Introduction

Organizational sustainability is often a very key ingredient to the survival or long-term presence of a business in a given market. However, the concept is often misunderstood to mean the financial sustainability of an organization because if an organization is unsustainable, the problem normally manifests itself in terms of financial challenges (Authenticity Consulting 2011, p. 1).

It is therefore important to understand that organizational sustainability is more holistic than previously believed and in simple terms, it could be equated to the sustainability of individuals, a group of people or even a country. This means that there are many aspects of an organization that have to be sustained (not just the financial aspect).

These factors withstanding, it is essential to note that there are a number of primary organizational aspects that if properly sustained, will lead to the overall sustainability of an entire organization. To better gain a more comprehensive understanding of this fact, this study will carry out a case study of British Airways to have a clear picture of its sustainability status.

British Airways has for long been deemed the national carrier for the United Kingdom (UK) (Winthrop Corporation 2000, p. 1). Its headquarters is in London and much of its activities are grounded at Heathrow airport where most of its operations (of its airline services to more than 300 destinations around the globe) are planned.

British Airways (and its subsidiary companies) have since inception undertaken passenger services (both at the local and international levels), freight services and mail services, although recent developments (in 2011) are bound to see a restructuring of the company’s operations to offer new products and services, after it merged with Iberia (a Spanish airline company) which now holds a significant number of shares in the company (Winthrop Corporation 2000, p. 1).

The company’s sustainability has often been dependant on a number of critical organizational aspects. One of them is the personnel or human resource aspect which has seen the organization go through treacherous years of intimidation and threats of strikes by the workers. Another basic organizational aspect is its financial sustainability which was brought to fore by increased competition in the airline and aviation sectors.

Lastly, the organization’s sustainability greatly depends on product, service and program sustainability, which has recently come to the management’s attention (again due to increased competition in the aviation market). This study will, therefore, explain how these sustainability areas are of importance to British Airways and how the company performs with regards to these three sustainability factors.

Product, Service and Program Sustainability

Product and service sustainability has often been associated with financial sustainability, considering products and services essentially attract customers to a given business, and so the higher the number of customers a business has, the higher the revenues it will receive.

Authenticity Consulting (2011) explains that if a business does not have high-quality products, programs or services, it is bound to affect its client’s participation and this will consequently lead to the realization of low revenues.

The liberalization of the airline industry, through a breakdown of economic barriers, has significantly led to increased competition among airlines around the world and in the same manner, given enough room for innovation in the creation of airline products, services and programs. This has especially been evidenced in in-flight services such as the provision of in-flight airline entertainment (The Hindu Business Line 2011, p. 2).

This has caused a lot of discomfort for most traditional airline companies like British Airways because new airline entrants have been on the forefront in spearheading the innovation of new products and services.

Currently, many airline companies are investing a lot of money in the innovation of new products and services as can be seen from studies done by The Hindu Business Line (2011) which suggests that airline companies in the year 1998 invested more than $1.8 billion in the development of new products, services and programs.

The significance of such investments have been acknowledged by many airline companies after recent research studies suggested that the quality of products and services essentially determine the level of customer satisfaction within a given airline company (The Hindu Business Line 2011, p. 2). This also affects a company’s bottom line.

British Airway’s Performance

British Airway’s sustainability in the airline sectors significantly depends on its products, services and programs because it has in the past traditionally enjoyed a longstanding monopoly in the provision of airline products and services in its traditional markets. However, recent decades have seen the entrance of new airline companies like Qatar airways, Emirates (and the likes) infringe on its market share through the provision of high-quality services, products and programs.

This has consequently caused a lot of jitters in the organization because the company has realized that if it does not change its traditional products or services, it may eventually lose out on its traditional markets. This has forced the company to come up with new products and services such as the ‘world travelers plus’ and the ‘lounge in the sky’ products and services (The Hindu Business Line 2011, p. 2).

These two new products are part of a wider scheme to come up with a comprehensive array of new products and services aimed at ensuring the company’s traditional clients are satisfied with the organization and remain loyal to it.

The ‘world travelers plus’ and the ‘lounge in the sky’ products and services are essentially a fourth-class cabin category of products and services which are also a product of a 600 million pound investment scheme undertaken by the company in 2001(The Hindu Business Line 2011, p. 4).

These new products and services were accompanied by a revamping of the company’s class cabins concord, check-ins and lounges, which have been attributed to the companies increased client base over the past few years (The Hindu Business Line 2011, p. 4).

