Executive Summary

In the USA, there was a new market evolving concentrating on the pastime. For enjoyable pastimes, many of the Americans were usually becoming more bird enthusiasts. Thus, watching birds, nesting, and feeding them became the most favorite activities in the pastime. The number of bird enthusiasts was increasing very rapidly. As a result, members of the American Birding Association (ABA) tripled in the 1990s and the number of bird watchers in the USA amounted to 50.4 million. In such a big consumer market, demands for bird feeders, nesting equipment, etc. were increasing very rapidly. Due to the vulnerability of bird feeders regarding squirrel and weather, several companies were selling their squirrel-free and weather guarded bird feeders. The market competitiveness was also growing with the increase of consumers. The Squirrel Defense Inc. (SDI) was one of the key players in the market.

The Solar Feeder of the SDI was an eco-friendly solar power-based bird feeder. It was first built for personal use only but later was commercialized for its surprising acceptance. The product was acclaimed as the best new product several times and was awarded. The product has been taken by the consumer enthusiastically and orders are placed continuously. However, the SDI was not capable to meet these orders and hence, was not able to have enough cash flows for its growth. Later the initiator of the company realized their problems and they found that they lack inefficient operational excellence, high production cost, inefficient promotional and delivery activities, and least investors’ interest grabber.

Therefore, to solve these problems, the company should employ a product development strategy. The strategy would let the company produce low-cost high-quality products, efficient promotional management, efficient delivery management, operational excellence, and economies of scale (to increase cash inflows for sustainable growth).

Introduction

Bird watching was increasing in the USA rapidly as a form of pastime. There were 50.4 million bird watchers according to the study institutionalized by both U. S. Fish and Wildlife Service and the American birding association. In the pastime, feeding the wild birds was the most popular activity of the residential bird watchers. The US Department of Interior did a study and found that the bird watchers spent on an average $843 million for feeders, nesting boxes, and baths per year. On the other hand, a study held by a group of students found that an average member of the American birding association was earning on an average $60,000 and the members are in between 40 to 60 years of old.

The association’s 65% members were male and increasing female members amounted to 35% of total members. In addition, the most members were from five states namely California, Florida, Pennsylvania, Texas, and Illinois. These data showed very strong demand for bird feeders in the marketplace. In addition, some companies marketed their bird feeders and gained enough profit. However, these bird feeders were coupled with the threat of being useless due to weather attacks and the attack of a squirrel. Since then several brands were selling squirrel-free bird feeders. The market was moderately competitive.

Ed Welsh developed the idea of producing solar-powered bird feeders and it was surprisingly declared as the best new product in several trade shows. The product was high priced due to the firm’s inability to produce high-volume products at a low cost. Therefore, the product was facing a problem not getting enough market acceptance where other bird feeders are available relatively at low prices. The main competitor of the product was the Wild bills, an electricity-shock-based bird feeder, which is much low priced than the solar feeder. The other two competitors were Vari-Crafts bird feeder and Droll Yankee’s BIG TOP. Both these two products are also low priced than the solar feeder (Brown and Abercrombie 3).

Solar Defense Inc. (SDI), the maker of a Birdfeeder, was surprisingly getting more and more awards along with a lot of orders from customers. However, the firm was in a problem due to its non-defined mission, vision, and objectives. The investors were asking for a business plan and marketing plan so that they could objectively evaluate the firm to invest in. On the other hand, the firm was in a problem with its high time consuming and costs bearing production system. The challenges for SDI[1] were to maintain sales; increasing and maintaining the efficiency of manufacturing, distribution, and advertisement, and promotion activities; managing investment and cash flows (Brown and Abercrombie 5.

