Introduction

Tawarruq comes from the term al-waraqa or al-warq meaning any silver or minted dirham provided as an exchange medium. In this concept, the term is assigned to an individual with plenty of silver coins. The term tawarruq originated from the word wariq, which implies dirham forged from silver.

However, the word wariq contains two accents in the Arabic language: warq and wariq. Additionally, tawarruk, as well as the verb that arises from al-Warraq, are only mentioned in variable nouns by linguistics since they cannot be directly trailled in the Arabic language as an al-istiraq (Mihajat 2011). It is given to a person that seeks money or dirham, and al-Iraq, which implies becoming rich. As a result, linguistics develops the term tawarruq for people that may pressure themselves on the means to obtain cash or, in other words, “al-wariq”.

The term tawarruq is linguistically applied to the process of searching or looking for money. Furthermore, Tawarruq refers to buying a product with delayed payment and later trading for cash to another person. There are three different parties involved in the process on a contract basis: the buyer, also known as mustawriq, that seeks liquidity, the seller or creditor, and the third party that buys the product (Ahmed and Aleshaikh 2014). The aim or goal of the subsequent trade is to obtain cash. It is essential to note that there are two distinct sales with no previous arrangement between the involved parties.

The Technical Meaning of Tawarruq

The technical meaning of tawarruq is that it entails a series of sale contracts in which a buyer purchases a commodity at a deferred cost and trades it at a reduced price in cash to an individual that is not the original seller. In simple terms, tawarruq entails buying assets by the mutawarriq on credit and trades it to another person different from the initial dealer on cash at a low price compared to the deferred price (Roslan et al., 2020).

This transaction is primarily referred to as tawaruq because the buyer obtains the commodity or product on deferred conditions. Moreover, the buyer does not aim to use the benefit from the acquired commodity but concentrates on how it allows him to obtain liquidity or cash (waraqh maliah). As a result, the objective of this trade is not to use the bought product but to gain liquidity or cash at the given time.

Problem Statement

The Islamic Shariah context allows Muslims to conduct themselves in a given manner per the set regulations. There are permissible and non-permissible activities which involve economic activities such as banking and other trading limitations. When conducting day-to-day tasks, it is required that forbidden elements such as Maisir, Gharar and Riba be avoided at all costs. The Islamic mode of banking and finance enables individuals to access monetary services and products.

Tawarruq is among the financial products provided by Islamic financial institutions such as banks, and it involves personal financing, liquidity financing and deposit financing. These financing options rely on tawarruq and Murabahah as their transaction backbone. It is crucial for the Islamic banks that operate in areas not governed by Shariah Laws to understand the limits of tawarruq to ensure that the transaction activities are conducted within the safe limits as required.

Most Islamic countries such as Malaysia, Qatar, Kuwait, Oman, United Arab Emirates, and Saudi Arabia have Shariah Regulatory bodies that monitor the Islamic banking systems in their regions. However, in other countries, such bodies do not exist; hence the need for understanding Islamic Banking as Islamic banks is significantly increasing. According to Ledhem and Mekidiche (2020), Islamic banking is significantly expanding its operation in many parts of the world, and many people recognize its operations. This provides the need for awareness regarding tawarruq as its forms the basis of most Islamic banking transactions.

Furthermore, there is a controversy surrounding tawarruq as some Islamic scholars believe that this financial product entails hilah and usury. According to Ibn Qayyim, tawarruq is impermissible and should not be allowed because it involves fraudulent activity and is against the Islamic Shariah laws and Allah (SWT) (Ahmed, Yahaya and Harashid 2012). The Islamic school of thought also have opposing views regarding tawarruq.

Shafi and Hanbali permit the tawarruq, while Ibnu Al Qayyim and Ibnu Taymiyyah prohibit its usage because they believe that the primary purpose of tawarruq is obtaining cash rather than then goods meant for trade (Mohamad and Ab Rahman 2014). However, in countries such as Malaysia, tawarruq forms a significant sector of the Islamic financial sector leading to criticism.

Purpose of the study

The purpose of this research study is to investigate the tawarruq concept in the current banking system. Additionally, the research explores tawarruq based on the Islamic Shariah laws, School of thoughts and various scholars’ views regarding the use of tawarruq in the financial sector.

Significance of the study

There are various benefits associated with the study conducted. First, it is vital to understand the concept of tawarruq from various Islamic scholars’ perspectives to make informed decisions. Second, it provides information regarding the principle of tawarruq during the early Islamic period to the current Islamic banking practices which is enhanced by the analysis of various scholarly materials. Third, it provides information regarding the detailed use of tawarruq and provides room for identifying the research gap.

Methodological Overview

The research uses qualitative research methodology to investigate the concept of tawarruq. Various research materials such as Islamic books and journals provide the required information on tawarruq. Materials that have been published within the last ten years are incorporated into the research study and are reviewed critically to ensure that the selected ones provide answers to the research questions. The materials are grouped based on the themes within the concept of tawarruq.

Scope of the study

This study will cover Islamic banking sector products, majorly tawarruq. It incorporates the history of tawarruq, which explains its origin. Furthermore, it also explains the methods for applying or executing the concept of tawarruq in banks, evidence of its acceptability or, in other words, permissibility, its types, as well as its rulings. In addition, the study covers reverse tawarruq, the ruling on organized tawarruq, tawriiq together with papering the cash debt.

Dissertation Structure

The dissertation has four chapters; the first chapter is the introduction which provides information regarding the purpose of the study, its significance and the methodological overview. The second chapter is the literature review section which provides the findings from various Islamic researchers and scholars. The third chapter is the methodology which provides the information on how the data was collected. The fourth chapter is a discussion which highlights the research findings.

Conclusion

The key aspects covered in chapter one include the contextual background of the study which involves linguistic and technical definition of tawarruq, the purpose of the research study, its significance and the methodological overview. Other key areas include the scope of the study, which provides an overview of the main areas that the research focuses and the dissertation structure. The next chapter of this dissertation is a literature review which provides various authors’ and scholars’ views regarding tawarruq.

Methodology

This chapter focuses on the methods and strategies that the researcher has applied to conduct data collection, data analysis, and findings of the research. The research uses secondary sources for data collection. Therefore, this section provides the methods for selecting relevant materials to ensure that only materials that meet the set criteria are selected and included in the research study. The main areas covered in this section include research approach, ethical consideration, data collection method, data analysis, research method, research design and study limitation.

Research Approach

The research uses both the inductive and deductive reasoning approaches in the collection and analysis of data. The inductive research approach involves collecting data relevant to the research question, and later the researcher identifies patterns in the data leading to the creation of themes (Azungah 2018). The deductive research approach involves the identification of a theory that needs to be tested. This approach uses three stages which include theory identification, formulation of the hypothesis, and analysis of the collected data to determine whether it supports or rejects the hypothesis.

Research Method

The research uses qualitative methods to collect the data pertaining to tawarruq. The qualitative method collects data that is non-numerical and is based on the views that various researchers portray in their research articles. In the current research, the qualitative method is used to collect data from secondary sources because the study uses a literature review methodology (Denzin et al., 2017). The qualitative method is mainly used in data collection that involves observation, interviews and focus groups. However, it is employed in this research because of the nature of the topic under investigation.

Research Design

There are multiple research designs that can be used when conducting qualitative research. Research design helps ensure that the collected data is significant in answering the research question. The current research uses the problem under study and data collection method to identify a suitable research design. Grounded theory is essential in explaining the origin of the problem under investigation. This theory enables the researcher to identify methods in which data will be collected and analyzed.

