Executive Summary

The aim of this paper is to construct a five years strategic plan for the Zurich Financial Services Group for the development of its services in its current and emerging markets. In addition, Zurich intends to boost its yearly revenue by 6% within next five years by using its resources and capabilities.

As a result, this five years strategic plan discusses the competitive challenges, mission, vision, SWOT strategic matrix, competitive forces, global strategies, and external and internal market atmosphere through the application of TELESCOPIC OBSERVATIONS method, financial ratios, and value chain analysis, key factors for success, BCG growth matrix for Zurich, branding models, and strategic group analysis to solve key issues.

Furthermore, this strategic plan concentrates on in putting together the 7p framework, budgetary requirements, control, milestones, and other corrective actions to reach its objective.

Key Issues

A brief account of key issues of the Zurich group is considered below:

Key Competitive Challenges

- It is a great challenge for Zurich to contend with high competitions from the insurers like AIG, Allianz-Group, Chubb-Group, Hartford Financial Services, ING Group, Prudential Financial, Sun-Life Financial, and Swiss Re (Swiss Re, 2010);

- Development of its services in the emerging markets would require huge capital investments (Frigo, 2009);

- The company needs to comply with all the legal and societal issues of the developing countries (Kokosinski, 2009);

- To gain competitive advantage over the competitors Zurich needs a proper utilization of its core competencies.

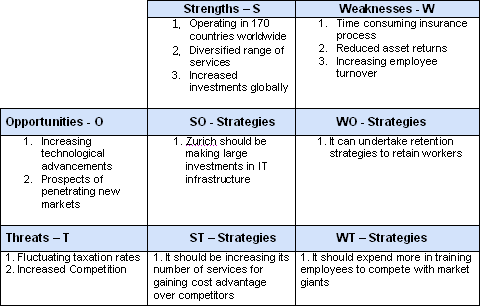

SWOT Analysis

The SWOT analysis of Zurich Financial Service Group has outlined below:

Strengths

- Zurich is one of the largest insurance businesses in Europe that have operations in about 170 countries worldwide with the help of 60,000 workers (The Times 100, 2010);

- It offers a wide range of services to its global customers;

- It possess a strong financial position through which it is able to do large investments for the development of the services provided (Insley, 2010);

- Strong operating performance throughout its core businesses and constant renovation of operating platforms reinforce its efficacy and competence.

Weaknesses

- The process of insurance making is time consuming for the customers;

- The recruitment policy of the company do not have a proper focus over its retention strategy (Zurich Financial Services, 2010);

- The company more often fails to address the cultural gap between expatriates and the company.

Opportunities

- The company is enhancing its services in terms of technology; this would ensure customers’ convenience, which in turn would induce them to take its services again and again;

- Kandell (2010) states that Zurich will be further developing its value chain system in future to increase its operational efficiency;

- It has a strategy to enter in some new markets for generating more income.

Threats

- Governmental regulations in some of its operating countries are getting very strict for the foreign businesses;

- Apart from a competitive pressure from the renowned businesses, many new players are entering the industry (Anon, 2010).

Vision, Mission, and Corporate Objectives

The Zurich Group considers its mission, vision, and corporate objectives by keeping in mind the factors that can influence its plan to develop its service in the operating markets.

Vision Statement of Zurich

It aims to continue providing pioneering services and other facilities to its customers through operational distinction and moral groundwork; through this, the company wants to be a leader in this industry within the chosen markets and deliver sustainable performance and highest customer satisfaction.

Mission Statement of Zurich

Zurich’s mission is to provide exceptional service and to be the best insurance provider of the world by means of an ingenious approach and incessant progression of uniqueness; moreover, it anticipates attaining this through employee leveraging, formation of manifold distribution channels, collaborating with concurring institutions, and utilizing IT facilities.

Corporate Objectives

The company has a number of corporate objectives for the enhancement of its business in the next few years in the existing markets. Currently, the company has the following corporate objectives:

- It aims to include a few more life endowment policies in order to raise its yearly sales by 4% over next five financial years.

