Introduction

A new product starts to compete with other products in the market based on its technology, concept and the service it is offering the targeted clients. As the market and industry within which the new product is operating within develop, competitors emerge and the platform on which competition takes place also evolves. This is given the fact that the market is a dynamic and not a static entity. The competition in such a case extends beyond technology, concept and service to include other factors such as cycle time, the quality of the new product and reliability of the same (Platt and Platt 2001).

The competition progresses as the industry matures and becomes more sophisticated. The competition in that case inevitably moves further to involve the price of the new product and those of other competitors. According to Platt and Platt (2001), competition on the basis of price leads to reduced profit margins for the producer. When this happens, the producer shifts their attention to cost reduction in order to maintain the competition (Garrett 2011). This means that the producer will try to reduce the costs involved in production of the product as much as possible (Archie and Wilbur 2000).

Horngren, Forster and Datar (2007) are of the view that as the producer shifts their focus to cost reduction, one major challenge arises. The producer realises that the costing structure for a product that is already under production is usually locked in such that even if cost reduction is effected, little or no impact is realised (Horngren et al 2007). This is given the fact that a significant portion of production cost is committed on the basis of decisions that are affected at the development level of the product under consideration. As such, the management realises that for cost reduction to have any impact on the market, it has to take place during the product development phase (Younker 2003).

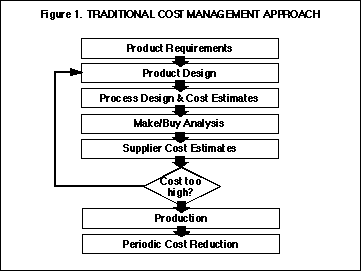

According to Crow (2002), production engineers have for the longest time concentrated on satisfaction of the target customer’s needs. As such, the cost of a given product has always been taken as a dependent variable that is affected by several decisions made by the management regarding that product. These are decisions such as the functions of the product, the major features of the same as well as its performance. To support this position, Crow (2002) argues that the cost of the product is usually analysed much later during the development cycle of the product. This means that more often than not, the cost of the product is usually more than what the management would have wished for (refer to Figure 1 for an illustration of this process).

The scenario depicted above is what Crow (2002) refers to as traditional cost management approach. To overcome the shortcomings of this approach as illustrated above, most production managers have realised the need to adopt a new and significantly different cost management approach. Target cost management has been found to be the best approach address the shortcomings of traditional cost management approach (Cannella 2001).

According to Ittelson (2008), target costing can be conceptualised as a pricing approach that is adopted by the management to address the limitations and weaknesses of conventional cost management strategies (Dekker and Smidt 2003). As a management tool, target costing can be used to bring down the comprehensive cost of a product throughout its production lifecycle (Bragg 2011). Target costing is complemented by production, engineering, research and design that are carried out throughout the production cycle (Baker 2005).

Bragg (2011) defines target cost as the maximum possible cost of a product throughout its production lifecycle that is required so that the producer can still maintain a desired profit margin when the product is sold at a given selling price. When adopting target costing strategy during the production and marketing of a given product, the management computes the desired cost of production using envisaged profit margin and a selling price that will enable the product to compete favourably on the market. The target cost is computed by subtracting the envisaged profit margin from the selling price that the management feels will make the product compete favourable on the market (Cavalieri and Pinto 2004). The formula below is the one used to determine target cost:

Target Cost = Anticipated Selling Price – Desired Profit Margin (adopted from Cooper and Kaplan 2008)

As the analysis above indicates, target costing is significantly different from conventional or traditional cost management approaches. According to Crow (2002), this form of costing is built on three major premises. The first is the alignment of the product with the purchasing power of the customers in such a way that the anticipated selling price is accessible to the target market. This can be achieved by letting the forces of a competitive market set the price for the product. The second premise upon which target costing is built is the treatment of the production cost as an independent rather than a dependent variable when the management is determining the requirements of the product (see also Horngren et al. 2007).