Data collection procedures

Various tawarruq definitions were used to identify multiple articles. Using varying definitions is crucial in ensuring that most of the research materials are included in the study. The databases used in collecting articles include the comprehensive Muslim library, Australian Islamic Library, Dawat-e-Islami, research gate, science direct, Google and Booksc. The search terms utilized to identify the required articles include “tawarruq”, “murabahah”, “inah and tawarruq”, “tawriiq”, “types of tawarruq”, and “rulings on tawarruq”. In articles such as journals, abstracts, titles and keywords were analyzed to ensure that they are relevant and suitable. Quran verses that provide information regarding tawarruq were also included. Additionally, articles that provide the history of tawarruq and those printed by Islamic bodies that regulate Islamic financing were also selected.

Inclusion and exclusion Criteria

This section provides a limitation on the materials to be included in the research study. It is crucial to ensure that research articles are either included or excluded from the study based on the set criteria. The purpose of this phase is to evaluate the materials that answer the research question either in parts or directly. This includes types of tawarruq, ruling on organized tawarruq, evidence that allows the use of tawarruq and those that deny its usage. Research materials were retrieved based on the citation number, the type of article, the search term, and the year of publication.

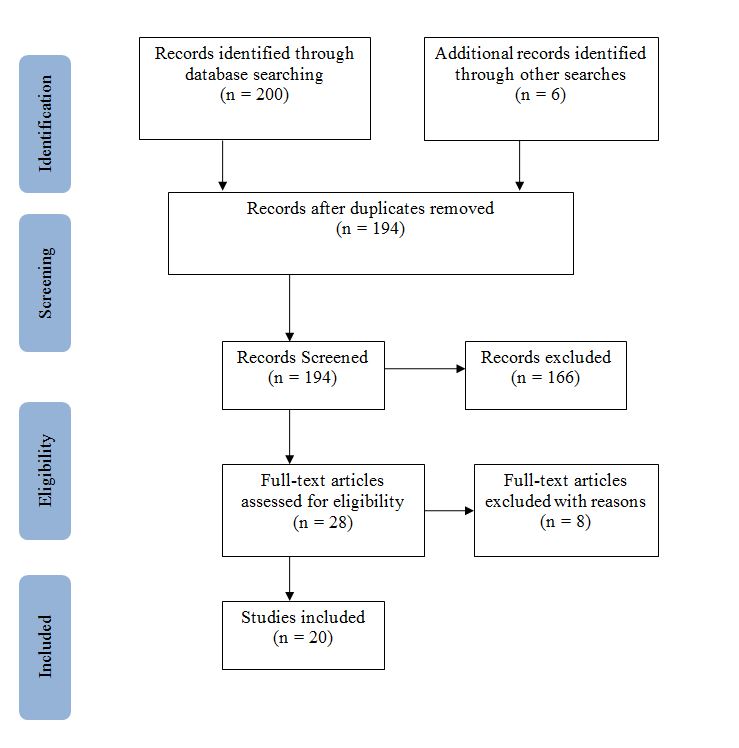

Materials that did not involve tawarruq and tawriiq were excluded. Two hundred articles were identified after the refining process. An additional six sources were retrieved from the research gate, leading to 206 articles. Twelve articles were then removed because of duplication. The remaining articles were then screened, which led to the elimination of 166 articles. The remaining articles were then checked for eligibility leading to the elimination of 8 articles.

Table 1.0: Inclusion and exclusion criteria.

Data analysis

Qualitative data analysis methods were employed to ensure that relevant themes were generated. Identification of themes was done by use of thematic analysis. This method was selected because the data collected is from secondary sources, and this method is helpful in the identification of themes that are consistent in various articles (Clarke and Braun 2016). During thematic analysis, the analysis focused on generating themes that answer the research question and focuses on the primary purpose of the research.

Ethical Consideration

Using secondary sources as the primary source of data collection has a significant ethical consideration. This is associated with the accessibility of the research materials collected from internet sources. The researcher requires permission from various authors and sites to access the necessary materials (Fleming and Zegwaard 2018). The provided information is only to be used when answering the research requirements. This led to the selection of materials that were relevant to the research study. Furthermore, the authors of research materials such as books and journals were given credit to prevent plagiarism.

Limitation of the methodology

This research uses secondary sources for data collection, which makes it a limitation. It is majorly due to the effect of generalizability, where various scholars tend to have opposing views. Furthermore, accessing materials from online databases and libraries poses a significant challenge.

Conclusion

The methodology chapter layouts the plan utilized by the researcher to collect the necessary research articles. The qualitative research design was used because of the nature of the research study and the need for analysis of various Islamic scholars’ views and arguments. The next chapter presents the literature review used.

Literature review

This chapter of the dissertation provides a review of various scholarly sources. Islamic schools of thought are identified and evaluated based on their arguments. Multiple scholars’ views are also analyzed based on the ruling and permissibility of tawarruq. This chapter is organized into two main sections: law schools and scholars’ views regarding tawarruq. Using the two views is essential in providing the necessary information regarding tawarruq. This chapter covers various aspects of tawarruq based on the views of the Quran, Hadith, and scholars.

Law Schools: The Hanafi School

This school of thought derives its label from Abu Hanifa, an Iranian who taught in Iraq. Hanafi School is flexible in that it focuses on the juristic interpretation, reasoning by analogy, ijma and qiyas, ray and private interpretation. The Hanafi School of thought allows the addition of new consensus and the cancellation of the old ones. On the concept of tawarruq and inah, there was confusion at a certain level. This led to the discussion of tawarruq under the heading of inah (Ahmed 2014). For instance, the definition of inah by Hanafi is that the borrower purchases a commodity from the lender for 12 dirhams.

Later, the buyer resells the product at 10 dirhams, making the owner profit of 2 dirhams. This description by Hanafi is based on inah when it is a tawarruq contract. Hanafi jurists contradicted the rulings regarding inah and tawarruq as it does not provide a clear distinction. Some disregarded the issue while others allowed tawarruq. Scholars such as Mohammad bin Al-Hasan, a Hanafi jurist, argued that tawarruq is the invention of individuals that take riba.

Abu Yusuf, a pupil of Abu Hanifah, allowed inah because he did not perceive it as prohibited riba. Ibn Al-Hummam later provided the difference between inah and tawarruq. Ibn-Al-Hummam used the view of Abu Yusuf to permit the tawarruq contract. Additionally, Al-Hummam agreed with the ruling of Al-Hassan on inah. The majority of the Hanafi scholars rejected inah because it involved bilateral contracts (Ahmed 2014).

Al-Sarkasi associated inah with an individual who, rather than giving out a loan when requested for one, responds by trading an item at a delayed cost. Moreover, as much as a majority of the Hanafi scholars reject inah, they permit tawarruq since it involves completing a trade or transaction by selling the commodity to a third individual who has no connection with the initial dealer.

Maliki School

This school of thought was set up by Anas Ibn Malik. It focuses more on qiyas than any other school of thought as it prefers it over Hadith because of the chain of transmission. Furthermore, Malikis also rely on ijma and Hadith of Medina scholars. Maliki’s customs are majorly based on the status of the Hadith. Scholars from the Maliki School of thought consider istislah and public welfare. They follow the traditions of Prophet Muhamad (PBUH), leading to a strong view of inah. They revoked inah as the commodity used during the sales transaction is still available.

