Southwest Airlines is a low-cost airline that operates in the United States and focuses on short, high-traffic flights. Its prospects are currently in question due to a combination of emerging demand issues and challenges to its operational and financial performance. Moreover, the COVID-19 pandemic may exacerbate these problems due to its significant and varied adverse effects, such as the bans on flights and the general economic damage due to lockdown orders. The current circumstances, combined with current trends in aviation and some of Southwest’s practices, namely fuel hedging, can overturn the company’s lengthy trend of profitability. This case study will discuss the growth rates of domestic demand in the United States as well as the airline’s excellent operational performance and potentially risky financial practices.

Main Body of Findings

As a mode of transport, airlines’ traffic growth is subject to the needs of their users and their capability to afford the service. As such, some of the factors described by Profillidis and Botzoris (2018), specifically purchasing power and technological improvements, are relevant because of their significant presence in the U.S. economy and aviation. Fraumeni (2019) was optimistic regarding both the nation’s current prosperity and its prospects, such as the increasing adoption of information technologies, which would motivate Americans to purchase more. Additionally, Kellari et al. (2017) projected significant efficiency improvements in current and future aircraft via the development of more efficient engines without altering the design of the plane, lowering costs and thereby increasing demand through the increased affordability of tickets. These factors appear the favour the United States, as its traffic has grown consistently since the 2008 financial crisis, and favors remained the largest market for airlines in the world (Belobaba et al., 2015).

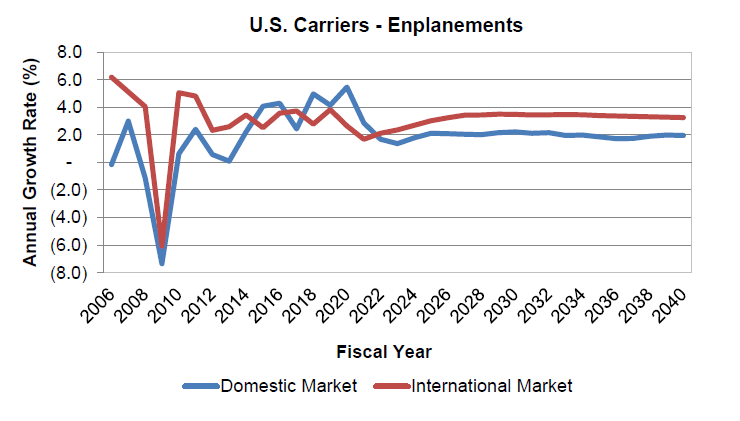

However, when viewed from an international perspective, concerns may emerge regarding the situation within the United States. Lai et al. (2018) contrasted the 2016 U.S. domestic flight market growth rate in the U.S., which was 3.9%, to that of China, where the same characteristic was at 7.1%. With that said, there is still significant potential in the market, as it was projected by the Federal Aviation Administration (2020) to grow over 50% by 2040. The domestic sphere is particularly important because it constitutes most of U.S. air traffic and because 80% of the tourism in the nation is local rather than international (Graham & Dobruszkes, 2019). As can be seen in Fig. 1, domestic market growth is projected to stabilize at 2% in the future, which is likely the result of the market’s age and saturation. Ison (2007) highlighted how increases in the density of air routes that are served are associated with diminishing returns, as these new routes compete for existing customers more than they create new ones. As such, carriers will generally have to rely on increasing traffic on existing ones.

It should be noted that the framework presented so far does not take into account various potential crises, such as the current COVID-19 situation. Cronrath (2017) discussed the well-documented volatility of the airline industry, which struggles to adjust supply to demand due to its high fixed costs. Moreover, as Gössling et al. (2020) noted, the current COVID-19 pandemic and the associated travel restrictions are already affecting airlines and the economy as a whole, with international traffic projected to decline by 20 to 30%. These losses are in large part the result of flight cancellations, which also affect domestic flights and, therefore, Southwest Airlines. As Vasigh et al. (2013) stated, the growth in air travel demand is closely associated with economic growth, which exacerbates the danger of the current crisis to the aviation industry. As a mostly American company, Southwest Airlines will have to address these concerns as well as any internal issues to survive.

Southwest Airlines’ financial performance in the past can be considered excellent. Throughout the last forty years, the company has consistently remained profitable and grew to become the largest U.S. carrier, valued at approximately $26 billion with 747 aircraft (Brown & Stewart, 2019; Southwest Airlines, 2020). According to Adler (2018), its success is a combination of cost leadership (superiority through having the lowest costs) and a blue ocean strategy (innovation to capture uncontested markets). However, in recent years, its expenses have been growing faster than its revenues, a change that the business claims to be a result of the Boeing 737 MAX scandal (Southwest Airlines, 2020). If this claim is accurate, the decline may be temporary and non-meaningful in the long term.

