Introduction

Financial analysis of a particular company analysis its past and future growth. Financial performance of the company is analyzed for the past five years in order to understand the situation of the company in the market. As per the financial report, the company has been going in loss from the past five years. The net loss as per the financial performance report is increasing every year. Statement of financial position can also be defined as situation of the company’s assets, its liabilities, and owner’s equity. In order to calculate the owners Equity as per the formula, the total number of assets minus total liabilities results in the owner’s equity.

The main aim of the project is to calculate intrinsic value of a share, compare it, and know whether it is overvalue or undervalue.

Background of the company

Mobily is one of the largest communication services company in Saudi Arabia and it is popular for its exceptional telecommunications services. They have a mission of exceeding the customers’ expectation. They offers internet and telephone services both fixed and mobile. Mobily’s wireless service provision is one of the fastest in terms of growth in the Saudi Arabia. Nonetheless, other products and services of the company encompass network business, supply business, vending shops, Internet services, Short Message Service (SMS), multi-media services, cellular and personal computer operations and satellite operations. They have cellular devices approaches more than the number of computer; carriers are increasing assuming the role of major Internet access companies, especially in upcoming markets.

Valuation of shareholder value

When calculating intrinsic value of a share, the future cash flows are estimated using the seven drivers of shareholders value model. These values have been estimated using historical data as provided below:

Stockholders are mainly concerned about the earnings that will eventually pay them back as dividends from the company or on the other hand retains in the company to expand shareholders interest in the company since the firm retains the earnings. Earnings per share (EPS) are expressed on a per share basis.

The effect of Different Growth rates on the share price

Growth rate of any particular company analyzes the assets, earnings and the growing dividends in the particular financial year. Dividend discount model initiates a clear understanding of different growth rates and the relationship between share price, rate of return and dividend is analyzed. Any particular company may have no growth, constant growth or non-constant growth.

The weighted average cost of capital

Cost of equity: Discount rate is used to calculate present value of future cash flows. In order to calculate the Discount rate one can use the Capital Asset Pricing Model (CAPM) equation. This is because CAPM is a model that is widely accepted and used as a way of assessing the levels of risks associated with a particular asset that is being considered for investment. Although this model is not perfect however its use has allowed investors to somewhat predict the level of the investment risk that is associated. The main message, which CAPM model gives to its users, is that how much return premium they can expect from their investment in any security keeping in view the riskiness relative to the market benchmark. This means that the expected return on investment in an asset depends upon the risk assessment of the stock in relation to the volatilities that can be observed in the comparable set of securities or market. This also implies that it allows investors to determine the expected return on their investments in a stock, which allows them to eliminate the unsystematic risk. Thus, based on this model risk associated with the investment can be ascertained based on the assumptions that this model uses. The equation is

re = rf + β (rm – rf)

According to gulfbase.com of 3rd January, 2012; the companies Beta is 0.72. Risk free market is considered 3% and market to be 17%.

Therefore:

- re = 0.03 + 0.72 (0.17 – 0.03)

- re = 0.01308

- re = 13.08%

This figure will not be used as cost of equity in the analysis as we are using book values not market values, Thus ROE is used.

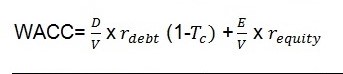

Weighted average cost of capital is the average cost of components of capital. The weighted average cost of capital is computed as

There is a difference between the intrinsic value and the market value. It means the stock is undervalued by the market as compared to intrinsic value. The main reason for the differences between the market value and intrinsic value is due to forces operating in the market. The share of the company is performing better than the market and it has lower element of market risk as compared to the market itself. The amount of systematic risk in the price of the share of the company is lowered by unsystematic risk.

Measurement of risk to shareholders

A company’s shareholders risk can be measured by the changes in its assets and equity in comparison to its debts. Beta is the measurement of fluctuation of a stock return for a particular period. Beta measures the risk of portfolio. Due to a lot of fluctuation in the foreign exchange market and the fluctuations in the interest rates investors are exposed to a lot of risk since the fluctuations affect their investment directly.

In order to measure the risk, a financial manager would consider building up a financial representation of the company and the market, which it operates in. This will provide a clear view of the risk assessment to the shareholder. In addition, a shareholder may consider a financial risk management for their investment. Diversifying investment is one of the ways, which are preferable in today’s market scenario. Diversifying investments help the shareholder spread their investment over a number of other investment opportunities.

Is the share over valued or Undervalued

A stock is undervalued when the intrinsic value is higher than the market value. Similarly, a stock is overvalued when intrinsic value of the share is lower than the market value. The share value increases when it declares a financial year profit, its disclosures about their future prospects and projects, this makes the investors invest in the organization when the organization is ready to buy back its own shares in some cases. An undervalued share is of a high risk since if the book valued price is lower than the market value there is a high risk to the investment made by the shareholders due to the loss already incurred due to the lower book value and even a higher risk is involved if the book value decreases.

The price of the share currently is 52 and intrinsic value $ 94.17.

The share or market price of Mobily is 52.00 and thereby is lower than its intrinsic value and, therefore, the stock is undervalued thus comprising a low risk to the investors and shareholders. The stock price is actually representing the company realistically in terms of its actual worth. The return on investment from the company is steady and growing steadily as well with many strong core competencies but not generating income in an explosive manner like well known technology companies do. The PE multiple is also average as well. In short, the company is a solid business however, does not belong to the impressive category either as a business or as an investment option. Solid and steady depict them perfectly.

Technically, they are the same but in the real world, the buy and sell strategy is inferior simply because there are broker’s fees that deduct amounts from your stock account every time there is a transaction on your behalf. The type of returns you gain in the end will be wiped out if ever there are any. In addition, any loss on your part would be exaggerated because of the added burden of transaction fees. Therefore, in the end, the best choice is still the buy-and-hold strategy because it saves you from transaction fees plus the flexibility of holding out much longer if the price is not favorable to you.

There is a difference between the intrinsic value and the market value. It means the stock is undervalued by the market as compared to intrinsic value. The main reason for the differences between the market value and intrinsic value is due to forces operating in the market. The share of the company is performing better than the market and it has lower element of market risk as compared to the market itself. The amount of systematic risk in the price of the share of the company is lowered by unsystematic risk.