Strategic Planning of Starbucks: Essay Introduction

The main objective of this report is to discuss the strategic corporate development history, strategic direction for the future, and the current strategic situation of Starbucks the selected organization.

Strategic Development History of Starbucks since 1971

In 1971, Jerry Baldwin, Zev Siegel, and Gordon Bowker established the first store of this company in the Pikes Place in Seattle aimed to buy and roast better quality coffee beans and sell them as fresh as superlative style. Thompson & Gamble (1999) stated that during the first few months, Starbucks’ key supplier of coffee beans was Peet’s, but later the partners planned to arrange roasting procedures by themselves.

In 1972, the owners decided to expand the business and set up another shop. Within 1980s, the partners’ strategies were to form four more shops in Seattle with intention to expand and generate more return. At this point, Zev Siegel left the business and Jerry Baldwin performed the role of CEO; Gordon Bowker stayed as a partner, but spent majority of his time to some other businesses of his own.

In 1981, Howard Schultz, the general manager of United State’s Hammarplast branch, which was a kitchen utensils and house-ware business, met Baldwin and Bowker and enthralled about their business philosophy. Schultz became craze about getting a job at the company, and finally, the owners decided to make him the head of marketing from Sept 1982 and supervising the retail shops.

In 1983, Schultz visited several coffee shops at Milan, Italy and thought that Starbucks could step on to this segment, so his plan was to serve brewed coffee, espresso, and cappuccino in stores. Baldwin and Bowker were not interested about this strategy, but their strategy was to buy Peet’s Coffee and Tea; in 1984 merger took place.

Afterwards, in April 1984, Baldwin agreed to open a 300 square feet store to sell beverages, and within two months, it became one of the best-performing shops. However, Baldwin was not happy at this achievement and he supposed that it is a disruption from the company’s main objectives.

Schultz intended to inaugurate espresso stores by himself and so he left Starbucks in 1985; his friend, Scott Greenberg, a corporate lawyer, assisted him to raise venture capital and go public. Schultz’s business, named Il Giornale was first opened in April 1986 in Seattle; he opened one more store 6 months later, and a third one in April 1987, in Vancouver, British Columbia; by 1987 his turnover was $1.5 million per year.

In March 1987, Baldwin and Bowker’s strategy was to sell the entire Starbucks business of Seattle; Bowker hoped to focus at his other companies, while Baldwin chose to focus at the Peet’s company. Schultz purchased the business in August 1987 and became the CEO, and its new name was Starbucks Corporation.

Changes in Strategy Made By Schultz from 1987

After acquiring Starbucks, Schultz planned to bring massive changes to Baldwin and Bowker’s conservative business ideas, and expand the business in many other cities and create beverage stores.

Within few weeks, however, the synchronization and the working spirits of the employees weakened. At this point, Schultz’s policy was to construct a fresh affiliation of mutual respect between the workers and top administration.

The CEO of Starbucks planned to attain the projected revenue of $60m in 1992, but this was difficult to gain because of shortage of experience, skills, and motivation of management (Thompson & Gamble, 1999). Schultz made several modifications in the organization including making of a new logo, equipping stores with espresso machines, and modernizing them to look Italian; he gave a cross between a retail coffee bean shop and an espresso bar café making it Starbucks’ signature design in the 1990s.

Starbucks’ first shop in Chicago opened in Oct 1987, and 3 more shops opened there in the next 6 months, but the turnover from those shops were much lower than expectations.

In Portland, Schultz’s plans worked and Starbucks’ operations were quite profitable; within 1991, the Chicago stores became profitable as well. The management decided Los Angeles as the first Californian city to penetrate mainly because of its position as a pacesetter and of US; the entry into San Francisco was rather upsetting because of a regulation, but later the city council changed the rule.

The management’s policy was to launch simply company owned coffee shops, and franchising was ignored to keep the business under complete control of high quality. Schultz’s approach of employing skilled executives, creating competencies above existing requirement, and setting up support systems made an excellent basis of a quick and moneymaking business by 1990s.

