Introduction

The considerably competitive airline industry today has prompted the players to consider collaboration with partners to foster their survival collectively. Because of globalisation and the heightened competition, the airlines of the current world regard the essence of joining strategic alliances as crucial for bolstering their competitiveness (Jiang, Wan & D’Alfonso 2015).

Initially developed to serve as small-scale deals that facilitate the cooperation of at least two airlines, current economic trends have favoured the emergence of strategic alliances characterised by enormous and ambitious projects that pursue the improvement of air transport networks. For this reason, the three strategic airline alliances, including Star Alliance, SkyTeam, and OneWorld, have put considerable efforts towards enhancing the competitiveness and sustainability of the individual partners. The three strategic alliances comprise between 15 and 28 carriers (Garg 2016).

Recently, new developments in the airline industry have forced competitors to consider new forms of partnerships that exist within or outside the three strategic alliances. Notably, the increase of joint ventures, embracement of equity models, the emergence of new groupings, and the formation of partnerships between and among low-cost carriers characterise the airline sector currently (Grauberger & Kimms 2016).

As such, analysing the current environment in the said industry concerning collaborative efforts geared towards fostering sustainability in different economic times is essential. Therefore, this paper captures the status of current partnerships in the airline sector before assessing their potential for success in the end. Additionally, the paper would focus on future projections concerning the three strategic airline alliances by addressing the aspects of adaptability, relevance, and survival. Moreover, providing recommendations regarding the strategic direction of the CEOs of the three strategic alliances would form the latter part of this paper.

The Three Global Strategic Alliances

As earlier identified, the three strategic alliances that dominate the airlines’ sector include Star Alliance, OneWorld, and SkyTeam. The strategic alliances provide a platform where individual carriers experience streamlined control of airline acquisitions and mergers. Further, the alliances facilitate the neutralisation of restrictions imposed by various governments on different carriers.

Furthermore, OneWorld, SkyTeam, and Star Alliance negotiate on behalf of individual partners regarding issues influenced by bilateral regimes (Jiang, Wan & D’Alfonso 2015). Therefore, the airline coalitions play a central role in combating the barriers that inhibit the competitiveness of individual members across borders. Thus, providing an overview of the key alliances before looking at the different forms of emerging partnerships in each is crucial.

Star Alliance

Established in 1997, Star Alliance has scaled the heights to become the largest airlines group in the sector. After its inception, Thai Airways International, United Airways, Air Canada, Scandinavian Airlines, and Lufthansa collaborated to offer widely expansive and efficient air travel. Currently, the alliance comprises 28 full members that coordinate the strategic efforts of the world’s leading aviation players and smaller regional carriers.

The Star Alliance pursues the facilitation of easy connection to any destination in the world possibly. Besides, the main ambition of the alliance is the provision of smooth travelling encounters. The airline achieves the goal through the close location of member carriers at airports, the construction of shared airport facilities including check-in kiosks, and the scheduled destinations (Grauberger & Kimms 2016).

Bilateral agreements between distinct airline companies construct the formal governance of Star Alliance. In a bid to foster multilateral governance, the aviation association formed the Alliance Management Team. The management board coordinates the efforts of individual carriers from diverse countries of origin in a way that creates conducive atmospheres for conducting their operations (Iatrou & Oretti 2016). Furthermore, the Star Alliance allows each member to maintain its cultural identity style thereby, introducing the richness of multiculturalism and diversity to the alliance. Further, the individual airlines uphold a shared commitment towards the provision of top-notch customer service and customer safety.

Star Alliance Partnerships

Over the years, Star Alliance has concentrated on the formation of partnerships that favour the realisation of its goal of taking passengers to every major destination or city on earth. The dawn of 1977 saw the partnership of five airline companies including Scandinavian Airlines, Thai Airways International, Air Canada, United Airways, and Lufthansa (Jiang, Wan & D’Alfonso 2015). The initial partnership provided a breaking ground for further mergers, acquisitions, and joint ventures besides other collaborations that have facilitated the realisation of Star Alliance’s goal, considerably.

The fluctuating economic trends currently have necessitated the alliance to widen its operations strategically thereby, attracting 28 airline companies up to date. The notable airlines include Copa Airlines that covers the South American skies, Air New Zealand and Ansett Australia operating the Oceania region, as the South African and Ethiopia Airlines provide air travel in Africa. In the recent past, Star Alliance attracted airline players such as Air India and Air China, considered the future industry giants.

