Organizational Structure

The financial systems of Singapore and Brazil present several differences related to various aspects of the economic background of the country, region, banking area, regulatory structure, etc. First of all, it is essential to pinpoint that

Singapore is one of the world’s leading financial centers, taking the fourth place after London, New York, and Tokyo in terms of foreign exchange transactions, while the financial sector of Brazil refers to the local and developing ones (Chuen & Gregoriou, 2014).

In particular, Singapore is the most important financial center of Asia and the market of the so-called “Asian dollars”. Created as a partner of the Eurodollar market, it was transformed into a regional center of operations with convertible currencies, a credit center, securities issuance, and management of financial funds. By the end of the 1990s, as argued by Chuen and Gregoriou (2014), despite the exchange rate policy and financial crisis in Pacific Asia, the volume of transactions was almost three times higher than that of the national banking sector.

In monetary terms, Singapore presents the most important source of international credit and the most reliable savings bank in the South-East Asia. In its turn, Brazil’s financial system can be characterized as moderate and relatively stable. Throughout the 1950s and 1970s, the accelerated industrialization was largely secured through scarce funding, and the issues of financial stability were considered secondary (“Brazil”, 2017). The undertaken anti-inflationary measures, as a rule, ended without apparent results, and short-term periods of slowing down the growth of prices were replaced by a new turn.

Speaking of the organizational structure of the given financial systems, it seems appropriate to identify their constituents. Singapore’s working capital reflected in income and expenditures shows a stable budget position with a surplus as well as a reasonable budget policy (Ell, 2017). Consequently, there is no need for the country’s economy to raise borrowed funds to finance current expenses that, in its turn, indicates its financial independence. In 2007, a 60 percent increase in the gross operating surplus occurred due to an increase in tax revenues, in particular, a twofold increase in the volume of revenues in the form of taxes on goods and services, stamp duties, etc.

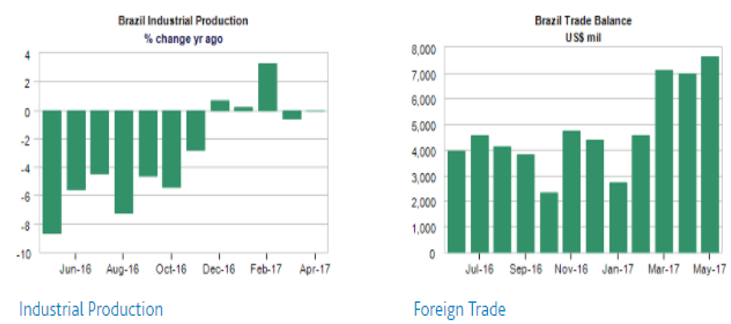

Brazil’s financial development is not so noticeable. The real GDP in Brazil in 2015 amounted to $ 2.32 trillion, which is 93 billion dollars less than in 2014 (“Brazil: Financial system stability assessment”, 2017). The rate of decline compared to 2014 was 3.85 percent. In spite of the recent decline, between 2006 and 2015, real GDP in Brazil increased by $ 474 billion with the average value of $ 2.15 trillion (“Brazil”, 2017). The following Graph 1 presents key economic indicators of Brazil dated April 1, 2017.

Stability in the Brazilian economy stems from the commodity sector, which provides a positive current account balance, as well as due to Brazil’s prudent macroeconomic policy, which strengthens foreign exchange reserves at historically high levels, thus reducing the government debt and significantly affecting real interest rates in Brazilian banks. The floating exchange rate, inflation orientation, and tight fiscal policy are the three core components of the Brazilian financial program.

The increase in productivity coupled with a high level of raw material prices contributed to the growth of Brazilian exports. The country reduced its arrears in 2006 by transferring its debt burden from the external debt to the domestic debt. The government of Brazil aims to achieve high growth rates while reducing the debt burden, which can create an inflationary situation.

