Introduction

In this paper, I will give detailed information on the general performance of the target corporation based on its marketing and financial analysis. I will highlight the background of this company and its business activities. I will then proceed to analyze the business effectiveness in context of its financial performance. The challenges in its financial performance will be identified. I will base my interest on the company’s transaction for three years that resulted to its performance. I will then make my recommendation on the course of the action that it is necessary according to my view. This idea may not be an effective idea today but it will be very effective and add value to the management of Target Corporation.

Company Background

The Target Corporation was formally known as the Dayton Hudson Corporation. Dayton bought the stock of Hudson’s corporation in 1969 forming the partnership. He later bought many retail chain stores that facilitated the growth of the target corporation. This corporation has two centers one in Minneapolis and the other one in Minnesota on top of that it has three divisions that cater for all the income groups as indicated in fortune (1999). These are Mervyn’s which caters for the middle income groups and it is located in California it deals with casual apparel and home furnishing. The second one is known as Marshall Field’s which is located in Chicago, Minneapolis and Detroit it deals with women and men apparel, accessories and home furnish. The last division is the Target found across the country and deals with the groceries and health and beauty products.

The corporation is headed by a CEO who is also the chairman the divisions are also managed by a different CEO and president. Each of the divisions runs as independently but they share technology, coordinate purchase and management of finance. Its mission is to provide quality goods at attractive prices in friendly environment. The corporation has continued to grow at a very high rate; in 2003 it had 1225 stores in 48 continental states. Their vision is to provide their services to all locations.

Analysis

Marketing analysis

The marketing strategy of this company is of a very high technology. It advertises in the local newspapers thus ensuring the local market is well informed of their products. The corporation also is aware of his targeted customers in each of its division and therefore tries at it level best to reach out to them. Yahoo a global internet company has leased the company’s space in the Marshall Field’s store. They use this opportunity to advertise their product through the net. They also operate direct merchandise and electronic retailing in their website known as www.target.com.

Financial analysis

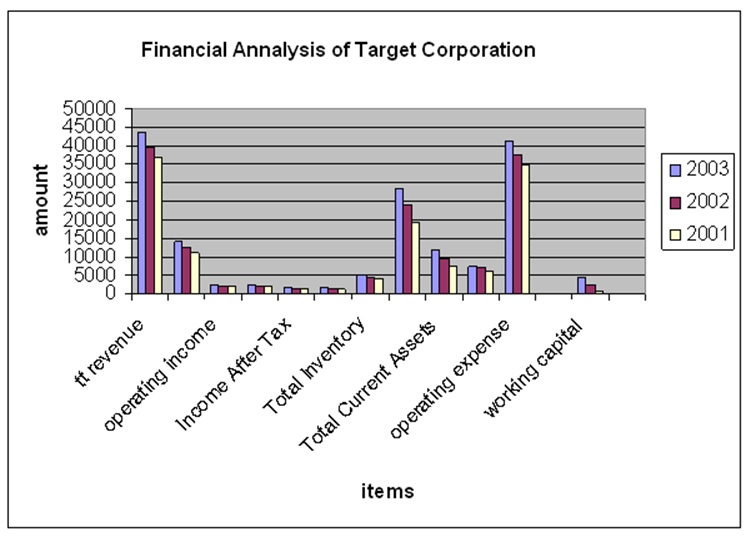

The financial performance of the corporation from the year 2001 to 2003 has been very encouraging. They recorded an increase of $390 million in their revenue in 2003 as compared to 2001considering the fact that the total operating expenses had increase as well as the income taxes. Also it is clear that the value of the dividend per share had also increased.

The graph below analysis several items in the profit and loss account as well as the balance sheet to show the performance of this business for three years. It can be seen that the financial position of this company continues to increase as it approaches the year 2003. The total revenue has increased from 36851 million dollars to43917 million dollars. This implies that target has increased its sales to a recommendable value within these two years. Another interesting factor about this corporation is that although it continues to increase its operating expenses its income after tax is also increasing. Considering the assets of the company they follow the same trend.

Identified Issues

In doing the analysis of this corporation I identified various issues that face Target Corporation at company’s level. Wall street journal (2004) the major problem with the companies operation is the increased operational expenses despite the high rate of expansion. Since this company shares the same technologies financial and supply services it should be reflected by a decline in operating expenses.

Recommendation

This company has the potential to meet its target in the near future. The operation expense is increasing as it grows its total debt also has an increasing trend. This might lead to a decline in the total income. My recommendation is that the corporation should not be thinking of outsourcing their debt instead they can go ahead and retain back their profit. They can also issue more shares to the public so that they can increase the value of the amount of the income of this company.

Fred (2004) the company also needs to improve their creativity in advertisement so as to fit in the competitive market. Since various division deals with similar lines they can merge them instead of one operating at a stone throw distance.

Implementation Plan

The first step would be to merge some of these companies that are near each other like in Kalamazoo in Michigan which has Marshall Field’s department stores and Mervyn’s in less than a mile from each other. By so doing I will reduce the number of staff and the managerial expenses. This will lead to decrease in the operating expenses. The likely negative effect is that it might result to the divisions losing its customers but this can be avoided by creating awareness about the company by advertising. David and Ronald (2001)

The other plan would be to issue more shares to finance the debt and cater for the operating expenses. This will decrease the value of these expenses as well as the debt. There might also be an increase in the ownership of the corporation which will decrease the value per share. The company should continue providing a good public image to avoid this.

Closing remarks

From the above analysis it is evident that the Target Corporation needs to increase on its operating expenses to improve its general financial performance. There is need to merge some of the divisional stores that are found near each other. There is need to have a proper auditing to know which branch should merge. With the current internal auditors in this corporation there is need for financial analysts to help in analysis of the merging stores. My service will be at your disposal once you decide the course of action to take.

References

Branch, Shelly. (1999). “How Target Got Hot.” Fortune: 168-174.

David, W. & Ronald, R. (2001). Corporate Performance Management. Butterworth: Heinemann Publishers.

Fred, D. (2000). Strategic Management: Concept and Cases. India: Prentice hall publishers.

Zimmerman. (2004). “Investors Aim Their Displeasure at Target.” Wall Street Journal.