These new products and services are also as a result of an additional 150 million pounds investment in an upgrade of its long-haul fleet (which includes new seats and seatback videos) (The Hindu Business Line 2011, p. 4). From these new products and services, British Airways has done a commendable job of improving its sustainability status with regards to its products and services.

Personnel Sustainability

There is concern among most businesses and managers across the globe that if a company does not have the right employees, then its products and services cannot have the significant impact they are intended to have (Authenticity Consulting 2011, p. 1). This means that the sustainability of a company’s products, services or programs is therefore directly dependent on the personnel sustainability.

Because of this relationship, we cannot ignore the link that these two organizational aspects (personnel sustainability and products, programs and services sustainability) have on the financial sustainability of a firm. This is true because if an organization does not have good employees, its customers are bound to experience ineffective products and services, which will ultimately lead to a significant decrease in the company’s profits.

Because of the importance of having a sustainable personnel team in the organization, Authenticity Consulting (2011) proposes that it is important for organizations to have a well-trained and supervised staff, and if there are employees who cannot deliver in time, they should be replaced with people who can. This analysis is important to British Airways because it has in the past been threatened by its personnel situation.

British Airway’s Performance

British Airways has over the years been faced with threats of industrial action from its workers because of the human resource strategy adopted by its managing board (Smale 2005, p. 1). The managing board actually undertook a new strategy of cost-cutting, which has not been well received by its workers.

This has caused many of its staff (especially the cabin crew) to walk out on the company, therefore leading to a slow down on some of the company’s operations. This has in turn painted a bad picture of the company, especially in the eyes of international investors.

The company has since held on to its strategy of withdrawing perks that the company employees used to enjoy (either as a result of the fact that the company is experiencing increased operational costs or as a result of the penalties imposed on workers who went on strike). This has in turn forced the company’s employees to move to the courts to seek redress regarding the situation.

The problem was started when one of the company’s auxiliary wings in the catering department terminated the employment of more than 350 members, and this move consequently caused a massive strike that has in subsequent periods been acknowledged by BA’s management as being out of control (Smale 2005, p. 1).

British Airways now goes on record as having had three successive strikes in three summers (an action which cost the company up to ten million pounds a day) (Smale 2005, p. 1).

The company currently enjoys very minimal staff loyalty and the current staffing levels are at an all-time low. There is also enough evidence to suggest that there is worker militancy that was characteristic of British Airways employees in the 70s and 80s and the vice is still being perpetrated by current employees (Smale 2005, p. 1).

There is therefore very minimal cooperation between British Airways employees and its management. This has consequently turned into an almost ‘cat and mouse’ game where the workers strategize to affect the company’s operations by striking when the company is supposed to cash in on high travel periods like summers or when the company’s shareholders are meeting (to spoil the company’s reputation in the eyes of its investors).

These kinds of employee actions pose a threat to the company’s long-term sustainability.

Financial Sustainability

As mentioned earlier, financial sustainability is normally a representation of how the organization performs with regards to other sustainability aspects. Often, when the above sustainability indicators are not effectively managed, a company experiences significant financial shortfalls.

Regardless of the situation, Authenticity Consulting (2011) notes that organizations should at all time maintain a financial reserve (so that they are able to survive in case of a financial disaster) and undertake contingency planning (to provide direction to the companies if they do not meet their financial targets).

The importance of maintaining a sound financial health for organizations cannot, therefore, be overemphasized because it is through good financial health that organizations can prove to their shareholders that the company is moving in the right direction.

With regards to British Airways, a good financial health is vital for its sustainability, considering most of its human resource challenges are brought about by management’s decision to cut-back on its operational costs (human resource is one of the areas they decided to cut-back on).

The company now has slightly over 40,000 employees (Smale 2005, p. 1). Nonetheless, it is vital to understand the importance of a good financial health for the company because it is only through a good financial health that the company can be able to regularly pay its workers. Moreover, it would not experience extensive employee objections due to withdrawn perks because it would not have to do so in the first place.

Also, considering most airlines are expanding into new travel destinations because of deregulation of the airline sector and increased globalization, it is essential for British Airways to expand in the same respect.

This will imply that the company needs to open up new offices, hire new staff, purchase more airplanes (and the likes) and this obviously means the company will require more capital to make the exercise a success. This fact reiterates the importance of having a good financial health to stay relevant in the market.

Finally, considering the company has experienced subsequent years of periodic losses (as will be evidenced in subsequent sections of this study), its financial reserve is quickly depleting and there are already increased concerns regarding the company’s ability to withstand future financial storms once its financial reserves run dry.