Financial Sector Regulatory Structure

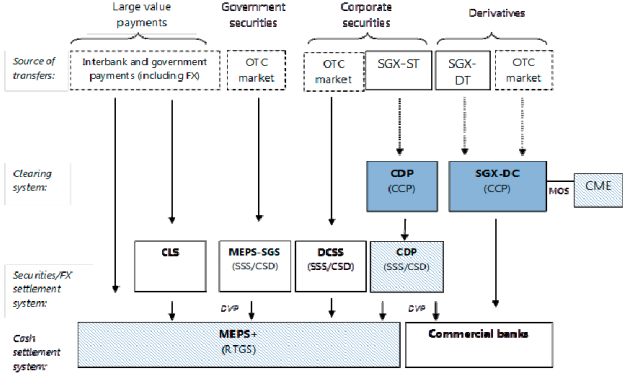

The structure of assessing the effectiveness of finance management in the case of Singapore can be observed via the official websites and studies. The reliability of the budget is reasonable and is implemented according to the government annual plan. The financial completeness and transparency achieved with the help of the comprehensive control exercised over the budget and budgetary risks since information on taxes and budget made open to the public. According to the recent report, “the Monetary Authority of Singapore (MAS) oversees the entire financial system, and has the analytical and operational capabilities to do so effectively” (“Singapore: Financial system stability assessment”, 2013, para. 10).

The formation of budget is conditioned by the state policy – when drawing up the budget, the priorities of the state policy are properly taken into account. The predictability and control over budget execution are well designed and quite predictable, relying on mechanisms for monitoring and managing the use of public funds. The detailed important FMIs are indicated below on Figure 1.

Accounting, registration, reporting, and other data are compiled, maintained, and disseminated in the amount necessary for decision-making, control, management, and awareness. The mechanisms for checking public finances and responding appropriately based on the results of continuous inspections by the management function successfully. Thus, Singapore’s financial regulatory can be regarded as a rather elaborate as they focus on a range of essential aspects and take them into account while planning, developing, and monitoring the prospects of the financial system.

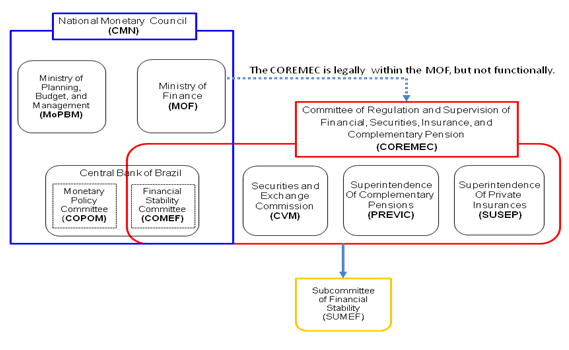

The financial system and the activities of the banking and financial sectors compose the key element in economic planning and policy of Brazil. Accordingly, banking in Brazil is characterized by a high level of the government regulation (Torres Filho, Macahyba, & Zeidan, 2014). The degree of this adjustment often comes as a surprise for foreigners. For example, in addition to the fact that Brazilian banks use the usual way of managing banking operations such as credit limits, credit extension controls, supervision by central banking authorities, etc., they also act in accordance with government directives.

In particular, they stipulate the issues of maximum interest rates for certain types of loans that are required to comply with the requirements for the provision of minimum interest on loans to small and medium-sized companies and the maximum percentages of the legal persons belonging to a foreign owner. The detailed structure of the financial regulation in Brazil can be observed on Figure 2.

The Central Bank of Brazil (BACEN) owns the principal responsibility for the regulation and supervision of financial institutions in Brazil. The Brazilian Securities and Exchange Commission (CVM) and the Federal Revenue Service System (SRF) also exert regulatory and supervisory influence on banks. These three regulatory organizations subordinate to the same political leadership and collaborate to achieve the common interests. Thus, one may conclude that Brazilian financial system is a rather centralized and government regulated body that is utilized to lead the country on its multifaceted development.

