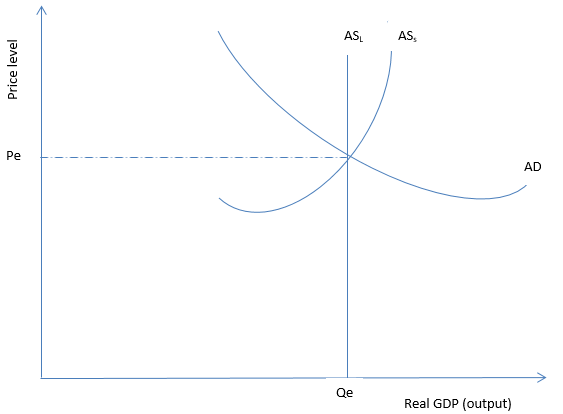

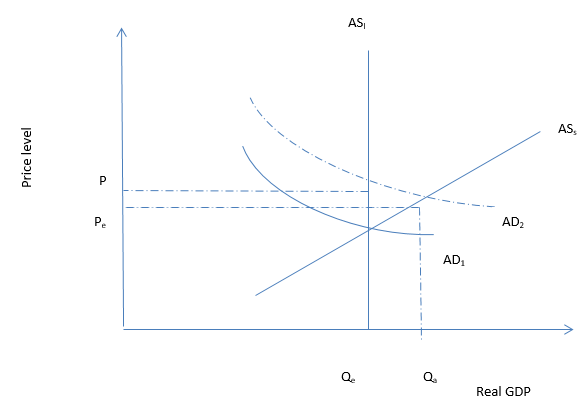

According to McEachern and Thomson South-Western (2008), the aggregate demand refers to the total amount of goods and service that an economy can need. However, aggregate supply is what the economy can produce and supply. In the short run and at equilibrium, the aggregate supply curve meets at a point, e, as shown in the graph below. This is the point of the total output level, Qe and price Pe (Mankiw, 2012). The cumulative supply and demand curves will converge at point Qx as indicated. Here, the equilibrium real GDP will be Qx and price level Pa. The long run supply curve is vertical.

At this point of equilibrium, there will be full utilization of resources at optimum employment level as illustrated. The short run aggregate supply curve can shift due to changes in factors of production and the level of technology. The economy usually assumes full employment at the equilibrium level.

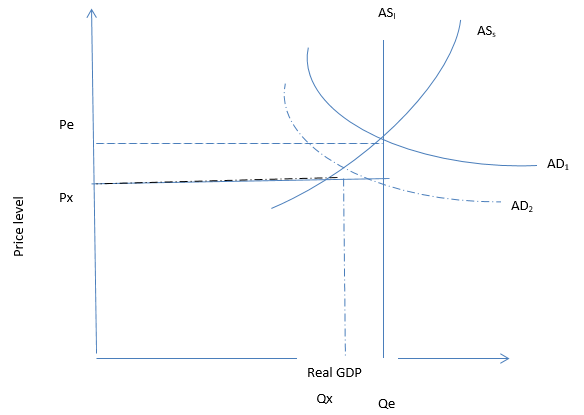

The Central Bank within the economy lifts interest rates

If the central bank raises the interest rates as one of the monetary policy, the investors will be willing to invest minimally. As a result, the aggregate demand will reduce. As shown in the diagram, the aggregate demand curve, AD1, shifts to AD2. This is because an increase in the interest rates makes the cost of capital expensive thus leading to less money for borrowing. In the long run, the supply curve becomes perfectly inelastic and remains constant as the monetary polices will have accomplished their work thus leading to no movement to AS (Meade, 1965).

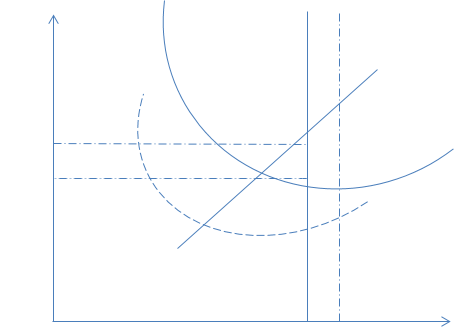

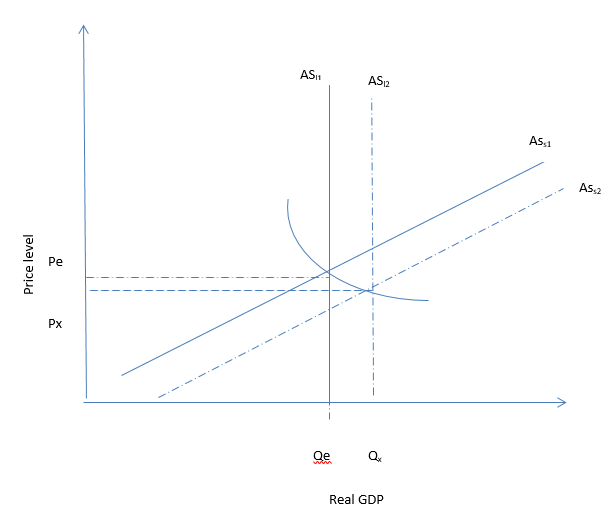

Increase in private domestic investment spending

As more private investors spend their money to open up new businesses in the country, more income will be generated. An increase in investment will usually cause the AD to shift to the right as indicated in the graph. In the long run, more investment leads to a shift in the supply curve to ASl2 (Bumas, 1999).