Star Alliance’s joint venture with SAS Group, in 2013, influenced the operations of the alliance considerably after Singapore Airlines intensified its flights between Singapore and Scandinavia (Garg 2016). The alliance strengthened the traffic of the alliance’s member airlines between Scandinavia and Singapore in a way that provides it with business growth opportunities.

Further, Star Alliance has seen some of its members engage in partnerships with groups outside the strategic airline association. For example, Singapore Airlines, a major airline at Star Alliance, acquired a 10% stake in Virgin Australia, for slightly over $108 million, in 2012. Important to note, Virgin Australia is an affiliate of the Virgin Atlantic Group, headed by a UK billionaire, Richard Branson (Garg 2016).

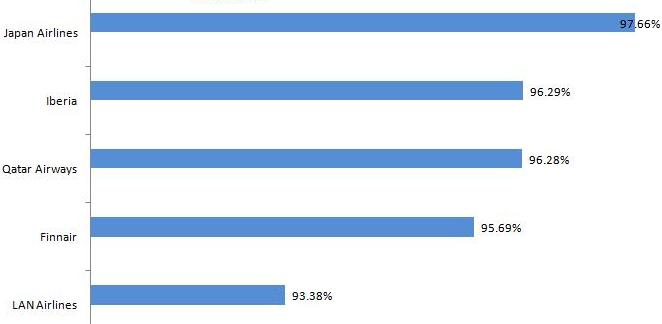

Therefore, partnerships with members of other airline groupings show the extent to which the current economic tides affect the major strategic airline alliances. The Star Alliance has come with the merit of enhanced survival of the individual entities. For example, in June 2016, the entities combined their operational capability to deliver collective synergies in terms of ensuring on-time flights while maintaining low delay times as shown in Table 1.

Table 1: Performance of Top 5 Airlines that form the Star Alliance

Source: China Aviation Daily (2016)

OneWorld

Established in 1999, OneWorld, headquartered in New York City, is a considerable strategic alliance in the airlines’ industry since it consists of giant airlines including Qantas, American Airlines, British Airways, and Cathay Pacific (Jiang, Wan & D’Alfonso 2015). The primary objective of the airline alliance is to the frequent world travellers’ first choice service provider in the industry.

Thus far, the strategic alliance has made remarkable strides towards the realisation of its objective by carrying at least 557.4 million travellers within the first eight months of 2016 (Grauberger & Kimms 2016). This objective was realised at a time when Oneworld recorded delay times that averaged at 13.48 minutes. This figure was the lowest in the industry. As indicated in Graph 1, each of the Oneword members has different scores in terms of time- performance. The aggregated scores give the entire alliance a higher notch in terms of competing effectively in the industry.

Oneworld alliance has a fleet of at least 3,560 aircraft that operate nearly a thousand destinations present in over 161 countries. Additionally, the airline player has engaged in further partnerships that have enabled it operates more than 13,814 departures daily. Notably, OneWorld became the first strategic airline alliance at the global level to incorporate interline ticketing amongst the member carriers. The ticketing system ensures that travellers benefit from greater flexibility and streamlined transfers throughout its network.

OneWorld’s Partnerships

The initial partnerships that saw American Airlines, British Airways, Qantas, and Cathay Pacific realised impressive results in line with the alliance’s strategic plan thereby, fostering the attainment of its objective. In the recent past, the entry of European airlines including Iberia and Finnair broadened the coverage of the air travel company in the region, thus, enhancing its competitiveness.

In a bid to enhance its sustainability, the alliance secured its partnership with LanChile to operate the Latin American region. Interestingly, the OneWorld lured a Middle Eastern airline, Royal Jordanian, the first carrier from the region to join a global strategic alliance, in 2005 (Garg 2016). Additional efforts to bolster the competitiveness and sustainability of the company saw it welcome on board the Malaysian Airlines and Japan Airlines to cover the Asian skies.

Currently, various forms of partnerships have influenced considerably OneWorld’s aim of establishing profound relationships with regular international travellers especially the business and corporate world cohort. Notably, the alliance focuses on satisfying the needs of its multiple and diverse clientele, and thus, despite its narrow coverage scope compared to Star Alliance and SkyTeam. Therefore, looking at the various forms of partnerships affecting the functionality of OneWorld is relevant given that the new partnerships have the potential of jeopardising the alliance’s focus on attracting more business clientele travelling internationally, regularly.