Banking Area

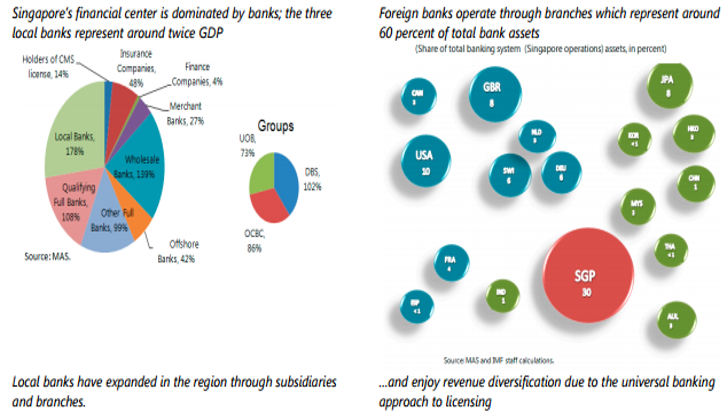

Singapore and Brazil have different banking structures. Among the leading banks of Singapore, there are ABN AMRO, Citibank, DBS, HSBC, OECB, Standard Charter, and Sob (see Figure 3 for details). The central bank of the country is the Monetary Authority of Singapore (MAS), which determines the monetary policy, regulates the activities of banking and financial institutions, and issues currency (Chuen & Gregoriou, 2014). Despite the absence of the currently supported government deposit insurance program, MAS is planning to establish such a system in the near future. The activities of commercial banks in Singapore are licensed and subject to the Banking Law.

The commercial banks of Singapore can utilize all perspective types of banking activities. Along with providing commercial banking services, including deposits, checks, and lending, they also may be involved in any other type of banking business that is regulated or authorized by the MAS (Tabak, Takami, Rocha, Cajueiro, & Souza, 2014). For instance, advisory services in finance, insurance broking, and capital allocation services may be conducted according to the Section 30 of the Banking Act that establishes all possible types of banking activities.

Currently, 113 commercial banks operate in Singapore, while five of them are registered at the local level and belong to three domestic banking groups (Chuen & Gregoriou, 2014). The commercial banks operate as banks providing a full range of services as wholesale banks or offshore banks. A significant share of the participation of federal and state banks provides government-subsidized loans at a low interest rate for agriculture and industry.

When private banks are included in the country’s banking system, the government’s involvement in their activities significantly increases. It should be taken into account that the banking sector of Singapore is characterized by the active development and growth supported by the stable government policy.

The Federal Constitution of 1988 governs the functioning of the Brazilian banking system. A distinctive feature of the banking system of the mentioned country is a high bank spread that implies the difference between the interest that the bank pays for borrowed resources and the interest that debtors pay to the bank for loans taken. Thus, the banking system of Brazil is characterized by rather high interest rates, the reasons for which are associated with a range of issues.

First of all, one may note the oligopoly of the banking sector as the seven largest banks own approximately 80 percent of assets. A high percentage of non-payment of debts and ineffectiveness of judicial mechanisms for claims for recovery of debts lead to the fact that customers who are able to pay have to pay for debtors. In addition, there are a high interest for financial transactions and a high norm of required reserves.

The banking system of Brazil consists of several banking institutions, each of which performs its specific role. Claessens and Forbes (2013) claim that the state and regional development banks were set up at the federal or regional level to issue low-interest loans in strategically important sectors of the economy at the federal level and in strategically important regions of the country. For example, the National Bank for Economic and Social Development (BNDES) and such regional banks as Bank of the Northeast of Brazil (BNB), Amazon Bank (BASA), etc. relate to the above category.

Paula (2011) states that the commercial banks are institutions authorized by the Central Bank to receive bank deposits and thus create payment facilities. The largest banks in Brazil are Banco do Brasil (Bank of Brazil), Itaú (Itau), Bradesco (Bradescu), and Santander (Santander) (“Brazil: Financial system stability assessment”, 2017). It is worth emphasizing that the Bank of Brazil is the largest bank in Latin America, and 68 percent of its shares belong to the Brazilian state (Paula, 2011).

While the investment banks specialize in providing loans for long periods, the savings banks accept individual savings and finance housing within the housing credit system. According to Claessens and Forbes (2013), the largest bank in this area is the Caixa Econômica Federal (Federal Economic Office) that relates to the government bank through which social programs are financed, including “Minha casa, minha vida” (“My Home, My Life”) housing program.

The traditional source of Brazilian loan for the purchase of consumer goods is the use of unsecured checks at the time of purchase. This practice is very common today, and it is an unofficial type of retail loan. At the same time, banks provide the largest number of loans to previously forgotten sectors, such as small and medium-sized companies, individual consumers, and real estate financing. The expansion of the loan could be even more active, if not for the high interest rates that are part of the official monetary policy.