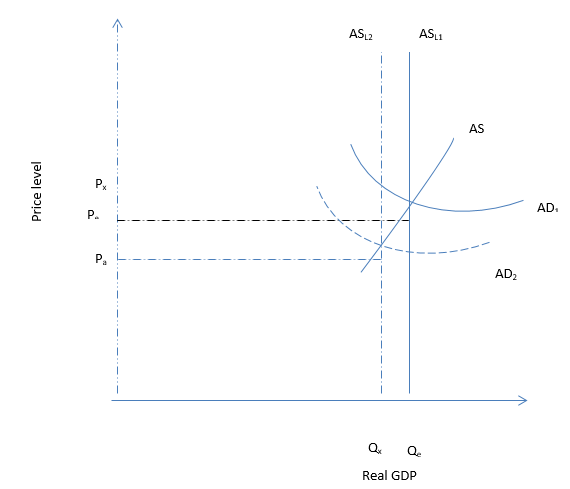

An increase in international oil prices

When there is an increase in international oil prices, in the short run, less oil will be demanded. Therefore, the demand curve will shift inwards to AD2 as less oil will be demanded. As a result, there will be an excess supply, Qx-Qe, shown below. Px will be established. In the long run, producers of oil will be able to arrange their factors of production and improvement on technology to facilitate excess supply. They will be forced to produce less oil leading to a shift in the long run demand curve. This will be from ASL1 to ASL2 as illustrated in the diagram to establish a new equilibrium, price Px (Lipsey & Chrystal, 2011).

The foreign exchange rate effects

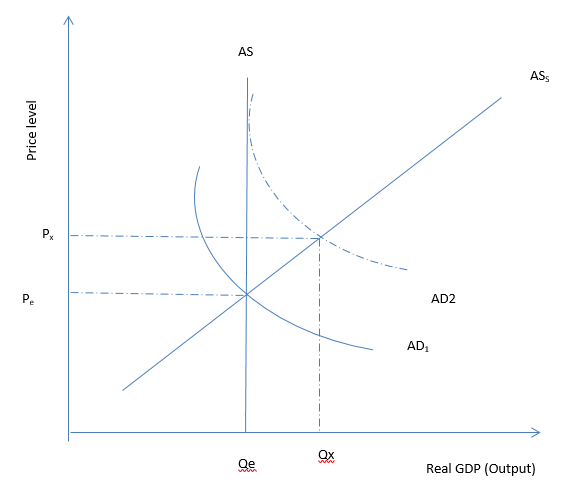

When foreign exchange rate appreciates, the net exports will rise. This is because more will be exported to foreign countries leading to an increase in aggregate demand. More goods and services produced by the economy will boost exports. In this case, foreign revenue will experience an upsurge leading to the advancement in the GDP. Thus, aggregate demand curve, AD1, will shift outwards to AD2. This is because exporters will be able to sell their commodities at Qx. There will be no effect in the long-run supply curve.

A fall in real estate prices in the capital cities of the country

More builders will want to venture in the real estate as it will become profitable. This is because more income will be generated in the real estate from the rent that they will charge in the short-run. Therefore, the short-run supply curve ASs1 will shift outwards to ASs2 as illustrated by the graph where Qa will be the new GDP. As a result, more real estate will be supplied. However, in the long-run, ASL1 will shift to ASL2 since more emits of real estate will be built leading to an increase of the real GDP as shown in the diagram.

The country’s main exports fall in price while the goods that the country imports from abroad rise in price

Prati (2011) suggests that when the price of export falls, exports quantity will rise. On the other hand, when price of goods is imported to the country rise, the quantity imported will reduce. Thus, the net exports will increase leading to increase in AD. As depicted, there will be a variation in the demand curve towards the outside. The shift will be as a result of increase in the net exports, which is a component of the total aggregate demand of the entire economy. A new GDP output Qx will be established. This will lead to a rise in the price level Px. This is because the country is exporting more goods to the country. The inflation in the economy increases as the prices of products increases. In the long-run, supply will not be affected.

References

Bumas, L.O. (1999). Intermediate microeconomics: Neoclassical and factually-oriented models. Armonk, NY [u.a.: Sharpe.

Lipsey, R.G., & Chrystal, K.A. (2011). Economics. Oxford: Oxford University Press.

Mankiw, N.G. (2012). Principles of macroeconomics. Mason, OH: South-Western Cengage Learning.

McEachern, W.A. & Thomson South-Western. (2008). Contemporary economics. Mason, Ohio: Thomson South-Western.

Meade, J.E. (1965). Principles of political economy. Albany: State University of New York Press.

Prati, A. (2011). External performance in low-income countries. Washington, DC: Internat. Monetary Fund.