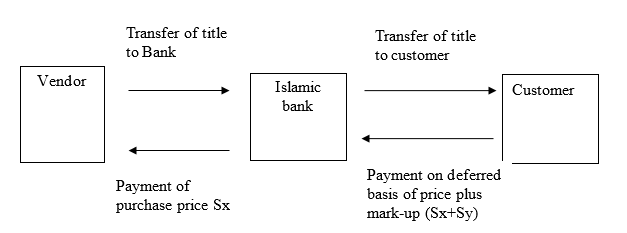

Murabahah is an Islamic term which is referred to by the name Fiqh in Islamic language and it commonly used in refer to a given kind of sale without making a clear reference on the financing of the product in its original form. It is actually seen as a mode of financing which is normally used by the Muslims when carrying out their financial operations and due to its popularity it has become one of the major financing products which are utilized by the banks (Usmani, 12). Normally it involves a transaction which the seller identifies the cost of the product to be sold and therefore the seller agrees to sell to another person where the seller in this case adds up on top of the original cost some value which is the profit gained by the seller in the transaction as shown below in the diagram (Usamin, 15).

Normally this cost which is added up by the seller is the known as mark-up thereon which clearly is known by the buyer before the buyer purchases the product or commodity (Lorenzo, 20). The profit that the owner of the commodity adds on the product is normally seen as a mutual consent which can either be agreed between the buyer and seller to be in lump sum or through a given particular agreed ratio of the profit which actually the seller of the product charges over the cost of the commodity (Jonsson, 16).

The most important requirement of Murabahah is that is requires an honest declaration of the cost by the seller of the product. It is normally viewed as one of the three types of other Islamic products which include; bayu-al-amanah which actually implies the ‘fiduciary’ sale (Usamani,23). The other two types are bayu-al-amanah and Tawliyah which means the sale at cost and Wadiah which actually implies sale at specified loss (Abbas, 32).

Murabahah is seen as the important product used by most banks which operate in Islamic countries especially when it comes to the banks that need to promote riba-free transactions and the ratio which is employed by banks while utilizing this product varies from one bank to another. Murabahah is used as an important instrument by the banks when it comes to asset financing transactions, property, micro finance as well as other transaction which actually involves the importation and exportation of commodities (Jonsson, 18).

The basic principle of Murabahah is that the seller should be in a position to truthful disclose the actual cost which the seller incurred while purchasing the commodity and therefore this implies that when such transactions are being carried out honesty is the key principle (Abbas,23). The profit which the seller gets usually is in lump sum and at times the buyer and the seller might agree that the profit be based on a given percentage of the total cost. When it comes to payment in Murabahah the buyer making some payment to the seller the buyer might make payments on the spot or at given consequence dates which normally are agreed by both parties are being convenient (Rob,12).

This clearly portrays that Murabahah does not mean making payments at a later date or deferred payment as believed in Islamic jurisprudence but rather Murabahah in really sense implies just making a sale like another transaction (Lorenzo,13).Murabahah can be differentiated from other kinds of sale since in Murabahah transactions the seller openly discloses the profit the seller is going to make while the other kinds of sale the seller does not necessarily need to disclose the profit he/she is going to make on the commodity since the sale is not in line with the cost plus concept (Rob,16).

Murabahah can be seen as trust sale since the buyer is always required to trust the seller when the seller is disclosing the true costs of the product (Shoult, 15). In circumstances where a third party acts on behalf of the buyer who intends to buy the products then the money which is paid in the transaction referred to as murabahah mark-up can be used to refer to the payment which is being made to compensate for the services the trader offers when it comes to locating, transporting as well as delivering the required products to the buyer. When the buyer is carrying out transaction sale in murabahah then it clearly indicates that the amount which accumulates to the profit margin should be specified in monetary terms (Lorenzo, 18).

Normally the profit which the seller gets is not viewed as the benefit which is resulting from the money capital since Islamic culture does not allow renting of money rather it is viewed as the profit that accumulates from the sale of the products. This transaction therefore should be clearly differentiated from the transaction where the banks or financial institutions purchase an item with an objective of making profit. This kind of sale is referred to as a ‘murabahah to the purchase-orderer’. People view this kind of sale as being a controversial method since it can easily be used as a means of circumventing the exclusion on riba (Lorenzo, 23).