The share of foreign participation in banking has recently increased (“Brazil: Financial system stability assessment”, 2017). The increase in the activity of foreign banks in Brazilian financial market and new additions to the general conditions for foreign investment are associated with two important factors. First, after decades of almost complete isolation from foreign direct investment, Brazil changed its policy. Secondly, it is a forecast that in the near future, high demand should decrease when the demand for a loan is likely to increase substantially, as Brazil has a relatively low debt-to-GDP ratio.

Financial System Policy

Initially, the government of Singapore pursued a protectionist policy with respect to its own banks, fearing that the local banking system could not withstand fierce competition from financial institutions with a long history. However, as operations in the financial market took a global character along with sales and investment growing exponentially, the country moved to the liberal foreign policy and attracted foreign banks to open their branches in the country. In effect of the above change, according to the globalization index of countries, Singapore ranked the fifth place in the world in 2015.

Speaking of Brazil’s financial system with regards to its financial system policy, one may claim that the main problem of Brazilian economy was the high rate of its exchange rate against the US dollar and euro. The measures taken by the Brazilian government, namely, the purchase of dollars by the Central Bank of Brazil in the spot market and the increase in the tax on foreign investment in the stock market allowed to lower the rate of the Brazilian real in 2012, but this was not enough (Torres et al., 2014).

The high real exchange rate had a negative effect on Brazilian exports, in particular, on the export of agricultural products, which in quantitative terms continued to decline. As a result, the index of entrepreneurs’ confidence decreased, and real investment in the Brazilian financial system fell. The Central Bank of Brazil decided to lower the bank discount rate to a record 7.25 percent for the country (Torres et al., 2014). This allowed the country to retain a high level of lending to legal entities and individuals as well as a relatively low unemployment. This shows that Brazil focuses mainly on the domestic banks.

Exchange Rate Policy

In its foreign exchange policy, Singapore is significantly different from other countries that experienced the so-called “economic miracle”, initially focusing on a market, open economy, free capital inflows, and integration into international financial markets. The paramount goal was a stable and strong national currency, and the financial regulator MAS promoted its strengthening. The choice between export support and price stability, as a rule, has always been decided in favor of maintaining stability. With this in mind, exchange rate weakening was allowed in reasonable limits only during periods of financial crises and recessions.

Since 1981, MAS has pursued a policy of a managed floating exchange rate of Singapore dollar, seeking to establish price stability. Nowadays exchange rate can fluctuate within the established limits that are not disclosed by the MAS publicly and regularly reviewed in accordance with macroeconomic factors. During periods of stability and economic growth, MAS pursues a policy of moderate strengthening of the specified direction, which helps to contain inflation, reduce the demand for currency, thus preventing overheating of the economy (“Singapore: Financial system stability assessment”, 2013).

In crisis periods, MAS reduces the rate of appreciation or allows the national exchange rate weakening to support exports and accelerate economic recovery. Among the other factors contributing to stability, there is the division of the domestic market of the national currency and the offshore sector through the introduction of the Asian Currency Unit (ACU) – a separate division of the financial institution for operations in foreign currency created to prevent excessive demand of foreign investors for the Singapore dollar and limit external shocks.

The experience of Brazil reflects the consistent implementation of anti-inflation programs with regard to exchange rate policy. The government was forced to make a bid for inflationary financing methods because of a lack of resources. The inflation rate in 1970 was expressed in double digits, but in 1989, inflation was out of control, and its level reached 1763 percent (Torres et al., 2014). The external debts increased more than twice, and the annual payment absorbed 33 percent of the country’s export earnings. In order to overcome inflation, a new monetary unit was introduced, and its fixed rate to the US dollar was established (Claessens & Forbes, 2013).

This financial situation required a reduction in social spending and the fixation of various prices. It should be admitted that this allowed curbing the rate of inflation for a short period of time (Zeidan & Rodrigues, 2013). In addition to the above factors as well as the reduction of bank interest rates, the population was forced sharply increase its consumer demand, which gave impetus to the momentum of production growth. The currency reform abolished the official fixed rate and the policy of the mini-devaluation. In the final analysis, a competitive economy was created that allowed the new Brazil to enter the world as a viable subject of international relations and was called the “Brazilian miracle”.

Advantages of the Financial System of Singapore

Singapore’s financial system seems to be more effective rather than those of Brazil. The first benefit of the given financial system is that Singapore presents the financial companies that concentrate on financing in small amounts, including loans for the purchase of cars and other durable goods as well as give loans for the purchase of housing (“Singapore”, 2017). The mentioned organizations are licensed and operate in accordance with the Law on Financial Companies.

