Issue

- Has Sue been paying her tax on rent? If yes, has she been receiving rent from the house?

- Does Sue make any taxable income as a result of selling the rental house and the land?

- Does the tax system of her country tax capital gains?

- Can Sue be treated as a resident or a non-resident and does the tax system involved treat them differently?

- Are buildings and land depreciated?

- Does the tax system in question allow for depreciation to be deducted before arriving at the taxable income?

- Does the tax system in question allow women to pay their taxes separately or do their husbands file collective tax returns for their families?

Rule

The information provided is not sufficient for one to tell if Sue has been receiving rent and if yes, she has been paying her tax. We cannot tell if Sue is a resident or non-resident since we are not told anything about her citizenship, permanent home or the number of days she has stayed in the country.

In most tax systems, capital gains are not taxed but this country’s tax system taxes capital gain. The capital gain is taxed after allowing for a discount depending on the entity being taxed. For partnerships, a discount of 50 percent is allowed before dividing the capital gains among the individuals for tax purposes (Lasser, 2012).

Companies are taxed on their capital gains but after receiving a discount of 50 percent on the gains. Individuals receive a slightly higher discount on the capital gains before subjecting them to capital gains tax. They are allowed to deduct a discount of 75 percent of the capital gains before taxing them. Usually both buildings and land are not depreciated instead they appreciate in value with time. Depreciation is not an allowable expense in most tax systems and in this case, it is not clear whether it is an allowable expense. However, capital allowance is a uniform allowable deduction that is used to replace depreciation and it is meant to encourage investments. It is issued to those who indulge in particular investments (Barkoczy 2013).

Women are not allowed to file separate tax returns unless they do not meet any of the specified conditions according to the laws of most countries. They are only allowed to file their returns separately when they are not married or have separated with their husbands in a manner that shows no signs of getting back together in the future. They are also given a chance to be taxed separately when their husbands are not residents of the country in question. Thus, they have an option of filing separate returns when they earn their income.

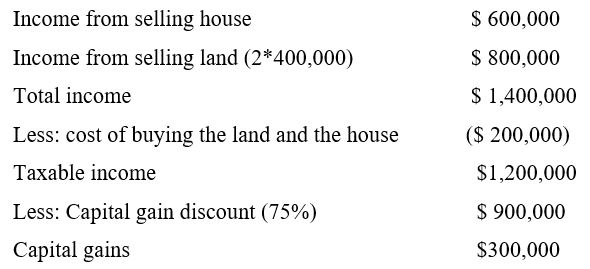

On the issue of the transaction; it is clear that Sue makes some profit upon selling the land and the house. The profit is obtained as shown in the calculation below:

Sue should pay a tax on the $300,000 capital gain which is taxable income obtained from the transaction. The tax amount she should pay depends on the taxation rates for an individual in her country. If her country allows personal relieve then she should set it off from the gross tax and pay the net tax obtained.

The capital gain obtained from Sue has to be allowed a discount of 75% before subjecting it to any taxes because Sue is an individual. The exact value as calculated above is $900, 000. In this case, Sue’s husband is not brought into the picture although it appears like the capital gain income is at arm’s length. Therefore, Sue should be allowed to file a separate tax return (Barkoczy 2013).

Application

The law requires any income obtained in a country to be taxed although this depends on whether one is a resident or a non-resident. For non-residents, the rule of taxing income at the source applies and their income is also subjected to final withholding tax at the source. The percentage depends on the rates of the country in which the non-resident person earned that income. No personal reliefs are allowed on the withholding tax. For residents, different rates apply. The rates for most countries are retrogressive and depend on the income bracket of an individual. Personal relief is allowed to the residents and it is deducted from the gross tax to arrive at the final tax (Nethercott and Devos 2012).

Conclusion

It is not clear from the information provided whether Sue is a resident or a non-resident. However, one thing is clear that she earns some income in the country. The taxable income earned is $300,000 and it is to be taxed. The amount of tax she will pay depends on her status of residence. If she has also been receiving rent and has not been paying her taxes, she should pay the tax together with the penalties stipulated in the laws of the country but if the country allows personal reliefs to its residents, then she will be allowed to deduct a personal relief from the gross tax liability before arriving at the net tax liability.

Reference List

Barkoczy, S 2013, Foundations of Taxation Law (5th Ed.), CCH Australia Limited, Sydney.

Barkoczy, S 2013, Tax Legislation and Study Guide (16th Ed.), CCH Australia Limited, Sydney.

Lasser, K 2012, Your Income Tax 2013: For Preparing Your, 2012 Tax Return, Wiley & Sons, London.

Nethercott, R and Devos, T 2012, Taxation Study Manual, CCH Australia Limited, Sydney.