Schultz believed extending health care coverage for part-time workers would be a good motivation for them, so, in 1988, he and his board of directors decided to extend the coverage; they presented all workers with good reward and an inclusive remuneration package.

Starbucks’ Strategies after Being Public

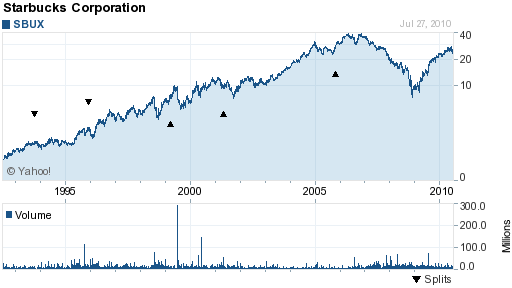

Starbucks became a public company in June 1992 and its initial public offering (IPO) of common stock was one of the most flourishing ones of that year; with the capital afforded by being a public, it hastened its growth strategy. Auch-Roy (2004) argued that for keeping equity between shareholders, the company’s shares were broken up 4 times from 1993; these fragmentations helped to prevent high prices from deterring small investors when the share prices augmented:

However, figure 1 shows the position of the share price of Starbucks in stock market.

In 1992 and 1993, Starbucks undertook the store expansion strategy intending regions that have business friendly demography to support the firm’s infrastructure; the management would choose a big city for serving as a “hub” so that professional groups can stay there.

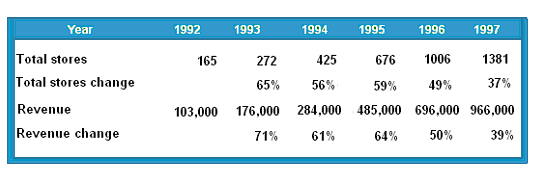

Schultz’s strategy was to launch 125 coffee shops by 1992, whereas he launched fifteen new shops by 1988, twenty by 1989, thirty by 1990, thirty-two by 1991, and fifty-three by 1992, building 165 coffee shops altogether; and as the number of coffee shops raised, the profits raised accordingly:

In 1994, the company started working with a wider variety of store formats with unique seating zones where consumers can assemble and enjoy peacefully. Schultz with his highest patience reconstructed the Starbucks’ top management and engaged the human resources with extensive skill in managing and escalating the retail chains, for instance, successor Orin Smith who was the CEO of the company completed MBA from Harvard University along with thirteen years’ success story at Deloitte & Touche (Thompson & Gamble, 1999).

For lessening regular store opening expenses, which deplorably increased to $350,000 in 1995, Starbucks centralized buying, improved contracts, set more charges for some stuffs, and combined work for the contractors showing fine cost control qualities. Until 1996, the company shunned debt, and funded expansion with equity capital and profits, lowering the total expense, but from 1996, market extension required more financing to make it economical for Schultz to allow debt to do the task.

In 1994, following long time negotiations and trialing, PepsiCo and Starbucks came into a joint-venture deal to produce fresh coffee related foodstuffs for mass distribution by Pepsi, and Starbucks came up with a new chilled coffee drink called Frappuccino in 1995. The drink had good sales only in hot weather cities; however, Pepsi executives were eager about it. Ensuing prolonged experimentation, the research team made a shelf stable edition of Frappuccino, which was very appetizing.

Thompson & Gamble (1999) pointed out “in 1995 Starbucks collaborated with Dreyer’s Grand Ice-Cream and Seattle’s Redhook Brewery to deliver coffee extract to gain the target market by developing new brands and improving existing products”. The company came in into discussions with United Airlines for serving its coffee at every United flight, and it finally became the coffee supplier of the 20 million travelers flying United every year.

The R&D teams identified that most of the customers are loyal and figure 3 demonstrates the actual customer base.

