Overview of Saudi Arabia Market

Saudi Arabia is among the largest countries in the Middle East from the geographical perspective.The country’s economy mainly depends on oil exports. The Saudi government has diversified its economy to the private sector involvement especially in the food production. Saudi Arabia remains an attractive place for the foreign investors with regard to its low inflation rates, low taxes and availability of sufficient capital. IMF estimated Saudi Arabia’s growth by 3.7 percent in 2010 after finding an average of 3.1percent for each year during 2005-2009. Saudi government imports about 80 percent of its total food supply (Mousa 1).

In addition, Saudi government has put in place objectives to achieve self-sufficiency in food production. However, this is a big challenge since it is among the world’s most scorched countries given the fact that it is located in the larger gulf desert. Insufficient agricultural production has caused persistent food imports and this trend is likely to increase in the future if nothing is done. Saudi Arabia is the world’s 19th largest food importer in value terms. Domestic food growth depends on scarce water resources. The latest agricultural development in Saudi Arabia is food production using technologies that consume less water. The agricultural sector represents only six percent of Saudi Arabia’s gross domestic product (GDP) (Mousa 2).

The general political condition in the country remains stable. The government’s continuous campaign intended at dislodging locally grown terror cells has shown results and many terrorist suspects have been arrested before executing their terror plots. In addition, Saudi Arabia has been a close associate, friend and business partner of the United States for over sixty years. However, the Saudi government and people are not pleased with the American bias towards Israel in the relentless political between Israel and its neighboring Arab countries. Supports for boycotts of the U.S. products are voiced whenever the Israeli-Palestinian conflict flares up. However, the country’s foreign policy has not had too much impact on its trade with the so-called ‘enemy countries’ like Iran and Israel. The country has imported a number of horticultural products from Israel (Saudia Online 2).

The main drivers of the food sector in Saudi Arabia are its huge population and the increased growth rate. The demographic profile indicates that the larger population in Saudi Arabia is below 30 years. This has greatly influenced the consumption of processed foods from the local industries. During Hajj, the additional requirement from pilgrims and changes in lifestyle has driven the sale of ready to eat foodkinds of stuff (Saudia Online 1).

Saudi Arabia’s food is acquired both locally and internationally. A well developed agricultural sector has significantly promoted local production, thus, making the country independent in a number of foodkinds of stuff. Saudi government has introduced a policy encouraging local farmers to expand their production from crops demanding a lot of water, to the farming of dates, vegetables, fruits, and alfalfa (Matrade 2). The availability of Halal food has never concerned the Saudi residents since their availability is guaranteed by the government. The country has been striving to be self-sufficient in the production of Halal.

However, it has not achieved this yet and has been relying on imports from countries like the U.S., Brazil and France. During Hajj, the hospitality and retail industry are normally forced to enhance their stock in expectation of increased number of aliens. Foreign pilgrims, always estimated to be around 2.5 million every year, normally spend at least a fortnight in the country. A number of multinational companies usually import their products in their own brand names. However, there are some multinational companies that have developed a habit of creating private label that appeals to the Arabic/Muslim community. A large number of foreign companies have adopted Arabic names, for instance, Al-Alali to appeal to the local consumers (Matrade 3).

Consumption Trend Analysis

Local farmers are practicing modern methods of irrigation in the production of vegetables such as zucchini, onions, tomatoes and potatoes. The country is a larger producer of wheat and barley. The increased growth of population and high movement of people to urban areas has resulted to a shift to protein-rich diet among the Saudi consumers. Urbanisation is now a major cause of Saudi Arabia’s demand for farm animal products such as milk, meat and eggs.

Urbanisation has triggered advancement of infrastructure facilitating business of perishable goods. Increased movement of people from rural to urban areas has also shifted food preferences. Majority of urban residents prefer a diet rich in farm animal protein and fats than those living in rural areas. Therefore, the pattern of food consumption in Saudi Arabia is steadily changing from energy-giving staple foods such as cereals to food rich in protein such as meat and milk. Combining this with the increased growth of Saudi Arabia’s population boosts demand for the farm animal products (Mousa 3).