- From $32,516 million direct written premiums and policy fees in general insurance in FY 2009, Zurich has a plan to augment these fees to $65,032 millions by 2015 through market enlargement strategy (Zurich Financial Services, 2009).

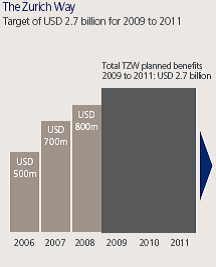

- By developing its services in the existing markets, it will be increasing its business operating profit from $26,029 million in 2009 to $52,032 million by December 2014 (Zurich Financial Services, 2009). In addition, Zurich has a plan to reach the target of 2.7 billion by FY 2011:

It will amplify its net investment result on Group investments by 3% in 2015 from 3,181 million in 2009.

Situational Analysis

This analysis is the delineation of the factors that Zurich confronts from the external environment and an appraisal of the externalities that can influence Zurich’s strategic approach to developing its services.

Macroeconomic Analysis

PESTEL Analysis of Zurich:

The PESTEL Analysis of the Zurich Service Group has outlined below:

Political Factor

For reason that Zurich operates in about 170 countries all over the world, and that all those countries possess different political atmospheres, its operations are largely under influence by political situations, for example, by regional treaties, trade policies, and conflict/wars, policies formulated by respective governments, elections and relationships across its trading countries.

Economic Factor

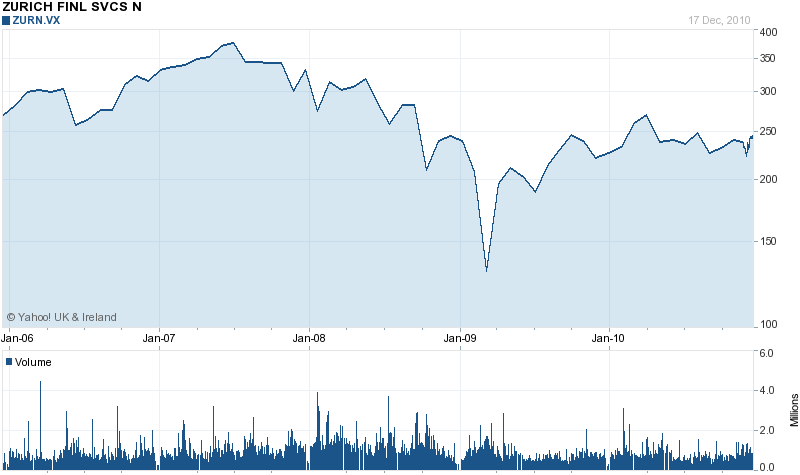

The development of the services of Zurich in the current and emerging markets require a huge capital investment. Therefore, it is necessary to address the current economic condition of the company. It is arguable that the share prices of Zurich were quite stable from January 2006 to the middle of 2008; however, due to falling demand of its services during the recession, the company faced a fall in stock prices at 2009 (Yahoo Finance, 2010). Currently, Zurich is reviving back its stock prices as shown in the following figure.

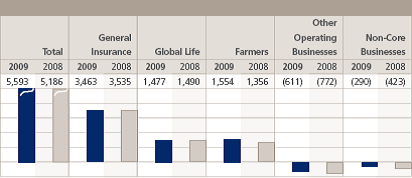

Zurich Financial Services (2009) suggests that the company’s business total operating profits was 5,593 million in 2009, which is a quite impressive figure. A comparison of the company’s performance indicators has shown in the following figure:

Socio-cultural Factor

Zurich’s main principle remains to adopt quickly the societal and cultural concerns of the countries in which it operates. For example, whilst operating in Middle East, the company bears in mind that the local vicinities over there are very conservative and responsive to religious sentiments. Zurich also works to mitigate cross-cultural barriers and gender inequalities for its employees.

Technological Factor

To compete with the global players, Zurich is constructing strong IT infrastructure for carrying out the operations; for example, its new software has expected to be profitable for future development.