Organizational Background

SDI is the manufacturer of the solar feeder, was instituted by Bo Haeberle and Ed Welsh in 1966 to manufacture the solar feeder for commercialization. The idea of Ed Welsh to make a squirrel attack free bird feeder for his brother came to its commercialization then. The squirrel is a smart animal, which consumed most of the birds’ feeds from the bird feeders and carried some of these to their nests, kept away the birds from the feeders, and even broke the bird feeders. The same happened to Ed’s brother then he (Ed) planned to add a motor battery to the bird feeder so that when the squirrel comes over then they get shocked and might go away. However, the squirrels were more intelligent than he could think and battery power was a problem. Then he decided to use solar cells for the bird feeders so that he could have non-disruptive service in the daylight and got surprising results.

The product was launched by doing a very small marketing analysis. Then the product was taken to Habitat of Humanity Auction in 1997 and it grabbed the most consumers’ attention and is priced the most too. Again, the product was taken to Bird Watch America Trade Show and it won the best new product award in 1998. The same product won several other awards subsequently. Thus, Ed and Bo became interested to commercialize the product. However, the problem appeared instantly namely product development cost was the highest but the volume of production was very low, hence, high cost was there. The firm issued its sales terms and provisions withholding delivery cost should be paid by the consumer, hence an additional charge (10-12% of sales) to its high price product.

The firm took orders through large distributors but delivered its products by using UPS, FedEx, or commercial courier services what was an inefficient distribution system. Nevertheless, the reason was the low volume production capacity. The firm used to place it promotions and advertisement through trade show to conventional and top catered birding stores and customers through its website. Again, the advertisement and promotion were also inefficient. The potential customer was thought the retired men and women but surprisingly 30 years aged homeowners were also buying the bird feeder. Due to the increase in the bird watchers and needs for bird feeders, the potentiality of the firm became vivid.

However, the company was bounded by itself. The main competitor of the firm was Wild bills but was not able to suppress the product. All potentialities were in favor of SDI but due to high manufacturing costs and high prices, the product failed to generate enough cash flows for the organization to grow. More and more customers were demanding the product but SDI failed to deliver. Moreover, potential investors were asking for a formal business plan for the organization. The aims of the organization became increasing production at the most possible reduced cost to provide a cheaper price to attain higher sales volume (Brown and Abercrombie 7.

Strategic Analysis: Vision, mission, objective, and strategy

The vision is the statement that summarizes where a firm likes to go in the future and mission means how the firm can reach there by the ways (Robbins & Coulter, 237). They further added that the objective means the planned status of issues that a firm is trying to achieve and a strategy is a planned way to achieve an objective. (Robbins & Coulter, 242)

The firm had no vision, mission, objective, or strategy in its early operation is written. However, from its operation the existing vision, mission, objective, or strategy can be as the following:

Vision: it is growing in the marketplace as the standalone bird feeder marketer.

Mission:

- Save bird feeders from the attack of squirrel;

- Using solar cells for reducing power consumption;

- Increasing appearance;

- Achieve high customer base.

Objectives:

- Reach a lot of customers;

- Gain extra profit from charging a high price.

Strategies:

- Using large distributors to take orders and using a commercial courier for delivery;

- Using craft manufacturing to make the product more appealing and qualified;

- Using traditional promotional tools to decrease costs;

- It argued to set higher prices than competitive prices.

Since the firm was in a problem with these so-called ideas, to attract investors and to evolve in the marketplace to get success, the organization required strong vision and mission statements in its business plan. The possible vision and mission statements for the firm in such a financially distressed position can be as the following:

Vision: We aimed to be the market leader by providing high-quality standalone bird feeders at cheaper prices.

Mission:

- Maintain product quality and meet consumer actual and latent demand;

- Actively identify all potential consumers and possible niches;

- Build company culture to boost the company’s acceptance and magnify the employee’s motivation;

- Extend sustainable return to the investors on their investment;

- Maintain a culture of continuous improvement throughout the organization;

- In-country and beyond country growth;

- Mass production with lean principle.

The External Opportunities and Threats

In the marketplace, the firm had the following opportunities and threats (Brown and Abercrombie 8).