Conversely, they did not mention tawarruq in their prohibitions. From the writing of jurist Ibn Rushd, Imam Malik responded to a question posed regarding individuals who engage in selling a product to other people, which is later retrieved from the third party without an arrangement between the first seller and the third party. Imam Malik perceived such a sale as inah (Ahmed 2014).

This implies that Imam Malik only accepts such a transaction when the third party is independent of the seller. Al-Qarafi argues that it is forbidden because the first seller organizes the sale. The Maliki School of thought shows that tawarruq is allowed so long as the first seller does not interfere with the second sale.

The Shafii School

This school of thought was founded by Muhammad ibn Idris al-Shafii. Shafii focused majorly on ijma and rejected various scholars’ views regarding istihsan (juristic interpretation) and istislah (public welfare). According to shafii, reasoning should be grounded on qiyas (line of analogy) and ijma. Most scholars following the Shafii school of thought reject public welfare because it varies depending on time and place. Shafii follows the chain of transmission to verify the link of Hadith. Shafii permits inah sale through his argument, which portrays that the buyer and the seller have the ability to decide on the transaction they want (Ahmed 2014).

This has made most scholars from the Shafii school of thought agree on inah being different from riba. They believe that inah prevents a person who wants cash from getting involved in haram. They conclude that a deal that prevents one from engaging in haram is good. However, tawarruq has not been mentioned in any Shafii books or as a type of inah. It can be concluded that since tawarruq involves selling a product to a third party at a lower cash price than the first seller, it is permissible.

Other scholars from the Shafii School of thought do not allow inah. For example, Ibn Hajar argued that although inah can fulfil the legalistic perspective, it involves a loophole used to generate riba-based loans (Ahmed 2014). Ibn Hajar concludes that inah is a sinful act; hence one should not engage. Zakariya Al-Ansari refutes inah because it is a burden to an individual in need situation as the seller sells the commodity at a large delayed price and later buys it at an insignificant cash price.

Hanbali School of thought

It was founded by Ahmad Hanbal’s disciples, and this school of thought bases its arguments on the Sunna and Quran. Scholars such as Ibn Taymiyya emphasize using the Quran and the Sunna. Ijmaa is only considered when it is from the rightly guided caliphs. Ibn-Taymiyya rejects independent reasoning because Allah is not bounded by human logic. Hanbali school of thought provides a clear difference between inah and tawarruq. According to Imam Ahmad, tawarruq is grouped into al-karahah (disliked) and ai-jawaz (permissible) (Ahmed 2014). Various scholars from the Hanbali School of thought forbid tawarruq.

However, Ibn-Taymiyah argues that the transaction is prohibited when an individual intends not to engage in trade or benefit from the transaction but to gain cash because one is in need. Ibn alQayyim argues that tawarruq leads to higher costs and losses, making it worse than Riba. Ibn al Qayyim concluded that Shariah law cannot disapprove riba on the basis of being lower harm and allow tawarruq, which is higher harm. Al-mardawi claims that most Hanbali scholars allow tawarruq.

The Difference between Tawarruq and Tawriiq

The concept tawriiq means documentation or taskiik, which refers to the transfer of the existing items or assets subject to circulation into Sukuk. This form of agreement or arrangement requires to be guarded by specific procedures and restrictions to attain the Shariah criteria that work based on the ownership of the investor on the assets that produce income. The process of giving a Sukuk is categorized into three parts with the perception of ensuring that the Sukuk bearers and the integrity of their circulation are protected (Rafiullah and Khan 2018).

Conversely, tawarruq involve the purchase of good by mustawariq at a deferred price and later sales it to another person with an aim of generating cash. Moreover, this primary standard has been modified to be compatible with modern banking operations (Rafiullah and Khan 2018). This means that the mustawriq can be the customer looking to acquire cash or the bank, and the bank is mainly an agent to complete the purchase or sale with a commodity dealer in place of the customer.

The Difference between ‘Inah and Tawarruq

‘Inah and tawarruq differ regarding the return of the asset or products traded. In ‘inah, the requester will have to return the object of sale to the dealer. On the other hand, the mutawarriq in tawarruq’s form will sell the assets to a new purchaser different from the initial one with no knowledge or arrangement of the original seller. Conversely, the requester arranges with the initial seller is organized tawarruq to sell the commodity to either return it to the first seller or sell it to another person, also referred to as a third person (Ahmed and Aleshaikh 2014).

Early scholars defined ‘inah is a credit trade of items for a deferred cost at a set coming date with the retrieval of the commodity at a lesser cost by the seller. Since ‘inah are fictitious, its sales are used by the seller of the product as a way of developing a debt similar to a loan that has interest. Another definition of ‘inah is where a middle man purchases the commodity over a delayed price in place of the individual that appeals an ‘inah sale and later sells back to the original seller by the ‘inah’s seeker at a lesser price than the original price.

The existence of an intermediary is the significant difference between the first and second forms of inah. Moreover, a different form of ‘inah would entail utilizing the credit and lending sale gain or charge interest (Ahmed and Aleshaikh 2014). Suppose that an individual would borrow 100 euros from a lender and later buy an item with a value of 50 euros for 100 euros from the lender.

In due course, the borrower will have to pay the 100 euros debt or loan with an excess of 50 euros on the initial cost of the product bought. Although the seller and the purchaser are similar individuals in ‘inah’s scenario, this type of sale appears identical to that of tawarruq. In both scenarios, the objective of the first sale is similar from the purchaser’s perspective.

Moreover, acquiring money comes as an ultimate goal in both transactions, and the initial seller trades the items or products on credit at a higher cost than the market price. Moreover, ‘inah and tawarruq are considered a ruse to avoid or evade participation in a loan with a rate of interest. Conversely, the subsequent sale determines the contrast between inah and tawarruq (Sras 2020). This is because the buyer trades the item to the seller in ‘inah, and the purchaser sells it off to a third party different from and has no knowledge of the first seller.

As a result, in individual tawarruq, the item is at the disposal of the mustawriq, who later sells it off at the market at the current cost to gain or obtain cash (Ahmad et al. 2017). Tawarruq enables a seller to gain or acquire liquidity without usury being involved since it includes a third party without preconditioning the original sale commodity to be resold or returned to the initial seller.

Types of Tawarruq

The term tawarruq can be classified into Al-Tawarruq at-Fardi, otherwise referred to as classical tawarruq and Al-Tawarruq alMunazzam, an Arabic term for organized tawarruq. Firstly, classical tawarruq is defined as buying an item at a deferred payment and then trading to a party different from the initial seller to acquire cash. Classical tawarruq can be described as a method where the Islamic Financial Institution (IFI) buys assets from the first dealer in the item market with cash (Mihajat and Hasan 2014). This will mean that the IFI gain ownership of the items and then sells them to the counterparty like a customer or another Islamic Financial Institution at a delayed cost, including the profit margin (Dabu 2014).

As a result, the counterparty will acquire commodity ownership and then sell it off to a second trader in the item market in cash. Lastly, the second trader acquires ownership of the identified item. This structure indicates that a real ownership transfer between the counterparty exists, and the counterparty holds complete right over the item. Moreover, every transaction is independent in the classical tawarruq structure.

However, in practice, in place of the counterparty, IFI will be selected as a mediator to trade the item to the other involved party while aiming at achieving cost effectiveness, known as organized tawarruq. Organized tawarruq, with contemporary definition, is the transaction where an individual (mustawriq) purchases an item from an international or local market at a delayed payment.