Current strategic situation of Starbucks

- According to the annual report 2009 of Starbucks, the main strategy of this company is to expand its international retail business to boost market share by selectively opening supplementary outlets in existing markets or opening outlets in new areas. In addition, it would like to escalate its net sales in existing stores to meet its long-term strategic goals;

- It has good motive to establish outlets where consumers are available due to working, traveling, shopping, or dining purpose. In 2009, specialty revenues accounted for 16% of total net revenues because Starbucks applied various process like licensing provision, food service accounts and further initiatives connected to its core businesses;

- Starbucks Global Responsibility strategy as well as commitments are integral to its overall business strategy (Starbucks, 2009);

- Building customer loyalty around lattes, cappuccinos, and other fancy beverages;

- It wants to ensure extraordinary services for all the stakeholders including staff, partners, consumers, suppliers, shareholders, community members, visitors, and so on;

- It is committed to offer quality products and services as the quality of the service experience or the safety of beverages or food may harmfully affect the company;

- It carefully selects employees and offers large remuneration;

- This company honored all customers and employees, for example, it valued poor, illiterate, or black customers;

- It has a store design group, which is responsible to design its outlets;

- In addition, Starbucks gives additional training facilities (including store operations with basis of managing people, and information systems) to motivate the employees, and licensees.

Resources and capabilities

According to the resource- based hypothesis, multinational organizations should have six types of resources. In this sense, Starbucks resources are as following –

- Financial resources- Due to global financial crisis, the financial position of the company weakened in 2008, but figure no 5 demonstrates that the share price of Starbucks in NASDAQ has been steadily increasing day-by-day. According to the annual report 2009, the company also failed to meet the sales target in the US market

Table 1: Financial resources of Starbucks

- Organizational resources: -Kembell, Hawks, Kembell (2002, p.1) pointed out that staff of Starbucks are one of their significant assets. According to the annual report 2009 of Starbucks, it plans to continue disciplined international growth of its retail and licensed store base. The purpose of global expansion in high traffic and visibility areas involving suburban centers, university campuses, and office floors is to launch relevant new products, and to improve new channels of distribution (Starbucks, 2009).

- Physical resources: – This includes constructions, property, equipment, furniture, leasehold improvements, machines, fixtures, kitchen appliance and so on. However, the net value of property, plant, and equipment of Starbucks was about $2,536.4 million, which was less than previous years (Starbucks, 2008);

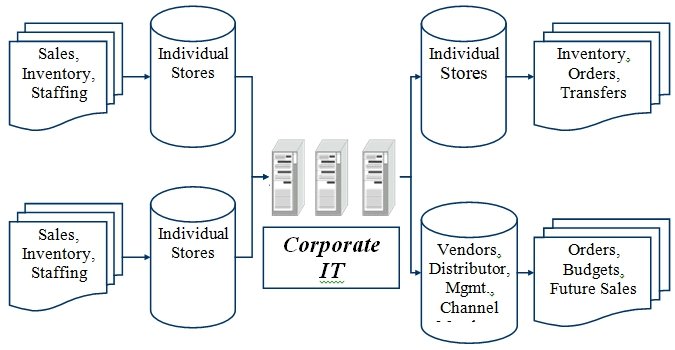

- Technological resources: – It has already integrated CRM system to contact with customers regularly, as consumers are the most important part of business. However, figure 6 demonstrates that integration of information technology creates a new dimension for the company to operate its business in case of the entire process of maintaining restaurant service, retailing and global operations, controlling security system, maintaining quality;

- Intellectual and human resources: – According to the annual report of the company, R&D teams (enrich with scientists, chemists, and so on) of Starbucks are responsible for the technical improvement of food and beverage items, so, it spent around $6.5m, $7.2m and $7.0m for the year 2009, 2008 and 2007.

- Reputation resources: – This Multinational Company affords a high brand value, which tends to expand in the future, particularly in North America where it has less recognition. This reputation is the outcome of consumer perceptions about the quality, trust, and ethical factors in every market segment. The generated goodwill for the year 2009 was more than $ 259 million around the world, which was $ 7 million less than from previous fiscal year.