In conventional cost management, the cost of the product is treated as a dependent variable that is influenced by other factors such as the decisions made by the management. The third premise on which target costing is built involves proactively working to attain the desired cost during actual production of the item. This means that the management has to make sure the decisions made to cut costs during the development phase are implemented during the production processes. In other words, decisions such as sourcing for quality raw materials, employing qualified and skilled labour force among others made during development phase has to be actualised during production (Hussein and Tam 2004).

Target costing has been found to effectively address two important aspects of a liberal and competitive market. One of them is the realisation of the fact that many producers have little or no control over price of their products in the market than they would desire (Bojadziev and Bojadziev 2007). This is given the fact that it is the supply and demand forces of the market that determines the price of a given product or service. A producer who ignores this aspect of the market is set to fail as far as their products are concerned. This is the reason why the management has to take into consideration the anticipated selling price of their product when computing target cost (Jiang and Hsu 2003; Joshi 2001).

The second aspect addressed by target costing is the fact that a significant portion of the product’s cost is set at the design stage of the same (Bojadziev and Bojadziev 2007). Once the product has been designed and the process of production initiated, the management can do little to cut back on its production cost. The management’s control over the production cost is great during the design phase. This is given the fact that the management can make decisions to use inexpensive parts and labour among other things to bring down the cost of production. Cost reduction at the design phase is also more robust and reliable than at any other stage during production (Bleck 2002).

It has been established that a firm operating in a robust, liberal and competitive market has limited control over market price of their product as well as the cost of production once the design is approved and undergoes the production process. This being the case, it is realised that the firm has a greater chance of improving its profit margin during the design stage. This is given the fact that the design of the product can be manipulated to incorporate the customers’ desires as well as to cut down on costs of inputs. This is where target costing comes into play (Younker 2003).

As illustrated by the analysis above, target costing has several advantages that can be exploited by the producer to increase profitability in a competitive market. This includes customer satisfaction, reduction or elimination of unnecessary costs among others (Cooper and Kaplan 2008). However, many managers continue to wonder the extent to which target costing can enable the company to address profit and product in an integrated manner. So, to what extent does target costing allow the company to focus on product and profit in an integrated strategy? This report is going to address this question. This author will analyse the research methodologies of studies that have been conducted in this field and the findings and conclusions that were made by these studies. The author will also critically review these past studies and make recommendations based on the findings made.

Preamble

In the process of analyzing how target costing can help the company focus on product and profit in an integrated manner, the author will make reference to the strengths and weaknesses of this strategy. As such, it is important to look at a brief overview of what target costing is all about.

Implementing Target Costing in a Company

Kulmala (2002) is of the view that many manufacturing companies such as Japanese motor companies have realised the need to adopt target costing in their production. This is given the fact that the world market is becoming more and more competitive necessitating the need for innovative strategies. This is especially so considering the fact that the demands and specifications of the customers are also becoming more sophisticated.

