-recovery sites as well as the location emancipation cloud.

As a result, like many large-organizations, the cost of supply chain management remains one key factor for SADAFCO upon which it takes decisions of formulating different cost reduction measures; on the other hand, cloud computing is relatively cheap, elastic, and ecologically sustainable solution that helps businesses to become agile and much more flexible to external-influences.

It is essential to note that adoption of cloud computing enhances businesses’ responsiveness; the speed at which new-computing capacity could requisite remains a key-constituent of cloud computing; adding additional-storage, network-bandwidth, memory, and computing power, everything gains a fast pace; majority of cloud providers adopt infrastructure-software, which could effortlessly adjoin, shift, or modify an application with extremely small interference by cloud-provider-workers.

Therefore, it is vital for SADAFCO to integrate a suitable cloud computing technology in its supply chain management in near future.

Industry Scan of the Practice

Laeequddin (2009) stated that UAE has a presence of entrepreneurs from more than hundred nations; Dubai Logistics City (DCL), launched in 2008, possess 11 million square meters area and is part of the 140 square kilometer Dubai World Central airport; moreover, the government ascertained business rules and directives to supervise the safety of the firms operating in the nation.

Dubai World Central airport possesses ability to deal with 120m travelers and 12m tons of cargo annually and offers feature to manage logistics industry from transportation to packaging and labeling of commodities –this contributes vastly on growth of the supply chain management of the businesses in UAE; it is notable that total spending in UAE’s food industry has exceeded $1.76b.

Further details of industry and the scan of the practice are discussed in the subsequent section of this paper.

Free Zones in UAE

Library of Congress (2007) mentioned that due to governmental policy of law liberalization, the intensity of foreign investment in UAE is growing in a remarkable rate as trading in “free trade zones” gives foreign investors the chance of gaining benefits from freedom from all sorts of duties; thus, the current policy of “free trade zones” encourages foreign entry in UAE.

It has been evidenced that traditionally the country emphasized to keep control over the foreign companies, although encouraging the foreign companies with favorable investment environment, energy, and infrastructural support for the rapid development of the UAE; therefore, after turning a member of the WTO, it became essential for UAE to declare some places as the “free zones”.

At the same time, the government also established free trade zones in some areas like Dubai where the foreign companies are entitled to own 95% of the ownership including controlling power, and so the free trade zones have turned as an effective attraction for foreign investment in UAE. This is one of the main reasons of why foreign companies like SADAFCO find it convenient to carry out its operations in places like Dubai.

Moreover, the foreign companies like SADAFCO are also enjoying corporate tax holidays in UAE along with immunity of personal taxes for the foreign entrepreneurs, while there are also opportunities of duty free importations.

Global Office (2011) argued that there are both forms of FDI inflow and outflow in UAE, but the attracting foreign trade zone has shaped another more influential driver for the multinationals while the total volume of FDI in free zones of UAE has reached at US dollar 73 billion.

Within last three decades, the export processing areas in the free trade zones has turned out to be a heavenly place of investment where local legislation do not encounter the multinationals to their restriction on free business operation and the country has turned as the second FDI attractive region in the world.

Green Supply Chain for SADAFCO

Hafez, Farag & Al-Sukayran (1993, p.1) pointed out that the present situation of the dairy product industry of United Arab Emirates is under serious threats due to the cattle infected by foot and mouth diseases in most of the firms; owing to lack of vaccination, the diary firms are going to encounter with a tremendous economic dissenter.

The raising health and environmental awareness among the people have developed the issue as a national agenda in the GCC region for the last few decades; and thus, recently, the center of attention of consumers have prolonged to the wider extent for sustainability that pressured the dairy firms to strengthen their measures to protect the supply chain with health hazard.

Such shifting market scenario forced the global diary firms to integrate green supply chain, while the company SADAFCO essentially establishes its green supply chain to continue its growing market position.

Sarkis (2003, p.3) defined the green supply chain management as a business process that the modern organizations apply to mobilize their raw materials and other supplies in cost effective manner without degrading the environment including the human race; as there would be some environmental hazards in the production process, the companies would be aiming to reduce such risks.