Capabilities

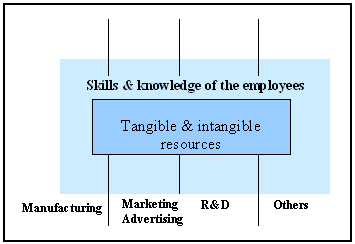

The flow of capabilities of the company can be shown as-

- Starbucks has capability to build good relationship with customers by offering quality products and services;

- It has enough financial capabilities to expand its business all over the world and capture US coffee market;

- Strong supply chain management system and distribution channel;

- It has capabilities to serve an attractive niche;

- Moreover, controlling and estimating the performance of the business;

- Larson (2008, p.55) Starbucks’ superior retail locations give them influential capabilities over its competitors;

- It has capability to develop new brands or industry trend;

- Sourcing, roasting and improvement in making worldwide famous coffees;

- Innovative and diversified adaptive tendency;

- Finally, it has corporate social responsibility to work for the development of the community and the environment.

Porter’s Five Forces Analysis

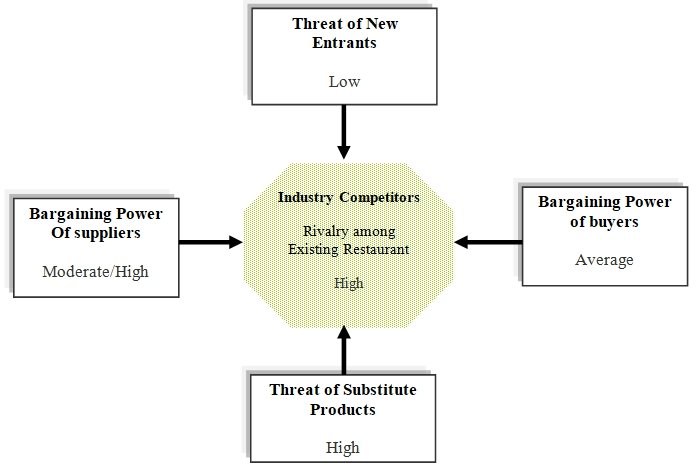

This paper will consider Porter’s five forces model of competition to discuss the current competitive scenario of Starbucks –

- Threats from new entrants: According to the current market environment, it is difficult for a new firm to enter in the market with large investment. However, retail market is highly competitive sector and investors will not appreciate a new company to invest for them due to global financial crisis. Aronin, Fetterman & Liu (2004) stated that the entry barriers for selling specialty coffee in rural regions are relatively low, as it opens outlets in places with no close competition;

- Bargaining power of the suppliers: The major suppliers of Starbucks are coffee beans suppliers, machinery, and other raw material suppliers. The supply of various food ingredients, for example, green coffee beans are being produced all over the world, but the price of coffee beans is subject to significant instability. According to the annual report 2009 of Starbucks, this bargaining power of the suppliers depends on several factors like producing areas, bad weather, and the actions of certain organizations, political situation, and financial circumstances.

- Bargaining power of the buyers: The buyers have a moderate level of bargaining power though quality, quick services, and other supportive factors like lower price and tastes of unique brand items influence the purchaser.

- Threats of substitute products: The threat of substitute products of Coffee is reducing, but most challenging substitute products for Starbucks are Pepsi, Coca-Cola and other energy drinks;

- Rivalry among existing competitors: The competition is extremely high, and Starbucks faces competition from restaurants and other specialty Coffee brands, retailers. However, McDonald, KFC, Dunn Brothers Franchise are the nearest competitors of the company