The mustawriq will request the financer to reschedule the trade at a low spot cost through his agent, special arrangement or in his capacity. Banking tawarruq is one form of the organized tawarruq, also known as Al-Tawarruq AlMasrai. In this form, the bank trades assets to the buyers from the market at a delayed price. The bank represents the purchaser to the third party in selling the commodity for cash and delivers it to the mustawriq.

In organized tawarruq, a commodity form, Murabahah is one of the most used concepts since IFI can receive a fixed return from it. Even though tawarruq and commodity murabahah are similar, they have three differences since commodity murabahah includes four parties, whereas tawarruq includes only three parties. Organized tawarruq is mainly used on the commodity murabahah since IFI can receive a fixed return.

Organized tawarruq can be described in a way that the IFI buys warrants from the first seller and pay location. Thereafter, IFI will trade the ownership to the counterparty who accepts the offer to buy them at a delayed price from IFI where the repayment date and the mark-up are prearranged. Moreover, the counterparty then selects IFI to trade the warrant on the spot to another buyer in their place (Dabu 2014).

Furthermore, the issuer could trade the warrants in a free market. As a result, the payment received by the counterparty indicates that the end buyer now receives ownership of warrants. Additionally, the counterparty will receive the warrants’ spot counter value in most cases if it arranges to trade them off to a third party by itself or appeals the IFI to complete the sale in its place. Lastly, the counterparty makes the delayed payment to the IFI, which transpires at a future arranged time and includes a pre-agreed mark-up in addition to the principal of the initial purchase.

History of Banking Tawarruq

The first use of the concept of tawarruq was first recorded when Ali bin Abu Taleb (d.40 AH) said that he would not forsake the hajj even if he had to use tawarruq to do it. This indicated that with some reservation, the transaction was allowed (Rahman and Manan 2014). Since Ali bin Abu Taleb would not accept utilizing tawarruq to attend hajj with money obtained and received from an impermissible transaction, his perception of tawarruq indicates the contract’s permissibility (Ahmed and Aleshaikh 2014).

Moreover, the hajj is mandatory in Islam for individuals who can attend the pilgrimage, possessing enough money. As much as the explicit use of tawarruq after a prophetic period indicates that it was applied and used, its use appears to have been limited since very few companions in fatawa mentioned it.

Arguments, discussions and applications of tawarruq started early in the beginning or start of the Islamic civilization. The domestic Islamic bank first explored the concept in Saudi Arabia, and other banks modelled the same. Most banks existed as Islamic windows and branches for commercial banks (Ahmad et al. 2017). In October 2000, Saudi British Bank started banking tawarruq, and the bank Al-Jazeera bank did the same later in 2002.

Motives behind Practicing Tawarruq

The motive behind using tawarruq is based on the objective that it allows the customer to acquire cash liquidity. For example, a customer can go to the bank and apply for an organized tawarruq if they are in need of cash that will cater for their personal needs, including education or wedding expenses. Banks mainly utilize the transactions of organized tawarruq over the buying of cash or metal commodities. These transactions enable the speeding of purchasing and selling of such commodities (Sharaiyra and Haswa 2019).

Additionally, these transactions reduce expenses and procedures due to the absence of procedural requirements for purchasing and selling such items. The motive of giving cash liquidity became evident in advertisements that banks provided for organized tawarruq financing that began in the 21st century in banks like Saudi British Bank (SABB) and Bank Aljazeera.

Additionally, Tawarruq enriches the industry’s product offerings as it contributes to the economic development of people in need. Tawarruq can enable small enterprise owners to expand their businesses, especially those with little working capital. Moreover, the rate of profit placed on the commodity purchased from the supplier should be in line with their effort and based on a win-win situation between the customer and the bank. This should be with regard to the ability of the customer to repay the debt. As a result, this arrangement may cause material finality, meaning the direct link to the real economic development for individuals conducting small retail businesses (Rahman and Manan 2014).

This is because it provides an alternative for entrepreneurs to purchase items or goods which will be their retailing stock. Following this, tawarruq can help entrepreneurs that conduct purchasing in bulk. Furthermore, tawarruq enables the bank to be the agent for rebuying the traded item and ultimately giving the cash as it is required by the client. A transaction using tawarruq provides a means of evading the prohibited riba’ which adds to its usefulness as a financing instrument.

Methods for Implementing Tawarruq in Banks

One of the methods in which tawarruq can be implemented in banks is the arrangement method, where some banks use the agency contract to avoid being involved in the second sale transaction. First, the Islamic bank can act as an agent to facilitate the transaction for the client. The bank will have to acquire tawarruq transaction documents such as documents when a customer approaches it for financing purposes (Rahman and Manan 2014). Such documents can include documents that appoint the given bank to work as an agent to trade the assets or commodities to the market.

For instance, this concept works when the bank purchases the commodity through a broker at London Metal Exchange on a spot basis. The bank then trades the assets to the client under the murabahah contract at the bank’s selling price, which is profit on delayed payment along with the principal amount. The client then appeals to the bank to trade off the item under the Wakalah contract in the market (Tawarruq 2019).

Finally, the bank will be selected as a sale agent in place of the client and trade-off the commodity to a second dealer different from the first. As a result, wariq that is a result of the trade of the product will be added to the client’s account. The customer will have to pay the agreed amount owed to the bank on the Murabahah concept using the agreed installment method.

Additionally, a tawarruq transaction can also happen even without the involvement of an Islamic bank. In this case, the customer finds the agent or buyer on their own without involving the bank (Ali and Hassan 2020). To begin with, the bank may sell any item to the other trader by Shariah on deferred terms (Rahman and Manan 2014). However, the bank must provide detailed information regarding the delivery of the goods to the client as much as the goods or items are not in the bank’s possession. The customer can then choose to sell the commodity to an agent or buyer of choice after delivery.

Ruling on Tawarruq

Most jurists accept tawarruq but must satisfy several requirements to be considered valid. To begin with, every transaction carried out in the tawarruq arrangement must be in line with Shariah’s conditions. Secondly, the agreement or arrangement involves two transactions between the client and a third party and between the customer and a third party (Rahman and Manan 2014). However, to avoid inah, these transactions are not allowed between the same cooperation or persons. This means that the item of the sale cannot be returned or sold back to the initial seller.

Thirdly, the subject of sale has to be tangible assets or commodities. Fourthly, the trade issue must be explicitly distinctive and defined than the other commodity and assets possessed by the bank. Fifth, before the item of sale can be traded to a third party, it must be taken from the buyer. Sixth, the buying and selling transactions must be independent and separated from the other since the contract cannot be valid if it includes the sales purchase conditions and vice versa (Rahman and Manan 2014). Lastly, the sale of the commodity can only be completed after the customer owns the products.

Tawarruq Permissibility and Evidence of Those Who Allow

Tawarruq and murabahah are finance products mainly used in Islamic banks. As mentioned in the Hanbali school of thought, Shariah scholars and most of Fuqaha initially permitted and endorsed tawarruq’s application in its classic form. Additionally, Murabahah’s position is accepted collectively by the four Islamic law schools and most Muslim jurists. However, there have been controversial issues on tawarruq’s permissibility recently where some argue that it is permissible and does not go against the established Shariah principle. This is because its application and use are to avoid Riba’ and thus cannot be regarded as a trick or, in other words, Hilah (Jamaludin 2018).