External strategic partnerships have also characterised the new face of the OneWorld alliance. Notably, members of the alliance have reached pacts with industry players that are not members of OneWorld. For instance, in 2012, Air Berlin, a member of OneWorld, entered into a partnership with Etihad Airways where the latter secured a 29.25 share of former’s equity.

Thus, the embracement of the equity model of partnership implies that Etihad Airways acquired the majority of Air Berlin’s stakes indicating that it has considerable control over financial matters and its operations. Etihad Airways has been known for engaging in strategic alliances through the equity model as seen in the case of its partnership with Alitalia and Jet Airways (Grauberger & Kimms 2016). Therefore, the approach tends to threaten the commitment of Air Berlin towards the realisation of the OneWorld’s strategic goals.

SkyTeam

Incepted in 2000, SkyTeam is less experienced yet the fastest-growing airline alliance out of the three global strategic alliances managed centrally from Schiphol Airport, The Netherlands. Originally, four carriers including Delta Airlines, Air France, Aeromexico, and Korean Air joined hands to facilitate the provision of the strategically wide coverage of the globe’s air travel hotspots. Thus far, 20 members who operate their flights in at least 1064 world destinations situated in 178 countries constitute the strategic alliance for airline companies.

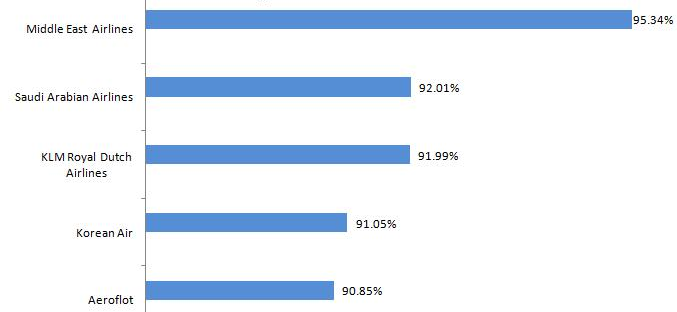

The diversification of the alliance’s coverage through partnerships has seen joining of Kenya Airways, Saudi Airlines, Garuda Indonesia, and China Airlines. In line with Clark’s (2010) views concerning alliances, just like the case of Oneworld and Star Alliance, SkyTeam Alliance’s entities evidence different performance levels, which help to build collective synergies. Graph 2 illustrates the on-time performance for a sample of five top SkyTeam member airlines by June 2016.

Partners such as KLM, established in 1919, the oldest carrier company that still operates using its original name, provide experience richness to the company. However, the current economic developments have affected the industry significantly implying that experience alone is not sufficient for the survival of the member airlines (Garg 2016).

SkyTeam’s Partnerships

The need to satisfy the diverse needs of customers has prompted some members of SkyTeam to collaborate with low-cost carriers (LCCs). Relevant to know, LCCs regard themselves as a different version of the airlines’ industry. Thus, partnering with strategic alliances would undermine their sense of belonging. Therefore, in a bid to counter the perception, members of SkyTeam such as Aeromexico are currently in talks with various LCCs to seal partnership deals.

Similarly, members of OneWorld led by Qantas joined hands with Virgin Australia, an LCC, while Star’s South African Airways partnered with Conair. Importantly, such partnerships seek to enhance the competitiveness Of SkyTeam since its rivals have already embraced partnerships with LCCs.

Further, members of SkyTeam have also found wider coverage of the skies by partnering with other carriers in code sharing processes. For instance, in 2015, KLM Royal Dutch Airlines to enter a codeshare agreement with Oman Air that would allow the latter’s customers to use the former’s flights plying the Muscat-Amsterdam route. Thus, the move implied that Sky’s goal of bolstering its coverage of various regions of the world by linking Europe and the Middle East.

Additionally, Kenya Airways agreed with Jet Airways, a leading Indian airline company in 2010. The move shows that SkyTeam carriers are continually partnering with other players from outside the group. The codeshare agreement has been integral in connecting India and the East African region, thus, opening up more opportunities for the growth of SkyTeam strategic alliance.

