Executive Summary

Saudi Research and Development Corporation (SRDC) is a private equity venture fund created to support investment ideas brought by PSU Students. It was revealed during several rounds of business plan presentations in the BUS 505 course taught by Dr. Mikhail Zenchenkov that MBA students can develop, present and implement outstanding business projects, thereby contribute to the economic progress of KSA. Saudi Arabia is an emerging market, which needs creative, socially-oriented, innovative business ideas for further social and economic growth. PSU as a private university has the advantage of having wealthy individuals: Al-Saud, Al-Romaizan, Al-Rajhi, Al-Sudairy, Al-Hokair, Al-Habib, and others who are serving on the university council and can be addressed as potential investors in the creation of the first in Saudi Arabia university-based venture corporation, which will grow and monetize bright ideas for the benefit of the Saudi society.

PSU will be the first hub of its kind, which will not only graduate the students but also provide them with the chance of implementing their business ideas through funded business plans. This fact alone can rank PSU as the best university to study in the Middle East. What else can motivate students better to learn, than knowing that you have a chance of bringing your business idea to life right where you study?

With the support of investors, faculty, industry advisors common efforts will be synergized to actively help PSU MBA students convert their bright ideas into working businesses.

We are at the right time of doing this project (Saudi Arabia needs new, high potential, high return, value-producing businesses), we have financial resources (families of potential investors), faculty (consultants and advisors), and students (intelligent ideas generators). We are one step away to leverage all these opportunities and create true social and financial benefits for the Kingdom and its people through the realization of this idea.

Mission Statement

SRDC focuses on providing potential investors with access to the available increasing business ideas which are innovative initiatives from PSU students. They will provide an opportunity for those that can provide substantial capital appreciation over three to five years from the time of investment. We aim to create a strategic partnership between intellectual and financial capital, – by supporting young and talented individuals who have distinctive, creative, and innovative business ideas, and willing to start a business, through the creation of financial, technical, industry, and complex advisory platform.

We believe that Prince Sultan University (PSU) is the right intersection point, a business hub with unique characteristics through which all the agents are to be linked and operate. Our students are idea creators/holders, our faculty serves as an expert panel for review and evaluation, the university board members provide guidance and expertise, as well as participate as primary investors

Management Team and Advisors

The Operational team, which will take care of daily operations and office work include a team of advisors, as well as community Advisors, are a group of individuals represented by the faculty, industry expert, limited partners, and partners (fully or partially involved) whose primary role is to provides advice, guidance, mentorship in areas such as strategy, marketing, legal; assist with industry connections and serve as active experts to facilitate projects. Their professional abilities would enable working towards attaining a higher profit margin within the first year.

Company and Financing Summary

Registered Name and Corporate Structure

SRDC will be registered as a limited corporation. Based on the legal advice the final decision will be taken concerning shares of investments.

Legal registration mode

The company will be registered under limited corporate partnership (Ward 2010). The physical location of the business will be convenient and easily accessible to university students and staff as well as other potential customers. Such locations encourage customers to easily consult with SRDC hence conveniently receiving and making appropriate consultations. The business will serve both high and low-income, young and old consumers especially dealing with Information Technology and Societal issues. The proprietors had previously engaged in similar business ventures hence providing the appropriate experience required coupled with business management skills acquired within formal employment (Burtler, 2006).

The credit-control department will work hand in hand with the sales team to ensure the smooth running of these operations. The mode of payment will vary from one customer to the other. Individual buyers will pay cash on delivery while corporate will pay at a later date through cheque. Should the business encounter problems of unsettled invoices, after exhausting all possible avenues in recovering the monies owed, the business will forward the case to its advocates to institute recovery proceedings in the commercial courts.

Management and Investor Equity

Investors are always attracted to promising enterprises with the capability of increasing turn-over within a period of fewer than five years. In most cases, equity investors usually assist with the management of expertise, contacts, and business ethics.

Additionally, SRDC will contract the services of full-time and part-time sales associates. However, with the increased growth of clients within the market, it will be of prime importance to hire more marketers, sales representatives together with administrative assistants. There will be extensive use of professional consultants within different fields associated with business operations at the same time a competent board of directors is necessary (US Small Business Administration, 2006).