However, some individuals argued that the concept of tawarruq has a harmful effect on clients and hence is forbidden (Mahyudin and Seman 2018). Some critics still resist tawarruq as they identify it as a financial item similar to a product with an interest basis. For example, in 2003, the Islamic Fiqh Academy of Rabbitah ‘Alam Islami, Mecca, ruled that in Islamic law, tawrruq-based products should be forbidden or regarded as Haram. The following are the arguments that supports tawarruq

Tawarruq Is a Type of Sales

Being a type of sale, tawarruq is identified as a transaction that allows an individual to obtain cash after purchasing a commodity at a deferred cost and later selling it to a different trader than the original one. Following the verses in Al Quran that indicate that Allah permits trade but has forbidden Riba, the concept of tawarruq becomes generally acceptable (Ahmed 2014).

Moreover, Islam allows any trade apart from the ones that result in promoting something, making outrageous profits, cheating, or injustice, which are all regarded as haram. It indicates that the term trade allows every sale as it is a generalization of all trade types; therefore, tawarruq can be considered similar to any sale.

Mutual Consent between the Parties

In Islam, if all involved parties agreed and contained a mutual consent towards their arranged transaction, all agreements made are considered legally permissible. This principle is evident in the Al-Quran (An Nisa’ 4: 29), which indicates that Islamic believers should not misuse their wealth among themselves except when it is a mutual agreement trade. As a result, the transaction is considered valid in Islam due to the free agreement, particularly in a debt transaction. Tawarruq works best on the ground of mutual agreement between the involved parties, such as the Islamic banks and the customer.

No Harmful Effect and No Element of Riba

According to Ibn Mas’ud, percentage profit margins or declared lump sum causes no harm indicating that tawarruq is determined and is allowed. From the reading in Al-Quran (An Nisa’ 4: 29), believers are forbidden from using incorrect means such as Ghisyh, Qimar, and Riba’ that go against Shariah to eat or take the products of others. The transaction of murabahah is not based on riba’ due to the profit margin that both parties agreed on, and the seller does not charge the purchaser a hidden payment.

Nonetheless, some place arguments that there are differences between the interest imposed by conventional banks via the loan granted and the profit margin in murabahah. The claim is that the profit margin presented in the transaction of murabahah is determined by an agreement between the involved parties, between the customer and the bank. On the other hand, the interest in a conventional bank is determined by maintaining the rate of interest developed in the financial market.

Moreover, if a default payment occurs, the customer with a credit loan will incur penalties, while that with murabahah financing will be able to evade the imposed penalties. Additionally, the price set or agreed to at the beginning of the murabahah contract is considered the fixed final price until the installment payment is completed.

As a result, no penalty is reached if a default of payment occurs (Yusoff, Ahmad and Abdul Ghani 2019). This is similar to tawarruq, where the sale is like trading the assets to a buyer through debt but at a high price who then sells the same items at a lesser price to another person at the same cost to ensure that the profit is different from the other price. Therefore, this form of trade or sale (tawarruq) is taken to be permissible since there is no riba’.

Tawarruq as an Element to Avoid Usury without Hilah

From the Hadith of Bukhari Muslim, the scholars who allow Tawarruq base their argument on the occasion where a peasant from Khaybar went to Prophet Muhammad (PBUH) with high-quality dates. This scenario began with Prophet Muhammad asking the peasant if all the dates from Khaybar were of good quality. However, the peasant said he received one kilogram of good-quality dates in exchange for two kilograms of low-quality dates.

This answer made Prophet Muhammad prohibit this kind of trade and proposed that the peasant trade all the low-quality dates that he owned for cash, which he could then use to buy good-quality dates. As a result, this Hadith provides an acceptable trading method that would enable traders to avoid usury with no Hilah as conditions of sale had been achieved, and this trade transaction had no usury.

Concerning tawarruq, Ibn Baaz said that it is not riba’ and that the right perception is legal due to the general evidence meaning and promotes relief and allows people to satisfy their needs. However, this is not legal for the one that trades it back to the original seller and is considered a transaction based on riba’, also referred to as Innah. Thus, this is forbidden or considered haram since it is a trick that aims at enabling an individual to avoid riba’ prohibition. Consequently, this matter displays the permissibility of sale transactions where the aim and differing goals with the use of a medium are allowed and can be fulfilled, evading the usury. This means that a Tawarruq transaction is permissible and not forbidden in the case where it is definitely required.

Actual Possession of the Commodity

It is mandatory for the buyer to acquire full ownership of the commodity before trading it off to a second trader for a Tawarruq transaction to be considered legal. This implies that the first should be different from the second sale. This requirement is based on Abdullah Ibn Umar’s evidence that the Prophet Muhammad forbade the sale of commodities until one gained complete ownership of the items (Mohamad and Ab Rahman 2014). Moreover, Abu Dawood narrated that the Prophet Muhammad forbade lenders to give loans to debtors with the condition that they purchase products from them that is completing one sale under two conditions.

In other words, this means that having two payments, one in a deferred price and the other in cash payment, is forbidden, and one is not allowed to trade goods he does not own or profit from items he does not have full ownership of. Additionally, At Tirmizi narrated that Imam Muslim reported that the Prophet Muhammad prohibited the trade of food grain until one acquires full possession.

The actual ownership in murabahah exists when the developer transfers possession to the bank first, then trades it off to the client. Even though a two-condition sale exists in a Tawarruq transaction, the party must first fully acquire the item before trading it off in cash payment to the other individual.

The Legal Maxim on the Permissibility and Prohibition

In relation to the legal maxim, permissibility is the original or initial rule about all things. Wahbah Zuhaily states that this legal maxim is applicable for items that have no prohibition evidence. Conversely, a legal maxim exists that dissipates the initial maxim that permissibility is the original and initial rule on all valuable items while prohibition is the original rule on all harmful items.

Moreover, Tawarruq is valuable in providing liquidity to individuals that require money instantly based on the legal maxim. Furthermore, unless evidence that prohibits a transaction exists, the original ruling on any transaction is permissible, and no legal evidence that forbids tawarruq is present. This follows that in Islam, a tawarruq transaction is legally acceptable.

Fatwas from Islamic countries on Tawarruq

The first ruling is of the Islamic Fiqh Academy, with a membership that includes Islamic nations compiled in the organization’s 15th annual session of the Islamic Conference. The academy provided a resolution that supports tawarruq on the requirement that the buyer cannot sell a commodity indirectly or directly back to the first seller at a lesser price. However, a tawarruq sale is considered usurious if this requirement is not observed. Second, the Islamic Judicial Assembly, a branch of the World Muslim League, ruled on the acceptability of a tawarruq during its conference of Rajab, 1419H.

Third, the accounting and Auditing Organization for Islamic Finance (AAOIFI) provided a Shariah standard on tawarruq application on standard No.3. The process involves the completion of two contracts, with the first encompassing buying an item on a delayed payment known as Murabahah and the second entailing the trading of an asset to another party on a cash-based transaction stated in Standard No 30 (2). Fourth, the Fatwass Permanent Committee for Scientific Research mentioned the tawarruq transaction in a case where an individual purchases an item on credit to later trade it off to the non-debtor in the market, allowing him to profit from its payment. The owner that purchased the commodity on a credit basis will be paid if the loan becomes payable.

Prohibition of Tawarruq and its Evidence

Since the majority of scholars have a diverse perception that tawarruq is permissible, the concept of tawarruq is debatable in determining its legality. This is because while some scholars do not permit the use of tawarruq due to some factors, there are some that allow its practice.

