Introduction

Money and banking is a wide topic that looks into various aspects that affect the economy. Money can be in different forms, but it has to be accepted generally as a ‘means of payment’ for goods and services. Money has a number of functions that are distinguishable. Money can also be of different values. The value of money is influenced by a number of factors, including the prevailing economic conditions (Mises 2009). In fact, money is one of the major factors that are used in assessing the economy of a nation. Money comes in different currencies depending on the country. Currencies could either be in notes or in form of coins. Money is usually stored in banks. The currencies can be exchanged in banks or money markets. Bank money refers to the balances held in accounts (checking or savings accounts).

Banking involves all the activities that are carried out in a bank. Some of the activities include lending money, accepting deposits, and issuing cheques among other activities (Mankiw 2009). This essay will mainly focus on money. The essay gives the definition of money and gives a brief description of the functions of money. The paper also explains the various sources of money, as well as the people to whom money is supplied in an economy. Further, the essay explains the ways through which money is supplied to the economy. Generally, the essay answers the question: What is money, and how and by whom is it supplied to the economy?

What is money?

The general definition of money is anything or any object that is accepted generally as a medium of transactions. Money is accepted as a ‘means of payment for goods and services’. In addition, money should be generally accepted as a means for repaying debts in a given economic setup. In other words, money can be defined as a ‘medium of exchange’, or a marker of value. Money is a marker of value because by being accepted as a payment for goods or for services, it becomes a determinant of the value of those goods or services (Eatwell, Milgate, & Newman 1987).

Money has long a history; it has been in supply for a long period of time and has undergone a revolution to become the way it is today. As a matter of fact, other items were used to act as money (means of exchange) in ancient times before the money used today came into being. Some of the items that were used as money include beads, shells, and salt among others. People used to do what is called barter trade, where people could exchange products for other products. However, this method was inefficient, and it is for this reason that money was invented to make the exchange exercise more efficient. Money is referred to in various names. For instance, money is referred to as dollars in the United States of America, while it is known as pounds in Europe. Below are examples of money images, both notes, and coins:

Functions of Money

Money has a number of functions and features. However, the functions can be summarized into five, namely; ‘medium of exchange, standard for deferred payment, unit of account, store of value and measure of value’ (Mises 2009). These functions are explained in brief as follows:

Money as a ‘medium of exchange’ came in to solve the problem of inefficiencies that were associated with barter trade (Mises 2009). Money is used to pay for goods and services. It is much easier to measure the value of a commodity or a service using money as opposed to measuring the value using items as it was during the time of barter trade. The use of money avoids incidences of double coincidence of wants. Money is accepted generally as a ‘means of payment’; hence its role as a ‘medium of exchange’.

The standard for deferred payment is another important function of money. Under this role, money can be used to pay debts in the future. The debts can be denominated to money. Debts incurred today can be paid in the future using money (Mises 2009). However, the value can change because of the effects of inflation and deflation. Despite this fact, money as a ‘means of paying’ debt is the only means through which creditors and the debtors are assured not to lose. Money can also be used as a measure of value. When one buys a product, the money he or she pays for the item is the value of that product. The price tag on a product or a service is its value. Money replaced barter trade and improved on the inefficiencies caused by barter trade. Money is important in keeping books of accounts since an asset can be valued using its money value.

As a store of value, money can be saved reliably and then retrieved in the future. The value of money has the capability of staying stable for a relatively long period of time (Mankiw 2009). Therefore, it is possible to store a certain commodity in form of money and then retrieve it in the future. For instance, if one has shares in a company, they can sell the shares and store the money, then repurchase the shares in the future. That way, money acts as a ‘store of value’ for the shares.

Finally, money acts as a unit for accounts. The term unit of account refers to the standard measure of the value of goods and services on the market, as well as a measure for other transactions that take place within the market (Mises 2009). This is important since it helps in formulating commercial agreements. Money is easily countable; it can also be divided into smaller units without incurring any loss in value. This makes money the best medium for units of accounts.

Where does Money come from?

There have been a lot of debates about where the money comes from. It has never been clear where and how money is created. It is quite ironic that people use money each day for various transactions, but it is shocking that not many citizens have an idea of where the money comes from. More interestingly is the fact that even the policymakers, bankers, and economists do not have a common understanding of how money is made, or where it comes from (Ryan-Collins et al. 2012). In fact, most people think that money is made or manufactured by the federal government. However, this is a misunderstanding. It is not reasonable for the federal government to make money. The reason to this is that the government would be manufacturing money whenever they want, thus they would have no debts in their name.