Environmental Factor

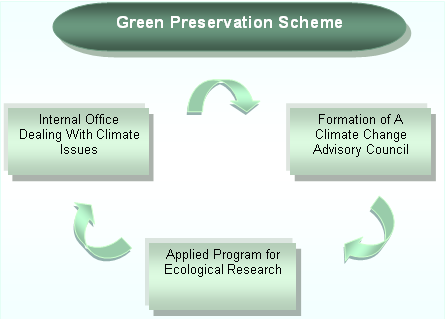

The company is very adept in managing issues related to pollution reductions. To implement ecological targets it is expending huge amounts in its green preservation proposal:

Legal Factor

Zurich Group complies with all the legal and regulatory requirements of the countries in which it operates internationally.

Industry Analysis

Zurich Financial Services is a player of an industry that is highly competitive because of the presence of numerous rival businesses. A detailed assessment of the industry analysis of this company has provided through the TELESCOPIC OBSERVATIONS technique –

Table 1: Part 1 of the TELESCOPIC OBSERVATIONS technique of Zurich Group. Source: Self-generated from Zurich Financial Services (2009).

Strategic Groups analysis

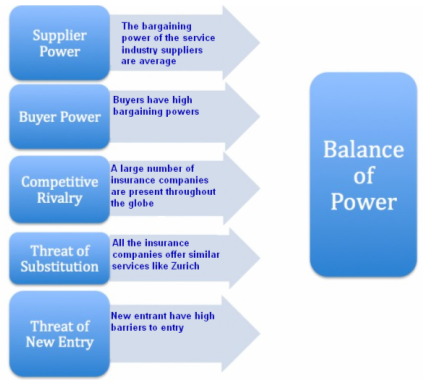

The strategic group analysis has conducted below with the help of Porter five forces model.

- Threat of New Entrants. The threats of new entrants are relatively low in this industry due to the presence of a number of obstacles to penetrate the market; it is rather hard for the new comers to sustain in such competitive environment.

- Rivalry among competitors. The competitive rivalry is quite high in the market because of the presence of many industry giants like Swiss Re and ING Group.

- Bargaining power of buyer. The existence of a large number of rivals means that the switching costs of the customers are relatively low. However, despite all these, Zurich has many loyal customers.

- Bargaining Power of Suppliers. There are adequate suppliers present in the industry making their bargaining powers quite endurable.

- Threats of substitute product. All the rival firms of Zurich offer similar types of services; in context, the competitive pressure over Zurich to diversify its service range increases. This has shown in the following figure:

Key Factors for Success

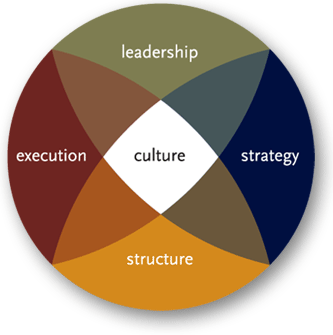

The annual report of Zurich suggests that the company has success factors in five main business areas:

- Corporate culture: Excellent working atmosphere with effectual communication between co-workers;

- Organizational structure: The operating structure of the company is very cost-effective to suit with its service type;

- Strategies: It focuses on methodical strategic decision-making;

- Leadership: It has strong top-level leadership;

- Execution: Zurich always remains very watchful in executing the strategies.

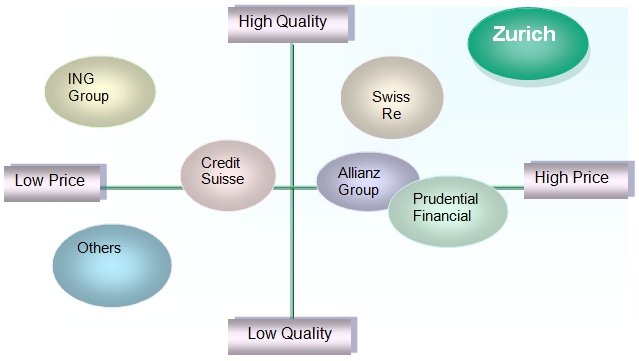

Positioning Map

Along with many competitors present in the global insurance industry, and with high quality services at high prices, the positioning map of Zurich will look as demonstrated in the figure below:

Competitor Profiles

- Swiss re: It is one of the biggest insurance companies in the EU and is located in Zurich, Switzerland; it not only provides numerous insurances to the clients but also helps them to assess risk;

- Allianz Group: It is located in Munich, Germany; besides of offering several services, this business has about hundred subsidiaries operating in many European countries;

- Prudential Financial: It is a US-based company with its headquarter in Newark; its services are available not only in America, but also in Asia and the EU countries;

- ING Group: Being situated in Amsterdam, Netherlands, it supplies services such as banking-services, life assurance, mortgage, wealth accretion for SMEs as well as wealth management services.

Market Analysis

Being a global market-player, it is important for Zurich to evaluate the current market condition for developing its services worldwide. To carry out this evaluation, the market analysis focuses on Porter’s five forces by means of the TELESCOPIC OBSERVATIONS technique –

Table 2: Part 2 of the TELESCOPIC OBSERVATIONS technique for Zurich Group. Source: Self-generated from Zurich Financial Services (2009).

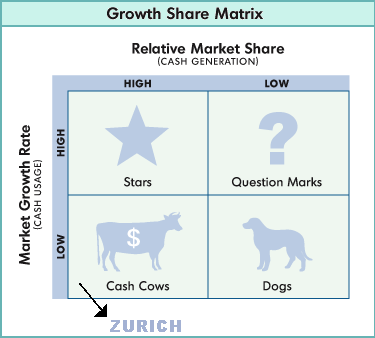

BCG Growth Matrix Analysis

The BCG matrix portfolio will help the assessment of Zurich’s market situation in context to market growth rate with relative market share –

- Star: With high-growth and high-share, Zurich occupied this section before the recession;

- Cash cow: Frigo (2009) states that due to recessionary impact Zurich is in this section with low-growth and high-share of the market;

- Dog: Zurich is not in this section as it expresses low-growth with low-share businesses requiring huge-investment to promote development;

- Question mark: Some rivals of Zurich clasped this position in economic-downturn by confronting optimistic growth-rate in some parts of the world.

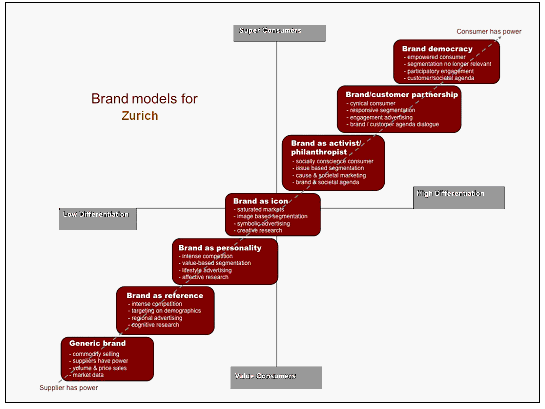

Branding models

Most of the time Zurich followed one brand or single brand strategy to operate global market but it has no specific existing branding model (after searching annual report, company’s website).

As there are no secondary data available relating to the Zurich branding models, this strategic plan suggest a branding models (in addition, the original instruction of this plan suggest to use theory) considering four segments of the market, such as super consumers, value consumers, low differentiation, and high differentiation; the branding models of the company in the segmented markets has shown below:

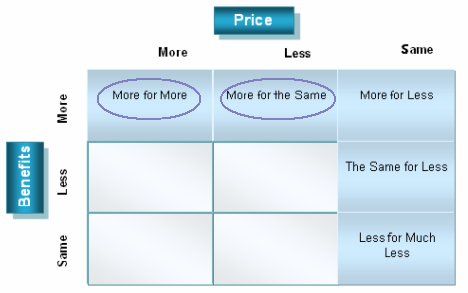

Market Positioning Map

Zurich would follow “more for more” or “more for same” strategy because it is already a renowned business and it is essential for the company to address a large part of the market in order to attain its aim to develop the services offered on current and developing markets.

