Executive Summary

Scope, Aim, and Topic

This document is a management consultancy report for Tata Motors. Its scope is confined to marketing, while the overriding aim is to explore the best international marketing strategy the company could use to increase its market share in Europe.

Background of Tata Motors

Tata Motors is an Indian automobile company, which sells different types of motorized vehicles (such as cars, buses, and lorries). It is also involved in the production and sale of military automobiles and construction equipment. The Mumbai-based organization employs about 81,000 people and is part of the larger group of companies known as Tata Group. The organization has a strong market presence in more than 175 countries. However, it has failed to make a strong mark in the European automobile market compared to its peers such as Toyota, BMW, and Volkswagen.

Data Collection Sources and Analysis Methods

Secondary data was collected and used to develop this report. A literature search was conducted from several databases, including Google Scholar, Mintel, and Statista. Keywords and phrases used to undertake the research include “Tata Motors,” “International marketing,” “Global Strategies,” and “Market share.” Information was analyzed using the SWOT framework, which explored Tata’s key strengths, weaknesses, opportunities, and threats.

Findings

Tata’s strengths include a diversified portfolio and a globally recognized brand. Its weaknesses are poor marketing policy, lack of market aggressiveness, and poor market penetration, while its threats include stiff competition, an increase in the price of raw materials, and the pressure to produce environmentally friendly cars. Comparatively, its existing opportunities include the use of innovation (Nano car) and a strong market position in the low-end segment of the automobile market.

Recommendations

- Pursue vertical integration strategies

- Market the Nano car as an environmentally friendly vehicle

- Target the low-end market segment and environmentally conscious customers

Scope, Aim, and Topic

Scope of the Report

The scope of this report is centered on investigating the right international marketing strategies for Tata Motors to use as a tool for improving the company’s share in the European automobile industry. The automobile industry will form the framework of the analysis. The focus of the analysis will be on investigating marketing strategies the Indian corporation could use to increase its market share in the European and American markets.

Aim of the Report

This report seeks to explore the best international marketing strategy that Tata Motors could use to increase its market share in the European automobile market.

Topic

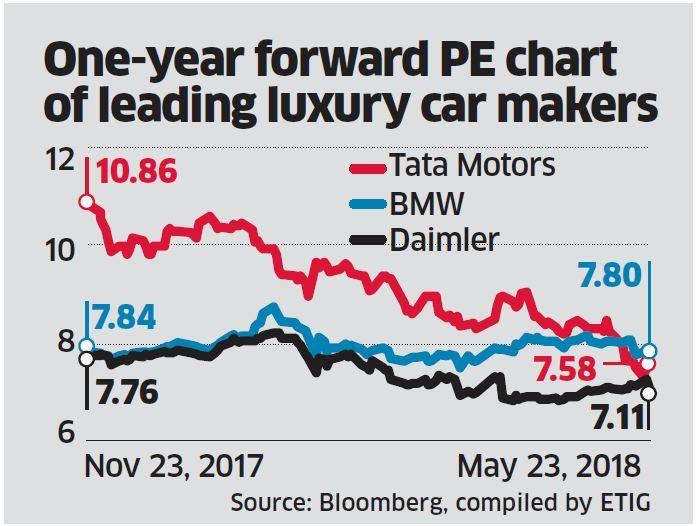

The topic for this report is “Seeking suitable international marketing strategies to increase the market share of Tata Motors in Europe.” Tata Motors was selected for investigation because it has failed to have a significant impact on the European automobile market (Shyam 2018). At the same time, a report by Morgan Stanley shows that the corporation has lost a 5% market share in the past year to control only 9% of the motor vehicle segment (Bhattacharya 2014). Within the same period, the company’s market share has declined by 10% within one year (from 15% to 5%) (Bhattacharya 2014). Figure 1 below supports this fact because it indicates the poor performance of Tata Motors, relative to its competitors, Daimler and BMW (in the European market).

The recommendations that will be highlighted in this report will be useful to the managers of Tata Motors to improve its market share, financial performance as well as enhance its overall international marketing strategy (Mathur & Agarwal 2016; Korde 2014).