With this kind of transact is contrary to the Islamic finance transaction whose culture is to have an objective which achieves a means of halal contracts. According to studies done by Shoult (23), Murabahah can be used a major tool which is used to facilitate short-term transactions when it comes to trade and recently the banks refers to it as ‘cost-plus financing’ which is used on frequent basis as way through which a given particular trade finance is viewed as letters of credit.

According to studies done by Rob (24), it shows that there are some guidelines and rules which exist when it comes to the making of a sale transaction between a seller and buyer in murabahah. These rules actually specify the fundamental conditions under which a valid sale can be identified as held with all its implications, and that all the basic ingredients of a valid sale in Shari’ah. To begin with the first rule is that the commodity to be sold should be available at the time sale of which clearly implies that anything which cannot be seen by the customer cannot be sold. Anything non visible which is sold in the transaction is considered null and void. An example is when A sells a car to B which he doesn’t belong to him then the sale is void (Rob,28).

The second rule is that the product to be sold should belong to the seller and if the product belongs to another person then it cannot be sold. An example is when Example: E sells to F a building which is at the moment owned by H, but E is hoping that he will buy it from H, within a given period of time and make a delivery to F (Abbas,42).This sale is therefore considered null and void, because the car doesn’t belong to E at the time of sale. The third rule is that the product being sold should be the product being sold should be in proper order at the moment the seller is selling it to another person. Here once the buyer acquires the property then the buyer is given full rights to own the product fully (Jonsson, 45).

The fourth rule is that the sale should be on the spot and complete, the other rule is that the property being sold should have value and should be known by the buyer in advance but the buyer purchases the product (Shoult, 24). Another important rule of Murabahah is that the transaction is only valid when the actually cost of the commodity being sold can be identified incase it cannot be identified then it clearly implies that the product cannot be sold on Murabahah basis but incase the product is sold on musawamah basis where the product to be sold is sold on bargaining basis this clearly means that the price of product being sold will be determined on mutual consent (Shoult, 28).

In addition if the seller incurs any expenses like acquiring the commodity, freight, custom duty all will be included in the aggregate cost of the product. In case the seller incurs expenses like staff salaries, rent of operating the premise then these costs are not included on the cost of the product rather the profit gained by the seller is meant to take care of these costs (Lorenzo,46) The other important rule is that a given price is the one which determines a valid sale an example is when D promises to make certain payments to A within a month from the time the sale occurred then the amount will be Rs 50 but if D makes the payment after two months then Rs is 55 (Lorenzo,58).

In addition there are more practical set guidelines when it comes to the buyer and seller carrying out transactions in Murabaha which have an aim of ensuring that clear transactions occurs between the bank and the customer and the trade is not clearly based on mere financing transaction. This guidelines are set to ensure that the bank is seen as the true possessor of an product before selling it to the customer and any charges which are added to the product truly reflects the time value of money (Abbas,56).

Work cited

Muhammad Us̲mani ,An introduction to Islamic finance; Published by BRILL, (2002),Pg 12-23.

David J. Jonsson, Islamic Economics and the Final Jihad: The Muslim Brotherhood to the Leftist/Marxist – Islamist Alliance; Published by Xulon Press, (2006), Pg 16-45.

Zamir I Abbas, An introduction to Islamic finance: theory and practice; published by John Wiley & Sons (Asia), (2006), Pg 23-56.

Rob Good, Indonesian business culture; Published by BH Asia, (1997), Pg 12-28.

Anthony Shoult, Doing business with Saudi Arabia; Published by Kogan Page, (2002), Pg 15-28.

Yusuf T Lorenzo, Mudarabah and Musharakah., A Compendium of Legal Opinions on the Operations of Islamic Banks: Murabahah, Institute of Islamic Banking and Insurance; Published by Institute of Islamic Banking and Insurance, (1997),Pg 13-46.