The general description of the source of money is that it is created by the central bank. The central bank does this by creating and extending credit through loans or buying assets. As the central bank creates loans, it also makes deposits in other banks in the country at the same time. It is from these banks that people get money to use for various transactions. Take, for instance, the money in England, where England as a country has three forms of money. These are cash, central bank reserves, and commercial bank money (Ryan-Collins et al. 2012).

Only the bank of England has the ability and the authority to make the central bank reserves and cash. The two forms of money are actually referred to as the central bank money. It is imperative to note that the central bank reserves a form of money that cannot be found in circulation. Therefore, the money that is found circulating in the economy is in form of cash, as well as commercial bank money. This can be termed as the source of money that people use in the economy. Commercial banks’ money is generated via borrowing and lending (Ryan-Collins et al. 2012).

In some nations such as the United States of America, the source of money for the government is the Federal Reserve. The government cannot print the money whenever it needs it. If the government was to print money, there would be a possibility that the money in circulation would be too much, leading to inflation. This will have a negative implication on the economy of any nation. Therefore, in America, the government creates US treasury bonds when it wants to spend a certain amount of money that it does not have at its disposal. The government then takes the bonds to the Federal Reserve, which in turn creates the amount of money that the government wants to spend and exchanges it with the treasury bonds (Michael 2012).

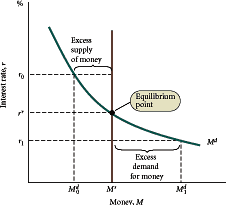

Lending and borrowing money is influenced by the forces of demand and supply (Lasher 2008). If individual wishes to borrow money, in most cases they will have a certain idea at the back of their mind on how they intend to use that money. This idea will go on to dictate the amount of money they borrow. Consequently, individual needs become a determinant of the money in supply. For example, if someone wants to build a house or business premises, the probability is that they will borrow a large amount of money and it will be a long-term loan. This is as opposed to someone who wishes to borrow money to increase his or her stock. Such a person will borrow in short term and will borrow a relatively lower amount. On the side of the banks, they either have long-term or short-term funds at their disposal. In case they have long-term funds, banks will not lend the money to a short-term borrower. These factors determine the quantity of money in circulation. The graph that shows demand and supply of money;