Exit Strategy

The success of the business venture will determine the potential of selling it to third-party investors. This will be done to obtain significant earnings. Investment banks would be involved in the process of transacting and managing the whole issue. There are few research and development companies within Saudi Arabia Riyadh City; hence the field is still very prime and marketable. Most businesses target clothing and jewelry stores where it is possible to buy goods in bulk and export to other regions (Joshi, 2008). One of the most promising areas of investment is those businesses within the ICT field. There are possibilities of becoming the second-largest provider of design and technological accessories to institutions in Saudi Arabia Riyadh City as well as the only premise capable of providing educational services (Adams, 1996).

Within such areas as ICT, there are possibilities of meeting thousands of like-minded individuals with the capacity of operating large businesses. However, there exist special contracts in line with trade shows owing to a strong customer base; this makes it difficult for starters to gain entry into the industry (Bplans Com, 2010).

Another barrier to entry is the ability to understand various development projects suitable for specific communities. For example, businesses like cyber cafes are leased stations, where each entrepreneur has their own space within the premises. Businesses operating under research and development initiatives may at times prove completely different. It also takes years for individuals to understand basic operations within the research industry. Currently, clients trust SRDC advice on the kind of business that would work best within various market segments. This provides possibilities of finding reliable customers and investors within the industry (Reuvid, 2006).

In contemporary society innovations and trends are bound to experience frequent changes. Such cases can be detected within the ICT industry. Additionally, there are modern ICT centers within every small town in entire Saudi Arabia. Most successful and profitable businesses within Saudi Arabia generate a higher percentage of revenue from retailing services giving great consideration to long-term investments. The majority of business development work does not currently indulge in IT accessories. This means there is massive potential within the ICT industry especially the retail sector (Lazear, 2000). To service all channels of operation, SRDC will have to operate warehouses within major cities with cheap land leases. At the same time, there would be the use of service clients through a variety of viable channels provided such as internet operations.

Warehouse

Main warehouses are located within Saudi Arabia Riyadh City. This is since they are centrally located to the majority of potential clients; Dubai is a strategic location for SRDC headquarters since it is easily accessible to international communities. This makes it easier for the management to commute to shows and make business visits within these cities. Additionally, Riyadh City has a booming business in the real estate sector which provides an opportunity for diversifying business operations. Within the current system, the workforce is drawn from different expertise available around the University (Rainsford and Bangs, 2008).

Showroom

As part of the exit strategy, it will be necessary for SRDC to open their Showroom within Riyadh City. Such a move would enable the central location of services provided by SRDC hence enabling easy access to clients and the community at large. The nature of activities within the showroom will determine consumer influx. This would facilitate easy interaction hence obtaining consumer ideas concerning purchases and market trends. SRDC center will provide organizations with website designs as well as access to phone orders enabling appropriate means of delivery. The organization will work with fewer employees for the first two years with operations taking place six business days every week.

Services Provided

Below gives details on some of the services offered by SRDC through Venture Capital Firm, Inc.

The Services

The SRDC will specialize in boosting private business investments organized by PSU students as well as individual business ventures with the ability to attract resources. This would be projected based on the level of revenue growth within the shortest time as well as the SRDC ability of satisfying consumer needs. Additionally, the focus will be on lucrative investments capable of prompting new business ideas and technology into the market. At the same time, existing businesses seeking rapid growth within their field will be considered for funding. The Venture Capital Firm will generate revenues by levying management fees from 1.0% to 2.5% of the aggregate assets under management coupled with a 20% incentive fee on all profits generated by the business.

Merchandise Operations

Currently, SRDC focuses on enriching its services by turning over its inventory after every financial quarter of the year. The high level of turnover is considered crucial because most operations are within the education and social development industries. Due to the high drive within the technological field, IT innovations are considered to have a relatively short lifetime, which is the reason why operations will be done professionally. Because of this, there will be involvement of high vendor relations connecting them with appropriate investors. SRDC will have established strong relationships with current investors which would guarantee the reliability, hence allowing quick venture of most innovative programs within the market. Such kind of relationships will grant SRDC some exclusive operational rights. However, finding reliable investors would involve including other clients from different regions. There are extensive plans for incorporating activities within a wider global market encompassing regions such as the far-East, Europe as well as USA (Partricia, 2002).