Internal Analysis

The TELESCOPIC OBSERVATIONS schema will assist the discussion of internal strengths and weaknesses of the Zurich Group:

Table 3: Part 3 of the TELESCOPIC OBSERVATIONS technique for Zurich Group. Source: Self-generated from Zurich Financial Services (2009).

Financial Ratios

All the figures have taken from projected balance sheet, cash flow, and income statement 2011 of Zurich –

- Return on equity = (Net income/Equity) = (4854/ 47217) = 10.2801%

- Return on capital employed = EBIT/(Total Assets-Current Liabilities) x 100 = 6796.5/(553371-506152.5) = 14.3937228

- Gross profit Ratio =gross profit/revenue from sales = 80,725.50/105,408 = 76.58384563

- Net profit ratio = EBIT/Sale*100 = (6796.5/105,408) x100 = 6.447802823

Above financial ratio analysis demonstrates that the financial investors will be interested to invest at Zurich.

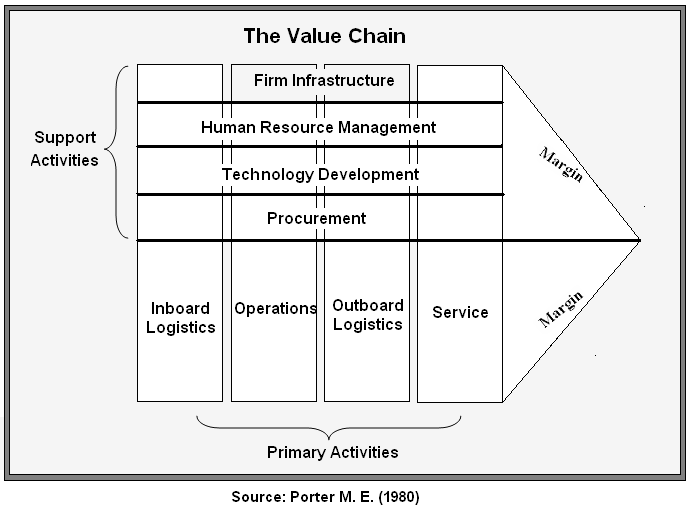

Value Chain Analysis

It has no specific existing Value Chain analysis (after searching annual report, company’s website). As there are no secondary data available relating to the Zurich Value Chain analysis, this strategic plan suggest following value chain figure –

- The company will be undertaking a five years plan do improve its value chain with integration of massive digitalization.

- In next two years, Zurich would develop communication software to manage its complex value chain system.

- Zurich will be enhancing its value system in future by vertical and horizontal integration.

Competitive Advantages

Zurich gains competitive advantage over competitors in terms of good working environment, better leadership, skilled top-level decision-makers, lean organizational culture, and superior promotional strategies.

Summary of Current Situation

The following figure shows the SWOT Strategic Matrix of the TELESCOPIC OBSERVATIONS schema for Zurich-

Marketing Objectives

Zurich will be resetting its marketing objectives to focus on its service development strategies by next five years.

- Zurich expects to increase its yearly profit by 6% within next five years (Zurich Financial Services, 2010).

- It will be raising its expenditure on marketing from $315 million in 2009 to $630 million in 2015.

- NCOIC (2010) states that by 2013, Zurich will be spending 1.5% of its operating income in market research.

- It wants to increase budget for promotional tools by 14% within 2015.