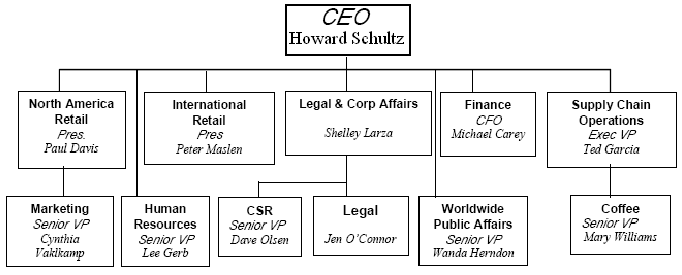

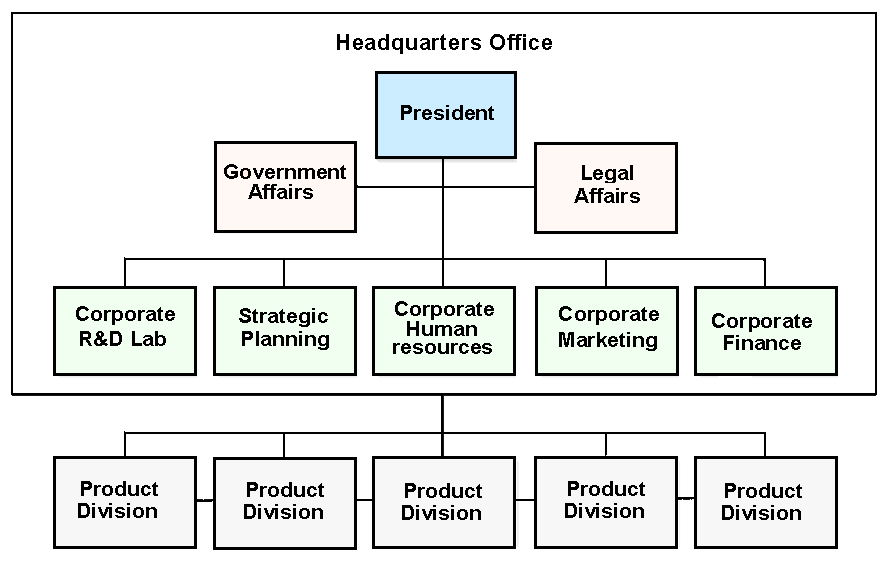

Organizational structure

To control the company, Starbucks is not following any hierarchical or formal organizational chart. As Starbucks is highly differentiated in its own industry, it has to maintain several common functional departments to operate the business, like Legal & Corporate department, HR, Finance, retail departments and so on. However, the following figure demonstrates a simple organizational of the company –

Key challenges of Starbucks:

- Global financial crisis is the main problem for Starbucks;

- Starbucks’ ability to discover qualified vendors who meet its standards and supply products on time and efficient manner is an important challenge;

- Risk of substitute products and development of other new products;

- High operating costs is one of major challenges for the company;

- it becomes difficult to ensure a consistent supply of high quality raw materials due to follow growth expansion strategy;

- Impersonator brands that pose potential threats.

Starbucks Strategic Plan: Future Plans

Formulation of strategies

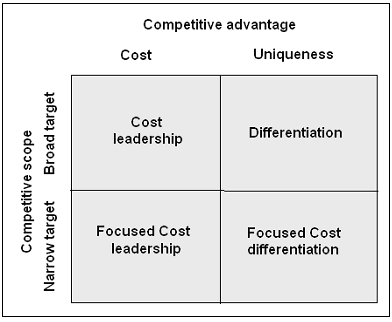

Business Level Strategy: Thompson et al (2007) pointed out that all business organizations are using this strategy either deliberately or unintentionally. However, Starbucks can deliberately apply these strategies in order to reach the target customers –

- Cost Leadership: Starbucks will be able to offer coffee, beverages, and food items at the lowest price than other competitors’ like- KFC, McDonald’s, Taco Bell, Wendy’s, and Dominos by implementing this strategy.

- Differentiation strategy: Starbucks follows the differentiation strategy and it should follow this strategy in future to deliver unique coffee, quality green coffees, and other new products to the target clients.

- Focus: It can adopt this strategy to concentrate on its core business by reallocating all business units.

Competitive dynamics: in this segment, the company could effort to generate competitive dynamics coming from a sequence of competitive proceedings and reactions between the rivals in the market, exaggerated by a range of features, such as resource resemblance, volume of business, modernization, superiority, and so on.

Corporate level strategy: This perception concentrates at diversification, which includes the company’s varying retail sector services.