Opportunities

- Increasing number of bird-watchers: According to the case there were 50.4 million bird watchers and the number of members of ABA was tripled by 1998. Since the number of bird watchers was increasing day by day then time, there was a strong chance that the firm can enjoy more consumers. Because of such an increase, there were eventual needs for more bird feeders. Even 30 years old people also became the buyer of bird feeders.

- Growing disposable income level: The ABA’s members had an income of $60,000 per year on average. Since the disposable income of a household was increasing, there had been an increase in expense on pastimes, especially in bird watching.

- Increasing number of female bird enthusiasts: The ABA’s female members jumped from 25% to 35%. Therefore, there was a further increase in the consumers base.

- Aging people: The most favorite pastime for aging people was bird watching, feeding birds, nesting birds, etc. The aged community (retired people) would be the niche market.

- Stage of the product life cycle: The solar feeder was in its initial stage. Therefore, there were many potentialities for the products’ growth and maturity.

- Expansion beyond the country’s boundary: There were increases of bird-watchers, pastime lovers, aging people, higher growing disposable income all around the world especially in European countries, China, Japan, etc. Therefore, the firm could easily expand itself beyond its country boundary. Moreover, it would provide more cost leadership (economies of scale).

Threats

- Level of competitiveness: Though the firm avoided thinking that the product had to face intensive competition, but there was intensive competition at least between Wild bills and the solar feeder. There were signs of further intensified competition because of the rise of BIG TOP and Vari-crafts.

- Product differentiation: Though the firm was providing standalone technology, the solar cell, but the technology could be essentially copied by other firms letting the firm become a generic one.

- Economies of scale: The firm was not profiting then time and if it could not apply mass production by forgoing craft production, then it would further lose economies of scale. In addition, the achievement of the same by another competitor would make the firm undesirable.

- Environmental and trade regulations: The country’s environment could possess a ban on the product and trade policy could remain in opposition.

The Competitive Profile Matrix (CPM)

Source: (Brown and Abercrombie 11)

In the above competitive profile matrix (CPM), the total weighted score of the solar feeder is the highest and is above 2.5 (average score), which means the product was in a favorable position than other competitors. The main competitors of the solar feeder were the Wild-bills (score 2.7) and subsequently BIG TOP (score 2.65) etc. (Katsioloudes, 86-88).

The External Factor Evaluation (EFE) Matrix

Source: ((Brown and Abercrombie 16)

The total weighted average score for the solar feeder is 2.65 which is higher than the standard average of 2.5 that means the firm had more opportunities than threats in the time. That is to say, future growth potentiality was the highest than being going away (Katsioloudes, 88-89).

The Internal Strengths and Weaknesses

The organization had some basic limitations for its standalone products and hence has more weaknesses (Brown and Abercrombie 18).

Strengths

- Solar power-based product: It was only a solar power-based bird feeder so it could save electricity or any other power. It could give continuous service in the pick time of birds feeding. It even worked at night or on rainy days. It is very cost-effective.

- Appearance and functionality: The product’s appearance was the most appreciated value of the product along with its standalone performance.

- Widely renowned product as the best product: The product was judged as the best product of that era several times.

Weaknesses

- Highly-priced: The product price has been set higher than the competitors that made the product is a high-end product but it engulfed the low-end or mid-end consumers, the firm had not any product. Hence, the firm got a relatively low response relative to its quality and performance.

- fewer economies of scale: The entire operational excellence of the firm was the lowest and hence the firm had not been able to break even. Such a condition had further increased production costs and prices of products.

- Inefficiency in advertisement and promotional activities: The entire advertisement and promotional activities were inefficient because of inefficient market targeting. On the other hand, having no flexibility also further made these programs fruitless.

- Inefficiency in the channel of distribution (system): The firm had been using large distributors to collect orders but delivered products through a commercial courier that cost consumers: furthermore. Moreover, it used the distributors for collecting money from consumers and it was an awkward system.

