Euro Disney was a company on the verge of economic collapse reflected on the grim figures of its financial statements. Below is an illustration of the statement from 1993/1994.

To steer the organization into profitability to become a market player and strategically position it in the market, the organization’s risk-taking intellectual executives had to embrace knowledge management skills integrated in the organization’s culture, behavior and vision to be a market leader, to gain a strategic market position.

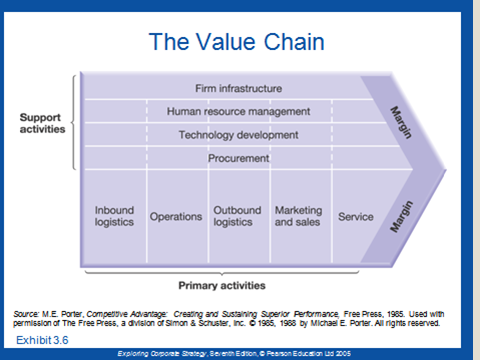

One of the key elements for the management was to use value addition and analysis techniques in the design and implementation of its value chain activities in addition to embracing the four concepts of product, price, promotion and place in the pursuit of a bigger market share, a strong brand name and image which are vital for any business interest.

These value chain activities could help position Euro Disney at a strategic position if the business managers envisaged them in the infrastructure of the company by identifying the human resources available, their knowledge and skills, the technology they had. Technology was catered for by integrating different subsidiary companies in addition to identifying logistical needs of the company and its subsidiary companies.

These value addition activities are a chain of events and activities which add value to the final product making it more valuable than the original product and competitive in the market. In addition to that, as illustrated in the case study, these value chain activities lead to the final cost of the product being lower than the value of the final value-added product. This is a combination of activities such as economies of scale, experience, supply costs, and the product design process. Euro Disney failed in this (Strategic Management 1).

Euro Disney has integrated the above factors in its value addition process particularly in the development and design of many of its unique products tailored to reflect the target market. The unique products include identification of cultural values of the target market such as the European markets and the Japanese market.

One of the successful integration of value addition activities included the Japanese Tokyo Disney land, a target market. The management of Euro Disney identified the unique market characterized by the 2 million customers annually, its potential as a tourist destination, readily available infrastructure, and a large market for its unique products.

The management, strategically thinking like their customers, tailoring and adding value to their products, strategically used the value chain analysis to identify the market potential and improve the quality of their product offerings.

According to the article Value chain (Business Edition) (1), one of the primary activities the management of Euro Disney in its value chain analysis incorporated in the infrastructure of the organization was identifying strategic value addition activities such as the creation of resorts for family vacation entertainment centers, large and unique cultural offerings for its customers, and family vacations for those who wanted to stay for a short period of time in those parks.

However, Euro Disney’s management in its business strategies was using the same value addition activities to destroy itself. The decision by Walt Disney to build Euro Disney was a financial disaster culminating in the loss of $43 million against an investment of $ 600 million, reflecting poor management decisions in the use of the value chain analysis concepts. In addition to that, these value addition activities were clearly illustrated in the development phase the company invested in. These included phase one and phase two of the development plans (Strategic management 1).

The above chart clearly illustrates Euro Disney’s value chain activities and the financial management activities of the company in terms of the subsidiary companies it formed in its value chain activities incorporated in its strategic management plans.

The unique financial management structure illustrated above clearly illustrates the unique relationship between different European subsidiaries and Euro Disney. In addition to that other subsidiaries were managed by different companies such as the Euro Disney SCA by Euro Disney SA a subsidiary of Euro Disney.

According to the article Strategic Management (1) additional value chain analysis activities by Euro Disney included the management’s ability to identify logistical activities incorporated in the structure of the management as illustrated in the case study, out bound logistics, and the operations leading to it, the marketing and selling activities and tasks, services provided after the product had reached the market in this case including the kind of services customers received when enjoying the facilities and services of Euro Disney and those offered by subsidiary companies culminating in the company’s margins.

The organization was keen in factoring intellectual needs of the customers by identifying cultural and intellectual needs. This was vital in knowledge management initiatives of the organization. The wide variety of strategies in customer needs and customer behavior were deciding factors in value addition activities. These cultural needs included the French culture in addition to knowledge management skills of identifying and emphasizing on intellectual needs in the design of its products.

The use of value chain analysis was directly linked to the organization’s failure realized in the first year of business when students demonstrated identifying inherent design problems which did not factor customer needs in the event of a rise in the number of customers. The design did not incorporate the organization’s image in the context of European needs with an emphasis on European cultural context.

It clearly bore the characteristics of the American culture, thus a failure in the part of the organization in using its knowledge management skills and value chain analysis techniques in addressing customer needs. Such a poor image does not place a company in a strategic market position, particularly in its initial stages entry into the market. The company was plagued with loss-making financial statements, bad economic situation, and plummeting number of customers in addition to dwindling profits. The organization was on the verge of collapse.

It was incumbent upon the management of the company and its subsidiary companies to take bold and decisive actions to redesign its value chain activities and align the company with a vision that could integrate it into the exiting market create a good brand name and image in its value chain activities.

References

Strategic Management, The value chain [Online] 1999-2007. Web.

Strategic management. The Value chain Web. 2002-2007. Web.

Value chain (Business Edition). IBM Corporation. Web.