Background of Tata Motors

Tata Motors is an Indian automobile company, which sells motorized vehicles (Tata Motors Production and Engineering 2018). Founded more than 73 years ago. The Mumbai-based organization employs about 81,000 people and is part of the larger group of companies known as Tata Group (Das 2016). Presently, the Indian firm operates three main subsidiaries, including Jaguar Land Rover, Tata Daewoo, and Tata Technologies (Das 2016). According to the company’s website, the organization has a strong market presence in more than 175 countries (TMCA 2018). Its mission, which is to innovate mobility solutions with a passion for the betterment of their customer’s experience, defines its operations in these markets. Its corporate vision is to be a high-performance organization, an achiever in stable financial performance, and a place for delivering exciting innovations (Tata Motors Production and Engineering 2018). Key values that fuel the company’s mission and vision are integrity, teamwork, accountability, customer focus, excellence, and speed (Tata Motors Production and Engineering 2018).

Data Collection Sources and Analysis Methods

Secondary Sources and their Justification

Secondary data was collected and used to develop this report. A literature search was conducted from several databases, including Google Scholar, Mintel, and Statista. Keywords and phrases used to undertake the research include “Tata Motors,” “International marketing,” “Global Strategies,” and “Market share.” Table 1 below explains why each research article was relevant to this report.

Table 1. Secondary Sources and their Justification (Source: Developed by the author for this work).

Employed Analysis Technique and Justification

Several techniques are available to analyze Tata motor’s marketing strategies. However, the SWOT analysis is selected for this review because it assesses a company’s key competencies or weaknesses, unlike other analytical techniques such as PEST and PESTLE, which are proficient when conducting an external analysis of a company’s environment. Furthermore, the SWOT analysis is selected for this report because its focus is on finding the appropriate marketing strategies to use in increasing Tata Motor’s market share in Europe. This review would require a proper understanding of the company’s internal competencies, which can be marketed in the target market. The SWOT analysis emerges as the best technique for undertaking this report because it focuses on a company’s internal operational dynamics. The findings of the SWOT analysis appear below.

Findings

Strengths

One of Tata Motor’s key strengths is its diversified portfolio, which limits its exposure to market risks (Das 2016). At the same time, the company is part of the larger Tata Group of Companies, which means that it can receive support from its parent company whenever there is a need to. This strength has a positive implication on the company’s sales and profit numbers because some of its products could compensate for the weaknesses of others. For example, the success of its Jaguar Land Rover subsidiary is compensating a lot for the weaknesses of the company’s other brands (Pathak 2016; Mukherjee 2016; Laddha 2016).

Tata Motors is a globally recognized brand. This is one of the company’s major strengths. Particularly, it is a well-known and leading brand in Asia (Crawford 2016; Singh & Arrawatia 2018). Internationally, its “Jaguar Land Rover” brand is celebrated for producing and selling some of the most iconic motor vehicle brands, such as Jaguar itself and the industry celebrated SUV brand, Range Rover (Karabag, Borah & Berggren 2018). Therefore, its strong global brand recognition is a significant strength of the company. Lastly, the company’s strong management team is also another strength of the company. This is seen through the corporation’s strong corporate management policy, which has helped the company acquire and turn around struggling businesses such as the Jaguar Land Rover, which Tata Motors turned into profitability after purchasing it from Daimler Motors in 2008 (IMB Institute of Management 2017; Karabag, Borah & Berggren 2018). Notably, the company’s acquisition policy has been characterized by the purchase of companies, which have similar management policies (Rienda, Claver & Quer 2013).

Weaknesses

Lack of Market Aggressiveness: One of Tata Motor’s weaknesses is its lack of market aggressiveness. In other words, it has not been able to compete with other companies at the same level of innovative zeal. Tata Motors has instead adopted a laid-back approach to industry competitiveness because most of its brands are old. Comparatively, its peers are developing new car brands almost by the year, but Tata Motors does not seem to reciprocate by doing the same.

Poor Market Penetration: One of the greatest weaknesses of Tata Motors is the poor market penetration in mature markets. Instead, the company has only managed to achieve a strong market presence in some selected Asia markets (Venkatesan 2013). However, this should not be the case because the automotive industry is global (Nieuwenhuis & Wells 2015). If a company chooses to only concentrate on local or regional markets, it runs the risk of other established car manufacturers stealing its market share in its domestic market (Charles & Anderson 2016; Lafley & Martin 2013; Buckley 2014; Robinson 2014; Gong 2013). Such is the case of Tata Motors because established global brands are continuing to pose a significant challenge to the organization’s regional success in Europe.