Illah of Riba’

Ibn Taymiyyah and his student Ibn Alqiyyam from the Hanbali School decided to forbid tawarruq. Ibn Alnqiyyam narrated in his book, A‘lam Almuaq‘in, that his sheikh, Ibn Taymiyyah, did not allow tawarruq and refused to allow it even after people asked him to. Moreover, he added that through tawarruq, the ‘illah of Riba’ is achieved. Conversely, compared to riba’, tawarruq is worse since it involves higher losses and costs (Rehman and Rehman 2020). The second caliph, Umar, narrated a tradition that rejected tawarruq by saying it was a riba’ origin. This meant the tawarruq had a trick that resulted in loaning money on an interest basis as done in several riba’ types, including Riba’ Anasiyah.

Tawarruq as a Sale of a Forced Person and Its Association with Inah

Imam Ahmad said that a tawarruq transaction is a trade of a forced individual like Abu Dawood narrated similarly from Ali, indicating that the Prophet Muhammad prohibited a forced person sale. Tawarruq is prohibited, as stated by the Malikis and their evidence is with respect to what Ahmad said in “Az-zuhdi,” which was narrated in Ibn Umar. Ahmad said that a time comes when people realize that no one seems to deserve dirham or dinar from his Muslim brother. He continued to narrate that the Prophet Muhammad said that individuals are considered to follow cow’s tails and abandon jihad in Allah’s way if they exercise Inah (Ahmad et al. 2020). This follows that they will receive punishment from Allah and will not deserve forgiveness unless they return to their religion.

The Objective of Buying and Selling Does Not Exist In Tawarruq

Every item is acknowledged with its objective instead of its sayings, and the precise cost is determined only with respect to or depending on its objective. This follows the saying of the Prophet Muhammad indicating that the prize of a person’s actions is in accordance with the intentions or objectives and will be rewarded depending on his aim or intention (Ismon 2014). The aim of a tawarruq transaction is to enable one to acquire money rather than completing a sale, making it an element of riba’ which is not allowed.

Mafasid overwhelm Masalih

Additionally, there are some scholars that prohibit the application of tawarruq since its mafasid overpowers masalih. Since the earliest days, the calculus of mafasid and masalih has been considered an essential Islamic jurisprudence tool (Ali 2017). Tawarruq contains harmful effects, including that it results in the development of debt with a volume expected to rise and leads to an exchange of money in the present and even more in the future (Ismon 2014). This is unjust regarding the involved uncertainty and risk, which results in gambling such as speculation through debt increase. Thus, it is the cause for a tawarruq transaction to be prohibited in the Islamic finance and banking system.

Ruling of Organized Banking Tawarruq

The concept of tawarruq is a finance product utilized in Islamic banks that was introduced after fatwas confirmed its validity and resolution from Islamic nations. Moreover, before a trade can be considered valid, the basic requirement of a valid trade in Shariah must be realized. Nevertheless, the conditions are contingent on some limitations in relation to the contemporary scholars when they place claims on a different tawarruq feature to be acceptable (Sharaiyra and Haswa 2019). In addition, as much as tawarruq operation is governed by regulation and legal frameworks, managing and monitoring such a transaction will be retained by Islamic banks to warrant that the Islamic finance systems function in line with the Shariah.

According to the Islamic Shariah law, a trade signifies taking one valuable item of value and exchanging it with another based on a mutual arrangement and agreement with the trade of commodity to obtain cash. The requirements for sale to be considered valid as outlined in the shariah law are utilized strictly before completing a transaction or trade (Idd 2020). First, the involved parties must both agree and be qualified to enter a contract. According to Shariah, every transaction of trade has the acceptance and offer that is Ijab and Qabul to complete a trade transaction which is acceptable.

Moreover, it is allowed to buy a commodity on credit through a mutual agreement in a particular transaction. The Hadith, where The Prophet Muhammad purchased grain from a Jew to be paid later at a specified time and promised to place his coat of mail as insurance or security (Al-hural and al-Hayth 2017). From this Hadith, some jurists perceive that if the first trader raised his cost when the buyer requested delayed payments, the price gap from the time delay is similar to interest as it is common in buying under installments. Likewise, this can be considered a price for the time, which is considered a haram sale or trade.

Second, during the time of sale, the item or subject matter of sale must be available, and the seller must have complete ownership of it at the given time. Thus the seller cannot sell the product in question to the purchaser, for he does not own it. As a result, the item of sale or subject of the transaction is an essential part of the sale as it warrants that there is no uncertainty or defect regarding the sold commodity (Bello, Hasan and Saiti 2017). This is because the basis of this feature is to ensure that the relationship between the seller and the buyer is maintained in the trade without risking agreeing to take a commodity that is absent at the time of sale.

Apart from that, the subject of the trade has to be in authentic or constructive possession of the sale during the transaction. Constructive indicates that the buyer has failed to complete the actual delivery of the commodity in question, yet the possession of the risk of the goods has been handed over to him. This means that the subject of the transaction is completely possessed by the purchaser and has acquired all the respective liabilities and rights of the goods (Roslan et al. 2020). Therefore, the trade has to be absolute and instant, meaning that a transaction set to be completed at a future date or event is considered void. This fundamental valid trade rule is used in every sale, except where the sale on delayed payment makes the transaction valid.

Moreover, the subject of every trade or transaction should be valuable. This is because an item that is not valuable cannot be traded or sold in accordance with the usage of sale and should not be used for the purpose of haram. Additionally, the subject of trade must be Maal-e- Mutaqawwam, meaning that it should be identified and explicitly known to the buyer through a thorough specification that can help differentiate it from other commodities not sold. Furthermore, the transaction can be considered if there exists an uncertainty in the item of trade and the aspect of Gharar or uncertainty is forbidden strictly in Islam.

Third, the sale or trade of a commodity means complete ownership transfer to the buyer against the payment of a cost that can be deferred, completed on the spot, or in advance. Moreover, the client can purchase the commodity after a transfer in possession has happened. This means that the sale can occur after confirmation or verification of the goods, indicating that the contract with the dealer of the goods has been completed. This is because confirmation or verification has the actual possession or ownership rule (Geronimo 2018). The logic is that selling an item before complete ownership can result in disputes, specifically if the commodities in question are discovered or realized as defective. However, constructive ownership can happen if actual possession is deemed impossible based on confirmation and clearing.

Finally, the seller has to state and set the initial cost and additional expenses sustained or incurred in the trade commodity and should be true and just in his word. The other expenditures, including processing, packaging, and transport charges, increase the product’s value and are added to the initial price as a tradition in the business society. As a result, to form the basis of murabahah, the additional expenses can be added to the purchase price. With that exception, the margin profit incurred on the buying price has to be agreed on jointly between the seller and the buyer. Moreover, the price cannot be raised or increased after the price has been set as regards the agreement with an exception of a rebate received from the dealer or supplier.

In addition, any unspecified cost cannot be used as a base of murabahah since it encompasses the similarity of uncertainty, making the murabahah transaction illegal. Conversely, most scholars allow it since the permissibility of items is the basic standard or principle, and no explicit evidence exists forbidding such a sale. Furthermore, no similarity to interest exists in such a sale as the seller is allowed to raise or alter the price as he believes to be appropriate. However, the seller has to ensure that the increase does not reach a point where it is regarded as deliberate exploitation or explicit injustice, which is considered haram.

