To any business, funding remains an issue of critical importance that needs to be addressed with utmost care. Sources of funds to any business remain a critical issue that demands that an organization’s strategic managers guard the sources of funding to guarantee business growth. Traditionally, funds for business come from the sales proceeds.

However, the fluctuating nature of the market makes it necessary for organizations to devise stable sources of funds to avoid unnecessary losses should the sales volumes drop significantly. Therefore, this means that although the main purpose of all business is to get revenue form the sales that they make, it is also important to invest some of the proceeds to some other forms of incomes to protect the company for some eventuality.

Sources of funds for McDonald in either starting a new or expanding the existing restaurants can be classified into three broad categories, which are:

- Internal sources of finance

- External sources of finances

- Long-term sources of finance

Internal Sources of Finance

One of the main sources of funds for McDonalds is sales proceeds. From the sales made by McDonald restaurants, the revenue earned minus all the expenditures incurred, gives it a surplus. This amount is retained by the business and used to finance its expansion into new market areas through establishment of new restaurants or purchase of new assets.

Owner’s savings is also another source of financing for the McDonald Inc in Kuwait. Owner’s savings ensure that the business owners have money at their disposal to use or furtherance of business. In most cases, when businesses are being started, much of the finance is usually from the individual savings.

Another source of finance for McDonalds Inc. is royalty from franchises. According to Keown, (2006), Franchises are businesses that use an already established brand name and in return pay the main firm some funds in form of royalties. The franchisee retains all the profits from the venture, but pays the Franchisor royalties and a minimal rental payment as agreed.

In this case, McDonalds continues to be recognized as one of the great franchising companies in the world in which over 75% of the McDonald restaurants are owned and operated by franchisees. This means that McDonald greatly gains from these franchises when they remit their payments to the franchiser. Franchising is, therefore, one of McDonald’s major sources of finance.

Retained earnings and retained profits are often used as a source of finance. Over the years that the chain has operated in Kuwait, their retained earnings have been used for their expansionary missions. Retained earnings also have been used for asset financing among other major ventures of the organization. Sale of assets is another way that McDonald can get finances for their business ventures.

This involves the selling off the excess assets that are held by the company so as to generate money that could be used to start a new business or expanding an existing one.

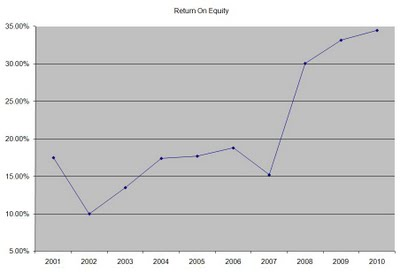

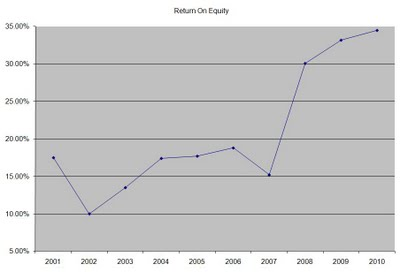

However, great caution should be taken into account when doing this and this is because, some of the assets could still be used in smooth running of the current business. The accumulated retained earnings have boosted the return on equity on McDonalds Kuwait as attested by the graph below.

McDonalds’ reatined earnings trends over a 10 years trend.

External Sources of Finance

McDonald also gets finances from partnership ventures. The partners contribute capital for the business and McDonald benefits from this business relationship in that through these capital contributions, it is able to finance its business.

McDonald can obtain finances from bank loans. This form of finances allows McDonalds Inc. to finance its initial costs. The loans come in either long-term nature or in short-term nature. Among the main financiers of McDonald’s Kuwait is the National Bank of Kuwait (NBK) which allows provides a varied form of loans to McDonalds.

Debenture loans are also forms of loans that are used by McDonalds in Kuwait just like in any other worldwide branches. Debenture loans are loans that are secured against with the assets of the business that is being invested in. Secured debentures attract fixed or variable interest rates depending on the assets they are attached to whereby the interest’s rates of these debentures can be predetermined.

