Company Overview

Southwest Airlines Co. (NYSE: LUV) is based in the United States, Dallas Texas. In terms of domestic passengers carried, southwest airline is the biggest airline in the U.S. with over for decades of service experience, the company is known within the airline industry as a low fare main domestic airline. Southwest has continued to set itself apart from the competition especially the other low fare airlines by delivering its products in a reliable manner coupled with unmatched customer service. The company was incorporated in Dallas Texas on 18th of June 1971 with its Boeing 737 plane serving three cities in Texas: Houston, San Antonio and Dallas. Currently, Southwest airlines are the US largest carrier in terms of passengers originating from the U.S. (Baker 2010, p.1).

Financial Analysis

Growth

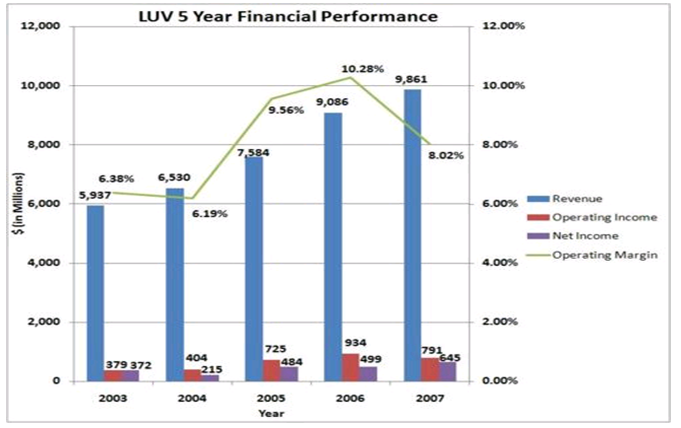

The total sales revenue made by Southwest airlines increased by a margin of 8.50 percent from the 2007 figure of to $ 9,086 to $9,861 in 2008. The company continued to register remarkable improvement in its sales revenues in 2009. The total sales revenues achieved stood at $ 11,023 representing an increase of 11.78 percent over the 2008 figure of $ 9861. However, in 2010, the company suffered a major shock following a drastic decline in its sales revenue by a margin of 6.1 percent ($10,350). The sharp decline can be attributed to the effects of the global crisis. Individuals and corporate bodies were forces to cut on their expenses; air fares included which led to a decline in sales for Southwest Airlines. However, the decline did not last for long as the company registered a significant increase in its sales revenue by a margin of 17 percent in 2011, with the total sales revenue standing at $ 12,104. According to the S&P 500 Capital IQ sales forecasts for the next five years, Southwest Airlines has a bright future as the sales are expected to grow by 3% in 2012; 5% in 2013; 8% in 2014; 9% in 2015 and 9% in 2016 respectively. This can be attributed to the fact that the U.S. economy which is the companys main market segment is on a recovery path, as people get back their jobs and their incomes increase, their travel expenses will equally increase.

Profit Margin

In 2008, Southwest Airlines revenues increased resulting in an increase in its profit margin from 5.49 percent in 2007 to 6.54 percent in 2008. However in 2009 and 2010 following the decline in the companys revenues, the profit margin dipped from 6.54 percent in 2008 to 1.61 percent in 2009 and a further decline to 0.96 in 2010. In 2011 however, the significant increase in its sales revenues resulted into an increase in its profit margin from 0.96 percent in 2010 to 3.79 percent in 2011 representing an increase of 2.83 percent. The significant drop in the profit margins in 2009 and 2010 is largely due to the impacts of the global crisis that led to reduced air ticket sales. Southwest airlines could not keep its margins up when its volume of sales declined. However, from the projections, the company will enjoy a stable profit margin over the next five years. The year 2012 is not yet the best year in the airline industry as most of the companies are still trying to cop up with the high fuel prices and the effects of the crisis.

Earnings Quality

In 2011, the company repurchased close to 27.5 million shares of ordinary stock at a cost of $225 million. This was in response to the decision made by the companys board of directors on 5th August 2011(Southwest 2011 Annual Report 1). In the same year, total amount spent in debt repayment amounted to $ 638 million. Because of this, the ratio of debt to capital improved from 50 percent in the period following Airtran acquisition to approximately 47 percent in December 2011. Among all the U.S. airlines, only Southwest airline was investment grade rated.

