Summary

Banks perform the business of buying and selling cash to their customers. The amounts involved in these transactions must be equal to the reserve requirement stipulated for the banks.

The reserve requirement is less than the customers’ deposits and is established to ensure that banks do not eat into the pockets of the customers. They can only transact using money that truly belongs to them and a portion of the customers’ deposits.

This should support all the net withdrawals that customers can make because customers have the right to take all their deposits. Once the bank obtains deposits from customers, it is allowed to retain the reserve requirement, and the rest of money is saved in a different institution.

However, the bank also adds an extra amount of money apart from the money deposited to give it a working reserve. This extra amount of money is required to accommodate cases in which customers withdraw more money than they have deposited.

This extra amount may go beyond the reserve requirement which may lead to insufficient funds. Working reserves prevent such occurrences and act as a backup to the reserve requirement. These two make up the primary reserves.

Banking is a revenue and profit generating business. These cannot be wholly achieved from the commissions charged for the services given.

They use a portion of money not included in the working reserves to invest in treasury securities, which can be liquidated easily if and when required. This money is referred to as the secondary reserve; it serves to increase revenue apart from what is obtained from the primary reserves.

This is not an optional activity, but it is a requirement by the banks regulatory agencies. Once some secondary reserves are invested in the treasury securities, the rest of the money is used in lending.

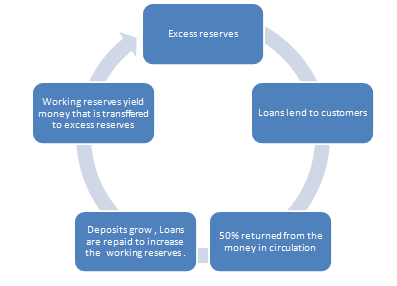

Banks cannot lend more than their excess reserves because they risk being insufficient from withdrawals. Lending results in increased money supply, in a nation, and it can be used to increase or decrease the amount of money in circulation.

The excess reserves can be obtained either from collecting loans without lending or borrowing money from other banks that have excess reserves.

The lending process involves the transfer of money from the excess reserves to the primary reserve. This is to ensure that the increased money in the customers’ account balances is accounted for without altering the primary reserves.

This automatically restricts the amount of money that a bank can lend; the maximum amount should be equal to the excess reserves.

However, based on the assumption that 50% of the money lend out will be deposited back into the accounts by other customers, the primary reserve and the excess reserve is bound to grow again.

This will provide an opportunity for the bank to lend more and the cycle continues thus allowing the bank to give more loans.

Fig 1. Money circulation

Source: Author

The excess reserves increase when the amount of net deposits exceeds the number of net withdrawals. In cases where banks operate on a small working reserve which is risky, they can obtain excess reserves from selling the treasury securities.

There are cases in which banks lose their excess reserves and are not able to lend. The money paid back from loans is used to raise the bank reserves. Therefore, the bank stops lending until it raises enough excess reserves.

This results in reduced money supply, in the market. Hence, the bank can regulate the amount of money in the economy by applying this process.

Works Cited

Ashby, David 2009, Money Mechanics Monetary Economics Reengineered with an Attitude and a Policy Agenda. 2009. Web.