How Money Is Supplied To the Economy

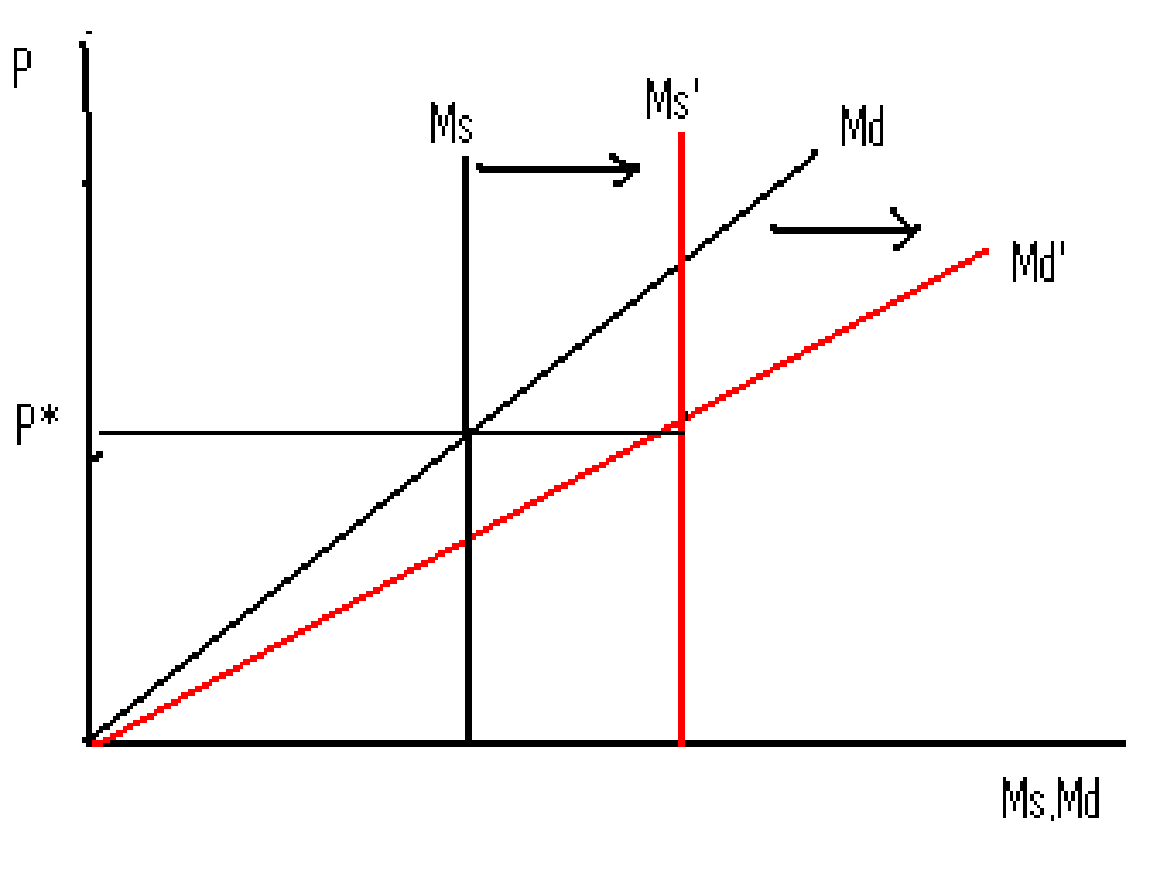

To start with, money supply refers to the amount of money or monetary asset in the economy during a certain period of time. The data on the quantity of money in supply is usually held by the central bank or the government of a nation. Money supply and the ways in which it is supplied to the economy is a very crucial issue (Ryan-Collins et al. 2012). This is because money is the determinant of price levels, business cycles, as well as exchange rates, and inflation. In fact, there is a very strong relationship that exists between the growth of money supply and price inflation. If the money in supply is too much, the consequences will be that the prices will also go high. This is the reason why the ways in which money is supplied to the economy have to be taken care of well. The monetary policies imposed in a country monitor the supply of money to avoid such incidences, which are likely to negatively affect the economy (Mankiw 2009). The diagram below illustrates the correlation between money supply and price levels:

There are two ways in which money supply in the economy can be explained. The first way is the endogenous way, while the second one is supplied by the central bank. In the case of the endogenous way, the quantity of money in supply is determined by economic activities. The distributional economic structure is the main source of inflation. The other method is whereby the central bank determines the quantity of money in supply. Under this method, the relation between money supply and the rate of inflation is usually weak. For instance, in the case of recession, money supply by the central bank after recession would lead to an increase in real production. In addition, in case the velocity of money changes, money supply by the central bank may not affect inflation (Mankiw 2009).

Conclusion

Money and banking are a wide topic that involves many issues that directly affect the economy. Money is anything that is accepted generally as a ‘means of payment’. Apart from being a means of payment, money has a number of other roles that it plays. The roles are usually summarized into five major roles. The question of where the money comes from is one that has been asked frequently, but not many people have been able to find the correct answer. Many people think that money is produced by the central government. However, this is not the case; instead, money comes from the central government or the Federal Reserve. Finally, money is usually supplied to the citizens or to the government. The major ways in which money is supplied is through the central bank or through endogenous ways.

Reference List

Eatwell, J, Milgate, M & Newman, P 1987, The new Palgrave. A dictionary of economics, Macmillan, London.

Lasher, W 2008, Practical financial management, Thomson South-Western Cengage Learning, Mason, OH.

Mankiw, NG 2009, Principles of macroeconomics, South-Western Cengage Learning, Mason, OH.

Michael, 2012, Where does money come from? The giant federal reserve scam that most Americans do not understand, Web.

Mindmillion 2013, ‘Euro notes & euro coins clipart’, Mindmillion, Web.

Mises, LV 2009, Theory of money and credit, Ludwig Von Mises Institute, Auburn, NY

Mishkin, FS 1994, Financial markets, institutions, and money, HarperCollins College Publishers, New York, NY.

Ryan-Collins, J, Greenham, T, Werner, R & Jackson, A 2012, Where does money come from? A guide to the UK monetary and banking system, Second Edition, Web.