The raising environmental conscious in the society and activist nongovernmental organizations kept continuous pressure on the business communities to integrate GSCM (Green Supply Chain Management) to protecting the environment by increasing analysis both academia and practitioner; thus, companies have to concentrate just not to profit maximizing, but also need to care the nature.

For SADAFCO, GSCM decisions are a major issue that the organization is striving for both in strong internal and external association with a model of dynamic approach to its business along with its affiliation to the environmental concerns, while the management and decision framework would take into account of multidimensional strategies to procure its raw materials and supplies.

At the base point, SADAFCO would take crash program to convince the suppliers to vaccinate the cattle in their firms; meanwhile it would investigate the production process of its other materials’ suppliers and urge them for their environmental awareness.

Third Party Logistics or 3PL

Manatayev (2003, p.1) pointed out that the changing dynamics of the logistics market has been aligned to the logistics outsourcing, which is identified as the third party logistics or 3PL that function in the most competitive market environment that shifted the logistics market commodity status with high profit margin to lower profit.

For SADAFCO there are huge opportunities to integrate third party logistics to reduce shipping and transportation cost and to use further value added service matching with the increasing customers choice and the aim to enjoy adequate profit and enhanced customer’s loyalty.

Halal Food Supply Chain

Blominvest Bank (2011, p.7) estimated that nearly 1.8 billion to 2 billion people are Muslim consumers in the world and it is one of the most influential factors for the manufacturers, investors, farmers and retailers of global market. However, Blominvest Bank (2011, p.7) further reported that food supply chain has changed from national and international level because of quick developments in technology and transportation system.

Therefore, Muslim executives are expanding their business in global market to maximize profits. According to the report of Blominvest Bank, anticipated market size of halal food products is $640.0 billion and the GCC countries are the largest importer of global halal products particularly KSA and the UAE are the chief importer markets (market size about $43.80 billion).

On the other hand, KSA is the largest food and beverages market in GCC region; so, SADAFCO provides more attention on every stage (production, procurement, processing, sale, and consumption) to deal with foreign parties because this company is committed to ensure 100% halal products or produce lawful products according to the Islamic law or Shariah.

According to the report of CPH World Media (2011), dairy production in the GCC Countries has increased by 20 percent over the last three years because of the development of supply chain management;

Therefore, SADAFCO has expanded business operation in the UAE and boosted its annual profits; for example, total sales revenue of SADAFCO was SR 1146 million in 2010. However, public awareness about milk products and increase of consumption rates help the company increase demand; however, SADAFCO needs to consider following issues to ensure halal products –

- Suppliers of raw materials will ensure that they follow legitimate way of entire process;

- Raw materials must not be stolen;

- Production system will only consider Islamic law or Shariah;

- Dairy products will not be harmful to public health.

Strategic Analysis

SWOT Analysis

Strengths

- According to NCB (2005), the company’s key strength is its ability to provide fresh foodstuffs right in the front of customers ensuring the scrupulous freshness standard, unique deliciousness, perfection, and superior fragrance.

- It possesses an overall good supply chain through which it is able to obtain constant fresh food supplies; it ensures good relation with the suppliers and eventually, regular supply of raw materials.

- It provides absolutely hygienic and healthy product range, which is essential for the customers of UAE.

- Tetra Pak Company (2010) stated that the company has lowered it operational-expenses by enhancing efficiency; moreover, the company produces a wide range of products, including tomato paste, juice, triangle-cheese, ice cream, cream jar cheese, tomato ketchup, bottled water, chips, cream, basateen, and so on.

- The company is considered an idol for its quality; moreover, because of the high superiority of its product mix, the customers are highly satisfied with the quality, for instance, Favorite brand Saudia UHT milk successfully captured 70 percent local market share because of its outstanding quality in terms of solidity and nutrients.

- Due to its quality, price, and marketing policy, the company is rapidly growing both in home and abroad.

- The business maintains its corporate governance with high degree of compliance with the general norms of the corporate practice of United Arab Emirates and pay attention to the local legislation.

- The company has a significant level of budgetary involvement for its corporate social responsibility policy and practice.

- The strong base of loyal customers has turned as competitive force for the company and the existing customer base is gradually increasing as well.

- This business is continuing its journey with remarkable footprint in the market with its long experience starting from 1976.

