Introduction

Every country exports or imports something, for this to work effectively; there must be some form of exchange, like the popularly known barter trade. Furthermore, when a United States tourist goes to the UK with his/her country’s currency (dollar), the money needs to be converted to UK money, (sterling pound). To make this easier, there must be an exchange rate based on the values of each currency. This paper will try to forecast the spot exchange rate between United States $ and South Korean W in the next one year, under the conditions given below.

Currency exchange rate

Exchange rate refers to the rate of conversion from one currency to another. This may differ depending on one currency’s valuation compared to another. Factors such as inflation, political in/stability, government securities, and trading may appreciate or depreciate the value of currency, thereby defining its exchange rate as compared to another. This is why there is policy guidance to help in controlling these factors.

South Korean Won

This is South Korean Currency; it trades in major parts of the world as South Korea is a hub of goods and services for exports as well as imports. Its currency is fairly stable although it was also affected by the economic recession.

United States Dollar

The dollar is United States’ currency symbolized as $. It is one of the main currencies of the world that trades in almost every part of the world. Its stability has been questioned recently due to the high debt and U.S. recovery from economic recession.

Calculation and Analysis

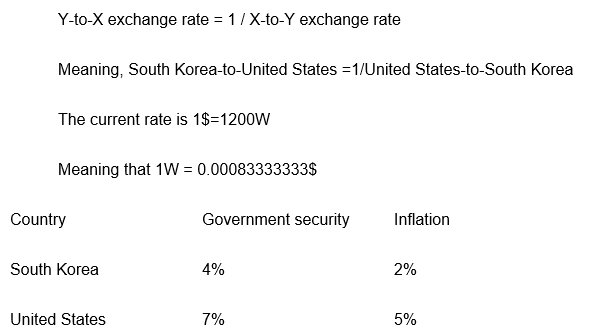

The current exchange rate as provided in the question is $ 1 at W 1200. According to the provisions given, United States has a one year government security rate of 7% as well as an expected inflation rate of 5%. One the other hand, South Korea has a one year government security rate of 4% and an expected inflation rate of 2%. The simple way of calculating exchange rates for known values is

Since the United States had government security of 7%, its maturity at the end of the year is expected to reduce their monetary value with respect to south Korean, that is, their value will be 1200*93%= 1116W; 1$ =1116W

During the same period, South Korea had government security at 4%, this reduces their monetary value to the dollar by 4%, their value will therefore be 96%*1 $=1116W

That is; 0.96$=1116W i.e. 1$= (1/0.96)*1116W=1162.5W

Again taking inflation rates into account, since the United States had an inflation of 5%, this will lower their monetary value by 5%with respect to South Korean, i.e. 1$=1162.5*95%W, which will give a rate of 1$=1104.375W. On the other hand, South Korea had an inflation rate of 2% meaning monetary devaluation by 2% with respect to United States $ i.e. 98%*1$=1104.375W. Giving 0.98$ exchanging for 1104.375.

Therefore, 1$ = (1/0.98)*1104.375W. i.e. 1$=1126.913265 in 6 decimal places.

Conclusion

Inflation reduces the monetary value of a country; this is similar to Government debts in form of securities which also leads to currency depreciation. The forecasted exchange rate between United States and South Korea in a year’s time will be as shown below.

1$=1126.913265 (6 decimal places).