- Lack of market segmentation (target market): The firm institutionalized its operation without having any market-related objective data. By doing a simple survey, it initiated its operations. Hence, the firm did not define its target customers, and products were not developed by keeping consumers in mind.

- Lack of cash flows: Since the production cost was high and the products were acutely delivered to the consumer, hence, the firm failed to generate enough cash inflows to break even. Therefore, it suffered from financial distress at the time.

- Lack of investment: Since the firm had no formal business or marketing plan that could attract potential investors, the firm had an investment problem.

- After-sales service and weather protection: Some other similar products were providing after-sales service and weather protection of their products. Since the consumers were interested to have squirrel and weather attack, free bird feeders.

The Internal Factor Evaluation (IFE) Matrix

Source: (Brown and Abercrombie 19)

In the matrix, the total weighted average score is 2.10, which is less than the standard average of 2.50; therefore, the firm had more weaknesses than strengths (Katsioloudes, 111-113).

The Strengths, Weaknesses, Opportunities, and Threats (SWOT) Matrix

The strengths and weaknesses provide a scenario of internal key factors and the opportunities and threats provide key external factors involving in the operation of an organization. The SWOT matrix of The Solar Feeder is as the following Source: ((Brown and Abercrombie 19) :

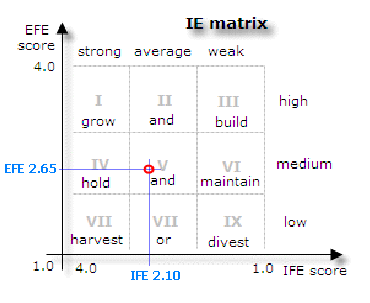

The Internal-External (IE) Matrix

The IE matrix is used to determine the strategy a firm should adopt to grow and sustain in the business. The matrix incorporates the value from the EFE matrix and the IFE matrix. In this case, the EFE matrix score is plotted on the y-axis, which is 2.65 and the IFE matrix score is plotted on the x-axis, which is 2.1. Then the required matrix is Source: ((Brown and Abercrombie 19) :

According to the matrix, since the values of both the IFE and EFE matrix are beyond 3 and above 1.99, therefore, the firm falls in the medium-average cell. Cells number IV, V, and VI poster that the firm should hold and maintain the business. The deliberate strategic spotlight is on product development and market penetration (Internal-External (IE) Matrix, 2009).

Crow, K. (2009) stated that product development presents the structure to familiarize a company’s development schemes along with its development progression. He further added that there is no ideal strategy for the company. The strategy comprises the SWOT of the company, the competitors’ SWOT, core competencies, competitive advantage, etc., and market demands and financial resources of the company. The company might focus on either Time to market orientation; Lowest product cost; Lowest development cost; Product performance, technology, and innovation; Quality, reliability, and robustness; Service, responsiveness, and flexibility or coupled them to sustain in the marketplace (Crow, 2009).

Advantage of product development strategy:

- Fastest order delivery to satisfy the consumers on time;

- Production cost gets the lowest and/or increase the proficiency of production to produce higher value product;

- Developing production system with the lowest cost or within a specified budget;

- High-quality products to the consumer;

- Standalone product with the fullest functionality and state of art innovation;

- Making consumers more interested in the company (Crow, 2009).

The disadvantage of product development strategy:

- Less emphasis given on consumers product association;

- Less competitive when the firm has already developed such type of product (Crow, K., 2009).

On the other hand, market penetration strategy is the approach of changing consumers’ mindset about the company using persuasion. The company can also decrease prices to persuade consumers. However, such persuasion is usually arranged through promotional activities undertaking to change consumer’s perceptions. The company could increase the efficiency of its advertising and promotional activities by doing some market researches (David, 201)

Advantage of market penetration strategy:

- New product association could be created;

- Using the existing product to satisfy consumers;

- Increased efficiency of marketing programs;

- Price rebates increase sales volume (David, F., 201).