Weaknesses

- Price of raw materials: The customers are dissatisfied due to high price of milk powder and tomato paste in global market, but the company is not responsible for price increase since unstable price of raw materials influence the company to increase price of these products.

- Supply of milk: According to Global Research (2009), the management team of the company addressed that the supply of milk could be one of the main weaknesses for this company because it has no cattle stock or home based raw milk production.

Opportunities

- Market leadership: it has enough financial capabilities to expand its market outside the GCC market with more products and to be the market leader within the target period.

- Market share: at the same time, it can capture a significant part of the global market share by changing the existing strategies and using the capital more efficiently.

- Cross- cultural centre: although it is a Saudi Arabian company, it has great opportunity to increase its brand image in global market by giving special facilities to the expatriates; however, in United Arab Emirates, the performance of this company it quite impressive in terms of cultures.

- Demand: Food & Agriculture Organization (FAO) reported that the demand for packaged dairy products are increasing gradually because of the fact that the people around the globe are becoming more and more conscious about the health benefits of such foods. This creates a very essential opportunity for the company to observe the augmentation in the sales and revenue from this market.

- Easy to enter: Most of the countries of the world are now members of the WTO, which gives the opportunity to enter new market easily by applying any entry mode strategies

- Joint Venture: As the company has a brand awareness in GCC countries for its products, it can expand the market in European, American, and South Asian countries by applying joint venture strategies.

- Diversification: According to the report of Global research, the corporation is a highly diversified company and it diversified its products vertically, therefore, it has the opportunity to develop the financial position by focusing on a few business segments.

Threats

- Competitors: The existence of strong competitors in national and international markets is one of the main threats for the company because sometimes the competitors offer lower price for similar products and use more effective strategies.

- Any possible political unrests in UAE can hamper it operations.

- Mad Cow disease or veterinary: the production system of the company may hamper due to the risk of animal diseases like mad cow; nowadays, the customers became health conscious and they stop to purchase milk products if they know about these diseases, and the affects of this on revenues will be wide spreading;

- Production per Cow: production of milk per cow is decreasing owing to increasing number of old cows, which may create hindrance of production system in near future in United Arab Emirates.

- Merger: merger with foreign companies may destroy the originality of the product line of the company; as a result, it could loss market share because of decreasing sales; for instance, merger with Danish companies was the main cause of market fall of this company.

- Legal issues: frequent changes of regulation may increase the cost for legal claims and increase costs in this sector as well.

PEST Analysis

Political Factor

Political factors can have a great influence over the operations of the company. If the operations of the company in UAE confront any political unrests like those occurring in Bahrain, Syria, or Egypt, then its revenue from the UAE market will fall down.

In order to ensure that the unrests in Middle East do not cause any adverse impact over its financial performance, the company needs to diversify in the markets of new countries so that the revenues remain stable under any circumstances.

Economic Factor

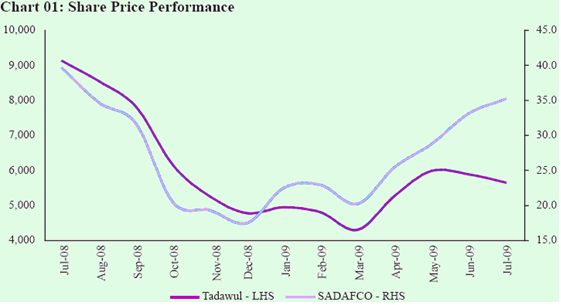

The financial strength of the company demonstrates its success while the recessionary economy has no greater impact on the company; as a result, the share price of the company has increased within a short period though it fell severely in 2008; however, the figure below shows the stock performance of the company:

Social Factor

Although the company is a Saudi Arabian company, the fact that both Saudi Arabia and United Arab Emirates are Muslim countries and are very much conservative in terms of social behavior means that the company do not face a great deal of problem in matching up with its social and cultural issues.

Nevertheless, it is important to state that the company is a very ethical business and it maintains great hygiene throughout the production process (SADAFCO, 2010). This is highly important because the consumers of UAE are highly conscious with “Halal food”.

Technological Factor

The company is upgrading itself technologically in order to better compete with the global competitors. Consequently, it has developed its own website, and is trying to include IT amenities in its daily operations.