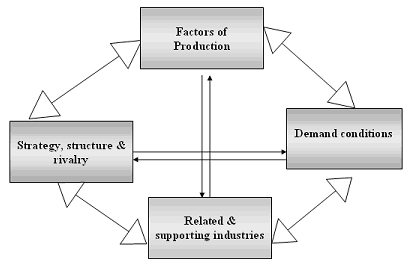

International strategy: As Starbucks is operating and distributing services over 16,635 stores in 50 countries, and it wants to expand its business all over the world, it should concentrate on the following issues to become a prospective player in the global market. According to the annual report 2009, it generated 19% of its total profits from international market due to high sales volume of goods and lesser costs. Therefore, it should continue this strategy in order to increase the present revenues as well as operating profits –

- In case of future expansion, it should assess the demand conditions;

- It should consider supply of raw materials and production factors to maintain quality of the products;

- It should put more focus on local and international competitors;

- Finally, it should take different actions, and strategies to attract local customers.

Co- operative strategies: Considering the current strategies and market environment, Starbucks can design various types of co- operative strategies like –

- Starbucks can combine the resources, capabilities, and core competencies with other similar companies for achieving mutual interest in decision-making, distributing, and manufacturing products;

- It can gain huge profits by licensing arrangements and joint ventures, for example, Joint venture with Pepsi-Cola Company, and a licensing agreement with Unilever.

Mergers and reforming approaches: by this approach, the business could purchase a control or 100 percent interests in other businesses by utilizing its capabilities efficiently intensifying market power, overcoming entry barriers in new areas, and reshaping own competitive scope etc.

By reorganization, Starbucks could maintain the plunge in acquirement with others by altering the working sets and monetary configuration. Starbucks could adapt numerous structures, such as economizing to decrease the number of workers and operating units with no change in business portfolio, and leveraging buy out (LBO) to buy all the business’s assets for the purpose of privatization.

One more imperative feature of acquirement is licensing of retail shops leveraging the zonal associates and stocks for developing proficiency. The licensees present an enhanced place of retailing and helping accessibility for which the business allows the cost for license together with royalties by selling coffee, CD, beverages, and many other products.

Implementation of strategies

Starbucks can implement the above projected and proposed strategies by restructuring the organization, maintaining corporate governance, motivating employees, and using resources.

Corporate governance: Starbucks will follow the listing rules of NASDAQ and SEC, recommendation of various reports, Companies Act, and the rules and regulation of EU, code of ethics, remuneration policy, and decision of the board of directors and so on (Starbucks, 2010).

The senior officers (including CEO, CFO, president, executive vice-president) will be responsible to apply above strategies and they should have to monitor the performance of the outlets, and its employees to increase profit from national and international markets. According to the annual report 2009, compensation committee sets the remuneration in accordance with compensation schedule and the SFAS No. 123 (R) or “Share- Based Payment Schedule” provision.

Organizational structure and control: Starbucks is a multi national organization and it follows high level of diversification strategy though more than 70% of its total profits generated from food and beverage sectors, it should apply one of the Multi-divisional Structures. However, the following figure suggests the co-operative (M-form) structure for future operation of Starbucks

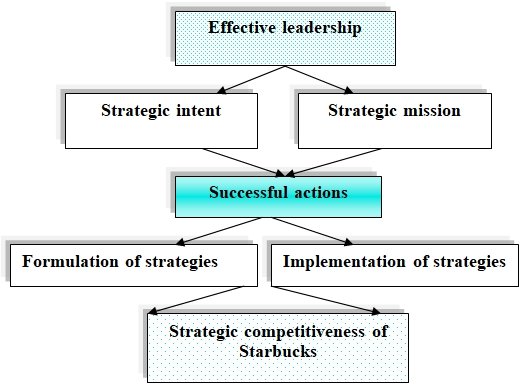

Strategic leadership: Leadership is an important issue for the development of the company, so, Starbucks should have effective leadership process to implement strategies and addressing key problems –

Opportunities of Starbucks

- Starbucks has the option to enlarge its business in retail operations;

- It has enough opportunity to improve its exiting resources;

- The company is developing the technological factors, and working with most modern equipments;

- It is also introducing fresh delivery channels, launching new products, and working with brand extension;

- It will be participating in emerging intercontinental markets;

- Constant domestic growth and dominance of this sector means that the business will get more profitable in the future.