- disadvantage of market penetration strategy:

- Less emphasis given on the product;

- Less emphasis on the operational excellence;

- Quality of the product is not judged rather price becomes the prominent feature;

- Less emphasis on consumers’ demands (David, 202).

The company might further undertake a partnership strategy. The partnership strategy includes the notions of building relationships with others such as distributors, suppliers, etc. The company might build a relationship with the distributors to enhance the distribution efficacy and might arrange a relationship with suppliers to reduce inventory costs and to have smooth production and operations (David, 202).

Advantage of partnership strategy:

- Smooth production and operations;

- Instant delivery of products to the destination;

- Less cost requirement to apply the strategy;

- Higher operational excellence can be achieved (David, F., 202);

- The disadvantage of partnership strategy:

- Quality of product is not regarded as the prominent criteria for development;

- Higher relationship maintaining costs might take out the share of its profit.

- Initially low rate of return is possible (David, 203.

The Quantitative Strategic Planning Matrix (QSPM)

The QSPM lies in the third stage (decision stage) of the strategy formulation framework. It incorporates all the data found in the prior two stages: stage one (EFE matrix, IFE matrix, CP matrix) and stage two (SWOT matrix, IE matrix, etc.). The QSPM for the Solar Feeder is as the following (Maxi-pedia, 1):

Source: (Brown and Abercrombie 24)

From the above matrix, it is apparent that the firm should go for a product development strategy because it has a total attractiveness score of 5.92, the highest among the three. The market penetration strategy is also with a total attractiveness score of 5.49 that means the firm might also employ the strategy for its existence. On the other hand, with a total attractiveness score of 3.11, the partnership strategy is not well enough to be taken for solving the organization’s present problems previously mentioned (Maxi-pedia 1).

Recommendations

The specific strategies

The SDI had to comply with the following specific strategies:

- Target market strategy;

- Mass production strategy;

- Quality, appearance, and functionality,

- Relationship strategy

- Promotional strategy

- Delivery strategy

- Continual cost reduction and process improvement.

The Specific Long-term objectives

The firm had to comply with the following long-term objectives:

- Grabbing at least 30% of market share by 2005;

- Having niche markets for better consumer satisfaction;

- Having operations abroad to decrease manufacturing costs;

- Having a widely networked delivery system;

- Minimization of costs in every of operating years,

- Extension of a product line that is initializing new product lines such as birdseed etc.

Cost for the implementation of the strategy:

The strategies planned by the company were to increase cash flow, increase production capacity, reduce prices, generate enough investment, increase efficiency in promotions management, and increase the efficiency of delivery. However, there were no specific strategies planned by the company. However, in the paper, there is a certain strategy to gain almost all the desires the management wanted to enjoy.

Implementation of the strategy

- Target market: Unless the firm defined its target market, it could not be able to design products. For this very reason, the firm had to arrange market research.

- Mass production: here the plant should be near the lowest-cost labor forces and also had to be near to five states aforesaid.

- Quality, appearance, and functionality: since the consumers were satisfied with the quality, appearance, and functionality, these should keep as it was.

- Relationship strategy: for low-cost production, the availability of raw materials is highly required. It is easier when bonding relationships with suppliers.

- Promotional strategy: the firm should increase the investment in advertising and promotional activities to be more consumers centric.

- Delivery strategy: Since the delivery system was a major problem, the firm had to have its delivery systems or delivery network (supply chain management) owned by either the firm or employing a third party specialized for the matter.

- Continual cost reduction and process improvement: the firm had to build a corporate culture of continual improvement and continual cost reduction.

The results that were to emerge after implementing the strategy are shown in the financial analysis section, the following section.

Financial Analysis

Squirrel Defense Inc. Balance Sheet (Projected)

Source: ((Brown and Abercrombie 52)

Squirrel Defense Inc.

Profit and Loss Statement (Projected)

Assumptions regarding the projection

- 2-years moving average. Except for sales due to the sales growth 211.49% sales growth in 1999, 220% is taken to be phenomenal for the succeeding projected years taken other things constant; and those are included in the costs for implementing the strategy; and purchase (160%).