No doubt in the past decade the airline industry has suffered a significant amount of challenges among them the worst aviation recession in history, the global credit crisis, rising jet prices going as much as five fold. These left the airline industry in total financial mess with the industry registering losses approximated at $ 50 billion (Southwest 2011 Annual Report 1). These challenges negatively affected many of the U.S. airlines ending of operations while others reorganized through bankruptcy. Southwest Airlines on its part withstood the challenges. In fact, it is the only major U.S carrier that has successfully delivered yearly profits to its stockholders for 39 consecutive years. The company declares dividends on quarterly basis. In 2007 and 2008, the dividend as a percentage of sales was relatively high 5.49 percent and 6.54 percent respectively. During the bad economic times 2009 and 2010, dividend payments as a fraction of total revenue declined to 1.61 percent and 0.96 percent respectively.

Balance Sheet

Southwest Airlines is a lowly leveraged company. For the past five years, its debt to equity ratio has been consistently low with a high of 0.73 in 2008 and a low of 0.3 in 2007. Within the airline industry, many companies are financially distressed that has necessitated huge borrowings to finance their operations resulting in huge debt to equity ratios for the individual companies and the industry as whole. Southwests debt equity ratio is far above the industry average. According to Morgan and Summers (2005, p. 1), Southwest Airlines are ranked second among the regional airlines in terms of debt-to-equity ratio and it falls within the 81st percentile. The financial position southwest Airlines is operating under is not ideal because it has a weak balance sheet. It is using more debt to fuel its growth and operations, if this is not checked; it can significantly affect the future prospects of the company (Kaser & Oelkers 2008, p. 42).

Similarly, over the past five years, the company has had a steady current ratio with a low of 0.9 in 2007 and a high of 1.58 in 2009. In 2007 and 2008, the current ratio was a bit low because for it only had $0.9 and $0.92 in its current assets respectively for every dollar worth of current liabilities. However, from 2009, the figure has remarkably improved and the company is in a position to meet its short-term obligations. In the last financial year 2011, the current ratio stood at 1.29 meaning for every dollar of current liabilities, Southwest Airlines has approximately $ 1.26 with which to pay them.

On the other hand, the companys quick ratio has been increasing considerably from 2007 with the highest performance in 2009 and 2010 (1.17 and 1.12 respectively). In 2011 however, the ratio dropped to approximately 0.8. Overall, we can conclude that the company is in a position to repay its short-term obligations and other financial obligations that are due within a period of one year (Cobbs & Wolf 2004, p. 303).

Valuations

Multiple Comparisons

Southwest Airlines (NYSE:LUV) is comparable to Jet Blue Airways Corporation (JBLU, Delta Air Lines (DAL), Alaska Air Group (ALK) all of which operate within the airline industry.

Price Multiple Comparison

The price multiples indicate how much the investor receives on the price paid on LUVs stocks. The price multiples tend to significantly vary with time. They are very useful in the valuation process when we compare them to those of the competitors operating within the same industry (Kotler 1997, p. 56). To begin with, the ratio of price to sales indicates how much an investor is paying for each dollar worth of sales. As at 16th April 2012, LUV had a price to sales ratio of 0.3973 coming second to ALK at 0.5742, while the other comparables JBLU and DAL had registered 0.3194 and 0.2475 respectively (Brooks 1994, p. 1). In terms of price to earnings ratio which indicates how much the investor pays for each dollar worth of earnings, LUV leads the list at 34.74, followed by JBLU (17.29), ALK (10.48), and DAL at (10.16) respectively as at 16th April 2012 (Kaser & Oelkers 2008, p. 1).

When valued in terms of price to book ratio, which indicates how much the investor pays for each dollar worth of net assets, LUV comes second last with 0.9046 as at 16 April 2012. DAL leads the list at 5.193, followed by ALK at 2.113 while JBLU scores the least 0.8185.

Comparing the historical figures for the above three ratios to the S&P 500, we deduce the following conclusions. LUVs P/E ratio has outperformed the S&P 500 for the last four years up to 2011. It is only in 2007 that LUV P/E was below S&P 500 (14.5 against 16.5). However, the price to book and price to sales ratios have consistently fallen below the S&P 500 ratio over the same period (Lancaster & Massingham 1996, p. 84).

Southwest Airlines EV/EBITDA was 5.89 in 2011. Compared to the competitors for the four years up to 2009, LUV comes third with an average of 13.41. The airline with the highest EV/EBITDA is ALK (42.44), followed by JBLU (14.25), and DAL at the last position with 3.28. It is evident that LUV is on the tail end, however. ALK is much of an outlier. If we are to compare LUV with the second best JBLU at (14.25), then we can conclude that Southwest Airline Company has a chance to grow its yields within the airline industry. In addition, the company registered a net margin of 1.1 percent. When we compare the 2011 4th quarter performance of LUV with other comparable companies, LUV takes the third position with a net margin of 3.7 percent. ALK leads with 6.13 percent, followed by DAL 5.06 percent while JBLU takes the last position with a net margin of 2.01 percent. LUVs net margin is relatively small implying that the company has a weak competitive advantage in its operation. However, the company enjoys significant levels of pricing power and capital intensity. The low net margin registered in 2011 can be attributed to significant expenditures on fixed assets following the acquisition of Airtran and the purchase of new planes.