However, they do not have the right to open deposit accounts, which can be used to withdraw funds on demand for checks, bills of exchange, or a payment request. They are also not allowed to provide unsecured loans in excess of $ 5,000 to any person or to effect transactions in any foreign currency, gold, or other precious metals, or to acquire stakes denominated in foreign currencies, shares or debt securities (“Data catalog”, 2017).

However, financial companies that hold more than ten million Singapore dollars in capital can apply for permission to operate in foreign currencies, precious metals, and share denomination in foreign currencies. Such a permit is issued on condition that at any given time the aggregate amount of the loan granted in foreign currency does not exceed ten percent of the capital of the financial company.

Another distinctive feature of the modern financial system of Singapore is the rule of law, strict judicial policy, competent and honest government, the lack of corruption, and openness of information (“Global shadow banking monitoring report”, 2015). As noted in the recent official report, “MAS is known and respected as an effective regulator/supervisor of the financial services sector” (“Singapore – Banking systems”, 2016, para. 4).

Throughout its history, the government has zealously fought corruption, applying the most severe penalties against the guilty, ranging from life imprisonment to death. Therefore, today in the ratings of the rule of law and the perception of corruption, the so-called “Asian Tiger” occupies a leading position, namely, the ninth and the seventh positions in 2015 and 2016, respectively (“Data catalog”, 2017). It is strict control over compliance with the “rules of the game” that has become a solid foundation of Singapore’s financial system.

Such an approach allowed the country’s economy to remain firmly on its feet during the crisis of 2008 and to prove that their financial system has already been formed and it is in no way inferior to the systems of the countries of the first world (“Singapore: Financial system stability assessment”, 2013). In addition, Singapore conducts sound internal and external economic policies, according to which Singapore moved Switzerland from the first place in the management of international assets of private clients in 2015.

The absence of the external debt, stable currency, liberal taxation, and export-import policy make Singapore one of the most investment-attractive countries of the 21st century. At the same time, “like the rest of the Brazilian economy, the financial system is exposed to the effects of volatile international markets, especially for commodities and capital” (“IMF survey: Brazil’s banks need to serve economy, navigate global risks”, 2012, para. 6).

The absence of double taxation, a tax on capital income and its growth, income received abroad, tax holidays for priority development sectors, and other tax incentives for entrepreneurs allow Singapore to occupy a leading position among countries with favorable conditions for doing international business (“Singapore: Financial system stability assessment”, 2013). In 2017, according to the index of economic freedom and positive conditions of doing business, the country occupies the second place in both ratings, with the results of 88.6 and 85.05 respectively accompanied by Hong Kong and New Zealand, fighting for leadership (“Finance and insurance”, 2017).

As for the current balance sheet, the government of Singapore does not attract borrowed funds from external sources and has no external debt. Ell (2017) states that the interest costs account for 1-2 percent of the current balance sheet, and interest payments tend to decline: <0.1 percent of GDP, despite higher loan sizes. The repayment of domestic loans and a new debt at a lower interest rate primarily cause the mentioned situation.

The overview of net loans and borrowings associated with net non-financial assets reveals that Singapore has a positive budget, net creditors, and surplus, leading to the decreasing trend in gross investment or an increase in capital receipts along with the long-term capital investments that have a high profitability contributing to the budget surplus. In effect, one may note a budget surplus estimated of 7-12 percent of GDP (“Singapore”, 2017).

Such budget revenues are more than enough to cover costs and economic development. Also, the policy of limiting the international use of Singapore dollars by financial institutions, non-residents was gradually liberalized, and a significant amount of international reserves of MAS was noted from 55 to 92 percent of GDP between 1980 and 2013 (“Data catalog”, 2017).

Singapore carried out a rather competent policy towards residents: for the most part, it stimulated the opening of branches of large banks, and only in the subsequent turn, medium and small ones. In addition, the country did not give up its positions with respect to state supervision, allowing only financial institutions to operate with an impeccable reputation (“Finance and insurance”, 2017).