The Success of Airline Partnerships in the Long Term

The success of the unending partnerships in the airlines’ industry is dependent on different aspects of the agreement. As noted, members of the three strategic alliances including SkyTeam, OneWorld, and Star Alliance have adopted several forms of partnerships that affect their functionality and sustainability in the long run. The increasing joint ventures, embracement of the equity model, emergence of new groupings, and LCC partnerships pose a sizable influence on the prosperity of the three global alliances. Thus, assessing the success rate of the emerging partnership forms that affect the performance of the global airline alliances in future is essential.

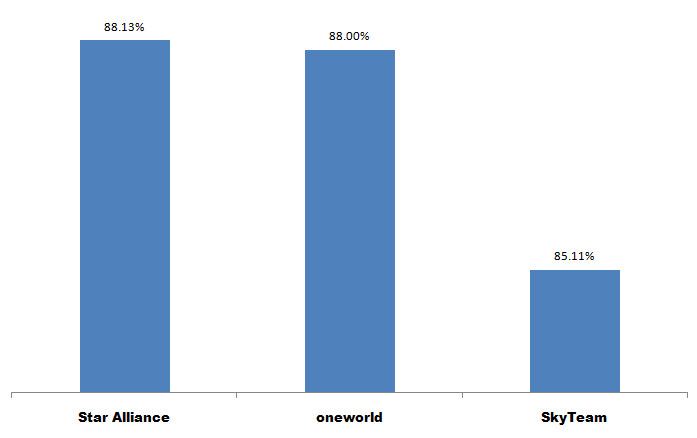

According to Clark (2010), when airlines combine their operational capabilities, they deliver higher performance. However, this finding does not suggest that different airline partnerships do not vary in their performance. For example, Graph 3 shows differences in the performance of Star Alliance, Oneworld, and SkyTeam using arrival time as the parameter for measuring their performance. The graph shows that Star Alliance delivered 88.13% of its flights right on time. The other two airlines were less punctual. Therefore, by June 2016, Star Alliance was the most punctual airline alliance across the world.

The increasing need for gaining a considerable share of the market has prompted several members of the main airline alliances to consider pulling out. Notably, players such as Etihad Airways have lured other competitors not affiliated to the three alliances to engage in codeshare agreements that have heightened their chances of surviving the competitive markets.

Further, the adoption of the equity model has influenced various members of the alliances to realise pacts that seek to bolster their coverage (Barbot & D’Alfonso 2014). Therefore, the different forms of partnerships experienced in the Aviation industry have mixed implications on the success of the global alliances for airlines besides improving the sustainability of individual members.

Joint Ventures in the airlines’ industry are increasingly heightening the chances of success among different players in the sector. Statistics reveal that Joint Ventures, which acted as the new forms of partnerships in the sector, characterised the operations of at least 45% of the giant carriers, in the next decade. Therefore, the current success brought about by Joint Ventures in the airlines’ industry hints greater prosperity in future.

For instance, Joint Ventures between Alitalia, Air France, KLM, and Delta, facilitate the realisation of at least 250 flights across the transatlantic skies daily, operating more than 500 destinations globally. Consequently, the partnership accounts for 25% of the travelling capacity between Europe and North America (Garg 2016). Thus, besides eliminating direct competition, I think Joint Ventures would be successful in the aviation sector by enhancing their efficiency while plying different international networks.

Further, I also believe that the embracement of the equity model by various players in the air transport sector is a strategic move towards bolstering the success of members. For instance, OneWorld’s Air Berlin has realised greater capital reserves after joining hands with Etihad Airways, Alitalia, Air Seychelles, Alitalia, Air Serbia, and Jet Airways (Lordan et al. 2015). Therefore, the members of the equity partnership strategy benefit from the creation of a total that exceeds the greatness of its parts.

The Future Prospects of the Three Alliances

The Star Alliance purposes to develop its prospects by adding into its networks ‘Hybrid’ and Low-cost airlines. In what the Star Alliance calls ‘Connecting Partner Model, Mango which is a South African carrier will enrol first. In the fresh arrangement, the routes managed by second-tier airlines will help increase the network of Star Alliance beyond its 28 core associates.

On another note, the Star Alliance, in the future, seeks to venture into new markets particularly Africa after increased pressurisation by some of its clients. However, the CEO, Mark Schwab, indicated that in many instances that network carriers are not able to cover this market and consequently the company in the future is going to develop connecting partners, which will proffer expanded network to its clients (Garg 2016).