Key Recommendations

In order to sustain in the market as a market leader, Starbucks Corporation should concentrate on the following issues:

- Starbucks should be alert about the expectation of market since the stock price is not in stable condition;

- It should offer organic foods and health drinks as customers are more health conscious (Knol, 2010);

- As the competition is too high in the US market and competitors provide services at lower price, it should try to increase demand by offering sophisticated service.

- It should reduce the operating costs and the amounts of remuneration to overcome from recessionary impact;

- It should more concentrate on the corporate governance issue because many large firm has already collapsed due to internal conflicts among directors, high remuneration, excess operation costs, and lack of leadership;

- Increase promotional activities help the company to raise market demand. Therefore, Starbucks should increase the budget for advertising by 10% to 15%;

- To start business in new area, it should be aware about war, terrorism, or political fluctuation of the place;

- It should increase the budget for research and development activities;

- To develop loyal customers, it should develop or adopt more efficient database system to collect and retrieve data about the customers to develop customer relationship management. As a result, it should integrate ERP/SAP software for the development of data, procedure of sales, improve complaints management, increase marketing campaign, develop after-sales service, encourage teamwork by sharing knowledge, and so on;

- Since Starbucks generated 73% of total revenues from US market, it should more careful about impact the financial crisis issue, fluctuation rate, social and political factors, purchasing power of customers, and other challenges;

- It should implement divestiture strategy to improve financial position as many stores are not enough potential for the company;

- It should focus on the marketing campaign in order to encourage younger customer to purchase the products of Starbucks;

- It should decrease the salary of the part time workers and it can recruit employees from Asian countries like India, Bangladesh etc. as they provide high performance with comparatively lower salary.

- As the brand mage plays a vital role to gain success in an industry, it should upgrade its beverage products to maintain the brand awareness in existing market;

- Finally, Starbucks should assess the market risks to apply new strategies, for instance, higher transportation costs, import of recession on profitability, and a number of mega competitors.

Reference List

Aronin, B. Fetterman, A. Liu, X. (2004) Rustic Coffee: A Strategy for Challenging Starbucks. [pdf] Web.

Auch-Roy, H. R. (2004) The Starbucks Corporation: Past, Present and Future. [Online] Web.

Berger, A. Buchman, J. Chase, D. & Hsu, S. (2010) Starbucks. Web.

David, F. (2008) Strategic Management: Concepts and Cases. 12th ed. New Delhi: Prentice Hall

Dess, G. & Lumpkin, G.T. (2008) Strategic Management: Text and Cases. 4th ed. New Delhi: McGraw-Hill.

Google Finance (2010) Basic chart of Starbucks. [Online] Web.

Hill, C. & Jones, G. (2007) Strategic Management: An Integrated Approach. 8th ed. London: South-Western College

Hitt, M. A., Ireland, R. D., & Hoskisson, R. E. (2001) Strategic Management. 4th ed. South-Western Thomson Learning.

Johnson, G. Seholes, K. & Whittington, R. (2006) Exploring Corporate Strategy: Text & Cases. 8th ed. London: FT Prentrice Hall.

Kembell, B. Hawks, M. & Kembell, S. (2002) Catching the Starbucks Fever. [Online] Web.

Knol (2010) Analysis of Starbucks. [pdf] Web.

Larson, R. C. (2008) Starbucks a Strategic Analysis: Past Decisions and Future Options. [pdf] Web.

Moon, Y. & Quelch, J. (2006) Starbucks: Delivering Customer Service. Harvard Business School

Porter, M. E. (2004) Competitive Strategy. Export Edition. New York: The Free Press

Stanley, A. (2002) Starbucks Coffee Company. Web.

Starbucks (2008) Annual report 2008 of Starbucks. Web.

Starbucks (2009) Annual report 2009 of Starbucks. Web.

Starbucks (2010) Corporate Governance of Starbucks. Web.

Thompson, A. A., & Gamble, J. E. (1999) Background of Starbucks Corporation. Web.

Thompson, A. et al (2007) Strategic Management. 13th ed. New Delhi: Tata McGraw- Hill Publishing Company limited.

Yahoo Finance (2010) Basic chart of Starbucks. Web.