We compute a reverse valuation of the market assumed growth rate for LUV in order for it to be regarded as valued at its existing market price. The growth rate applied to calculate LUVs free cash flow is derived from CAPITAL IQ growth rate projections of free cash flows for LUV over the next five years (2012-2016). Similarly, a discount rate of 7 percent is applied as it represents the yearly average rate of return for the S&P 500 for the last 10 decades. Based on CAPITAL IQ free cash flow growth rate of 7 percent for Southwest Airlines, current price for LUV stock of $ 8.08 and a discount rate of 9 percent, we compute the companys growth price to be $ 15.97 being an undervaluation by a margin of 97.68 percent (Smith 2004, p. 31).

The companys stability price stands at $ -1.07. the stability price ascertains the companys value based upon its capacity to sustain its operations using its average operating margins. The negative stability price for Southwest airlines is a clear indication that the company requires a considerable amount of capital to run its operations. This is because, the capital expenditures made outweigh the companys adjusted operating income. The company heavily depends on the growth of its revenues to sustain its operations. As a result, it has to significantly spend in order to achieve the desired level of revenue growth. These huge expenditures cannot be financed entirely from the companys account, as a result, it will have to borrow externally to fuel its growth (Smith, Berry & Pulford 2002, p. 105).

Valuation of Shareholder Returns

For the last 39 consecutive years, the company has been consistent in the distribution of dividends to its shareholders. Such an outstanding dividend record implies that that the company has a sound foundation in the airline industry market. In addition, such a policy is likely to continue in the near future. Similarly, the company is well known for its efforts in value creation for the shareholders through stock buybacks. These efforts have been significant in enhancing the financial metrics and boosting relative ownership stake of each individual shareholder in the company because of having few outstanding shares and holding the same volume of stocks (Mcdonald 2011, p. 116).

Conclusion and Recommendations for the Future

Generally, the acquisition of Airtran, the Rapid Rewards program in addition to low ticket prices are excellent avenues for Southwest airlines to create a loyal customer base. Frequent travelers will continue to fly Southwest Airlines not just because of the low fares but equally due to exemplary customer service and the fact that they are rewarded for every flight they take. The company can enhance its market leadership by expanding its rewards program especially during the current hard economic times. This will help it create a very new market segment of loyal customers. For instance, when a customer who travels less frequently earns 50 points on first flight, the chances are high that the next time he/she travels, Southwest airlines will be his/her airline of choice because the 50 points can cover the cost of baggage check. Expanding its rewards program in addition to using its strengths in customer service, the company will build a solid, devoted and sustainable customer base. This will boost the companys profitability and further strengthen its position in the Airline industry as a market leader.

References

Baker, M 2010, The Strategic Marketing Plan Audit: a detailed top management review of every aspect of your company’s marketing strategy, Axminster, Devon, Campridge Strategy Publ.

Brooks, C 1994, Sports marketing: competitive business strategies for sports, Prentice Hall, Englewood Cliffs.

Cobbs, R & Wolf, A 2004, Jet Fuel Hedging Strategies: Options Available for Airlines and a Survey of Industry Practices, Springer, Northwestern University.

Kaser, K & Oelkers, D 2008, Sports and entertainment marketing, Thomson South-Western, Mason.

Kotler, P 1997, Marketing Management: Analysis, planning, implementation and control, (9 edn.), Prentice Hall, New York.

Lancaster, G & Massingham, L 1996, Strategic Marketing Planning and Evaluation, Kogan Page, New York.

McDonald, M & Payne, A 1996, Marketing Planning for Services, Butterworth- Heinemann, London.

Mcdonald, M 2011, Marketing plans: how to prepare them, how to use them, John Wiley Chichester.

Morgan, M & Summers, J 2005, Sports marketing, Thomson, Southbank, Vic.

Smith, G 2004, ‘An evaluation of the corporate culture of southwest airlines’, Measuring Business Excellence, vol.8, no.4, pp. 26-33.

Smith, P, Berry, C & Pulford, A 2002, Strategic marketing communications: New ways to build and integrate communications, Kogan Page, London.