The fact that the Saudi Arabia’s population is 100% Islamic and that the two holy Muslim cities are based in the country makes the Islamic laws be strictly observed, thus, increasing demand for halal foods. The demand for halal food has been increasing significantly due to rising Muslim population in Saudi Arabia. Therefore, most of the foods stuff supplied in the Saudi Arabia’s market is Halal (Matrade 2).There is also an increased awareness of healthy food or functional food in Saudi Arabia, such as carbohydrates rich in high energy.

Consumers rely mostly on dairy products and cereals with health benefits, which range from anti-oxidants to pro-biotics. This range aims at promoting wellness and longevity, thus, preventing emergence of chronic diseases other than providing basic nutrition to the body (Matrade 3). Food sector in Saudi Arabia has witnessed an average growth rate of about 7.6% on the last seven years. The following table shows the development of this sector for 2004 to 2010. It also shows that the numbers of outlets have increased by 3 million in the last seven years.

Figures for growth in food sector from 2004-2010 (Euro monitor)

Figures for forecast growth in food sector from 2011-2014 (Euro monitor)

The sex segregation law, imposed in Saudi Arabia, restricting male-female interaction in the community has also played a major role in consumers’ preference for take-away foods. This has affected the whole home delivery practice for Saudi families since they are incapable of enjoying complete experience in union with their whole family. In view of these situations, take-away food services have amounted to more than USD 1.4 billion, which represent approximately 25% of the sector’s total revenue (Matrade 3).

Business model description

Market predictors of the Saudi take-away food sector and consumer trends point out a strong growth in demand in this sector due to increasing predilection by Saudi consumers to eat at home. However, the market place has remained quite competitive. This business model adds value to this environment by: enabling restaurants and food services that do not offer delivery services (in order to avoid added logistics expenses) to gain a portion of the growing take-away food market, providing a complete online repository of all partner restaurant menus with prices, location indicator and food delivery tracking functionalities to customers, and offering a unique pricing system where the margins are derived from partner restaurant’s savings in operational expenses as opposed to an additional delivery fee borne by the consumer (Mousa 3).

Customer divisions

With a larger population of residents, Saudi government offers the ideal site to change this idea into a beneficial business. As shown above, the food sector in Saudi Arabia has experienced a steady 7.6%% growth for the period of 2004-2010.Part of these sales are from take-away food services obtainable by fast food restaurants and pizza chains fulfilling the socialising needs of consumers who prefer to eat at home both for lunch and dinner gatherings as opposed to visiting restaurants as interactions between opposite sex in public places are restricted owed to sex segregation laws (Mousa 3).

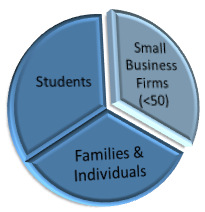

The materialisation of fast food restaurants and pizza chains has enhanced the provision of take-away food services. Whereas a large percentage of these chains’ revenues comes from the consumer segment, there is an increased demand for lunch catering services in the market over the recent years (Mousa 4). From the above table, there are three main target customer division identified:

Business to business (B2B) arrangements for small business firms that do not own a self-service restaurant for lunch delivery services and business to consumer arrangements (B2C) for young generation aged between 15 – 40 years. This group is further segmented into students and young families. Whereas these families and individuals are the main focus for dinner delivery services, targeting the student community offers the Saudi Arabia market extra revenues from delivering lunch on campus but also bulky delivery deals for parties and special occasions. The above segments can further be sub-categorised based on income levels, family and business size and location at the qualification stage (Mousa 4).