Since the company is formed under the umbrella of corporate partnership based on the availability of limited employees, implementation of a complex inventory control system would not be necessary. However, with the rapid growth within the industry, the company will experience challenges based on engaging clients in the whole transaction processes and tracking the entire inventory within the company. Such systems are also necessary for tracking market trends as well as information (Katja, 2006).

Display System Operations

SRDC will base their operations on attracting businesses with effective display systems since they can sell far more accessories than those without attractive online brands. However, there is a tendency of most clients finding it difficult to go to fixture stores to transact businesses. This would demand that clients be supplied with affordable technological systems. Currently, SRDC links business groups with opportunities that enable them to access a variety of funding sources. SRDC will be sourcing for potential investors from all over the world and linking them to local manufacturers and community-based organizations with well-designed financial programs. Such relationships encourage purchasing of personalized displays and recruitment of professional expertise for the reasons of attaining minimum required target. However, SRDC will not focus on exploiting organizations based on available resources but assist them to organize themselves for a brighter future. By making access to financial grants easier at affordable rates, SRDC will ensure that a bigger percentage of the region is catered for including those from the low-end market.

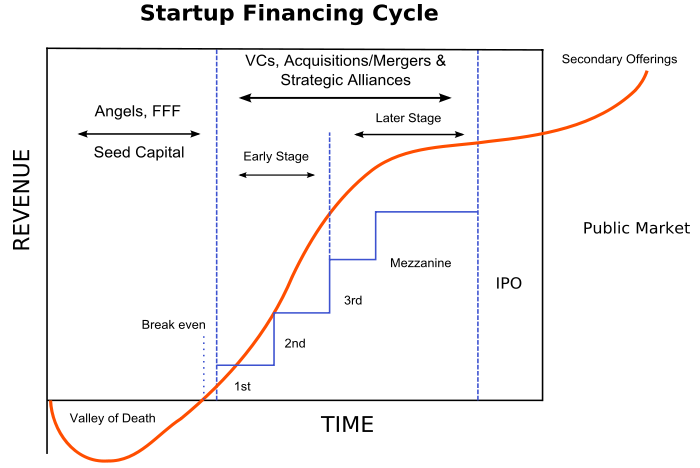

Investments into New Businesses Ideas or Existing Business

The main revenue source for the business will come from individual capital investments and dividends tied to investments within such aspects as new businesses Ideas, innovative startup businesses, or from an existing business that is seeking expansion of their capital base. The center of this revenue unit will come from the capital appreciation that is realized when a business in which the Venture Capital Firm has a stake is sold privately or via an initial public offering. The business will have several highly educated investment professionals that can provide insight into the economic viability of any business that is reviewed by the SRDC for a potential investment.

Educational Services Operations

There will be a need to invest in exclusive educational training programs since entrepreneurs from the institution require basic business operations knowledge. Therefore, SRDC’s first program should focus on the creative utilization of available resources. In these ventures, there will be a need for contracting professionals for the quality delivery of provided courses. Such a venture will initiate improvement in educational goals hence preparing clients to borrow and buy more ideas after seeing the creative ways of utilizing available resources. These capital oriented ventures from SRDC’s will offer extensive business information necessary for business start-ups. We find that such a line of educational services assists in transforming various clients from ordinary entrepreneurs to ICT experts. This enables students to gain the confidence required within the professional workplace hence becoming more effective business people (Katja, 2006). SRDC will hold annual shows within major towns and will have the first Dubai show this fall. Since we contract with platform artists, they will provide the necessary equipment needed for learning purposes. Our employees teach IT and business portion. SRDC also plans to begin online educational shows. These shows will be taught by our sales staff, and they will help educate business owners and their employees on how to use our products, follow the latest business trends, and be more effective retailers (Totten, 2006).

Investment process

SRDC is looking for student entrepreneurs with business ideas capable of commanding high growth potential. Their determination to expand grants them the upper hand whenever they are in the process of giving out part of their company, and/or part of their control to achieve their targets. The SRDC venture fund is based on a pooled investment concept where a group of investors combines their capital into one fund to be managed by the fund managers. Investors in an SRDC fund will be referred to as Limited Partners (LPs), because of their “limited involvement” in fund operations, while VC managers are referred to as General Partners (GPs), because of their full involvement in deploying funds and managing the investments.