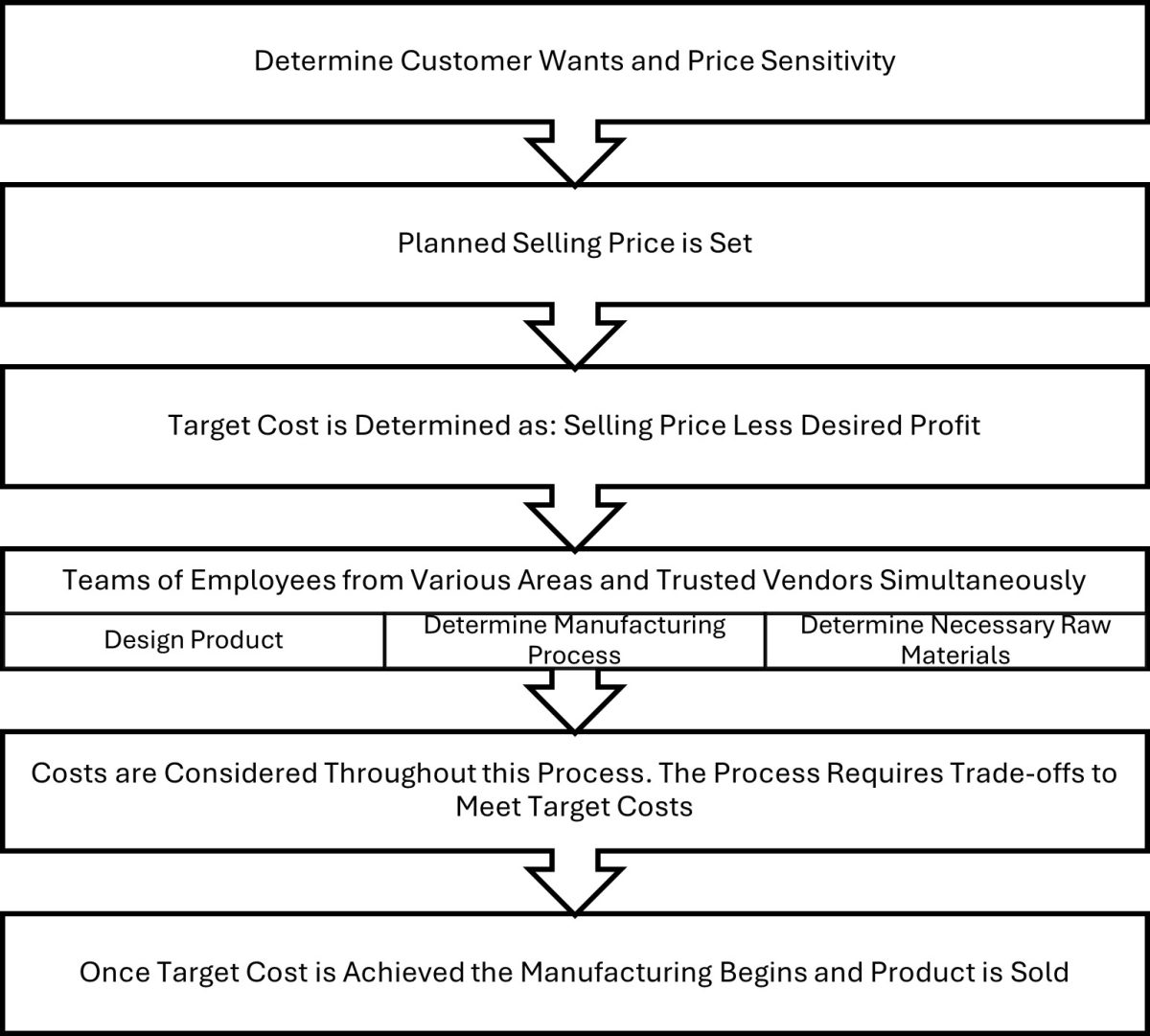

After the management has computed the target cost during the design stage, the blue print that is so developed is then passed on to the production team to act upon. The production team is expected to make the product in such a way that the computed target cost is not exceeded (refer to Chart 1 for an illustration of the target costing process).

There are various steps that are involved in the implementation of an effective target costing strategy in an organisation. These are analysed below.

Steps In Implementing Target Costing

Re-orientation of Organisational Culture and Attitudes

According to Crow (2002) and Ellram (2000), this is the first and most important step in the implementation of an effective target-costing strategy. It is also the most treacherous step in the implementation process. It involves changing the culture and attitudes of the members of the organisation from traditional cost management to target cost management. This means that the organisation now focuses on market-driven pricing strategies as well as prioritisation of the requirements of the target market. This is as opposed to the traditional focus on technical aspects of product development.

Setting a Market Conscious Target Price

The management needs to set the target price of the product based on several factors operating within the market. This includes the niche occupied by the producer in the market, the level of market penetration, level of competition in the market among others (Cheah and Ting 2005). This should also be taken into consideration if the producer is setting the target price in response to a proposal or quotation bid. The target price in such a case must be competitive enough and affordable to the client in order for the producer to win the bid (Cheah and Ting 2005).