Distribution Channels

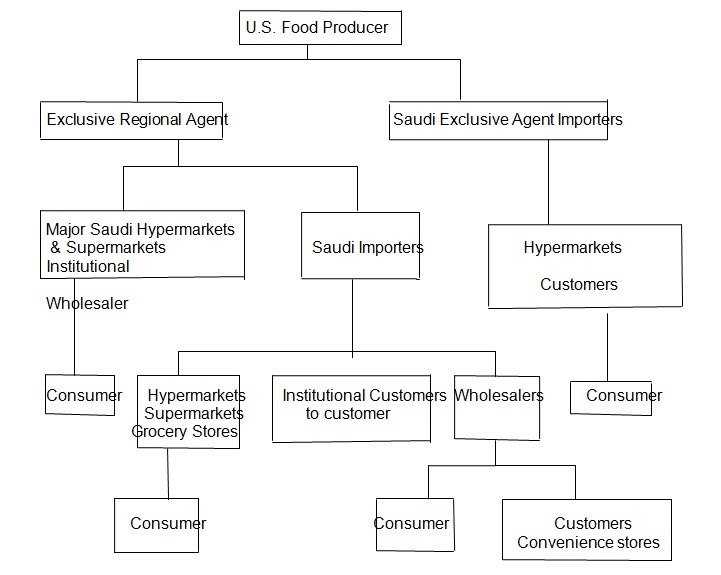

A range of marketing channels are shown in the flow chart below showing the means by which food imports arrives in Saudi Arabia from a manufacturing plant in the U.S (Matrade 5).

Food producers usually make direct sales to sole agency importers, wholesalers, or U.S.-based consolidators. U.S.-based consolidators make purchases from producers and/or wholesalers. Saudi importers and Saudi supermarket chains make purchases directly from U.S. consolidators. The main Saudi importers run a well-formed country supply channels and make direct sales to retailers, institutional customers and wholesalers. Corner grocery stores and convenience stores provide a source for their products locally from wholesalers (Matrade 5).

Most of the food importations in Saudi Arabia are carried out by private businessmen who have employed consolidators. After the consolidators have acquired the products from the foreign suppliers, they put a sticker on them and make arrangement for their transportation to Saudi Arabia. Consolidators regularly advocate for products that are new to the market products to Saudi Arabian importers. Popular food products in Saudi Arabia range from vegetable products, cereals, and bakery and poultry products among others. The increased consumer awareness in Saudi Arabia has increased demand for dietary and healthy food stuff (Saudia Online).

Local Food Processing Sector

Food production in Saudi Arabia is rapidly expanding. The Saudi government has always extended their assistance to the local food processing companies in the form of credit facilities and subsidies, and imposition of higher tariff rates on the imported products that are also being produced locally. Locally produced food products have their market in the whole of Arabian Peninsula, as well as Yemen (Saudia Online). The extended Saudi market has forced foreign companies to team up with local companies to produce their brands. Those companies include General Foods, Delmonte, Frito-Lay, and Nestle. Most of readily available consumer food items in Saudi supermarkets for sale are, however, imported. Most of the local food stuffs are processed using foreign ingredients (Matrade 6).

Due to Islamic religion, Saudi Arabia has banned imports of alcoholic beverages, live swine, pork, and ingredients for food stuffs that contain pork products, for example, pork fat and gelatin. They have also banned food products such mule and donkey meat, frog legs, swine leather, poppy seeds, hemp seeds, and hops (Matrade 7).

Pricing of food products

Products are priced competitively to food items. Saudi agents normally negotiate for low prices for the imported products to maximise profit. These agents used to get high profit margin in the past but, nowadays, the margins have gone down due to stiff competition in the local and international market. Other Halal food companies should know that the Saudi government has no control over pricing of products by local supermarket. From this, a difference is seen in prices for a product from the others in the market (USAID 1). The Middle East and North African countries (MENA) have been experiencing general inflation in the past five years.

This inflation is attributed to the overall increase in food prices. Food inflation has been high in MENA than the general inflation with rapidly increasing food price indices surpassing the overall price indices. However, the situation has been relatively stable in Saudi Arabia thanks to the government’s effort subsidise the agricultural sector. The government understands the crucial role played by this sector in sustained economic development and food security. These subsidy programs contributed to the increased food production in Saudi Arabia, particularly fruits, dates, poultry, and fish among others. In addition, this subsidy program has made the country a surplus producer of fish dairy milk and dates.