In the coming days also, Star Alliance will draw partners within its ranks where side-shoot low priced airlines provide routes that their parent does not. Some of such partners include Lufthansa’s EuroWings, Scoot Airlines, and Air Canada’s Jazz (Barbot & D’Alfonso 2014). On a different note, although clients using the Connecting Partner airline will get the benefits accruing from using the Star Alliance Gold associates as well as those offered by partners, the airlines might not be part of the Star Alliance

Opportunities for the OneWorld alliance can be viewed through its urge to protect its position in the current market. To protect this position, the company intends to develop steadily, parallel to the air travel industry growth. Additionally, to foster the efficacy of the approach, the alliance purposes to secure clients in the expanding sectors of the industry.

In this understanding, the company made the Total Value Proposition declaration to boost the association’s commitment to Japan Airlines. The Total Value Proposition amounted to US$1.8 billion. This significant figure is directed towards ensuring the JAL would not flinch from the OneWorld Alliance. Keeping the JAL in the alliance is significant because due to its critical value in connecting other members of the alliance to Japan.

SkyTeam alliance views its opportunities in China and the larger Asian market. In seeking to expand its services in China and the broader Asian region, SkyTeam alliances aim to partner with China Airlines to complement the Shanghai-based and Guangzhou Airlines.

The working together of SkyTeam and the three Chinese airlines will give SkyTeam alliances a strong position in China. Further, the partnering of SkyTeam alliance with China Airlines helps the former effort to be the dominant air service provider in Asia. China Airlines will bring in four fresh international routes, which will ultimately connect China and Asia with the view of tapping into the numerous opportunities that arise from China, which is the second-largest growing economy in the world (Iatrou & Oretti 2016).

The Need for Adaptation

The prospects facing the strategic alliances require the players to put in place adaptive measures that would facilitate their survival in the ever-changing market environments. Notably, the new forms of partnerships provide greater flexibility that allows airlines to operate in wider networks.

The more comprehensive coverage of individual players is a key factor that enhances competitiveness. Additionally, players such as Star Alliance need to intensify efforts towards the incorporation of Alliance IT in its systems to foster effectiveness, a move that can be bolstered by partnerships (Lordan et al. 2015). Thus, carriers need to adapt to the long-haul networks that encourage flexibility in a way that reduces direct competition among the key players.

Adapting to the current trends implies that the members of OneWorld, SkyTeam, and Star Alliance need to intensify strategic partnerships with LCCs to meet the widening demands of customers. Thus, legacy carriers need to join hands with LCCs such as Southwest Airlines and Ryanair by adopting approaches including joint ventures and the equity models among other strategies (Iatrou & Oretti 2016). In this light, the need for adaptation is crucial for the success of individual carriers and the irrespective strategic alliances at the global scale.

The Relevance of the Prospects to the Strategic Alliances

The prospects that would influence the airline industry hold considerable relevance. Thus, they require the consideration of SkyTeam, OneWorld, and Star Alliance. Therefore, taking into account the different aspects of changes that require adaptation is vital for the realisation of the goals designed by the three global airline alliances. Therefore, the future anticipations imply that the different members of the major airline alliances need to gain a significant share of their domestic markets, secure a dominant position the regional markets, and the creation of a global presence in the sector through strategic partnerships and entering marketing alliances (Barbot & D’Alfonso 2014).

In the past, the efforts of KLM, a key member of SkyTeam, to gain a significant ground of the domestic market allowed it to incorporate the equity model of partnership to acquire a weighty share of domestic players such as NetherLines besides its charter carrier. The move is also relevant today for other carriers since it goes a long way in enhancing competitiveness at different levels.

Notably, the 1988 move by SAS to acquire the German carrier, Deutsche BA, proved integral in bolstering its success in the European market thereby, fostering its performance in the region (Lordan et al. 2015). Moreover, gaining presence in the entire international markets is necessary for the sustainability of the alliances since gaining more coverage of the skies implies the need for further partnerships with carriers having similar interests.

The Survival of Strategic Airline Alliances

The current economic atmosphere in the aviation sector puts the survival of carriers in the different strategic alliances in jeopardy of survival. Previous inquiries reveal that members of strategic alliances involved in Joint Ventures and shared marketing approaches have greater chances of survival. In this regard, associations need to encourage individual carriers to engage in Joint Ventures that foster codesharing, pooling, marketing, and block space (Iatrou & Oretti 2016). Thus, the integration of IT alongside such partnerships has the potential of bolstering sustainability in the end.