5-steps Investment process (adopted from The Veeceepreneur – Guide to Venture Capital in the Middle East & North Africa):

- Initial introduction: Students entrepreneurs approach SRDC with a business plan and clear transaction proposal for their review. Typical business plans include these key sections: Executive Summary, Company History and Overview, Products and Services, Market Analysis and Competition, Management Team, Future Strategy, Financial Projections, Historical Financials, Transaction Details and Structure, and Exit Routes.

- Initial screening: The SRDC will run an initial screening of the opportunity to decide if it meets the standard investment criteria and if the company is in an attractive sector and exhibits high growth potential. The Advisors will ask detailed questions and request clarifications before they decided to pursue the deal further.

- Full review: The Management team will develop a full Investment Paper and assess the opportunity from all angles, run different scenarios, and return analysis. Once the investment is approved, the green light is granted to draft a Terms Offer (non-legally binding). At this stage, the initial terms (including price) are agreed upon and negotiated.

- Due diligence: Once the SRDC agrees on the terms, the due diligence phase is initiated. Advisors with the Management team are to carry out financial, commercial, and legal due diligence on the company. If no major concerns come out of the due diligence process, the SRDC proceeds to the next stage. In rare cases, some issues are uncovered in the due diligence phase that is not drastic enough to pass on the deal but might lead to a change in some of the terms (including price).

- Final negotiation and completion: The concerned parties then draft the Sale and Purchase Agreement, the Shareholders Agreement, and amend the Articles of Association to complete the deal.

Market Analysis

Trade Shows

Marketing communication mix and use of the internet will provide potential keys necessary for creating SRDC’s marketing plan. This is since they are considered convenient and less costly means of obtaining new programs. There will be show contracts with internationally recognized business ventures like multinationals. The company will invest more to increase the level of attendance in trade shows which would be used as an incentive for improving business ventures and at the same time attracting more innovative ideas. SRDC will stage their own educational and training shows within major cities on an annual basis to capture more clients. Such a venture will utilize the use of part-time employees capable of utilizing various creative ventures. There are plans for hiring more sales associates, which will enable the attendance of more shows throughout the region.

Online Catalog

SRDC’s online catalog would be accessed through their website account this will provide the only wholesale website capable of offering a complete definition of available business opportunities. This will provide the best ways of serving clients that SRDC cannot cater to on regular occasions due to distance (Axsater, 2006). At the same time, there will be a possibility of using direct mailing on loyal clients. Small flyers would be used to sensitize students from other institutions and the surrounding community. The sources would include the nature of services offered by SRDC and appropriate contact channels. This will be used in recruiting more clients to the venture (FiField, 1993).

Branding

SRDC will venture into creating private-label brands that will be used for identification purposes in various cities. The name used would play a major role in attracting clients based on the kind of services provided. SRDC will ensure that the brand is trademarked for legal purposes. This will create brand recognition for SRDC services hence drawing much attention within most learning institutions within Saudi Arabia. Dwelling on technological creativity will offer business advantages to SRDC clients.

Positioning

SRDC will position itself as the number one implementer of innovative ideas within Saudi Arabia. This will be extended to other regions such as the US, UK, Africa, and Asian continents, and Far-East regions. We have had steady growth over the years, and with new expansions through online businesses, SRDC can only anticipate growth within all Saudi Arabia Cities.

Economic Outlook

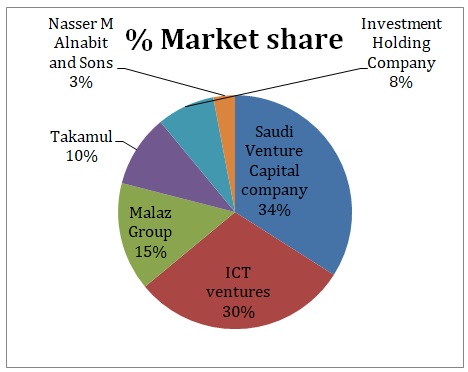

This section of the analysis will detail the economic climate, the venture capital industry, and the competition that the business will face as it progresses through its business operations. The economic climate in Saudi Arabia is filled with investors but most are looking for free risk fast profit. Currently, the economic market condition in Saudi Arabia is moderate with several competitors such as Saudi Venture Capital Investment Company, ICT Ventures, Malaz Group, Takamul Investment Holding Company, Nasser M Alnabitand Sons. However, the Venture Capital Firm should be able to continue to realize substantial profits from its investments, as many of these companies’ revenues are not dependent on the ongoing economic climate. As stated above, some firms are dedicated to providing financing to new businesses and innovative startups. As such, it is hard to quantify the competition that the business will continue to face as it progresses through its operations.