Weak Marketing Policy: Another weakness associated with Tata Motors is a weak marketing policy, which is partly responsible for its lackluster performance in mature markets such as Europe and America. Having a strong market policy should have helped the company to understand the demand of their customers and produce or innovate products that would align with these needs (Cheng Lu 2014; Karam 2016; Verbeke 2013; Cuervo-Cazurra & Ramamurti 2014). This weakness is also partly responsible for the company’s poor communication plan because it has not effectively been able to communicate its value to its customers to generate more sales.

Opportunities

Nano Cars are produced by Tata Motors and are hailed for being relatively cheaper than most green cars in the industry (Kalla 2015; Singh & Shalender 2014; Saqib 2016; Singh & Joshi 2015). Because the company was a leader in the innovation of such brands of cheap vehicles, it could easily plug into the green revolution in the automotive car segment and position itself as a market leader in this regard.

Another opportunity that could define Tata Motor’s business is associated with its Indian roots. Since the company is Mumbai-based it stands a good opportunity for positioning itself as an automotive solutions provider for the low-end of the market (Karabag, Borah & Berggren 2018; Parboteeah & Cullen 2017). Coming from an emerging economy, Tata Motors could position itself as being a leader in the manufacture and sale of automotive products that are specifically designed to appeal to low-end customers (Motohashi 2015; Panibratov 2017).

Threats

Competition is a significant threat to the operations of Tata Motors. This particularly true based on the fact that most of the company’s competitors have been in the industry for a long time. Therefore, Tata Motors may not enjoy the lean quality and production standards that some of its competitors do.

The push for more environmentally friendly cars is also a threat to the operations of Tata Motors because the technology that should help it develop cars for the future is still at the infancy stage and some customers are already demanding better, affordable, and more fuel-efficient cars, which it is not yet producing (at least in large quantities). This threat is largely conceived under the larger framework of business sustainability because companies around the world (including Tata Motors) are under pressure to make sustainable products; otherwise, they will be rendered moribund or obsolete if they do not change (Peng 2016; Johnson et al. 2017; Anguelov 2014). In the short-term, this threat could undermine the competitive advantage of the company, but in the long-term, it has the potential of severely undermining the relevance of the business in the first place.

Lastly, the rising prices of raw materials in the global economy also poses a significant threat to the operations of the business because it undermines the competitive advantage that Tata Motors could offer its customers and increasingly makes some of its cars unaffordable to certain sections of the market. Notably, most of the vehicles produced by Tata Motors are running on diesel, which is slowly increasing in price around the world as managers try to phase it out because of environmental concerns (Gourav 2018). Table 2 below summarises the SWOT findings.

Table 2. SWOT Analysis (Source: Developed by the author for this work).

The findings highlighted above show the potential for Tata Motors to position itself as a leading global automotive brand in Europe by leveraging its strengths and minimizing its weaknesses. The model chosen above is useful to this report because it highlights specific areas concerning the company’s marketing operations, which should be improved or emphasized for improved performance in Europe. Some of the key recommendations that emerge from this review are outlined below.

Recommendations

Target Low-end European Market and Consumers who Love Environmentally Friendly Cars

Tata Motors should market itself as an automotive brand that addresses the needs of low-end customers and environmentally conscious consumers. The focus on the low-end segment of the market is informed by the entrenchment of established European car brands, such as Mercedes Benz, BMW, Audi, and Volkswagen (just to mention a few), in Europe. Besides being European and enjoying a strong local following from its domestic customers, some of these companies have been in existence longer than Tata Motors and have developed operational synergies that the Indian car manufacturer may not be able to fairly compete with, especially being a foreign (Indian) company. Therefore, Tata’s best probability of success would be in the target market segment that is relatively unexplored by these established car brands – low-end market (Kim & Mauborgne 2015; Spotts 2014; Elsalhy & Shariff 2013).

Tata Motors already has a good record of succeeding in such a market because it has reported good sales numbers in India, Bangladesh, Pakistan, and other Asia markets. Therefore, its marketing strategy should be designed to appeal to the low-end of the automobile market because its customers are often concerned with issues such as the cost of the vehicle (preferably low cost), a vehicle that consumes low volumes of fuel, and the cost of a car. These are just a few of the purchasing considerations that car buyers in the low-end segment may be interested in. Tata Motors has a good experience serving the need of such customers in the Asian market and it could replicate the same in the European market through the adoption of an elaborate market strategy that targets low-end European car buyers.