Marketing Strategies

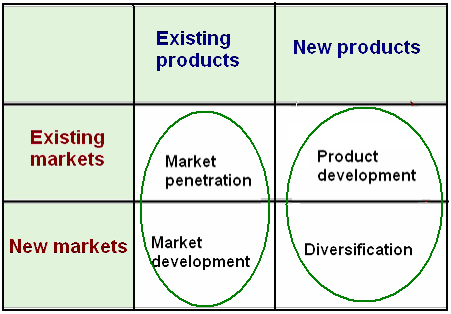

According to the David (2008), marketing strategies indicate number of tools or matrix, which require developing business aim. In this case, it is necessary to focus on the Ansoff’s Matrix, and the SWOT Strategic Framework, as Zurich Financial Service would like to expand its operation in current and emerging market.

Ansoff’s Matrix

According to the view of Stoner, Freeman, & Gilbert (2006), business organisation apply this matrix in order to discuss the main prospects while these firms would like to gather more revenue by developing business operation.

- Market Penetration: NGFL (2009) stated that market penetration is an applicable tool while it develops existing market with existing products; therefore, this strategy is match with present aim of Zurich;

- Market Development: In contrast, Jankowicz (2005) pointed out market development is the most suitable strategy to capture emerging market by introducing existing product line. So, Zurich Financial Service would pursue this strategy in order to enter new market with existing service;

- Product Development: Kotler & Armstrong (2006) stated that this strategy is applicable while company develop new products in existing market; Zurich can develop new product like “Takaful” in existing market considering this strategy;

- Diversification: At the same time, Zurich can introduce new products like “Takaful” in new market within next 5 years by considering this strategy (Hill & Jones, 2007).

The SWOT Strategic Framework

The table below shows the SWOT strategic framework of the telescopic observations for Zurich along with proper strategic plans for its development in next five years –

Table 6: the SWOT strategic framework of the telescopic observations for Zurich. Source: Self-generated from Panagiotou and Wijnen (2005, p.10).

Implementation

This section focuses on considering the internal operational affairs of the Zurich Financial Service Group through a brief depiction of the factors related to marketing mix. A proper development strategy of the following seven factors would help the company to enhance its business in the existing markets.

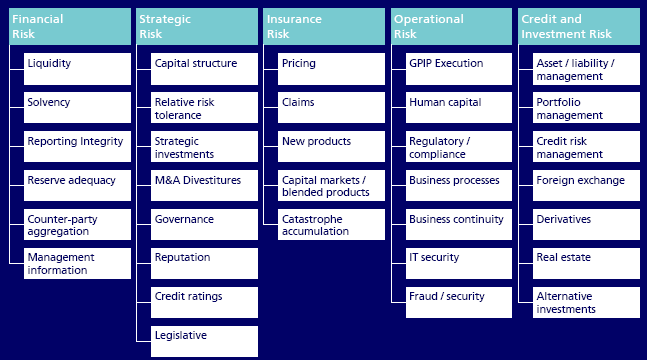

Product

Fisher (2003) argues that Zurich offers an extensive range of common insurance services to its global customers; the most well known once are motor insurance, buildings and contents insurance, risk management, business insurance, life assurance, pensions/investments, etc; currently, it is undertaking massive diversification strategies for improving it services. Moreover, its services cover the risks illustrated in the figure below:

For further development of its service in the emerging markets like Middle East, the company should diversify to include services like the Islamic insurance acknowledged as takaful as a future prospect for profitable acquisitions in next five years.