A ban was imposed on issuing licenses for work in case of a bad credit history or suspicious financial transactions as it happened with the Bank of Credit and International Commerce. More to the point, the success of the banking system is ensured by the liberalization of the monetary, financial, and legal framework for foreign banks and other financial institutions wishing to work in Singapore. “Domestic banking groups are training bankers to cater to the needs of small- and medium-sized enterprises (SMEs) and, in some cases, to support them in their efforts to internationalize their business” (Singapore: Banking sector risk, 2015).

It is also easy to carry out any banking operations due to the possibility of their implementation in the electronic form. In the view of the mentioned facts, Euromoney named Singapore Development Bank the best digital bank of the year in 2016 (“Singapore”, 2017). Singapore is one of the few countries that did not sign the EU Savings Taxation Directive, which allows states to receive information about all financial transactions of their citizens as it proposes the importance of strict compliance with the banking confidentiality laws. This fact highlights the offshore zone of Singapore among the rest that is why, as noted by Hofmann (2017), plenty of businesspersons today prefer it to other similar zones, including Swiss offshore zone.

Drawing from the evidence presented in this paper, one may conclude that the financial system is a set of interrelated and interacting parts, links, and elements that directly participate in financial activities and contribute to their implementation. It consists of financial institutions, including organizations and institutions that carry out and regulate financial activities, the Ministry of Finance, the central bank, stock and currency exchanges, and financial instruments that create the necessary conditions for the flow of financial processes. The financial systems of developing countries such as Brazil are characterized by great diversity due to their large number and due to the significant differentiation of their economic and financial development levels.

In its turn, the financial system of Singapore is created according to the following scheme: first, an effective monetary system is created, the state of which does not hinder the development of production and cannot cause crises, then an efficient and powerful credit system emerged on its basis, and then the effective and powerful financial market appeared. After that, if there is a sufficiently strong currency, the national system of redistribution of financial resources within the national borders turns into a factor of importance for the regional and international finance. Under especially favorable conditions, Singapore’s financial system presents the basis for the global operation.

To date, the banking system of Singapore is recognized as one of the best worldwide, but it all began with a modest attraction of foreign capital in foreign currency (“Singapore: Financial system stability assessment”, 2013). After that, the city-state has already started trading in securities, options, futures, and foreign currency. The foreign exchange market in the country is divided into internal and external accounts for residents and non-residents. These accounts differ in the fact that external accounts remain outside the state control.

References

Brazil. (2017). Web.

Brazil: Financial system stability assessment. (2017). Web.

Chuen, D. L. K., & Gregoriou, G. N. (2014). Handbook of Asian finance: Financial markets and sovereign wealth funds. Oxford, UK: Academic Press.

Claessens, S., & Forbes, K. (2013). International financial contagion. New York, NY: Springer Science & Business Media.

Data catalog. (2017). Web.

Ell, K. (2017). Singapore: Detailed economic analysis, indicators and forecasts. Web.

Finance and insurance. (2017). Web.

Fuentes, J. P. (2017). Brazil: Detailed economic analysis, indicators and forecasts. Web.

Global shadow banking monitoring report. (2015). Web.

Hofmann, C. (2017). Shadow banking in Singapore. Singapore Journal of Legal Studies, 8(2), 18-52.

IMF survey: Brazil’s banks need to serve economy, navigate global risks. (2012). Web.

Paula, L. F. D. (2011). Banking efficiency, governance and financial regulation in Brazil. Revista de Economia Política, 31(5), 867-873.

Singapore. (2017). Web.

Singapore: Banking sector risk. (2015). The Economist. Web.

Singapore – Banking systems. (2016). Web.

Singapore financial centre overview. (2016). Web.

Singapore: Financial system stability assessment. (2013). Web.

Tabak, B. M., Takami, M., Rocha, J. M., Cajueiro, D. O., & Souza, S. R. (2014). Directed clustering coefficient as a measure of systemic risk in complex banking networks. Physica A: Statistical Mechanics and its Applications, 394(2), 211-216.

Torres Filho, E. T., Macahyba, L., & Zeidan, R. (2014). Restructuring Brazil’s national financial system. IRIBA. Web.

Zeidan, R., & Rodrigues, B. (2013). The failure of risk management for nonfinancial companies in the context of the financial crisis: Lessons from Aracruz Celulose and hedging with derivatives. Applied Financial Economics, 23(3), 241-250.