Market the Nano Car as an Environmentally Friendly Vehicle

Tata’s marketing team should also target customers who want to buy environmentally friendly cars because the company has demonstrated that it could develop cars that would cater to this need. One of the greatest strengths that the Indian firm has over its rivals (and that could be communicated in its marketing strategy) is its ability to develop an environmentally friendly car (Tata Nano) at a lower cost than most of its competitors (Kalla 2015; Singh & Shalender 2014; Saqib 2016; Singh & Joshi 2015). Few car companies in the European car market could produce and sell a similar electric car at a low cost. In other words, although Tata’s competitors are also targeting environmentally conscious customers by making electric vehicles, it could leverage its low-cost model and compete favorably in the European car market as suggested by Srinivasan (2016), Herstatt and Tiwari (2016).

The pursuit of the above-mentioned strategies would help Tata Motors to overcome some of its weaknesses, which are highlighted in the SWOT analysis reported above. To recap, the weaknesses are poor market penetration, lack of market aggressiveness, and weak marketing policy. Some of the recommendations highlighted in this report would also address some of the weaknesses highlighted here. For example, developing environmentally friendly cars based on innovation, such as that witnessed through the Nano car means that the company has to develop new products that are relevant to the contemporary needs of low-cost customers (Mathur & Agarwal 2016; Korde 2014). This strategy means that Tata Motors has to keep up with other car manufacturers in the production and development of new models. It may solve the problem of poor market penetration, and the lack of market aggressiveness. The problem of having a weak marketing policy could also be addressed by the same strategy because targeting environmentally friendly customers and low-cost-car buyers would be tapping into the company’s strengths, thereby improving the quality of its international marketing strategy (Farrell 2015; De Mooij 2013).

Pursue a Vertical Integration Strategy

Tata should also focus on pursuing vertical integration strategies to address the problem of the rising cost of raw materials. In the past, the company has mainly focused on pursuing a horizontal integration strategy. The quest by companies to acquire or collaborate with firms that are in the same sector underscore this plan. It partly explains why Tata Motors acquired Jaguar Land Rover. A vertical integration strategy would mean that the business collaborates with (or acquires) businesses that are outside of the automotive industry. This strategy would help in reducing its operational cost and improving the supply chain coordination (Kaynak & Seyoum 2014). Since mainstream car manufacturers dominate the European car market, Tata Motors could have more opportunities to differentiate itself from its competitors by having increased control over its raw materials. Broadly, this strategy could also contribute towards the improvement of its competitive position (Naga 2016). Collectively, the adoption of these recommendations could significantly improve the market share of Tata Motors in the European market.

Reference List

Anguelov, N 2014, Policy and political theory in trade practice: multinational corporations and global governments, Springer, New York, NY.

Bhattacharya, S 2014, Plummeting car sales, market share: is it time to give up on Tata Motors.

Buckley, P 2014, The multinational enterprise, and the emergence of the global factory, Springer, New York, NY.

Charles, G & Anderson, W 2016, International marketing: theory and practice from developing countries, Cambridge Scholars Publishing, Cambridge, MA.

Cheng Lu, W (ed) 2014, Brand management in emerging markets: theories and practices: theories and practices, IGI Global, New York, NY.

Crawford, M 2016, An analysis of operating environment & strategy: a case study of Tata Motors.

Cuervo-Cazurra, A & Ramamurti, R (eds) 2014, Understanding multinationals from emerging markets, Cambridge University Press, London.

Das, S 2016, Resurging Tata Motors: sniff out corporate credit risk with Altman z-score+, Sribatsa Das, New York, NY.

De Mooij, M 2013, Global marketing and advertising: understanding cultural paradoxes, 4th edn, SAGE Publications, London.

Elsalhy, M & Shariff, A 2013, How to settle the tussle between business model innovation approaches, viewed 11 August 2018, .

Farrell, C 2015, Global marketing: practical insights and international analysis, SAGE, London.

Gong, Y 2013, Global operations strategy: fundamentals and practice, Springer Science & Business Media, New York, NY.

Gourav, K 2018, Strategic analysis of Tata Motors.

Herstatt, C & Tiwari, R 2016, Lead market India: key elements and corporate perspectives for frugal innovations, Springer, New York, NY.

IMB Institute of Management 2017, Tata Motor’s transformational resource acquisition path, viewed 10 August 2018, .

Johnson, G, Scholes, K, Whittington, R, Regnr, P & Angwin, D 2017, Fundamentals of strategy, Pearson, London.

Kalla, N 2015, ‘Tata Nano: A positioning disaster’, IOSR Journal of Business and Management, vol.15, no. 6, pp. 47-53.