Setting the Target Cost

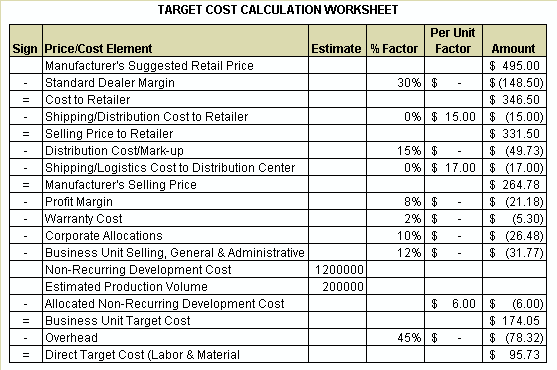

After the target selling price has been set, the company is now in a position to compute the target cost for the product. This can be done using a target cost calculation worksheet (refer to Table 1) employing the formula that was provided earlier in this paper.

Identify and Analyse Alternatives

It is noted that there are various alternatives that are available to the management as far as cost reduction is concerned. This means that there are alternative designs that may have been adapted to cut down on the production cost of the item. At this stage, the management should consider these various alternatives at each step of production process (Garrett 2011). The management will then settle for the alternative that is most suitable for their product given the situation under which they are operating.

Cut Back on Indirect Cost Application

Joshi (2001) notes that a significant portion of production costs are incurred indirectly. The scholar sets these indirect sources of costs at about 40 per cent of the total production cost. This being the case, the management cannot afford to ignore them. To cut down on these costs, the management can adopt various strategies such as coming up with a new strategy for indirect business processes such as outsourcing as well as cutting back on what Jiang and Hsu refers to as non-value-added costs. Also, the management should endeavour to identify all the sources of costs in the production process. This way, they can easily isolate indirect costs and try to avert them (Glautier and Underdown 2004; Horngren et al 2007).

The steps set out above vary from scholar to the other. There are those scholars who will provide a list of steps that is larger than the one provided above while others will go for a list that is much shorter. However, as much as the language used by the scholars and the prioritising of the steps varies from one to the other, the concept is likely to remain constant. These steps will significantly inform the extent to which target costing will benefit the company (Wardell 2011; Rawls 2011; Solway 2009).

A Critical Analysis of Target Costing

In this critical analysis, the author will address the strengths and weaknesses of target costing. These weaknesses and strengths will significantly affect the benefits that the strategy will have in a given organisation.

Advantages and Benefits of Target Costing

Proactive Approach

Canella (2001) is of the view that target costing has several advantages over traditional cost management. One of them is the fact that it is a proactive approach that is adopted by managers to manage the costs of production. It involves not only the managers but also the designers, engineers, production supervisors among others. As such, it is a participatory way of managing production costs.

Customer Oriented

This strategy takes into consideration the needs of the customers as well as their purchasing power (Cavalieri and Pinto 2004). At the design phase, the needs of the customers as well as the components that they are willing and able to pay for are included in the product. During the process of determining the target cost, the company takes into consideration the purchasing power of the client.

Brings Together Various Departments in the Organisation

This point is related to (i) above. According to Ellram (2002), target costing brings down barriers and boundaries separating various departments within the organisation. This is given the fact that various departments are needed to set the target price. This includes the marketing department (to collect information about the market), the research and development department (to come up with new and cost-effective designs) and the finance department (to compute the target cost) among others. This improves cooperation within the organisation.

Reduces Non-Value Added Processes

As earlier indicated in this paper, one of the major steps in implementing target costing in a given organisation is the reduction of indirect cost applications. This is done by having the management identify all costs involved in production of a given item. This way, indirect costs are isolated and identified to be addressed. The management can reduce these costs by restructuring the whole production process so that the non-value-added processes can be eliminated or reduced (Davila and Wouters 2004). This greatly streamlines the organisation’s production processes.

Disadvantages and Limitations of Target Costing

The Need for Detailed Data

According to Gagne and Discenza (2005), detailed data is needed to formulate and implement this cost management strategy. This means that the firm have to invest in data collection procedures for example to obtain information regarding competition in the market and the purchasing power of the customers (Ellram 2000). This may in the long run lead to additional costs for the firm.