Essentially, the company will be unsustainable upon such an eventuality or it may be forced to take debts (a move which would ultimately lead to its bankruptcy if things do not look up in the airline industry).

These financial aspects are quite important not only for British Airways but all other airline companies because their financial books are normally affected by intrigues in the world economy such as the recent global economic downturn and airline accidents, which have a severe financial impact on the companies.

British Airway’s Performance

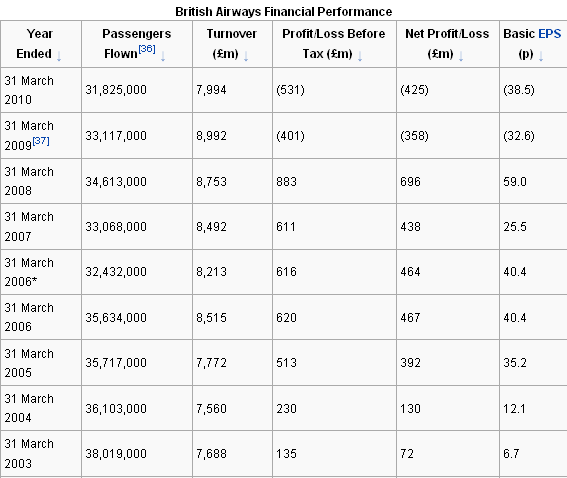

Recent financial performance reports of British Airways have significantly increased investor concerns of the company’s survival (in light of increased competition). In March, 2010, the company reported one of its worst financial performances in decades, brought about by the recent global economic crunch, volcanic ash clouds in the European airspace and a number of employee strikes and walkouts (Mcghie 2010, p. 1).

These factors caused the company to report financial losses of up to 425 million pounds in the period ending March, 2010 (Mcghie 2010, p. 1). This financial performance has caused jitters among the company’s board members who are increasingly registering concerns over the company’s long-term sustainability, considering the company is quickly eating into its only cash reserve of about two billion pounds (Mcghie 2010, p. 1).

As mentioned earlier in this study, this poor financial performance is a symptom of the poor management of other functional areas of the company as noted with the crippling employee strikes that the company has endured over the past few months.

The following diagram best represents the company’s financial standing.

The poor financial performance is one that is quickly painting a bleak future for the company considering it reported a 358 million pound loss in the previous year 2009 (Mcghie 2010, p. 1). In fact, during the year 2009, the company was forced to withdraw its dividend issue, and also in the same year, the company’s shares plunged by more than 6% to 152p (Mcghie 2010, p. 1).

Remarks made by the company’s managing director, Willie Walsh, that there is no hope for future economic improvement in the company’s primary markets have even cast a darker cloud on the future prospects of the company considering the company expects to make more losses in coming years (Milmo 2009).

These repeated losses have further increased concerns that the company may not be able to shoulder another blow in the coming years. Milmo (2009) reiterates this concern by admitting that:

“I understand from staff the atmosphere at BA is like the losses at an all-time low. I think we are seeing the final throes of a once successful airline, with losses of £3 million per day (recent management meeting info) it won’t take long to get through the money BA retains from forward passenger bookings (about £1 billion)” (p. 10).

Conclusion

This study identifies the fact that British Airways is facing a sustainability problem in the sense that some of its major organizational aspects which determine its survival are not being properly managed or not performing to the expected standards.

The major sustainability aspects posing significant challenges to the company include its personnel management and financial performance. However, with regards to its products, service and program innovation, the company is fairing on well. Nonetheless, from the entire analysis, we understand that the three sustainability areas mentioned above are all conjoined, in that; they affect each other in one way or another.

To improve the company’s financial performance, it is therefore quite important for the company to properly manage its human resource, because as evidenced from the company’s financial performance, its losses were significantly caused by the series of losses in the last three years.

It, therefore, comes as no surprise that the biggest financial streak of losses for the company started after it started experiencing industrial action. Comprehensively, we can acknowledge that the company needs to reenergize its human resource functions and at the same time, capitalize on its product and service innovations to revamp its financial performance and consequently enhance its sustainability.

References

Authenticity Consulting. (2011) Organizational Sustainability. Web.

Mcghie, T. (2010) Record Losses at British Airways Spark Survival Fears. Web.

Milmo, D. (2009) British Airways Makes Worst Ever Loss. Web.

Smale, W. (2005) BA’s Long History Of Staff Disputes. Web.

The Hindu Business Line. (2011) British Airways Launches New Products, Services. Web.

Winthrop Corporation. (2000) British Airways Plc. Web.