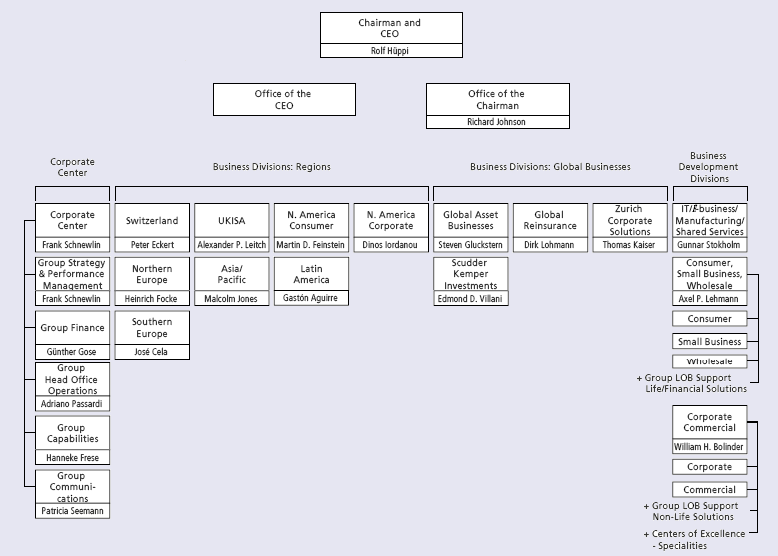

Place

Zurich has placed its services in a number of countries throughout the world. In so doing, the business had to come up with an intricate operational structure by means of which the placements of its services are done. According to the following figure, Zurich has placed its service in Northern Europe, Asia Pacific, Latin America, Southern Europe, and in some parts of the Middle East.

Additionally, the company must try to open more offices in upcoming five years in the developing markets to ensure effective communication between customers.

Price

In setting prices for its services, Zurich considers the overall economic condition of the market in which it is operating. The pricing also depends on the type of services provided (Pandey, 2007). For being a more buyer-oriented business, Zurich must try to get customer-feedbacks.

Promotion

Kotler & Keller (2006) stated that brand value of a company mostly depend on successful promotional activities; so Zurich is about to bring massive changes in its promotional strategies as a tool to develop its services in current and emerging markets within the next five years. Consequently, there will be changes in the content of the advertisements done in print and television media and engagement of more brokers and agents. Moreover, Zurich should allocate more budgets for five years in this segment to enhance advertising campaigns.

People

As a part of its strategic plan of service enhancement, it will be undertaking several policies for its personnel. Therefore, the company should focus on employee training, recruitment, and retention strategies in the emerging markets.

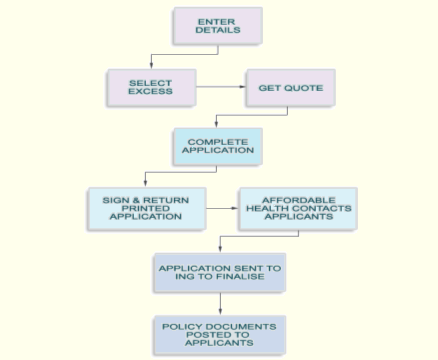

Processes

The awareness of the insurances available reaches the customers by means of advertisements and or by agents and brokers appointed by the company. Next, the customers need to add all the necessary detail and follow the following process to buy the insurances:

However, for reducing consumer’s efforts, Zurich should emphasize on digital e-gadgets that ensures consumer-convenience.

Physical Evidence

The physical evidence of the company suggests that it has several offices in all the countries it operates in; for example, in Switzerland, UK, USA, Saudi Arabia, and so on. For better outcomes in terms of service enhancement, Zurich must try to invest more on its physical attributes in next five years.

Budgetary Requirements

Zurich Financial Service Group is well-established insurance, which has enough financial capabilities to develop its business in current market as well as emerging market. The researcher of this project considered key financial indicators, income statement, cash flow, and balance sheet to consider the financial performance of Zurich.

Key Important Indicators

According to Zurich Financial Services (2009), the key financial indicators of the Zurich Financial Service Group are –

- Business operating profit 17.2%.

- Global Life – new business margin, after tax 21.3%.

- General Insurance – combined ratio 96.8%.

- Business operating profit $ 3,463.0 million.

- Total investments $257,773.0 million.

- Total Assets was $327,944.0 million in 2009 (Annual report 2009), and $553,371.0 million will be 2011.

- Total liabilities $ 30,416.0 million (Annual report 2009).

Projected Profit and Loss Account of Zurich

Table 6: Income Statement of Zurich. Source: Self generated from Annual report.

Projected Balance Sheet of Zurich

Table 7: Balance Sheet of Zurich. Source: Self generated from Annual report.

Projected Cash flow of Zurich

Table 8: Cash Flow of Zurich. Source: Self generated from Annual report.