Reverse Tawarruq

This is a type of tawarruq that is conducted by the financial institution using organized markets. Reverse tawarruq significantly differs from the acceptable classic tawarruq, which is allowed. In this tawarruq, it lacks the aim of conducting an actual exchange, making the cash to be obtained through extra borrowing (Asni 2021). The additional borrowing is permitted because it relies on maturity, which is similar to interest, as only the fiduciary transactions are allowed on the products used for exchange. The involved bank initially sells the product using the client’s name when it has already been sold at a differed base price. The reason behind these transactions is preplanned, making them operate in a sale and buyback transaction that is not permissible by many Islamic scholars (Alkhan and Hassan 2019).

The transaction is the same as the interest-based loan used in traditional banking with the same goals and outcomes. This makes it different from the classic tawarruq because its aim is not free from interest. Banks that participate in tawarruq need to ensure that it is classic tawarruq transactions to avoid compromising their principles. They are required to avert reverse tawarruq at all costs as it encompasses an involvement of interest that is not permissible by Islamic laws and regulations.

Reverse tawarruq does not use the criteria used in classic tawarruq. The transactions implemented lead to the sale and buyback of the commodities in question, which Islamic laws forbid. There are certain cases where the transaction does not involve an actual sale contract leading to the development of the interest loan (Ismail, Gniha and Zain 2016). This type of transaction is only permissible when the participating bank has a liquidity problem and when there is a need to restructure the debts that cannot be paid. This uses the permissibility principle, which states that prohibited things tend to be allowed at times of necessity (Nurhisam 2016).

This implies that the operation can be executed when there are no other options, and the situation is demanding. However, the transaction needs to be carried out at minimum levels. The regulatory body or the relevant authority has to impose limitations on tawarruq transaction rates based on the situation under the need. For instance, the economic situation and the bank’s condition can be considered.

The banks involved and with liquidity problems have to try using other financial products such as sukuk, participation accounts, etc., that other banks render before engaging in reverse tawarruq. Tawarruq should be considered the last option when there are no alternatives (Ali and Hassan 2020). The participatory banks have to be the third party during the time of need when performing the reverse tawarruq transaction. This will also enhance solidarity among the banks involved. When engaging in reverse tawarruq, the transaction should be divided into stages to give out the implication of murabahah. This is misleading as it brings out the impression of murabahah rather than tawarruq.

Tawriiq, Its Reality, and It’s Ruling

Tawriiq is a financial concept where the debtor defers his loan to a different individual. The debtor then becomes an individual that owns liquid cash since he is the only person of delayed debt in a different person’s possession. As a result, every individual that owns a deed transfer (sakk), papering debts documents on the basis of developing paper money that makes it possible and easy to be circulated (Tawarruq 2019). However, it is a must to differentiate a cash debt from one still in custody since debts contain cash and other items that can be illustrated in custody.

Papering the Cash Debt

If cash is realized in the delayed debt, tawriiq becomes unacceptable. Moreover, papering this kind of debt is similar to selling or trading off the debt to a third party, different from the debtor. The debtor sells it to another individual at an immediate cost that is lower compared to the value indicated in the papering deed through the sakk. Therefore, papering the delayed debt at a lower cost compared to the same debt ends up to be considered as riba of surplus. In addition, papering it and delaying it with a coat not the same as the debt results in the riba of nasiah (Tawarruq 2019). Until the Maliki School of thought permits the trading of debt to a debtor who agrees to it, this is the decision of the scholars with regards to these conditions making it a receipt occurrence. However, because of the element of riba, papering the cash debt is forbidden.

Consequently, hawalah, which is the Arabic word for real transfer, is the alternative of the shariah for tawriiq. With reference to the evidence that Imam Malik in Muwatta narrated that Sa’id ibn Musayyab, Sulaiman ibn Yasaar, Abubakr Ibn Muhammad Ibn Azm, and Ibn Shihaab all forbade people to trade wheat with gold on credit then later purchase dates using the obtained gold before collecting it from its dealer. However, it is acceptable if he uses the gold used to purchase the wheat right before collecting the gold and transfers the individual from which he purchased the dates to his debtor that traded the wheat with gold and has the coat of dates on him.

Papering the debt in the, another’s care

Prohibiting descriptions of gharara and jahalah restricts the debt in the custody, and regarding the known standards, it was in animal products such as milk or farm crops such as seed. However, Islamic financial establishments have transferred the value of the same commercial products into shares and referred to them as a speculation deed that is Sukuk mudarabah. Every case has a ruling that is legally provided the deed of mudabarah denotes a mutual share in the mudabarah since it could be a combination of debts of mudarabah or ‘inah goods (Tawarruq 2019). In the first case, if the source of mudarabah comprises inah’ goods, it can be traded in exchange for cash at an equivalent, higher or lower price.

Moreover, this resembles the trade of properties that is common share or mutual share, which is not prohibited since it does not have doubt of riba’ or gharar. In the second case, if mudarabah is based on murabahah delayed debts, then it is prohibited to paper the respective debts in immediate cash lower than the debts. As a result, tawriiq cash debt is the ruling of this case. With reference to the third case, considering that the mudarabah sack mixes with the products of inah’ and the deferred murabahah debts, or if the products are more compared to the delayed or deferred murabahah debts or the other way round, the distinction should be done in two forms.

The first form is where the commodities are more compared to the debt amount. In this case, the shares that represent these debts and the items can be papered or traded. As a result, the most common carry the ruling for all, and any that is possible to be waived subsequently may not be for the others (Tawarruq 2019). The second form is where the murabahah debt is higher compared to the goods’ value. Following this scenario, it is prohibited to paper these debts since the minimum cannot overpower the majority. Furthermore, the shariah law acknowledges that the most are supposed to represent all.

The purpose of the study has been met as it has portrayed the concept of tawarruq based on various grounds. This has provided the necessary information regarding tawarruq as an Islamic Banking product with safe and unsafe limits. On the arguments regarding tawarruq, there are opposing and proposing views regarding its permissibility. The permissibility and prohibition are grounded upon the various schools of thought such as Hanbali, Maliki, Hanafi, and Shafii. Multiple scholars have brought about their views regarding tawarruq based on their arguments on the schools of thought, Quran, Hadith, and Sunna (Fa-Yusuf and Ndiaye 2017). On the permissibility of tawarruq, it is necessary for the actual good to be present to ensure that the transaction is relevant.

Centered on the views of various regulatory bodies, scholars agree that the bank must purchase the commodity or get hold of the actual good without making the client have a written promise or being bound to the agreement. Most scholars that permit tawarruq argue that the transaction should not involve unclear agreements or transfer of ownership of goods under consideration (Rehman and Rehman 2020). This portrays that the transaction should not avoid the actual transfer procedure of the actual commodity. This step will ensure that tawarruq is permissible as it legitimizes the transaction. The process does not involve nominal or monetary transactions since it is based on purchasing and selling actual products.

The profit margin should be labeled and agreed upon by the parties involved. This ensures that the price of the good is fixed and does not involve usury even when a default is experienced. The analysis shows that the validity of tawarruq relies upon the actual purchase of the product and the cost associated with being disclosed to the parties involved in the transaction. This lays the ground for genuine tawarruq, prohibiting other transactions that do not satisfy the above requirements. It can be concluded that the rules imposed in tawarruq transactions are aimed to ensure that they are within the Shariah laws and that their usage requires supervision by an authorized body. This will prevent products that involve usury and other financial products that are against Shariah laws.