Southwest Airlines is renowned for its focus on operational performance to create cost savings and foment innovation. It operates as a point-to-point carrier that focuses on high-traffic routes, achieving efficiency through low turnaround times and closely networked operations (Billig & Cook, 2017). Moir and Lohmann (2018) praised Southwest Airlines for being the sole U.S. airline that formulated a strategy, which involves high network density, fleet uniformity and cost leadership, and followed it completely and successfully. Barnes (2018) suggested that the company achieved this success by imitating industries that perform better in some aspects than airlines and innovate for success. With that said, it also compromises on service onboard planes, though in doing so, it has saved costs and increased its market share to one of the largest in the nation (Smith, 2016).

Southwest Airlines may also be more ready for various crises than much of its competition. Dyer et al. (2017) suggested that it remained profitable throughout various downturns because of its high load factor, with up to 79.3% of seats consistently filled on its flights due to the low turnaround times, which were minimized through various speed improvements. The business also has a robust focus on its employees and customers, driving loyalty and improving performance through an emphasis on employee happiness and engagement as well as reliability and low prices (Kraft et al., 2017; Halpern & Graham, 2018). Employees respond with innovations, with MacNeice and Bowen (2016) describing the case of a worker who developed a revolutionary scheduling program at home.

With that said, as Vasigh (2017) indicated, while the company may be better prepared to deal with the various dangers to the aviation industry than many of its competitors, it is still vulnerable to them. Southwest Airlines (2020) expressed concern regarding the current COVID-19 crisis, noting that the company is significantly underperforming compared to projections. A massive decline in stock price has resulted from the crisis, as Fig. 1 shows. Fuel, which is particularly relevant to airlines per Wensveen (2016), is an especially significant source of concern, as the company spent $4.3 billion, or 22.3% of its total operating expenses, on it in 2019 (Southwest Airlines, 2020). Giachetti (2016) stated that Southwest Airlines engages in aggressive fuel hedging due to expectations that oil prices will continue to rise. If, as in the current situation, oil prices fall considerably, the company can sustain a significant loss on its investment.

Recommendations

First, it is necessary to discuss fuel price hedging, as it has significant pros and cons. Gajjala and Dafir (2016) identified benefits such as a reduction in distress costs and improved capital conservation as well as a lowering of debt costs. However, Chatterjea and Jarrow (2019) provide the example of Southwest Airlines not saving $535 million, or 15.9% of its total fuel costs, while other companies recorded losses between $366 million (for Delta Air Lines) and €905 million (for Lufthansa), as a result of fuel price hedging. Vasigh (2017) attributed these losses to excessive usage of the practice, which leaves airlines vulnerable to the opposite price extreme. Hedging is still highly beneficial to the stability of an airline, but Southwest Airlines should reduce the percentage of the fuel that it hedges to avoid massive losses.

A merger may be the most promising solution for the improvement of the company’s stability. Tabacco (2016) described Southwest Airlines’ 2011 acquisition of AirTran, a smaller low-cost carrier. The practice’s primary benefit is the economy of scale that is created as a result, enabling increased efficiencies and cost savings (Iatrou & Oretti, 2016). However, as Lelieur (2017) warned, long-term planning before the act is necessary to secure the majority of the benefits on schedule. As such, Southwest Airlines should monitor potential crises and begin planning a merger immediately if it expects difficulties in the foreseeable future.

In the event of long-term success, Southwest Airlines should shift its concern to the saturation of the market. Panibratov (2017) proposed international expansion as a strategy that is frequently used by businesses in search of a new market. Billig and Cook (2017) predicted that developing regions would be responsible for 70% of future air traffic growth, as citizens of nations such as India and China move up into the middle class and become able to afford flights. Southwest Airlines’ operational excellence can allow it to overcome emerging competition (Voigt et al., 2017). As such, a venture to expand into these new regions, possibly through acquisition and reorganization of an existing LCC, as was the case with AirTran, can prove highly beneficial and profitable.

Conclusion

Although Southwest Airlines’ operational performance is excellent, the company’s outlook identifies several significant issues. Demand in the United States is likely slowing down significantly due to market saturation. Many of the factors that create losses, such as the Boeing 737-MAX grounding and the COVID-19 pandemic, are beyond Southwest’s control. However, some of the practices that it engages in, particularly fuel hedging, have also led to high additional costs as a result of their excessive and risky applications. As such, it should limit its amounts of hedging and consider options to combat depressions and guarantee future growth. Mergers appear to be the most feasible solution to the first issue, improving the resilience of the entities that engage in it. To secure long-term growth, Southwest may turn its attention to developing nations such as China and India once its current situation stabilizes.