The equity model of partnerships is with detrimental outcomes amid its considerable contribution towards enhancing resource commitment. Essentially, the complexity of the equity model has undermined the effective functionality of strategic airline alliance members. For instance, the equity model prompted governance conflicts between KLM and Northwest, British Airways and USAir, and KLM and Alitalia (Iatrou & Oretti 2016). Therefore, the approach could undermine the survival of strategic alliances shortly.

Moreover, strategic airline alliances that embrace at least two partnership typologies have a greater chance of survival compared to the ones engaging in at least one form of partnership. Thus, joining groupings, realising agreements with LCCs, and embarking on Joint Ventures heighten the odds of prospering in the competitive skies (Lordan et al. 2015). In this regard, the CEOs of SkyTeam, OneWorld, and Star Alliance need to consider several recommendations that would bolster their competitiveness in the industry.

Recommendations

Star Alliance

The Star Alliance as a major player in the global strategic alliances needs to concentrate on increasing the number of its joint purchasing initiatives in a bid to reinforce its position in the airline sector. Important to note, the CEO, Mark Schwab, needs to consider engaging in partnerships with lower-tier carriers and LCCs through Joint Ventures, instead of the equity model it has adopted on several occasions. In doing so, members such as Singapore Airlines, Turkish Airlines, United Airlines, and Air Canada could make significant efforts towards fostering sustainability.

Additionally, Star Alliance needs to focus on the integration of robust IT systems in its entire network. The management of the IT infrastructure from a centralised point would allow the members of the alliance to harvest the positive outcomes of an integrated system that seeks to satisfy the dynamic needs of customers. Notably, the Star Alliance Gold initiative would benefit significantly from the absorption of technology to the alliance’s network of carriers.

OneWorld

The CEO of OneWorld, Bruce Ashby needs to take into consideration a few crucial issues that would see the increased competitiveness of the members of the strategic alliance. The alliance needs to shift from the equity model approach of partnerships since it affects its survival negatively, in the end. For instance, the Total Value Proposition with JAL has not realised the anticipated growth regarding the network of the alliance. Thus, embracing partnerships with other aviation groups and LCCs is preferred to heighten the competitiveness of OneWorld.

SkyTeam

The CEO of SkyTeam, Perry A. Cantarutti needs to regard some initiatives that would be handy in fostering the survival of the youngest global airline alliance. Importantly, the player needs to intensify its efforts towards securing partnerships with carriers in the Asian continent. In this regard, realising strategic partnerships with more Chinese carriers besides China Airlines and Guangzhou Airlines is recommended.

Additionally, SkyTeam needs to venture into more partnerships with other alliance in a bid to cement its position as the fastest rising strategic alliance globally. In this regard, besides engaging in joint ventures with Star Alliance members, SkyTeam needs to consider luring the carriers affiliated to OneWorld. For example, attracting JAL, an unsettled member of OneWorld is a strategic move that would bolster its competitiveness in the aviation sector.

References

Barbot, C & D’Alfonso, T 2014, ‘Why do contracts between airlines and airports fail?’, Research in Transportation Economics, vol. 45, no. 1, pp.34-41.

China Aviation Daily 2016, Global Alliance On-time arrival performance Report for June 2016. Web.

Clark, P 2010, Stormy skies Airlines in crisis, Routledge, London.

Garg, C 2016, ‘A robust hybrid decision model for evaluation and selection of the strategic alliance partner in the airline industry’, Journal of Air Transport Management, vol. 52, no. 2, pp.55-66.

Grauberger, W & Kimms, A 2016, ‘Revenue management under horizontal and vertical competition within airline alliances’, Omega, vol. 59, no. 1, pp.228-237.

Iatrou, K & Oretti, M 2016, Airline choices for the future: from alliances to mergers, Routledge, New York, NY.

Jiang, C, Wan, Y & D’Alfonso, T 2015, ‘Strategic choice of alliance membership under local competition and global networks’, Journal of Transport Economics and Policy (JTEP), vol. 49, no. 2, pp. 316-337.

Lordan, O, Sallan, J, Simo, P & Gonzalez-Prieto, D 2015, ‘Robustness of airline alliance route networks’, Communications in nonlinear science and numerical simulation, vol. 22, no. 1, pp.587-595.