References

Ahmad, Ellida, Mariyam Shihama, NurSulaim Tarmizi, Saidu Mudi, Samia Djama, and Aishath Muneeza. 2017. “Tawarruq as a Product for Financing within the Islamic Banking System: A Case Study of Malaysian Islamic Banking System”. International Journal of Management and Applied Research 4 (1): 31-43.

Ahmad, Zaki, Faathih Zahir, Ahmed Usman, Aishath Muneeza, and Zakariya Mustapha. 2020. “An Exploratory Study on the Possibility of Replacing Tawarruq Based Islamic Banking Products Using Other Alternatives”. International Journal of Management and Applied Research 7 (2): 147-164.

Ahmed, Essia, Sofri Yahaya, and M Harashid. 2012. “Shubuhat on Matter of Bai’Alinah and Tawarruq”. International Journal of Business and Technopreneurship 2 (1): 85-101. Web.

Ahmed, Habib, and Nourah Mohammad Aleshaikh. 2014. “Debate on Tawarruq: Historical Discourse and Current Rulings”. Arab Law Quarterly 28 (3): 278-294.

Al-hural, Yasir Abdul-kareem, and Huda al-Hayth. 2017. “The Provisions of Organized Tawarruq and Its Economic Effects”. Dirasat Shari A and Law Sciences 44 (1): 231-245.

Ali, Mohammad. 2017. “Toward Islamic Banking without Tawarruq”. ICR Journal 8 (2): 256-259.

Alkhan, Ahmed Mansoor, and Mohammad Kabir Hassan. 2019. “Tawarruq: Controversial or Acceptable?” Arab Law Quarterly 33 (4): 307-333.

Asni, Fathullah. 2021. “The Difference Of Shariah Risk Potential and Shariah Risk in Personal Financing Products Based on Tawarruq Munazzam Contracts Practised in Malaysia”. Qualitative Research in Financial Markets 14 (1): 95-118.

Azungah, Theophilus. 2018. “Qualitative Research: Deductive and Inductive Approaches to Data Analysis”. Qualitative Research Journal 18 (4): 383-400.

Bello, Nabil, Aznan Hasan, and Buerhan Saiti. 2017. “The Mitigation of Liquidity Risk in Islamic Banking Operations”. Banks and Bank Systems 12 (3): 154-165.

Clarke, Victoria, and Virginia Braun. 2016. “Thematic Analysis”. The Journal of Positive Psychology 12 (3): 297-298.

Dabu, Ibrahim. 2014. Tawarruq, Its Reality and Types. Ebook. Web.

Denzin, Norman K., Yvonna S. Lincoln, Maggie MacLure, Ann Merete Otterstad, Harry Torrance, Gaile S. Cannella, Mirka Koro-Ljungberg, and Terrence McTier. 2017. “Critical Qualitative Methodologies”. International Review of Qualitative Research 10 (4): 482-498.

Fa-Yusuf, Habeebah Simisola, and Ndeye Djiba Ndiaye. 2017. “Issues with the Use of Tawarruq in Malaysia”. Journal of Islamic Banking and Finance 5 (2): 1-9.

Fleming, Jenny, and Karsten Zegwaard. 2018. Methodologies, Methods and Ethical Considerations for Conducting Research in Work-Integrated Learning. Ebook. Web.

Geronimo, Rusell. 2018. “Taxation of Islamic Banking Transactions”. Bratislava Law Review 2 (2): 79-90.

Idd, Baliq. 2020. “Organized Tawarruq: Between Decisions of Jurisprudence Councils and Sharia Standards” 7 (24-25): 11-57.

Ismail, Abdul, Nik Gniha, and Mat Nor Zain. 2016. “Tawarruq Time Deposit With Wakalah Principle: An Option That Triggers New Issues”. International Journal of Islamic and Middle Eastern Finance and Management 9 (3): 388-396.

Ismon, Nur. 2014. “Legality of Tawarruq in Islamic Finance”. Tazkia Islamic Finance and Business Review 7 (1): 1-28. Web.

Jamaludin, Azahari. 2018. “Why In Favor Of Tawarruq Not Bai’ Al-Inah in Personal Financing Product?” International Journal of Islamic Banking and Finance Research 2 (1): 83-90.

Ledhem, Mohammed, and Mohammed Mekidiche. 2020. “Economic Growth and Financial Performance of Islamic Banks: A CAMELS Approach”. Islamic Economic Studies 28 (1): 47-62.

Mahyudin, Mohd Izuwan, and Azizi Che Seman. 2018. “The Application of Bay’ Al-Tawarruq in Islamic Banking Institutions in Malaysia: A Study of Bank Muamalat Malaysia Berhad”. New Developments in Islamic Economics, 169-179.

Mihajat, Muhammad, and Aznan Hasan. 2014. “Tawarruq Practice for Liquidity Management: Comparative Study between Komoditi Syariah Indonesia and Bursa Suq Al Sila Malaysia”. International Journal of Excellence in Islamic Banking and Finance 4 (1): 1-16.

Mihajat, Sastra. 2011. The Real Tawarruq Concept the Product of Islamic Bank for Liquidity Risk Management. Ebook.

Mohamad, Nasrun, and Asmak Ab Rahman. 2014. “Tawarruq Application in Islamic Banking: A Review of the Literature”. International Journal of Islamic and Middle Eastern Finance and Management 7 (4): 485-501.

Mohammad, Nasrun. 2014. Tawarruq in Malaysian Financing System: A Case Study on Commodity Murabahah Product at Maybank Islamic Berhad. Ebook.

Nurhisam, Luqman. 2016. “Bai ‘Al-Tawarruq: Concept of Islamic Financing?”. Journal of Emerging Economies and Islamic Research 4 (3): 49.

Rafiullah, Sheikh, and Atiquzzafar Khan. 2018. “Liquidity Management Mechanisms of Islamic and Conventional Finance: A Shariah Appraisal”. Policy Perspectives: The Journal of the Institute Of Policy Studies 15 (2): 1-24.

Rahman, Zainor, and Siti Manan. 2014. “Tawarruq As A Useful Instrument To Finance Retail The Halal Way”. Procedia – Social and Behavioral Sciences 121: 281-290.

Rehman, Mujeeb ur, and Ghulam Shams Rehman. 2020. “U-2 the Application of Tawarruq in Contemporary Islamic Banking: A Review of Fiqh Academies’ Perspective”. Al-Aijaz Research Journal of Islamic Studies &Amp; Humanities 4 (1): 22-39.

Roslan, Muhammad Faruq, Omar Bamahriz, Aishath Muneeza, JinZi Chu, Zakariya Mustapha, and Mohamad Zabidi Ahmad. 2020. “Application of Tawarruq in Islamic Banking in Malaysia: Towards Smart Tawarruq”. International Journal of Management and Applied Research 7 (2): 104-119.

Sharaiyra, Suhaib Walid, and Maher Haswa. 2019. “The Effect of ‘Motive’ on Characterising Organised Tawarruq”. Arab Law Quarterly 33 (2): 179-197.

Sras, Yahya. 2020. “Islamic Scholars View On Bai Al-Nah and Al-Tawarruq”. Journal of Applied Business and Economics 22 (9): 1-9.

Tawarruq. 2019. Ebook. Web.

Yusoff, Amir Fazlim, Azlin Alisa Ahmad, and Nik Abdul Rahim Abdul Ghani. 2019. “Classical Tawarruq: A Potential Alternative to Baiʿ Al-ʿīnah In the Malaysian Banking and Finance Industries”. Arab Law Quarterly 33 (4): 400-419.