Willingness and Cooperation Needed

As already indicated earlier in this paper, the formulation and implementation of target costing strategies require the input of various stakeholders both within and without the organisation (Davila and Wouters 2004). This means that extra effort is needed to bring all of these key players together and synchronise their activities (Dal-Ri, Alonso and Duarte 2005). This might be treacherous if the stakeholders are still embracing the culture and attitudes of traditional cost management strategies.

Puts the Quality of the Products in Jeopardy

Dal-Ri et al. (2005) is of the view that target costing may jeopardise the quality of the products in some situations if not well implemented. This is given the fact that the management may resort to the use of cheap components that are of low quality in an effort to bring down the costs of production (Fung, Tang, Tu and Wang 2009). This may reduce the quality of the product which might in effect reduce its ability to compete in the market.

The strengths highlighted above are some of the factors that may motivate an organisation to adopt target costing in its production processes. The weaknesses and disadvantages on the other hand are some of the costs that the organisation may incur in the implementation of the strategy. It is however noted that the benefits far outweigh the costs, making targeting costing a better option for managers keen on improving the performance of the product in the market. This means that target costing can go a long way in helping organisations focus on product and profit in an integrated manner. However, there are some costs that are involved in the process.

Evaluating Research Methodologies in Literature

In the sections above, the author introduced the reader to various aspects of target costing as a cost management strategy in organisations. An overview of the strategy was provided where a comparison was made between the strategy and traditional or conventional cost management strategies. The author provided the reader with steps that are crucial in implementation of target costing strategy in an organisation. This was followed by a critical analysis of the strengths and weaknesses of target costing as a cost management strategy.

In this section of the report, the author is going to provide the reader with an evaluation of methodologies that have been adopted by various researchers and scholars in this field. The researcher will analyse the effectiveness of the methodology that was used and the possible effects of alternative strategies.

Evaluation of Research Methodologies

A New Look at Management Accounting by Talha, Raja and Seetharaman (2010)

In this article, the authors present the reader with a comparison of the conventional management accounting systems with new techniques in management accounting. The authors are of the view that management accounting have for the longest time failed to embrace innovations in the information and communication technology sector. This view is held by Benner and Linnemann (2003) when they argue that there is need for managers to incorporate innovations in information technology in their accounting systems.

According to Talha et al. (2010), product costing is one of the major areas that management accounting has failed to incorporate with innovations in technology. This means that up-to-date manufacturing and management technologies have not been exploited fully by managers in management accounting (Dababneh 2003).

Talha et al. (2010) adopt a meta-analysis of literature that is available in this field. The research uses secondary data from various sources to address the issue of management accounting in contemporary organisations. The articles meta-analysed in this study were mostly retrieved and accessed from online databases using various search engines. The search engines include Google, Altavista, Excites, Lycos and Infoseek (Talha et al. 2010). The databases from which these articles were accessed using these search engines include IFAC, Chartered Institute of Management Accountants (herein referred to as CIMA) among others. The articles were found in various publications such as CPA online newsletters (Talha et al. 2010), technical bulletin among others.

One of the major strength of meta-analysis as a methodology is the fact that it enables the researcher to compare and contrast the perspectives and views of different authors (Solway 2009). As such, the study enjoys the contribution of different authors. The researcher notes agreements and disagreements among various authors when conducting a meta-analysis.

However, a major weakness of this methodology is the fact that the researcher does not come up with any new knowledge. All the researcher is involved in is organisation of knowledge of other scholars in the field. The researcher may once in a while express their opinions in the study, but this is drowned by the voices of the scholars whose work is being reviewed.

Target Costing in New Zealand Manufacturing Firms by Rattray, Lord and Shanahan (2007)

In this research, Rattray et al. (2007) acknowledge the fact that research on target costing has mostly focused on manufacturing firms inside Japan. Little research has been carried out in other countries outside Japan, and Rattray et al. (2007) set out to address this problem. They set out to analyse target costing in New Zealand and see the extent to which companies in this country are using the strategy.