There’s great change within the world in the socioeconomic, technological, and cultural sectors. Such rapid changes are felt within the economic world especially the business sector since it involves high competition within the dynamic business environments. A good example can be seen from the previous 2000-2009 economic crunch. Markets, products, technology, and competitive conditions are rapidly changing. According to Kersley (2006), concepts of environmental dynamism and competitiveness and also struggle for survival and success within international businesses possess great challenging facts within the sector. From such a perspective, all aspiring entrepreneurs must innovate creative business plans indicating various strategies capable of achieving a possible set of objectives. By focusing on its strengths, its key customers, and the underlying values SRDC aspires to grow and achieve reliable clientele and at the same time focus on attaining the highest market share within research and development (Tony, 2008).

Customer Profile

SRDC will not directly have customers. The business intends to look for investors with a high portfolio to obtain a substantial amount of capital from innovative individuals, as well as other investment companies investing in such innovative ideas. SRDC distinguishes itself from its competitors by focusing on providing technologically sensitive means of operating businesses which ultimately leads to an increase in profits, adds to their education level, and becomes better business people. The business management team has many years’ experience within the research and development Industry within Saudi Arabia hence can rhyme well with the target market.

Customer Needs

The projects will incorporate IT advisers available for various small group organizations since they require expert advice. They will offer a system capable of providing customers with required services based on available merchandise, materials, and skills. Innovative ideas dealing with ICT would enable a fair deal, especially when using entrepreneurs who not only understand the ICT industry but also wide network models (Erdener, 1993).

SRDC has a culture focused on education and enrichment of innovative ideas from PSU and the community at large. However, it is important to understand that ideas from cosmetologists and experts within the beauty industry are crucial for the expansion of the business. They will offer advisory services to clients concerning the nature of colors and products which do not match them hence delivering towards such human appearances. There will be provision for educating clients on the necessary skills required for taking businesses to higher levels. The focus will also be on social development work. This makes them capable of assisting consumers in locating the hottest and freshest merchandise. Such strategies only focus on providing centrally located customer services hence an increase in profits realized (Robbins, 2008).

All these process systems will be delivered through educational classes as well as necessary consultancy provided by SRDC. There will be a teaching of students on various skills required for handling products and services and also showing them various trends utilized in displaying and selling merchandise. Also included will be various means used in the process of being effective advisors to clients. The business will choose to ensure that various upcoming artists have trustworthy clients capable of boosting their businesses to strong positions. This requires services of middle-men capable of providing the educational services hence steering them towards the right direction. In such cases, students and the community at large would be helped in becoming better business people.

Marketing Plan

SRDC intends to develop a marketing campaign that will attract investors and potential investment companies and individuals with innovative ideas to the brand name of the firm. Below is an overview of these strategies.

Marketing Objectives

- Develop relationships with private business brokers in Saudi Arabia to lead potential investors and customers to SRDC (word of mouth).

- Develop a strong presence among other venture capital firms.

- Remain within the letter of law regarding the advertisements and marketing campaigns carried out by the SRDC.

Marketing Strategies

SRDC will maintain an interactive website that showcases the operations of the firm, its principals, its portfolio investments, and the site will feature a login system where accredited investors would view their accounts and other information that is limited to accredited investors. As stated above, SRDC will also make it known that it is in the business of investing in new startups with innovative concepts, existing businesses that need growth capital, and technology businesses. This will ensure that the business can make investments quickly into profitable businesses. SRDC will use different types of advertisements.

The business venture as outlined targets youths below thirty-five years of age interested in owning business enterprises. These categories of clients are usually subjected to moderate salaries hence are willing and capable of venturing into other lines of business based on research and development within communities. The business also targets customers from all social levels as will provide the latest affordable market trends. The project location will be within the vicinity of the University.