In 2011, the agricultural sector contribution to Gross Domestic Product (GDP) was 5 percent and employed more than a half a million workers. Despite of the government heavy investment on commercial dairy and poultry production, production in horticultural sector has increased tremendously. The government has continued to push and support selective agricultural production by offering interest free soft loans, allocating free farm lands, and subsidising production. Some of the selected food products that have been subsidised by the government include 17 energy and protein rich animal feed like Soya meal among others. In 2005, Saudi Arabia acceded to the World Trade Organisation’s Doha agricultural intervention and has been supporting the effort to correct and avert trade restrictions and distortions in the global market (USAID 2).

Competition Among Major Retailers

Géant and Carrefour entered the market in 2004 alongside Hyper Panda. This year was characterised by a condition- of-the-art shopping experience and aggressive competition. Currently, Panda Hyper and its supermarket chain is the largest retailer in the country. It has struggled to reduce costs to enhance its competitiveness. It has also attempted to increase its profitability by introducing various revenue schemes (Saudia Online). Local distributors have being asked for listing fees ranging from $2,000 to $27,000 that depend on the size and power of the distributor. The power of the distributor to negotiate a lower listing fee depends on its size.

Often distributors authorise retailers to carry out special offers to consumers including buy one and get one free for products with less than 60 days or less remaining on shelf (Saudia Online). Food product dealers in Saudi Arabia continuously search for new products and often achieve this through promotion and advertising with the help of middlemen. To woo Saudi consumers, advertisement is considered to be a fundamental requirement. Most of the Saudi supermarkets are in the verge of introducing category management. As the system is becoming more popular, several product brands are likely to be eliminated in the near future (Matrade 7).

Franchising has seen amasing growth in the Middle East region over the last few years with the increased number of international companies seeking to establish their presence in the region. The last five years have seen an incredible growth in the Franchise market in Saudi Arabia with a lot of successful American, European and local franchise ideas taking shape. Many of the brand names are already well-established in the market (International Markets Bureau 1). Most of the franchise ideas are focused on the restaurant, food and retail fields.

Closely observing the trend, most of the local Saudi franchise developers have managed to promote more than 30 Saudi ideas using franchising within the country with some of them going international. Franchising is supposed to be an ideal business model for small to medium enterprises in Saudi Arabia (International Markets Bureau 2). Despite of the global economic crisis, the Saudi economy has remained resilient due to stricter fiscal policies and regulations. However, it should be noted that there is still no specific law or regulation applicable to the franchise industry in the country. Franchise agreements frequently copy the existing agency agreement set forward by the Ministry Commerce and Industry (International Markets Bureau 3).

Conclusion

The Saudi government has set up goals to achieve self-reliance in food production. However, this is a big challenge since it is among the countries situated in the larger gulf desert. Insufficient agricultural production has caused persistent food imports and this trend is likely to increase in the future if Saudi government does not act. Packaged food, in this country, is exhibiting a healthy, upbeat growth and has been rising at a rate of 5 percent per annum. The positive growth rate is largely attributed to the increasing disposable income among the Saudi residents.

In addition, the country has been witnessing increased employment rate among the youths which has put a lot of pressure on the local and international food companies to respond to the increasing demand for take-away foods from the growing middle income earners. They are also forced to launch new products, emphasising on the consumer health benefits. Food processing industries in Saudi Arabia majorly relies on foreign raw materials. The expanded market in the food industry has encouraged driven foreign companies to team up with the local companies in producing their brand.

The relatively young populations in this country are becoming increasingly conscious about their health and are now switching to health and dietary foodstuff and beverages. In addition, the inclusion of women into the workforce has considerably impacted on the consumption of take-away food. Families have become so dependent on packaged food because of their busy schedules that leave them with minimal time to cook. The sex segregation law, imposed in Saudi Arabia, restricting male-female interaction in the community has also played a major role in consumers’ preference for take-away foods. This has affected the whole home delivery practice for Saudi families since they are incapable of enjoying complete experience in union with their whole family.