The researchers used a questionnaire survey research design. They mailed 80 questionnaires to manufacturers in the country with instructions to complete and mail it back. A major strength of this methodology is the fact that the respondent is given the chance to complete the questionnaire at their own pace. However, a major weakness is the fact that the rate of response is usually low. For example, only 39 per cent of the questionnaires mailed by Rattray et al. (2007) were completed and mailed back to the researchers.

Cost Accounting Fundamentals, 2nd Edition by Bragg (2011)

This book was revised in 2011 and in 18 chapters it addresses many fundamentals of cost accounting. Target costing is just one of the cost accounting strategies that are addressed in this book. In chapter 10, the author addresses the fundamentals of target costing in contemporary organisations (Bragg 2011).

The author cites the work of other authors in this book. The methodology adopted in collecting information in Bragg (2011) is similar to that in Talha et al. (2010) given the fact that both uses information from other authors. However, Bragg seems to freely express his opinions and conclusions in the book based on the analysis of other author’s works. Like in Talha et al. (2010), the major weakness of this methodology is the fact that the author does not add any new knowledge in the field. However, the author is able to organise the knowledge of other people in the field by identifying agreements and disagreements.

Modelling the Subjectivity in the Target Costing Process: An Experimental Approach Based on the Fuzzy Logic Concepts by Dal-Ri et al. (2005)

In this article, Dal-Ri et al. (2005) acknowledge the fact that target costing is characterised by one major weakness that threatens to negatively affect its benefit as a cost management tool. This is the fact that most of the data and information that is used by managers in computing target costs might be inaccurate and unclear. This position is supported by Jariri and Zegordi (2008), Hergeth (2002) and Siegel (2008) when they address the major weaknesses of target costing.

The methodology used by these authors is a simulated experiment using fuzzy logic concepts to analyse the weaknesses of target costing processes. It is similar to the use of a case study to analyse target costing as a cost management strategy. The major strength of such a methodology is the fact that it enables the researcher to get an insight into the case that is being studied. The researcher is able to critically analyse the case and obtain detailed information regarding the same. The major weakness of this methodology is the fact that it concentrates more on the case and fails to take into account information from other sources. As such, the information gathered from a case study is usually limited.

Findings of Studies in this Field

Gagne and Discenza (2005) are of the view that target costing is one of the most important aspects of manufacturing companies today. Target costing brings together marketing and accounting aspects of the manufacturing company. This is given the fact that the managers have to collect information from the market regarding the ability of the consumers to purchase the product as well as the level of competition in the market. The information is integrated in the accounting processes as the managers compute the target cost for the product (Feil, Youk and Kim 2004: Swenson, Ansari, Bell and Kim 2003: Fung et al. 2009).

Ellram (2000) argues that it is important for the management to involve key stakeholders in the target costing process. This is given the fact that target costing is ideally a participatory management process. Ellram (2000) especially focuses on the importance of integrating the purchasing and supply departments in the target costing process. This is given the fact that the purchasing department is tasked with sourcing of raw materials and inputs using the price margins set forth by the target costing computations (Castellano and Young 2003). The supply department on its side distributes the product using the selling price determined through target costing.

Hergeth (2002) argues that target costing is a crucial component in the textile industry. This is given the fact that the survival of any company in this industry is highly dependent on the ability of the company to offer the client with quality products at the right price (Hergeth 2002). The author argues that for the longest time, textile industries have adopted the conventional cost-plus calculation of selling price. The conventional strategy has various weaknesses given the fact that it is not in synch with the market forces.

Practical Application of Academic Literature in this Study

As already indicated in the introduction section of this paper, the major aim of this report is to analyse the extent to which target costing can allow the company to address product and profit in an integrated manner. The analysis of findings of other studies in this field that was conducted above was aimed at highlighting this issue to the reader.