It has planned to allocate more budgets next year for integrating further advanced IT infrastructures in order to better control its supply chain. In addition, this is one of the most significant factors for the company as the foodstuffs and milk products need proper preservation.

Additionally, integration of new technologies helps the company to boost the productivity and maintain the temperatures and humidity of the production place, while the weather of the United Arab Emirates is not so suitable for dairy food products.

Therefore, the company also planned to employ a highly expert team of researchers on the research and development department in order to find out the best technologies that can suit to preserve the dairy product for a long time and ensure the freshness.

Benchmarking

Numerous businesses use benchmarking to initiate transformations by checking competitive companies’ achievements and discovering the probable plans for innovation; moreover, it compares how companies manage product-development processes (Amaral & Sousa, 2009; Anand & Kodali, 2008; Carpinetti & Melo, 2002; Dattakumar & Jagadeesh, 2003; Tidd, Bessant, & Pavitt, 2005; Hinton, Francis, & Holloway, 2000; Sweeney, 1994; and Wong & Wong, 2008).

Although such business practices are moderately new in the industries of United Arab Emirates, as a globally recognized business, SADAFCO always strives to reach the highest benchmarks in the industry; it is committed to assure best standards of quality in its production procedures and has achieved International Standards Organization (ISO) certification in some of its plants. NCB (2005) stated that the company has fixed its SMART objectives to integrate an excellent benchmarking standard by the next five years so that it can obtain ISO certification in each of its plants.

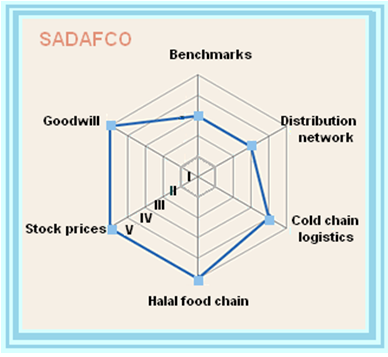

Spider Analysis

The following diagram illustrates the spider analysis of the company, evaluated on the foundation of benchmarks, strength of distribution network, cold chain logistics, halal food supply, stock prices, and goodwill:

The above spider analysis is based on the following magnitude:

Figure 8: Applied Metrics. Source: Self generated.

As marked in the above figure, the company’s performance is at acceptable level in case of benchmarks and distribution network, first-rated in terms of cold chain logistics, and pre-eminent in terms of halal food supply, stock prices, and goodwill.

Managerial Implications and Recommendations

Because of certain flaws in communications of the supply chain, it becomes extremely tough for the company to manage everything in a cost effective way and to lower down the production expenditure. This, in turn, results in lack of economies of scale, and increases price of the products.

The consumers in the industry possess high bargaining power because of the presence of a large number of competitive firms, so they do not show any interest to buy highly priced products. Because of all these reasons, it is viable for the business to incorporate cloud computing to managing its supply chain. Incorporation of cloud computing would provide the firm with a range of benefits.

For example, cloud-computing is elastic; it can enlarge /abridge mechanically and offer resources on-demand for numerous archetypal magnitudes as well as servers, storage and networking, which SADAFCO requires; on-demand feature of cloud computing means that as demand increases/decreases, the capability could much effortlessly correspond the demand; in addition, there is no need to over provision for the peaks.

At the software level, it would endorse SADAFCO’s developers and IT-operations to expand, organize, and function rapidly without collapsing, devoid of thinking about the position or infrastructure; moreover it can also provide minor agencies or working partners of SADAFCO with trouble-free access to a cost effective, flexible technology podium for functioning efficiently in terms of applications capacity and scalability.

Therefore, SADAFCO is recommended to implement hybrid cloud computing for data storage.

This will give SADAFCO a chance to make use of both public and private cloud at the same time and get the benefits of both sharing data with the communities and stakeholders and managing them efficiently within the firm – this would lower the costs of sharing information externally and internally.

It is very much important for SADAFCO to make sure that its data storage costs remain much lower even after sharing them with all the communities of its operations where people would come to know more about SADAFCO in order to participate in the organization’s programs.

It would also assist SADAFCO to achieve its aim of ensuring cost efficiency in different channels of distribution. SADAFCO is further recommended to select the hybrid cloud provider carefully, as it is obligatory for the providers to be highly flexible in order to make sure that the system can be updated any time at request. They should be efficient enough to ensure cyber security and capable to recover quickly from potential hacking.