Karabag, S, Borah, D & Berggren, C 2018, ‘Separation or integration for successful acquisition? A comparative study of established and emerging economies’ Firms’, Journal of Applied Economics and Business Research, vol. 8, no. 1, pp. 1-23.

Karam, A 2016, The China factor: leveraging emerging business strategies to compete, grow, and win in the new global economy, John Wiley & Sons, London.

Kaynak, E & Seyoum, B 2014, Export-import theory, practices, and procedures, Routledge, London.

Kim, WC & Mauborgne, R 2015, Blue ocean strategy, expanded edition: how to create uncontested market space and make the competition irrelevant, Harvard Business Review Press, Cambridge, MA.

Korde, P 2014, ‘A study of cost analysis and control concerning Tata Motors Limited,’ Abhinav International Monthly Refereed Journal of Research in Management & Technology, vol. 5, no. 5, 24-29.

Lafley, A & Martin, R 2013, Playing to win: how the strategy works, Harvard Business Press, Cambridge, MA.

Laddha, S 2016, ‘Acquisition strategy: analysis of Tata Motor’s Jaguar Land Roar’, International Journal of Management & Business Studies, vol. 6, no. 1, pp. 17-21.

Mukherjee, D 2016, ‘Case analysis: Tata Motors’ acquisition of Jaguar Land Rover’, The Business and Management Review, vol. 8 no. 3, pp. 48-54.

Mathur, S & Agarwal, K 2016, ‘Financial analysis of automobile industries (A comparative study of Tata Motors and Maruti Suzuki)’, International Journal of Applied Research, vol. 2, no. 9, pp. 533-539.

Motohashi, K 2015, Global business strategy: multinational corporations venturing into emerging markets, Springer, New York, NY.

Naga, A 2016, Strategic management, Vikas Publishing House, New York, NY.

Nieuwenhuis, P & Wells, P 2015, The global automotive industry, John Wiley & Sons, London.

Panibratov, A 2017, International strategy of emerging market firms: absorbing global knowledge and building competitive advantage, Taylor & Francis, London.

Parboteeah, KP & Cullen, JB 2017, International business: perspectives from developed and emerging markets, Taylor & Francis, London.

Pathak, AA 2016, ‘Tata Motors’ successful cross-border acquisition of Jaguar Land Rover: key take-aways’, Strategic Direction, vol. 32, no. 9, pp. 15-18.

Peng, M 2016, Global business, 4th edn, Cengage Learning, London.

Rienda, L, Claver, E & Quer, D 2013, ‘The internationalization of Indian multinationals: determinants of expansion through acquisitions’, Journal of the Asia Pacific Economy, vol. 18, no. 1, pp. 115-132.

Robinson, L (ed) 2014, Proceedings of the 2008 academy of marketing science annual conference, Springer, New York, NY.

Saqib, N 2016, ‘Repositioning – a case study of Tata Nano’, Abhinav National Monthly Refereed Journal of Research in Commerce & Management, vol. 5, no. 11, pp. 37-45.

Shyam, A 2018, Muted demand in developed markets may weigh on Tata Motors volume growth.

Singh, N & Arrawatia, M 2018, ‘A study of financial performance analysis of Mahindra & Mahindra and Tata Motors’, Kaav International Journal Of Economics, Commerce & Business Management, vol. 5, no. 1, pp. 582-587.

Singh, S & Joshi, M 2015, ‘Newmarket creation via innovation: a study on Tata Nano’, aWEshkar, vol. 19, no. 2, pp. 87-99.

Singh, N & Shalender, K 2014, ‘Success of Tata Nano through marketing flexibility: an SAP–LAP matrices and linkages approach’, Global Journal of Flexible Systems Management, vol. 11, no. 4, pp. 11-16.

Spotts, H 2014, Assessing the different roles of marketing theory and practice in the jaws of economic uncertainty: proceedings of the 2004 academy of marketing science annual conference, Springer, New York, NY.

Srinivasan, R 2016, International marketing, 4th edn, PHI Learning Pvt. Ltd., London.

Tata Motors Production and Engineering 2018, Vision, mission, and core values.

TMCA 2018, Markets.

Venkatesan, R 2013, Conquering the chaos: win in India, win everywhere, Harvard Business Press, Cambridge, MA.

Verbeke, A 2013, International business strategy, 2nd edn, Cambridge University Press, London.