The academic literature analysed by the author in the process of addressing the research question in this report possesses practical applications as far as the report is concerned. For example, the literature enables this researcher to compare and contrast the findings and opinions of other scholars in this field. Additionally, the researcher is able to identify agreements and disagreements among scholars in this field. The researcher will then come down in favour of a given school of thought in this field. By analysing the literature, the researcher is able to identify knowledge gaps in the field and recommend areas for future research.

Focused Critical Review of Literature

In the evaluation of Talha et al. (2010) study earlier in this paper, it was mentioned that the researchers used meta-analysis to collect and analyse data for the study. It was also mentioned that the use of information from more than one source makes this paper a credible reference for any future research in the field. Talha et al. (2010) are of the view that technological change in recent years has greatly affected the way many organisations operate. As such, the authors suggest that technology can be harnessed by the management to improve production and other operations of the organisation. Integration of technology in management accounting processes is such one strategy of improving the operations of the organisation. In the literature review section of the article by Talha et al. (2010), the authors analyse the findings of various researchers in this field. This aspect makes this paper an important source of information regarding management accounting.

Dal-Ri et al (2005) provide useful information on how strategies such as fuzzy logic can be used to improve target costing in an organisation. The use of a simulated case study of application of fuzzy logic concepts in the production of a tennis racquet goes a long way in helping the reader identify the practical application of target costing in an organisation. However, the fact that the Dal-Ri et al. (2005) used a case study makes it hard to generalise their findings and apply them to other fields such as the production of other items apart from a tennis racquet.

Conclusion

In conclusion, this report finds that target costing can go a long way in helping the organisation focus on product and profit in an integrated manner. Target costing helps the managers to analyse how reduction of production costs can improve the company’s profitability.

However, the report also found that the organisation is likely to incur costs in the process of implementing target costing techniques. This is for example the need to collect detailed cost data as well as the need to bring together different individuals to implement the strategy. However, the benefits of the strategy are more than the costs, and as such, the report recommends that the target costing strategy is viable solution for any organisation in today’s competitive world.

Recommendations

- This report recommends managers to adopt target costing in their cost management as it is more effective than traditional costing techniques

- The report also recommends that managers should be aware of the various costs and benefits that are involved in the process of implementing target costing techniques. This way, they can avoid the costs while exploiting the strengths

- More studies need to be carried out to determine the impact that target costing can have on other industries that incur running costs such as the service industry. This is given the fact that most studies in this field have focused on target costing in the production of goods and not production of services

References

Archie, L I and Wilbur, I S 2000. Target Costing for Supply Chain Management: Criteria and Selection, Industrial Management & Data Systems, 100(5), 210-218.

Baker, W M 2005. The Missing Element in Cost Management: Competitive Target Costing, Industrial Management, March-April, 2005, 123-135.

Benner, A R and Linnemann, F 2003. Quality Function Deployment (QFD)-Can it be used to Develop Food Products? Food Quality and Preference, 14(4), 327-339.

Bleck, Y T 2002. Manufacturing Industries Embrace a New Kind of Cost Management, The Guardian, Web.

Bojadziev, G and Bojadziev, M 2007. Fuzzy Logic for Business, Finance and Management, Singapore: World Scientific.

Bragg, S M 2011. Cost Accounting Fundamentals: Essential Concepts and Examples, New York: Free Press.

Cannella, G 2001. Target Costing and How to Use it, Journal of Cost Management, Fall 2001, 39-50.

Castellano, J F and Young, S 2003. Speed Splasher: An Interactive, Team-based Target Costing Exercise, Journal of Accounting Education, 21, 149-155.

Cavalieri, S and Pinto, R 2004. Parametric vs Neural Network Models for the Estimation of Production Cost, International Journal of Production Economics, 91(2), 165-177.

Cheah, C and Ting, S 2005. Appraisal of Value Engineering in Construction in Southeast Asia, International Journal of Project Management, 23(9), 98-109.

Cooper, R and Kaplan, R S 2008. The Design of Cost Management Systems: Text, Cases, and Readings, Upper Saddle River: Prentice Hall.

Crow, K 2002. Target Costing, DRM Associates.

Dababneh, J 2003. Boeing Unveils Quarter Profits, New York Times, March 23, p.4.