McDonald could use this source of finance to fund its existing business or start new ones. However, the business cannot sell the assets without the lenders’ consent and in case the business fails, the lender always take the first priority in being compensated over the owners and the shareholders and also this applies in case of winding up of the business.

Bank overdrafts as sources of funds are also used to fund McDonald’s operations. This is a good source of short-term finance as it helps solve the immediate problems that are being faced by the organization quicker than looking at the long-term ways. The overdraft has more advantage than a loan on the short-term.

Venture capital is another source of finance that McDonald can use to its existing business or start a new one. Venture capital is used by business in the initial stages of their development. For venture capital arrangement to be successful, an investor known as a venture capitalist must be willing to invest a huge sum of money into the business.

This means of soliciting funds has the advantage that the business in most cases end up being successful, but also runs the risk of the venture capitalist demanding to hold part of the business ownership or they may request very high returns at the expense of the business (Braun & Larrain, 2005).

Despite this shortcoming, McDonalds in Kuwait has utilized this from of financing where the venture capitalist is allowed to have some stake in some franchised outlets.

McDonald can also use credit from suppliers as a source of funding. Once goods are supplied, it takes about thirty days for the payments to be made and it gives McDonalds time to sell and then pay at the end of this period. The advantage about this is that the money that could have been paid to the suppliers once they had delivered the goods can be used to pay for other commitments.

However, caution should be taken so that there are no delays in paying the suppliers on time according to the business agreement. Related to this form of financing is the hire purchase. Hire purchase is an arrangement that can ensure the acquisition of an asset is easy in that the buyer does not have to pay for the asset in full amount.

A deposit is paid and the buyer can use the asset, but continue with paying installments at the end of every agreed period. For McDonalds, hire purchase has been a useful method for financing major forms of restaurant infrastructure as the initial installations are usually expensive. Since the arrangement allows the chain to use an asset before it fully pays for them, this form is seen as a source for funding.

Long Term Sources of Finance

Leasing

In leasing a firm hires or obtains fixed assets and pays contractual payments agreed upon. To ease its operating costs, McDonalds inc. forms contractual agreement with stakeholders and other parties and uses their assets for an agreed period of time. Among the main leased items are the premises that that chain uses to house its restaurants as well as other assets that are used by the chain of restaurants for day to day business operations.

Feasibility of McDonald Inc financing there operations internationally or locally

The possibility of McDonald financing its activities locally is more viable. This is because availability of capital locally is high. The reasoning is, the company is able to internally fund itself from the retained earnings, working capital, and with other internal sources of fund available.

This form of financing is economical as the chain is not required to pay interest on this amount. On the other hand, it is possible to get funds from local external sources such as bank loans, bank overdrafts, and credit from suppliers. These sources attract interest charges, but usually at rates that are rationally low.

However, this does not mean that it is impossible for McDonald Inc. to access funds from the international sources. External funding is achievable in the following way. McDonald is the biggest fast food retailer in the world. It has more than 29000 restaurants and operates branches in over 120 countries with the first Asian franchise being opened in 1967 in China.

This franchising has resulted to over 65% of the total revenue earned by the company being from its franchises. From the above explanations it is evident the cost of obtaining these external financing in relatively low. External financing is appropriate if the chain is in the process of expansion.

From the above analysis, it is evident that McDonalds uses internal sources of finance to fund its operations. The preference given to internal sources as opposed to external sources may be justified by the nature o business operation adopted by McDonalds Inc.

The franchising approach has allowed the branches of McDonalds in Kuwait to be self sufficient as they have attracted local investors who come with their initial capitals. This way, the chain has been able to maintain a good book of account that is devoid of foreign debt.

Use of internal sources of funding has also ensured that the chain does not suffer form the effects of a fluctuating international currency hence translating to predictable business trends. This proves that it is feasible for the company to finance its operations locally as opposed to using foreign funding to finance the operations.

References

Braun, M. & Larrain, B. (2005). Finance and the Business Cycle: International, Inter- Industry Evidence. The Journal of Finance. 60(3) pp 1097-1128.

Keown, A., J. (2006). Foundations of finance: the logic and practice of financial management. New York: Prentice Hall.