Promotions and Outreach

The main strategy of SRDC involves educating consumers on the uniqueness and benefits of establishing business enterprises based on different fields. Through various media branches and inclusion of partnerships, the venture will utilize high profile free advertising, which is recognized for setting the stage for current positioning. These would include venturing into cooking competition and businesses where products will be sold through a live cooking show featuring low calorie and vegetarian recipes. The outreach will target high-end, low-medium, and restaurant segments. In other sectors like electronics ventures, SRDC would use in-flight magazines and commercials featuring center-spread with color photos targeting both high-end segments. Youth leadership training will be utilized to incorporate the low-moderate segment.

Expansion Plan

The Founders will discuss the expansion plan if the expectation that the business will have a high-profit margin during the first years of operation. SRDC intends to implement marketing campaigns that will effectively target innovative Ideas outside PSU or companies that will generate high income and develop the economic progress of Saudi Arabia. Affiliates of the company formation can be considered in off-shore locations for international expansion, attracting overseas funds, tax reduction, and simplified bookkeeping: Hong Kong, Seychelles, BVI.

SRDC plans to grow steadily over the next five years, becoming the largest provider of entrepreneurial skill expertise within various fields such as IT and other technological accessories within Saudi Arabia. There’s a need of encouraging a high level of expertise within each industry in the international market, this is possible through massive funding from willing investors. Another important focus should be placed on educating brand specialists since any business venture requires brand recognition for purposes of gaining breakthrough within the market.

Strategy for Achieving Goals

To accomplish most of its ventures, SRDC should endeavor to increase the number of employees including sales associates within all cities starting with Riyadh. Such moves are considered less risky since employees will be contracted on a part-time basis and at the same point, associates will be paid on commission. There are also plans for achieving expansion goals through the use of a new sales force capable of venturing into more online shows on an annual basis. This will ultimately lead towards attracting more traffic on website and phone sales facilitated by contracted administrative assistants and web design specialists.

To improve high customer service levels, there will be a need for fulfilling extensive training to all new employees including sales associates. Additionally, SRDC profit-sharing plan will offer incentives capable of keeping sales associates more motivated towards excellence. There are also plans for keeping the cultural base of education alive within the company. The focus is on providing financial incentives and grants to talented individuals within various communities. There will also be updated information on the latest technological changes provided through the institution’s curriculum based on market trends. At the same time, to achieve strong brand recognition for SRDC business services, there will be the provision of using creative designs and displays. There are plans of taking to the next level latest business trends, using current improved means of integrated marketing communication mix and technological line of ideas. Lastly, there would be the utilization of preferred means in implementing preferred advertisement plans capable of providing marketing ventures for SRDC within the international community (Ryan, 2004).

Organizational Plan and Personnel Summary

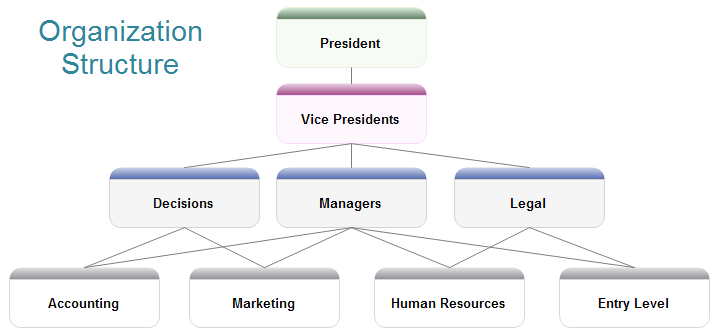

Management Structure

The overall manager who is the President will be endowed with the responsibility of managing and supervising all daily management operations of the organization. They will work closely with the Vice-President who will play a major role in supervising various individual and group projects. For organized activities, all junior managers will be given a wide degree of decision-making authority within their line area of service. The organization has strong affiliations towards customer service hence focuses on grooming highly motivated employees capable of delivering high customer service levels. This has made the institution to design a duty sharing roster as well as a financial sharing plan. Such documents assist in aligning company objectives with the client’s areas of interest (Lemieux, 2007).