References

Adler, R. W. (2018). Strategic performance management: Accounting for organizational control. Taylor & Francis.

Barnes, D. (2018). Operations management. Macmillan International Higher Education.

Belobaba, P., Odoni, A., & Barnhart, C. (2015). The global airline industry (2nd ed.). Wiley.

Billig, B., & Cook, G. N. (2017). Airline operations and management: A management textbook. Taylor & Francis.

Brown, K. G., & Stewart, G. L. (2019). Human resource management. Wiley.

Bureau of Transportation Statistics. (2020). Final full-year 2019 traffic data for U.S. airlines and foreign airlines U.S. flights. Web.

Chatterjea, A., & Jarrow, R. A. (2019). Introduction to derivative securities, financial markets, and risk management (2nd ed.). World Scientific Publishing Company.

Cronrath, E. (2017). The airline profit cycle: A system analysis of airline industry dynamics. Taylor & Francis.

Dyer, J. H., Godfrey, P., Bryce, D., & Jensen, R. (2017). Strategic management: Concepts and cases (2nd ed.). Wiley.

Federal Aviation Administration. (2020). FAA aerospace forecasts: Fiscal years 2020-2040. Web.

Fraumeni, B. M. (Ed.). (2019). Measuring economic growth and productivity: Foundations, KLEMS production models, and extensions. Elsevier Science.

Gajjala, V. N., & Dafir, S. M. (2016). Fuel hedging and risk management: Strategies for airlines, shippers and other consumers. Wiley.

Giachetti, R. E. (2016). Design of enterprise systems: Theory, architecture, and methods. CRC Press.

Gössling, S., Scott, D., & Hall, C. M. (2020). Pandemics, tourism and global change: A rapid assessment of COVID-19. Journal of Sustainable Tourism. Advance online publication. Web.

Graham, A., & Dobruszkes, F. (eds.). (2019). Air transport – a tourism perspective. Elsevier Science.

Halpern, N., & Graham, A. (eds.) (2018). The Routledge companion to air transport management. Taylor & Francis.

Iatrou, K., & Oretti, M. (2016). Airline choices for the future: From alliances to mergers. Taylor & Francis.

Ison, S. (ed.) (2017). Low-cost carriers: Emergence, expansion, and evolution. Taylor & Francis.

Kellari, D., Crawley, E. F., & Cameron, B. G. (2017). Influence of technology trends on future aircraft architecture. Journal of Aircraft, 54(6), 2213-2227. Web.

Kraft, P., Stahlhofer, N. J., & Schmidkonz, C. (2017). Conscious business in Germany: Assessing the current situation and creating an outlook for a new paradigm. Springer International Publishing.

Lai, K. K., Zheng, Y., & Wang, S. (2018). Forecasting air travel demand: Looking at China. Taylor & Francis.

Lelieur, I. (2017). Law and policy of substantial ownership and effective control of airlines: Prospects for change. Taylor & Francis.

MacNeice, B., & Bowen, J. (2016). Powerhouse: Insider accounts into the world’s top high-performanceorganizationss. Kogan Page.

Moir, L., & Lohmann, G. (2018). A quantitative means of comparing competitive advantage among airlines with heterogeneous business models: Analysis of US airlines. Journal of Air Transport Management, 69, 72-82.

Panibratov, A. (2017). International strategy of emerging market firms: Absorbing global knowledge and building competitive advantage. Taylor & Francis.

Profillidis, V., & Botzoris, G. (2018). Modeling of transport demand: Analyzing, calculating, and forecasting transport demand. Elsevier Science.

Smith, T. J. (2016). Pricing done right: The pricing framework proven successful by the world’s most profitable companies. Wiley.

Southwest Airlines Co. (LUV). (2020). Web.

Southwest Airlines. (2020). Southwest Airlines Co. 2019 annual report to shareholders. Web.

Tabacco, G. A. (2016). Airline economics: An empirical analysis of market structure and competition in the US airline industry. Springer International Publishing.

Vasigh, B. (2017). Foundations of airline finance: Methodology and practice. Taylor & Francis.

Vasigh, B., Fleming, K., & Tacker, T. (2013). Introduction to air transport economics (3rd ed.). Ashgate Published Limited.

Voigt, K., Michl, K., & Buliga, O. (2017). Business model pioneers: How innovators successfully implement new business models. Springer International Publishing.

Wensveen, J. (2016). Air transportation: A management perspective (8th ed.). Taylor & Francis.