Projected Marketing Budget of Zurich Financial Services in 2011

Table 9: Marketing Budget of Zurich. Source: Self generated from Annual report.

Control, Milestones, and Corrective Action

Control

The organisational chart of Zurich Financial Service Group is intricate like other insurance companies. According to the annual report 2009, this company is dedicated to practice efficient governance system for the advantage of its shareholders, clients, and workforce. This company is controlled in accordance with the local rule and regulation while the CEO of Zurich is responsible for the controlling the board of directors, and managing the company.

Milestones and Corrective Action

The five years strategic plan of Zurich will be placed to the board of directors for review and approval on January 01 2011 and designs its timeframe to go into operation within three months (90 working days) that counted December 31 2015. However, the purpose of this milestones and corrective action report is to propose the ways of how Zurich to develop its services in both its current markets and in emerging markets. The subsequent Gantt chart shows the milestone plan for next 5 years –

Table 10: Gantt chart of Zurich Financial Service for five years. Source: Self Generated.

Reference List

Anon (2010) Zurich extending its range of life insurance products. Web.

David, F. (2008) Strategic Management: Concepts and Cases. 12th ed. New Delhi: Prentice Hall

Fisher, W. (2003) Risk Management at Zurich Financial Services. Web.

Frigo, M. L. (2009) Strategy Risk Management: The New Core Competency. Web.

Hill, C. & Jones, G. (2007) Strategic Management: An Integrated Approach. 8th ed. London: South-Western College

Holytornado. (2009) Effective Online Brand Strategies for Targeting Prosumers. Web.

Insley, J. (2010) Zurich Insurance fined £2m for losing customer details. Web.

Jankowicz, A. D. (2005) Business Research Projects. 4th ed. London: Thomson.

Johnson, G. Seholes, K. & Whittington, R. (2006) Exploring Corporate Strategy: Text & Cases. 8th ed. London: FT Prentrice Hall.

Kandell, J. (2010) Zurich Financial Rebounds From Insurance Industry Crisis. Web.

Kokosinski, K. (2009) Strategies for Measurement and Reduction of the Carbon Footprint of Zurich Financial Services. Web.

Kotler, P., & Armstrong, G. (2006) Principles of Marketing. 11th ed. Prentice-Hall of India Private Limited.

Kotler, P., & Keller, K. L. (2006) Marketing Management. 11th ed. Prentice Hall.

NCOIC (2010) Zurich Financial Services: System Oriented Architecture (SOA). Web.

NGFL (2009) The Ansoff Matrix. Web.

Panagiotou, G. & Wijnen, V. R. (2005) The “telescopic observations” framework: an attainable strategic tool. Emerald Group Publishing Limited, 23(2). Web.

Pandey, I. M. (2007). Financial Management. 9th ed. New Delhi: Vikas publishing house Ltd.

Porter, M. E. (2004) Competitive Strategy. Export Edition. New York: The Free Press

Stoner, J. A. F., Freeman, R. E. & Gilbert, D. R. (2006) Management. 6th ed. New Delhi: Prentice-Hall.

Swiss Re (2010) Our mission and priorities. Web.

The Times 100 (2010) Providing a customer-centric service. Web.

Thompson, A. et al. (2007) Strategic Management. 13th ed. New Delhi: Tata McGraw- Hill Publishing Company limited.

Weihrich, H. (2009) The TOWS Matrix — A Tool for Situational Analysis. Web.

Yahoo Finance (2010) Basic Chart of ZURICH FINL SVCS N. Web.

Zurich Financial Services (2009) Financial Report 2009: Zurich Help Point. Web.

Zurich Financial Services (2009) Global excellence through coordination. Web.

Zurich Financial Services (2010) Zurich at a Glance. Web.

Zurich Financial Services (2010) Corporate social responsibility. Web.

Zurich Financial Services (2010) Environmental Policy. Web.

Zurich Financial Services (2010) The New Zurich. Web.