Corporate Organization

Organizational Budget

Management Biographies

President has worked within the industry for the last twenty years. In the late 1990s, the president opened an ICT center and software engineering Warehouse in Riyadh. She worked full-time for five years before establishing SRDC in 2012. The president is required to have a minimum qualification of degree in ICT or research and development. Vice-President of Operations had worked within the ICT industry and at the same time worked as an administrator within the University. Vice-President of Operations had worked within the ICT industry and at the same time worked as an administrator within the University. Vice-President of Marketing has been around the IT Industry since birth; hence have enough experience required for management of SRDC.

Table 1: Showing the salaries of employees.

Financial Plan

This section provided multi-year projections for income, cash flow, balance statement, as well as estimated financial ratios. Such historical financial information on SRDC is available upon request (Charles, 2003).

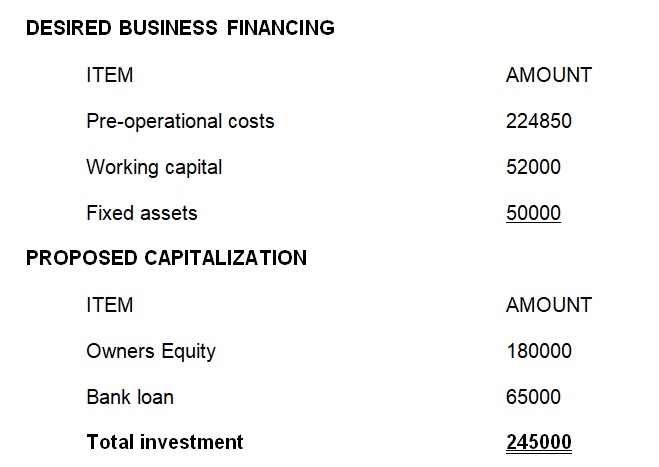

Financing and Required Funds

SRDC is seeking to raise capital from some investors. The business will use several limited partnerships to effectively make investments into the brightest innovative business idea that holds a significant amount of promise. Primarily the financing will be used for the following:

- Development of the SRDC location.

- Financing for the first six months of operation.

- Financing for the investments to be made by the SRDC.

At this time, SRDC requires (SR) of investment funds.

Pricing

Underlying Assumptions

Sensitivity Analysis

Source of Funds

Pro-forma Income Statement

As at the first 2 years

General Assumptions

All operating expenses are assumed to be fixed costs with the cost of goods sold being the only variable cost. Primarily the financing will be used for the development of a strong financial base for six months and financing lucrative investments to be made by the SRDC

Profit and Loss Statements

Pro-forma Income Statement (profit and loss account)

Cash Flow Analysis

Breakeven Analysis

Expected Profitability Ratios

Reference List

Adams, B 1996, Streetwise, Small Business Start-up: Your comprehensive guide to starting and managing a business, Web.

Axsater, S 2006, Inventory Control, Web.

Bplans Com 2010, Business plans for beauty and hair salon, Web.

Burtler, D 2006, Enterprise planning and development: Small business Start-up survival, Web.

Charles, G 2003, Financing the Small Business, A streetwise Publication, Web.

Erdener, K 1993, The Global Business: Four key Marketing strategies, New York ,International Business Press, Web.

FiField, P 1993, Marketing Strategies: the difference between Marketing and Markets, Web.

Katja, A 2006, Design and use patterns of adoptability in enterprise systems, Web.

Kawasaki, G 2006, The Zen of Business Plans, Web.

Kersley, B 2006, Inside the Workplace, First Findings from the 2004 Workplace Employment Relations Survey, Vol. 63, No. 12, pp. 96-123, Web.

Lazear, E 2000, The Future of Personnel Economics, Economic Journal, Vol. 110, No. 467, pp. F611-F639, Web.

Lemieux, T 2007, Performance Pay and Wage Inequality, IZA Discussion Paper 2850, Vol. 5, No. 16, pp. 101-117, Web.

Partricia, P 2002, Retaining your Best Employees: Nine Case studies from the Real World of Training, Web.

Reuvid, J 2006, Start up and run your own Business, Web.

Robbins, S 2008, The truth about Managing People, Web.

Ryan, B 2004, Finance and accounting for business, Web.

Tony, G 2008, Management Account Financial Strategy, Web.

Totten, M 2006, Financial Planning, Web.

US Small Business Administration 2006, Business plans, Web.

Ward, S 2010, Choosing a form of business ownership, Web.