Saudi consumers have the tendency of shopping in supermarkets because of the availability of foreign products. In addition, the high number of foreigners and pilgrims in Saudi Arabia has increased demand for diversified and high quality food products. Saudi Consumers rely mostly on dairy products and cereals with health benefits, which range from anti-oxidants to pro-biotics. This range aims at promoting wellness and longevity, thus, preventing emergence of chronic diseases other than providing basic nutrition to the body. For that reason, Saudi consumers enjoy a wide variety of high quality foodstuff.

The country has been striving to be self-sufficient in the production of Halal. However, it has not achieved this yet and has been relying on imports from countries like the U.S., Brazil and France.The fact that Saudi Arabia’s population is predominantly Muslim and the fact that the country two holy Muslim cities are based in Saudi Arabia, has increased demand for halal foods. The country also strictly observes Islamic laws. The demand for halal food has been increasing significantly due to rising Muslim population in Saudi Arabia. Therefore, most of the foods stuff supplied in the Saudi Arabia’s market is Halal. Availability of Halal food has never concerned the Saudi residents since there availability is guaranteed by the government.

The country has been striving to be self-sufficient in the production of Halal. However, it has not achieved this yet and has been relying on imports from countries like the U.S., Brazil and France. During Hajj, the hospitality and retail industry is normally forced to enhance their stock in expectation of increased number of aliens. Foreign pilgrims, who are always estimated to be around 2.5 million every year, normally spend at least a fortnight in the country. A number of multinational companies usually import their products in their own brand names. However, there are some foreign companies that have developed a habit of creating private label that appeals to the Arabic/Muslim community.

A large number of foreign companies normally adopt Arabic names, for instance, Al-Alali to appeal to the local consumers. Most of the food importations in Saudi Arabia are carried out by private businessmen who have employed consolidators. After the consolidators have acquired goods from the foreign suppliers, they put stickers on them and send them to Saudi Arabia via air or sea. Consolidators regularly advocate for products that are new to the market products to Saudi Arabian importers.

A section of the Saudi consumers generally prefer the U.S. products over the local products.

They view these products as meeting high quality standards than those from other countries including their own. Therefore, the U.S products have enjoyed high preference and demand in the Saudi market. Demographic profile indicates that the larger population in the Saudi Arabia is below 30 years. This has also influenced great consumption of processed foods from the local industries. The increased distribution of the hypermarkets and supermarkets in the country has really helped to distribute the U.S. products and other foreign products.

Saudi Arabia’s food market is a market with greater completion, where various food products are offered, be it locally produced, franchised or imported products. Food product dealers in Saudi Arabia continuously search for new products and often achieve this through promotion and advertising with the help of middlemen. To woo Saudi consumers, advertisement is considered to be a fundamental requirement. Saudi Arabia being a relatively free market, consumers are highly sensitive to price changes. Despite of high preference for quality, cutthroat pricing is fundamental in maintaining market share.

However, experts argue that cutthroat pricing in Saudi market should not scare foreign investors because in the long run product quality plays a critical role in consumer loyalty. Foreign companies are urged to study the market first before making an entry. To achieve this it is advisable to regularly attend food stuff trade fairs held in Saudi Arabia to familiarise with Saudi products, local and foreign competitors, and different market segments. In addition, foreign companies should engage local companies to create a direct link with the local consumers. Individual contacts are considered a very essential key to access Saudi market.

Works Cited

International Markets Bureau. “Packaged Food Sales in Saudi Arabia.” Marketing Indicator Report, 2011. Print.

Matrade, Jeddah. Product Market Study: Market of Halal Products in Saudi Arabia, Riyadh: Franchise Exhibition of Middle East, 2010. Print.

Mousa, Hussein. Saudi Arabia: Retail Food Sector, Riyadh: U.S. Agriculture Trade Office, 2009.Print.

Saudi Online. Agri-Food Sector Profile. 2010. Web.

USAID. “Food Price Trend in Middle East and North Africa (MENA).”World Bank’s World Development Indicators, 2009. Print.