Another important recommendation would be to conduct thorough research for assessing the risks involved with hybrid cloud before uploading important data online. It would be feasible for SADAFCO to evaluate that apart from financial risks, what other probable troubles may arise due to such IT integration.

Conclusion

From the study of the supply chain practice of the corporation, it is notable that although the company possesses a quite organized distribution channel, it is not exceptionally cost effective. Any interruptions at any stages of the channel may cause delay and increase costs of transportation; so, it is highly imperative for the business to manage the supply chain more efficiently.

Therefore, for being more efficient, the integration of latest IT infrastructure in the system is recommended. Moreover, the company should further focus on developing its CPFR.

Reference List

Amaral, P. & Sousa, R. (2009) Barriers to internal benchmarking initiatives: an empirical investigation. Benchmarking: An International Journal, 16(4): 523-542. Web.

Anand, G. & Kodali, R. (2008) Benchmarking the benchmarking models. Benchmarking: An International Journal, 15(3): 257-291.

Blominvest Bank (2011) Food and Beverage Industry in the MENA Region. Web.

Carpinetti, L. C. R. & Melo, A. M. (2002) What to benchmark? – A systematic approach and cases. Benchmarking: An International Journal, 9(3): 244-255.

CPH World Media. (2011) Food Industry: Mena – Culturing a Land of Opportunities to Harvest Tons of Success. Web.

Dattakumar, R. & Jagadeesh, R. (2003) A review of literature on benchmarking. Benchmarking: An International Journal, 10(3): 176-209.

Edwards, J. D. (2003) CPFR – Collaborative Planning, Forecasting, and Replenishment. Web.

Global AgriSystem (2011) Cold Chain. Web.

Global Office (2011) Massive Free Zone FDI Growth. Web.

Global Research (2009) Saudia Dairy & Foodstuff Co. SADAFCO. Web.

Hafez, S. M. Farag, M. A. & Al-Sukayran, A. (1993) Epizootiology of foot and mouth disease in Saudi Arabia: Current status on dairy farms and control measures in operation. Web.

Hinton, M., Francis, G., & Holloway, J. (2000) Best practice benchmarking in the UK. Benchmarking: An International Journal, 7(1): 52-61.

Hoppe, R. M. (1999) Outlining a Future of Supply Chain Management – Coordinated Supply Networks. Web.

Kim, S. M. & Mahoney, J. T. (2006) Collaborative Planning, Forecasting, and Replenishment (CPFR) as a Relational Contract: An Incomplete Contracting Perspective. Web.

Kumar, P. & Kumar, M. (2003) Vendor Managed Inventory in Retail Industry. Web.

Laeequddin, M. (2009) Supply chain partners’ selection criterion in United Arab Emirates: a study of packaged food products supply chain. Web.

Laeequddin, M. (2009) Supply chain partners’ trust building process through risk evaluation: the perspectives of UAE packaged food industry. Supply Chain Management: An International Journal, 14(4): 280–290.

Library of Congress (2007) Federal Research Division Country Profile: United Arab Emirates. Web.

Manatayev, Y. Y. (2003) Commoditization of the Third Party Logistics Industry. Web.

NCB (2005) Prospectus Saudia Dairy & Foodstuff Company. Web.

SADAFCO (2010) At a Glance. Web.

Sarkis, J. (2003) A strategic decision framework for green supply chain management. Journal of Cleaner Production. Web.

Sweeney, M. T. (1994) Benchmarking for Strategic Manufacturing Management. International Journal of Operations & Production Management, 14(9): 4-15.

Tetra Pak Company (2010) Tetra Pak Operational Cost Reduction Programme helps dairy leader SADAFCO improve productivity and cut operating costs. Web.

Tidd, J., Bessant, J., & Pavitt K. (2005) Tools: Benchmarking. Web.

Williams, M. L. (2010) Combining CPFR with S&OP to Attain Optimum Customer Service. Web.

Wong, W. P. & Wong, K. Y. (2008) A review on benchmarking of supply chain performance measures. Benchmarking: An International Journal, 15(1): 25-51.