Dal-Ri, F Alonso, J and Duarte, C 2005. Modelling the Subjectivity in the Target Costing Process: An Experimental Approach Based on the Fuzzy Logic Concepts, The International Journal of Digital Accounting Research, 5(10), 203-222.

Davila, A and Wouters, M 2004. Designing Cost-competitive Technology Products through Cost Management, Accounting Horizons, 18(1), 13-16.

Dekker, H and Smidt, P 2003. A Survey of the Adoption and Use of Target Costing in Dutch Firms, International Journal of Production Economics, 84(3), 293-305.

Ellram, L 2002. Supply Management’s Involvement in the Target Costing Process, European Journal of Purchasing and Supply Management, 8(4), 239-244.

Ellram, L M 2000. Purchasing and Supply Management’s Participation in the Target Costing Process, Journal of Supply and Chain Management, 234-239.

Feil, P Youk, K H and Kim, I W 2004. Japanese Target Costing: A Historical Perspective, International Journal of Strategic Cost Management, Spring 2004, 10-19.

Fung, R Y Tang, J Tu, Y and Wang, D 2009. Fuzzy Financial Optimisation in Product Design using Quality Function Deployment, International Journal of Production Research, 23-28.

Gagne, M L and Discenza, R 2005. Target Costing, Journal of Business and Industrial Marketing, 10(1), 16-22.

Garrett, K 2011. Target Costing and Lifecycle Costing, ACCA, Web.

Glautier, M and Underdown, B 2004. Accounting Theory and Practice, London: Pitman Publishing.

Hergeth, H 2002. Target Costing in Textile Complex, Journal of Textile and Apparel, Technology and Management, 2(4), 1-10.

Horngren, C Foster, G and Datar, S 2007. Cost Accounting: A Managerial Emphasis, Upper Saddle River: Prentice Hall.

Hussein, M and Tam, K 2004. Pilgrims Manufacturing, Inc: Activity-Based Costing versus Volume-Based Costing, Issues in Accounting Education, 19(2), 539-553.

Ittelson, T R 2008. Financial Statements: A Step-by-Step Guide, London: McGraw Hill.

Jariri, F and Zegordi, S H 2008. Quality Function Deployment, Value Engineering and Target Costing: An Integrated Framework in Design Cost Management- A Mathematical Programming Approach, Scientia Iranica, 15(3), 405-411.

Jiang, B and Hsu, C 2003. Development of a Fuzzy Decision Model for Manufacturing, Journal of Intelligent Manufacturing, 14, 169-181.

Joshi, P L 2001. The International Diffusion of New Management Accounting Practices: The Case of India, Journal of International Accounting Auditing & Taxation, 10, 85-109.

Kulmala, H 2002. The Role of Cost Management in Network Relationships, International Journal of Production Economics, 79(1), 33-43.

Platt, M and Platt, H D 2001. Using Target Costing in a Turnaround: Controlling Product Costs Throughout the Value Chain, Turnaround Management Association, October 1, 2001.

Rattray, C J Lord, R and Shanahan, Y P 2007. Target Costing in New Zealand Manufacturing Firms, Pacific Accounting Review, 19(1), 68-83.

Rawls, K 2011. Surviving in a Competitive Market, New York Times, Web.

Siegel, P H 2008. Studies in Managerial and Financial Accounting: Applications of Fuzzy Sets and the Theory of Evidence to Accounting, London: Jai Press.

Solway, J 2009. Accounting and Costing in a Financial Crisis, The Guardian, April 23, 4.

Swenson, D Ansari, S Bell, J and Kim, I 2003. Best Practices in Target Costing, Managerial Accounting Quarterly, Winter 2003, 10-19.

Talha, M Raja, J B and Seetharaman, A. 2010. A New Look at Management Accounting, The Journal of Applied Business Research, 26(4), 83-96.

Wardell, H N 2011. Management in 21st Century, New York Times, June 3, 9.

Younker, D L 2003. Value Engineering: An Analysis and Methodology, New York: Marcel Dekker.