- Costs for implementing the strategy are taken to decrease because of increased efficiency and economies of scale.

- The fixed assets requirement is taken to be minimal due to being less capital incentive industry.

Ratio Analysis

Source: ((Brown and Abercrombie 55)

Timetable for the action

The timetable for the action of the firm should be the following:

Specific annual objectives and policies

The specific annual objectives and policies of the firm for the year 2000 included the following:

- Opening or enlarging the production capacity: the firm had to either open or enlarge its manufacturing capacity to meet existing market demand.

- Delivering all the existing orders: In that year, the firm had to deliver all the orders, which were placed for the products.

- Redesigning advertising and promotional activities: – In that year, the firm had to renovate its promotional activities that were existing consumer-centric.

- Building a well-planned business plan to attract investment from investors as required.

- Employing the lowest cost of labor for low-cost mass production,

- Redesigning the existing delivery system to build the fastest delivery system and to cut consumers costs.

Procedures for strategy review and evaluation

The firm had to employ the following for strategy and evaluation:

- Reviewing the strategy basis: By employing the Competitive Profile Matrix (CPM), it defines whether the firm could be competitive in the marketplace or not. The External Factor Evaluation (EFE) Matrix defines whether external opportunities are used and threats are mitigated or not; Internal Factor Evaluation (IFE) Matrix defines whether internal strengths are still strong and weaknesses are transformed to strength or not.

- Evolution of company performance: the company would use the following (David, F., 203):

- It should use key financial ratios such as profit margin, ROE, ROA, etc.

- A Balanced Scorecard: a balanced chart is a chart, which incorporates four performance areas of a company such financial performance, growth, operational excellence, and customer knowledge.

- Audit: financial audits help to establish correspondence in between the statements based on the strategic plan and reputable criteria.

Conclusion

The SDI introduced a completely new bird feeder for bird enthusiasts and gained the acclaim of being the best new product several times. The product has developed for the personal cause but later became the industry icon. Using solar power to make bird feeders free from squirrels was the standalone idea then time. The product was very eco-friendly from then and therefore, gaining a large consumer base. After two years of operation, the SDI faced problems regarding its operational excellence, high-cost manufacturing, inefficient promotion and delivery management, and financial distress. To manage the emerged situation the firm was planning to be a market player strategically.

In this paper, through rigorous analysis, the alternative strategies for the firm are selected and recommended accordingly. The product development strategy is the prominent strategy because it would help the firm to meet its above-stated problems’ solutions. There are specific guidelines to the firm to implement the strategy to gain the best from the strategy and “when to do what” is described. In this paper, the impact of the implementation of the strategy is also analyzed. According to financial analysis, by implementing the strategy, the firm would be able to boost up its financial performance. The ratio analysis also shows some kind of result, there is a high deviation between the strategy-implemented period and before the implementation of the strategy. Finally, the paper suggested a way to review, evaluate, and control the strategic implementation for the long run superiority. The paper has biased in some way toward some data, if the actual data can be obtained from the company it would be a great source of the organizational strategic condition.

Works Cited

- Brown Lew, and Abercrombie Emily, “The Solar Feeder”, Case Research Journal, Vol: 23 (1), 2001.

- Crow Kenneth, Product Development Strategic Orientation. Web.

- David Fred, Strategic Management: Concepts and Cases, 12th edition, Prentice Hall, 2008. Web.

- Katsioloudes, Marios, Global Strategic Planning: Cultural Perspectives for Profit and Nonprofit Organizations, USA: Butterworth–Heinemann, 2002.

- Maxi-pedia, 2009, Internal-External (IE) Matrix. Web.

- Maxi-pedia, Quantitative Strategic Planning Matrix (QSPM). Web.

- Robbins Stephen, and Coulter Mary, Management, 7th edition, India: Prentice-hall of India Private Limited, 2003.